USDC De-Pegs, Causing Mass Market Chaos

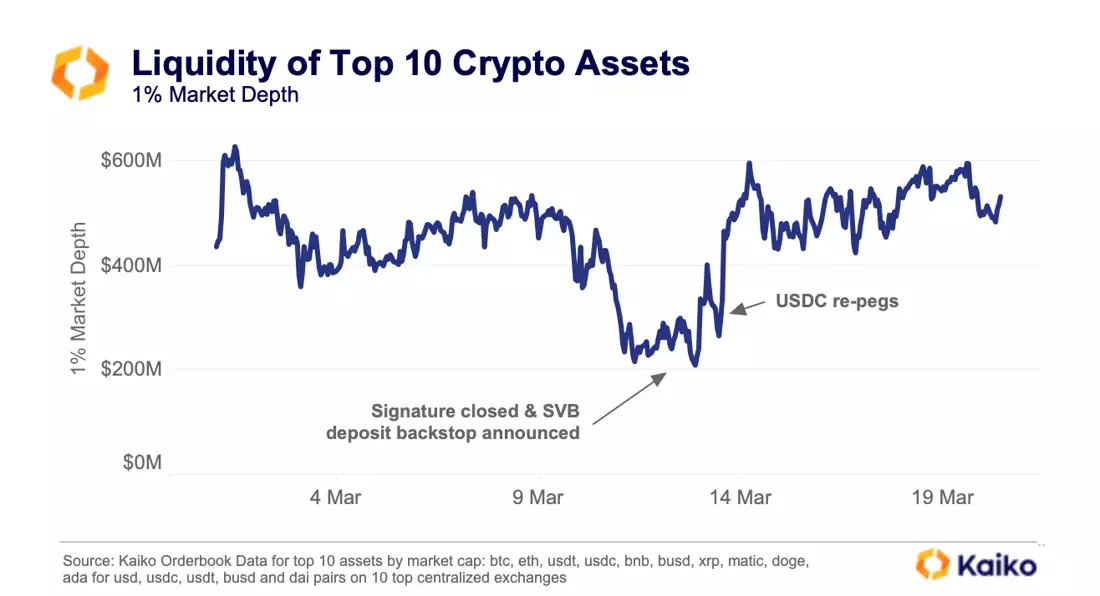

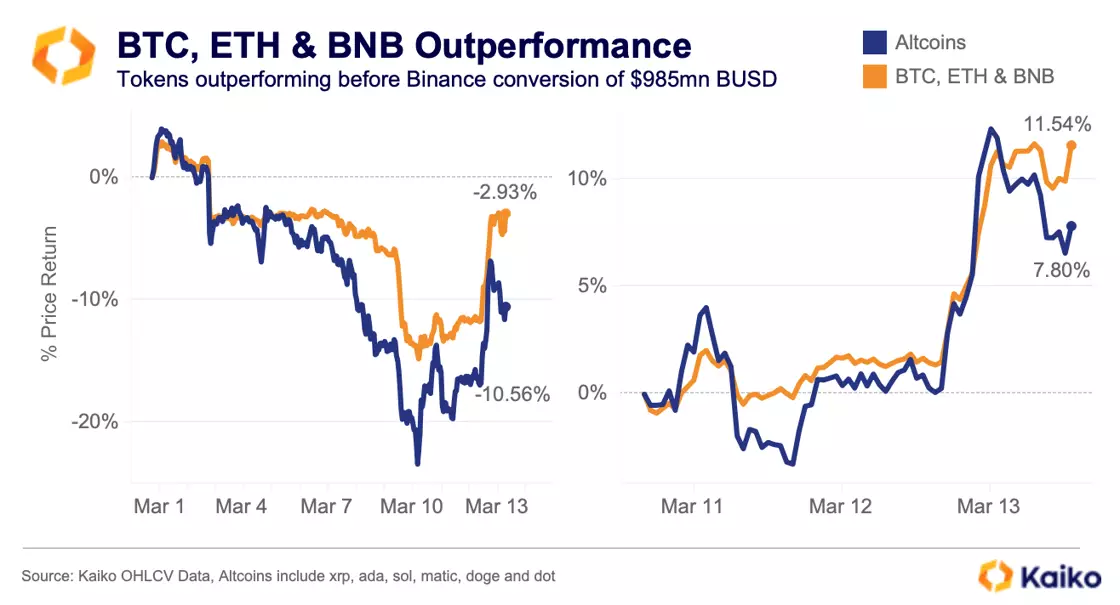

In the hours following Sillicon Valley Bank’s collapse, news emerged that Circle, issuer of the USDC stablecoin, held $3.3bn of reserves in SVB, triggering panic that the stablecoin was no longer fully backed. As of Sunday night, we know that Circle’s reserves are safe, but over the weekend both centralized and decentralized markets descended into chaos. Today, we’ll walk you through what exactly happened.

The Outsized Role of Centralized Exchanges.

