The path to $100k for btc

Between November 5 and 13, BTC surged 30%, setting multiple new record highs and pushing the total crypto market value past $3 trillion for the first time since November 2021. This sharp upward move suggests the market had not clearly and fully anticipated a Republican victory.

Ethereum, which had lagged behind Bitcoin since the Merge in September 2022, is also up 32%, from $2.4K to $3.3K in a week, slightly outperforming Bitcoin. These recent gains indicate that Ethereum is also well-positioned to benefit from a potentially softer regulatory environment in the U.S., which could boost transaction volumes, provide clarity on ETH staking, and potentially allow ETH ETFs to distribute staking rewards, making them more attractive to institutional investors.

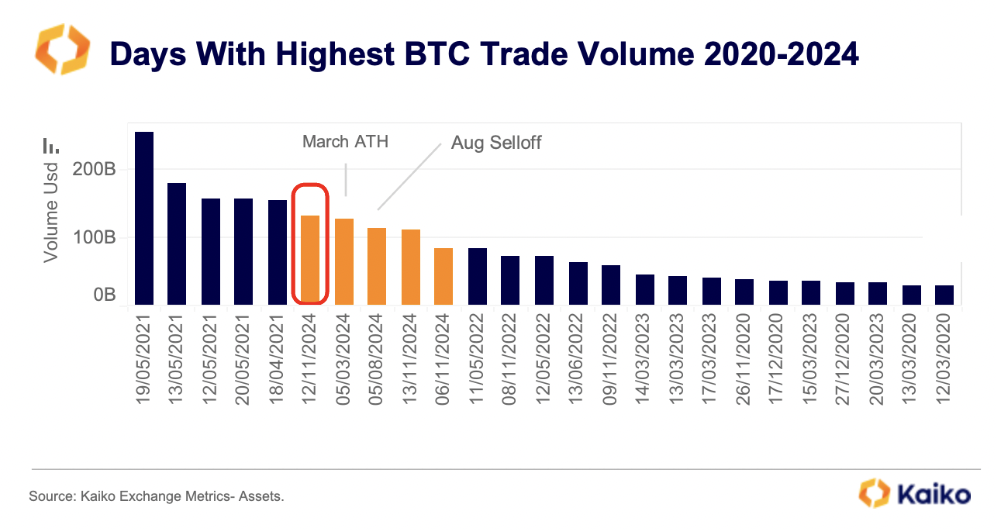

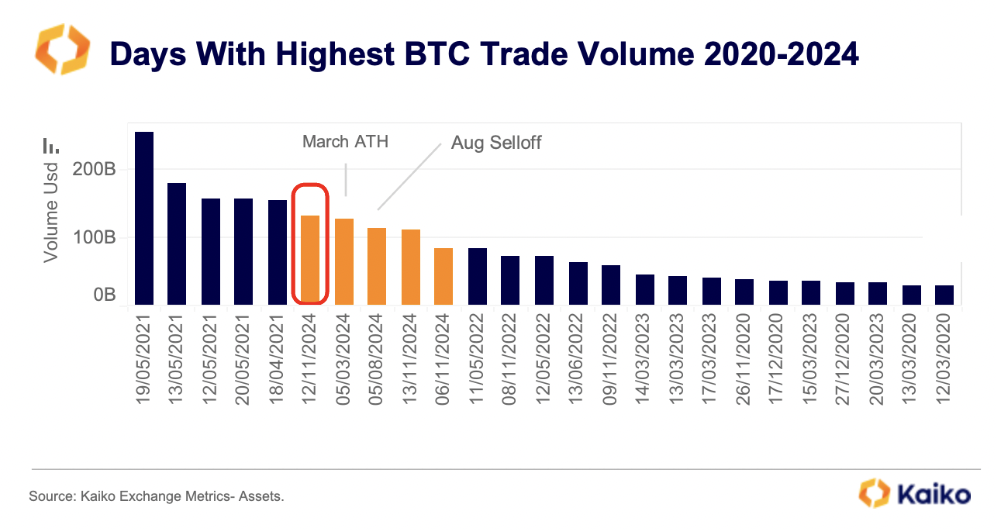

Trade volumes rise to March highs as momentum grows.

Since November 5th, cryptocurrency trade volumes have increased meaningfully, reaching their highest levels since March. This increase indicates growing market participation and suggests that the rally may have further momentum. BTC recorded three of its top five highest daily volumes this year in November, surpassing volumes seen during the August 5th risk-off selloff and its previous all-time high on March 5th.

