New Report: LATAM's rise in global crypto markets

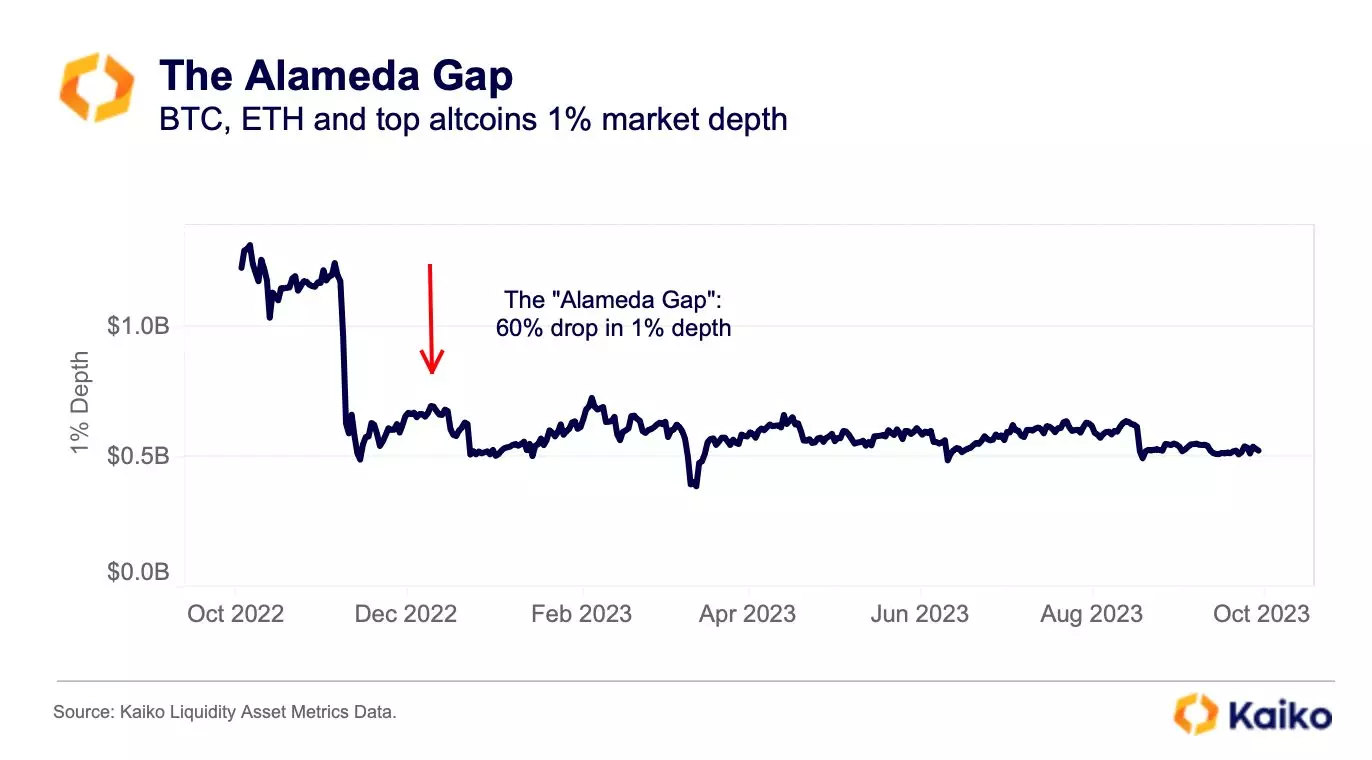

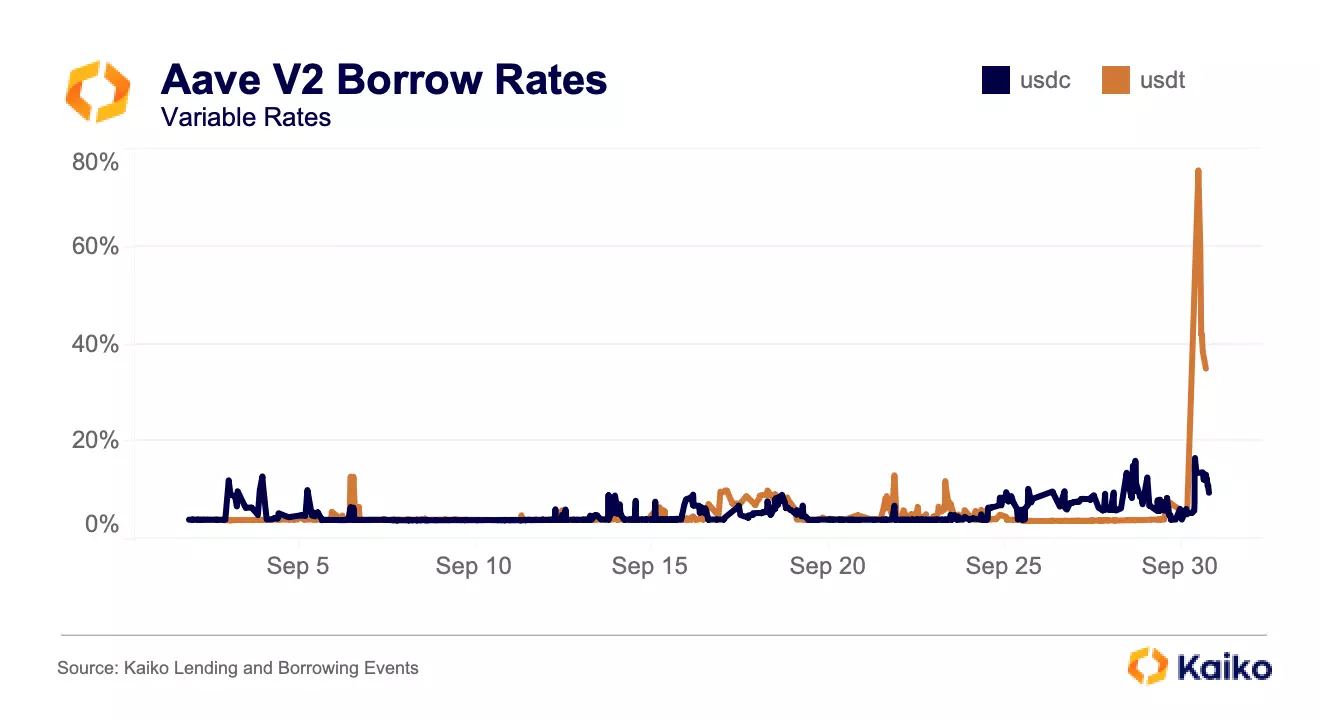

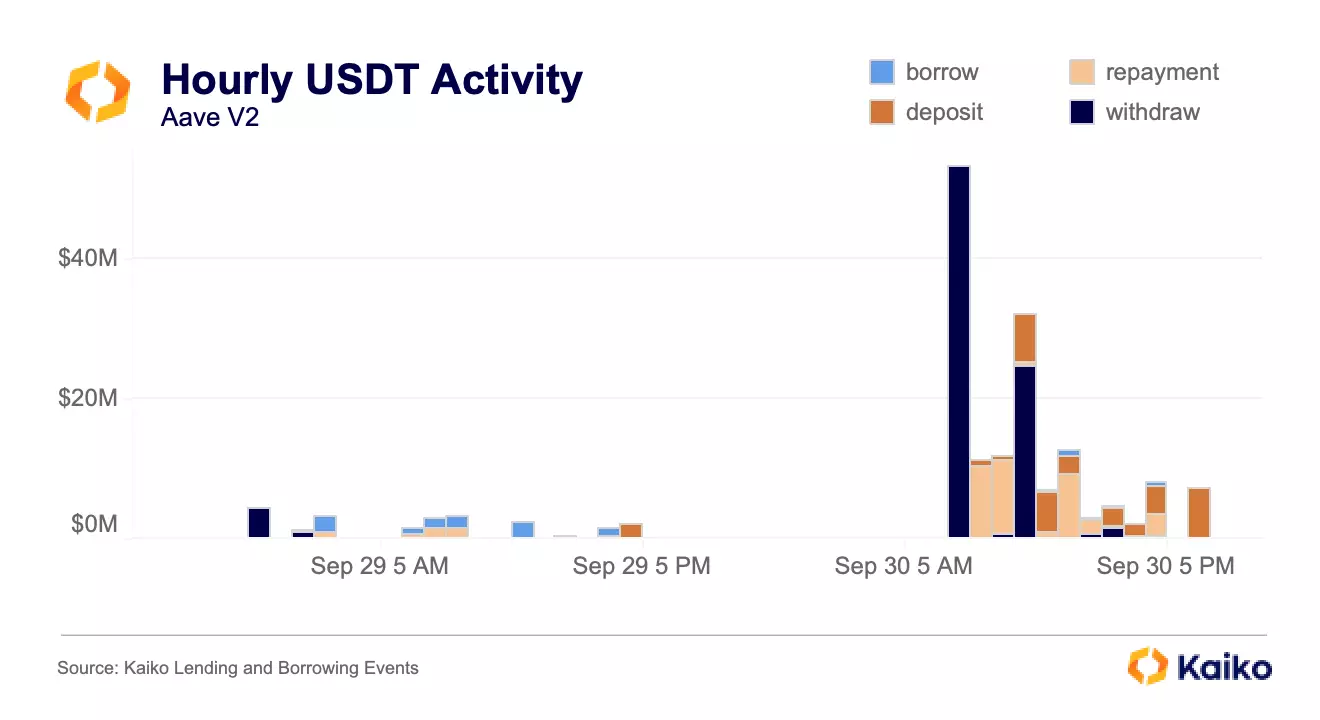

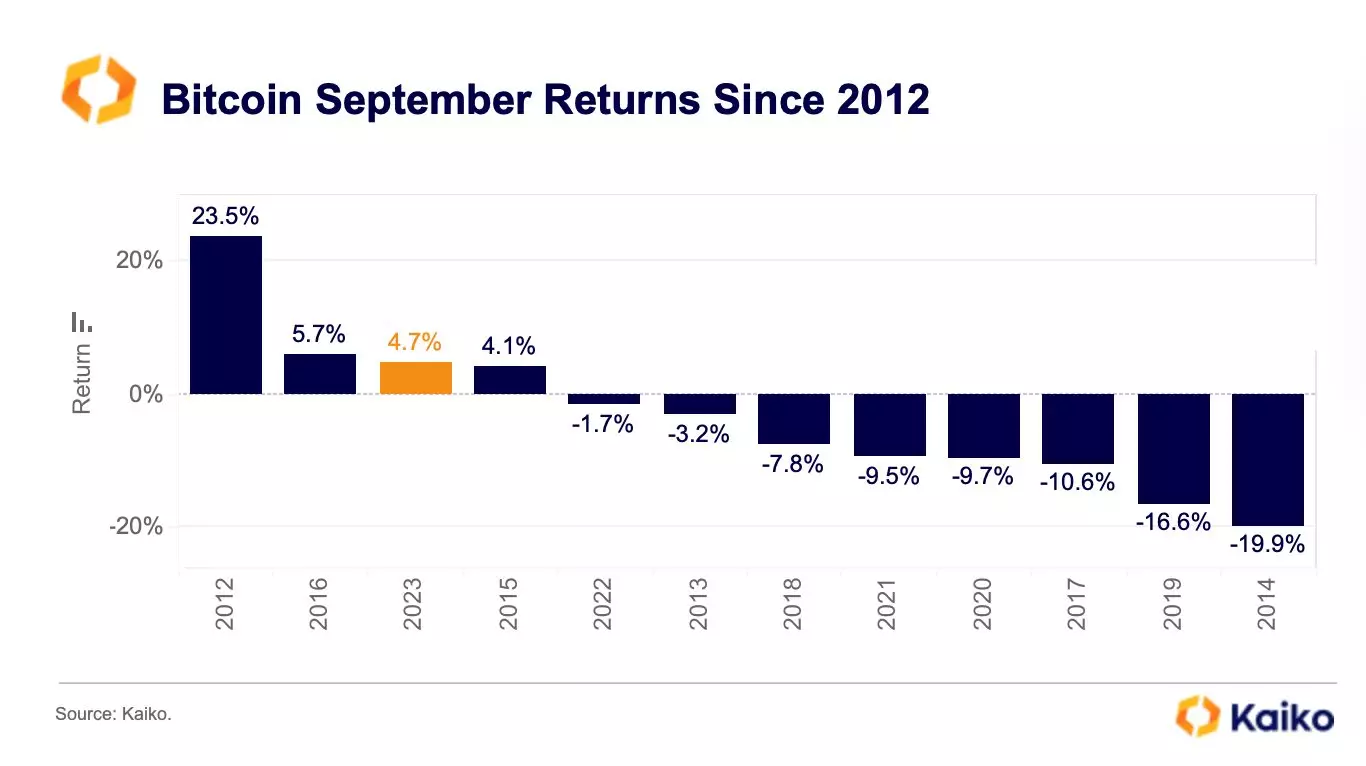

