Join us for our latest webinar in collaboration with Cboe

ETH’s Big Post-Shapella Rally

Welcome to the Data Debrief!

ETH hit 11-month highs following the Shapella upgrade despite expectations of significant sell pressure after more than 1mn staked ETH were withdrawn. BTC also soared past $30k for the first time since last June and is up more than 80% YTD.

-

ETH’s post-upgrade rally and bullish derivatives trends

-

The rise of TUSD on Binance

-

The shift in trade volume towards APAC hours

-

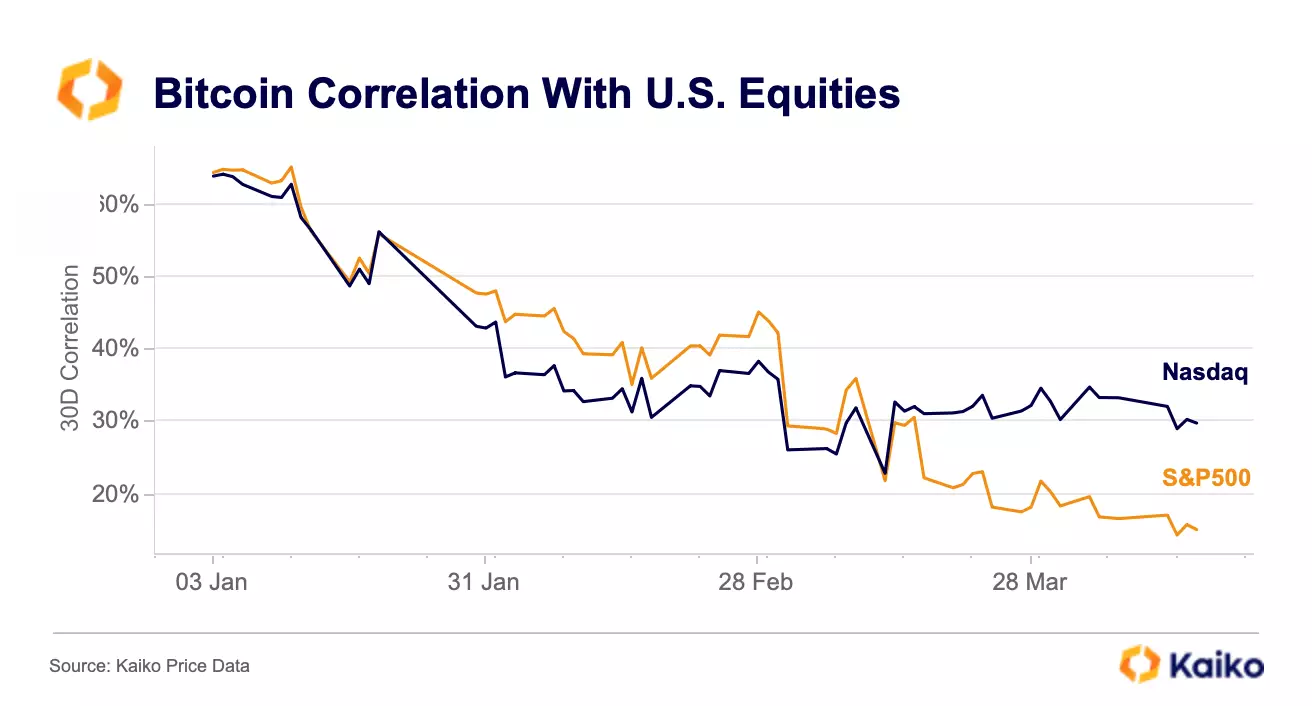

BTC’s diverging correlation with Nasdaq and S&P 500

Trend of the Week

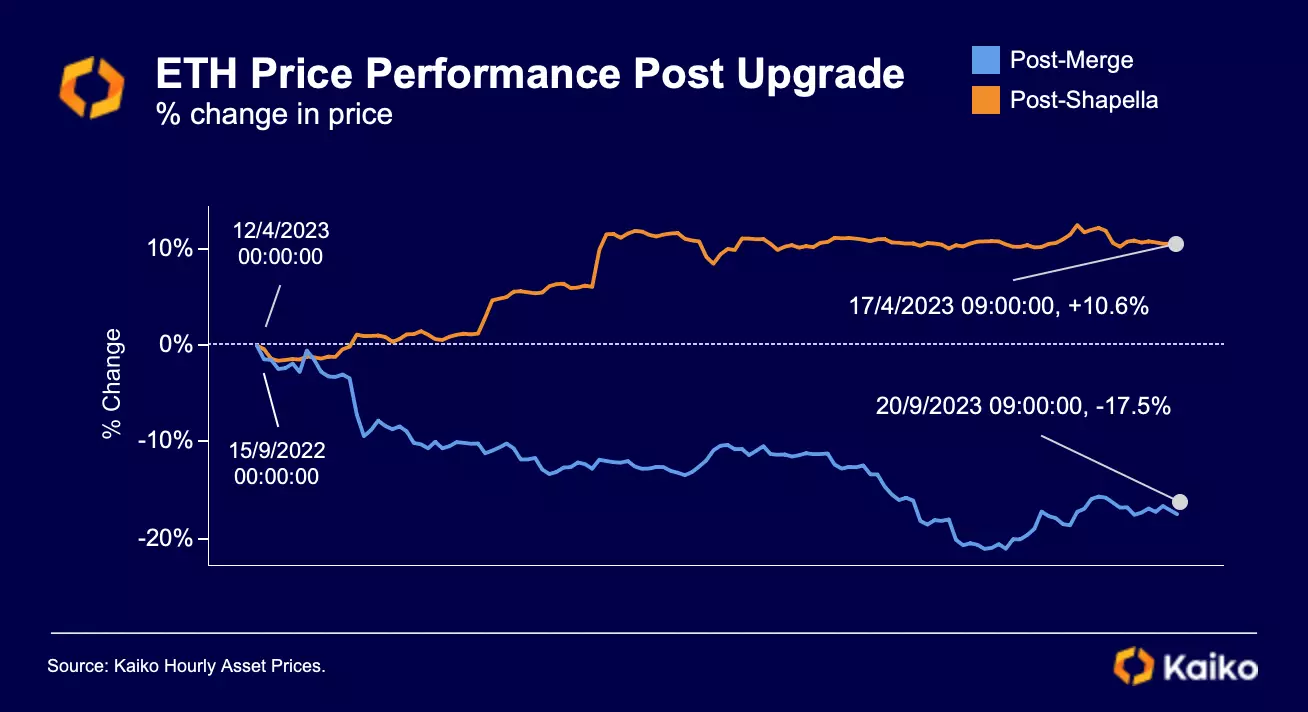

ETH soars following Shapella upgrade.

Last week, the Shapella upgrade went live without a hitch, enabling millions of staked ETH to be withdrawn. While Ethereum’s Merge upgrade last September was more of a “buy the rumor sell the news” type of event, Shapella appears to have had the opposite impact on price. ETH spot prices dropped by nearly 18% post-Merge while they are up 11% since Shapella, despite fears of mass selling.

