Data Points

Will ETF hype fuel ETH’s comeback?

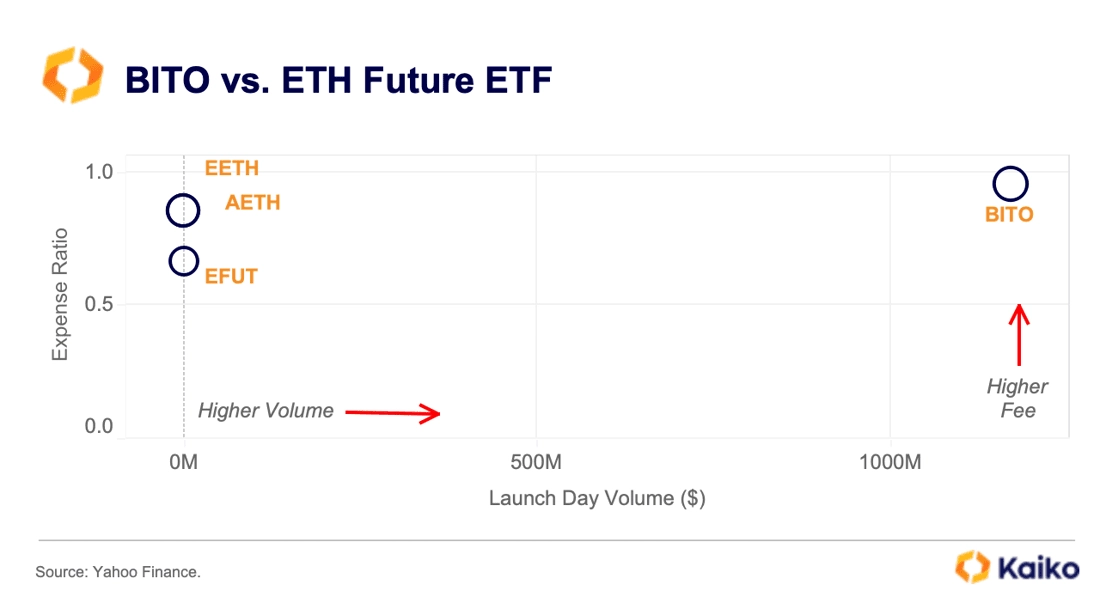

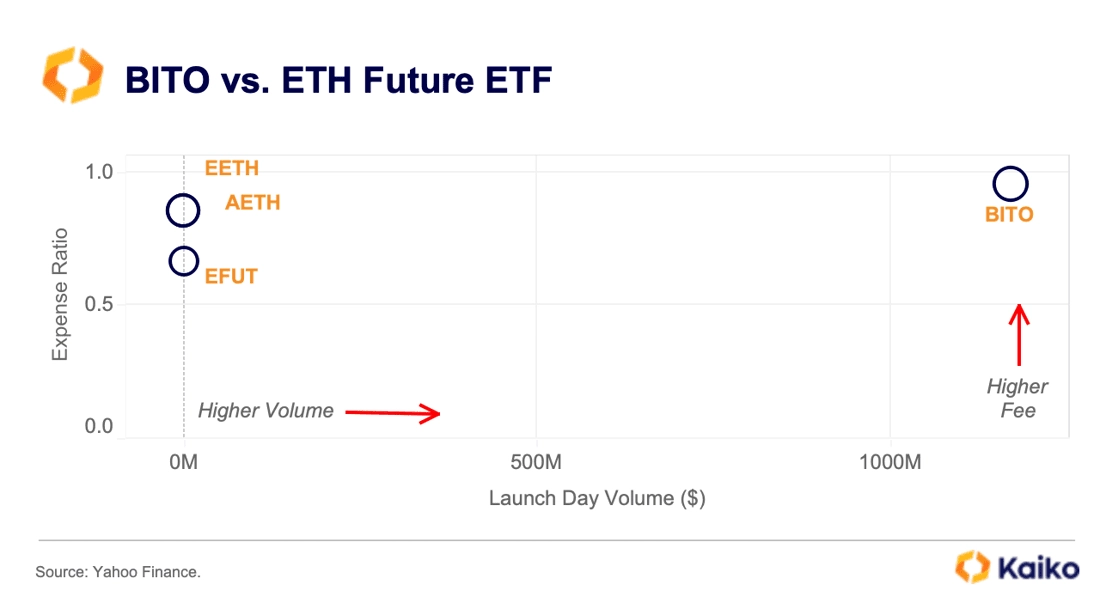

In 2021, BITO was the first BTC futures-based ETF listed in the U.S., registering one of the highest ever launch days by volume for an ETF. One year after BITO listed, a wave of ETH futures products began trading. Although the ETH futures ETFs launched in a different market environment, there is no denying that their volume was disappointing. EETH, AETH, and EFUT only had a few million in trade volume on opening day of trading, about 1,000x times less than BITO’s $1.2bn opening. Does this mean ETH spot ETFs will have a similarly lackluster first day if they’re approved?