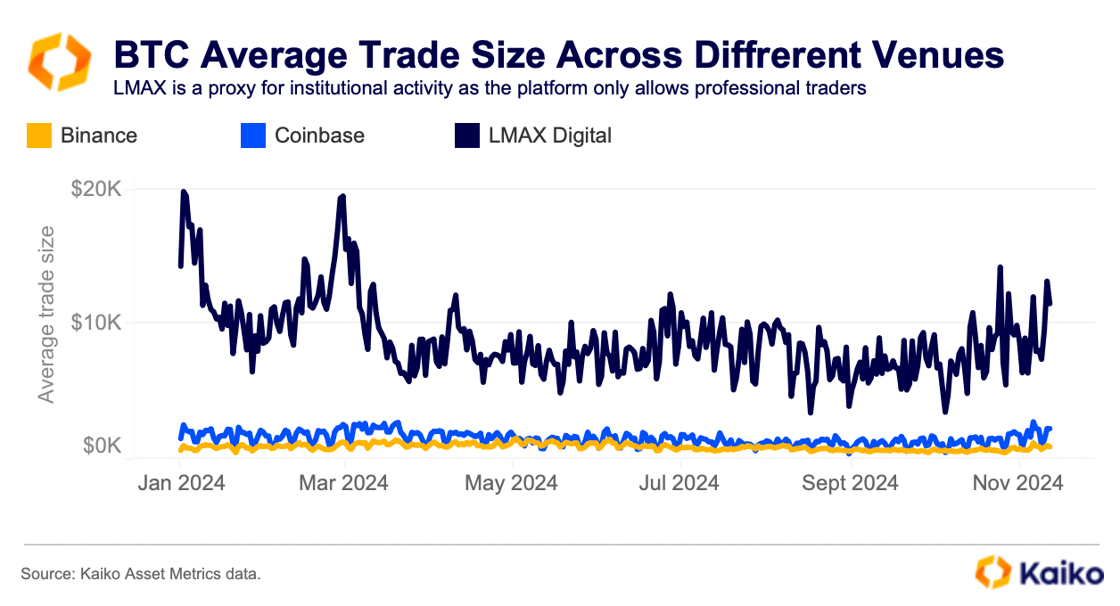

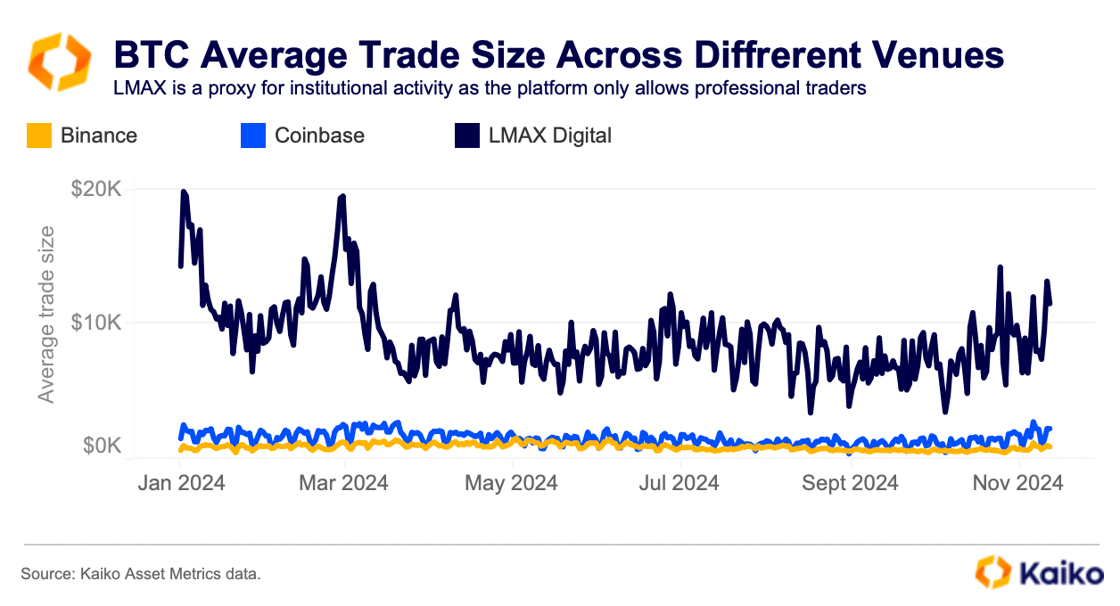

Although it’s difficult to determine whether the rise in trading is driven by retail or institutional traders, we’ve observed an increase in the average trade size, especially on institutional-only exchanges such as LMAX Digital. This could suggest growing participation from larger traders, although the average trade size has yet to reach the levels seen in January.

