Data Points

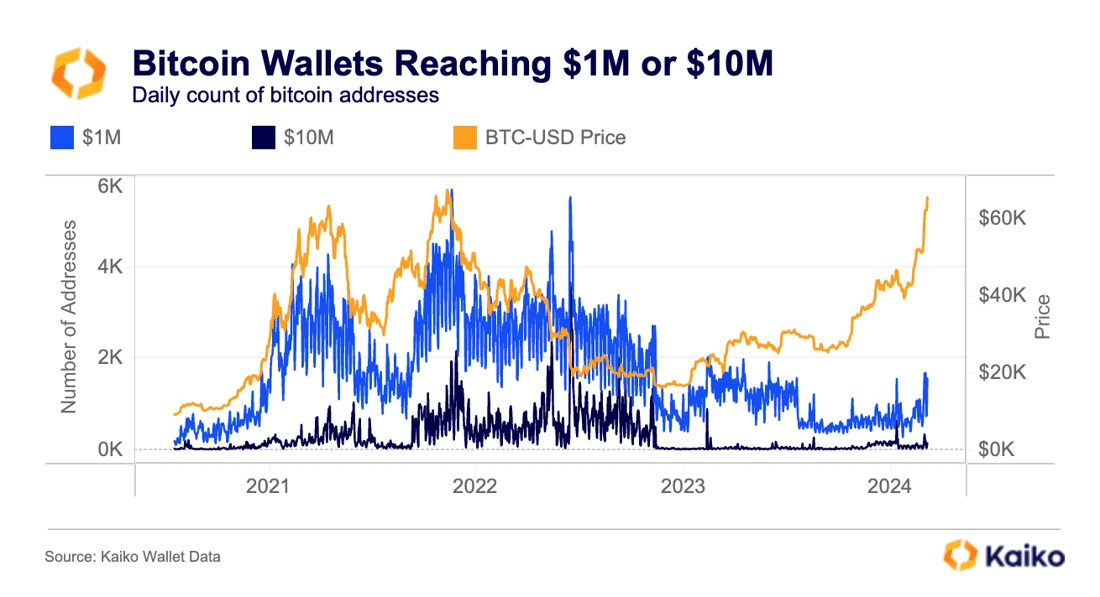

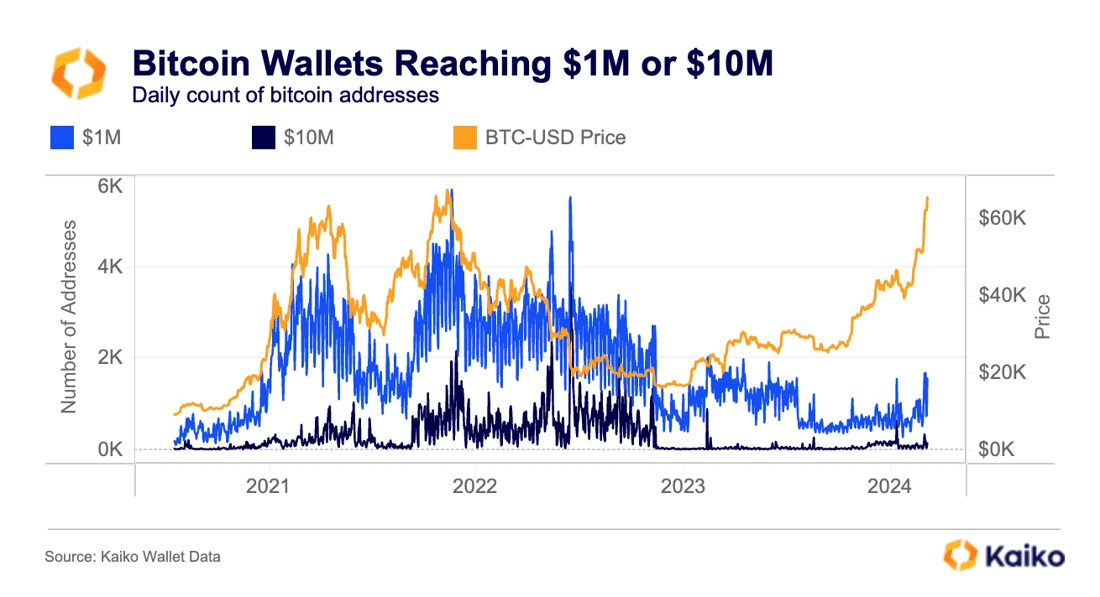

Where are all the new BTC millionaires?