View Deep Dive

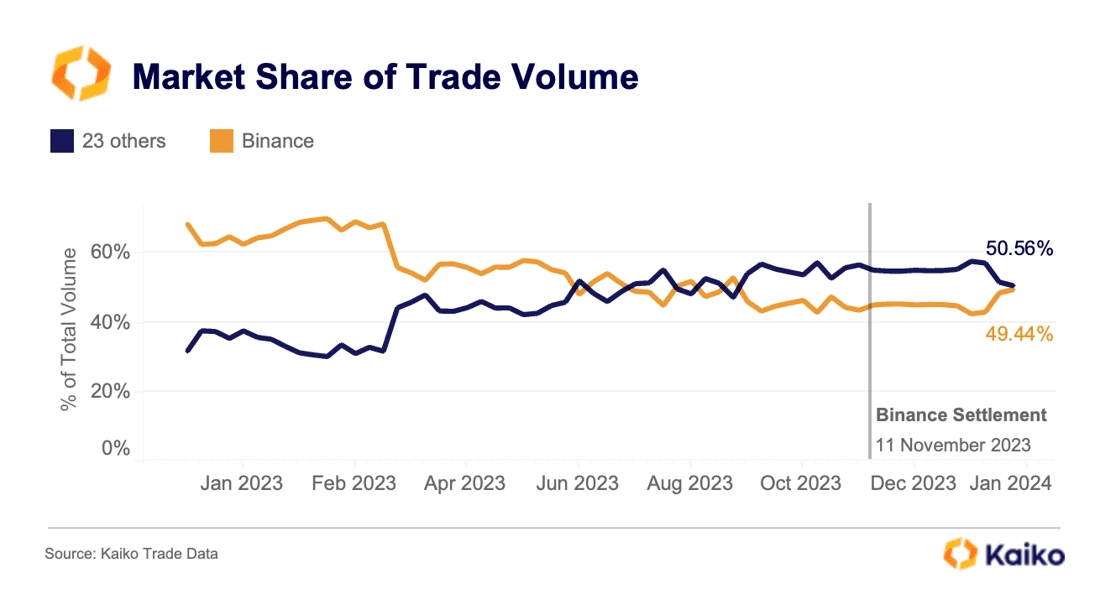

Binance’s market share recovers post-settlement.