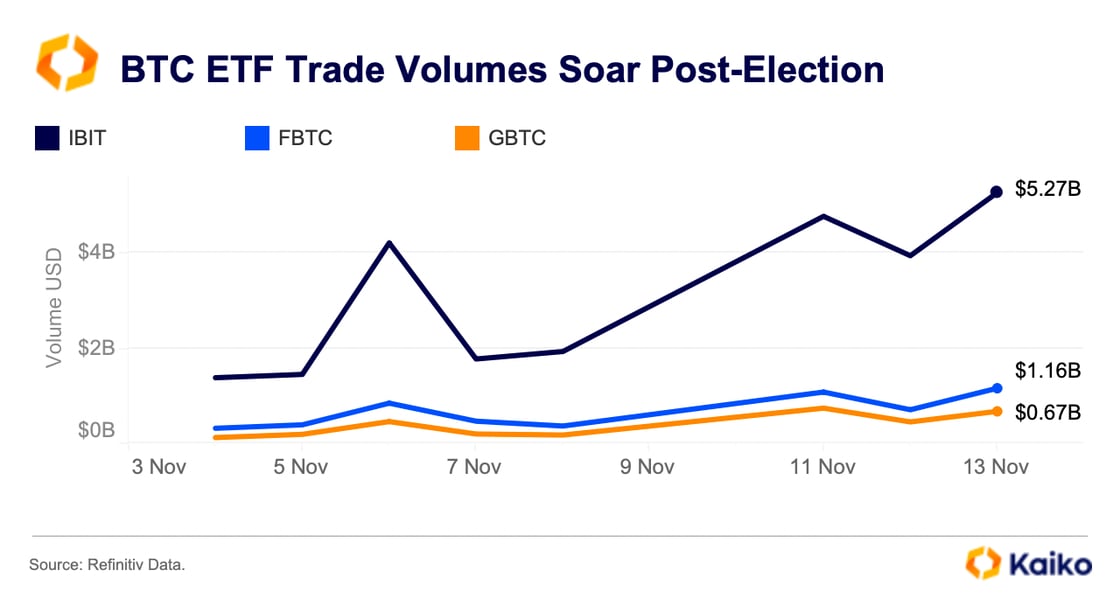

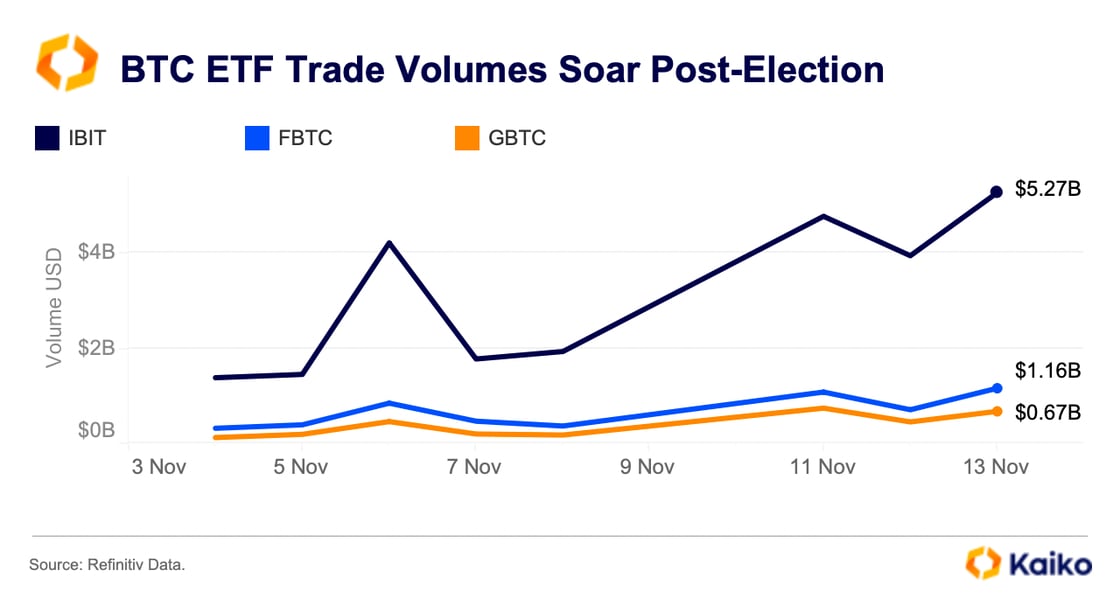

Spot ETFs smash records amid BTC rally.

Last week, both spot crypto markets and BTC ETFs saw record-high trading volumes, with BTC ETFs alone recording $6 billion in trade volume following the U.S. general election. BlackRock’s IBIT was a major beneficiary of the growing demand, seeing nearly $2bn in inflows so far this week as its total assets under management rose to over $40bn, putting it in the top 1% of all equity ETFs in the world. IBIT exceeded $5bn in trade volume on Wednesday while Fidelity’s fund had over $1bn for the first time since March.

BlackRock’s spot ETH ETF, ETHA, took in $101mn on Monday, its largest daily inflow since August 6. This suggests traders are beginning to consider ETH ETFs after a muted launch. Now positive flows year-to-date after registering their best weekly inflows yet. Furthermore, there have been no outflows in 6 days from Grayscale’s ETHE, which has bled over $3.1bn since converting to a spot ETF in July.

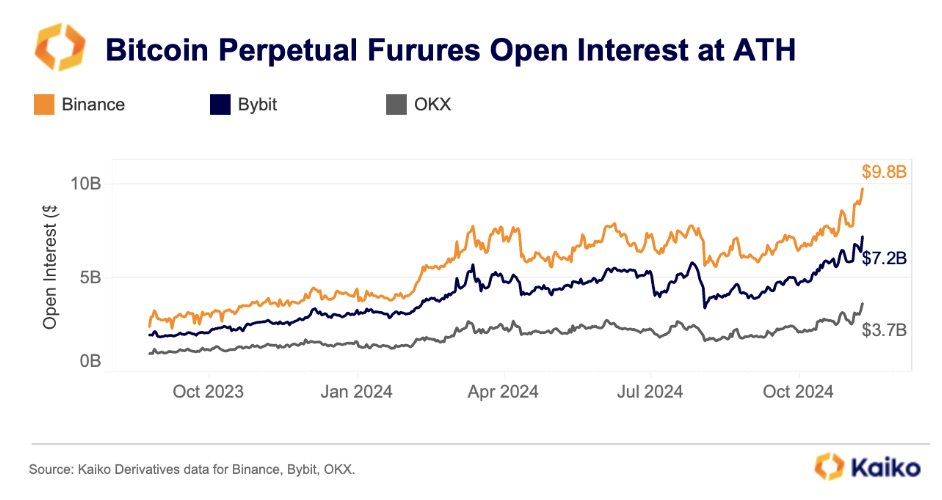

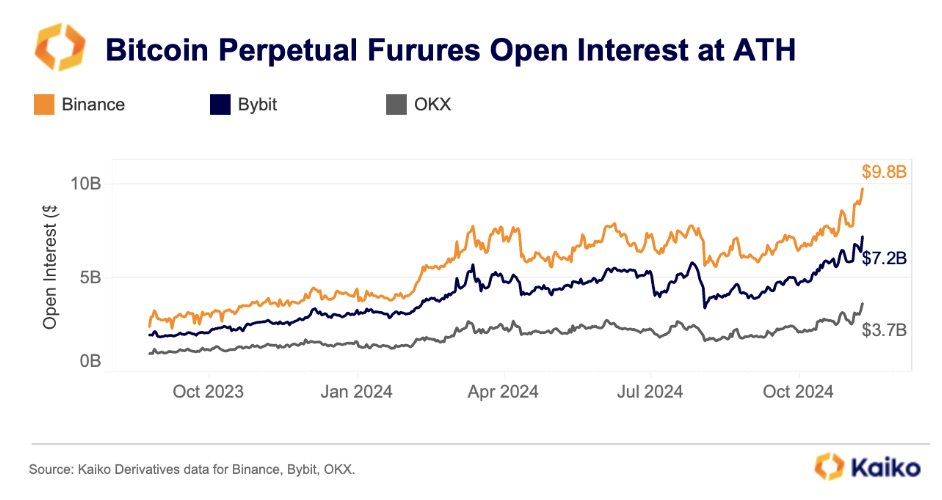

Derivative markets see robust inflows.

