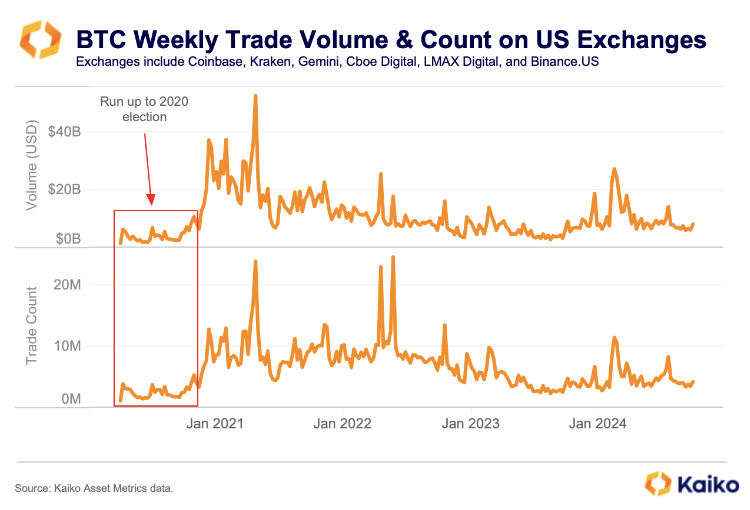

Four years ago crypto was much smaller and less widely accepted. Back then Larry Fink considered Bitcoin an “index for money laundering.” It wasn’t until later 2020 and early 2021 that the BlackRock CEO began to shift his views publicly. Nowadays Fink routinely discusses the benefits of Bitcoin and the potential of digital assets like Ether.

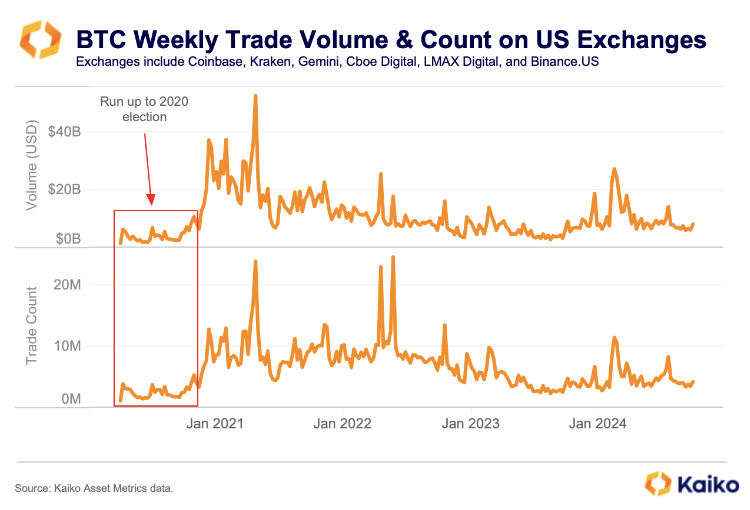

Trading volumes and access to digital asset investments have also improved over the past four years, despite what might be considered a hostile regulatory environment in the US and several public bankruptcies and court cases. The growing activity is evident in both higher dollar-denominated trade volume and increasing trade counts since 2020.

