Data Points

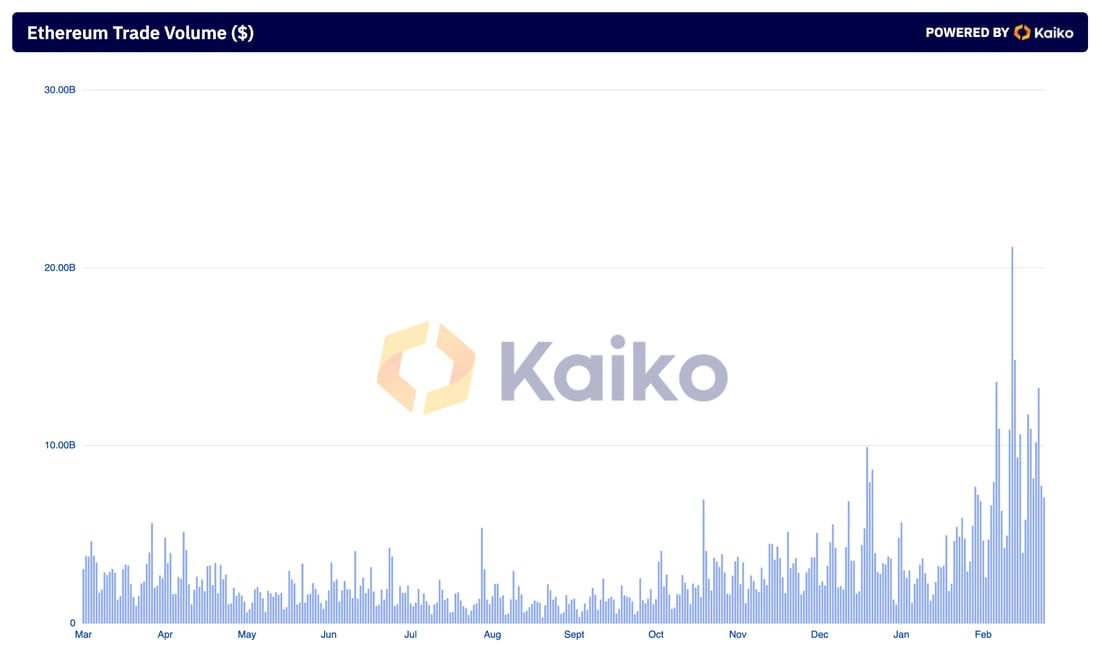

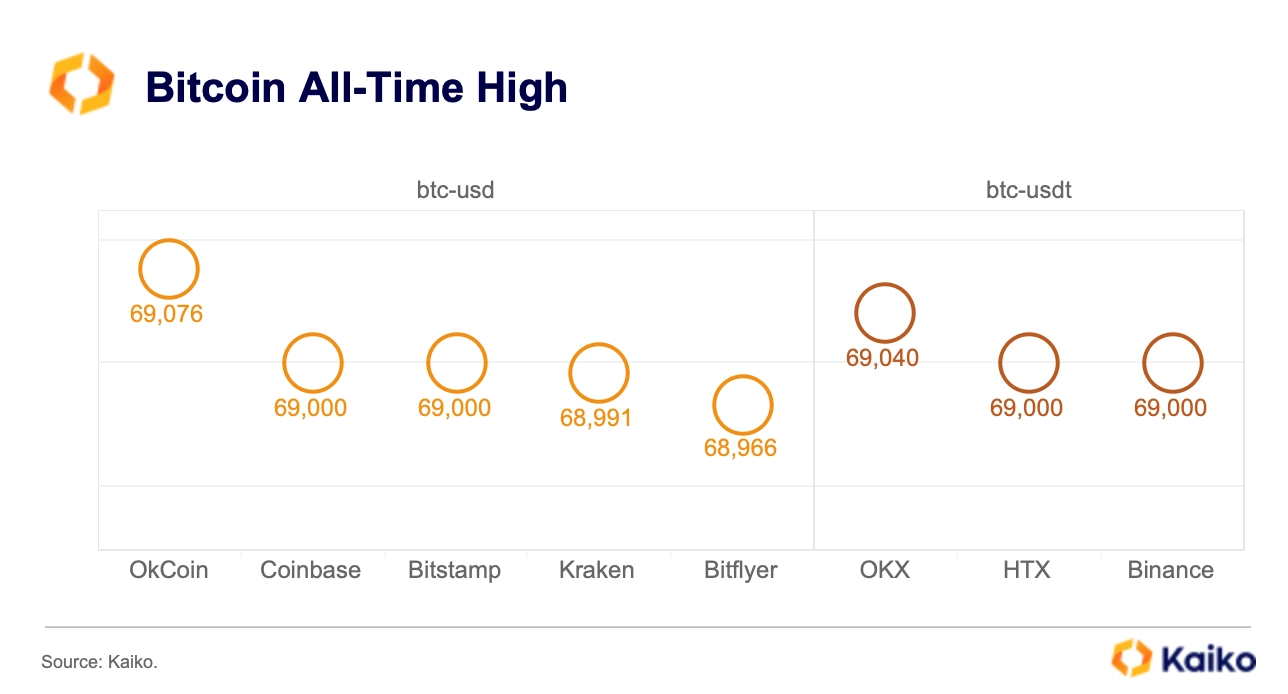