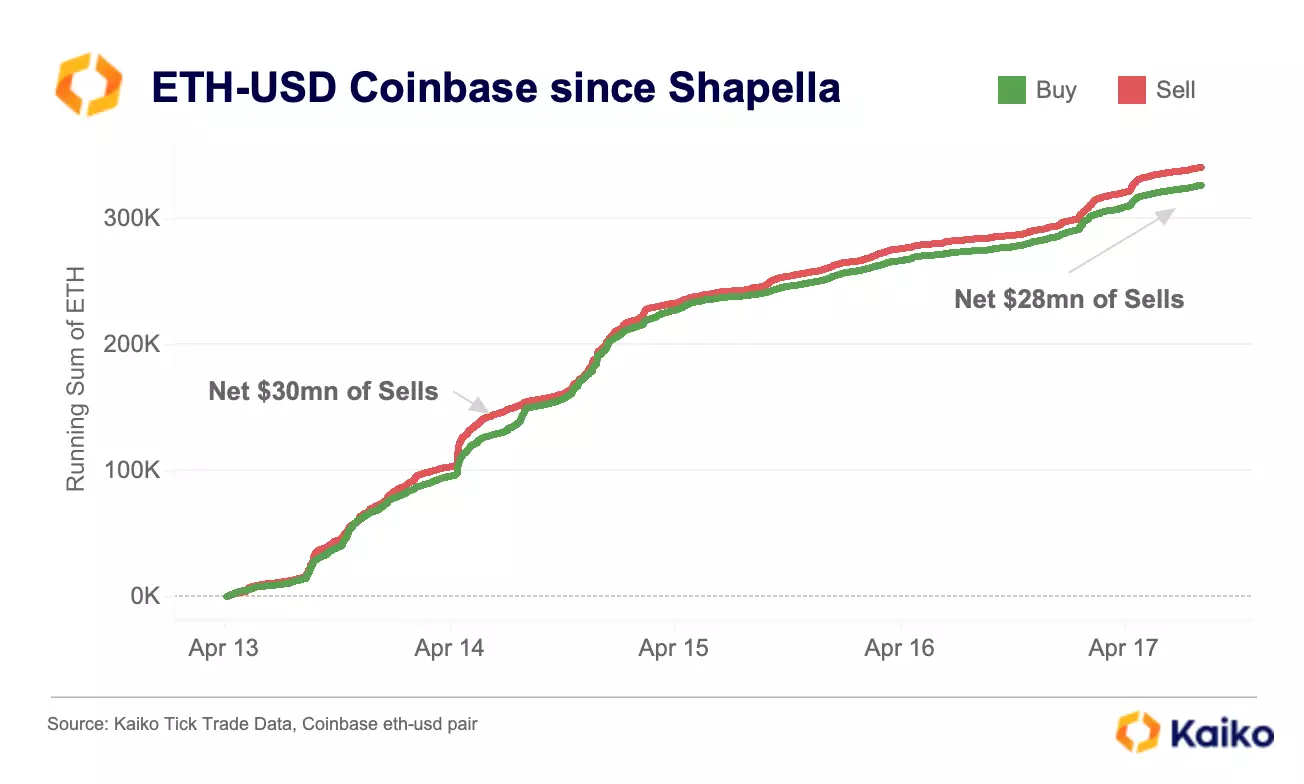

Interestingly, despite ETH’s rally, the Coinbase ETH-USD pair has seen more sell orders than buys. Coinbase is ahead of its rival Binance in granting withdrawals of ETH staked with the centralised exchange and early analysis of buy/sell volume suggests this has led traders to cash out their ETH for USD.

As it became possible to redeem staked ETH for ETH on Coinbase, tick trade data shows sells of ETH outpaced buys by over $30mn. That number stands at $28mn of net sells as of this morning, but is nevertheless an interesting dynamic to watch, particularly ahead of Binance enabling withdrawals on April 19, which could result in more sell pressure for ETH.

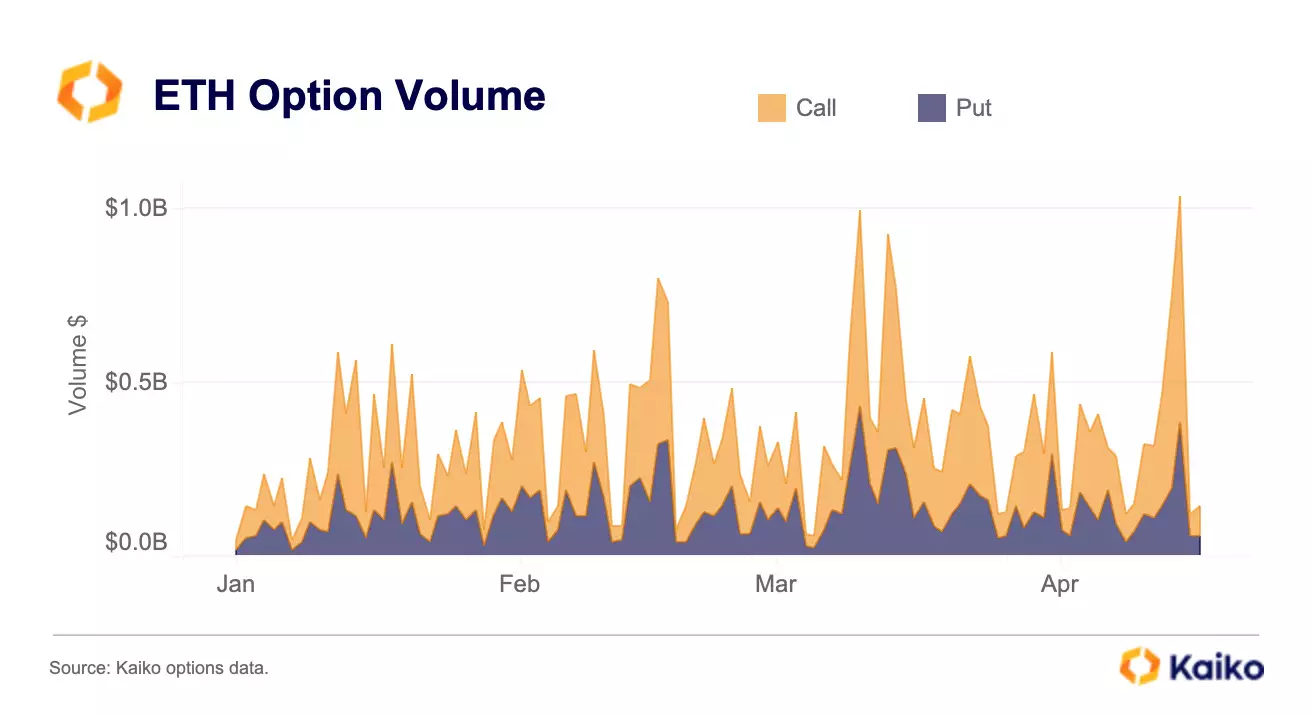

There were significant inflows in derivatives markets last week, suggesting that the overall market sentiment is turning bullish. ETH option volumes on the largest options market Deribit exceeded $1bn for the first time since the FTX collapse, driven by bullish bets.

