Data Points

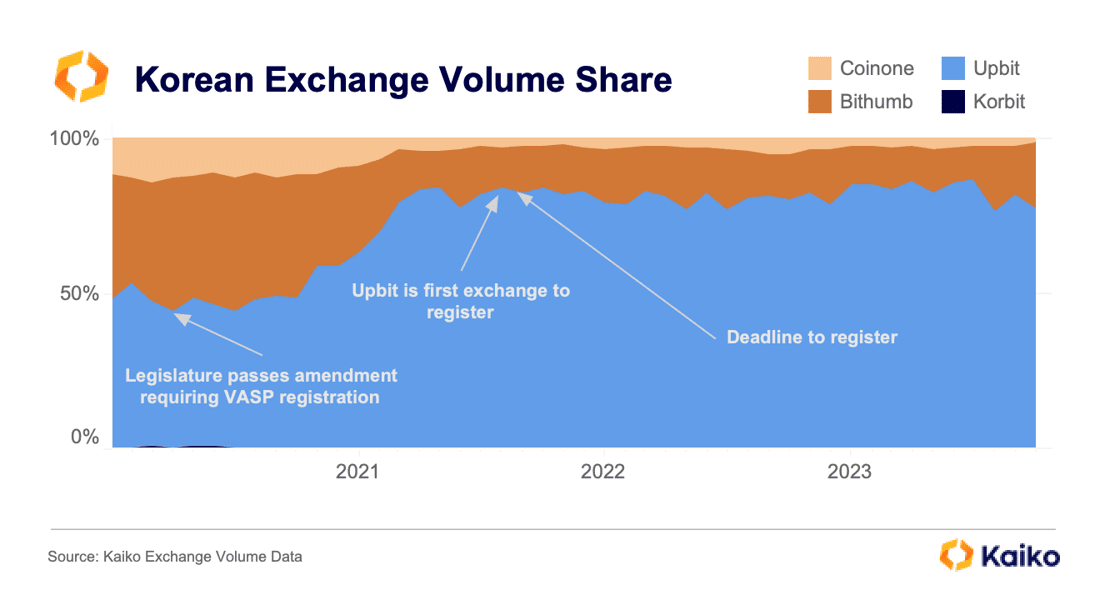

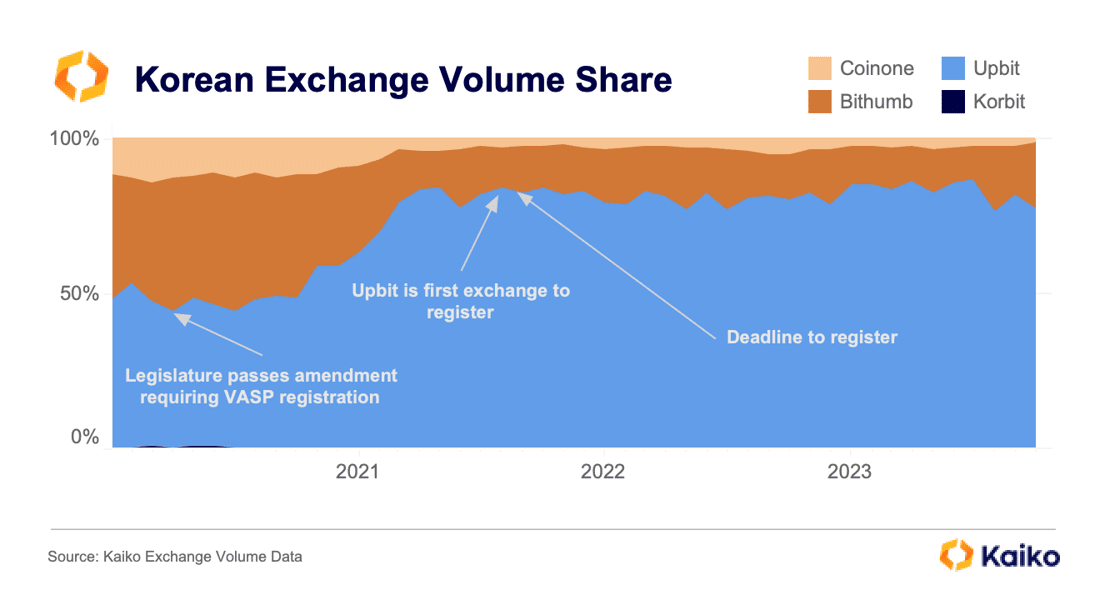

Exploring the Korean crypto market.

