Liquidity

One of the most exciting features of Market Metrics for our research team is the ability to quickly pull liquidity data that is global, aggregated, and extremely detailed. In this section I’ll go through the data, starting at the most aggregated and getting progressively more granular.

Below is a look at LDO liquidity across all the CEX instruments that we cover, converted into USD and charted at both the 0.1% and 1% market depth levels. As a reminder, our market depth takes the total quantity of bids and asks within x% from the mid price.

1% market depth has surged from post-FTX lows of under $300k to nearly $2.5mn today. 0.1% market depth has increased nearly 1,000% from post-FTX levels to hit nearly $400k today. These are signs of a healthy market, especially in the environment in which many altcoins are suffering from illiquidity as market makers have either collapsed (Alameda) or begun to slow operations.

Different market depth levels may be interesting for different purposes. For higher frequency traders, 0.1% market depth is more relevant whereas longer term holders like VCs or hedge funds may be interested to see how large orders will impact order books. Luckily, Market Metrics includes liquidity data from the 0.1% level to the 10% level.

Additionally, it can be informative to see bid and ask depth separately to better understand market dynamics. Below is a chart of bid and ask depth at the 0.5% level as well as price to see how the three interact.

Bid depth has consistently been higher than ask depth in the past year. The difference between the two reached its apex in February 2023, just days before LDO hit its highest level since August 2022. It’s also possible to increase the granularity of this metric, either by taking hourly data or breaking it down by exchange.

