Liquidity

The future of fiat vs. stablecoin usage on CEXs.

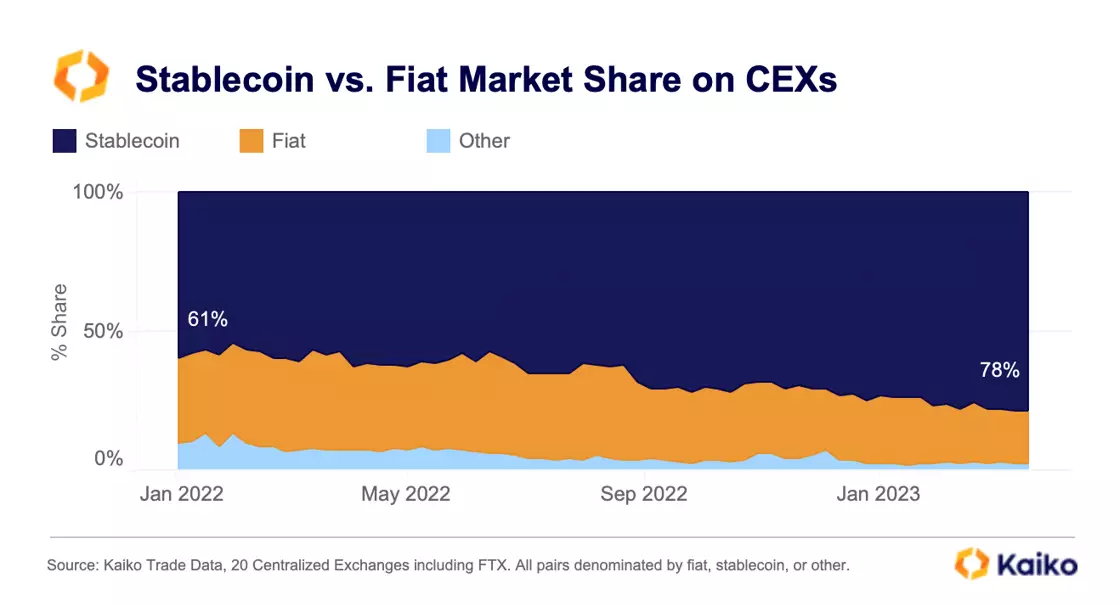

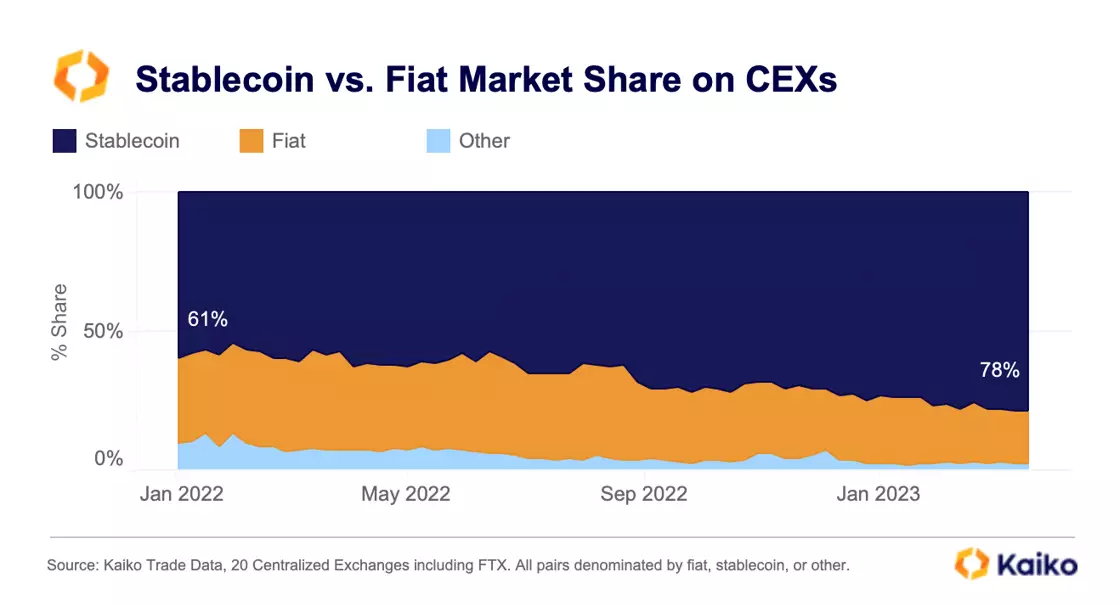

What is the future of fiat vs. stablecoin usage on centralized cryptocurrency exchanges? With the impending end of BUSD, a temporary USDC de-pegging, an increasingly fraught banking sector in the U.S., and growing regulatory scrutiny of stablecoins, this question has never been more relevant.

Today, 78% of all trades on centralized exchanges are denominated in stablecoins while only 19% of trades are denominated in fiat currencies. The remaining volume is traded against BTC, ETH, or exchange tokens like BNB. With increasingly limited fiat on-ramps, we can expect stablecoin market share to increase on centralized exchanges, especially on off-shore platforms like Binance which are already getting cut-off from fiat payment rails.