Betting on the election

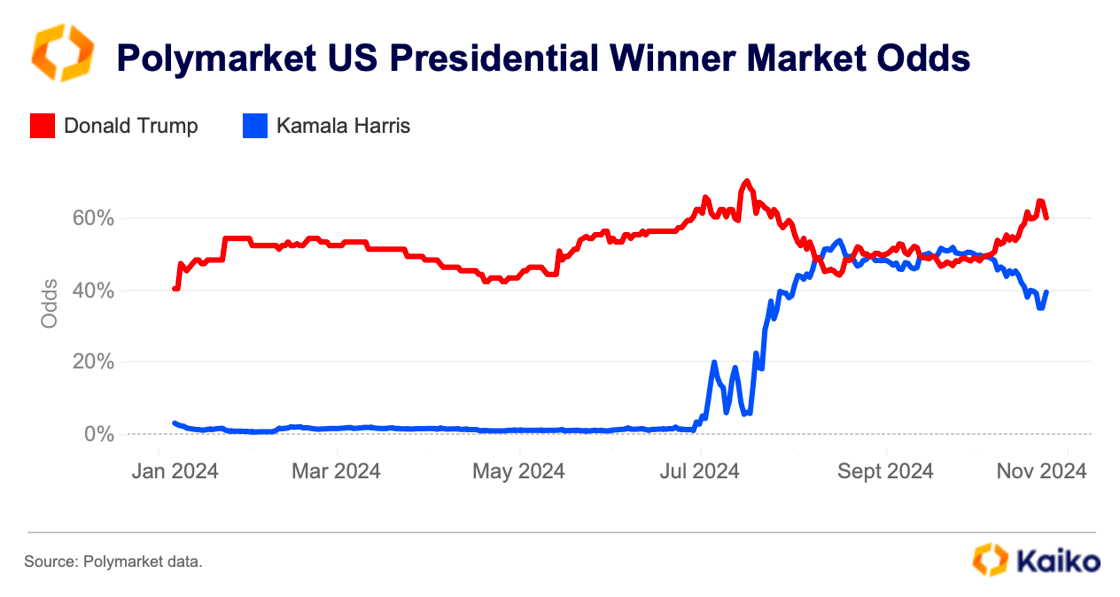

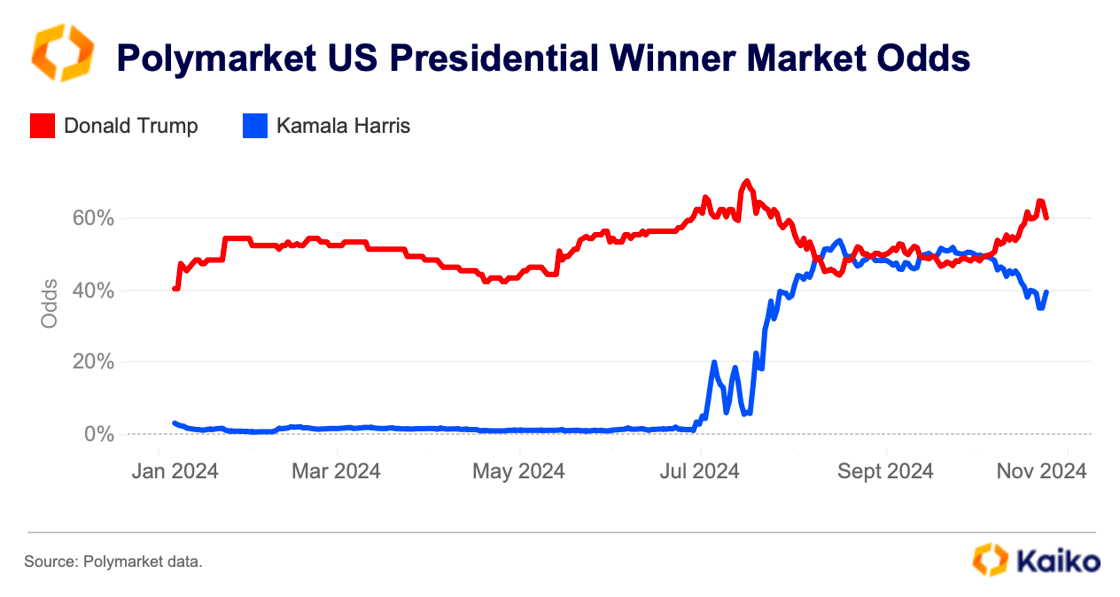

Polymarket, an on-chain prediction market built on Polygon, has garnered mainstream attention during this election as bettors flocked to punt who will be the next US president. But how efficient is Polymarket and is Donald Trump really that far ahead?

First off, Polymarket isn’t available in the US, so the current odds don’t reflect the thoughts and intentions of US voters. For instance, Polymarket says it identified one Whale backing Donald Trump is a French national.

Furthermore, market odds shouldn’t be equated to polls. They both have different incentives. Polls aim to measure results within a margin of error, while the aim for Polymarket users is picking the winner—they don’t care if its by one vote or a landslide.

Since launching its US Presidential winner market in January there’s been just over $2bn traded volume. At the same time, open interest on the platform has never exceeded $250mn, according to on-chain analysis on Dune.

These metrics suggest that the market is highly illiquid and has little predictive value on the outcome of the election.

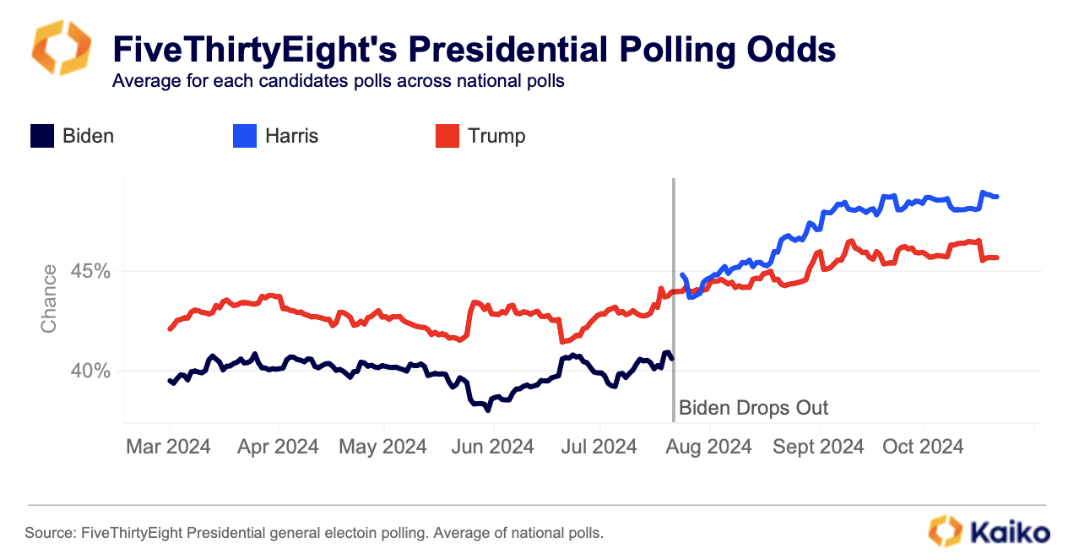

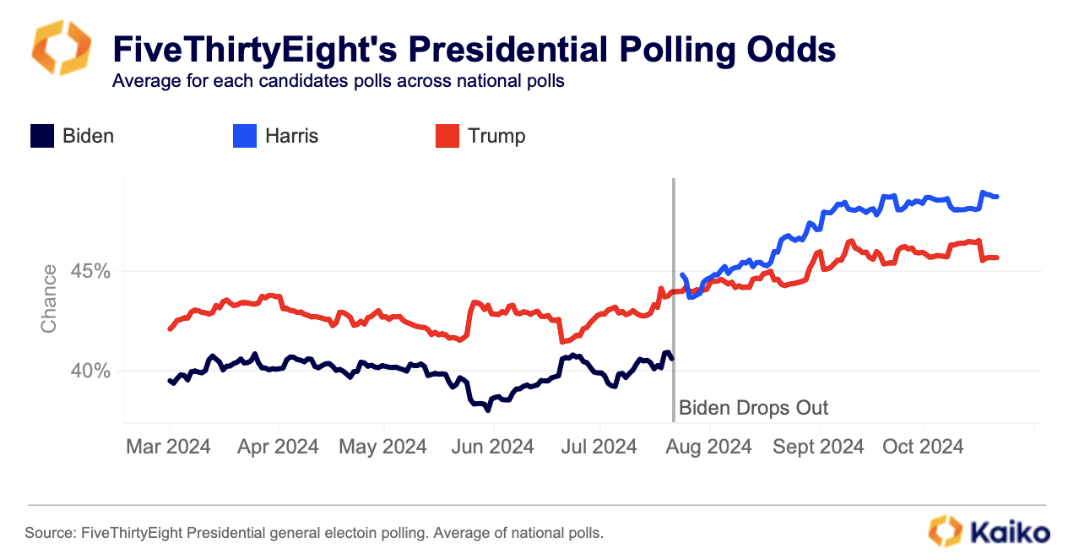

With that in mind, we looked at the polling numbers in the US for more insight. Across all national polls, there is far less conviction. The race is seen as a toss-up by many pollsters, including Polymarket advisor Nate Silver.

The FiveThirtyEight average of national polls has Vice President Kamala Harris leading by just under two percentage points, with her polling at 48.2% versus Donald Trump’s 46.4%. Most other well-regarded polls, including those from the New York Times and the Economist, have Harris ahead by between one and two percentage points.

As polls are too close to call and on-chain prediction markets are still in their infancy it’s important to consider other markets.