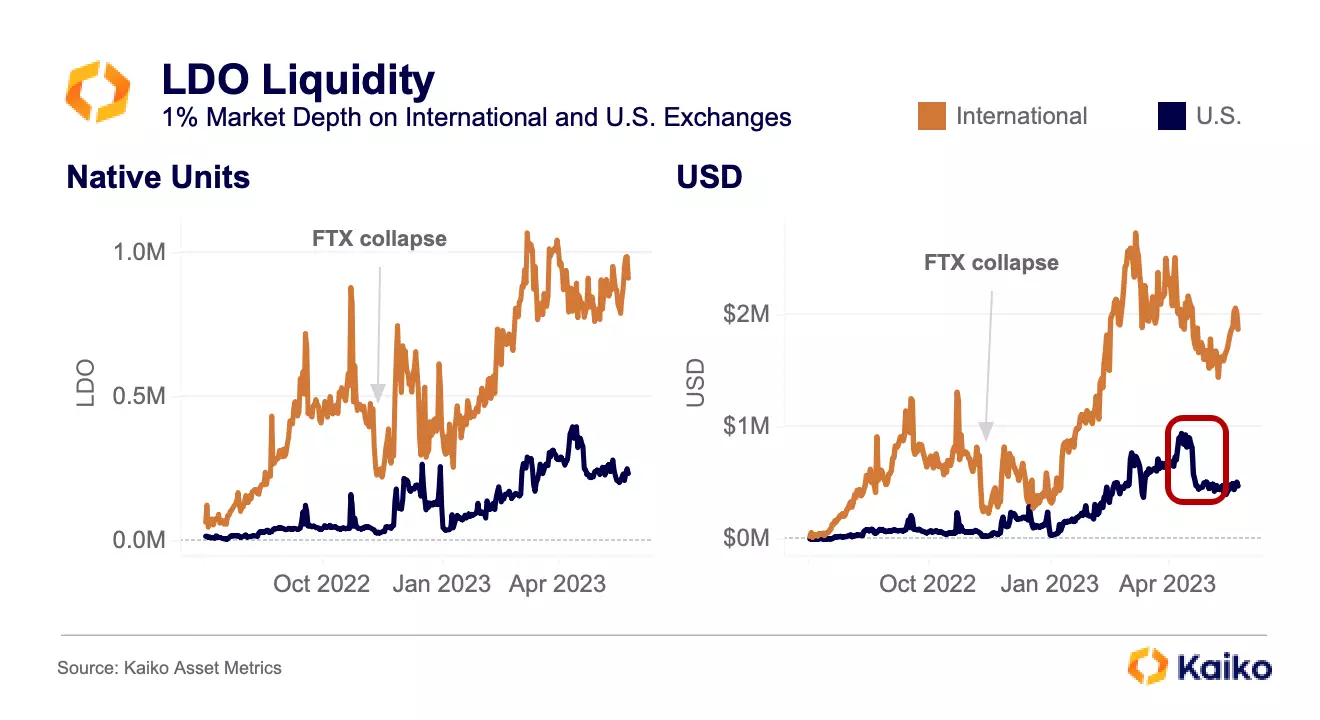

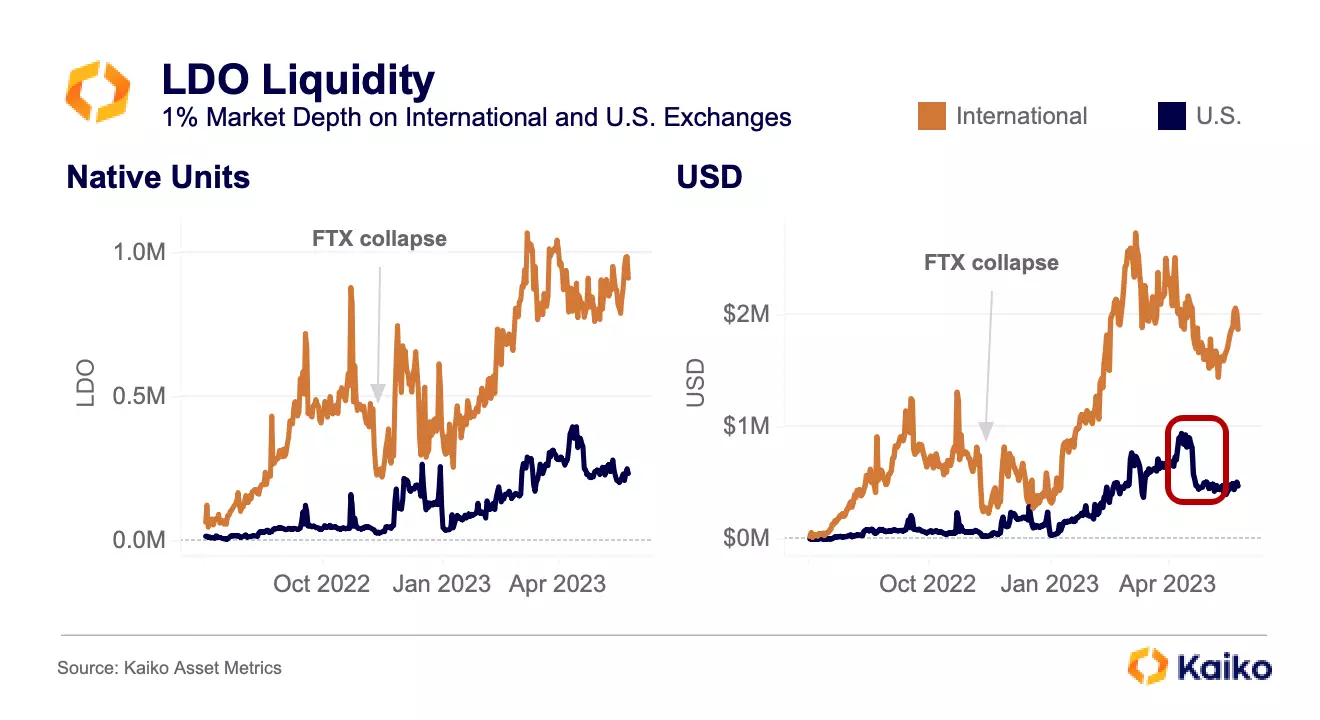

For institutions that are constrained to a specific jurisdiction for regulatory reasons, it can be informative to see how liquidity is distributed across different exchanges. Below is charted 1% market depth split between U.S. and international exchanges, presented in both USD and native units for a more comprehensive view.