Despite the recent price surge, on-chain bitcoin whales are seeing a slow return. Using Wallet Data, we were able to compute the number of new daily millionaire wallets and found that they have remained below two thousand per day. During the last bull run, more than four thousand wallets were reaching the million-dollar mark daily, and more than two thousand wallets were reaching $10M.

This could be due to a few things: (1) New capital has yet to arrive in full force. (2) Large whales are taking profit as BTC hits new highs. (3) Whales are storing their holdings with custodians, rather than personal wallets.

In 2021, there was a huge influx in capital as all manner of bull sought to benefit from the crypto hype. This time around, whales could be taking a more cautious approach, waiting to see if the gains have legs before investing.

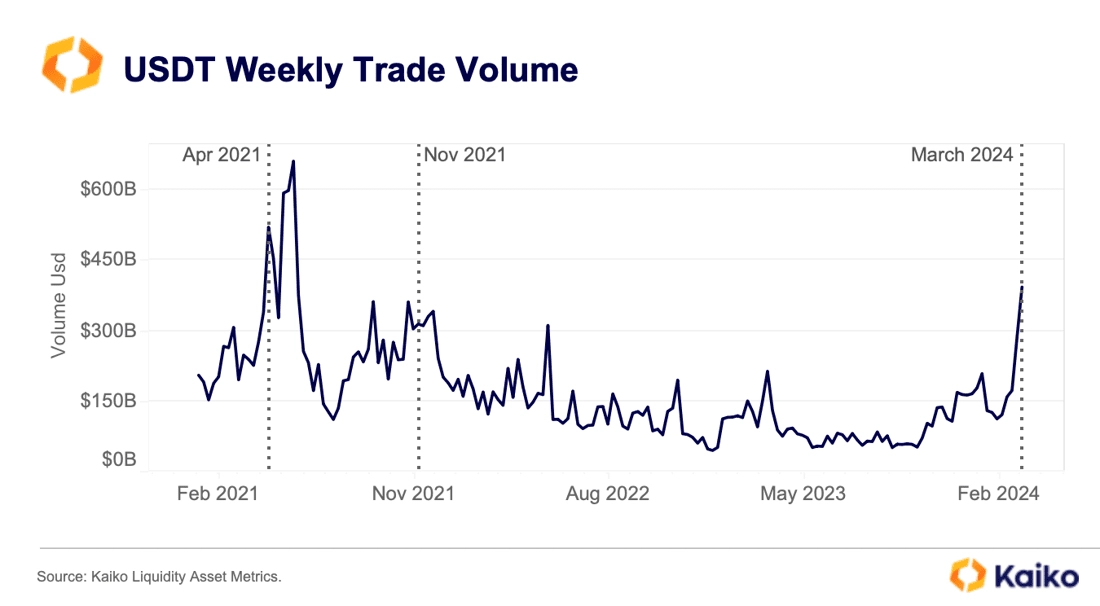

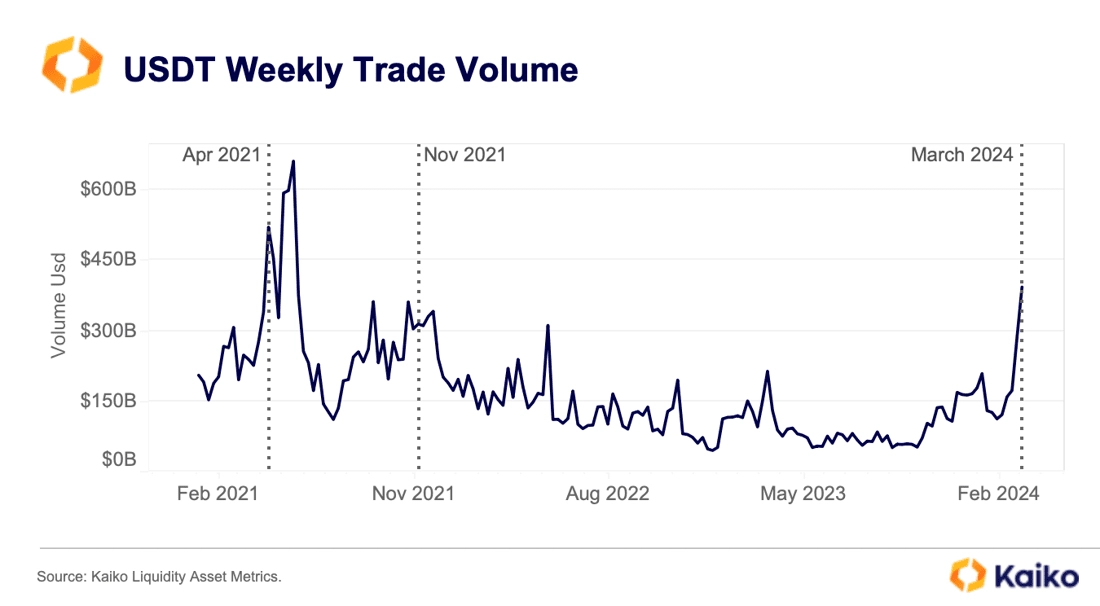

Tether volumes continue to lag market cap.

Last week, the market cap of Tether’s USDT stablecoin hit an all-time high, surpassing $100bn. USDT trade volume on centralised exchanges has certainly increased in line with crypto prices. However, volumes remain well below their peak of $661bn reached in May 2021, and are about equal to volumes hit during the last bull market. As such, it is not fully clear why market capitalization is a full $30bn higher than it was in 2021.

