Data Points

Is a spot bitcoin ETF imminent?

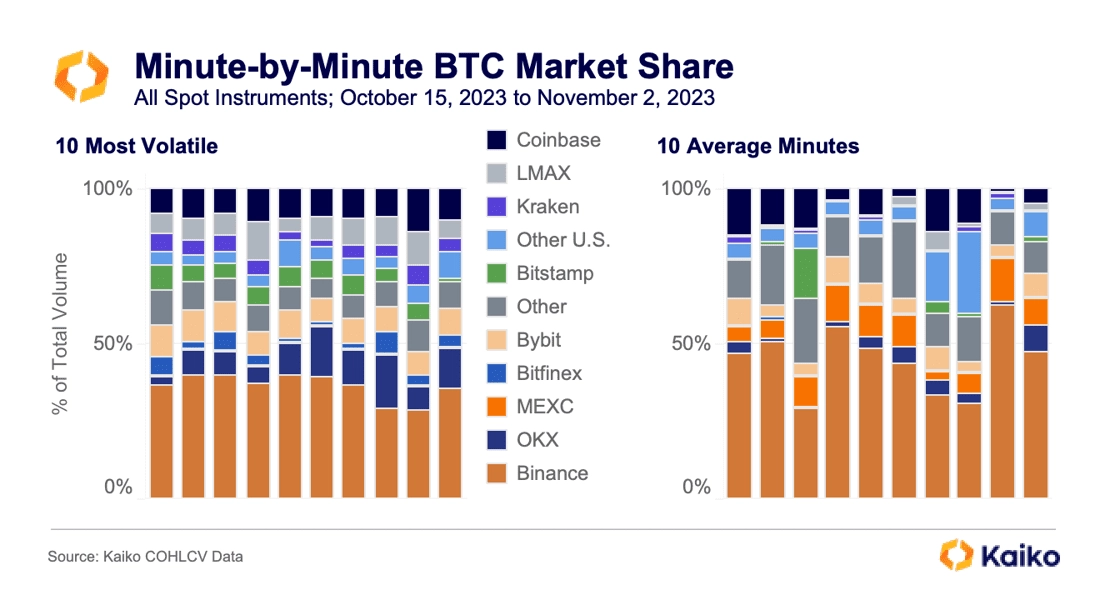

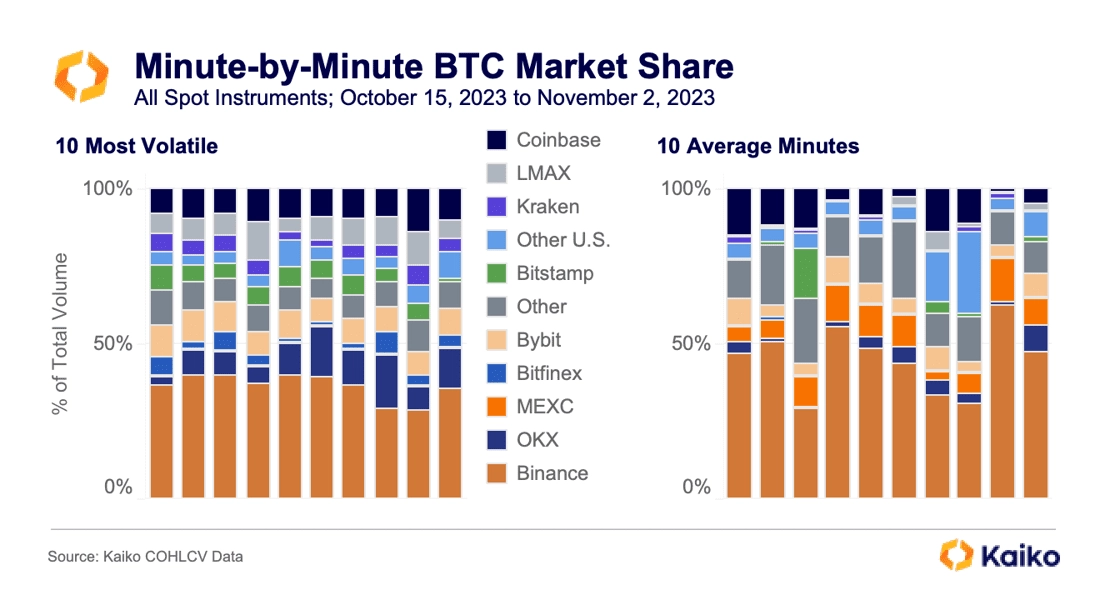

The SEC has cited a lack of surveillance sharing and the potential for manipulation as reasons for rejecting previous spot bitcoin ETF applications. Are new surveillance sharing agreements with Coinbase enough? Our latest Deep Dive takes a granular look at BTC volumes to better understand which exchanges have the most influence on price.