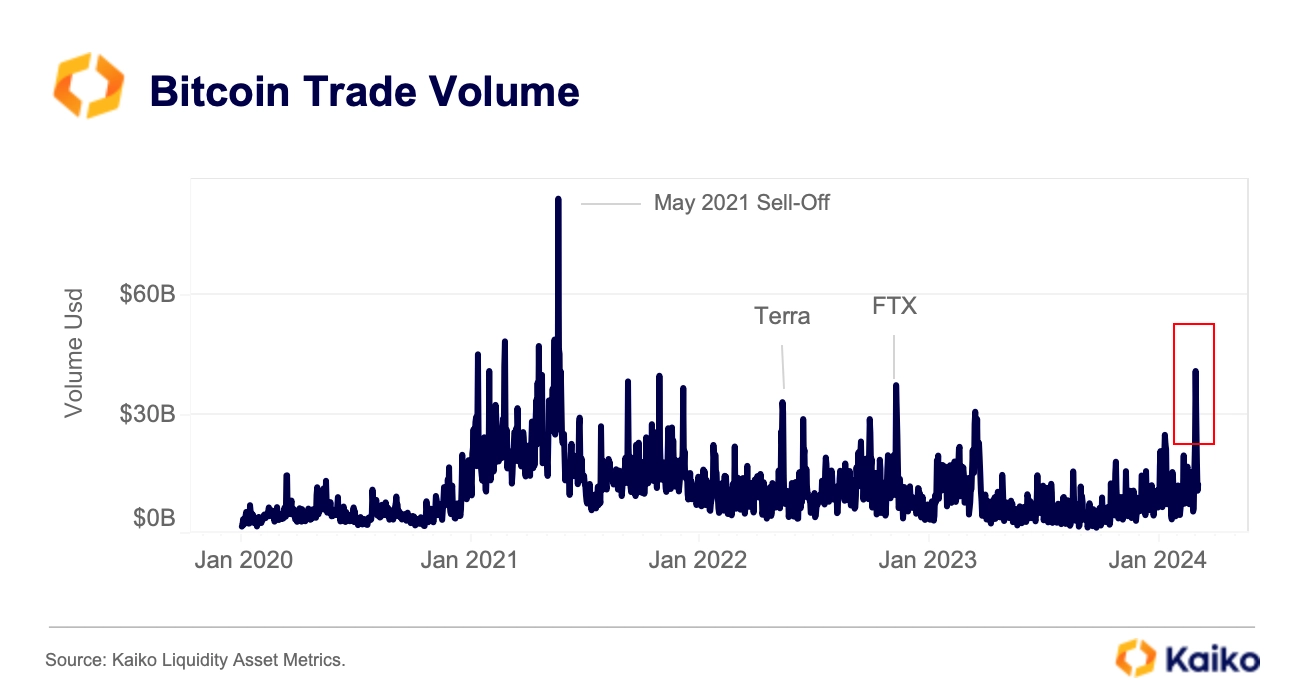

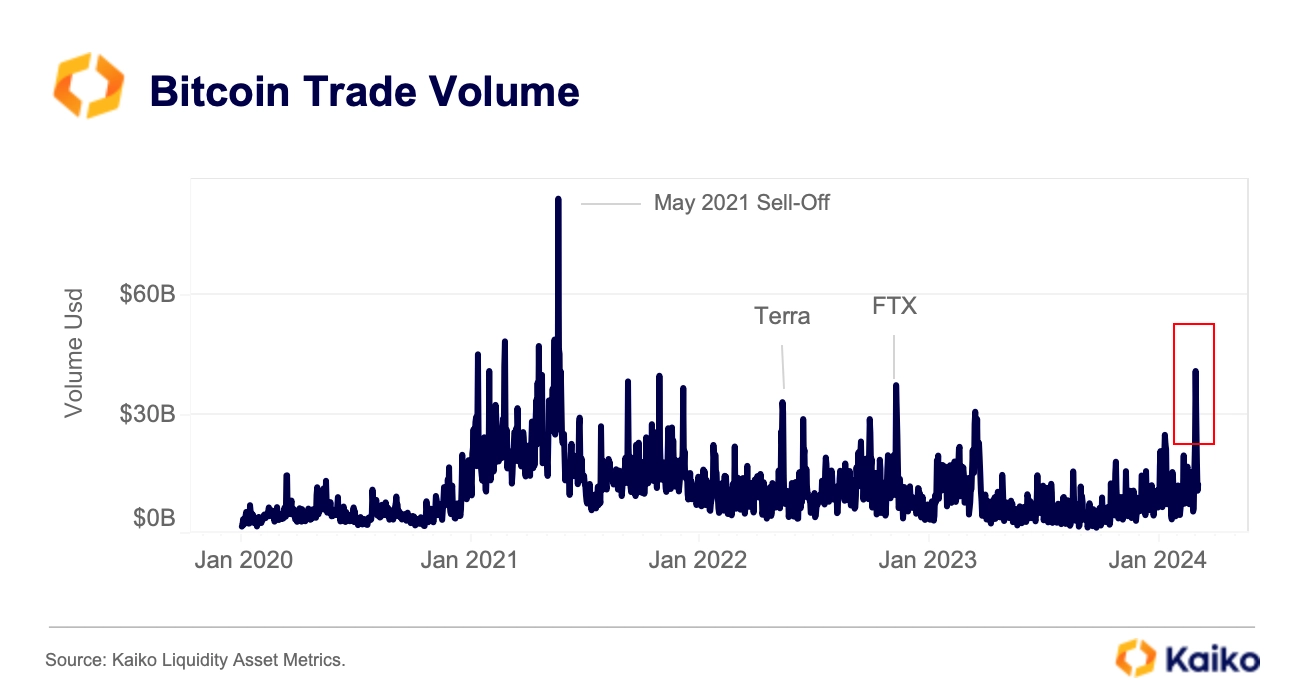

Bitcoin trade volume hit highest since May 2021.