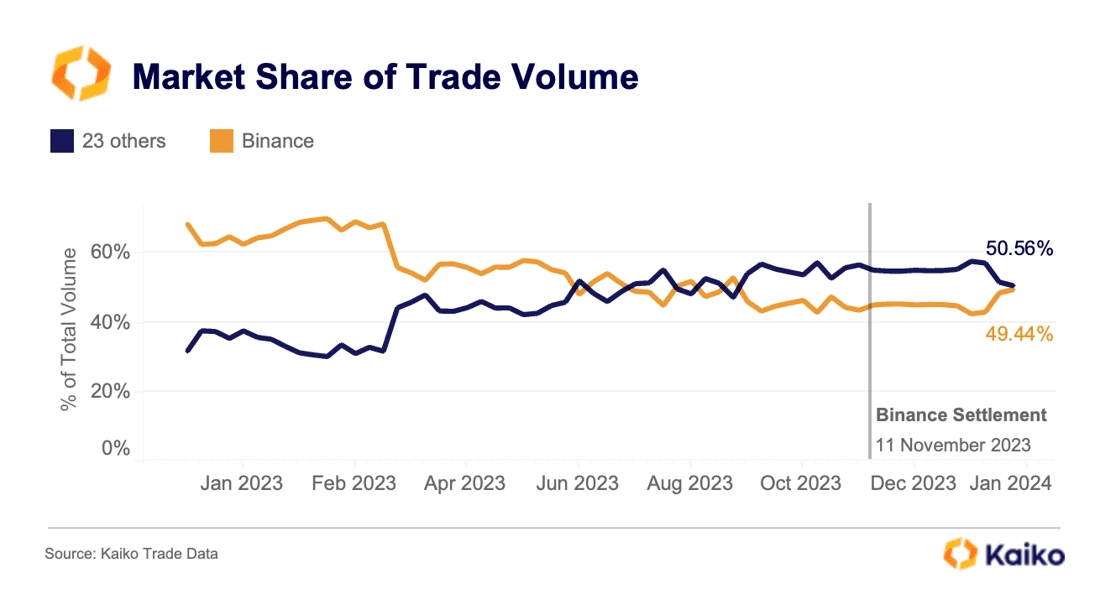

It’s now been a little more than two months since Binance’s settlement with the Justice Department. How has trade volume held up? Binance’s market share relative to 23 other centralized exchanges barely saw a dent in the immediate aftermath. Over the years, Binance has expertly leveraged zero-fee trading pairs to boost volumes, so it is important to take this into account when analyzing the exchange’s market share.

In early December, Binance rolled out another round of zero-fee promotions for BTC, ETH, and 4 other crypto assets. Then, in early January, ETF hype caused a surge in global trade volumes, which helped Binance’s market share recover to nearly 50%. Its share still remains lower than last year’s highs, but the exchange has proven to be mostly resilient in the aftermath of the settlement.

Flashcrash: What happened with OKB?