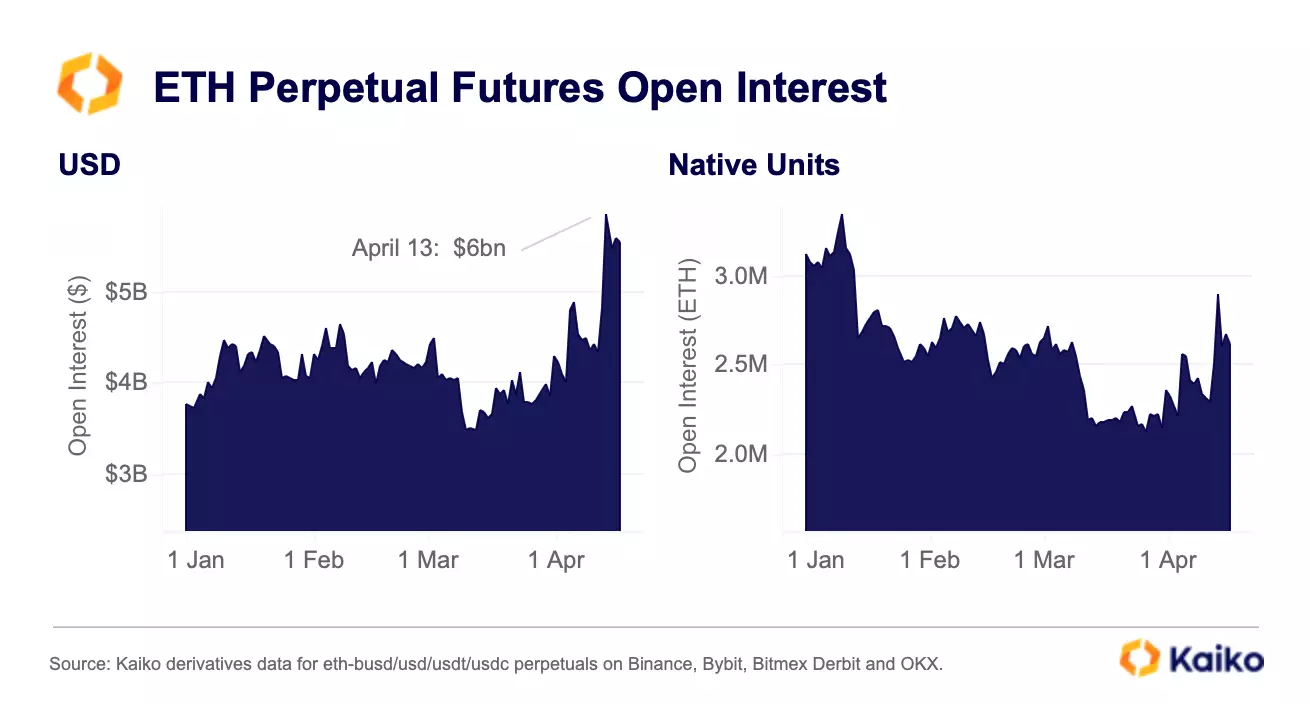

Call volumes rose to a yearly high of $700mn in the days following the Shapella upgrade, outpacing puts (bearish bets) by a large margin. ETH open interest for perpetual futures markets hit a multi-year high of over $6bn and funding rates have remained positive.

While part of the increase in open interest was driven by rising ETH prices, the amount of open contracts in native units also jumped double-digits, up more than 20% last week, despite remaining below its levels from early March.

Never miss an analysis.

Subscribe to our free weekly Data Debrief email, or learn more about our premium research subscriptions here.

Price

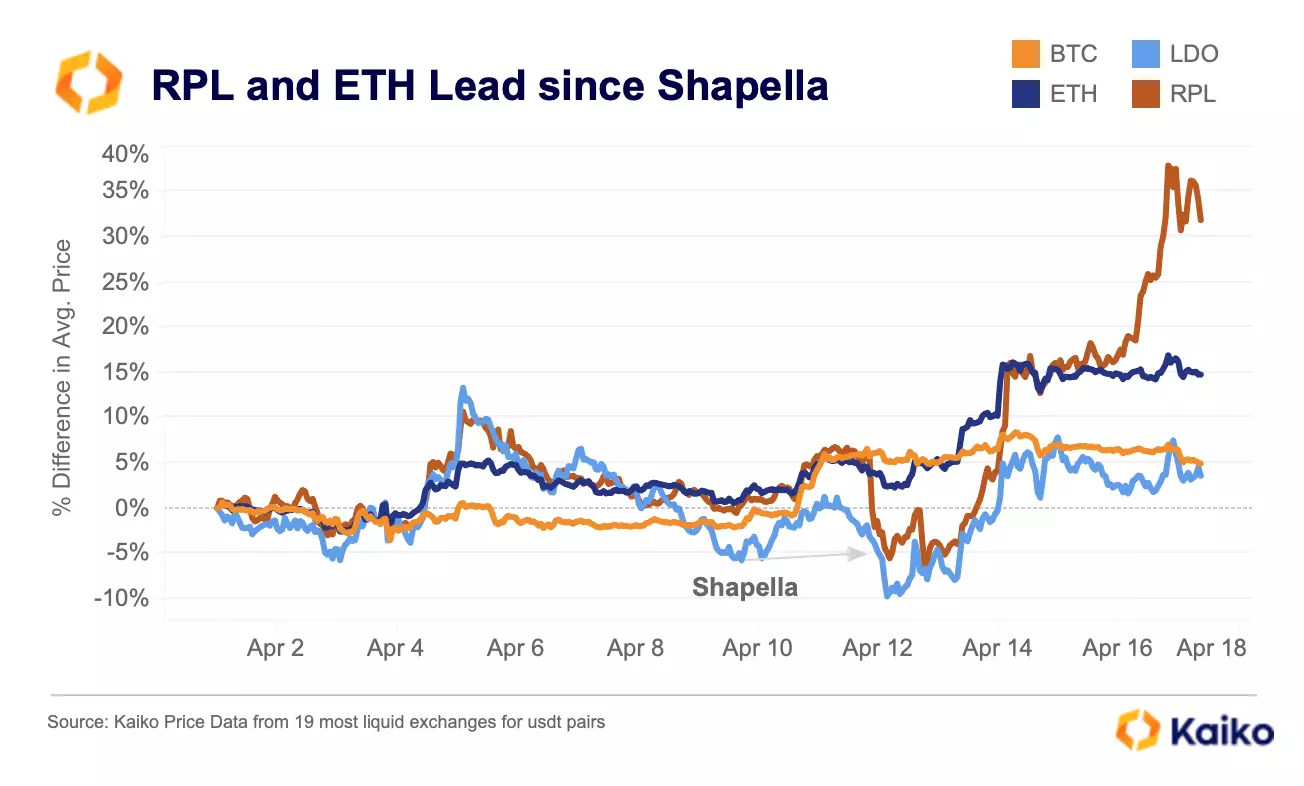

Rocketpool outperforms ahead of Atlas update.

Since the Shapella update, Rocketpool (RPL) has dramatically outperformed not only BTC and ETH, but also its closest rival and market leader of liquid staking protocols, Lido (LDO). Rocketpool is a smaller player in the Ethereum staking industry at the moment, with only 2% market share of depositors, compared to Lido’s 31% and Coinbase’s 12%.

However, since Shapella, RPL is up close to 40% amidst potentially bullish catalysts. Rocketpool is also undertaking its own update this week, Atlas, which will decrease the amount of ETH required to become a validator on the protocol from 16 ETH to 8 ETH. Usually 32 ETH is required to become a validator on the Ethereum network, so this upgrade should give Rocketpool a competitive edge over other protocols in the form of more validators and a more decentralized network and may allow it to gain market share.