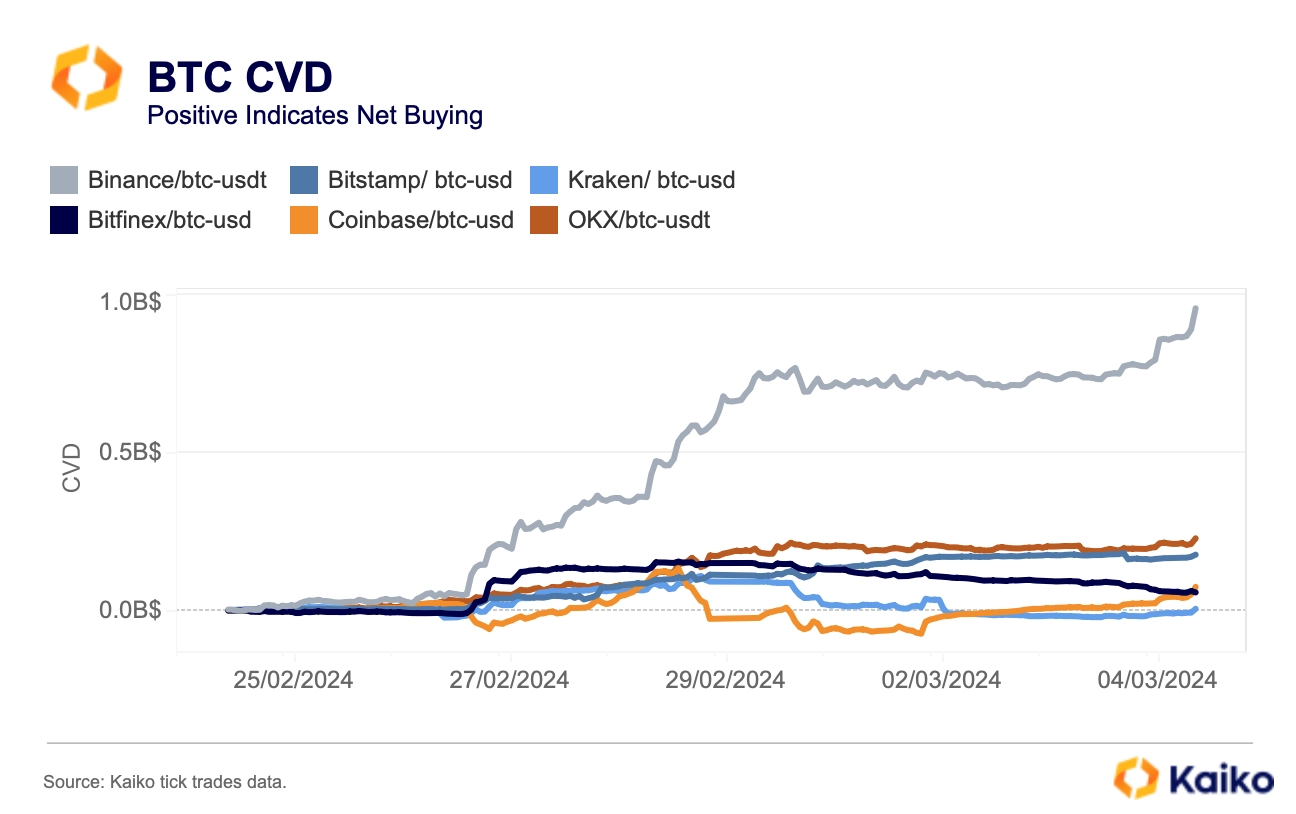

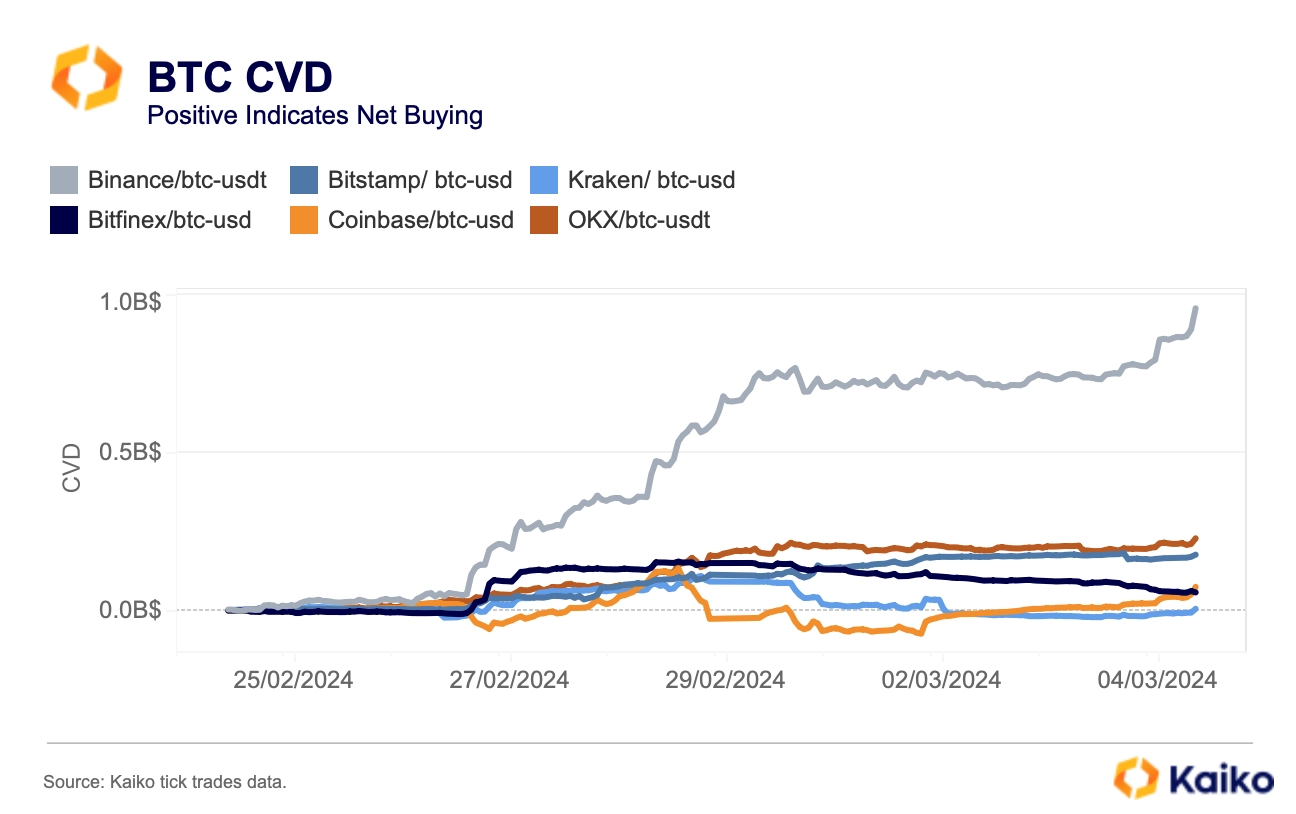

Last week’s price rally was mirrored by both a surge in spot trade volumes and derivatives activity. Bitcoin daily trade volume exceeded $40bn, its highest level since the May 2021 sell-off, surpassing its previous peak hit in the aftermath of the FTX collapse in November 2022. Buying exceeded selling on most exchanges and trading pairs, with offshore platforms leading the way.

Binance saw net buying of nearly $1bn over the past ten days while U.S. exchanges saw significantly less buying activity. It should be noted that Coinbase Prime transactions are not included in our trade data, so we cannot trace the impact of ETF flows on spot activity (prime brokerage data is not public).