Positioning in the crypto derivatives markets

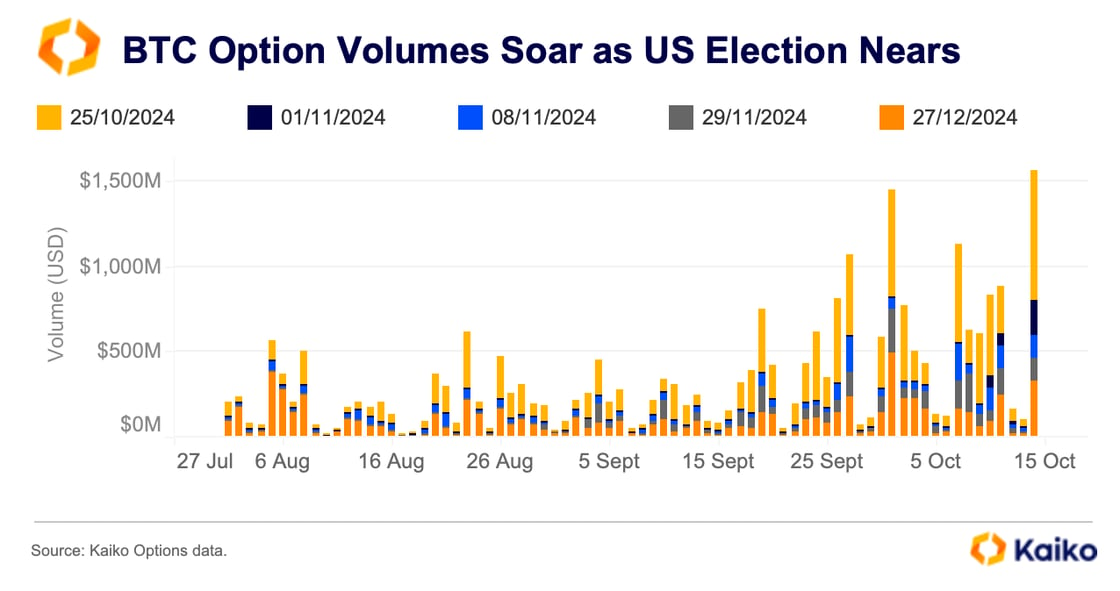

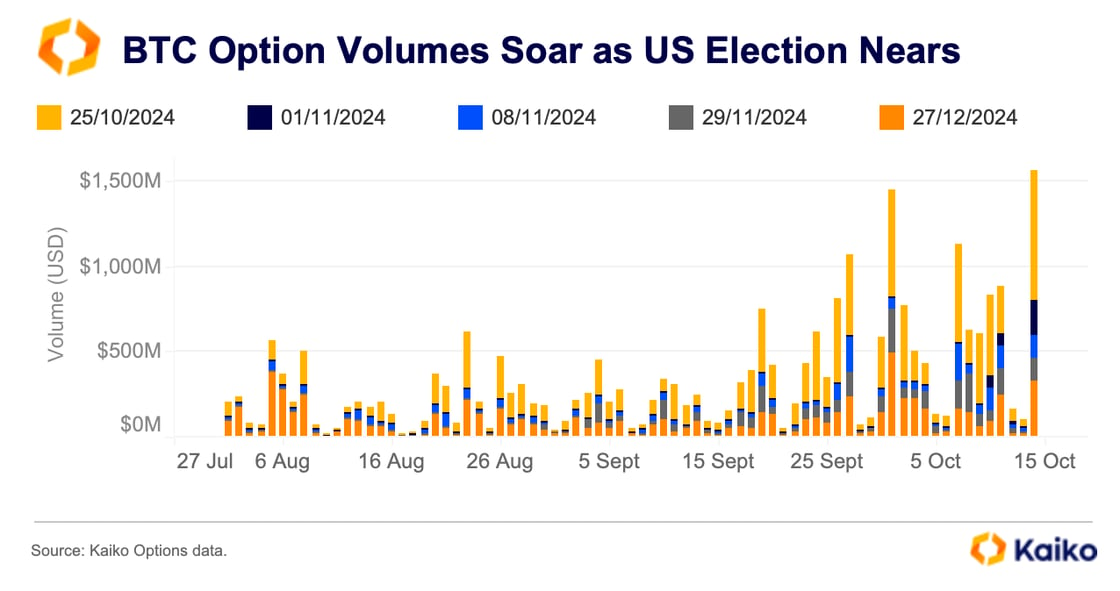

The crypto derivatives space is much larger and offers a wider range of investable products; therefore, the activity in these markets offers hints at who is leading the race. Notably, options volumes on Deribit have picked up ahead of the election.

Much of the trading activity on Deribit is focused around the end of October and early November as traders position themselves ahead of the election. December 27 expiries have also seen an uptick in activity, with large volumes on $100k strikes. This might suggest that traders see upside potential following the election, regardless of who wins the race.