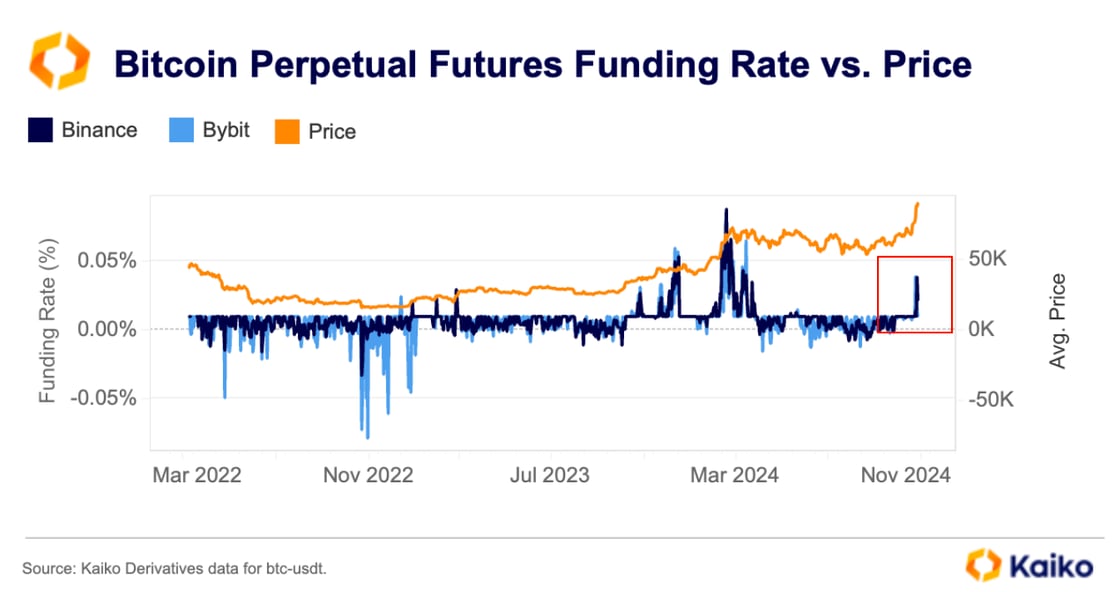

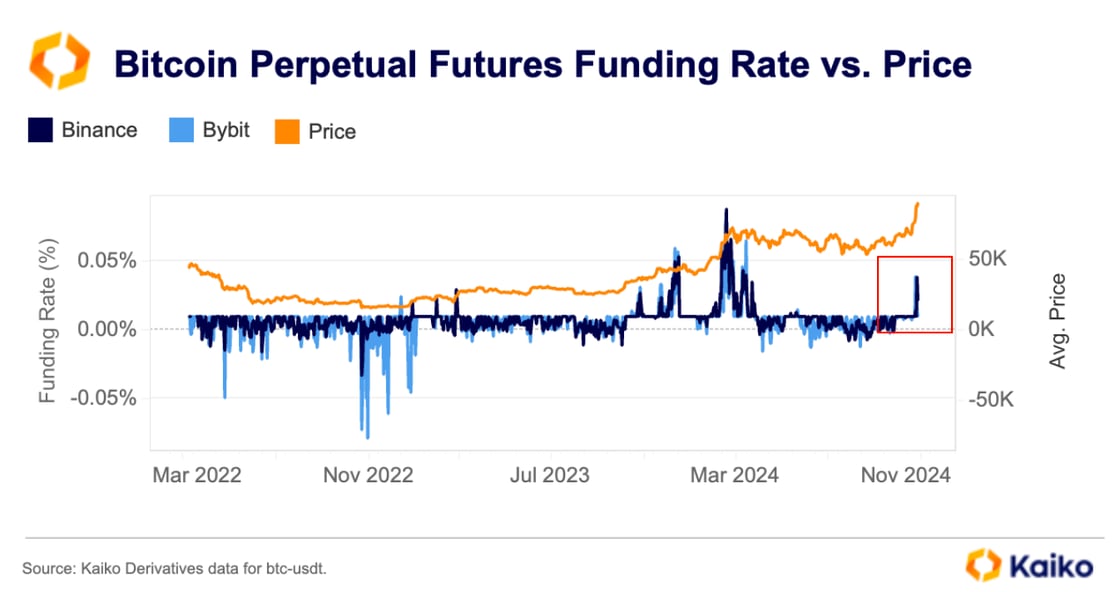

In addition to structured products like BTC and ETH ETFs, traders have increasingly utilized derivatives. Consequently, BTC perpetual futures markets hit record highs over the past week. On November 11, BTC open interest in USD terms reached an all-time high of $20.7 billion across Binance, Bybit, and OKX.

Funding rates also turned positive, indicating growing bullish demand. However, open interest in BTC terms remains below its levels from October 2022, and funding rates are still lower than in March, when BTC was also at an all-time high. This suggests that the move is not driven by excessive leverage.