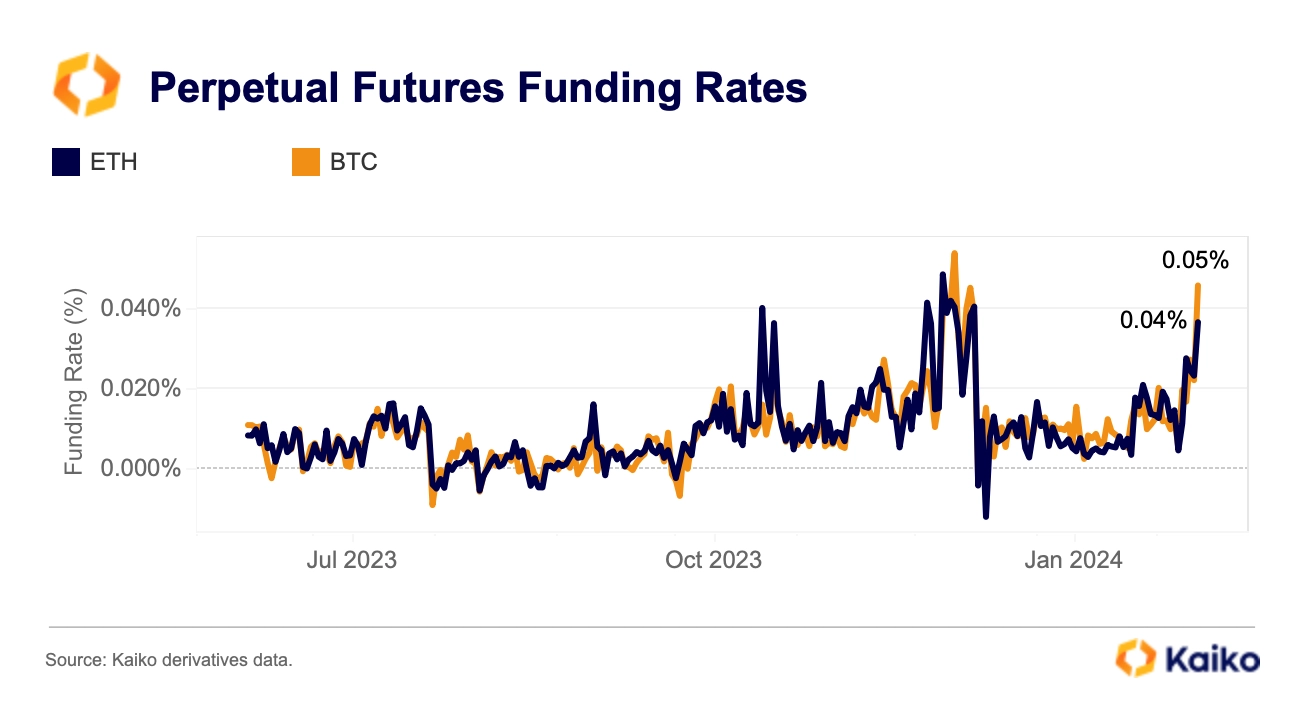

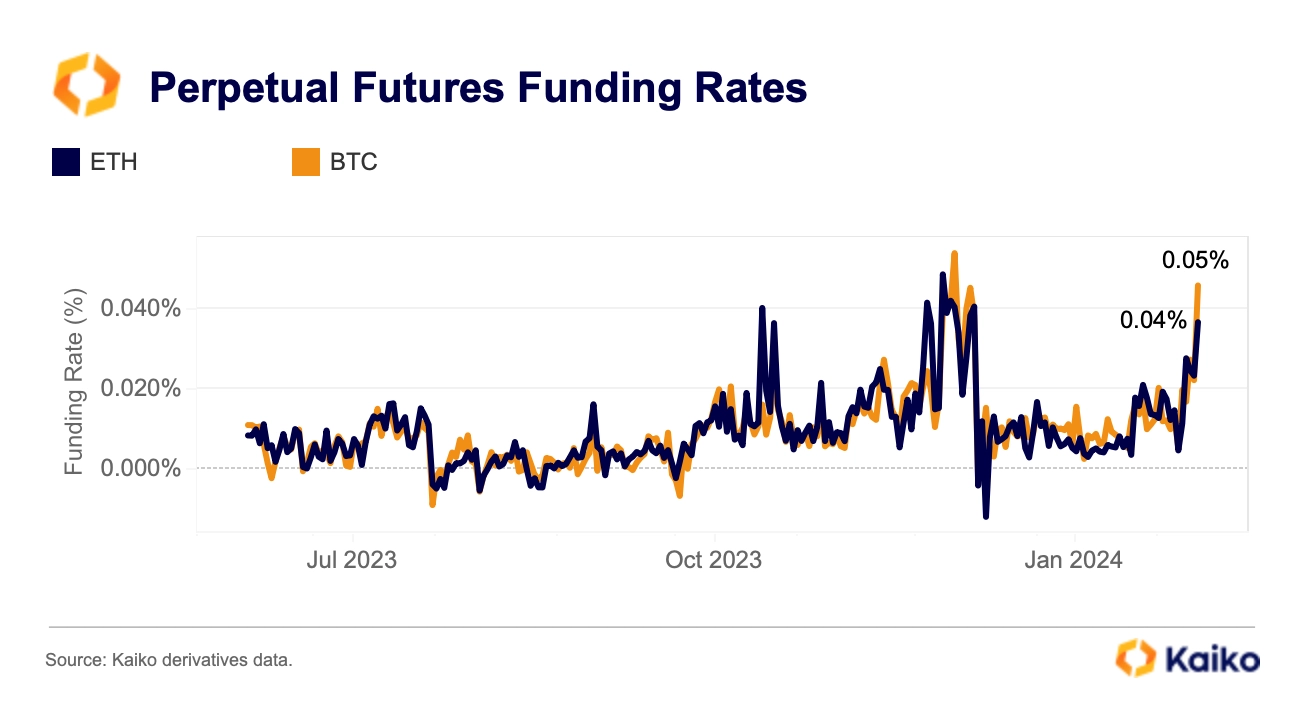

Both BTC and ETH funding rates hit their highest levels since the ETFs approval in early January suggesting rising demand for bullish leverage.