South Korea is one of the most unique markets in crypto. Its government has been proactive – relative to countries with similarly sized economies – in regulating the industry, passing its most significant legislation in early 2020. In our latest deep dive, we explore the South Korean crypto market and the rise of Upbit, one of the largest crypto exchanges in the world for altcoin trading. Altcoins are overwhelmingly the crypto asset of choice, with XRP dominating volumes over the past few months.

View Deep Dive

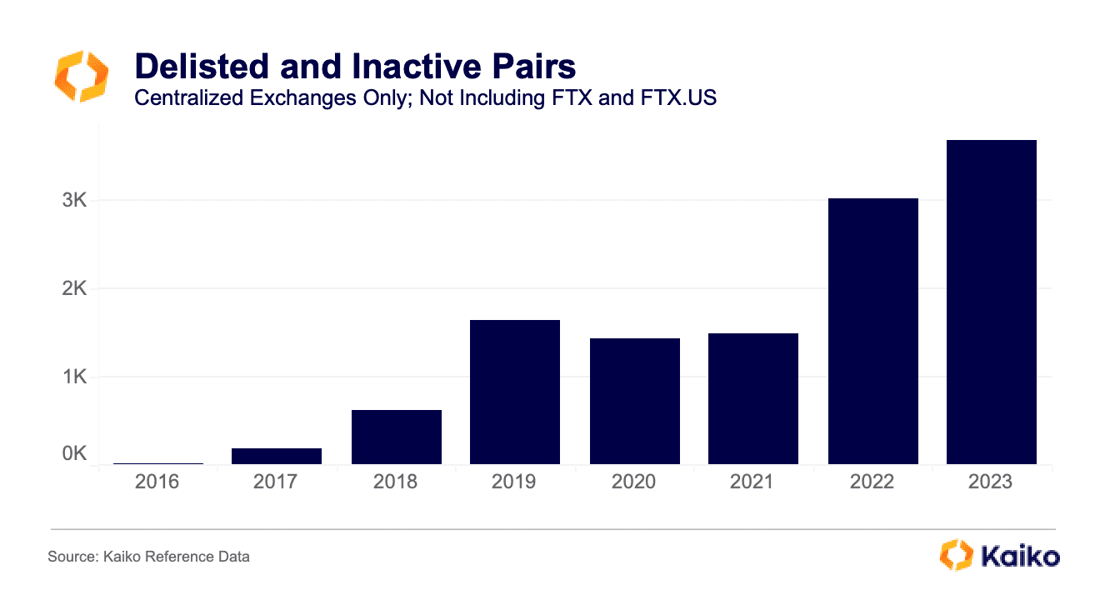

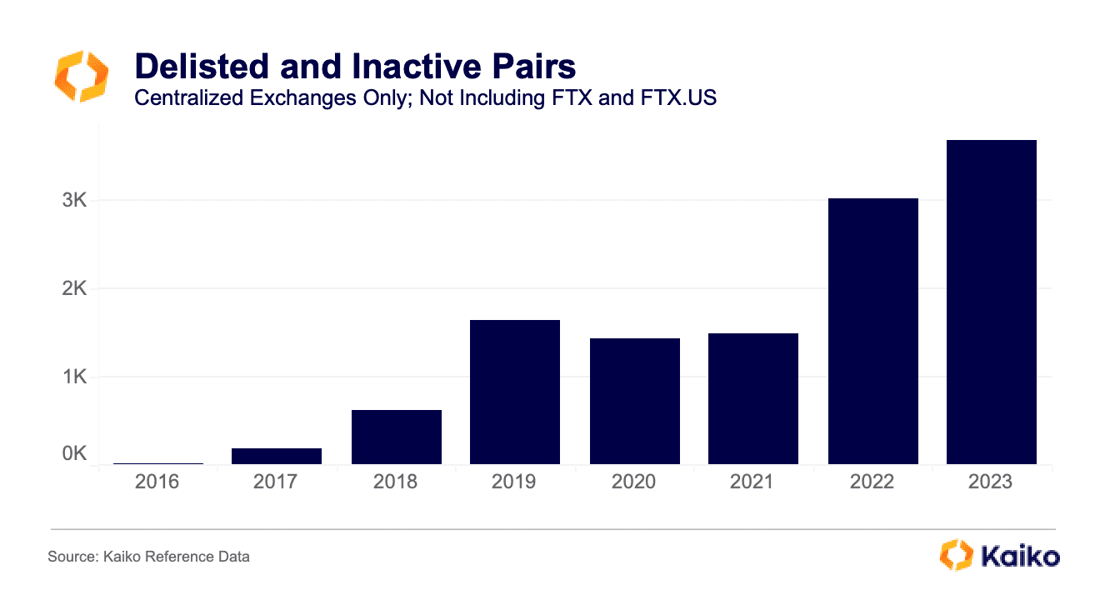

Number of delisted markets hits new high.

Low volume and liquidity can pose a challenge for exchanges to maintain hundreds of active spot markets. Since the start of 2023, we have observed an increase in the number of delisted and inactive spot instruments on centralized exchanges, which recently hit all time highs above 3.5k.

The trend is not as dire as it seems, simply because from 2021 – 2022, there was a massive expansion in the number of traded instruments as exchanges raced to capitalize on the bull market. With a global drop in liquidity and prices, it’s normal to observe a corresponding drop in traded instruments.

You can check out Bloomberg’s coverage of this trend here, powered by Kaiko data.

Lost volume: the exchanges that are no more.