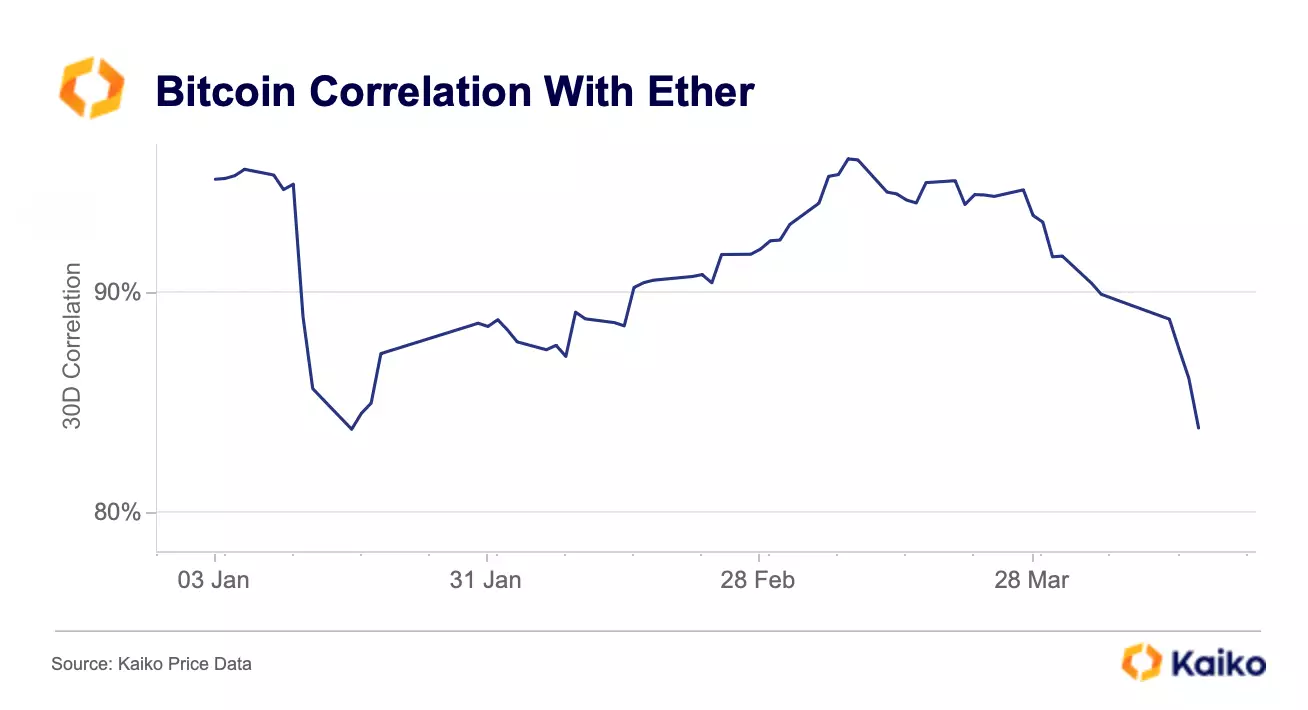

ETH’s correlation with BTC dips to 3-month low.

BTC’s correlation with ETH, calculated using a 30-day rolling window, has dropped to its lowest level since January, following BTC’s double digit March rally. While ETH gained some traction last week, it has been underperforming in March as investors took a cautious approach amid rising regulatory scrutiny. The correlation between the two assets has been particularly volatile over the past seven months, after it hovered around 90% for most of the past year. The trend could suggest that investors are increasingly perceiving BTC and ETH as conceptually different assets instead of grouping them together. The two successful major ETH upgrades within just 8 months will probably contribute to this shift.