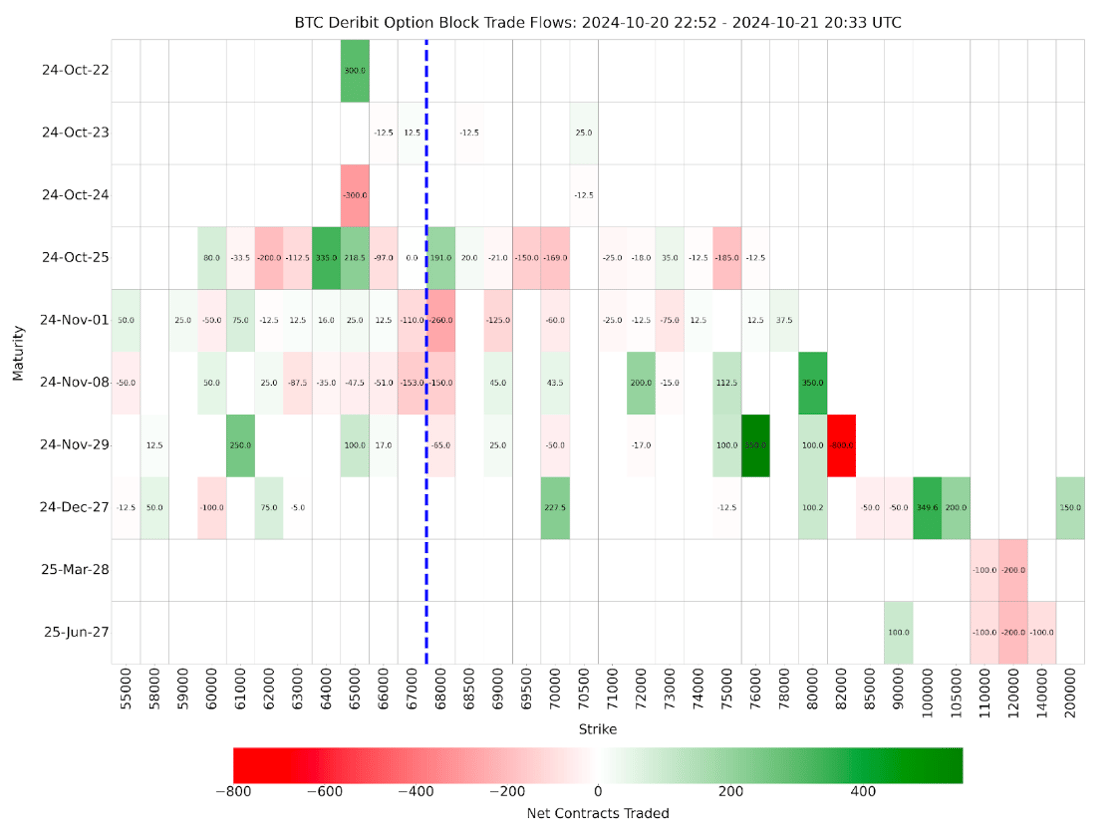

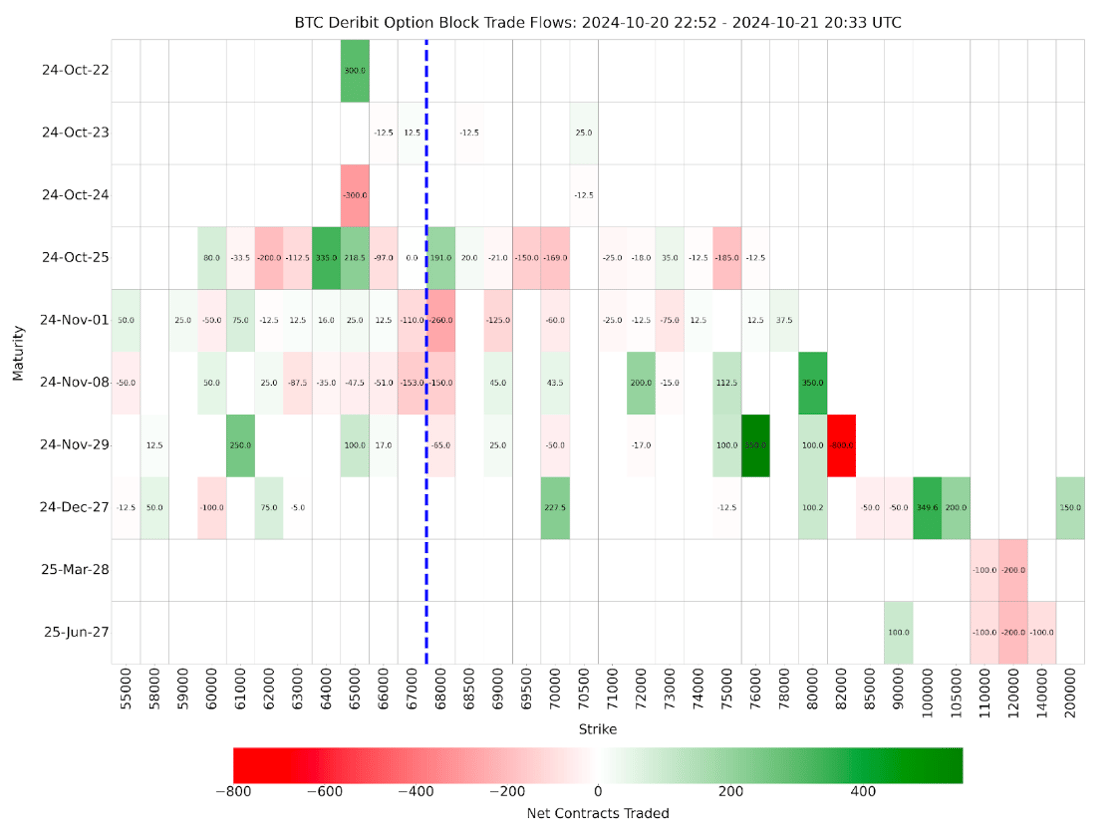

If we analyze block trades on Deribit, we can get an idea of institutional activity. These trades are typically made by large traders, often institutional investors, executing large orders without significantly impacting the market. These trades are privately negotiated.

Below we can see block trades on Deribit between Monday and Tuesday. The blue line represents the current market price of BTC, while the green and red blocks indicate the amount of contracts bought and sold, respectively. The more intense the color, the larger the buy or sell volume.

Activity is clustered around October and November expiries—with the October 25 contract heavily traded. Notably the November 29 contract had some bullish volumes over the past 24 hours, with 550 contracts at $76k strike bought.