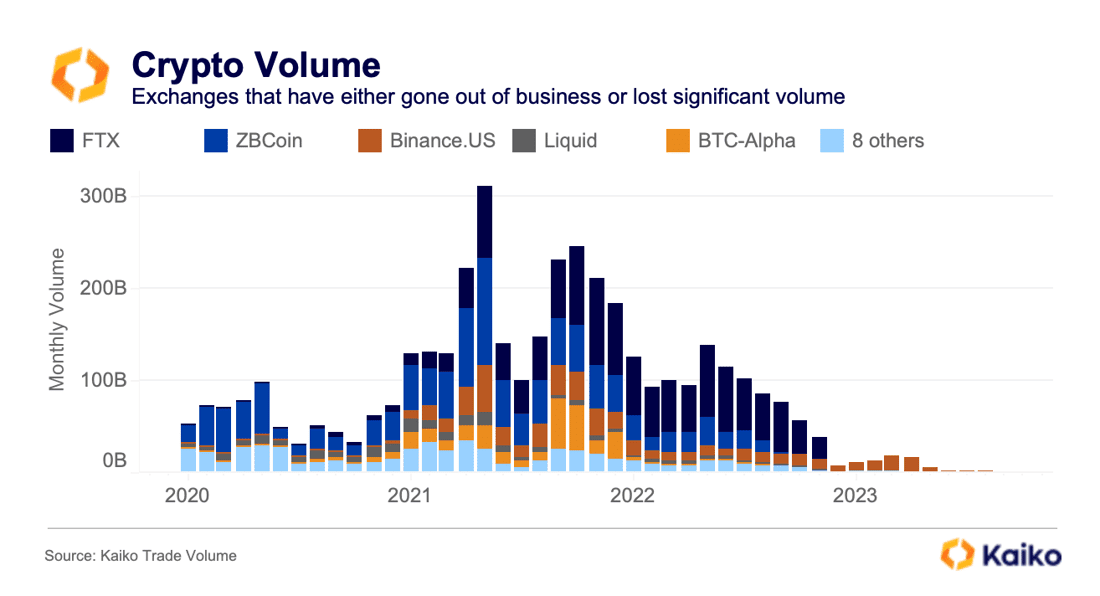

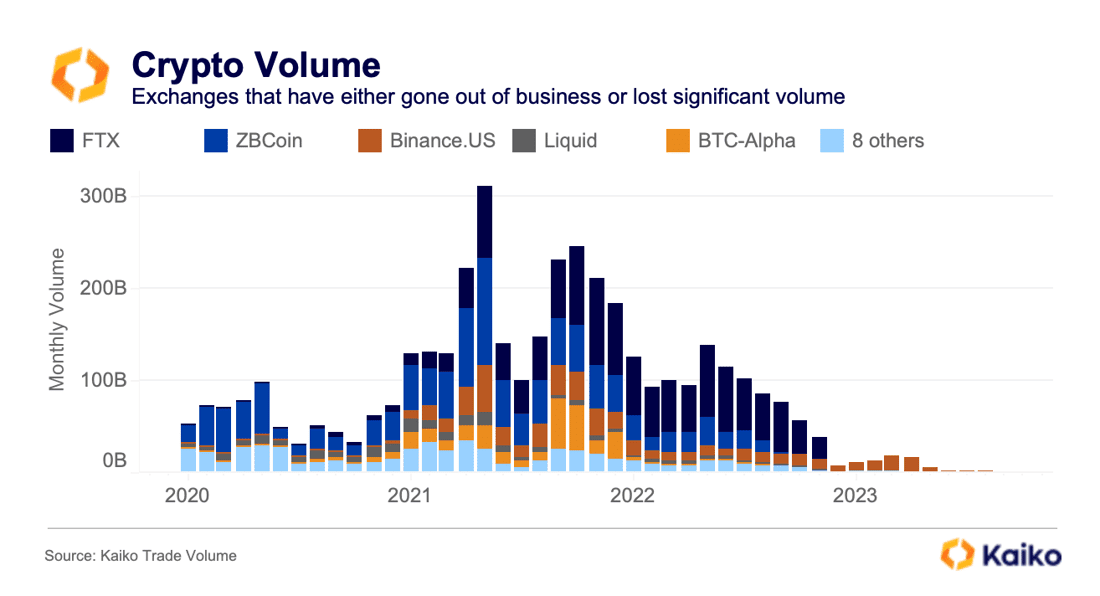

During a bear market, it is natural for some exchanges to go out of business or suffer a sharp drop in volume, especially in an industry with 100+ platforms. Over the past two years, we’ve seen this trend play out as volume becomes increasingly concentrated on a small number of exchanges.

Some exchanges go out with a bang, like FTX, while others disappear quietly, slowly delisting pairs until no volume is left. Binance.US is a good example of this; last spring, they were forced to halt all fiat transactions following several enforcement actions, which triggered a steady slowdown in activity.

The above chart shows trade volume for 13 exchanges that have either gone out of business or had volumes severely impacted by external events. At one point, these exchanges accounted for as much as $300bn a month. As of September, only Binance.US, Bitbank, Bittrex, and OkCoin are still processing trades, with a little over $600mn in transactions for the month.

