Data Points

Long-term volatility slumps to multi-year lows.

Crypto traders love volatility, so it is no surprise that the overall drop in trade volume is closely correlated with long-term volatility. 180D volatility for both BTC and ETH is at multi-year lows of 46% and 49%, respectively. While BTC started the year trading at just $17k, its gains have been slow and hard-won, in contrast with previous bull markets when BTC soared over short periods of time. ETH, which has historically been much more volatile, is now just as sluggish as BTC.

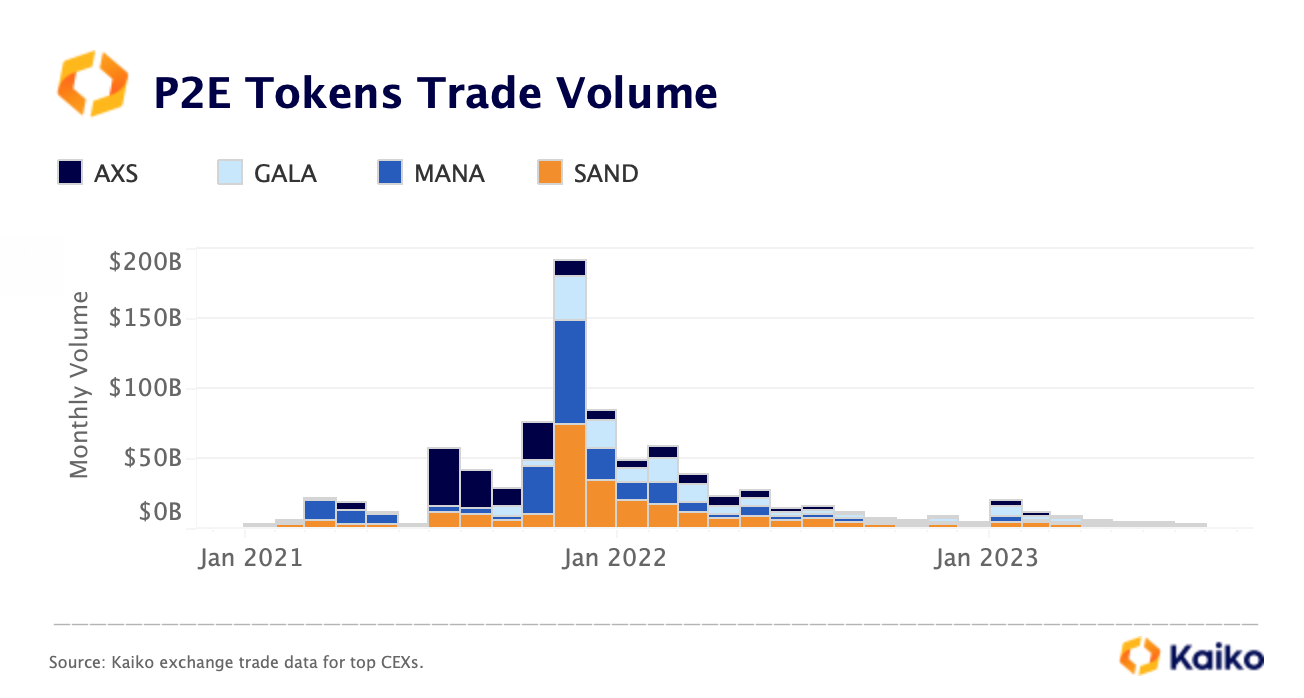

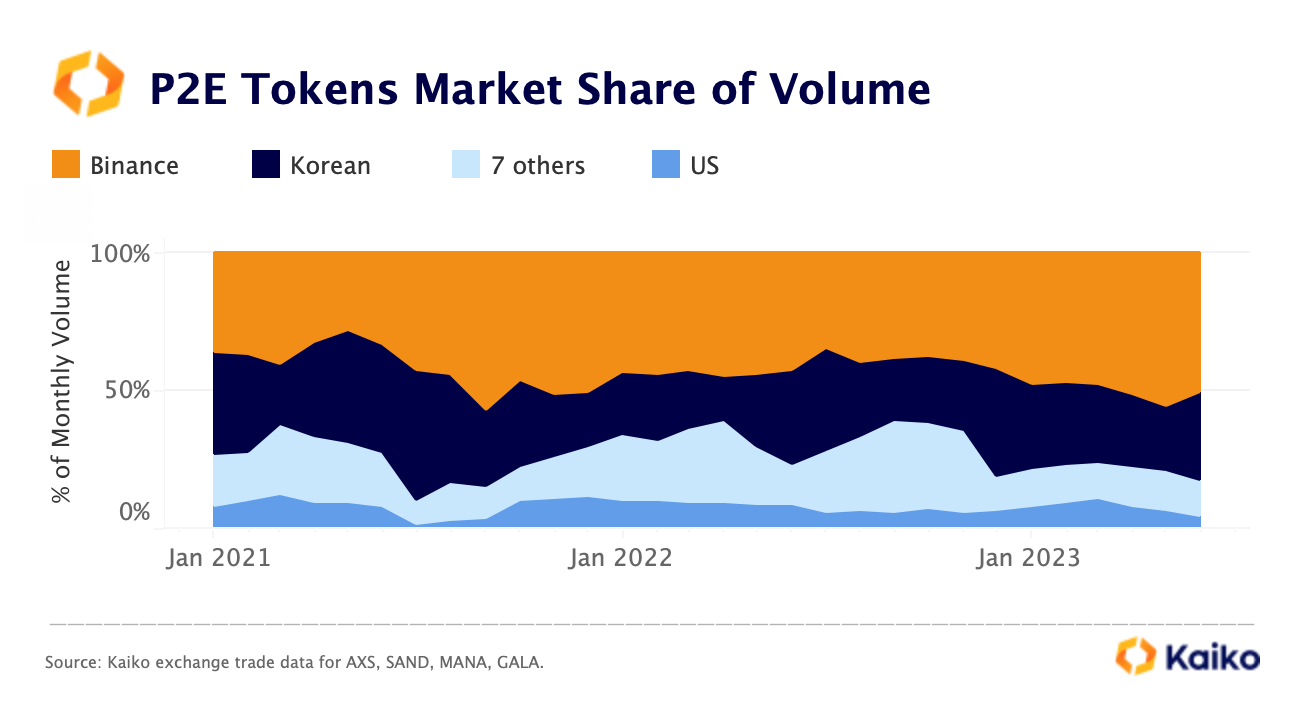

Is play-to-earn gaming dead?