We find that it’s hard to imagine a scenario in which an entity could manipulate an ETF’s price over a short time frame without also attempting to manipulate the price on Coinbase, meaning it should fit the definition of “significant market” as required by the SEC.

Read it here.

SOL liquidity analysis: breaking down the rally.

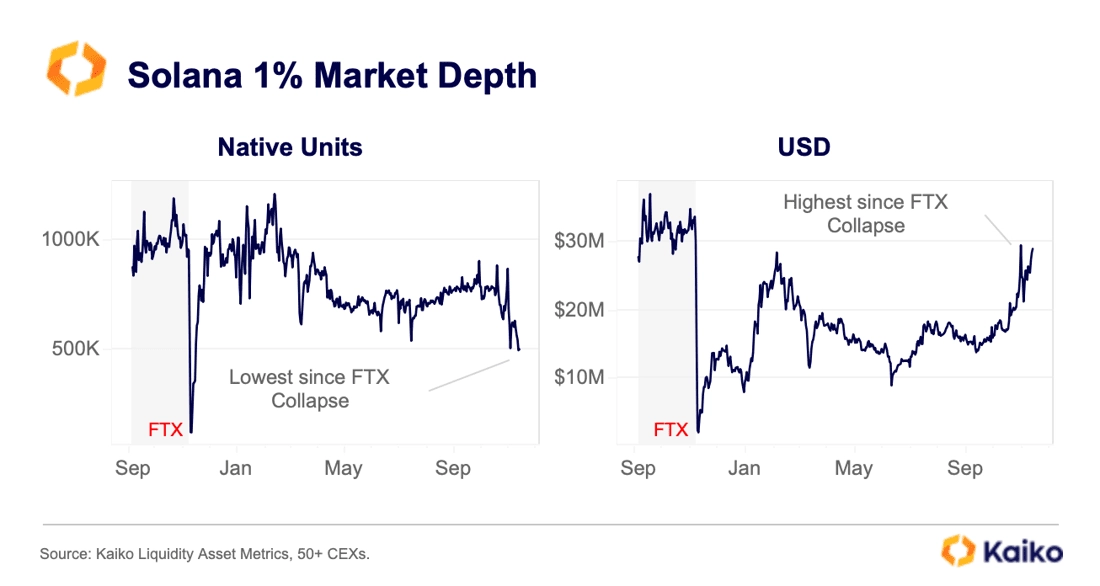

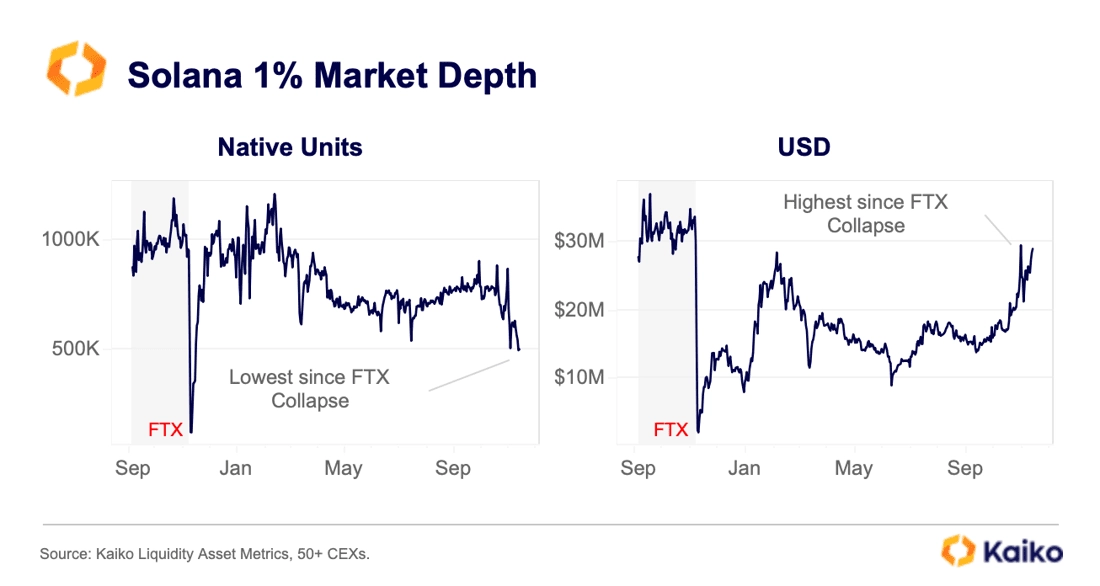

Solana continues to soar with no obvious catalyst, hitting $60 for the first time since May 2022. The cryptocurrency is now ranked 7th in market cap, just behind USDC. Has liquidity increased on centralized exchanges to match the trend?

We find that it has not, at least when measuring liquidity in terms of the depth of order books. Our measure for liquidity — market depth at 1% of the mid price — shows that the total quantity of bids and asks on SOL order books has fallen. When denominating this liquidity in USD, rather than native units, it has increased, largely driven by price effects as the token is up 40% week-on-week.

However, the data suggests that market makers have not returned to SOL markets. The low liquidity could actually be contributing to SOL’s gains; the less ask-side liquidity, the easier it is to push up the price of SOL.

The price surge is particularly surprising considering that the FTX bankruptcy estate has reportedly un-staked and transferred to centralized exchanges millions of SOL tokens. Back in September, the defunct exchange obtained a court approval to start selling its crypto assets boosting fears of a price crash. However, SOL prices have rallied ever since, outperforming BTC by a large margin.