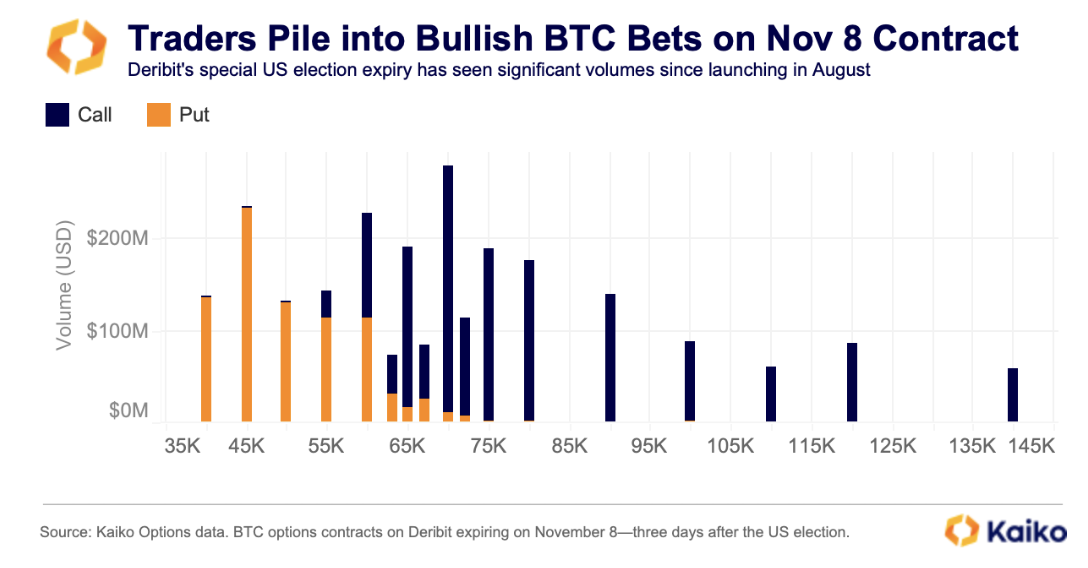

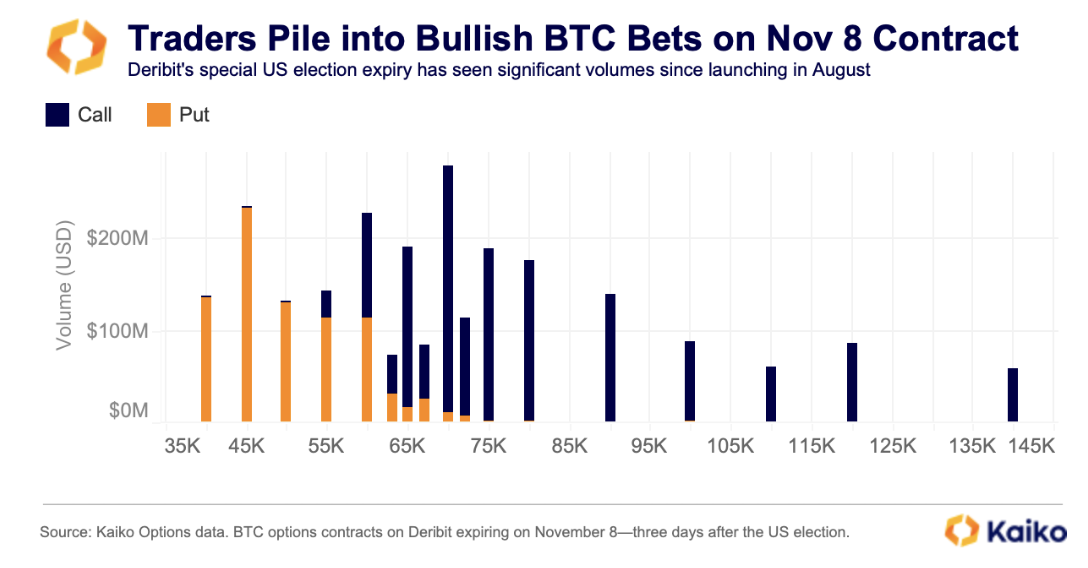

Deribit’s special US election contract on November 8 has been heavily traded since it was launched in August. The expiry was added ahead of the firms usual listing schedule to expand investors options to trade around the election.

Since August there has been $3bn in volume traded on this expiry alone, with most bets tilting bullish. The majority of activity is clustered around the $65k to $80k range, implying that traders see prices trading around record highs post-election.

The contract, which has seen significant volume, expires just three days after the US election and one day after the Fed’s next meeting—both events are likely to drive spikes in volatility. That heightened volatility opens up possibilities for traders willing to accept the increased risk.