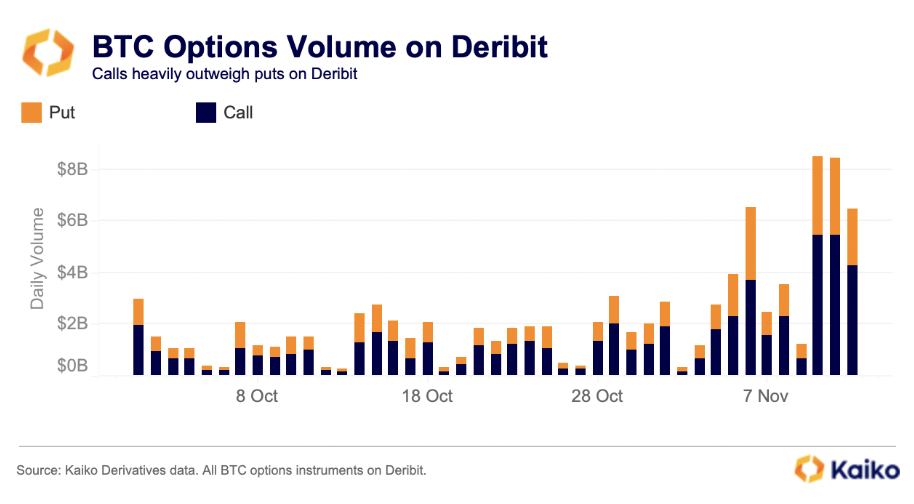

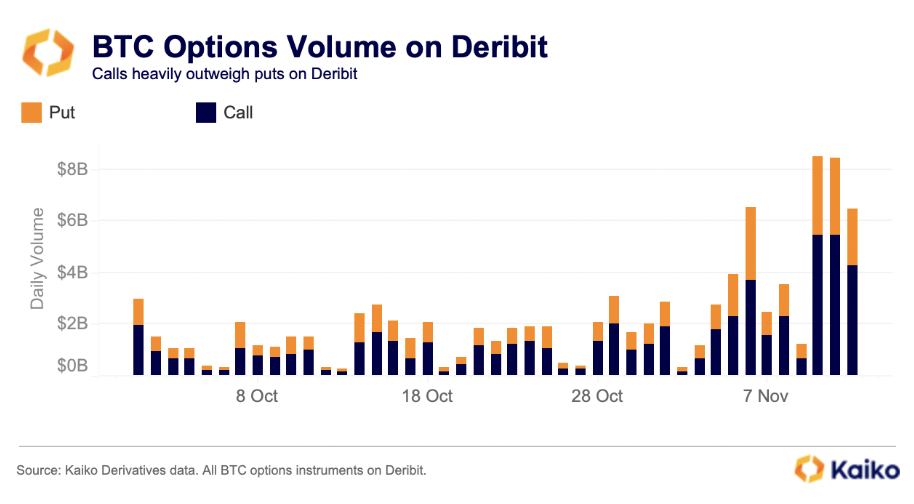

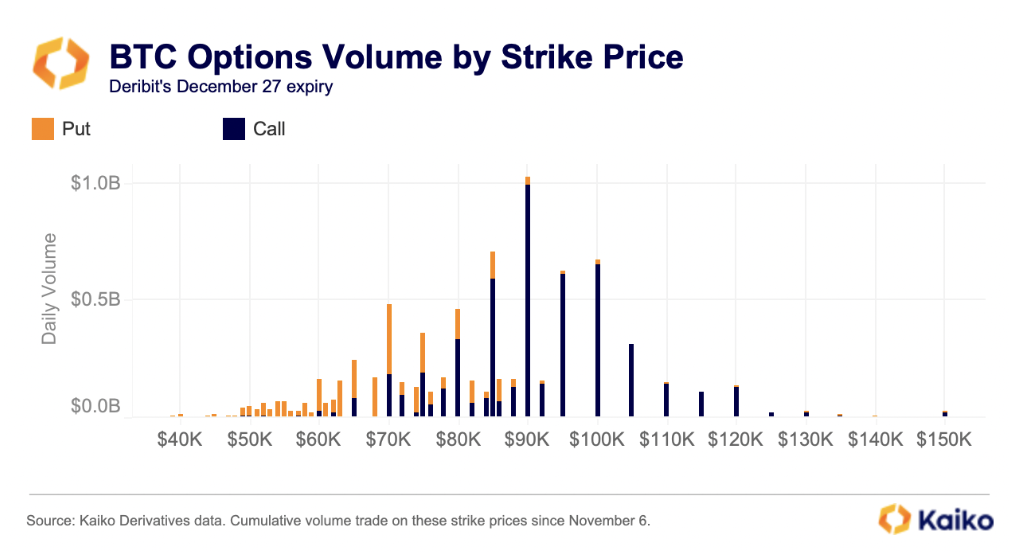

Options volumes soar, traders pile into end of year bets.

There was $7.9bn in BTC options traded on Deribit, the largest crypto options exchange in the world, last Wednesday following the US election. Volumes rose again on Monday as BTC approached $90k, with over $8.2bn in daily volume, $5bn of which were calls—or bullish bets on the price of BTC.