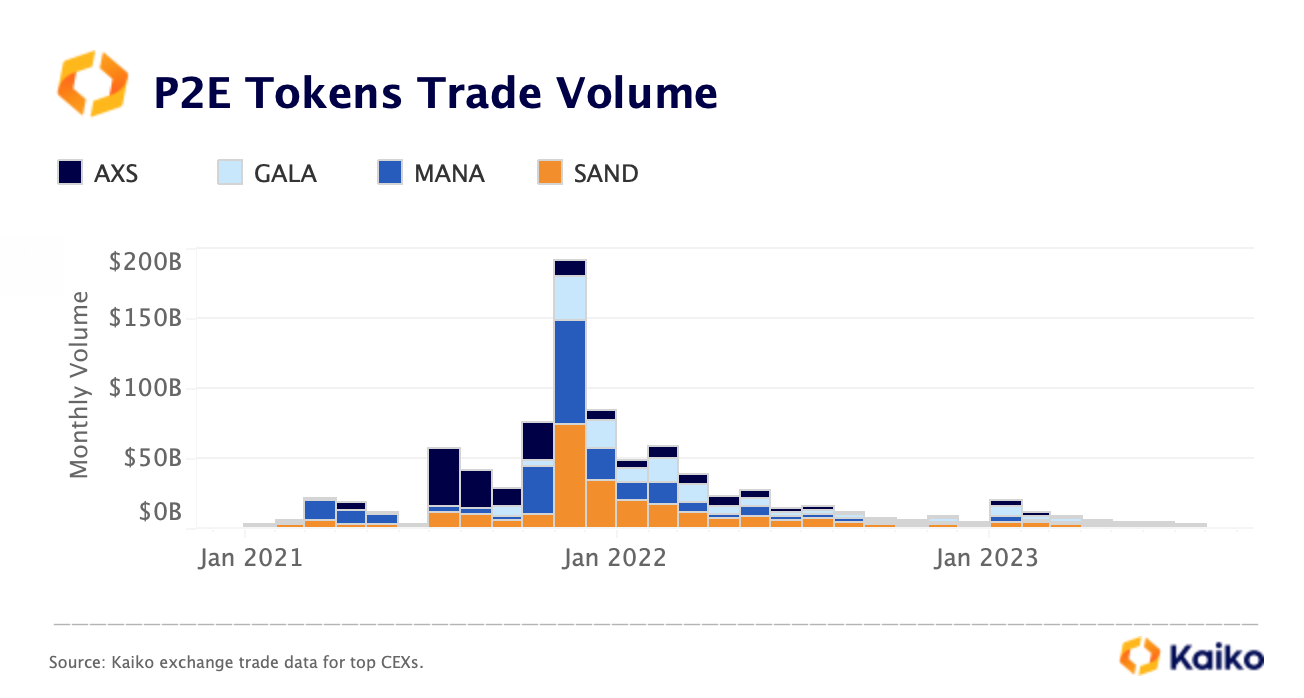

After massive popularity in late 2021 along with mainstream enthusiasm for the metaverse, play-to-earn (P2E) games such as Axie Infinity, the Sandbox, and Decentraland have lost steam over the past year. The monthly trade volume for the top metaverse tokens by market cap has fallen between 95% and 99% since November 2021, from $190bn to just $3bn in June 2023.