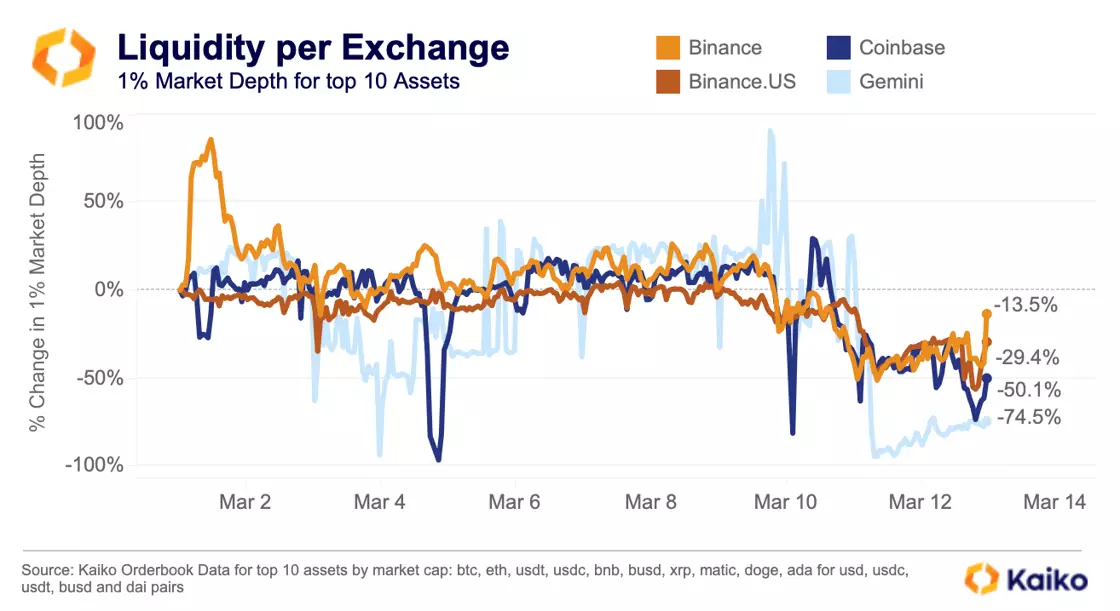

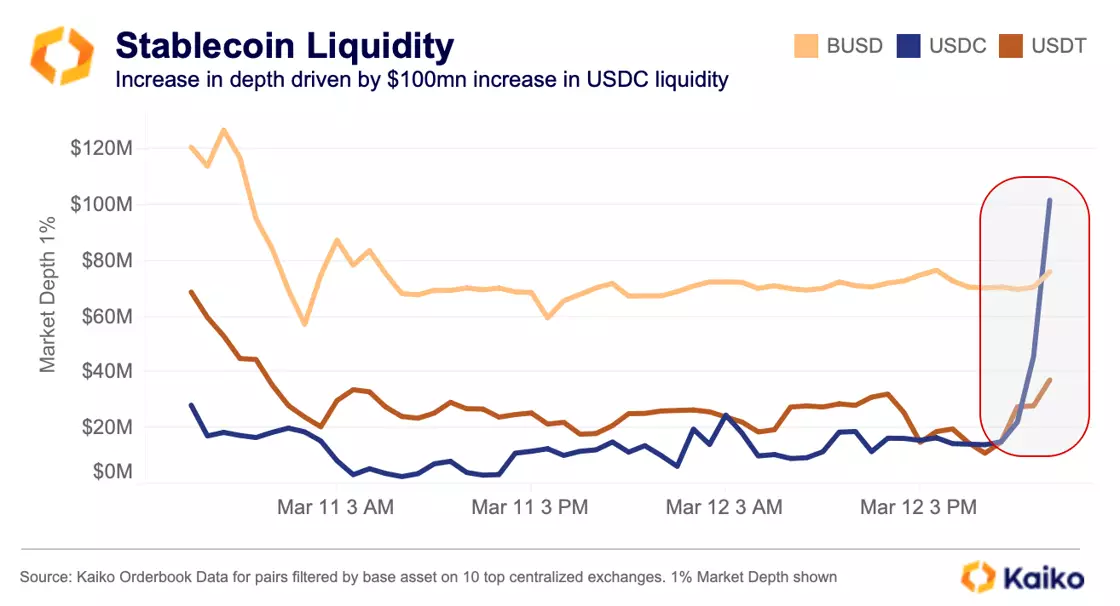

USDC’s primary use case is within the DeFi ecosystem, and as such it is relatively illiquid on centralized exchanges. As of last week, it denominated less than 0.5% of total CEX trade volume. However, CEXs played an outsized role in initiating this weekend’s market chaos.

This is because traders had only one thing on their mind amid the uncertainty: where to liquidate their USDC holdings.

Today, there are only 8 active USDC-USD trading pairs on CEXs, which effectively serve as a real-time exchange rate into the dollar. Over the weekend, these trading pairs became the only direct fiat off-ramp amid a halt in redemptions with Circle and Coinbase.

