Join us for our latest webinar in collaboration with Cboe

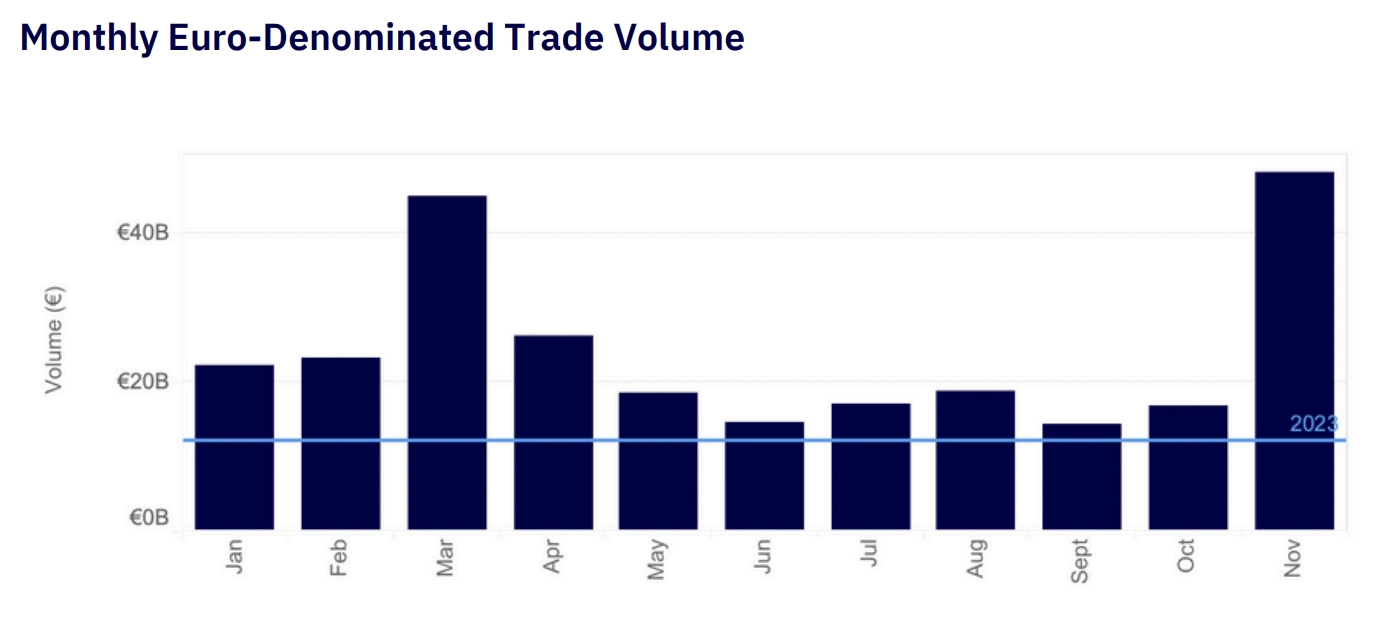

2024 marked a transformative year for the European cryptocurrency market with euro-denominated trade volumes surging to a multi-year high in November. Exchanges catering to the region capitalized on this growth, listing a record number of Euro-denominated trading pairs to meet growing demand.

Part 1: The Euro’s Growing Role in Crypto

Part 2: European Crypto Exchanges and Token Trends

Part 3: Euro-backed Stablecoins Adoption

Pt. 1: The Euro’s Growing Role in Crypto

Throughout 2024, euro trade volumes against cryptocurrencies stayed above last year’s average, signaling growing demand.

→ Euro-denominated volume neared €50bn in November, nearly double October’s level.

→ The Euro maintained its place as the third most traded fiat currency on crypto exchanges.

Pt. 2: European Crypto Exchanges

November saw weekly euro-denominated trade volumes surge to €12B, surpassing the March peak, as Bitcoin reached new all-time highs above $100k following the U.S. elections.

→ The euro cryptocurrency market remains highly concentrated, with four platforms accounting for over 85% of the total euro-denominated trading volume.

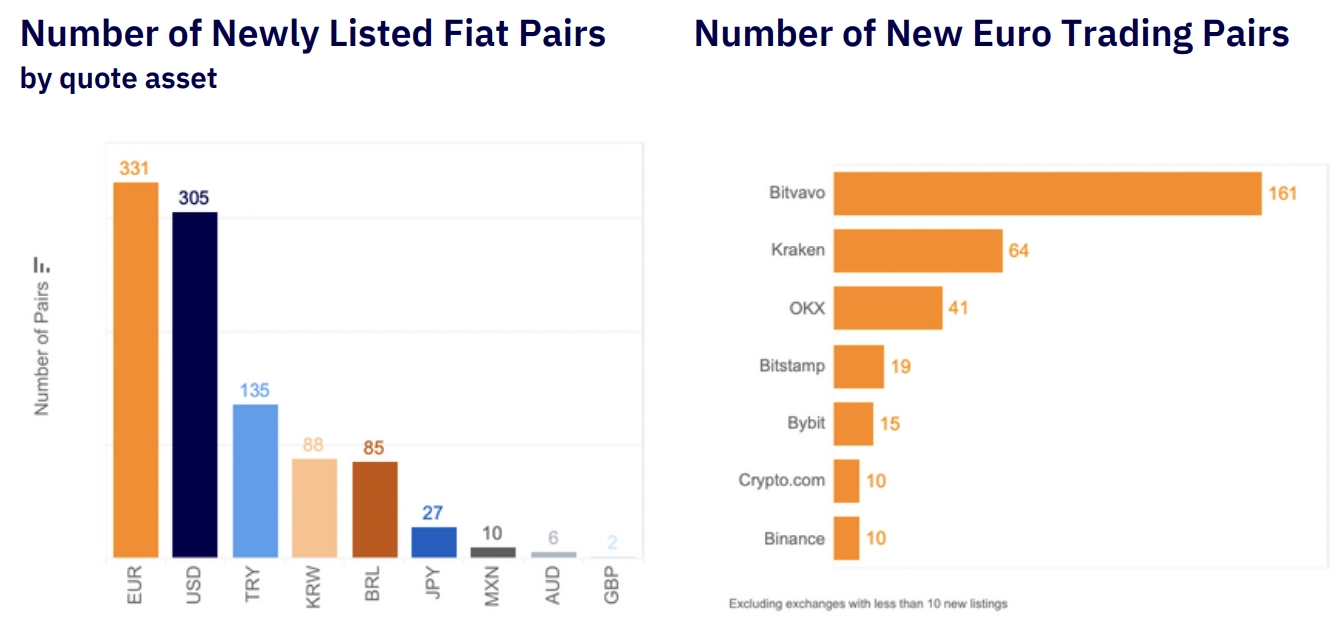

→ Bitvavo and Kraken remained the largest cryptocurrency exchanges for euro trading by volume, solidifying their dominance in the European market.

Pt. 3: European Token Trends

European traders continue to favour Bitcoin in 2024, while also joining in the memecoin frenzy.

→ Bitcoin remains the most traded asset against the Euro, with cumulative volumes of nearly €50B since the beginning of the year.

→ In 2024, euro-denominated trading pairs topped new listings, with over 331 pairs launched— more than USD and TRY.

Download the Report.

This research report was paid for by Bitvavo, but written independently by Kaiko. This content is for informational purposes only, does not constitute investment advice, and is not intended as an offer or solicitation for the purchase or sale of any financial instrument. For any questions, please email [email protected].