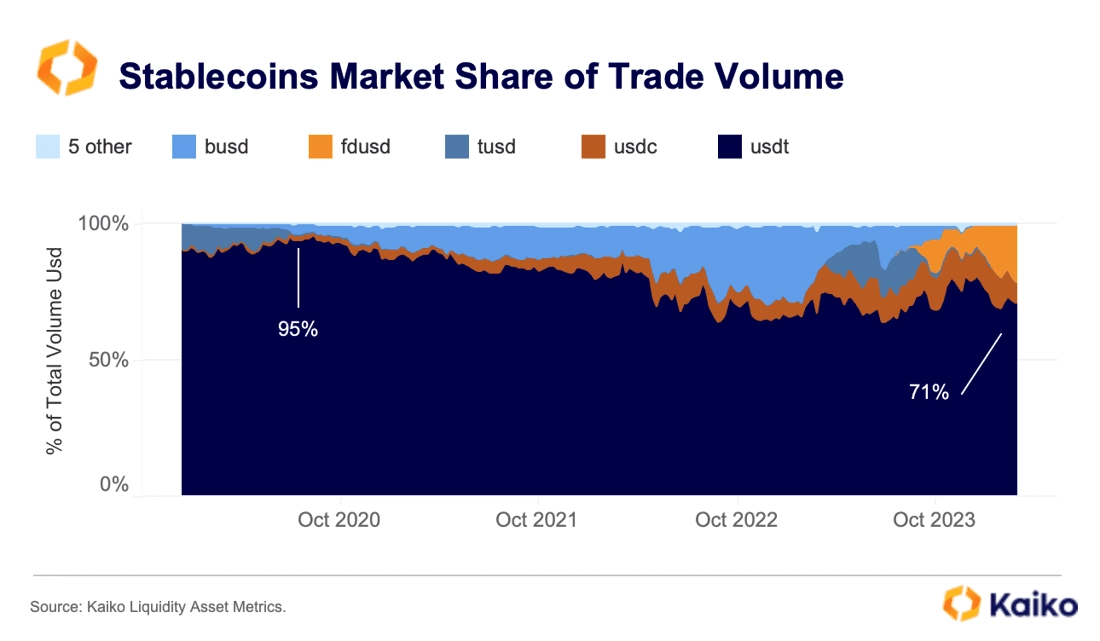

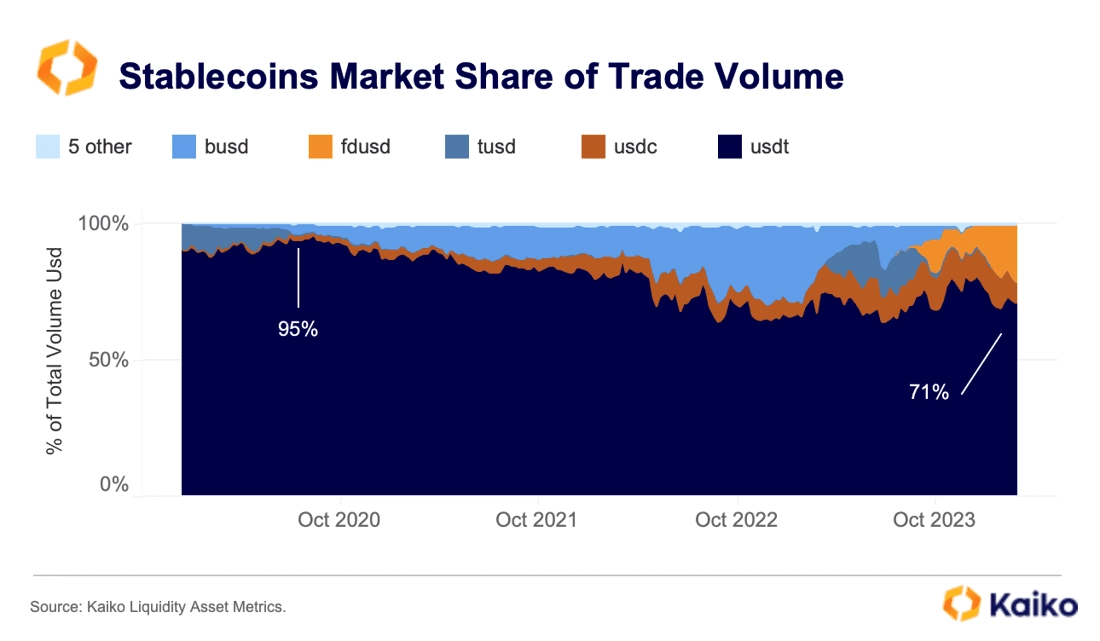

Further, even though USDT’s market capitalization is at all time highs, its market share of trade volume has declined relative to the 2021/21 bull run.

USDT’s market share has dwindled from more than 95% in late 2020 to 71% currently. The main winners appear to be Binance-backed alternatives such as FDUSD which emerged as the second most traded stablecoin on centralised exchanges this year with a market share of more than 21%.