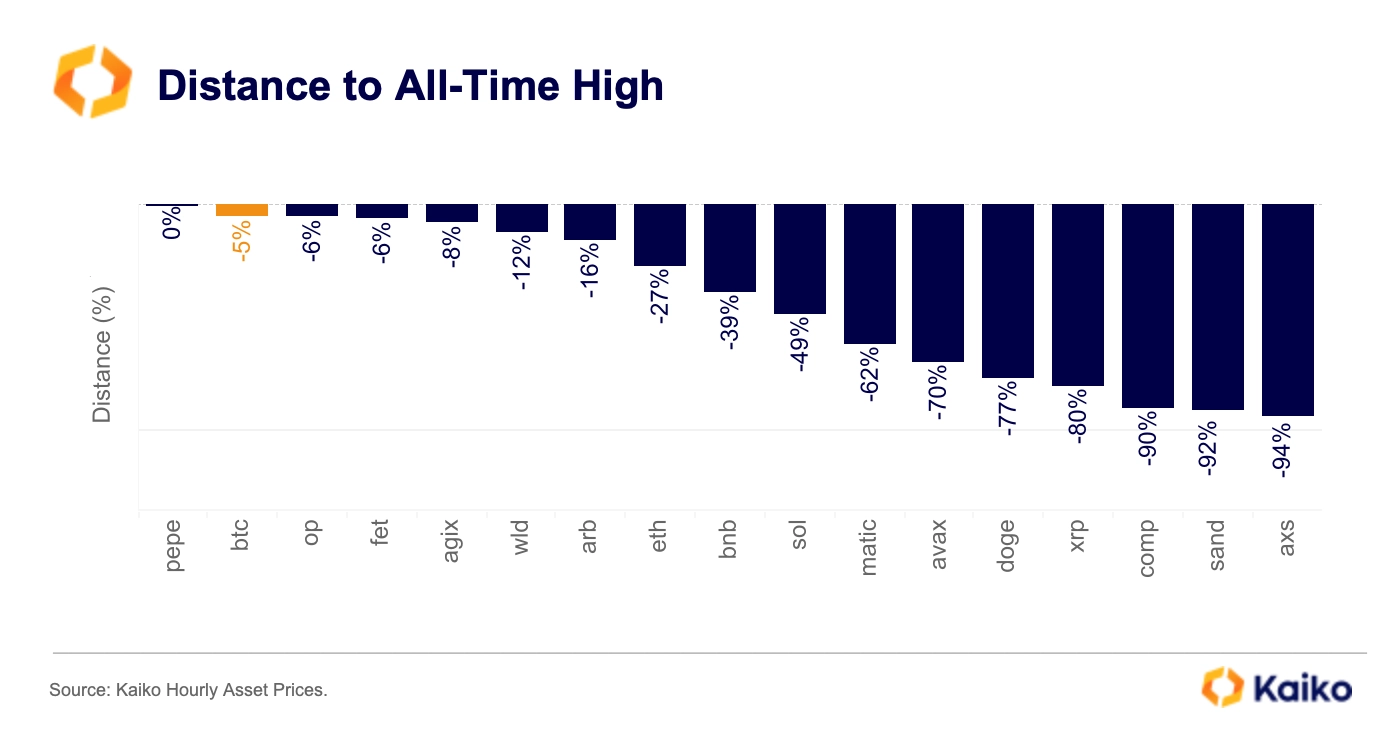

The amount of BTC and ETH open interest in USD terms is currently at its highest level since late 2021. Speculative pockets of the market saw a significant surge alongside Bitcoin suggesting risk appetite is back.