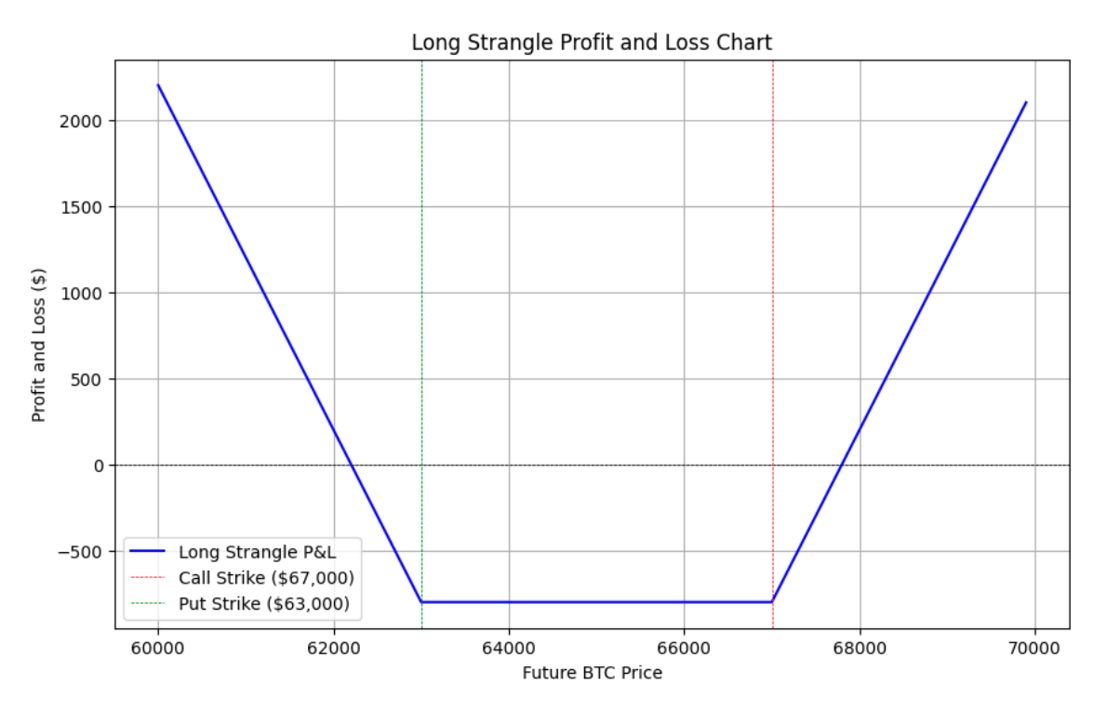

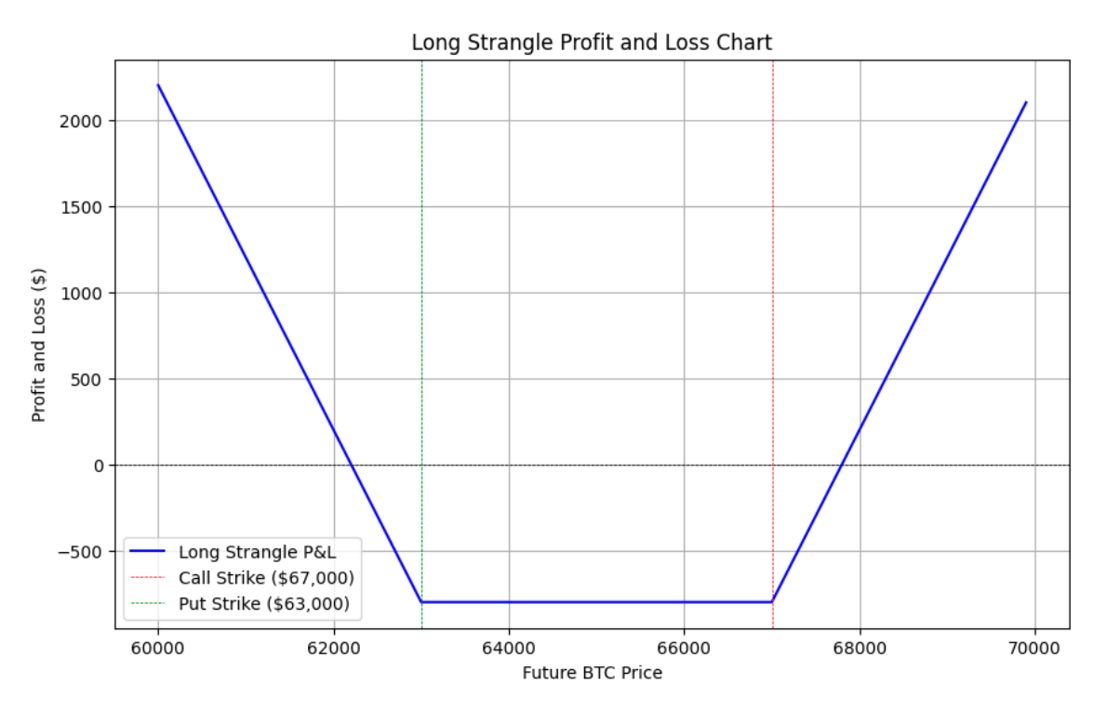

One popular options strategy for this November 8 expiry is a long strangle. It involves buying both a call and a put. In the example below, the trader has purchased a $63k put and a $67k call.

The goal with this strategy is to capture large price moves; therefore, the trade works best when there is an increased chance of volatility.

What traditional financial markets are saying?

Broader financial markets and more established crypto markets, such as derivatives, likely provide more insight into how the market perceives the election outcome than prediction markets and polls.

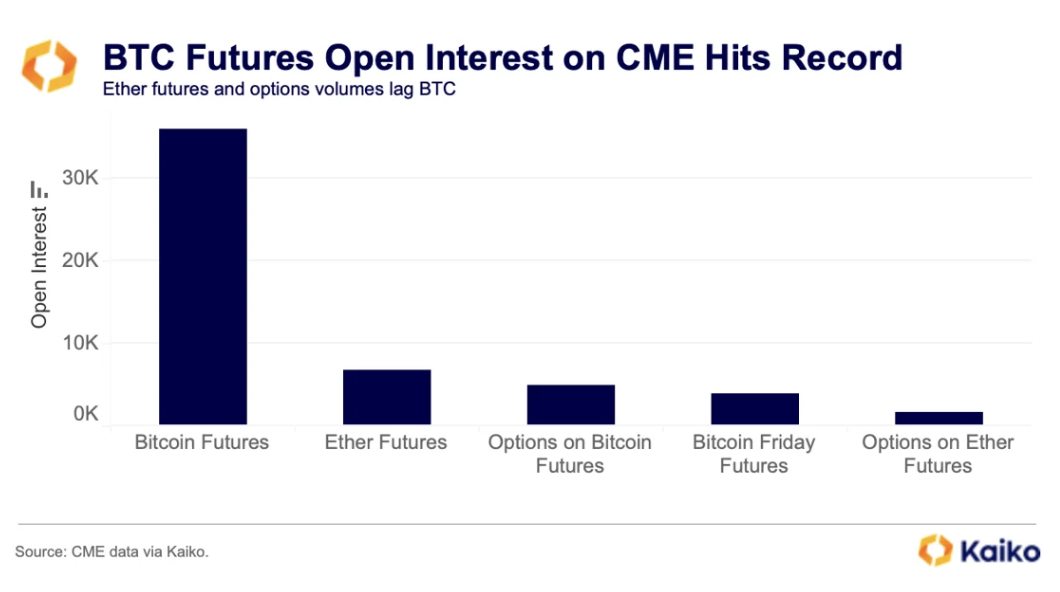

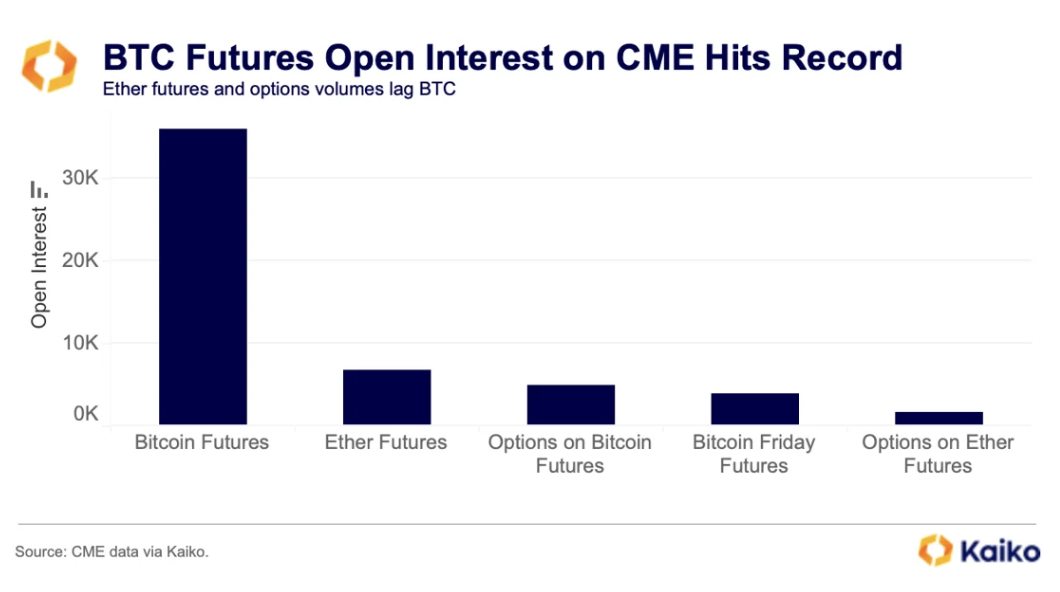

In the realm of Bitcoin ETFs, where crypto intersects with traditional finance, investor inflows have surged. Investors have been drawn to BTC futures on the Chicago Mercantile Exchange (CME), with open interest on the exchange hitting consecutive record highs over the past few weeks.