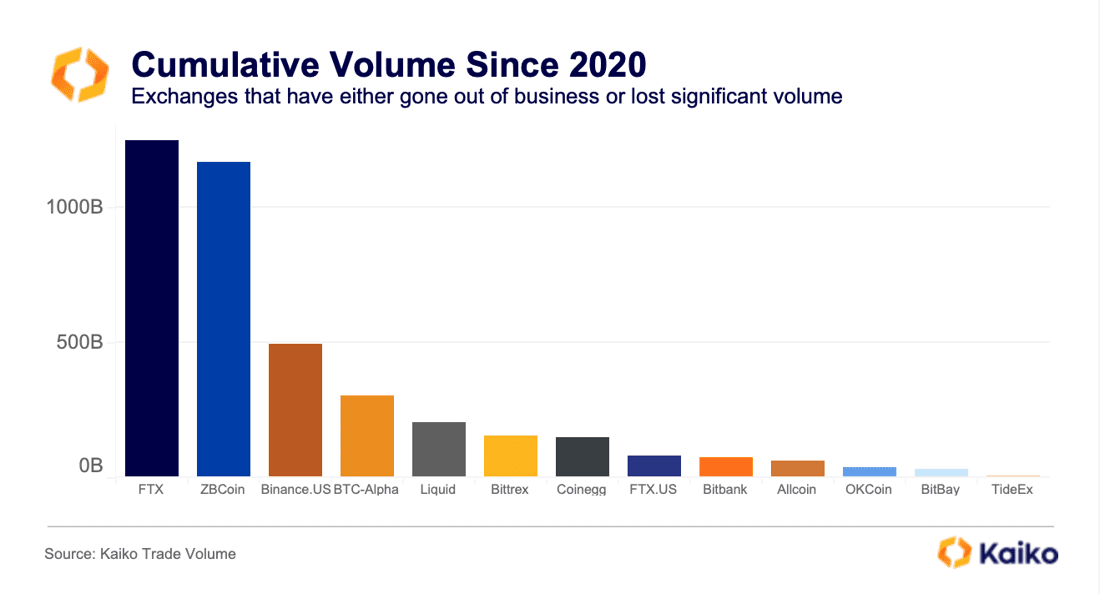

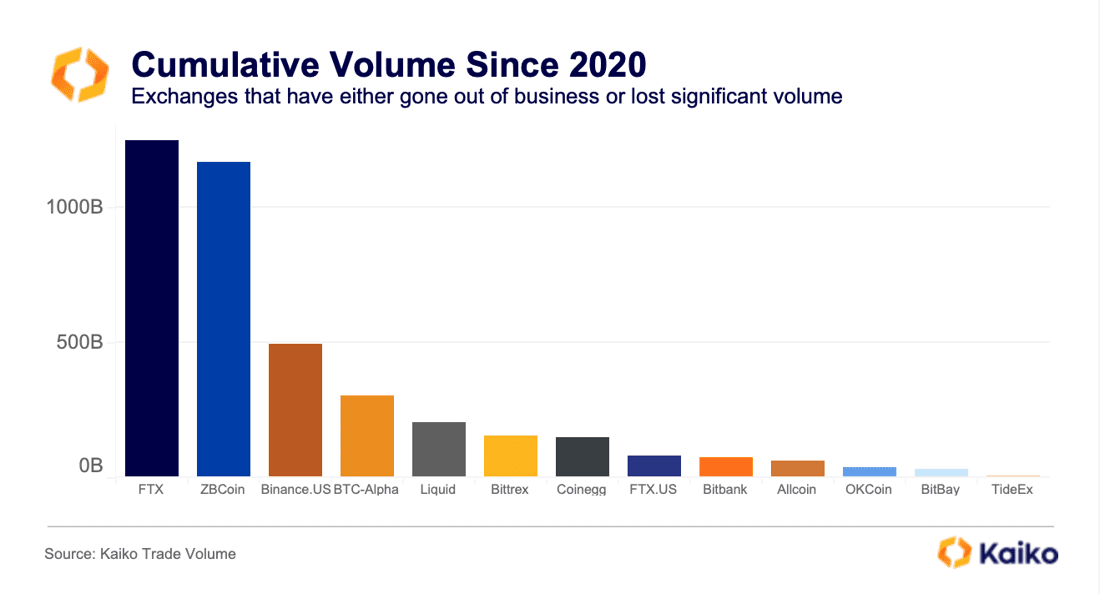

FTX was by far the largest exchange in this group, processing more than $1 trillion in volume since the start of 2020. Today, trade volume is increasingly concentrated on a handful of exchanges. Our recent research showed that just eight exchanges account for 90% of global trade volume. More concentrated markets can benefit individual traders, offering more liquid and stable markets. However, concentration can also pose a challenge in a sector that historically lacks transparency.