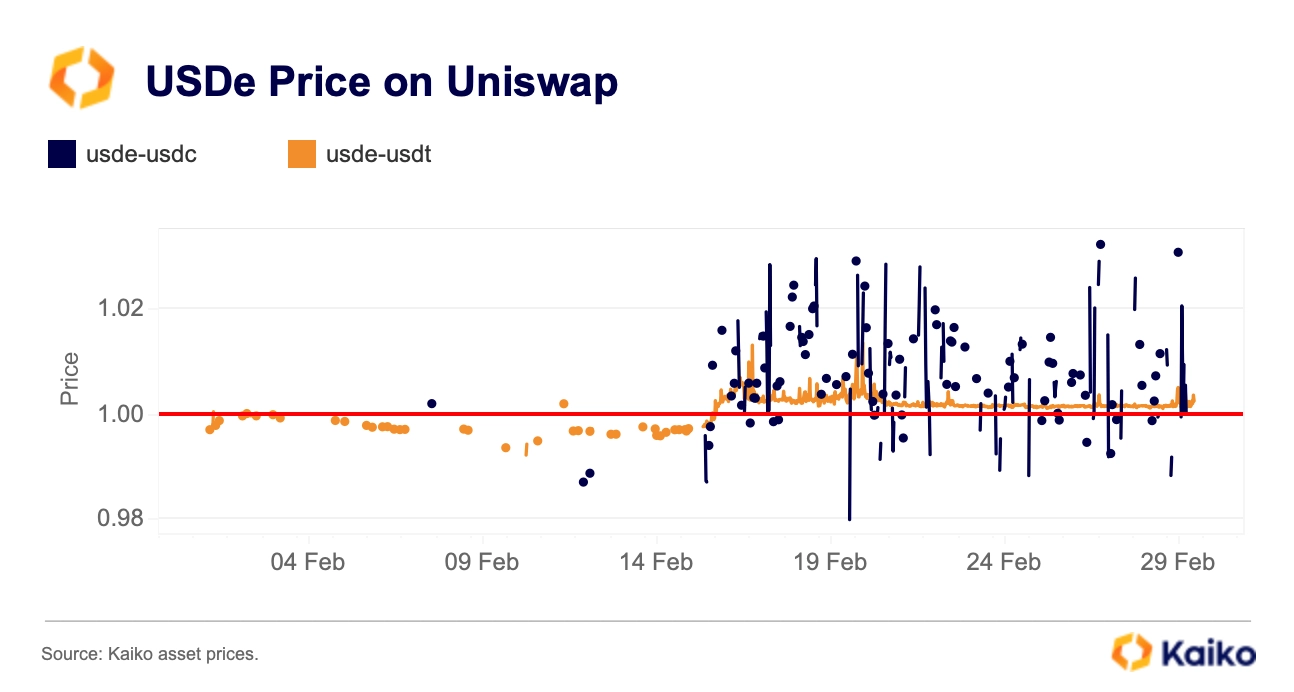

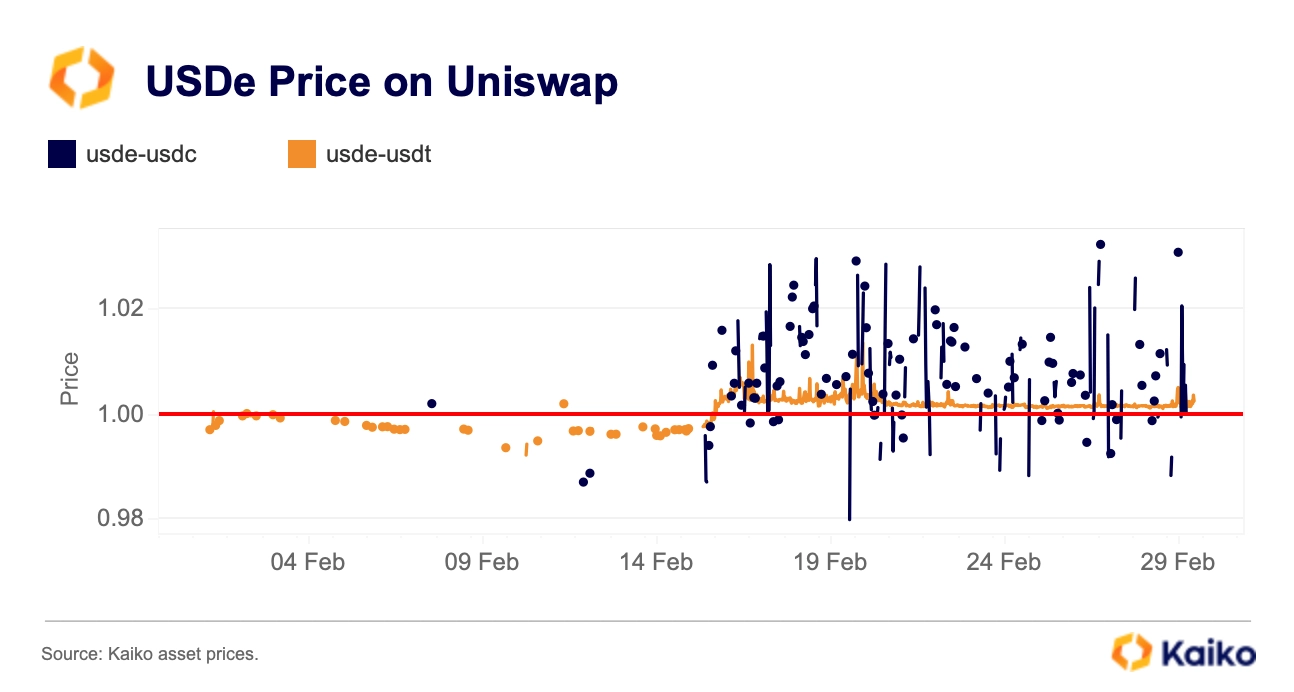

Ethena’s USDe trades at a premium on Uniswap.

Ethena Labs’s newly launched synthetic dollar USDe made a controversial debut in February due to its double-digit yield and the company’s marketing strategy. The token, which currently trades on Unswap, has been trading at a premium against USDC and USDT since mid-February, suggesting strong demand. Its average trade volume over the past two weeks amounted to more than $45mn, which is above the average volume of most small-cap centralized stablecoins. USDe is intended to be pegged to $1 and can be staked, generating variable yield depending on ETH’s funding rates.

Yield bearing products have gained traction over the past few months despite facing a tightening regulatory environment. At the end of 2023 a U.S. court ruled that stablecoins in combination with related yield protocols such as Terra’s UST are securities.

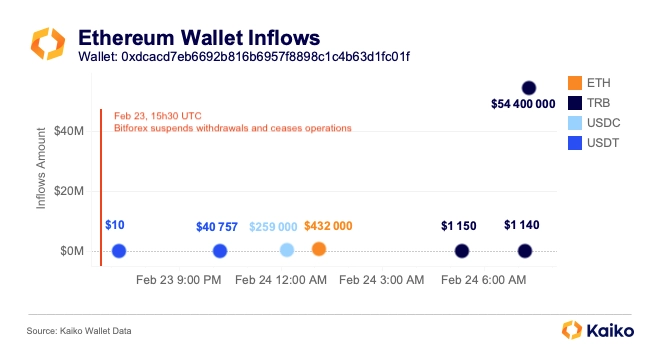

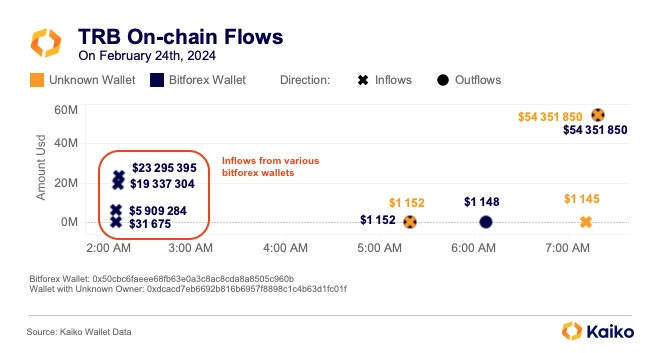

Mapping suspicious on-chain transactions from Bitforex.

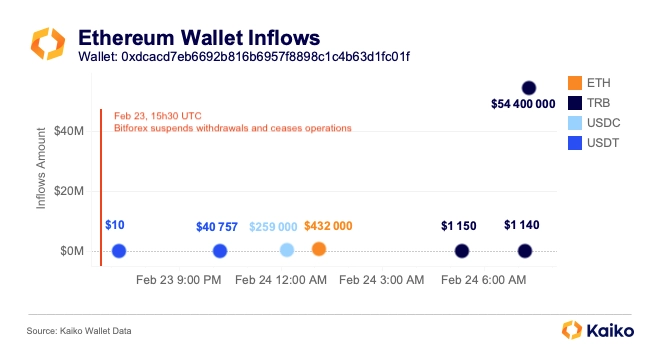

At 15h30 UTC time on Feb 23, Hong-Kong based exchange Bitforex abruptly halted operations without notice following suspicious transfers of nearly $60mn from the exchange’s hot wallet. Using Kaiko’s Wallet Data we investigated the largest transfers that occurred on Ethereum. Other smaller transfers were made on Bitcoin and TRON amounting to a little less than a million USD.

The chart above shows that an unknown address, 0xdc.., received over $55mn from Bitforex on Feb 23-24, hours before the exchange’s shutdown. Most of the money ($54mn) was sent using a little-known and illiquid token — Tellor Oracle’s TRB.

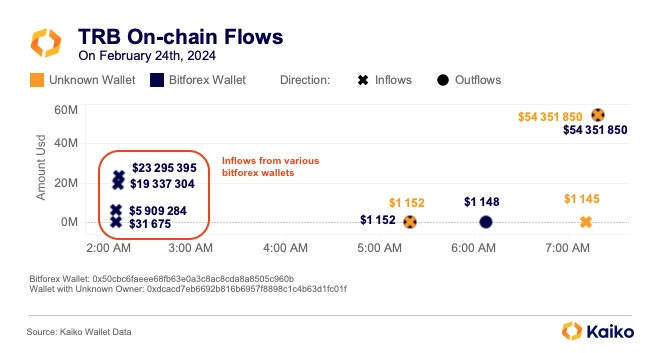

Looking more closely at the largest transfer of $54mn in TRB, the funds have been received by Bitforex’s hot wallet from four different addresses just 5 hours before they were transferred (as a single transaction) to this unknown address.

Interestingly, our data shows that they have not moved since. Created back in 2018, Bitforex facilitated an average of $1.3bn in daily trade volumes over the past year, which is comparable to HTX. However, as we wrote last year, there is evidence that some of its volume was in fact artificially boosted via wash trading.