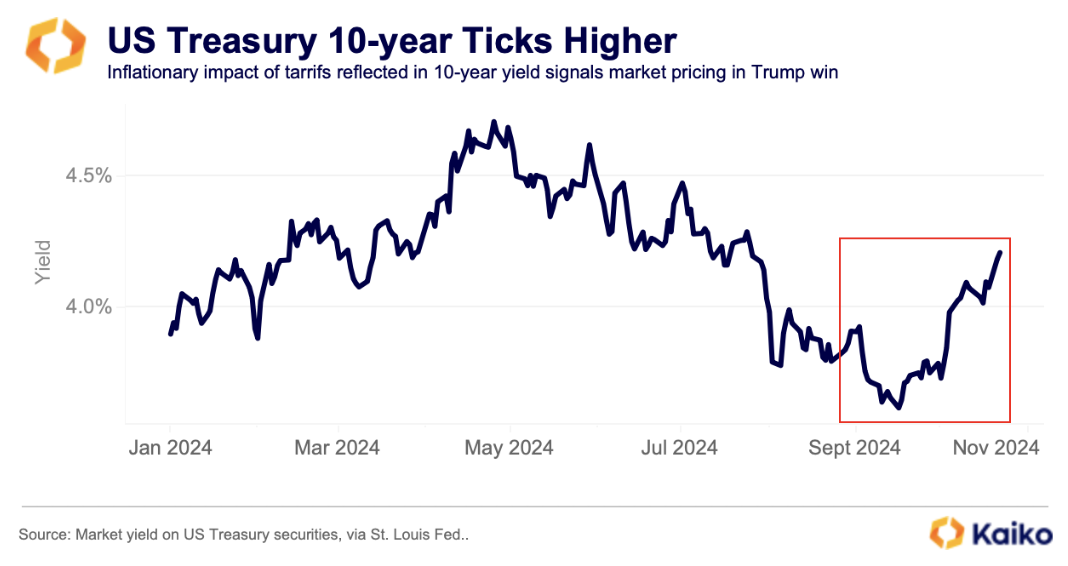

It’s not just crypto markets that offer insights into the outcome of the election. More established and larger markets, such as US Treasuries, provide further indications of positioning ahead of the vote.

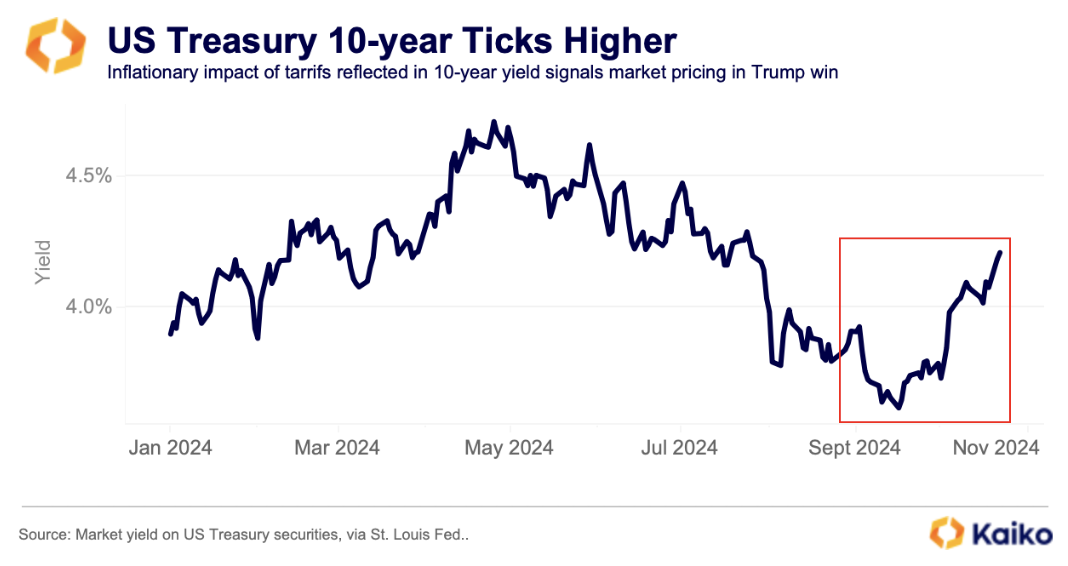

Donald Trump wants to “make tariffs beautiful again”. The Republican candidate has repeatedly promised to increase tariffs if elected, a policy that would have an inflationary impact if implemented. Therefore, another bellwether for Trump’s potential success next month is evident in the US 10-year Treasury yield.

Since the end of September, yields have ticked higher as the Republican candidate’s chances of winning the election improved. In essence, a Trump victory would be seen as inflationary, and this has likely contributed to the increase in yields.

Alternatively, it could be argued that either candidate will have an inflationary impact if elected. As Paul Tudor Jones argued on Tuesday, ‘All roads lead to inflation.