Liquidity

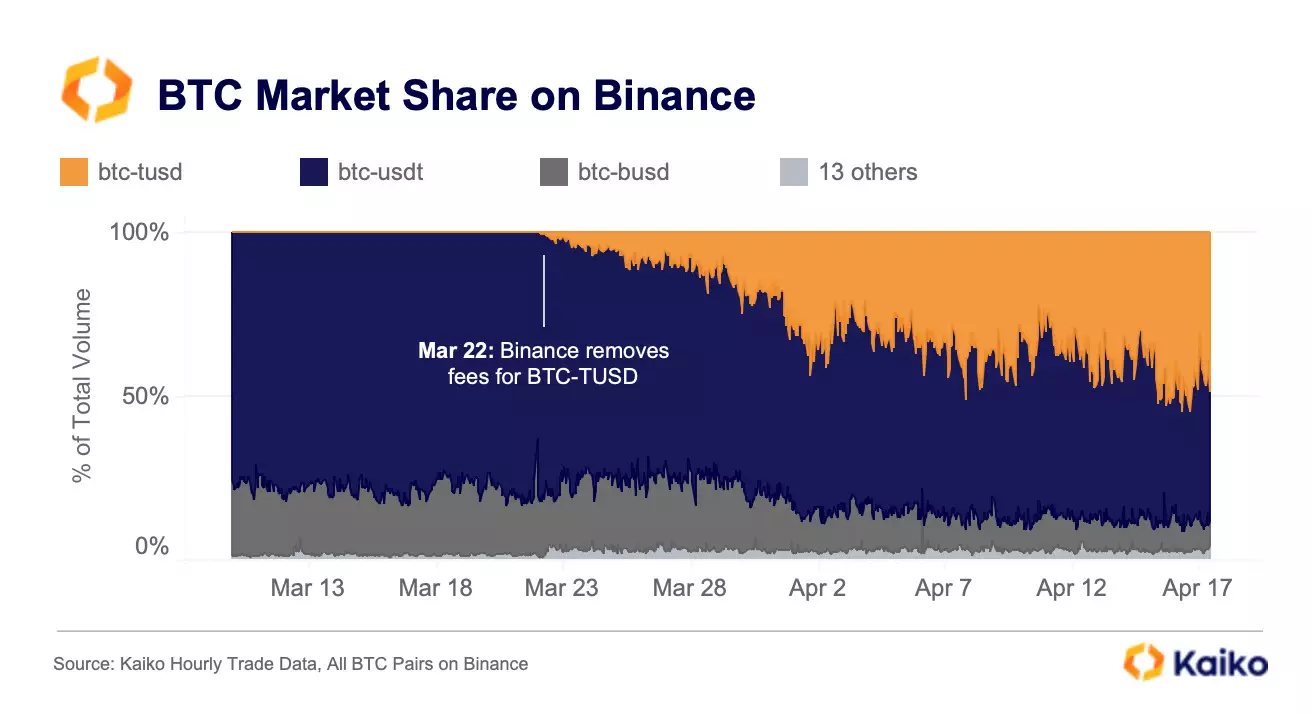

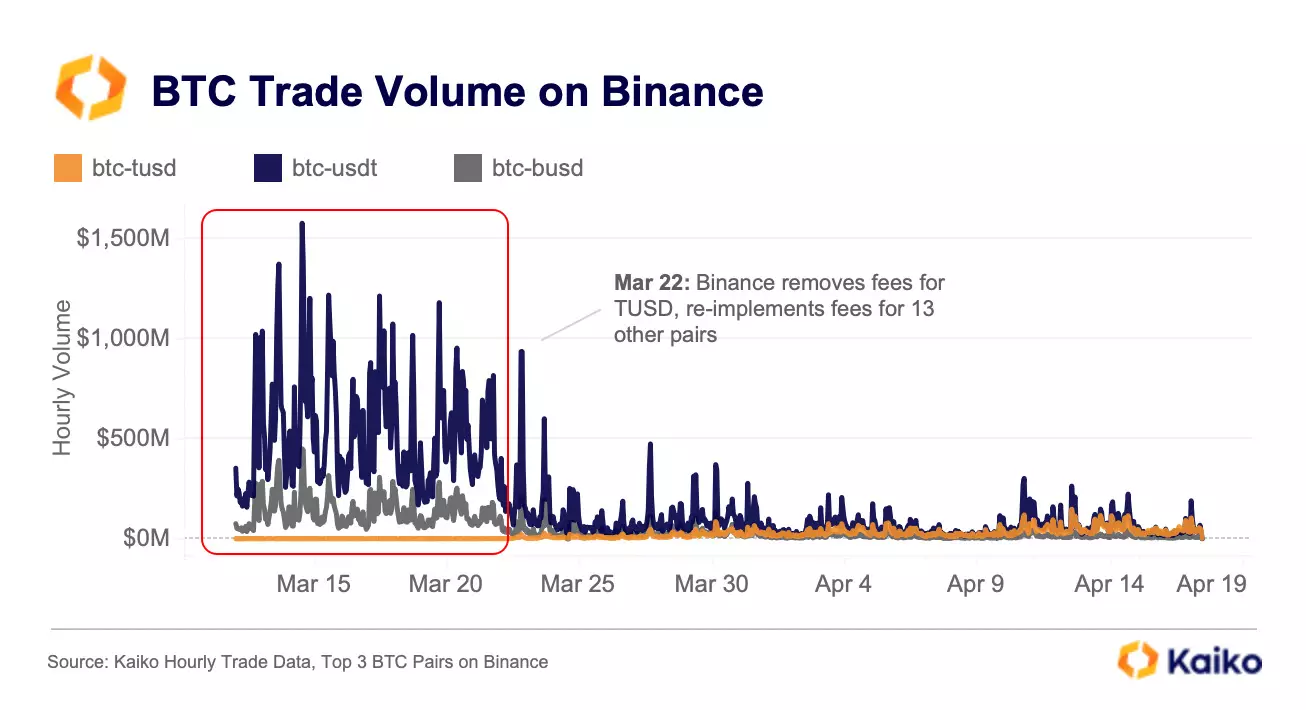

TUSD claims 50% market share on Binance.

That was fast. It took less than one month for Binance’s BTC-TUSD pair to become the largest bitcoin market on the exchange (and in the world). On March 22, Binance halted its zero-fee trading program for 13 BTC trading pairs. The exchange also re-listed its BTC-TUSD market and removed trading fees for the pair, making it the only fee-less pair on the exchange. Last week, trade volumes for the pair officially surpassed 50% relative to all other BTC pairs for the first time, including BTC-USDT.

When looking at trade volume for the top three BTC pairs on Binance, we can see a dramatic drop ever since Binance changed its fee policy. TUSD has grown from nothing to around $60mn an hour, but this is paltry compared with USDT’s average of nearly $1bn an hour before fees were re-implemented.

While TUSD is now dominant on Binance, the data suggests that most traders are still reluctant to begin trading the relatively unknown stablecoin. Ultimately, Binance’s market share is still down 10% since the change in fees, and it looks like one zero-fee pair for a small stablecoin is not enough to reclaim what was lost (for now).

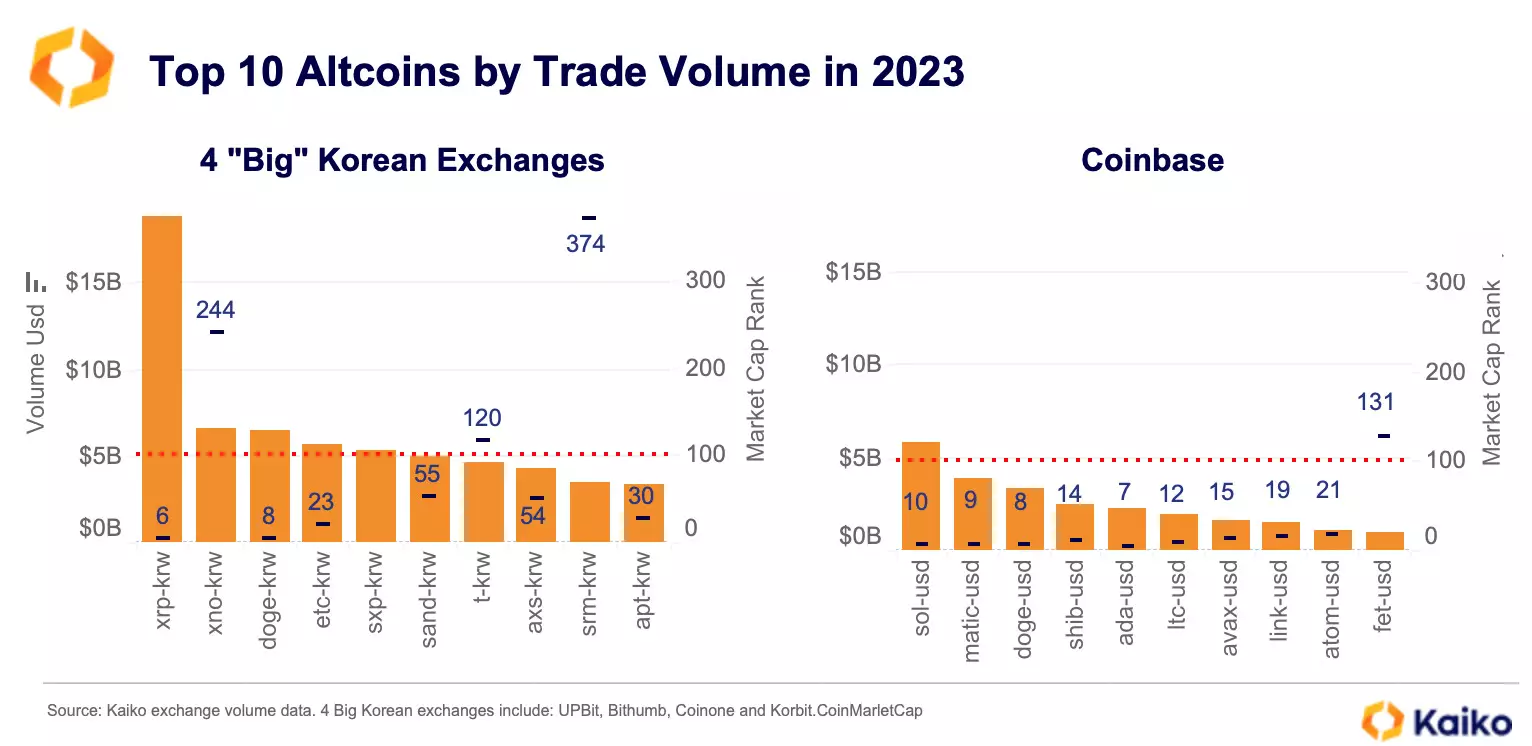

Exploring altcoin trading on Korean markets.

Last week, we showed that more than 90% of trade volume on the “big 4” Korean exchanges was for altcoins, in stark contrast to other exchanges where this share averages between 40-60%. To better understand the market structure of Korean exchanges, we looked at the top ten altcoins by cumulative trading volume in 2023 and compared them to Coinbase. We also include the market cap rank of each token.

We find that XRP is by far the most traded altcoin on Korean markets, which along with Binance is a major marketplace for the token after it became the subject of a legal dispute with the U.S. SEC in late 2020 and was delisted from Coinbase. Korean markets have played a role in the recent XRP rally, with XRP-KRW trading volume rising to a multi-month high in late March.