Immediately it’s clear that international exchanges hold about four times more liquidity than U.S. based exchanges. Like all tokens, LDO’s liquidity took a hit after FTX’s collapse, but unlike other tokens it rebounded extremely quickly. In USD terms, it took LDO just two weeks to return to pre-FTX liquidity levels on international exchanges. By November 25, U.S. exchange liquidity had tripled from pre-FTX levels.

From January 2023 until late March, liquidity surged for both regions in both USD and native units. However, in April liquidity took a hit as LDO’s price slumped. This was particularly evident on U.S. exchanges, where 1% market depth dropped from $1mn to $500k in just a few days.

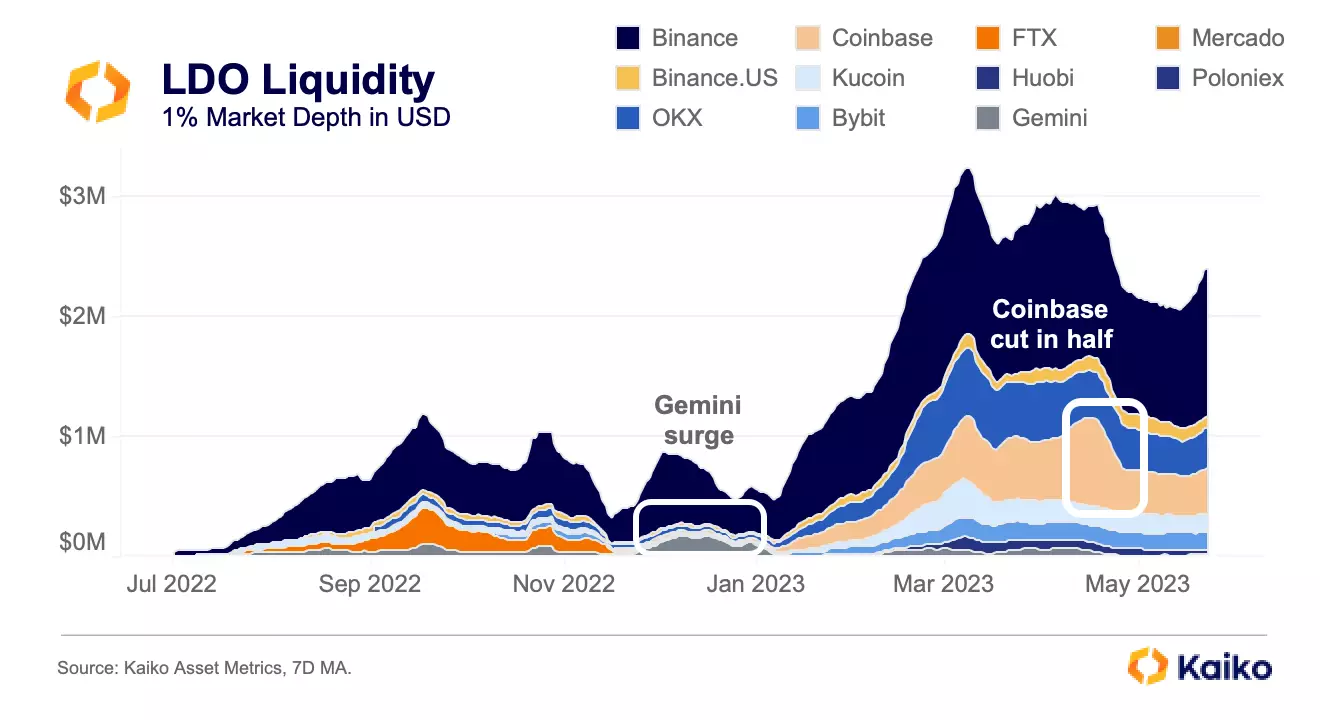