Additionally, the firm has been reported by Japan’s Financial Services Agency, alongside MEXC, Bitget, and Bybit, for operating without proper registration within the Japanese territory. Given these elements, the overall situation surrounding Bitforex is quite concerning for users’ funds, suggesting a possible exit scam or a hack.

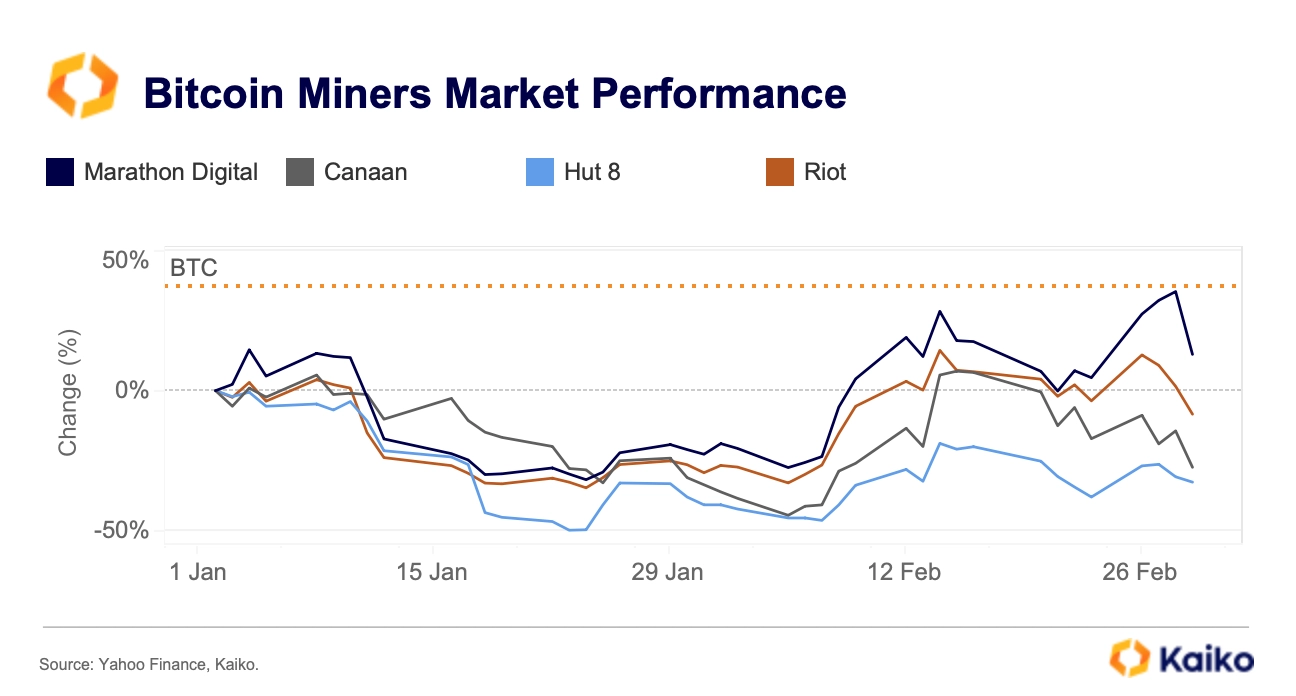

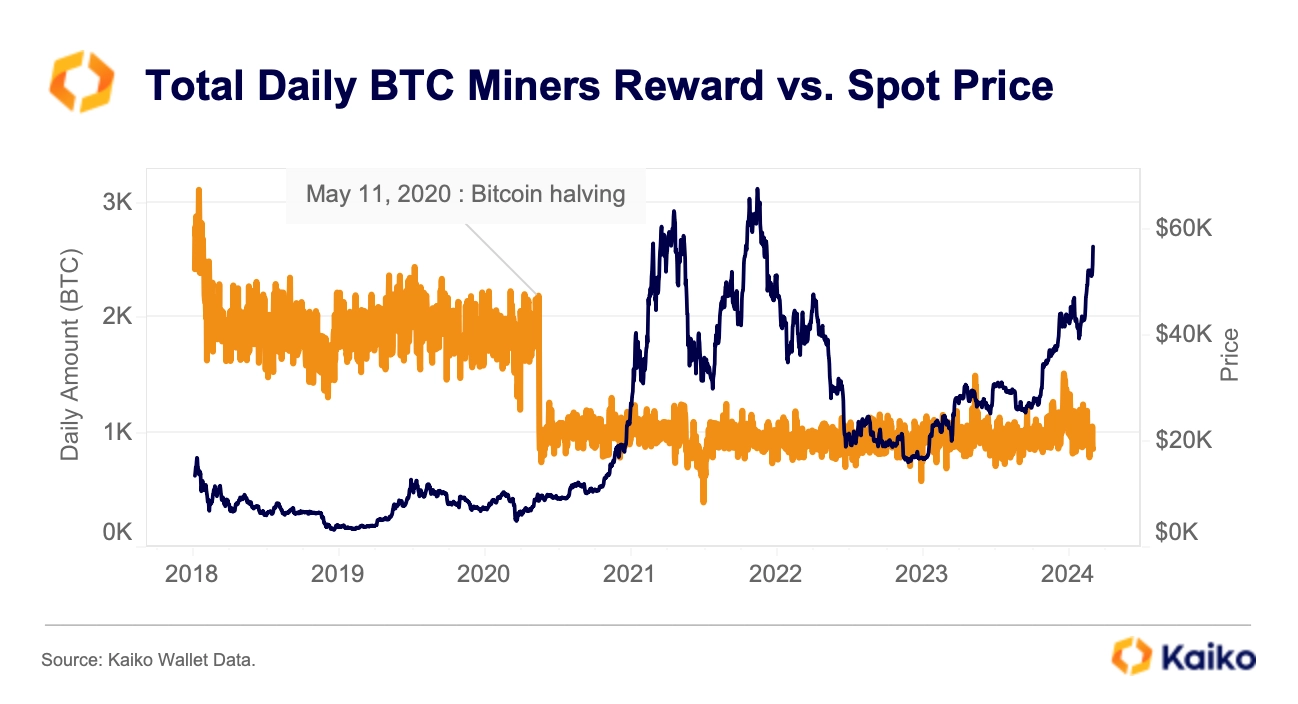

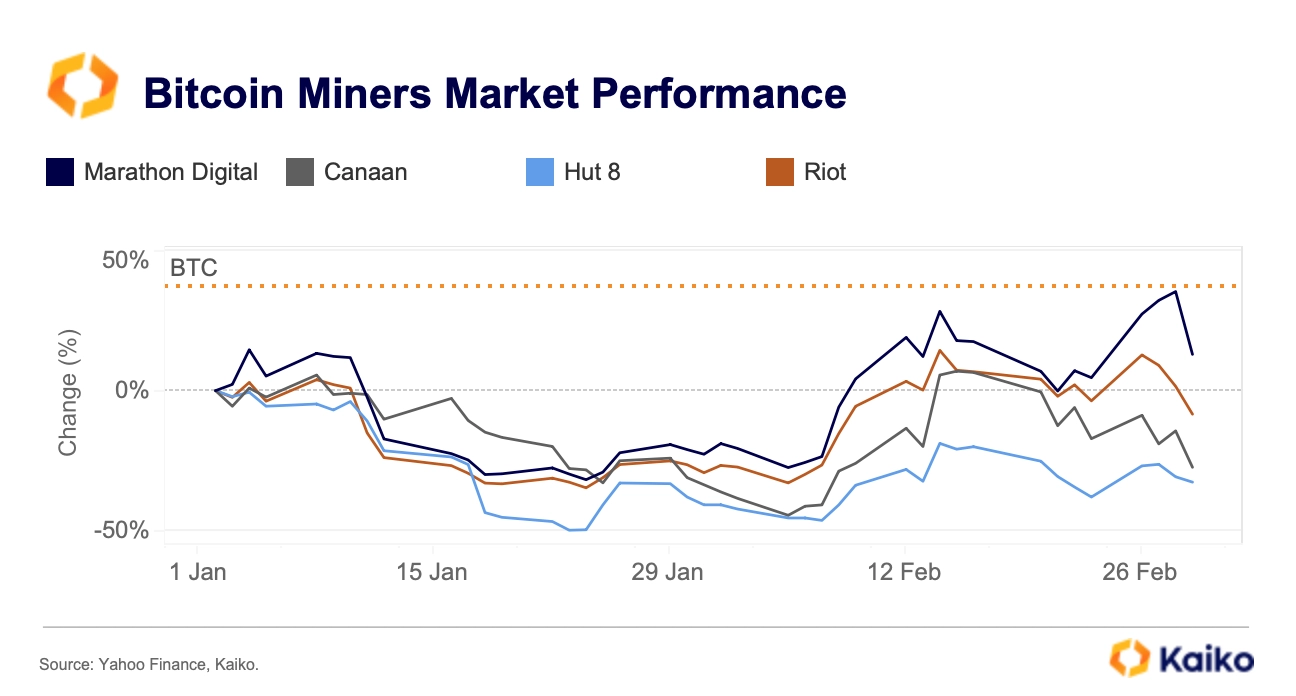

Bitcoin miners underperform ahead of the halving.

With approximately 45 days left before the next Bitcoin halving, all eyes are on the share price of Bitcoin miners. The largest U.S. publicly traded miners have strongly underperformed spot Bitcoin