Looking Back on FTX’s Impact

02/10/2023

Data Used in this Analysis

More From Kaiko Research

![]()

USDC

07/07/2025 Data Debrief

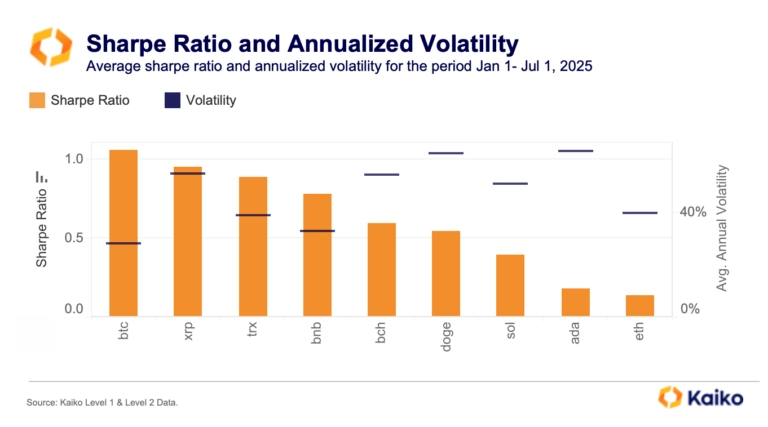

Gap grows between Bitcoin and altcoins.Bitcoin came close to a new all-time high last week before strong U.S. jobs data dented rate-cut hopes and pulled markets lower. Yet momentum remains intact, driven by institutional demand and a clear shift toward Bitcoin over altcoins. This week, we explored the structural shifts that may be laying the groundwork for a breakout.

Written by The Kaiko Research Team![]()