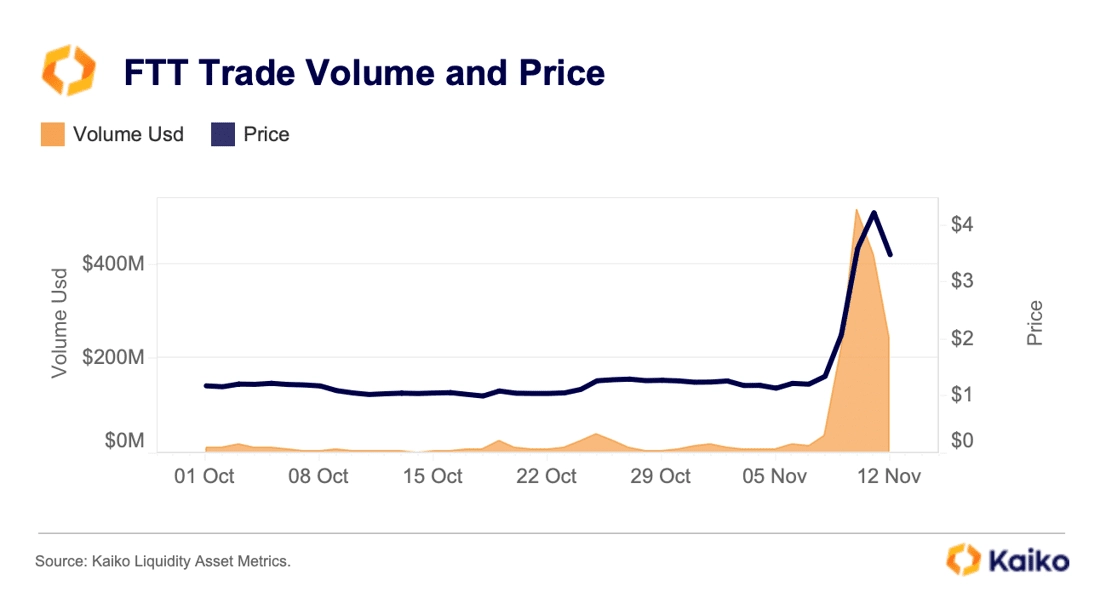

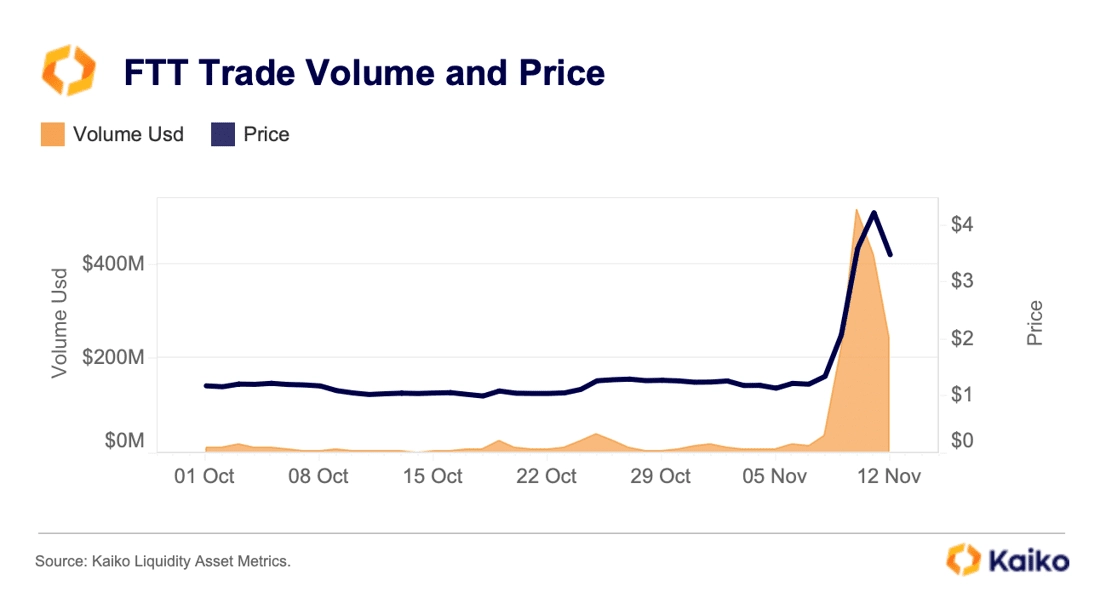

FTT price and volume surge on FTX.

FTX’s token FTT unexpectedly surged by more than 180% last week after comments by SEC chairman Gary Gensler boosted hopes that FTX 2.0 could get a green light. Several buyers are reportedly interested in acquiring the defunct exchange’s assets after Sam Bankman-Fried’s guilty verdict earlier this month. FTT daily volumes surged to around $500mn, led by Binance, which accounted for nearly 90% of FTT’s trading volume. Despite having no use case and an unclear future, FTT continues to be traded on a dozen of crypto platforms, with an average daily trade volume of around $20mn.