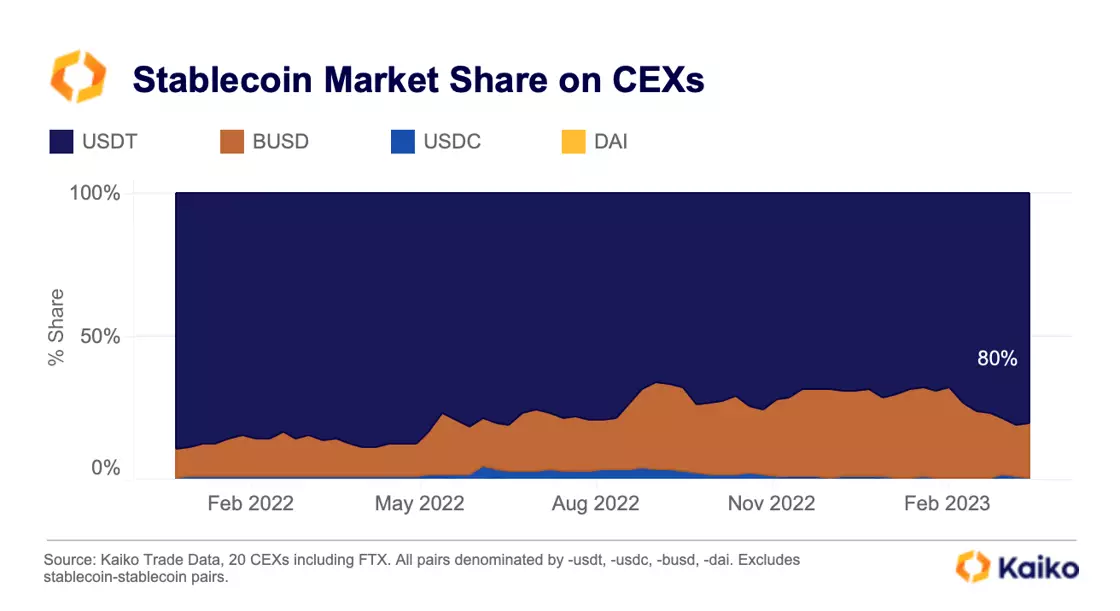

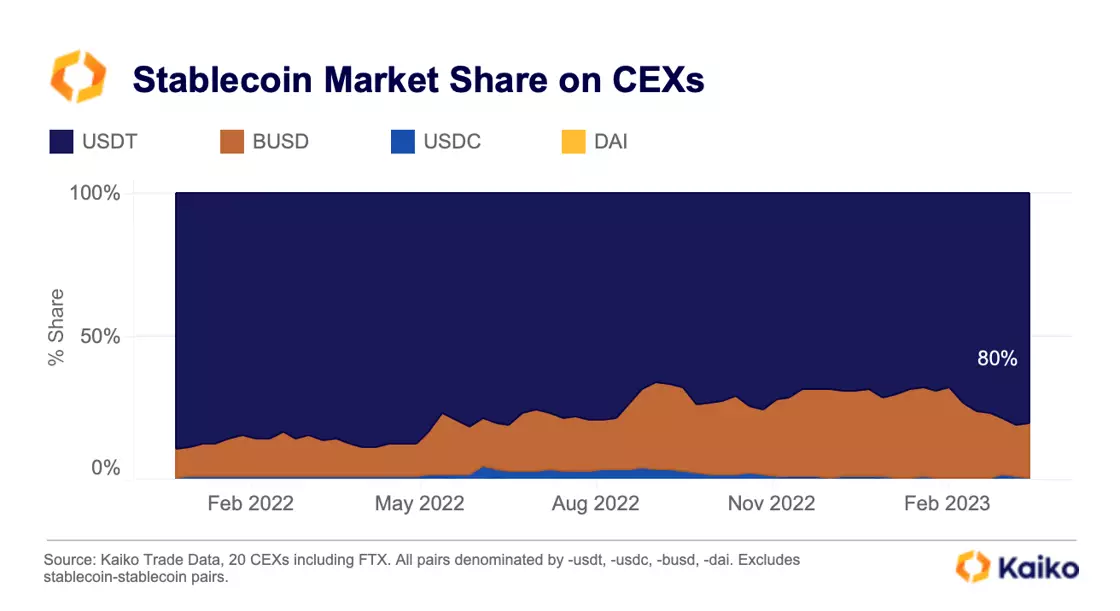

So which stablecoins are leading the race? It’s hardly a surprise: 80% of all stablecoin-denominated trades are using USDT.

At the start of the year, Binance’s BUSD accounted for 30% of volume, but this number has since fallen to 19% and will probably continue to dwindle until the stablecoin is officially discontinued next year. As for USDC and DAI, both stablecoins have very little usage on centralized exchanges and are mostly used within the DeFi ecosystem.