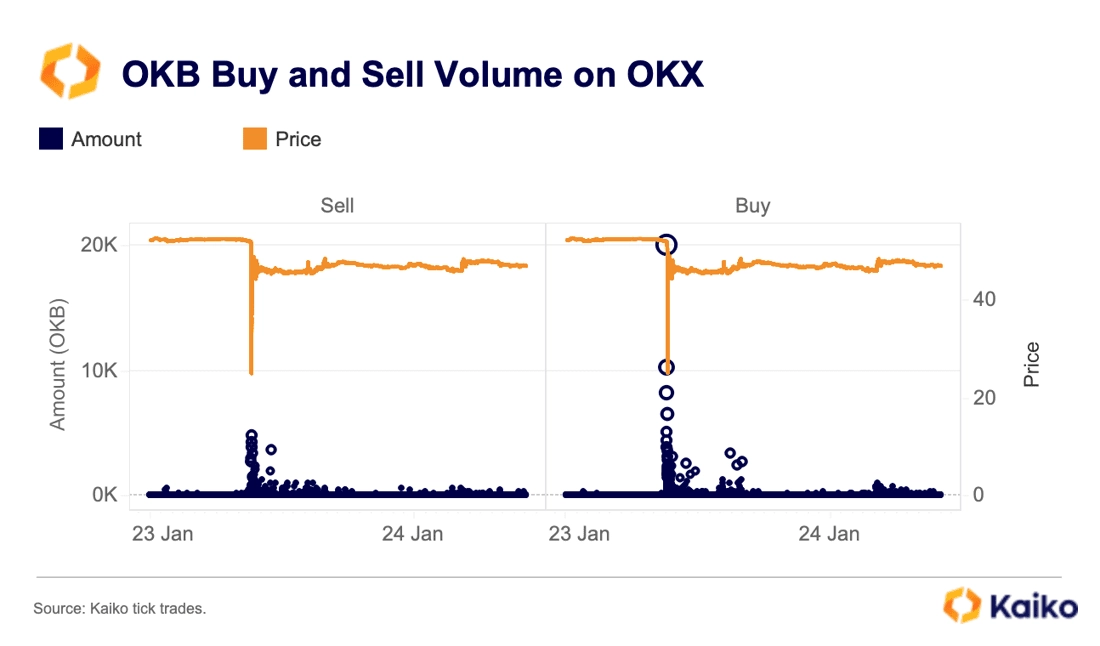

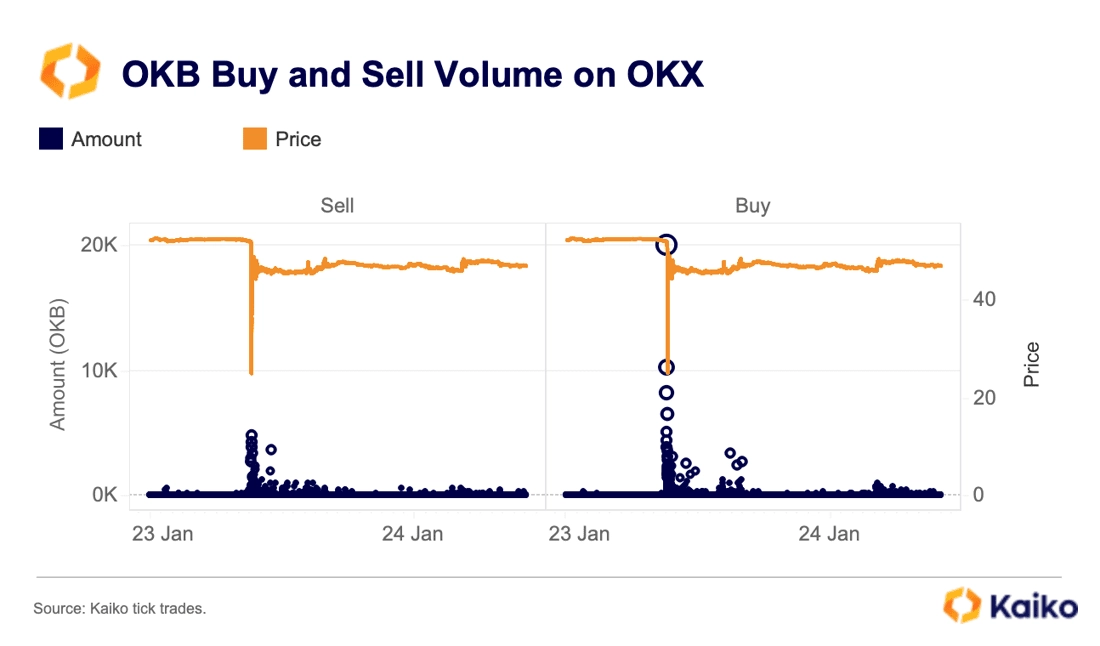

On January 23, the price of OKB, OKX’s exchange token, experienced a flash crash, dropping from $51 to less than $24. After an investigation, the exchange stated that the crash was due to the automatic liquidations of several margin positions after an initial price drop of 4.6% from $50.69 to $48.36.

The chart below shows that traders bought the dip after a series of sell orders led to the price crash, with buying significantly exceeding selling. At the time of writing, OKB price is yet to recover and continues to hover below its pre-crash levels.