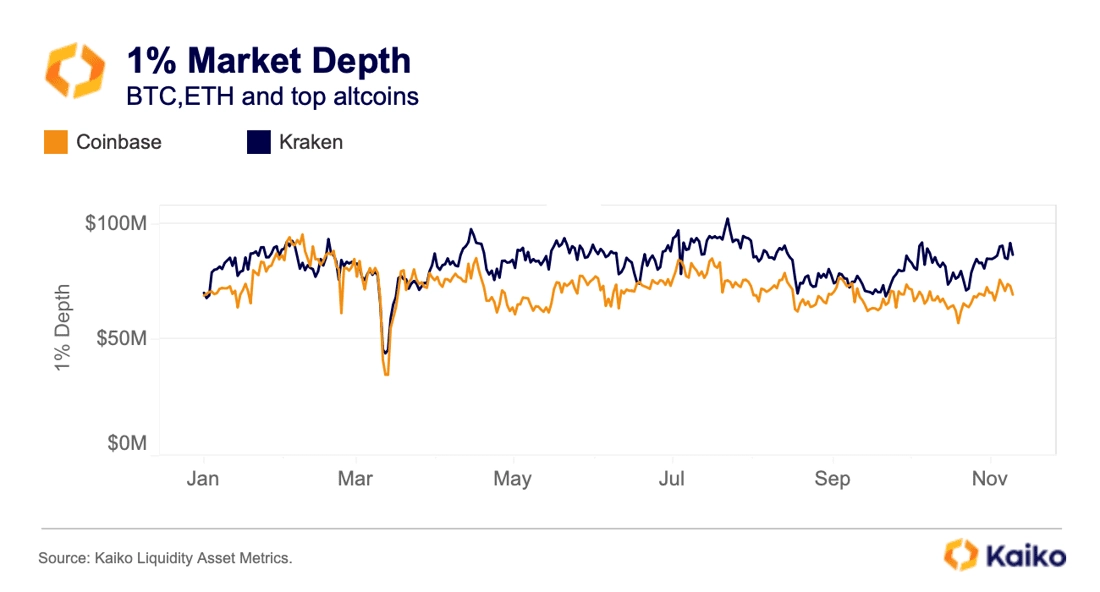

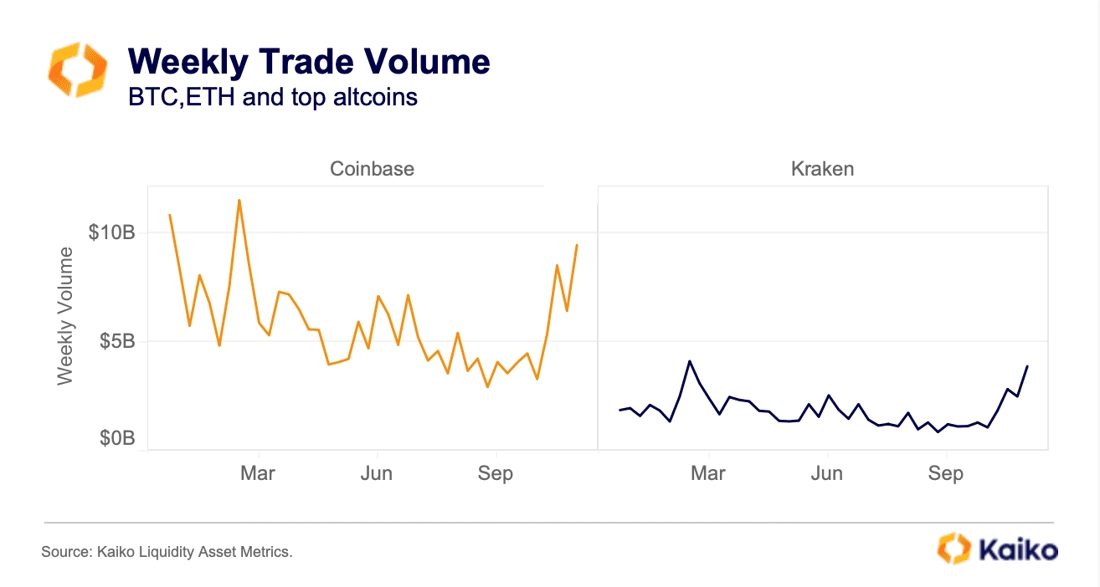