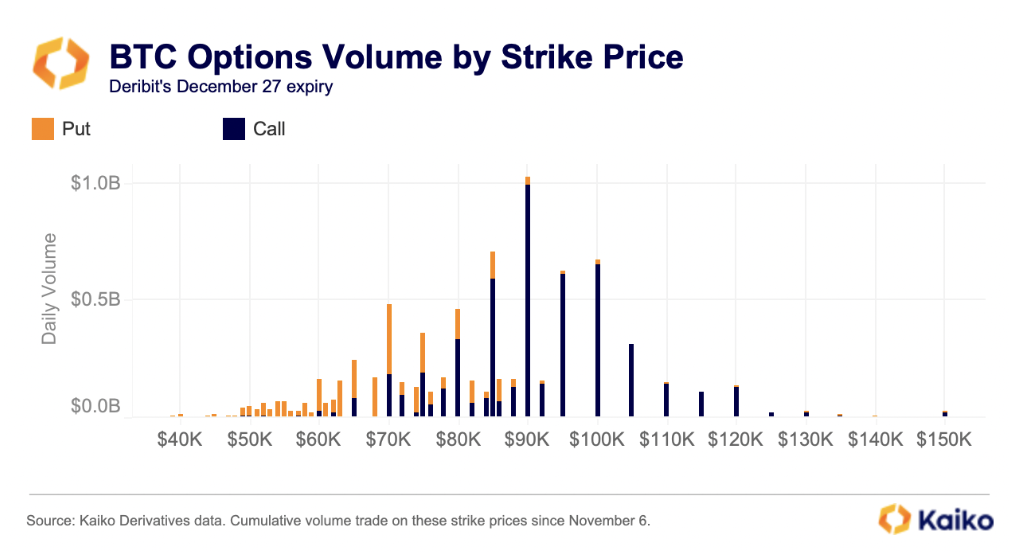

Options activity on Deribit indicates that traders expect the current rally to continue through the end of the year. Since November 6—the day after the U.S. election—heavy trading has been observed in call options with strike prices between $90,000 and $120,000 on Deribit’s December 27 expiry.

Many of these options are already in the money, with BTC trading above $91,000 as of November 13. This rapid price increase has led to some risk repricing in options on Deribit, as reflected in our Implied Volatility data.

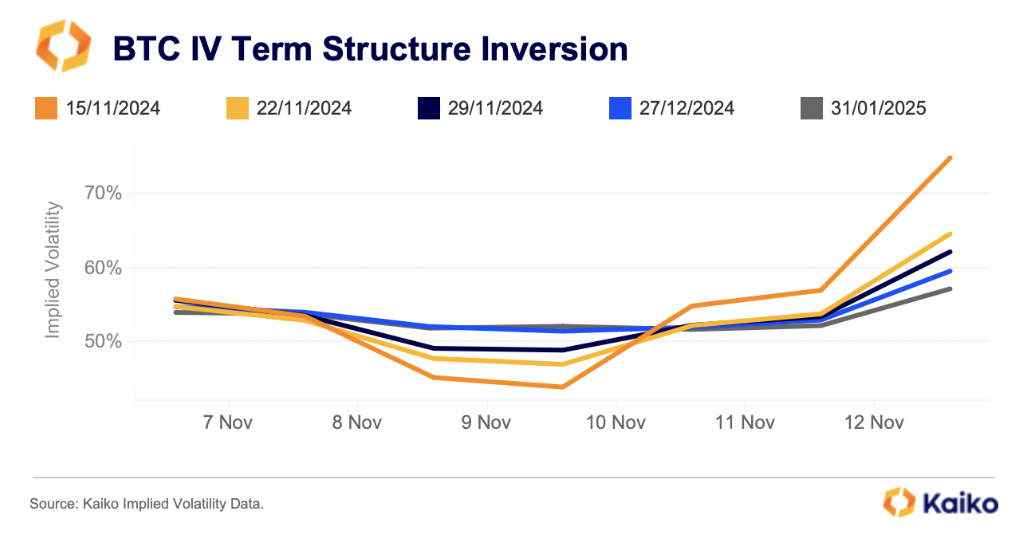

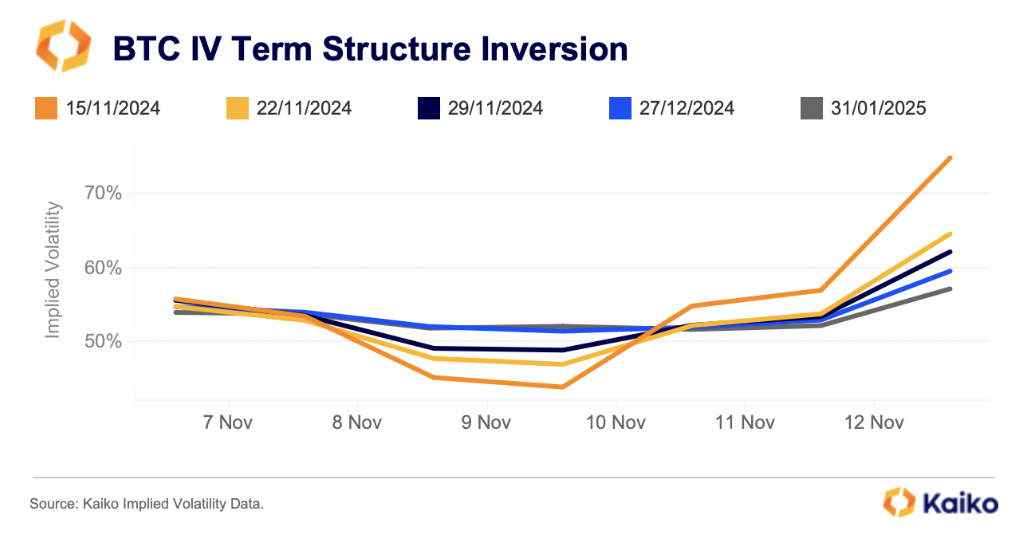

Increased demand for hedging as IV raises

After the U.S. election, Bitcoin’s implied volatility (IV) dropped, signaling a decline in market uncertainty. However, as Bitcoin hit new all-time highs over the weekend, short-term expiry contracts saw higher IVs than longer-term ones, creating an inverted term structure—usually a sign of heightened near-term market risk

The inversion intensified between Sunday and Monday (Nov 10 and 11) as BTC traded near $90k for the first time. BTC at-the-money IV on Deribit’s Nov 15 expiry, dark orange below, rose to 75% from a low of 44% post-election.