The number of daily active users has also collapsed, as these platforms have been struggling to retain users amid falling in-game rewards. According to DappRadar, the Sandbox had only a few hundred users over the past 24 hours.

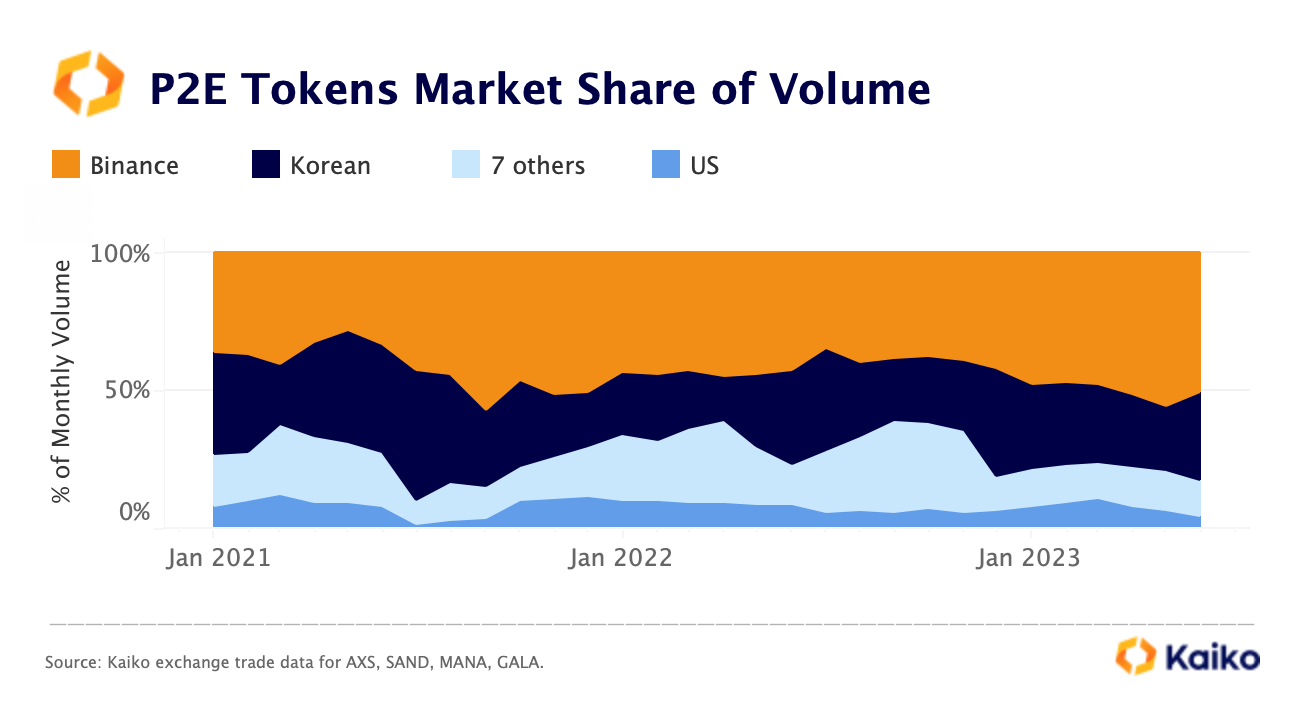

These tokens are mainly traded on Binance and Korean markets, which hold a combined market share of more than 80%. The share of U.S. exchanges has dropped to just 4% in June, its lowest level since late 2021.