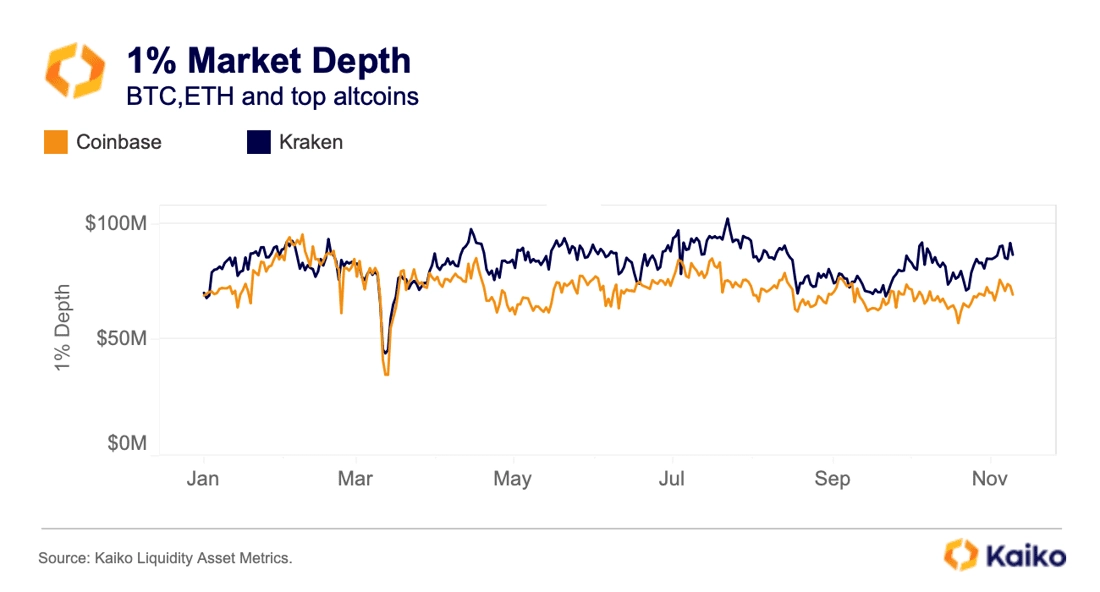

Kraken’s market depth surpasses Coinbase’s.