The second most traded altcoin in terms of trading volume — peer-to-peer network Nano’s token XNO, which is ranked 244th in market cap — saw its trading volume surge in early April following a sell-off on Bithumb. As a result, its price has moved away from that of USD markets, falling by 40% in April, while on Binance.US it has increased by 1.3%.

It is worth noting that the most traded altcoins on Korean exchanges rank between 6 and 374 by market cap, while the top altcoins on Coinbase fall below the top 100. An interesting exception is the token of the Fetch.ai network (FET), which provides infrastructure for smart autonomous services. FET-USD is the 10th most traded altcoin this year on Coinbase, although it ranks 134th by market cap. The trend reflects the growing interest in AI-related projects,

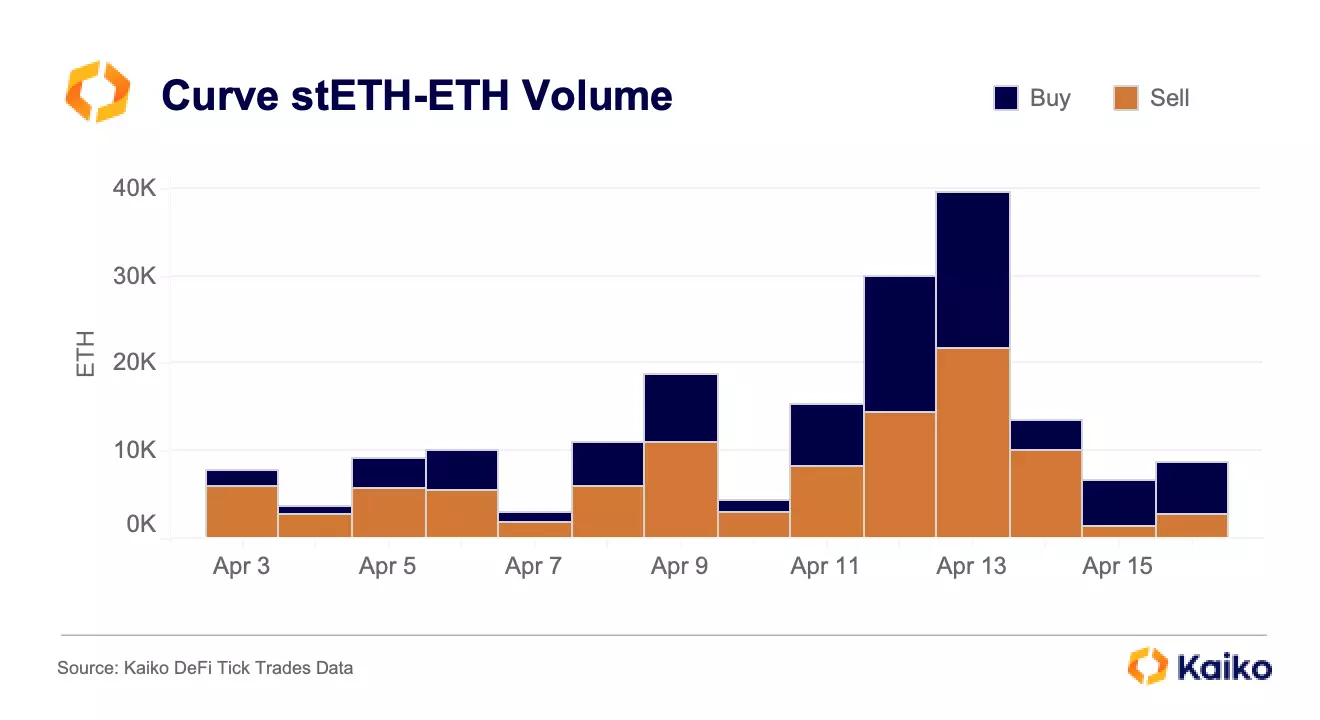

Curve processes 85k stETH volume in three days.

Curve facilitated the vast majority of stETH volume across any exchange, centralized or decentralized, as nearly 85k stETH (over $150mn USD) was traded from April 11-13, with April 12 the day of the upgrade. During this time period, Uniswap V2 and V3 processed just under 500 stETH volume combined. Additionally, on Curve, these days were nearly perfectly balanced in buy and sell volume; sells had outpaced buys for the entire week before the upgrade. Over the weekend, buys became dominant, accounting for 11.5k ETH of the pair’s 15k ETH volume.

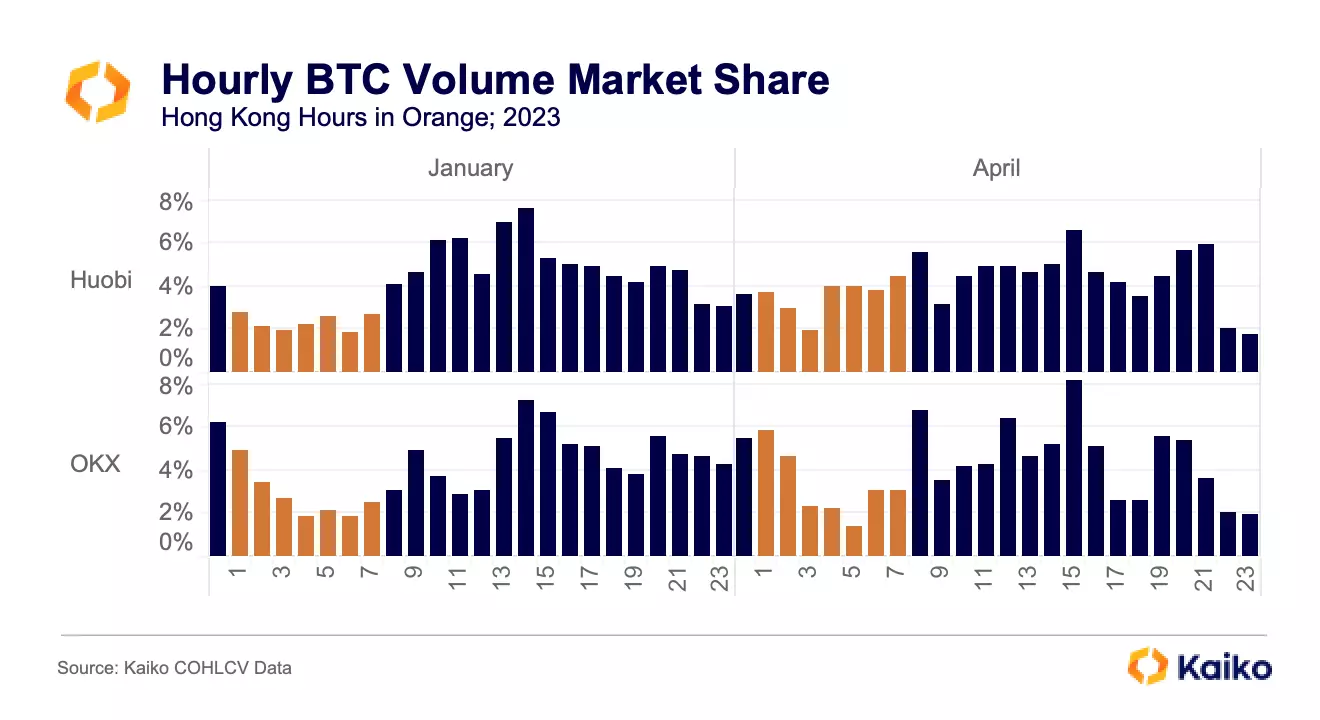

APAC hours gain market share as Hong Kong recommits to crypto.