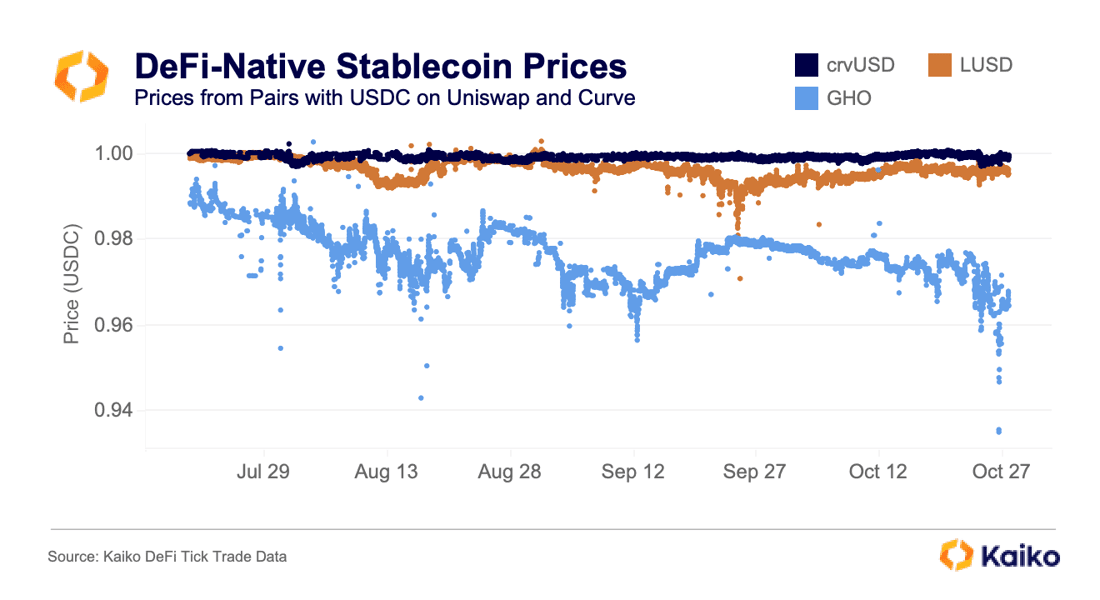

crvUSD maintains peg as other stablecoins struggle.

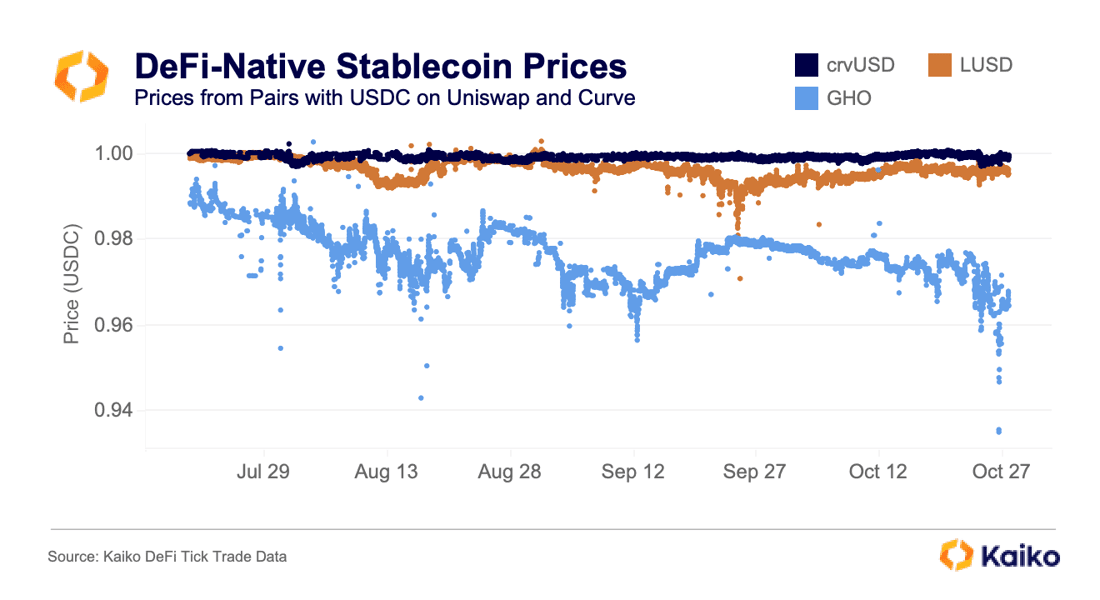

Curve Finance’s stablecoin — crvUSD — has been a rare source of activity amidst the bear market, which hit DeFi protocols especially hard. Just a few months after release, crvUSD’s market cap breached the $100mn threshold and today stands at about $125mn, compared to the DeFi-native stablecoins LUSD at $225mn and GHO at $25mn.

Like Curve itself, crvUSD is complicated and popular with DeFi power users. Like other DeFi stablecoins, it allows users to deposit Ethereum liquid staking derivatives (LSDs) to borrow the stablecoin, though it incorporates liquidation ranges, “soft liquidations”, and allows users to leverage their collateral up to 9 times. Arbitraging and yield farming opportunities have allowed crvUSD to maintain its peg quite well since inception. Meanwhile, Liquity’s LUSD and Aave’s GHO continue to show significant peg deviations, in large part due to limited use cases and flawed mint and redemption mechanisms.

![]()

![]()

![]()

![]()