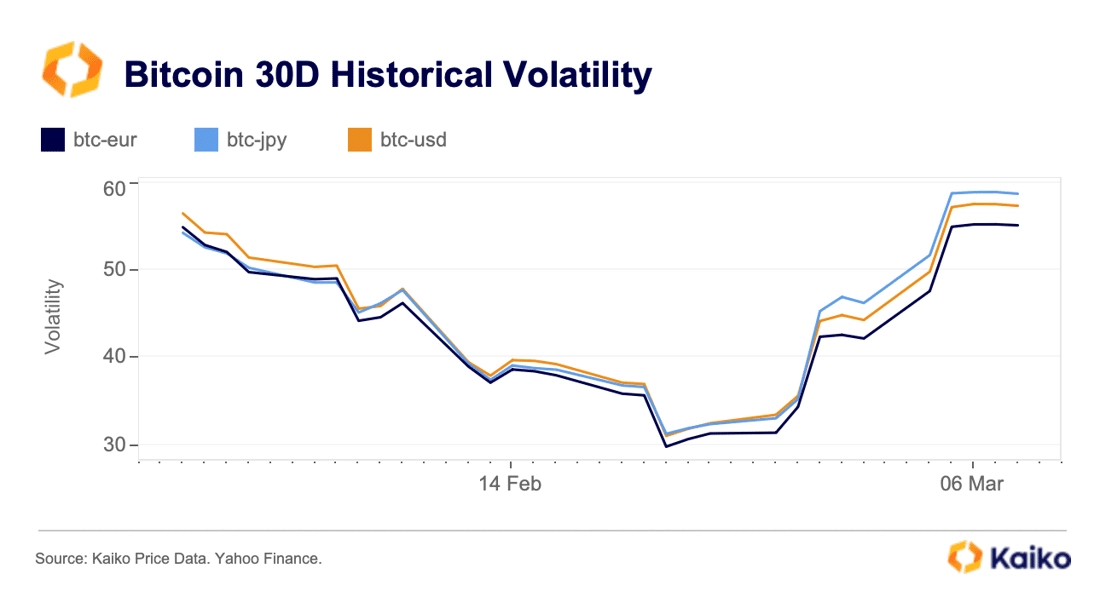

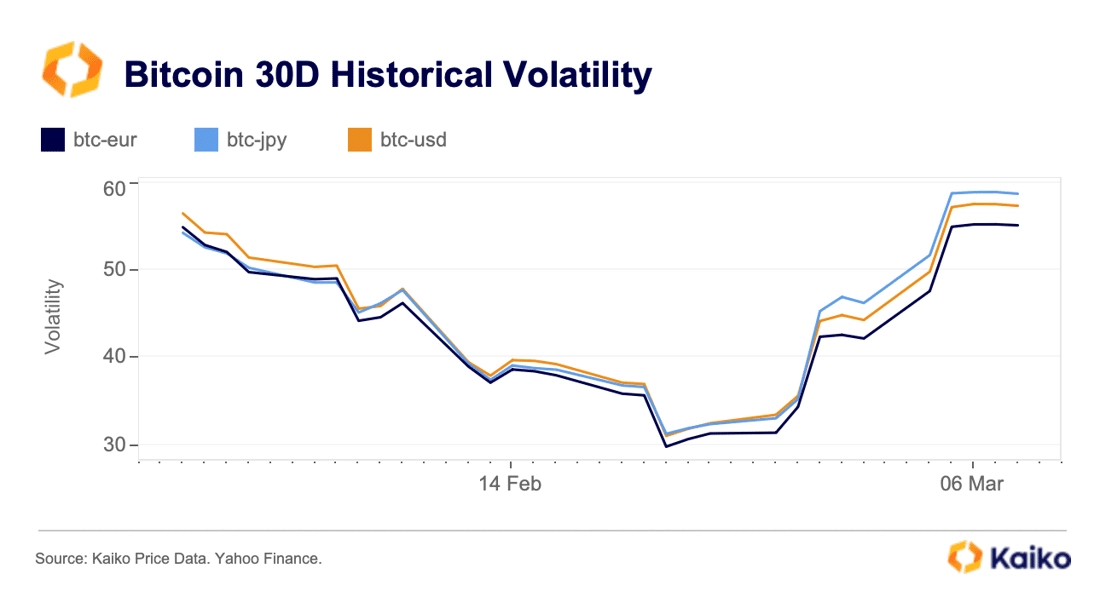

Bitcoin volatility hits yearly high.

Bitcoin’s 30-day realised volatility surged to its highest levels since April 2023 last week after touching a yearly low just two weeks prior. Interestingly, volatility for btc-jpy and btc-usd trading pairs was higher than for btc-eur. The diverging volatilities for different fiat markets is a sign of market fragmentation, and could worsen if liquidity continues to be unevenly distributed.