Hong Kong last week hosted the Web3 Festival at which numerous government officials confirmed the city’s new openness to crypto while alluding to new regulations for DeFi. A representative from the city’s financial regulator – the SFC – said that the “SFC views DeFi activity through the same regulatory framework that applies to financial activities… as long as DeFi activity holds within the scope of securities and futures, it would be subject to the same regulatory requirements.”

Despite the possibility of strict DeFi regulations, Hong Kong’s revised regulations have generated excitement and activity. Huobi and OKX – two exchanges founded in China – have confirmed that they will seek licenses to operate in the country in June. The two exchanges are already reflecting increased activity in the region, with Huobi’s share of BTC volume during HK trading hours jumping from just 16% in January to 25% in April; OKX has registered a more modest increase, from 19% to 23%.

Implied Volatility

Surfaces Now Live

Kaiko’s IV surface data follows the launch of IV Smiles last year. The new addition includes space and time interpolation, enabling even more precise and complete analysis for clients. The product now has the ability to provide accurate volatility for a range of expiry dates and strike prices, even those not listed.

-

introduction of multi-source aggregation

-

more robust and manipulation-resistant, using a trusted transparent methodology

-

advanced algorithms and new interpolation framework

-

stay ahead of market trends & make informed trading decisions

Derivatives

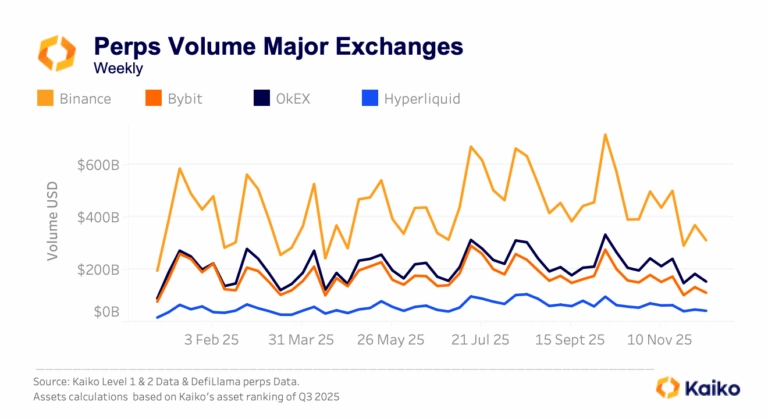

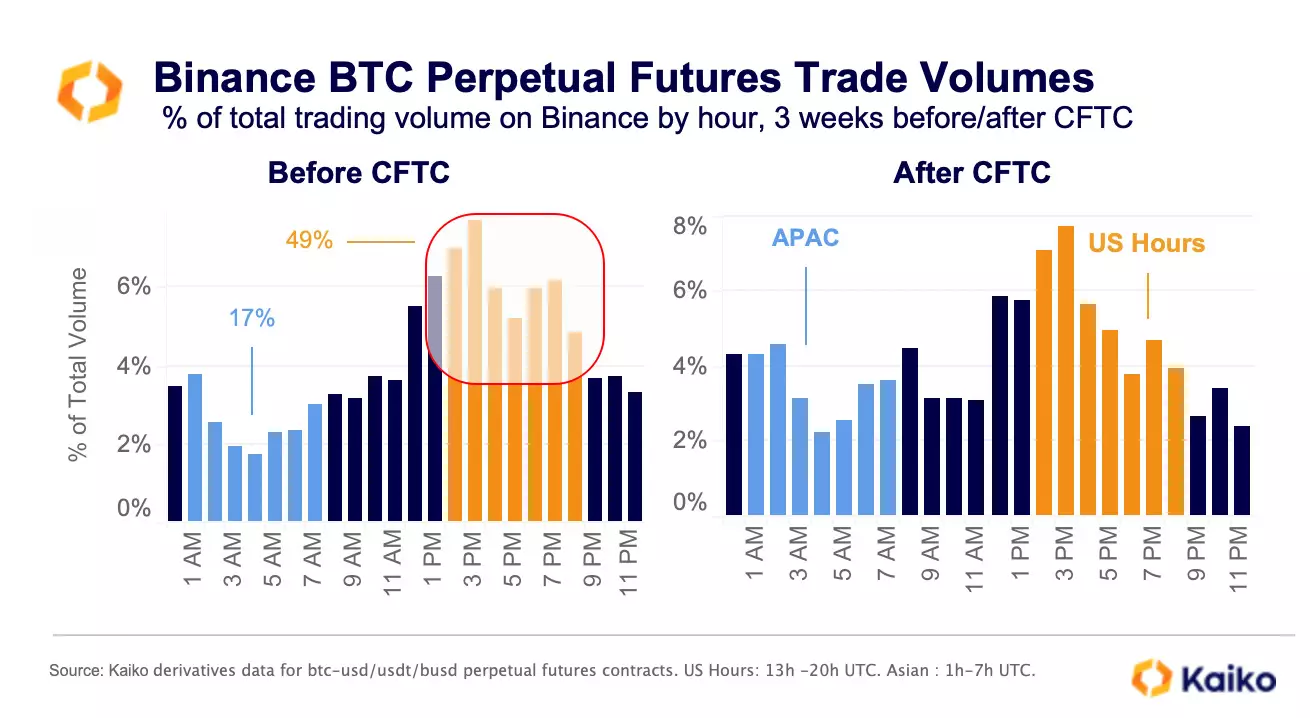

U.S. volume decreases on Binance following lawsuit.

Last week, we showed that trading volume for BTC perpetual futures on Binance have increasingly shifted toward U.S. trading hours over the past year. However, in the three weeks since the CFTC filed a lawsuit alleging that the exchange was allowing U.S. customers to trade derivatives on its international platform, we have seen a reversal of that trend.

Since March 27, the share of trading between 1:00pm and 8:00pm UTC (9:00am-4:00pm ET) has fallen from 49.1% to 43.5%. By contrast, the share of trading during APAC opening hours (1pm-7 p.m. UTC) has increased from 17.6% to 24%. Despite a slight increase in trading during the overlap between EU and APAC hours, the overall share of trading during EU opening hours has declined. This shift, which occurred relatively quickly after the initiation of the lawsuit, could indicate both a drop in U.S. activity and migration towards APAC.