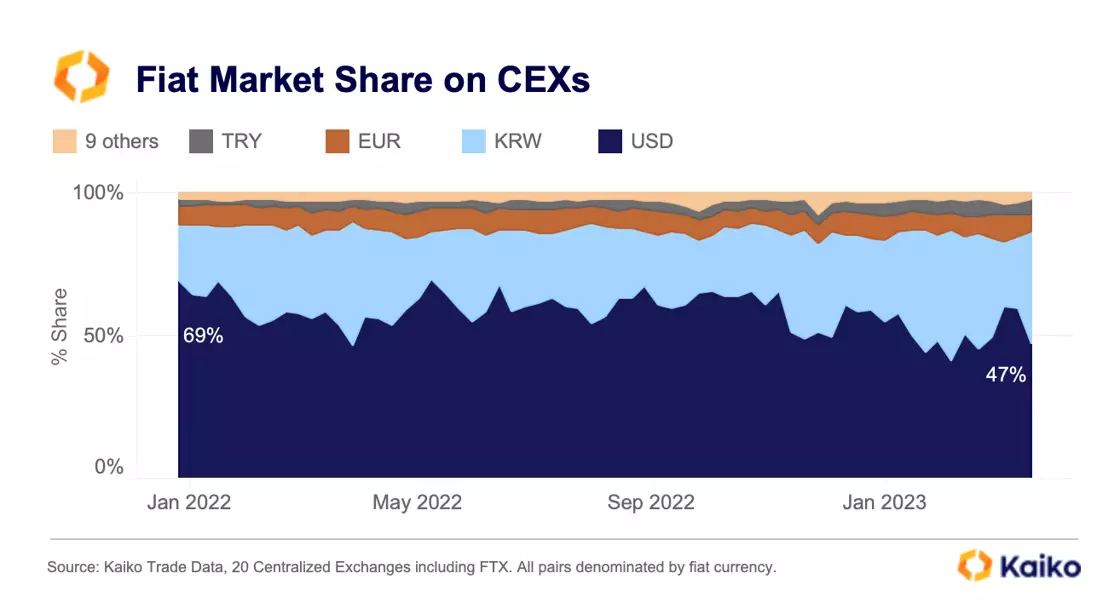

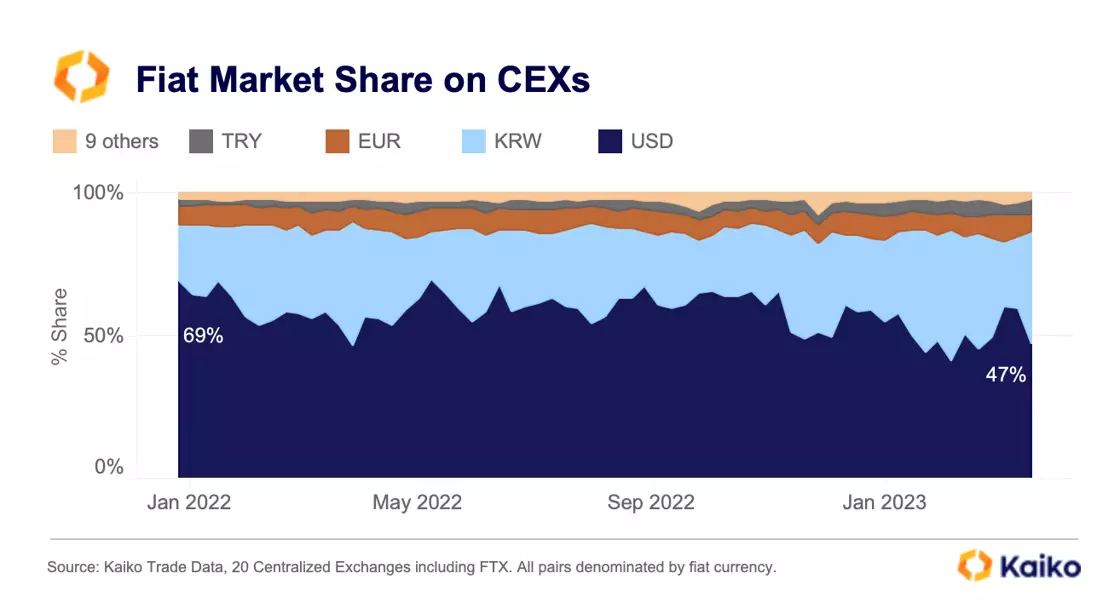

But with every regulatory crackdown comes opportunity, especially for regions abroad. The big question on everyone’s mind is whether Europe or APAC can replace some of the fiat payment rails that have been dismantled in the U.S. Looking at the market share of fiat-denominated trades on exchanges, we can observe that overall, the dollar is still dominant with 47% market share.

The Korean Won comes in second place at 39% suggesting continued interest in this region. APAC has largely been preserved from the banking troubles rippling through the West. The Euro also presents a strong opportunity, but today has very limited use on centralized exchanges, with fiat-denominated volumes at just 6%. The next 10 largest fiat currencies account for a tiny fraction of total crypto volume. Overall, there remain few strong options in a crypto ecosystem without the dollar based on patterns in trade volume, but only time will tell.

Weekend liquidity is consistently lower.