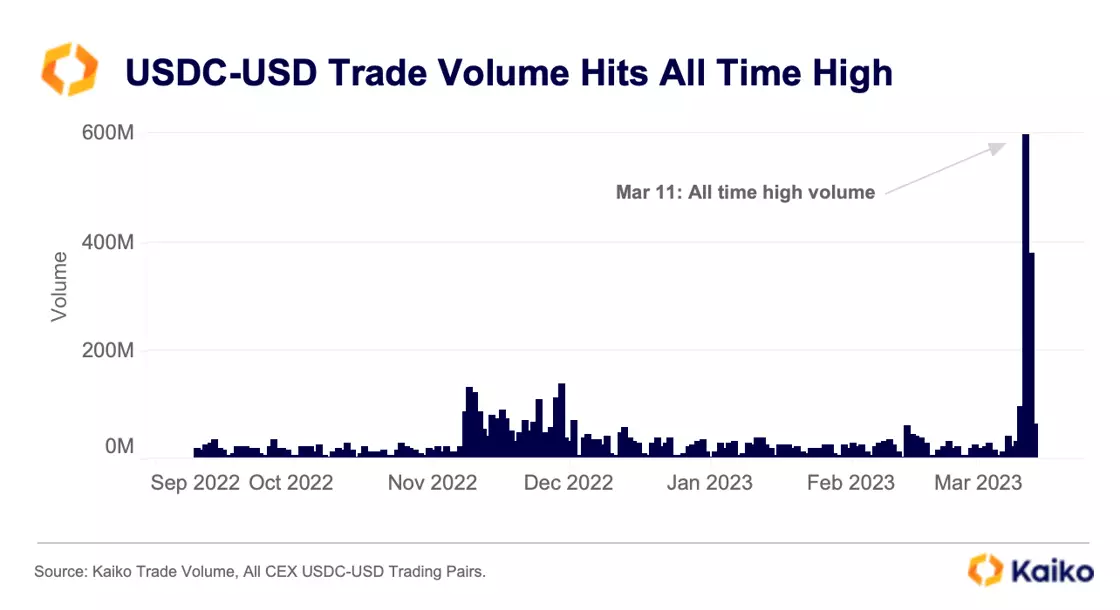

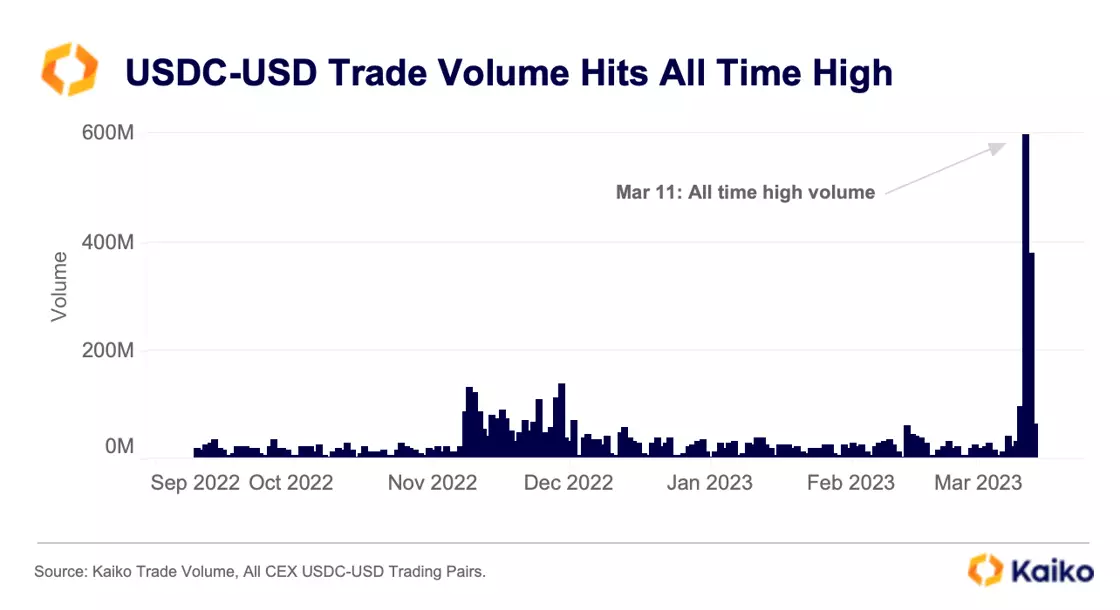

The problem, though, is that these USD pairs are relatively illiquid: daily average trade volume was just $20-$40mn in the first week of March. On Saturday, trade volume for these pairs hit an all time high of $600mn, dominated by Kraken which offers the most liquid USDC-USD pair.