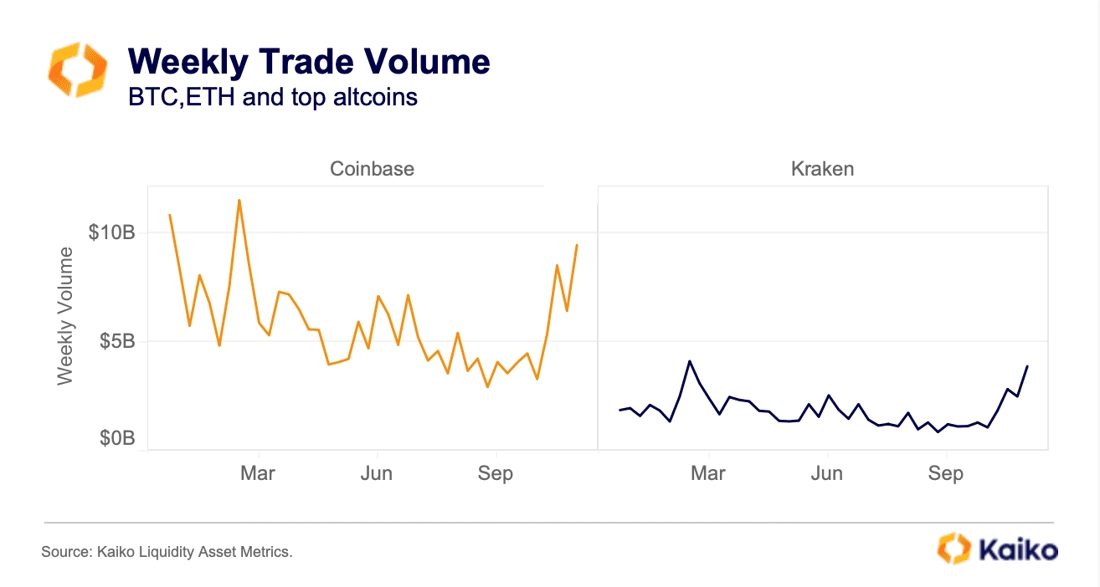

Despite having three times less trade volume than Coinbase among the tokens examined, Kraken’s liquidity as measured by 1% market depth has been slightly greater than Coinbase’s since April. Our aggregated market depth data includes BTC, ETH, and the top 30 altcoins.

We first noticed Kraken’s strong liquidity in the early summer when analyzing the impact of the regulatory crackdown on exchange liquidity. Kraken holds nearly 40% of the market depth among U.S.-available exchanges, compared to Coinbase’s 33%. The trend is interesting because Coinbase remains the largest U.S. exchange by trade volume with a market share of over 57%.

The weekly trade volume on Kraken for these tokens averaged $2bn in 2023 compared to $6bn on Coinbase.

Interestingly, although Kraken lags behind Coinbase in overall volume, the exchange is the largest stablecoin-to-fiat market. Stablecoin-to-fiat trading pairs account for nearly 37% of Kraken’s trade volume compared to only 16% for Coinbase and 10% for Gemini. This suggests that many traders are using exchange as a fiat on/off ramp and to arbitrage stablecoin and fiat prices.