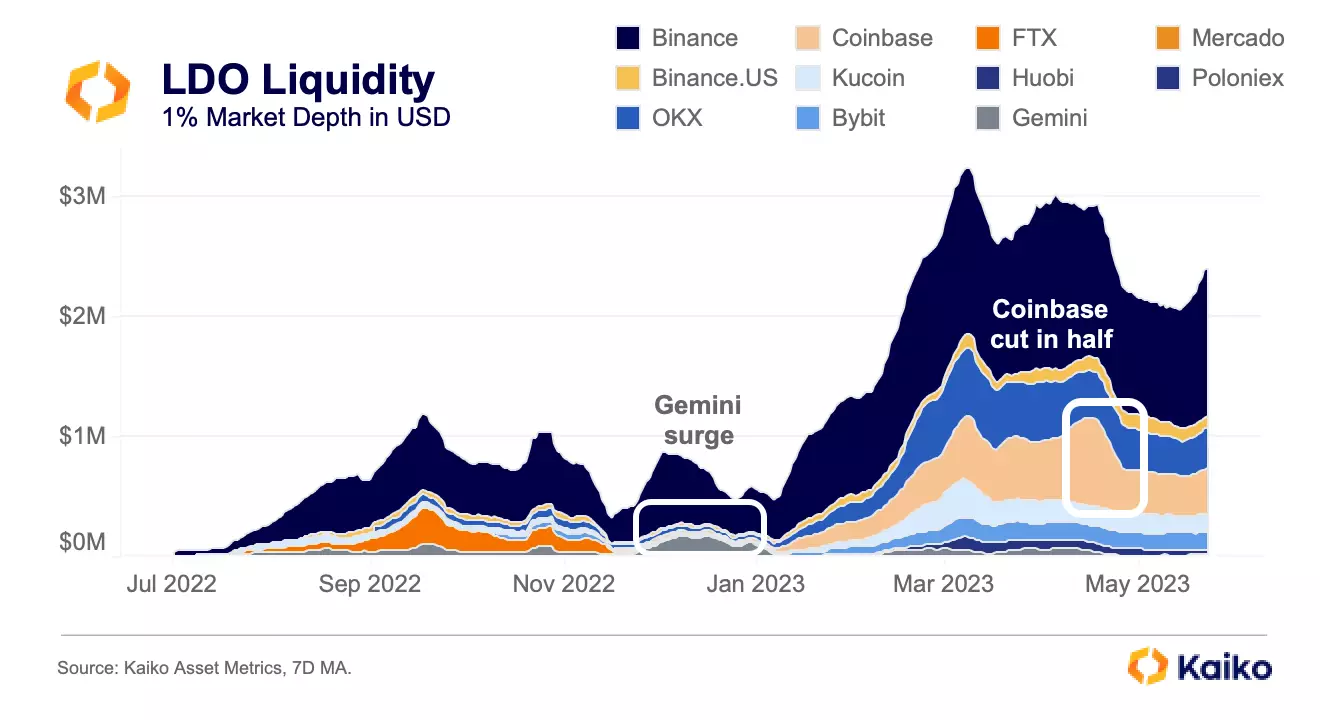

To investigate this further, we can split out the data by each exchange. Below is charted all liquidity on the exchanges.

There are a number of interesting takeaways from this chart. First, the drop in Coinbase liquidity was largely responsible for the drop in overall U.S. liquidity, as it is the most liquid U.S. exchange. Notably, this drop in liquidity came just a few days before Jane Street and Jump announced that they would be slowing U.S. crypto operations.

Going back a bit in time, FTX was once the second most liquid market for LDO. After FTX folded, Gemini briefly became the second most liquid market, adding almost the exact same amount of liquidity that FTX lost. We can investigate this further.