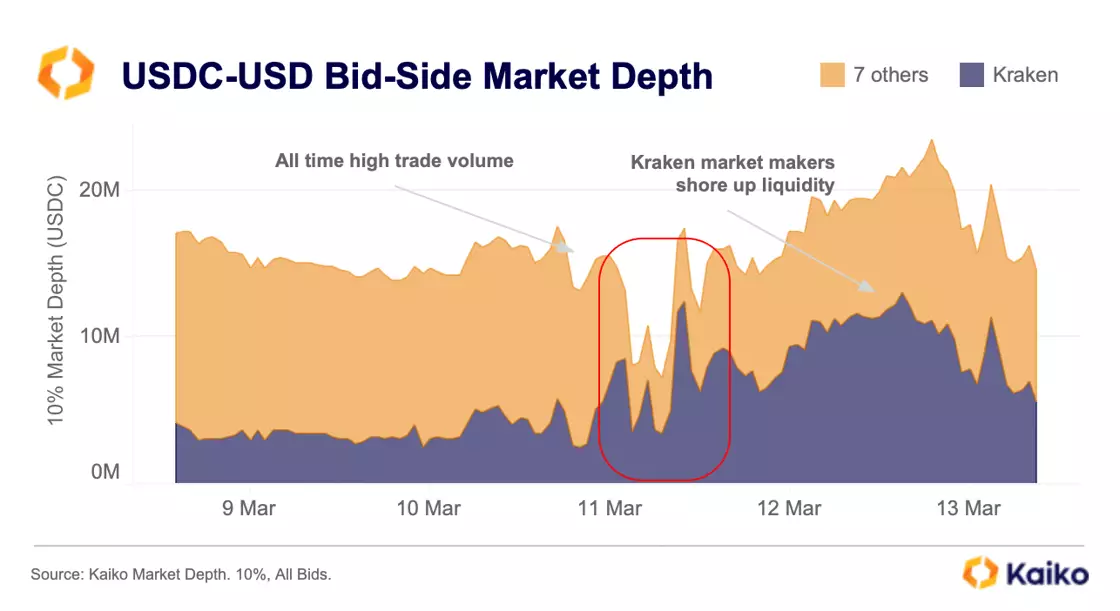

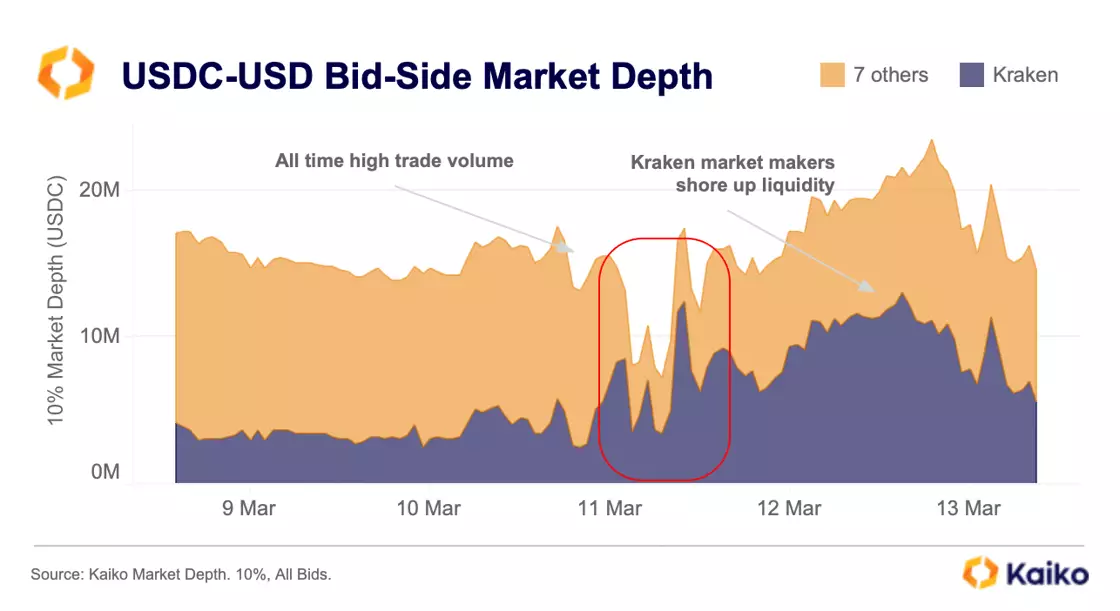

As expected, order books could not support the influx in sell volume, which caused USDC’s exchange rate to nosedive. Before USDC de-pegged, under 20mn in bids sat on USDC-USD order books, which were overwhelmed by hundreds of millions in sell volume.

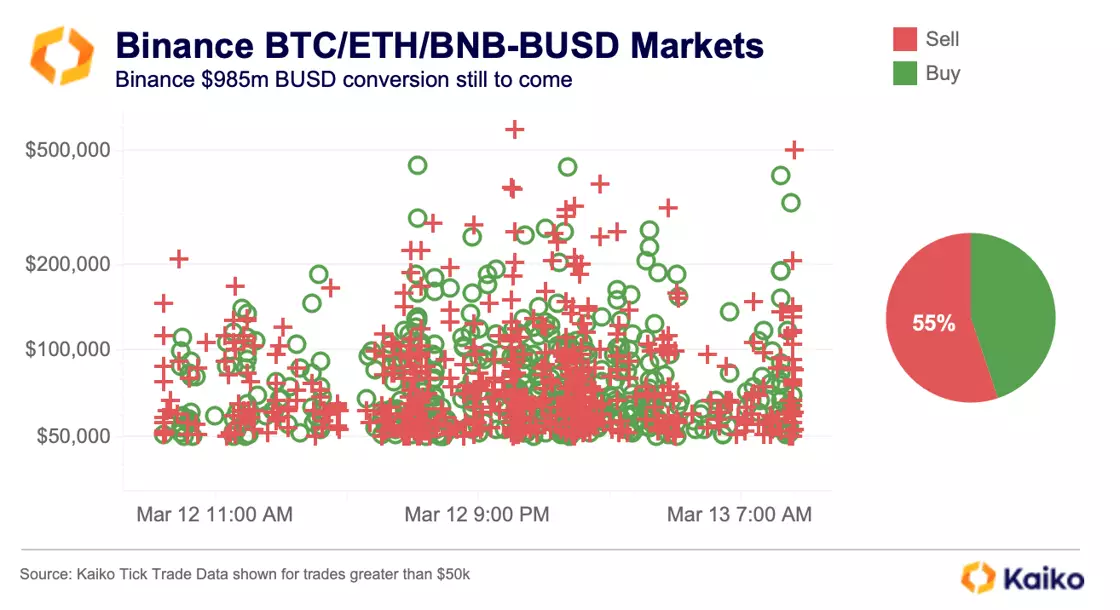

While USDC-USD trading pairs saw record volumes, the majority of crypto market activity is not actually conducted with the dollar. Most traders use offshore exchanges, which don’t offer a direct USD conversion for USDC, but do offer USDC-USDT pairs. The problem with this is that Binance, the world’s largest exchange, had delisted all USDC trading pairs back in September.

By midday Saturday, Binance finally re-listed the USDC-USDT trading pair, but by then USDC was already trading at a steep discount on less liquid CEXs. Shortly after, trade volume for USDC-USDT pairs hit $9.9bn, an all time high, as traders rotated out of USDC or scooped up USDC at a discount.