YTD. The divergence was striking last week, with all five miners closing the week in the red despite Bitcoin’s double-digits gains.

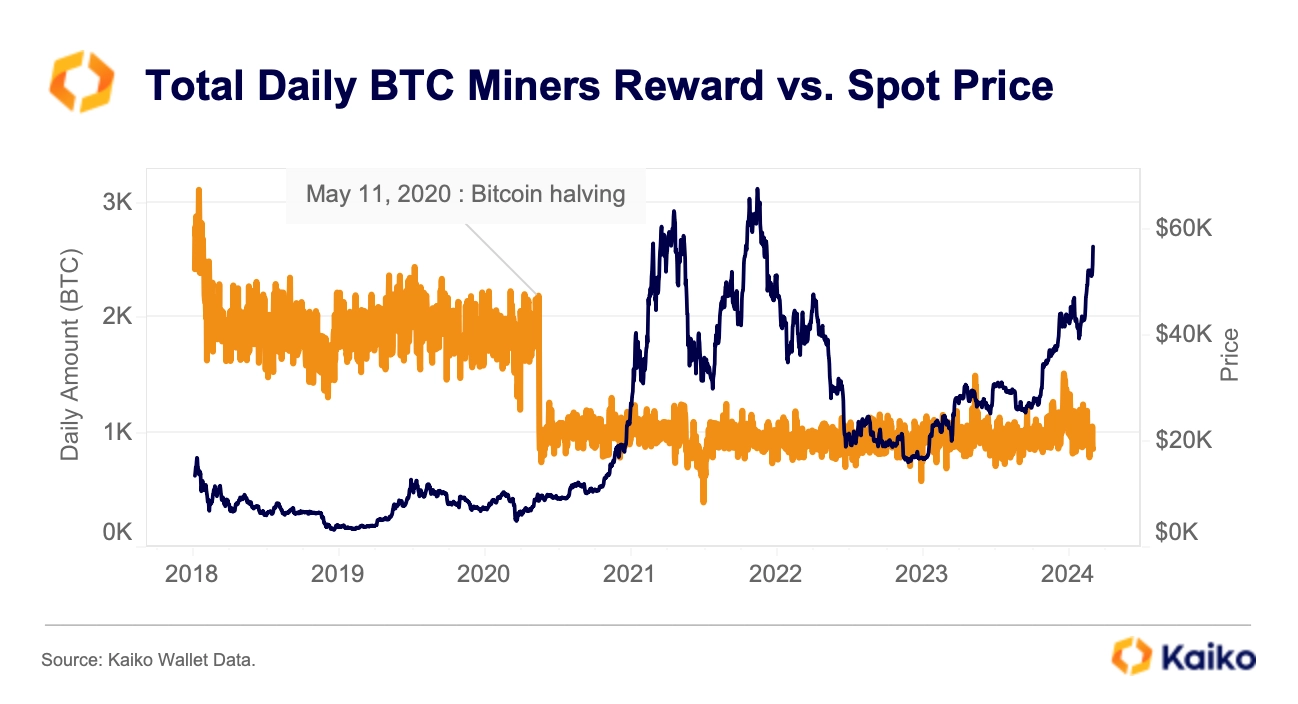

Miners face revenue challenges in the short term as the halving will bring down miner rewards to 3.125 BTC per block from the current 6.25 BTC. Historically, this has favored miners with lower energy costs and led to some miners’ capitulation and a drop-in hash rate (a measure of competition).

Miners are in a better position relative to previous halving events as steady ETF-induced demand could provide support for a Bitcoin price surge – driving miners’ profitability in the aftermath of the event.

![]()

![]()

![]()

![]()