USDC

30/06/2025 Data Debrief

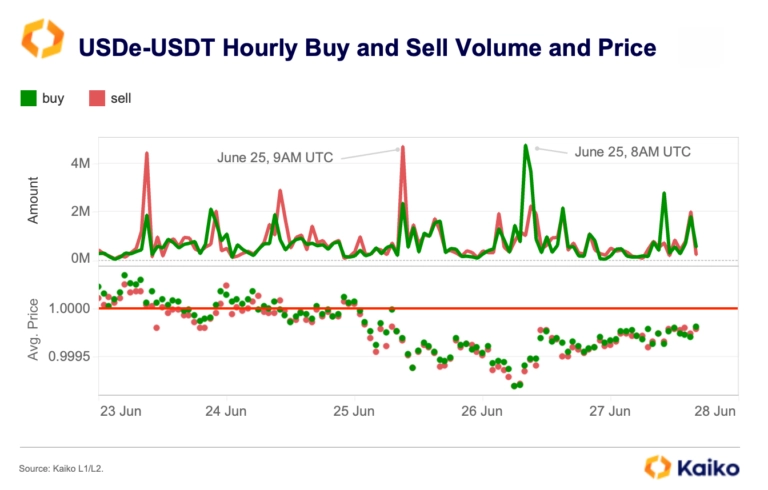

USDe faces regulatory setback in Europe.This week we’re diving into Ethena’s USDe, a stablecoin that’s quickly captured market share and regulatory attention. As global rules tighten and stablecoins become more integrated into mainstream finance, can USDe keep its momentum? We break down the data and the latest headlines.

Written by The Kaiko Research Team![]()

USDC

16/06/2025 Data Debrief

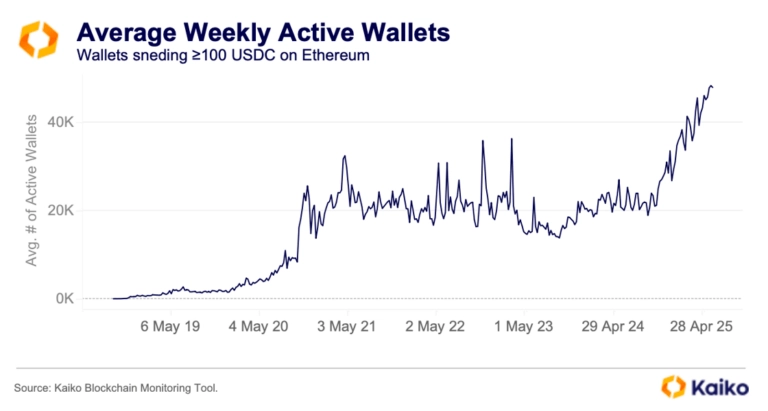

The data behind Circle’s $18B Valuation.Circle’s IPO debut on the New York Stock Exchange on June 5th captured market attention, with shares surging well beyond expectations and outperforming other major crypto listings. This special edition of our Data Debrief examines the on- and off-chain data signals that set the stage for this blockbuster launch and help explain the drivers behind Circle’s remarkable valuation.

Written by The Kaiko Research Team![]()

USDC

16/06/2025 Data Debrief

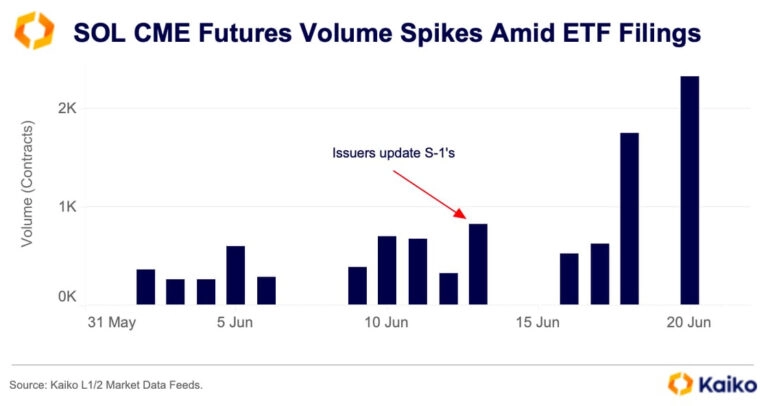

Traders position for potential SOL ETF.This week we’re talking all things Solana. As ETF issuers line up to launch funds tracking SOL the market reaction has been muted in parts. However, looking in the right place shows signs of institutional demand.

Written by The Kaiko Research Team