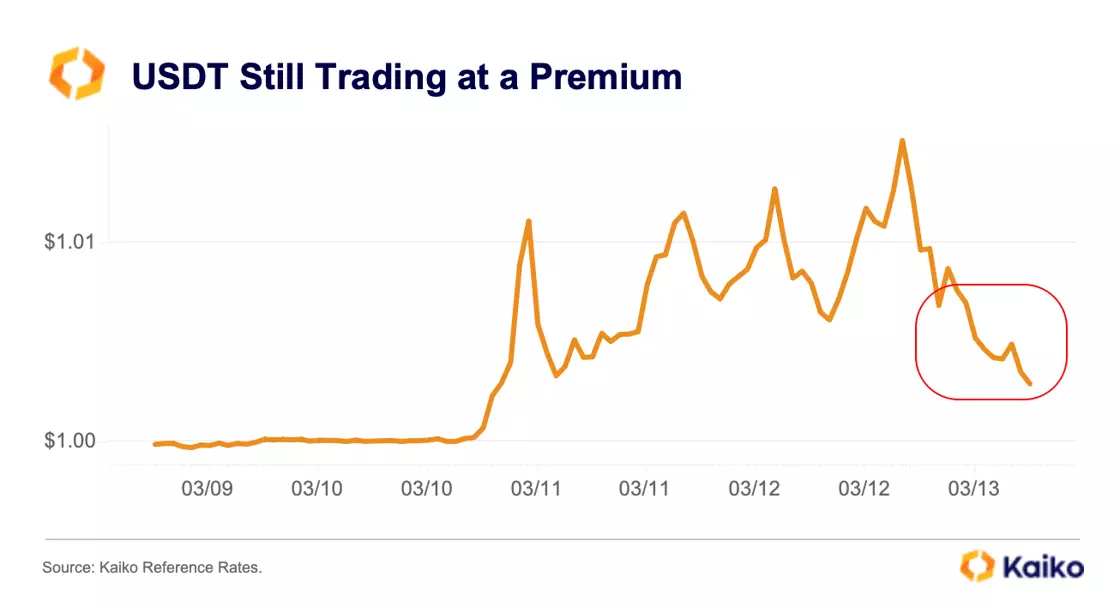

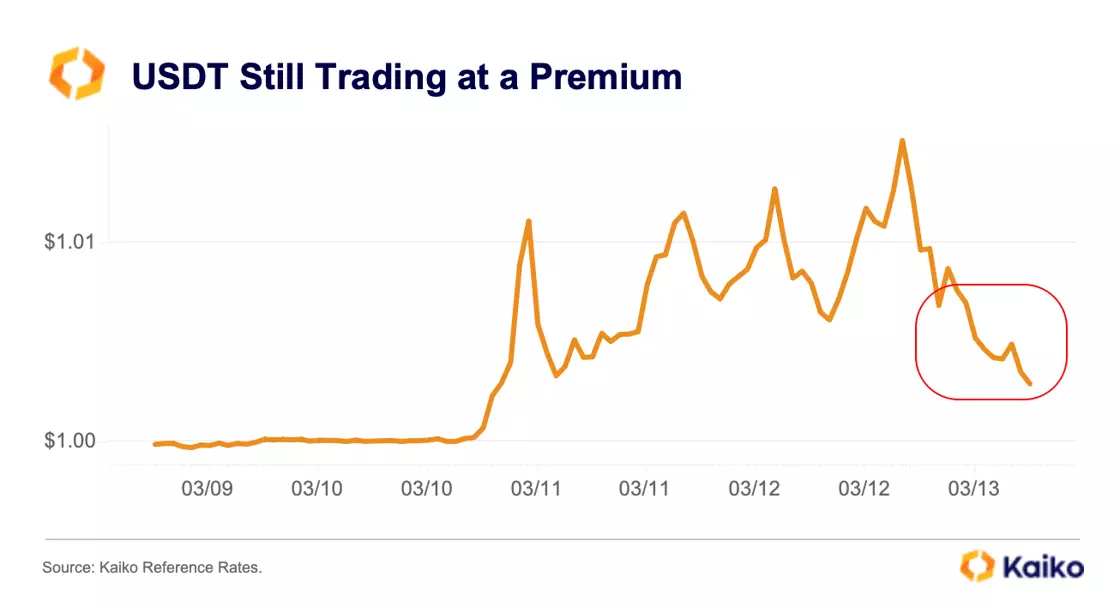

Overall, the sells outweighed the buys, causing Tether to trade at a strong premium to both the dollar and USDC.