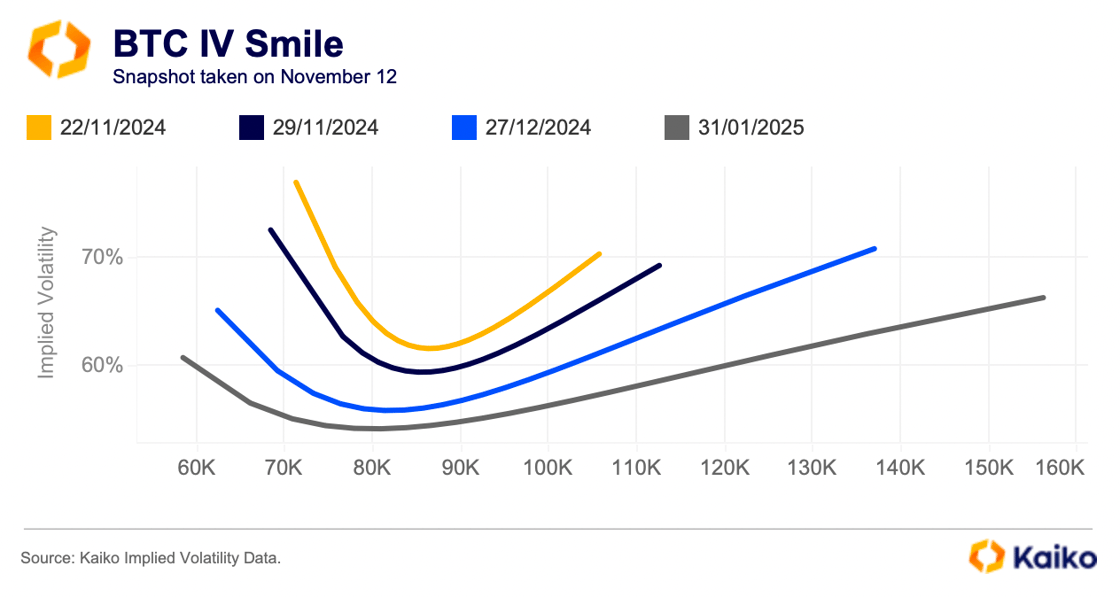

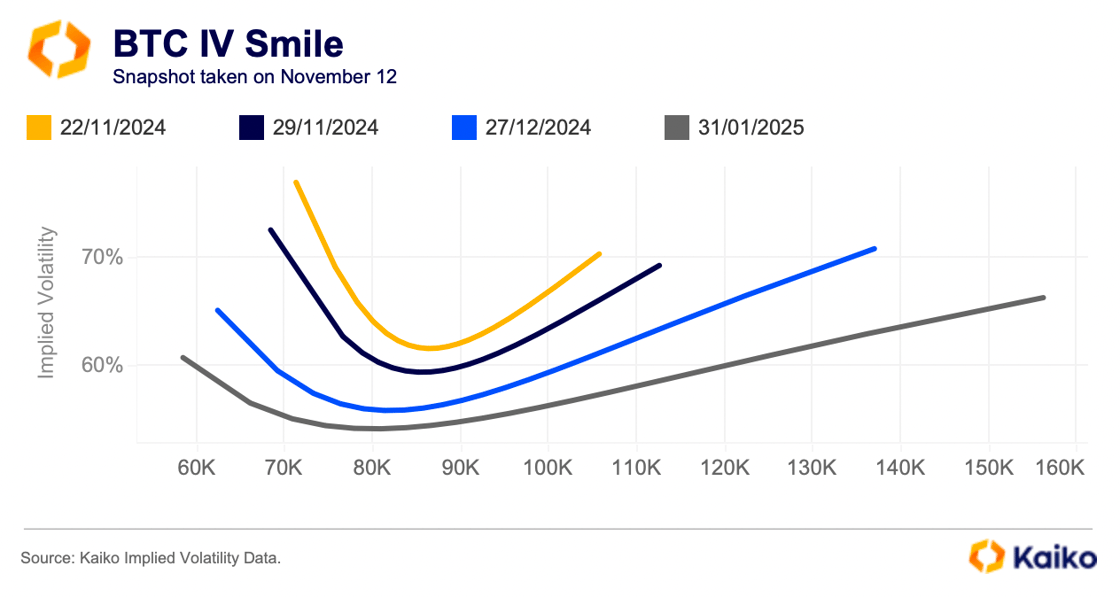

Looking at BTC IV smiles on Deribit we can see that there’s demand for options to both the upside and the downside. Which suggests hedging against volatility—both higher or lower. This is typically the case in crypto markets as asset prices are prone to sharp moves higher or lower.

IV on the left wing of the smile below is slightly higher than the righthand side. This could suggest that traders are willing to pay more for protection against a correction in the near-term. Overall the market is still positioning bullish as the high IV on longer dated expires (blue and gray above) shows.