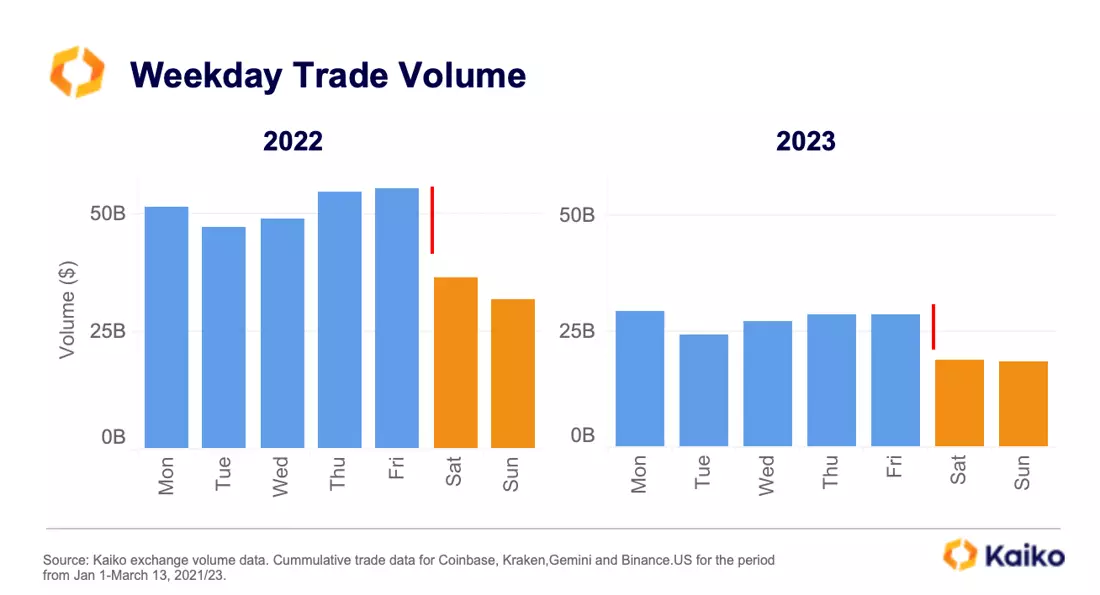

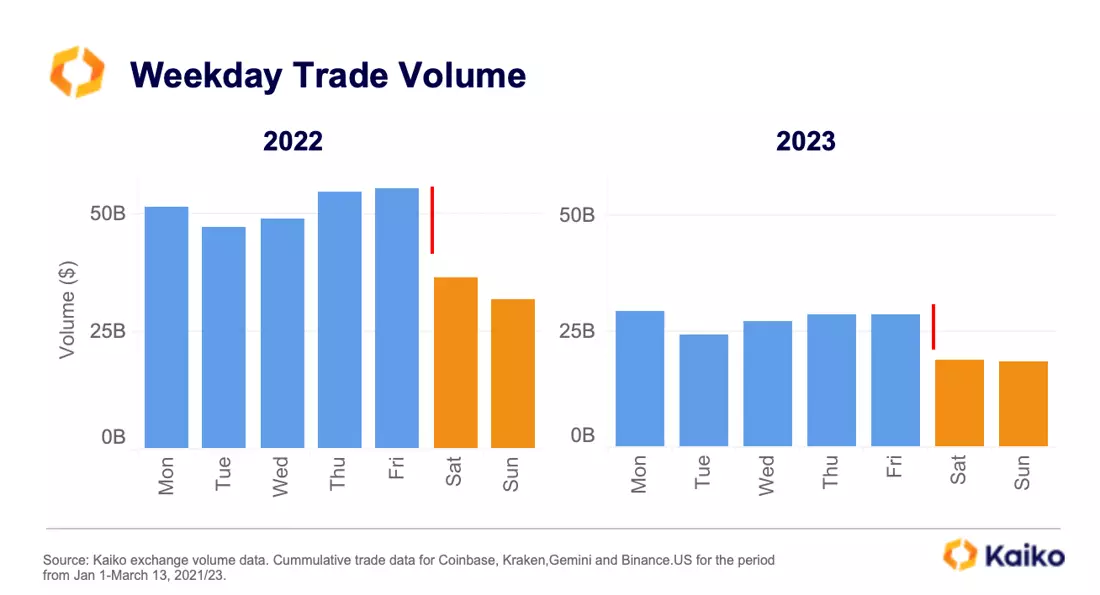

Weekend and overnight liquidity management has always been a challenge for crypto markets, which operate 24x7x365 and struggle to match their needs with traditional financial institutions.