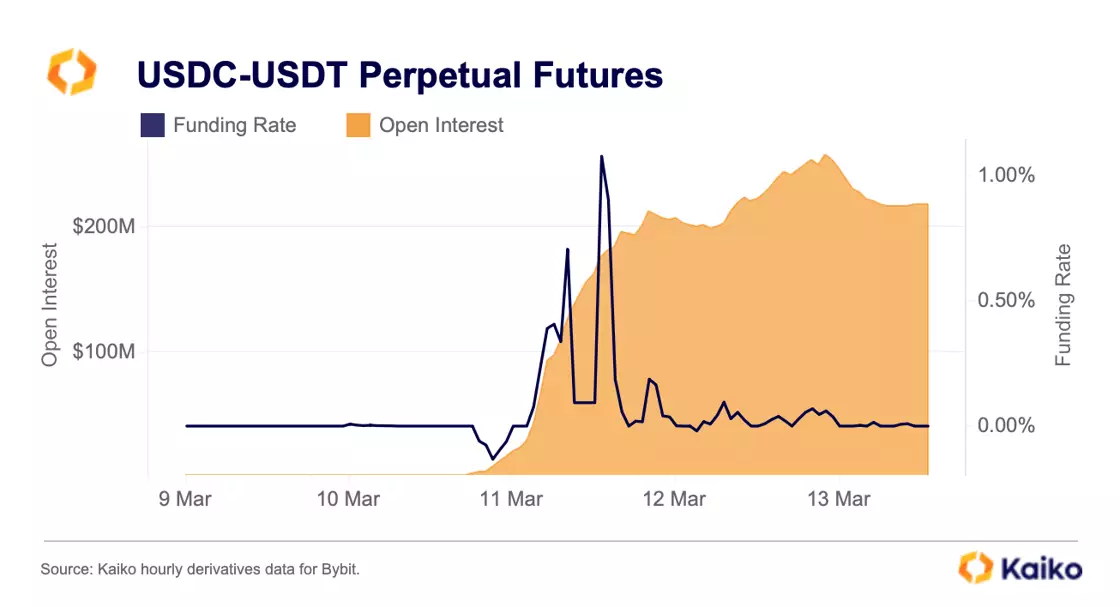

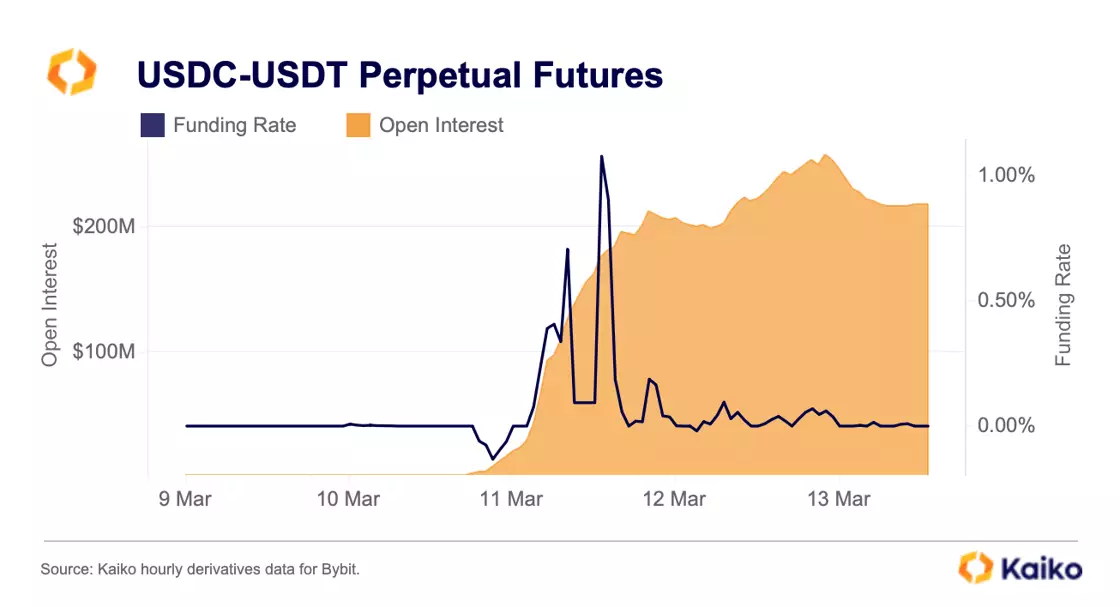

As Binance re-listed a host of USDC trading pairs, derivatives exchanges also jumped to capitalize on the volatility. Up until this weekend, traders were only able to speculate on the price of USDC on Bybit, which historically had very little activity. Over the weekend, open interest skyrocketed to an all-time high of $256mn. Funding rates remained volatile, oscillating from a negative 0.13% to a positive 1.08% as traders took both short and long bets, but have reverted to neutral as of this morning.

Several other derivative exchanges scrambled to list USDC perpetual over the weekend with a leverage varying from 10x on Bitmex, 20x on OKX, and up to 30x on Binance.

So why did trade activity on CEXs play such a big role in broader market upheaval if USDC isn’t used widely on these exchanges? The quickest answer is that DeFi price feeds for stablecoins don’t provide a true USD exchange rate because you can’t trade fiat currencies on a DEX. This is why many protocols use decentralized price oracles to determine liquidation levels, with data often pulled directly from centralized exchanges.

The answer also lies with how large price display websites such as Coingecko and Coinmarketcap compute their price feeds, which rely heavily on centralized markets. Notably, Curve is not listed on either Coingecko or CMC’s USDC markets page, despite offering one of the most liquid markets.

Overall, illiquid centralized spot markets, the emergence of several USDC derivatives contracts, and viral screenshots from price display websites exacerbated the de-pegging event. Much like a bank run, narrative became reality, which flooded into the DeFi ecosystem.

DeFi Bears the Brunt of USDC De-Peg.

DeFi is practically built on USDC. The stablecoin provides crucial stability to lending protocols and accounts for a significant portion of the reserves of decentralized stablecoins like DAI. Many DeFi protocols were built under the assumption USDC would never de-peg.