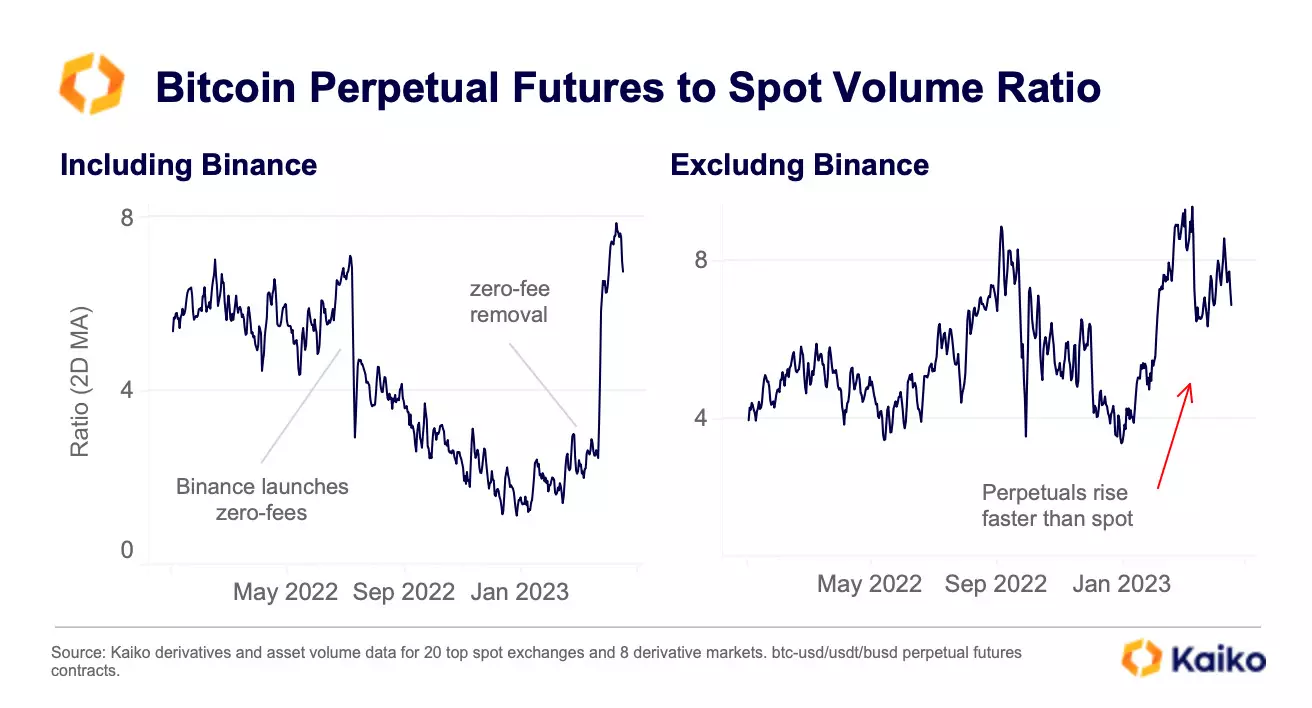

BTC derivatives gain traction after months of stagnation.

The ratio of BTC perpetual futures to spot volume resumed its increase in April, hitting its highest level since July 2021, suggesting strong derivatives inflows. We calculate the ratio as the volume of BTC perpetual futures divided by spot volume for the top 15 BTC spot markets. The ratio decreases when spot volume rises faster than perpetual futures volume.

The introduction of zero-fee BTC trading on Binance last July caused global BTC spot volume to soar, which arguably made the ratio a less reliable indicator of spot vs. derivatives demand. Thus, we calculate the ratio both including and excluding Binance.

Interestingly, the gap between the two ratios – with and without Binance – widened significantly in early 2023. While the ratio with Binance was at a low level of 2 to 3, without Binance it rose to over 10 in early March before falling sharply in the second half of the month. This suggests that derivatives volumes drove the market in early 2023, while the March rally was mainly due to the spot market.

Both ratios have rebalanced after Binance removed its zero-fee promotion on March 22, and are now moving in the same direction – with an increase in early April. This suggests that derivatives inflows have accelerated and are also contributing to the current price movements. The trend seems to reverse last week with spot markets gaining ground after the Shapella upgrade.

Macro

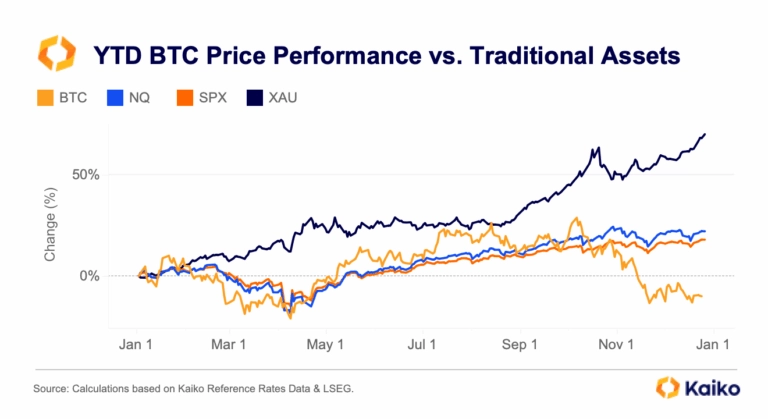

Bitcoin’s correlation with U.S. equities diverges.

The gap between BTC’s correlation with the tech-heavy Nasdaq 100 and the broader S&P 500 is the widest since May 2021. BTC, up 52% since March 10, remains more correlated with tech stocks, which have also benefited from bets on Fed easing and are up 11%. The S&P 500 lagged behind, dragged down by falling financials, which make up about 10% of the index. Its correlation with BTC is currently at a two-year low of just 15%. Overall, BTC moved less in line with risk assets this year as crypto-specific factors such as low liquidity and seller exhaustion also played a role in price performance.

Data Used in this Analysis

Derivatives Metrics

![]()

Metrics and analytics products tailored to the cryptocurrency derivatives market.

Liquidity Metrics

![]()

The most granular order book data in the industry optimized for quantitative analyis.

Trade Volume

![]()

Centralized exchange data sourced from the most liquid venues, covering all traded instruments.

More From Kaiko Research

![]()

Derivatives

29/12/2025 Data Debrief

Santa Rallies, Cycles, and Year-End Reflections for BitcoinAs markets approach the end of the year, Bitcoin finds itself at a familiar crossroads, caught between cyclical behavior and a steadily developing market. While year-end seasonality has historically played a role in shaping price action, recent data suggests that cyclical drivers are increasingly dominant.

Written by Laurens Fraussen![]()

Derivatives

22/12/2025 Data Debrief

Crypto in 2026, What Breaks, What Scales, What ConsolidatesCrypto markets enter 2026 in a markedly different position than in prior cycle transitions. Rather than resetting after a speculative peak, the market appears to be progressing through a phase of institutional consolidation.

Written by Thomas Probst![]()

Year in Review

01/12/2025 Data Debrief

Kaiko Research's Top 10 Charts of 2025In this report, we look back on 2025 and the key forces that shaped markets. From BTC record highs and fleeting altcoin rallies to major liquidation events and evolving regulation, we examine what shaped a seminal year for crypto.Written by Adam Morgan McCarthy![]()

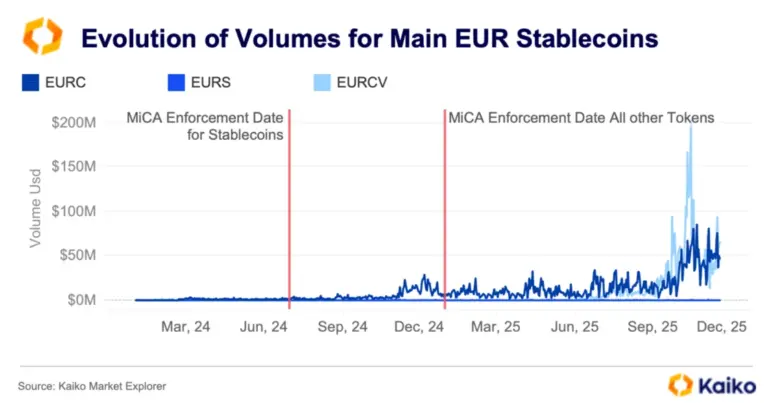

Stablecoin

24/11/2025 Data Debrief

MiCA's Impact on Crypto in EuropeEurope is progressing with a conservative structured crypto framework that leans towards regulating innovation.Written by Adam Morgan McCarthy