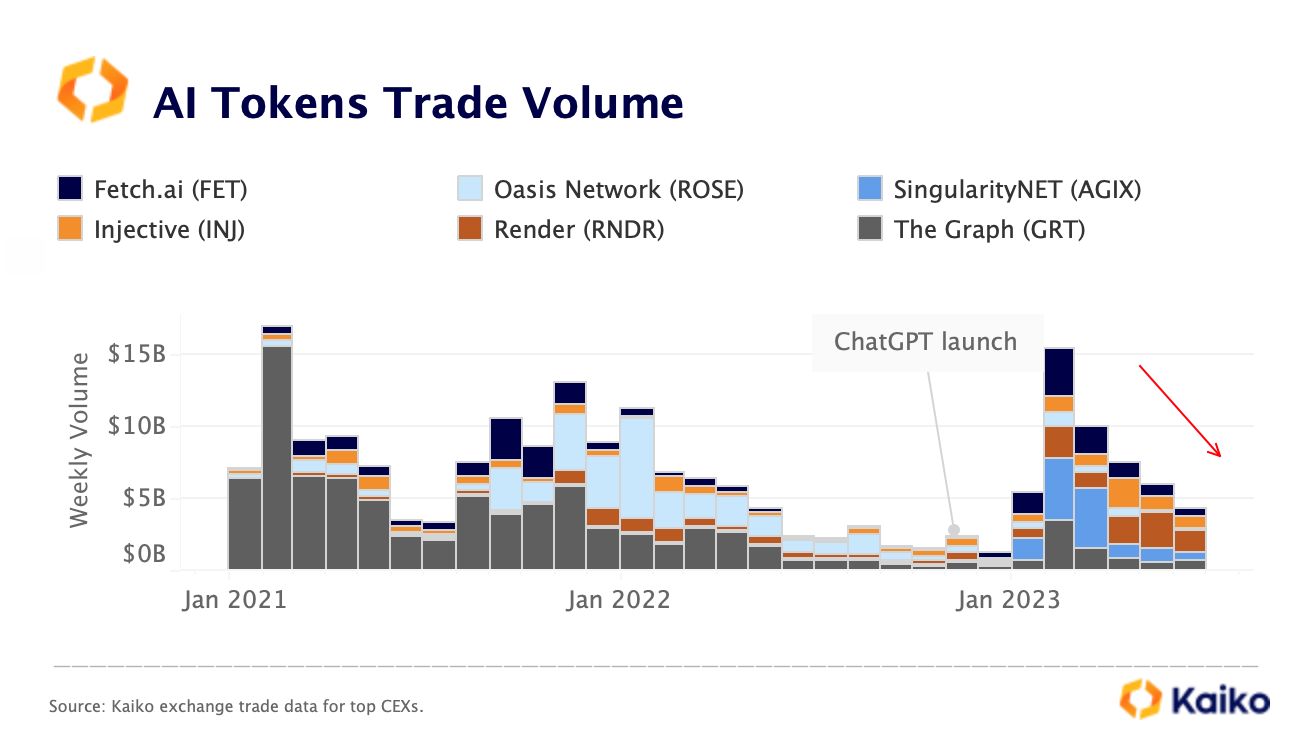

The surge in metaverse-linked tokens came after Facebook changed its name to Meta back in October 2021 and announced that it would invest heavily in the metaverse. More than a year later the company’s metaverse division has lost over $13.7bn and Meta is now focusing on efficiency using another buzzy technology: artificial intelligence.