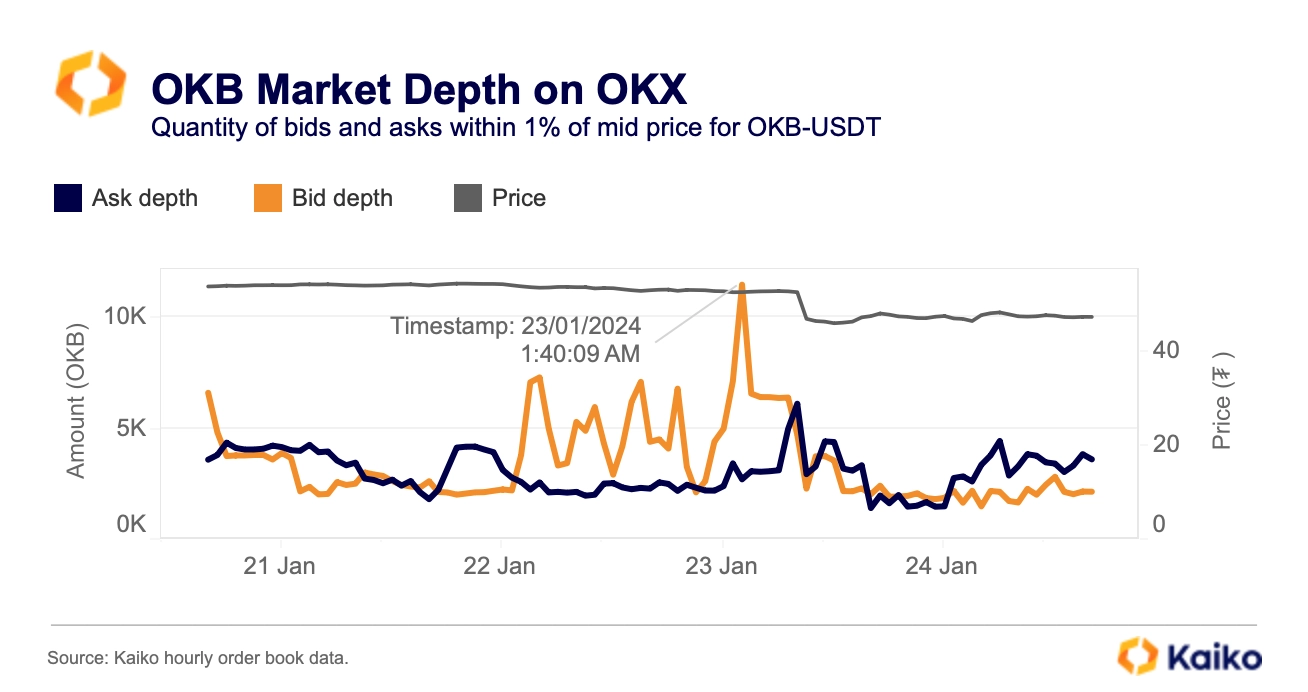

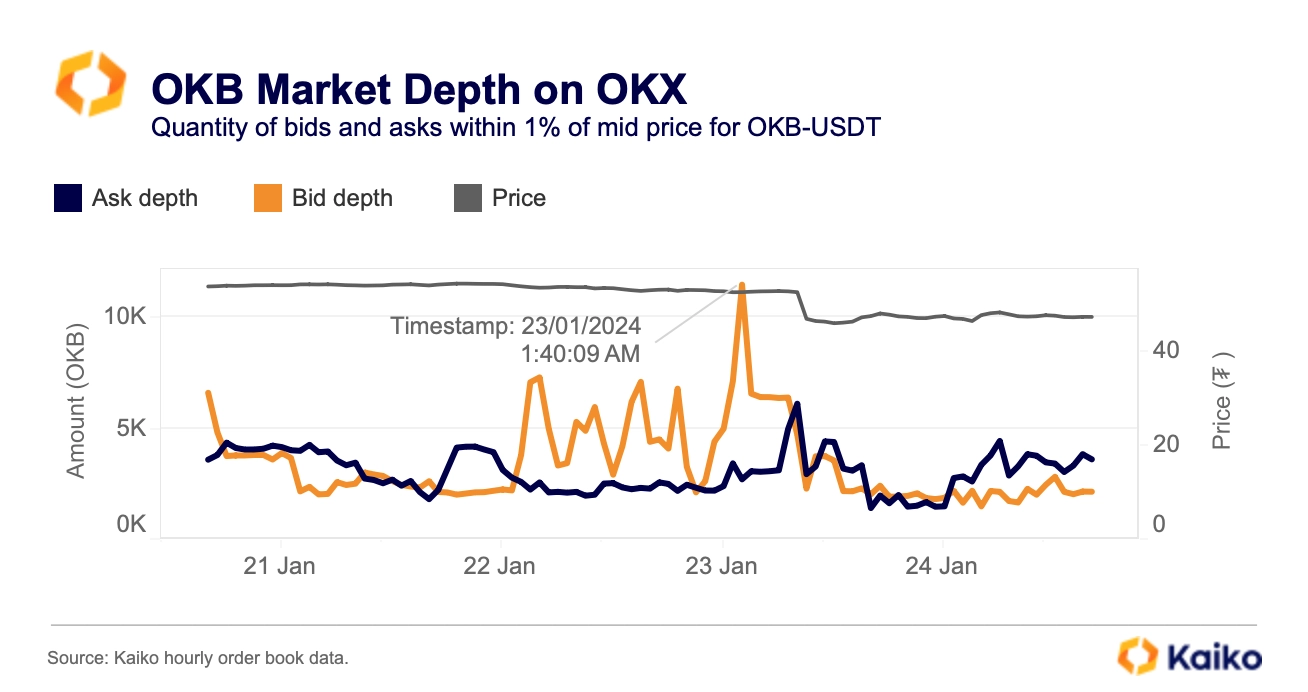

Interestingly, market depth on the bid side spiked hours before the price crashed at around 2AM UTC time, which could suggest market makers were preparing for volatility ahead, which does not fully match the narrative of events.

Exchange tokens enable holders to benefit from lower transaction fees, vote on new coin listings, and earn passive staking rewards. They are typically almost entirely traded on their affiliated exchanges. This is one of the reasons why these tokens remain relatively illiquid compared to others despite sometimes boasting large market caps.

EUR Tether has traded at a discount since November.

Large institutional players such as BlackRock and ARK have increasingly been praising BTC’s safe-haven characteristics. A safe haven is an asset that is uncorrelated with equities during times of market turmoil.

BTC’s 60-day correlation with the Nasdaq 100 has indeed declined significantly over the past year. It has been close to zero on average since June of 2023 as BTC price movements have been driven by the hype around spot U.S. ETFs. Typically, a correlation between -0.2 and 0.2 is regarded as very weak.