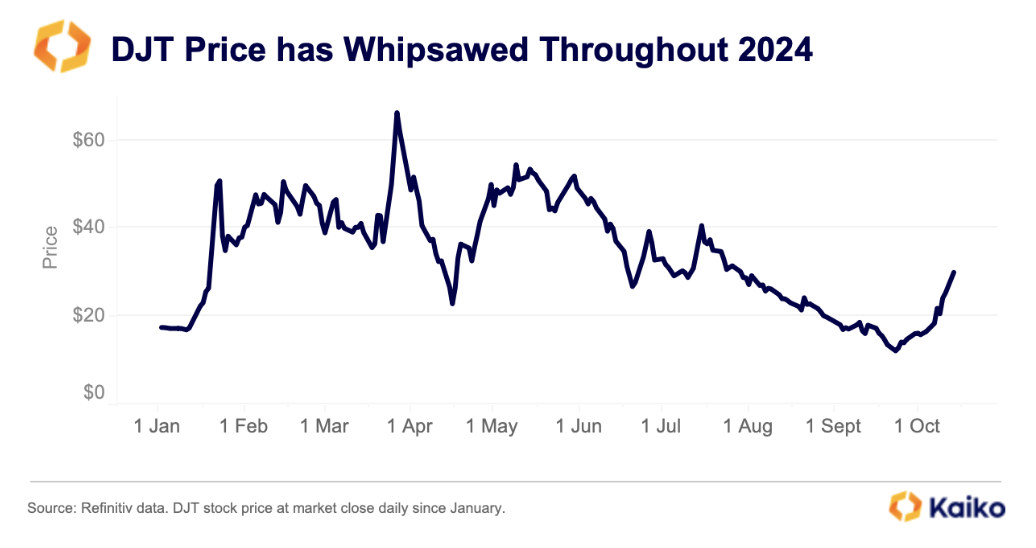

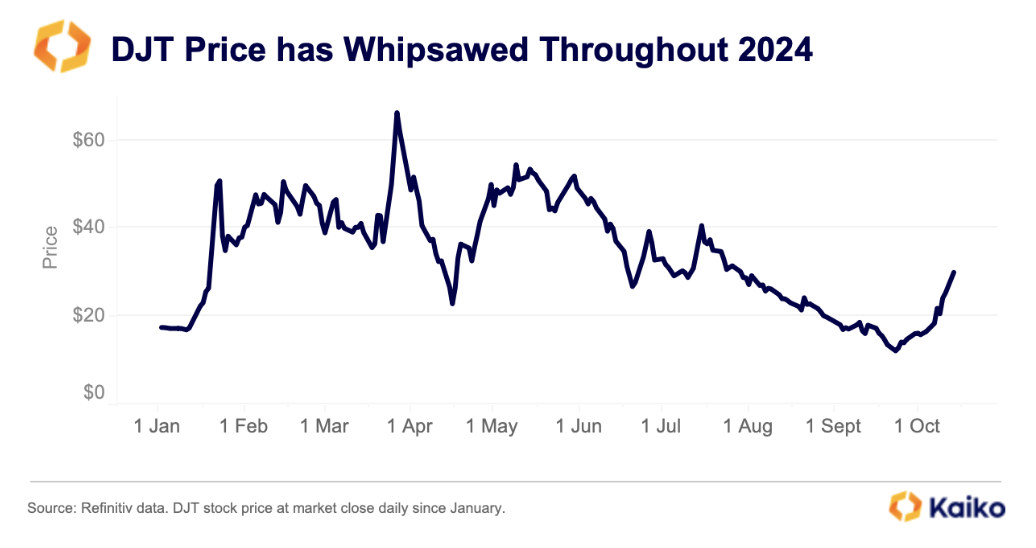

However, the performance of the Trump Media and Technology Group (DWAC) reinforces the theory that markets are pricing in a Republican victory. The stock has been extremely volatile this year and trading has been halted multiple times throughout the year as prices plunged by double digits intraday. Since January, the stock is up nearly 80%, although it has experienced several double-digit drawdowns in that time.

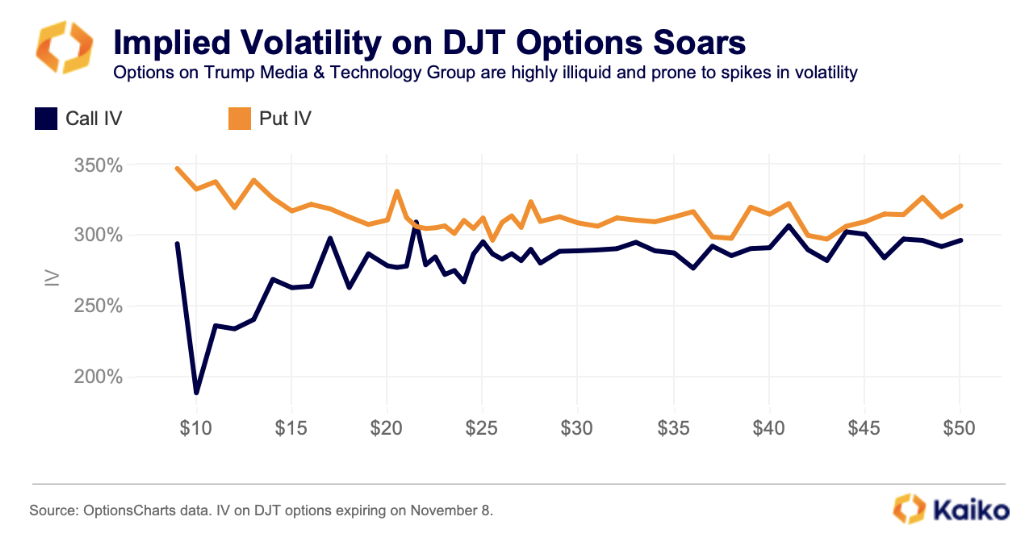

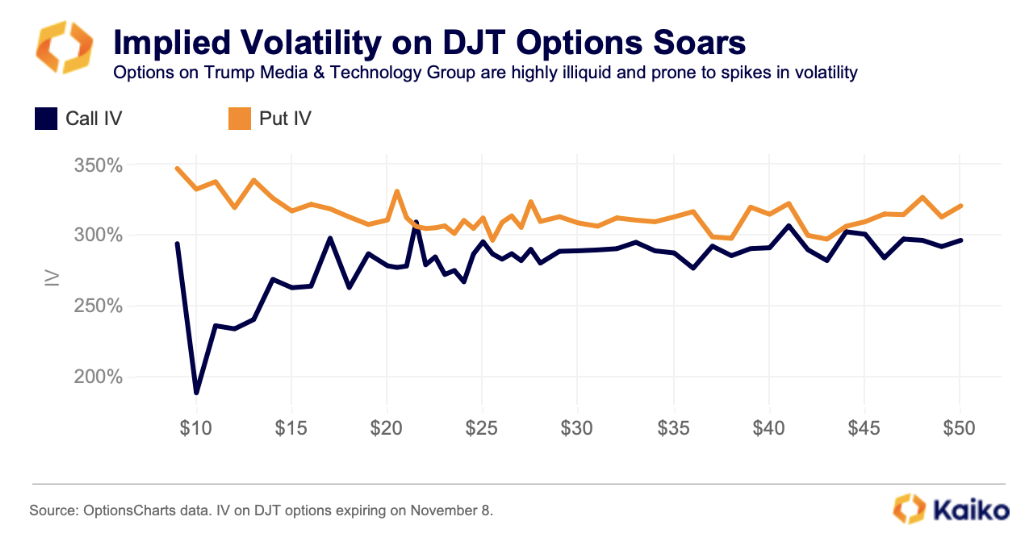

Options on the firm’s stock offer another insight into positioning ahead of the election. The current volatility skew on DJT options expiring on Friday, November 8, shows that implied volatility (IV) on puts is far higher, suggesting that traders are hedging against a fall in the price of the underlying stock.

Extremely high implied volatility and sparse trading volumes make these options contracts less attractive for many traders.

Conclusion

While Polymarket may have entered the public conversation during this election, it is still in its infancy, and its predictive power remains up for debate.

Therefore, we remain focused on positioning and activity in crypto markets, namely in the derivatives and options space, which offer greater insights into where smart money is going ahead of November 5.

Venues such as Deribit have a proven track record during market events and have significantly higher liquidity profiles. Moreover, the bullish positioning on Deribit, especially on expiries near the election, is not solely driven by retail investors but rather by institutions, as shown through our heatmap analysis of options trades.

What’s clear from analyzing these markets is that short-term volatility is expected, while traders are positioning for upward momentum in the aftermath of the election. In a close race like this, such positioning suggests that either candidate will be a net benefit for crypto in the long run.

Next week, we’ll break down which metrics to monitor in real-time during the election and afterwards to measure potential price moves, whatever the outcome may be.

![]()

![]()

![]()

![]()