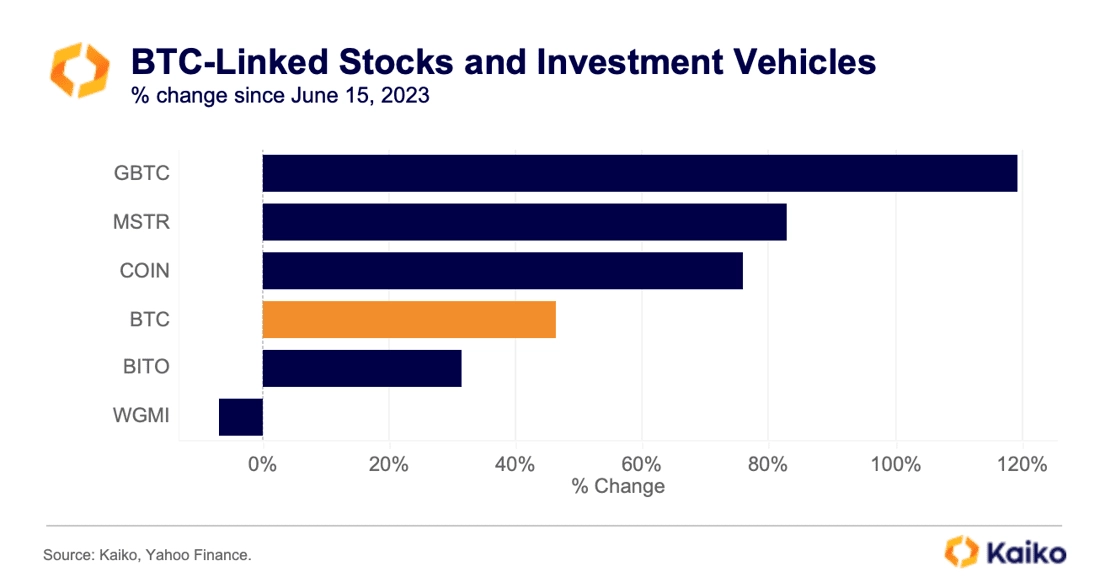

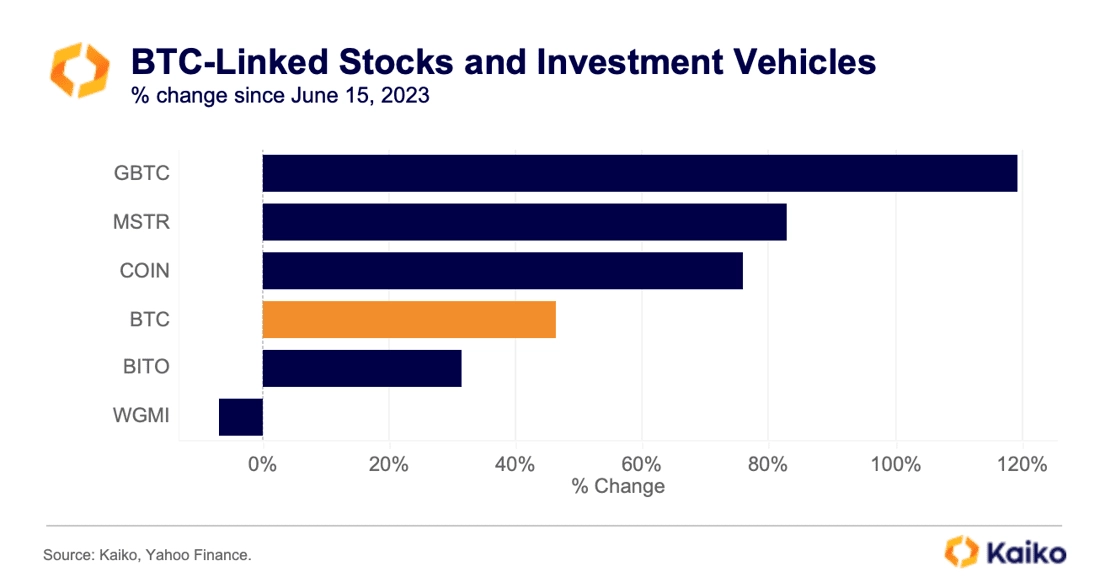

BITO underperforms spot BTC since June.

Inflows into BTC-linked investment vehicles have gained momentum in recent weeks in parallel with the upswing in the crypto market. However, since the BlackRock BTC spot ETF filing mid-June, BTC-linked investment vehicles and stocks have performed differently, suggesting that investors are also considering the potential impact of a spot ETF on the market. While GBTC has risen by almost 120% since mid-June, the largest BTC futures ETF — BITO — has underperformed. Spot ETFs are considered more efficient than futures ETFs and are likely to cannibalize the market.

Interestingly, MicroStrategy – the largest corporate holder of BTC — is the second-best performer, outperforming Coinbase. While MicroStrategy’s share prices may suffer from increased competition following the approval of a spot ETF, analysts expect the company to benefit from BTC’s halving next year. Also contributing to this performance is the expected change in the U.S. Financial Accounting Standard Board’s accounting rules for digital assets, which will increase the attractiveness of BTC as a treasury asset.

![]()

![]()

![]()

![]()