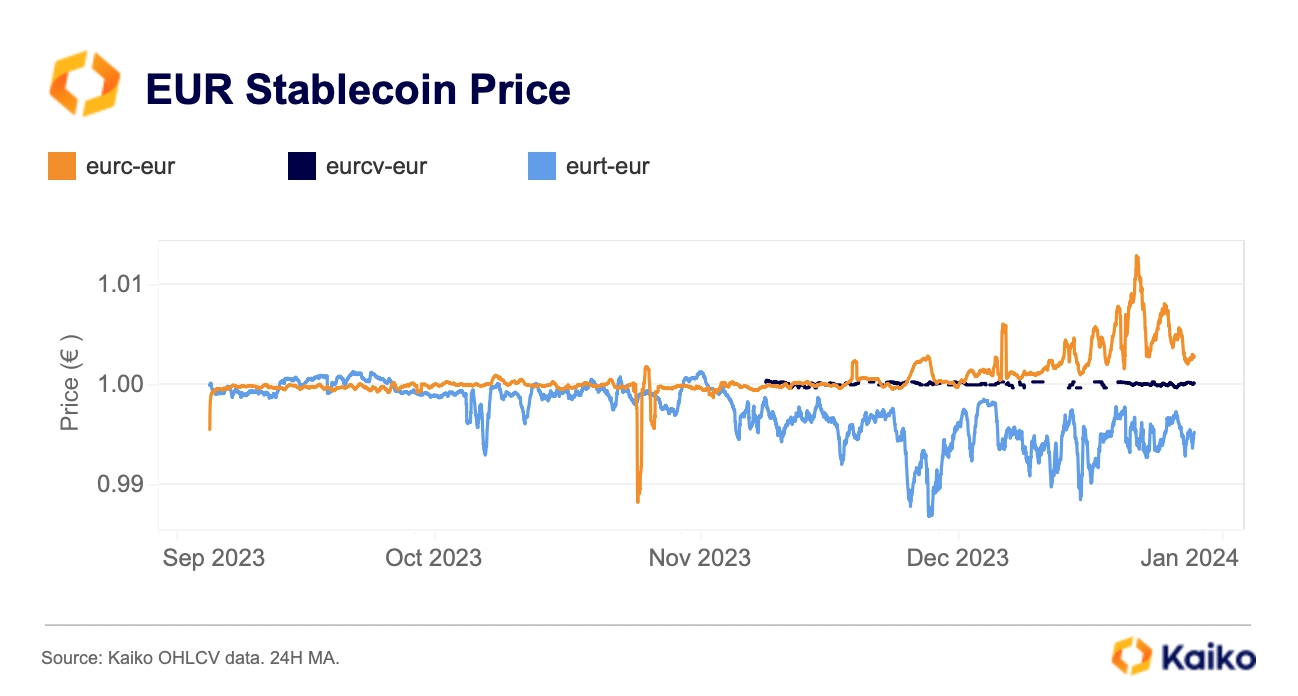

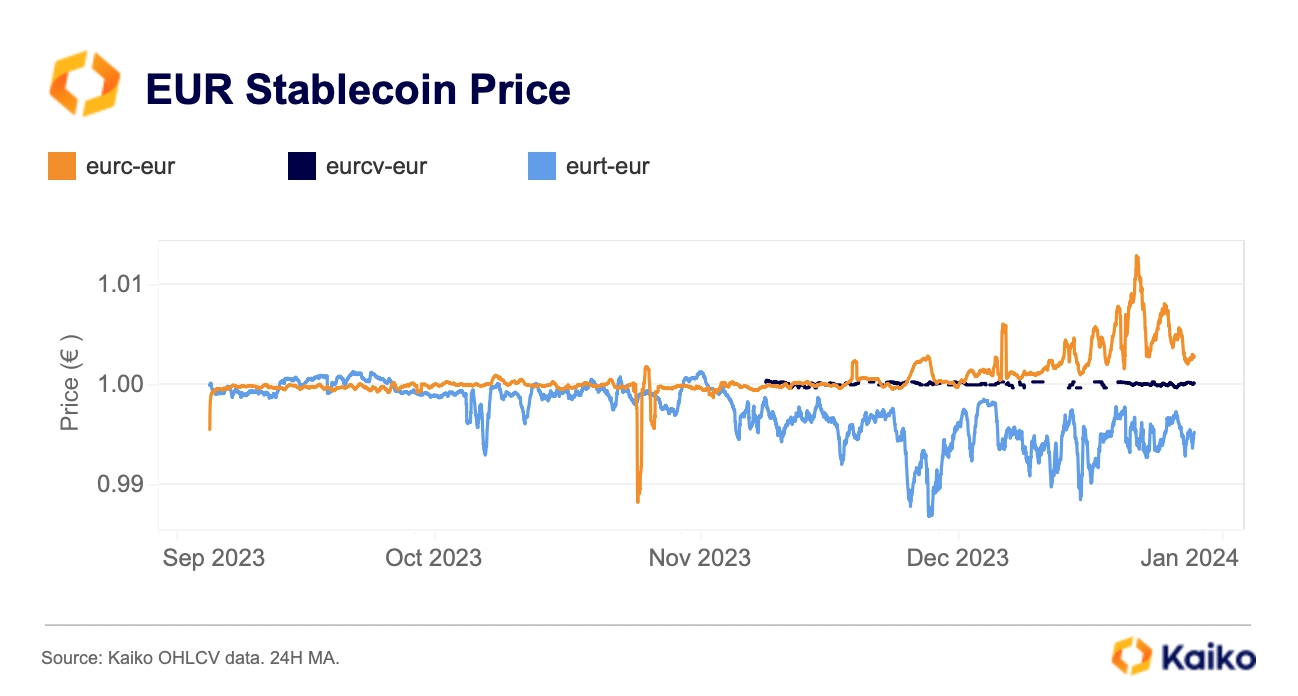

The EUR stablecoin market has come to life with the launch of several new offerings over the past few months. However, volatility has also risen; one of the largest euro stablecoins by market cap — EUR Tether (EURT) — has traded at a persistent discount to the euro since November. In contrast, Circle’s EUR Coin (EURC) has been trading at a premium, suggesting increased demand. The first stablecoin issued by a bank, Société Générale’s EURCV, has mostly kept its peg since launch in early December.

The EUR stablecoin market remains very fragmented, with EURT mostly traded on off-shore platforms such as HTX and Bitfinex while EURC dominates trading on DEXs. This could partly explain their volatility.