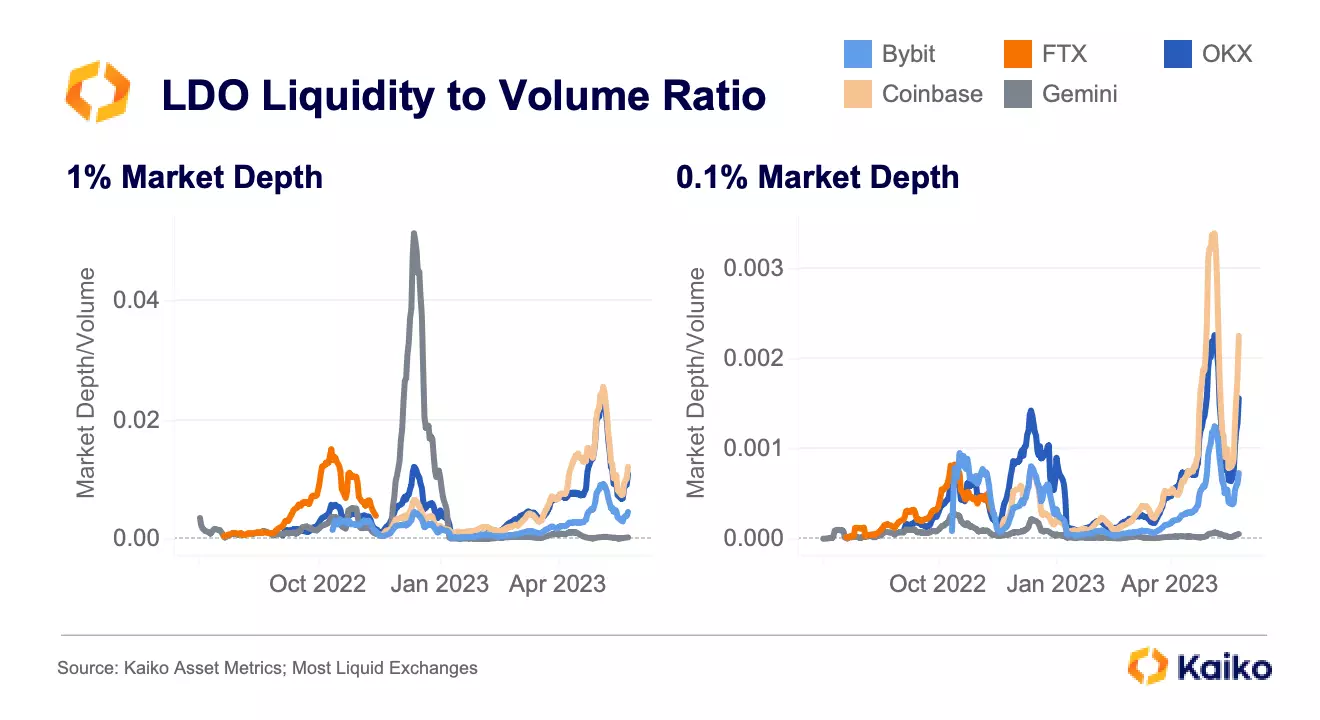

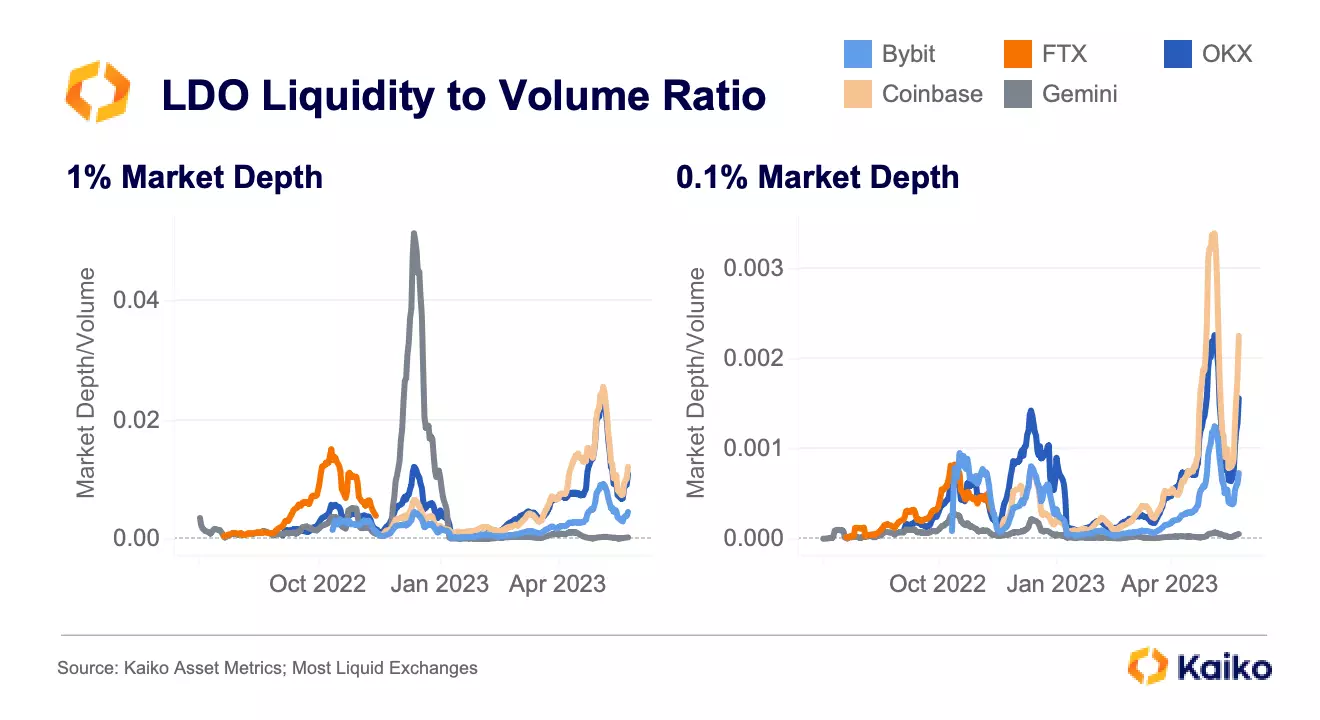

Because they are included in the same endpoint, it’s easier than ever to include volume and liquidity in the same analysis. Here, for example, is a market depth to volume ratio, where larger values represent more market depth relative to volume. Additionally, I’ve used two different market depth levels to provide a more complete picture.

On the left, there is a huge spike in Gemini’s ratio, meaning that a large amount of liquidity was added within 1% of the mid price relative to volumes. On the right, Gemini’s ratio barely budges and is in fact the lowest of the charted exchanges. This means that Gemini had the most volume relative to its 0.1% market depth. Taken together, this suggests that Gemini had a lot of liquidity added, though not in response to increasing volumes. Additionally, most of it was added farther away from the mid price.

On the left, there is a huge spike in Gemini’s ratio, meaning that a large amount of liquidity was added within 1% of the mid price relative to volumes. On the right, Gemini’s ratio barely budges and is in fact the lowest of the charted exchanges. This means that Gemini had the most volume relative to its 0.1% market depth. Taken together, this suggests that Gemini had a lot of liquidity added, though not in response to increasing volumes. Additionally, most of it was added farther away from the mid price.

In practical terms, if I was a higher frequency LDO trader in December 2022, I would probably opt for OKX (amongst the charted exchanges). However, if I had a large position to liquidate, it would be worth considering using Gemini.

![]()

![]()

![]()

![]()

On the left, there is a huge spike in Gemini’s ratio, meaning that a large amount of liquidity was added within 1% of the mid price relative to volumes. On the right, Gemini’s ratio barely budges and is in fact the lowest of the charted exchanges. This means that Gemini had the most volume relative to its 0.1% market depth. Taken together, this suggests that Gemini had a lot of liquidity added, though not in response to increasing volumes. Additionally, most of it was added farther away from the mid price.

On the left, there is a huge spike in Gemini’s ratio, meaning that a large amount of liquidity was added within 1% of the mid price relative to volumes. On the right, Gemini’s ratio barely budges and is in fact the lowest of the charted exchanges. This means that Gemini had the most volume relative to its 0.1% market depth. Taken together, this suggests that Gemini had a lot of liquidity added, though not in response to increasing volumes. Additionally, most of it was added farther away from the mid price.