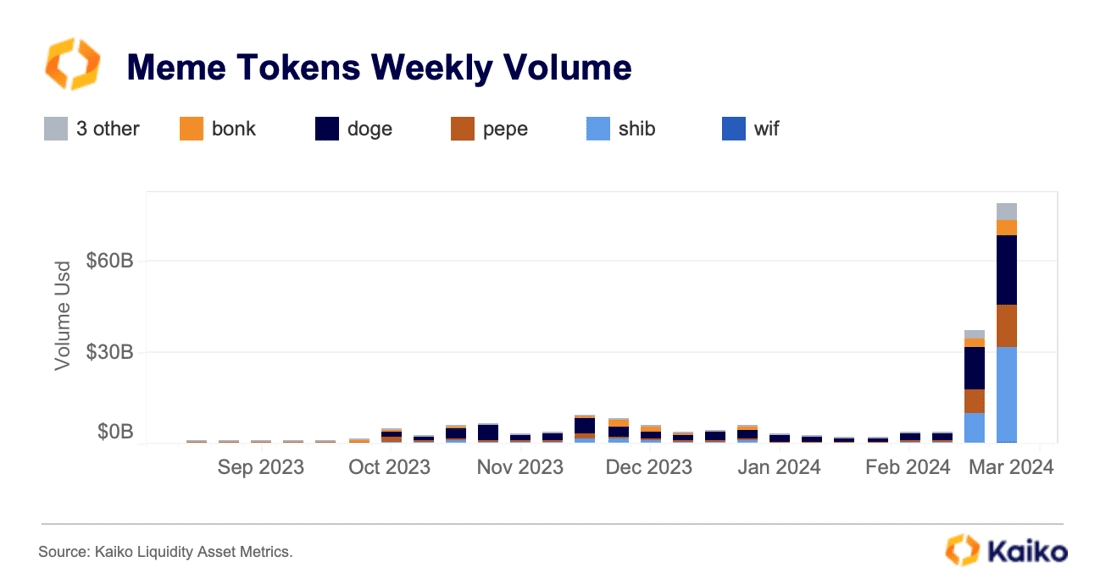

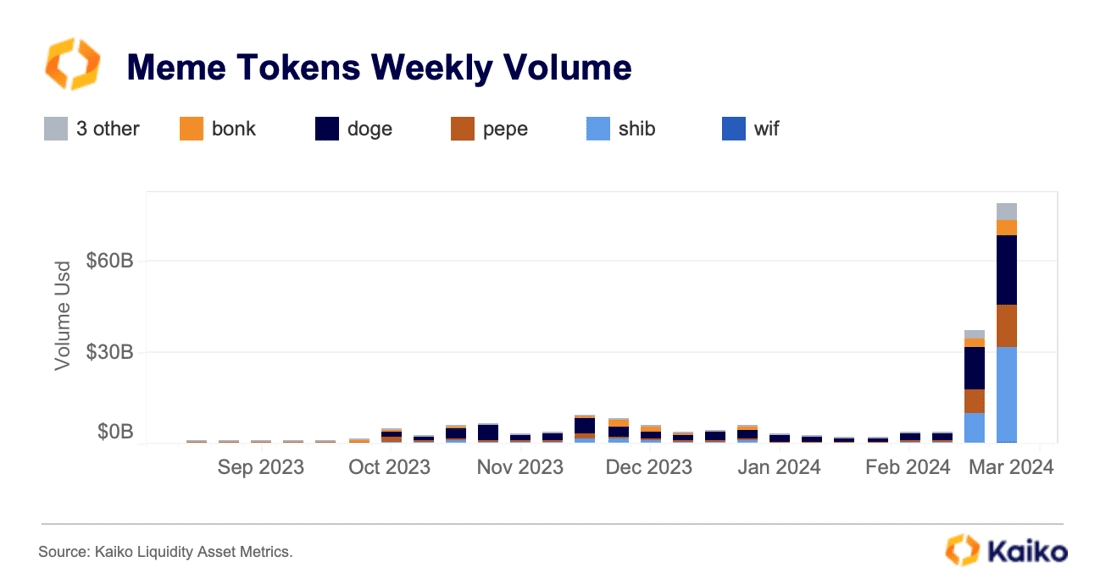

A trading frenzy for meme tokens sees no end.

Meme tokens have seen outsized gains over the past weeks with weekly trade volume hitting a multi-year high of nearly $80bn. SHIB saw the largest volumes at $31bn. surpassing the market’s leader DOGE ($23bn) and other large cap non-meme altcoins such as SOL. PEPE and Solana-based BONK also saw significant trading of $14bn and $5bn respectively. The meme frenzy has boosted Ethereum’s network fees to a two-year high and exacerbated the competition between Layer 2 networks and Coinbase’s Base, which registered an all-time high in deposits.