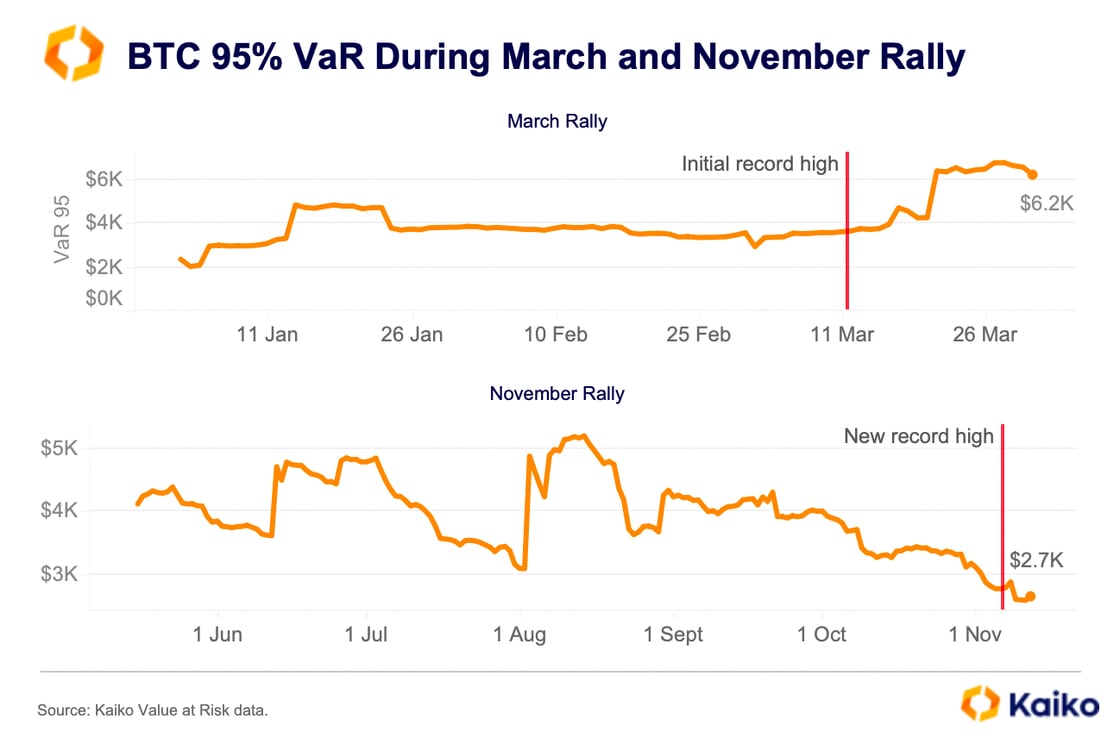

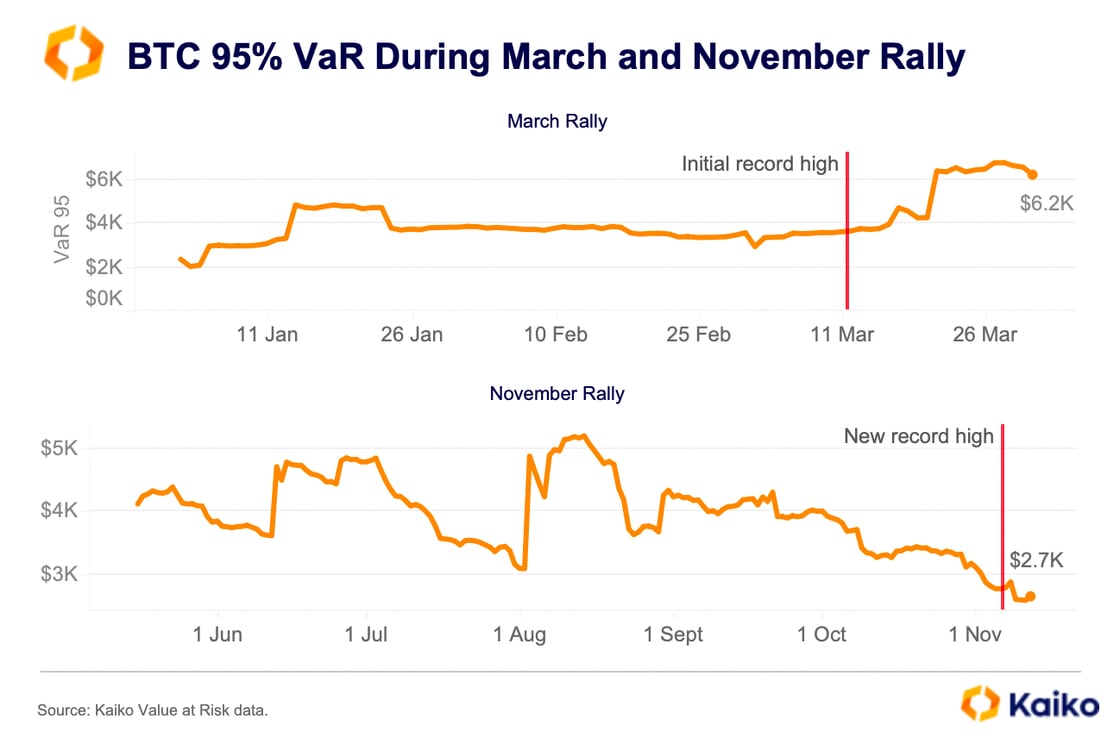

Measuring risk in BTC portfolios using VaR

Value at Risk (VaR) is a risk indicator used to quantify the extent and probability of potential losses in a portfolio. It is especially valuable in risk management, as it assigns a cash value to a specific confidence level.

The BTC VaR at the 95% confidence level has steadily declined since August, indicating reduced downside risk. For a hypothetical portfolio that invested $100,000 in BTC six months ago, the 95% daily VaR is currently $2,700—meaning losses exceeding this amount would occur about 5% of the time, or one day out of every 20. In contrast, the daily loss for this portfolio would have been higher in March, with the 95% VaR around $4,000, reflecting increased volatility as prices fluctuated.

Conclusion

BTC prices have soared to all-time highs since the U.S. election, but markets show few signs of overheating. Open interest in perpetual futures has increased, but funding rates remain stable. Higher implied volatility indicates prices could keep climbing or see a correction. Meanwhile, options traders are betting on BTC hitting six figures by year-end.

The macro outlook also supports risk assets. The U.S. Fed started an easing cycle with a large rate cut before the election—a big change from the 2017 Trump victory, when rate hikes were expected. However, uncertainty remains around the pace of the Fed’s future rate cuts, with the next meeting set to be closely watched.

The road to $100k for BTC is still open.

![]()

![]()

![]()

![]()