In 2023, volumes were on average 33% lower on weekends relative to weekdays. This gap varies significantly between exchanges, ranging from 40% on Gemini and Kraken to 30% on Coinbase and 24% on Binance.US. The recent closure of two of the main crypto-friendly banks in the US – Signature Bank and Silvergate – will likely exacerbate market fragmentation between exchanges.

To execute OTC deals and stablecoin redemptions smoothly outside regular banking hours, the industry was heavily reliant on real-time payment networks such as Silvergate’s Exchange Network (SEN) and Signature’s SigNet. With these networks gone many traders may choose to stay away from the market on weekends. This will result in even thinner weekend markets and worsened price discovery.

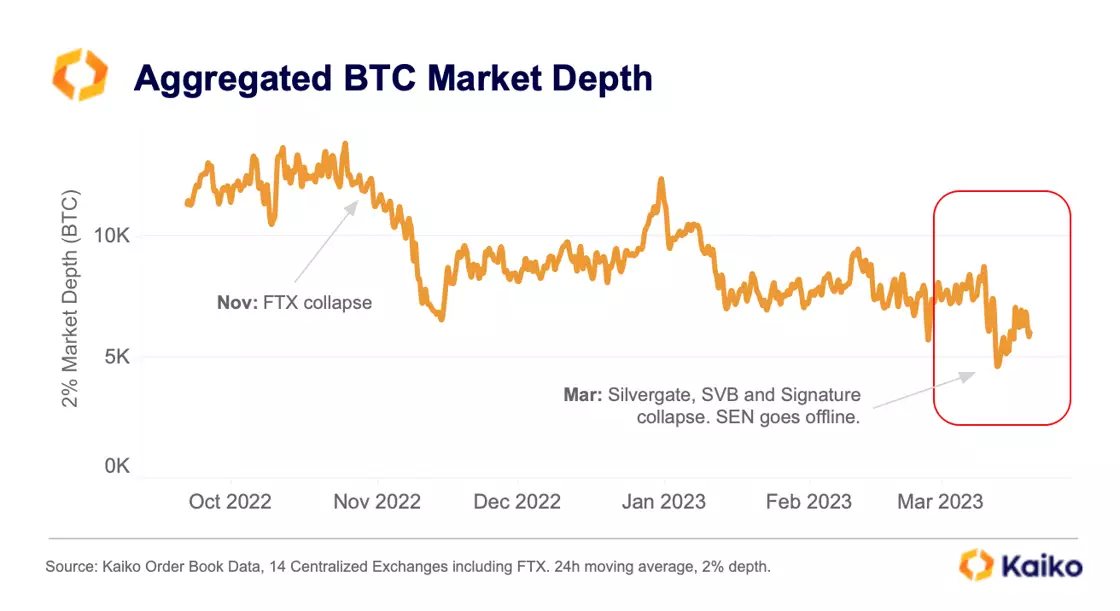

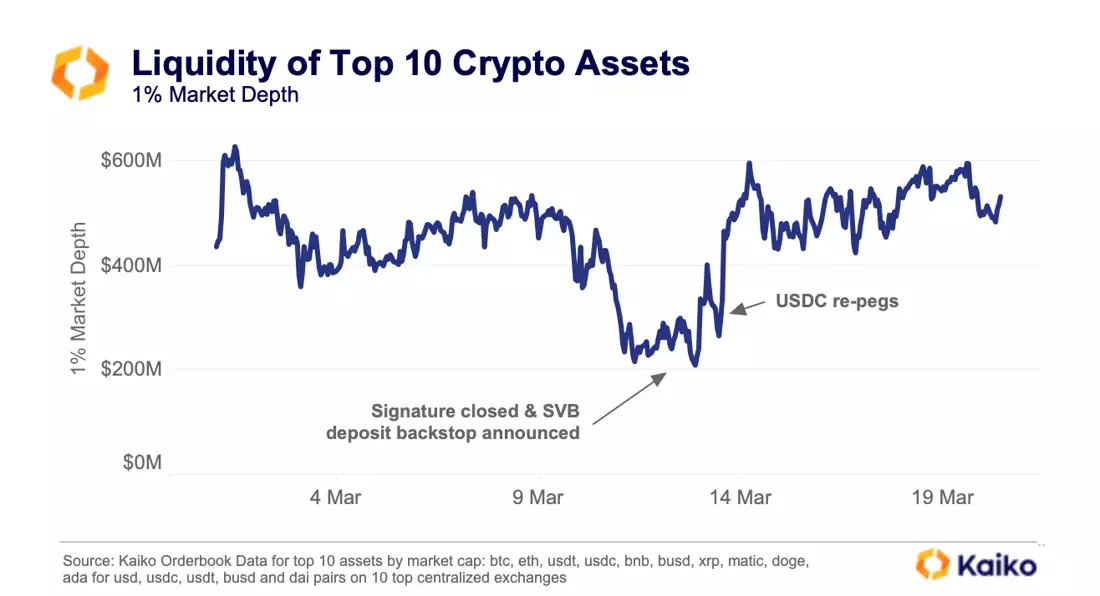

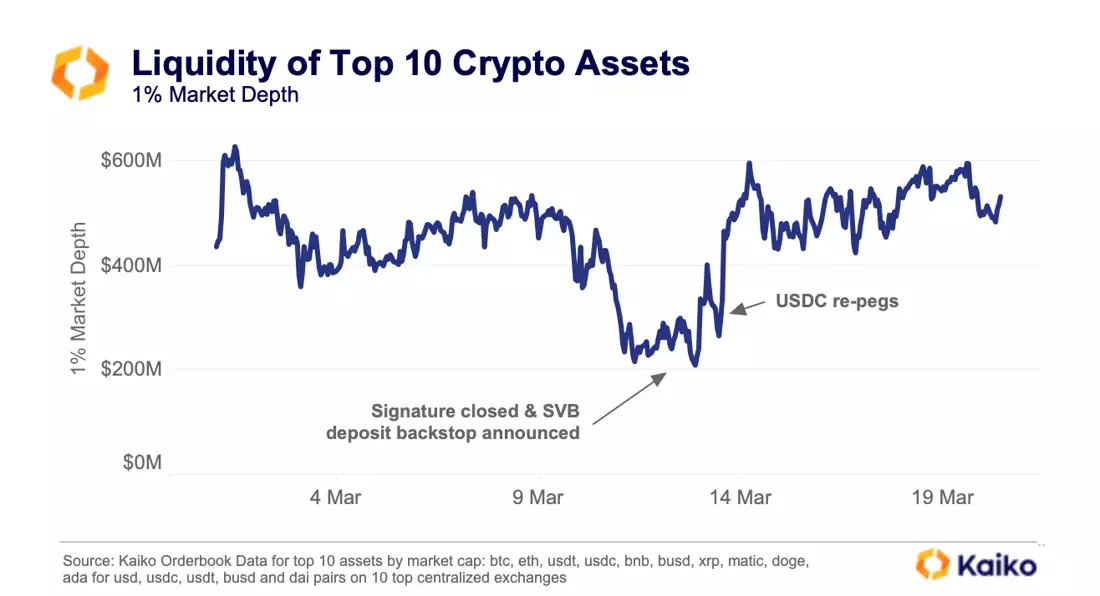

Overall liquidity improving thanks to USDC repeg.

Taking the 1% market depth of the top 10 assets in crypto gives us a useful gauge of the liquidity in the overall crypto market. After the incidents with Signature, Silvergate and Silicon Valley Bank led to a market-wide panic and a de-peg of USDC, liquidity in crypto markets halved in a few days as market makers pulled money out of the market. Since then, liquidity has vastly improved in markets largely thanks to USDC re-pegging.

As we explained last week, the majority of the spike was driven by a $100mn increase in USDC liquidity. Since then, there has been a gradual move upwards in overall liquidity as a result of the rally in crypto prices in the last week. With more liquidity comes less volatility as prices tend to have more support to both the upside and the downside.

![]()

![]()

![]()

![]()