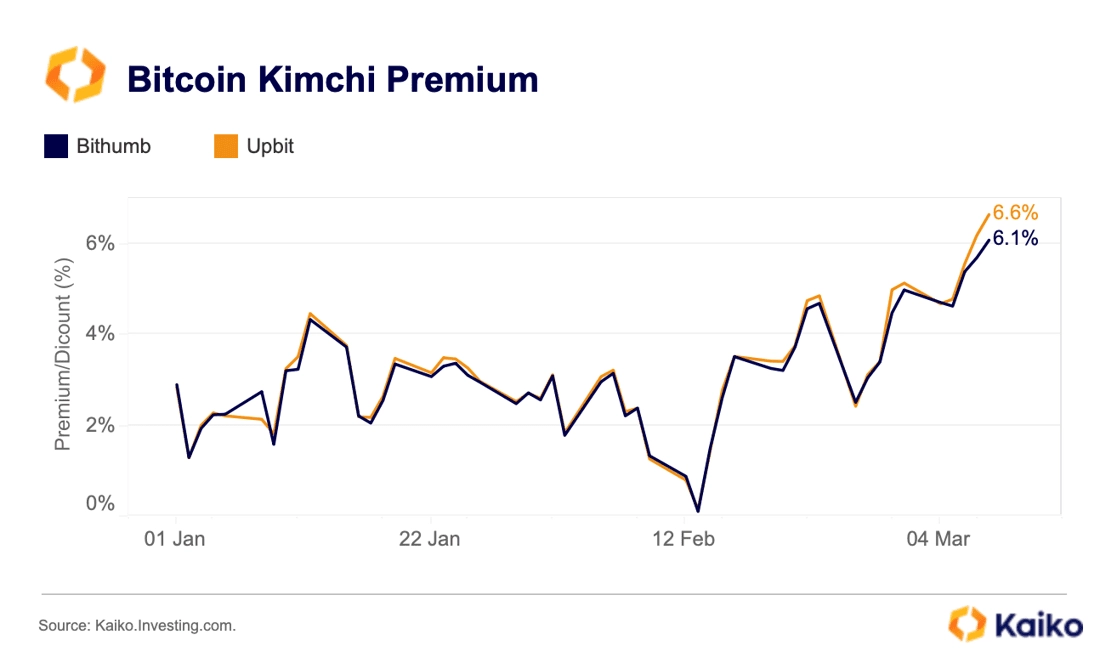

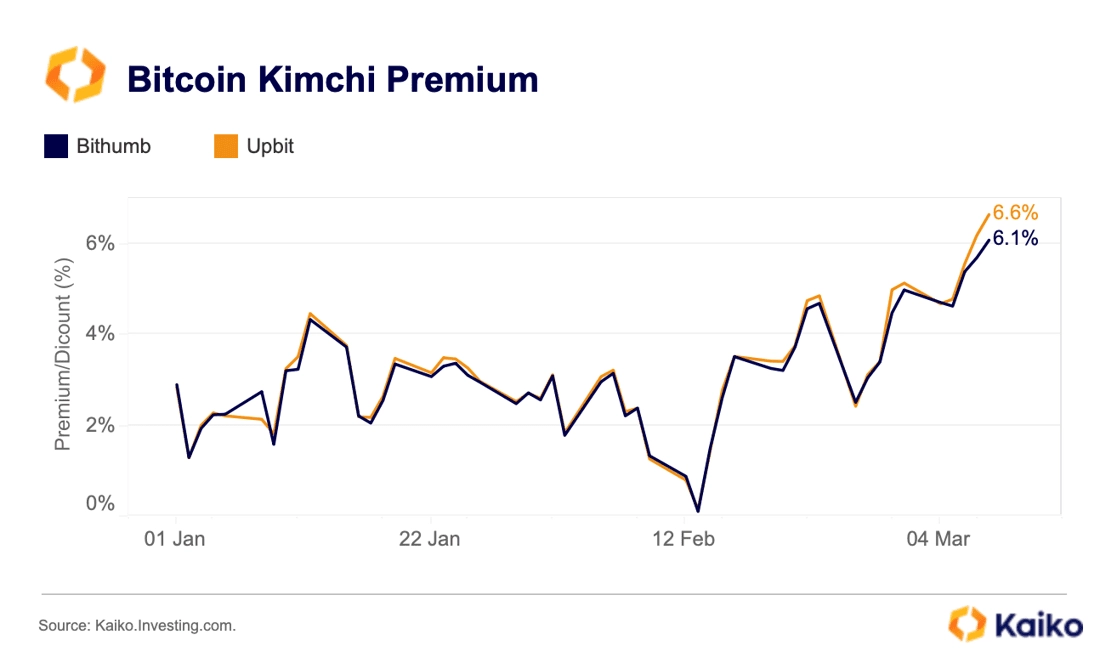

The Kimchi Premium is back.