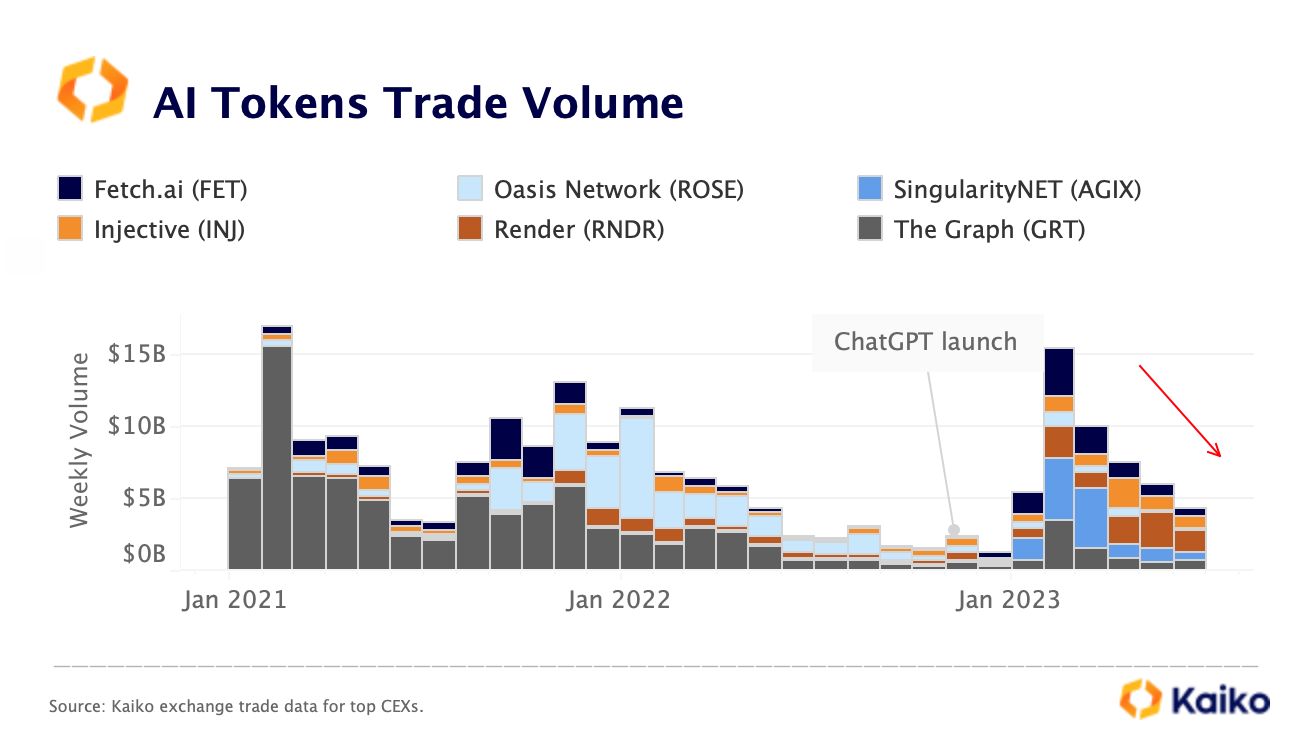

Since the launch of ChatGPT back in November 2022, AI has been the main driver of U.S. tech equities gains. AI-related crypto projects such as Render, which facilitates cloud-based 3D graphics rendering and decentralized machine learning platform SingularityNet (AGIX) have also registered significant gains this year. However, while volumes for AI-linked tokens surged in early 2023, they have declined since, hitting a yearly low in June.

Market makers enable large WLD trades after launch.

Worldcoin had one of the most unique launches in recent memory, complete with eye scans, huge loans to market makers, and possible wash trading, as detailed in our recent Deep Dive. The project launched by releasing up to 143mn WLD tokens, 100mn of which was loaned to market makers. Users who participated in the project’s pre-launch were eligible to receive 25 WLD tokens.

In the past, projects that airdrop have had inefficient launches with significant price divergences as users rush to claim the token and sell on a DEX or move them to a centralized exchange. In Worldcoin’s case, 99% of initial supply was in the hands of market makers, meaning price discovery happened quickly and large orders were facilitated almost immediately. As shown above, Huobi led with large orders ahead of Binance’s listing; Bybit and Uniswap also facilitated a good number of large orders early on.

ARKM holders stabilize after nearly 65k claim airdrop.

As we covered last week, ARKM launched on July 18 with significant price divergences on centralized exchanges. On-chain, users rushed to claim tokens, with over 55k claiming in the first 24 hours after launch. However, as the above chart shows using Kaiko’s new wallet data, the total number of users holding ARKM only briefly topped 30k, meaning that users were quickly selling their airdrops. Currently, about 65k users have claimed their tokens while only 19k wallets still hold tokens. Heavy selling after an airdrop is common, and holders remaining steady over the past week indicates that the wave of airdrop selling is over.

Off-chain, liquidity dropped post-launch, with bids and asks hovering around $75k and $50k, respectively. Bids have consistently remained higher than asks, suggesting that there is buying support despite the token’s drop. Heading into the weekend bids and asks doubled before retreating slightly.

On-chain data indicates that Arkham sent 35mn tokens in total to market makers GSR Markets and Wintermute, who then deposited the tokens on Binance and Bybit. Arkham itself sent 50mn tokens to Binance, in total meaning 85mn of 150mn circulating tokens were quickly sent to centralized exchanges.

![]()

![]()

![]()

![]()