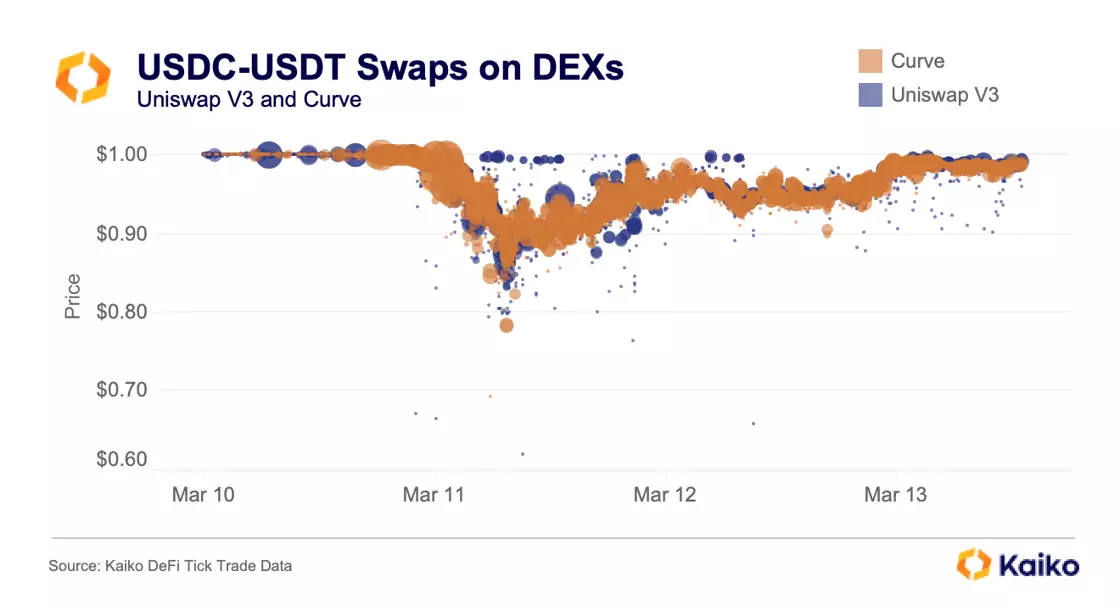

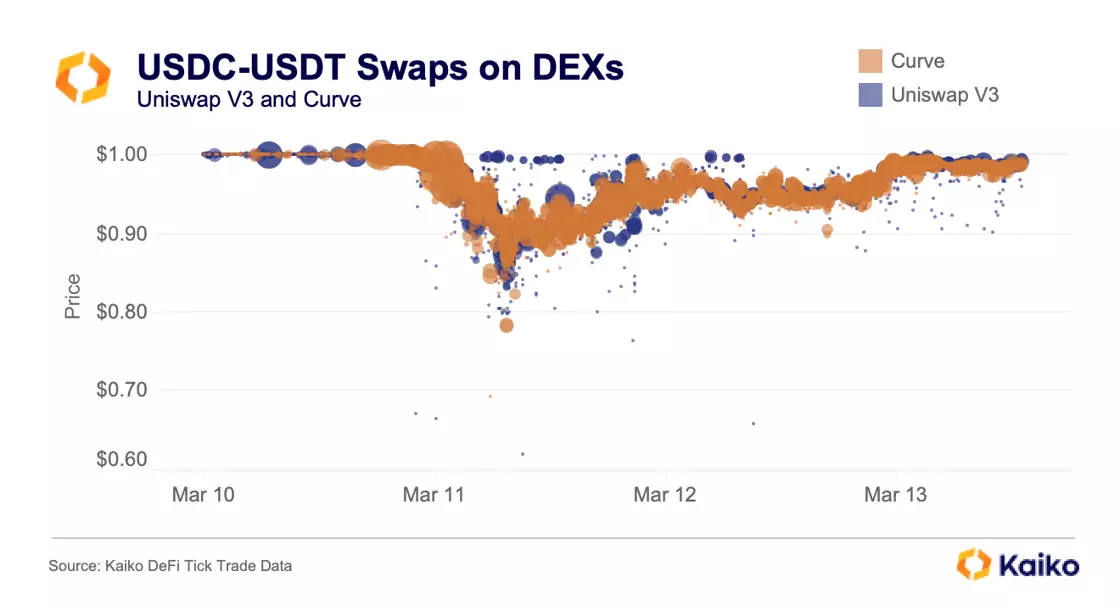

Over the weekend, Uniswap and Curve processed record high trade volumes as traders swapped USDC for ETH and other stablecoins, particularly USDT. Since March 10, Curve and Uniswap V3 have facilitated almost identical USDC-USDT volumes, at $5.91bn to $5.96bn, respectively. On Uniswap V3, USDC hit a low of $0.6188 relative to USDT; on Curve it hit $0.6911.

The rush to escape USDC left the Curve 3pool deeply imbalanced, with USDT reaching a low of around 2% of the pool. Today the 3pool holds just under $400mn, almost 95% of which is USDC and DAI, again reflecting the strong demand for USDT.