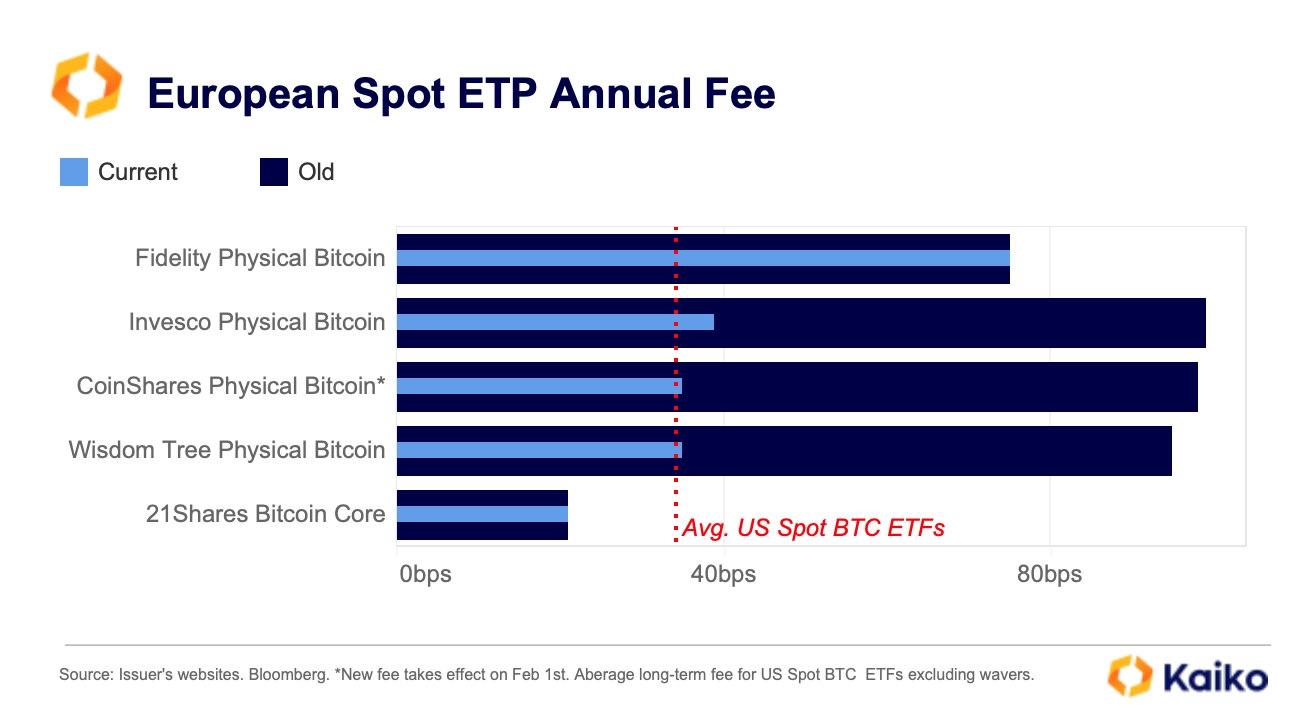

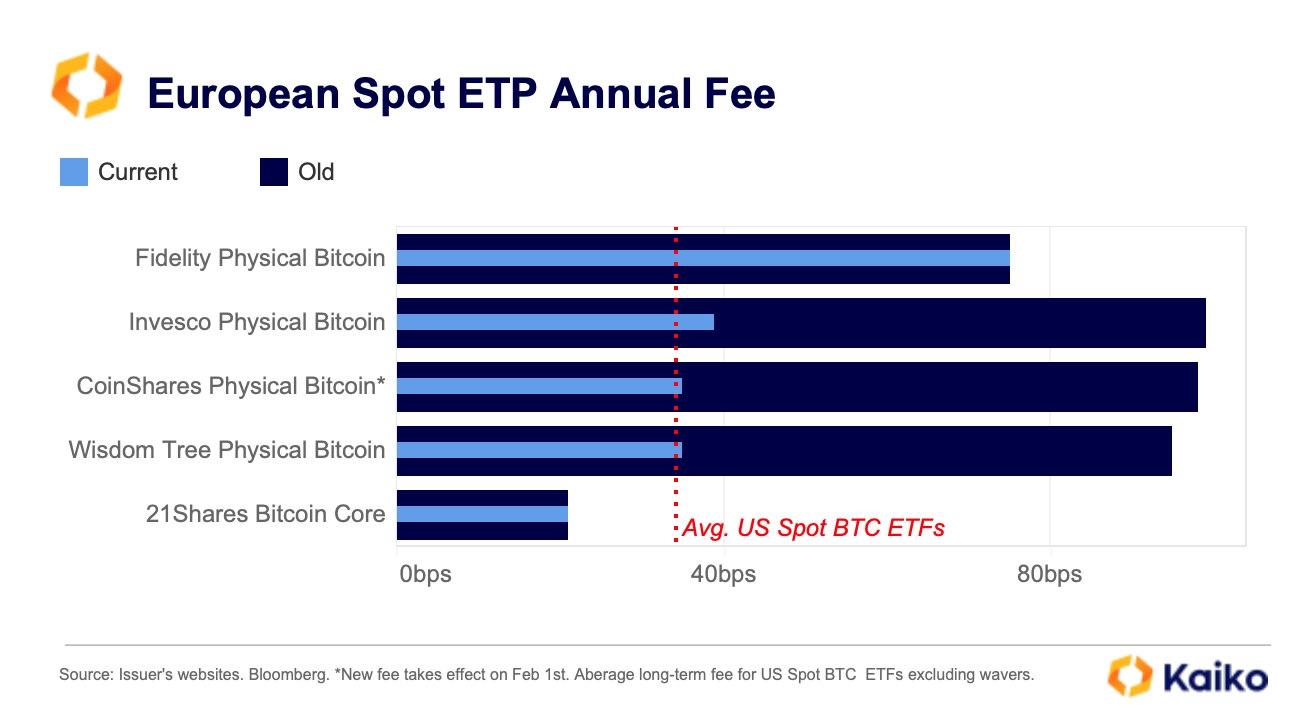

The ETF fee war spills into Europe.

The simultaneous launch of 11 spot BTC ETFs on the world’s largest stock market has boosted international competition, with issuers in other jurisdictions either preparing to launch their own spot vehicles or lowering fees on their already existing products.

Last week, CoinShares, Wisdom Tree and Invesco announced fee cuts for their physically backed exchange-traded products traded in Europe, bringing their fees more in line with the U.S. average. Canadian ETFs are also under price pressure, with several smaller issuers lowering fees.

Centralized crypto exchanges are also likely to face price pressure, with spot ETFs often more cost effective. Most exchanges charge between 8bps and 50bps per transaction for retail users (the lowest volume tier), as well as withdrawal fees, which can vary depending on the token, chain, or transfer method.

![]()

![]()

![]()

![]()