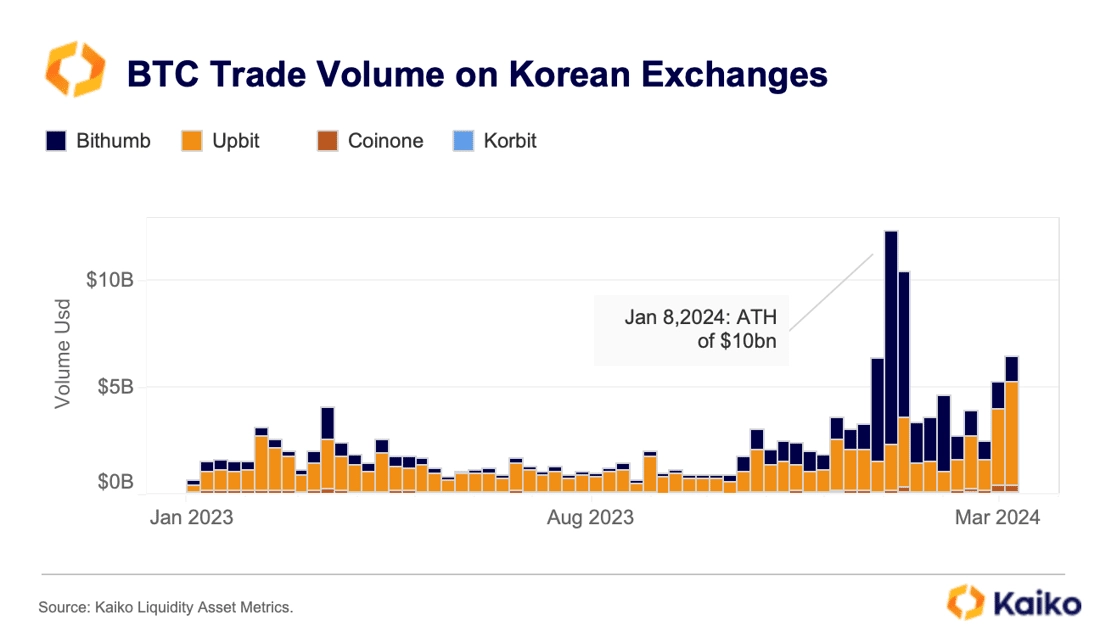

Bitcoin’s premium on Korean markets — the so-called Kimchi premium — rose to a yearly high of nearly 7% last week, just as Bitcoin hit an all time high . Since 2016, Bitcoin has traded at a premium of up to 50% on Korean markets due to South Korea’s unique regulatory framework which restricts cross-border capital transfers for foreigners. The Kimchi premium declined significantly during the crypto bear market, averaging just 1.5% in 2022 as crypto demand on Korean markets cooled after the Terra collapse.

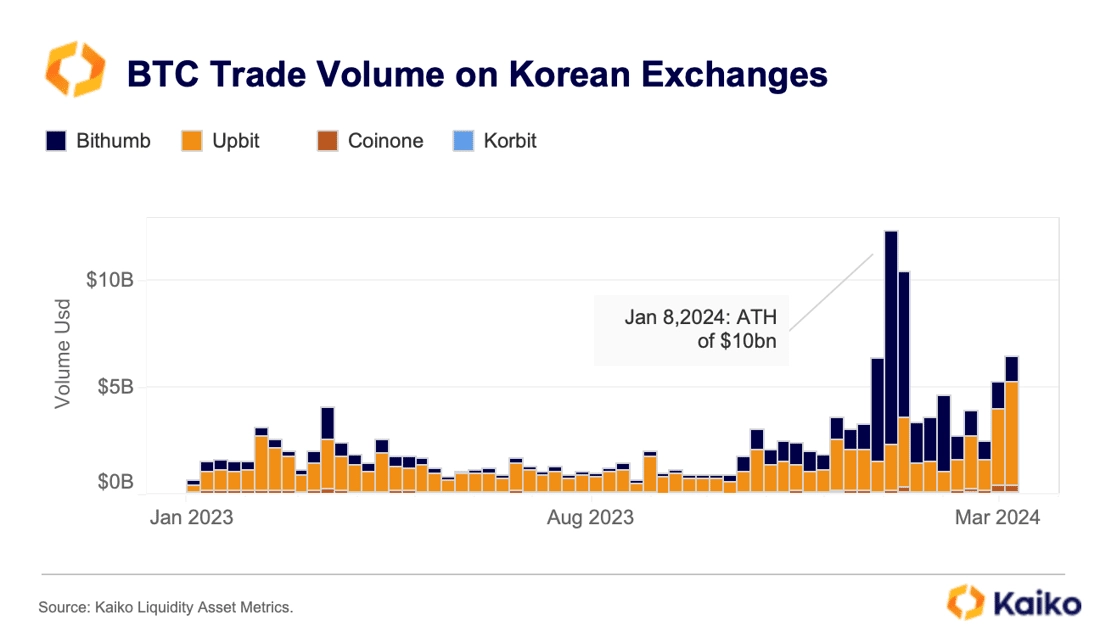

While Bitcoin typically accounts for a small share of trade volume on Korean exchanges which are dominated by altcoins, the recent rally has boosted Bitcoin demand. BTC trade volume on Korean markets surged to an all-time high of more than $10bn in early January, surpassing Coinbase. The increase has been driven by Bithumb which briefly became the largest Korean exchange by trade volume.

![]()

![]()

![]()

![]()