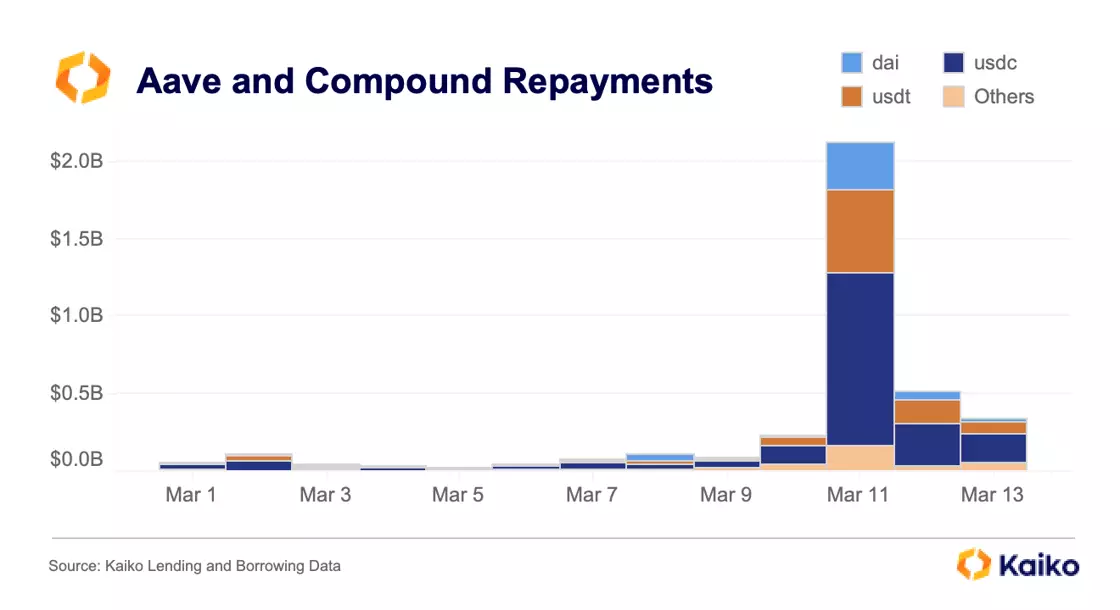

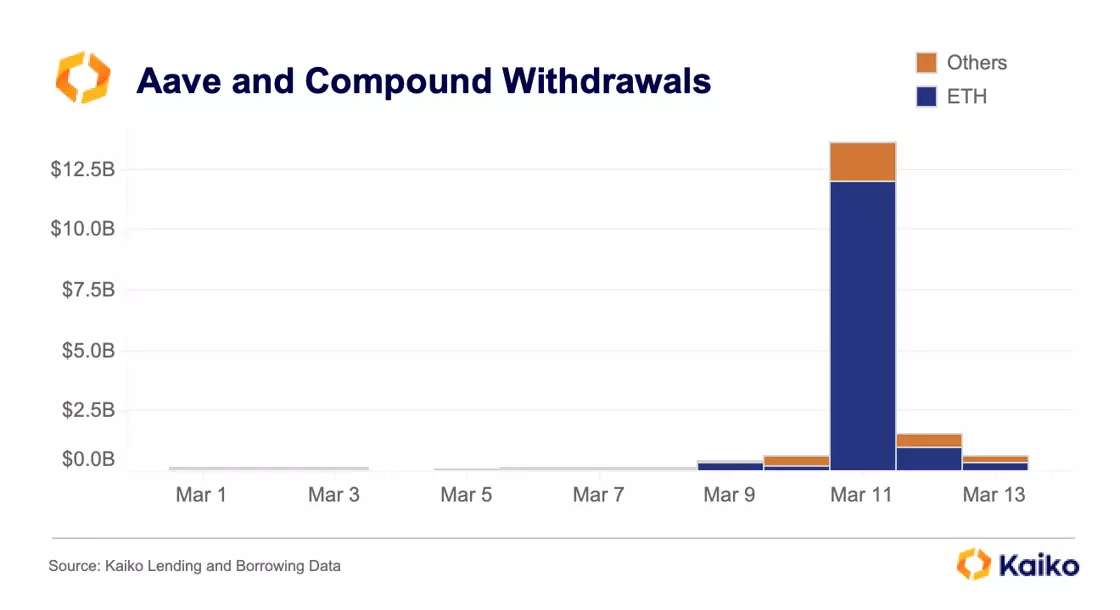

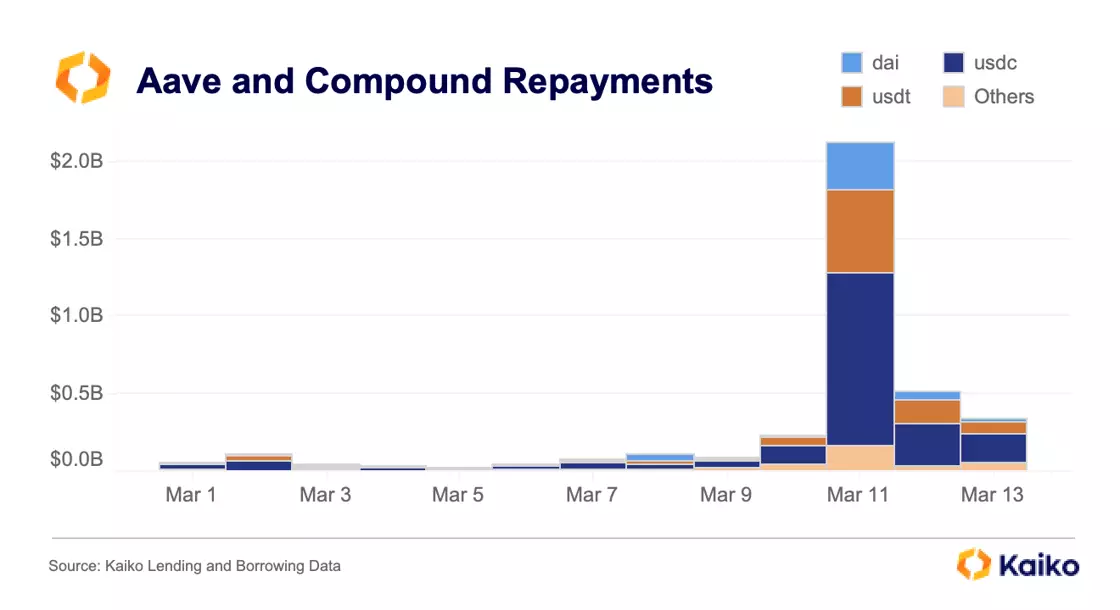

Lending and borrowing pools were also affected. On March 11, Aave and Compound received more than $2bn in repayments, mostly of USDC, as borrowers were able to repay their loans at a discount because of its depegging.

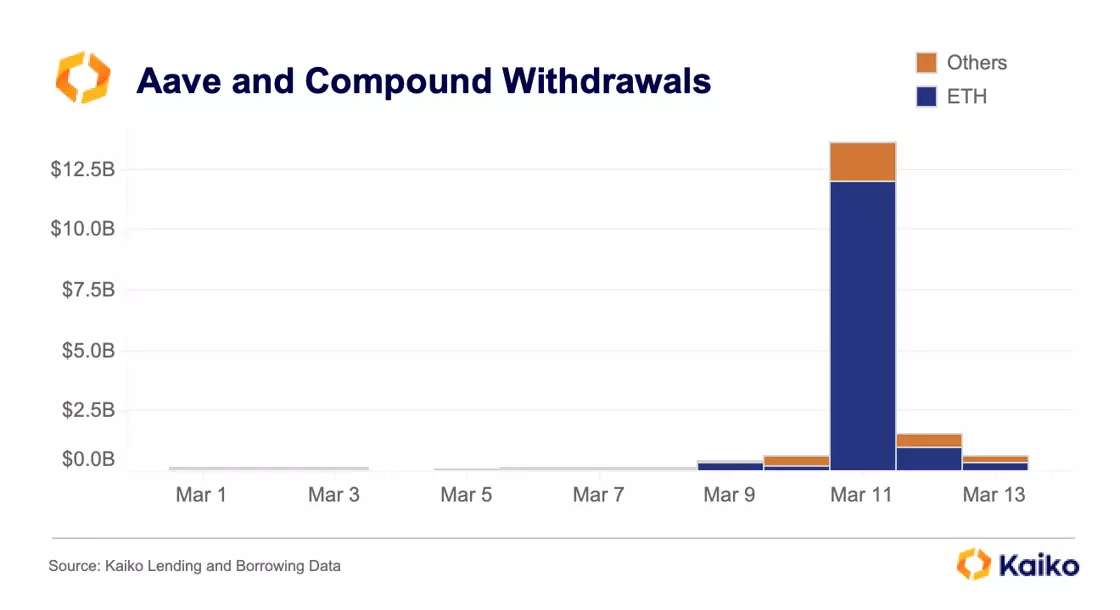

$400mn total was removed from Compound while $13.1bn was withdrawn from Aave, $11.9bn of which was ETH. Note that this does not mean that TVL dropped by $13.1bn; there were $13.6bn deposits on Aave that day as bots were particularly active on the protocol.

Overall, DeFi markets experienced two days of huge price dislocations that generated countless arbitrage opportunities across the ecosystem, and highlighted the importance of USDC.

![]()

![]()

![]()

![]()