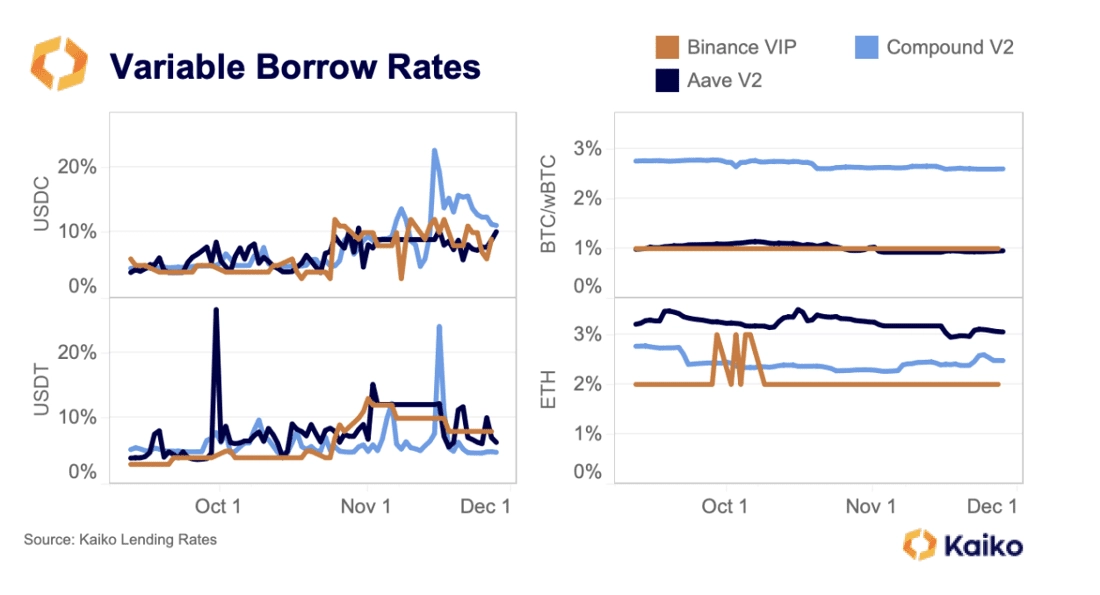

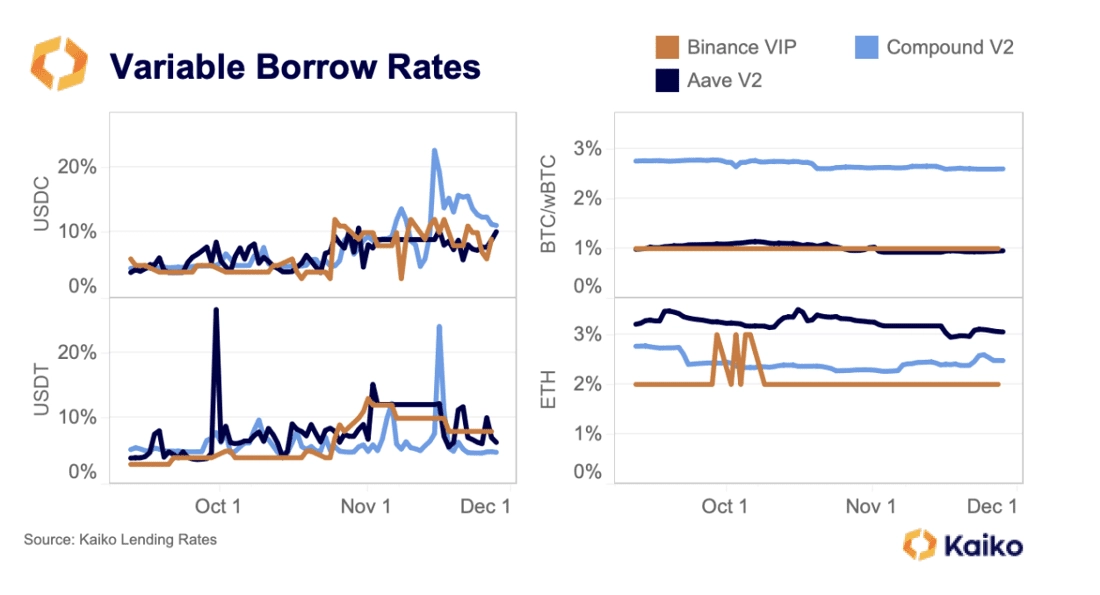

Binance’s VIP stablecoin borrow rates mirror those on decentralized protocols.

Last week, we discussed how demand for stablecoins on-chain has been rising. This has been mirrored off-chain, too. Binance offers large loans to its VIP customers with good credit history; up to $100mn in the case of USDT. Like Aave and Compound, these rates are flexible, changing over time as demand increases or decreases. In the past three months, USDC’s APR on Binance has risen from 5% to 10%, while USDT’s has gone from 3% to 7%. This has largely tracked the changing rates on the two major Ethereum lending and borrowing protocols.

For BTC and wBTC, Binance’s APR has been nearly identical to Aave V2’s, while Compound’s has been higher. Meanwhile, Binance’s ETH APR has stayed at 2%, barring a few spikes, less than on its DeFi counterparts. This is likely due to greater ETH borrowing demand in DeFi, where some users deposit an ETH LSD, borrow ETH, swap it for an ETH LSD and repeat the process until they’ve achieved their desired leverage, in a process known as “looping”.

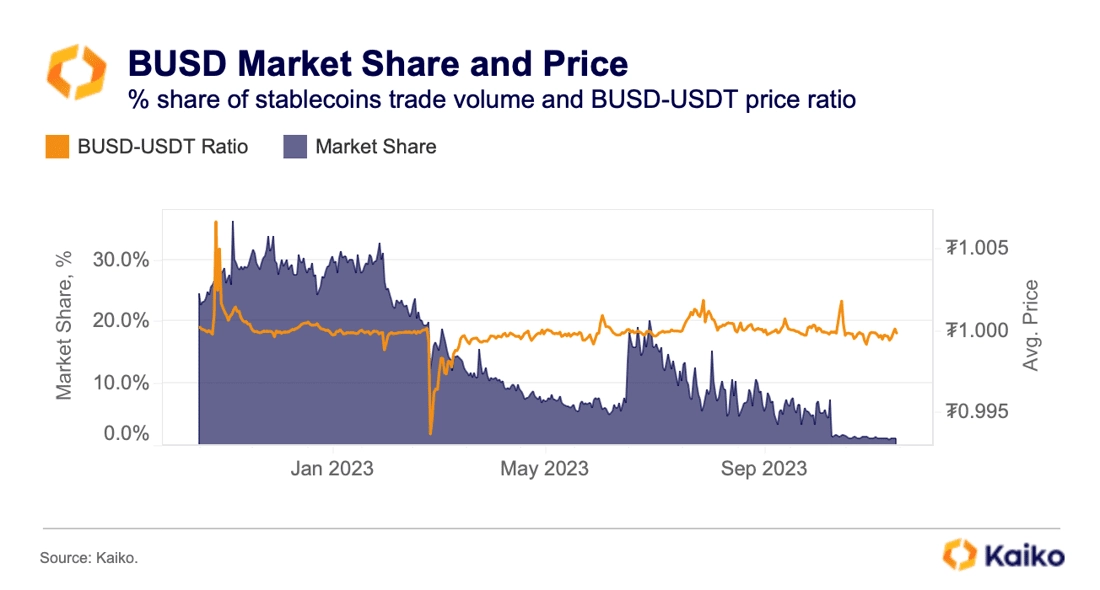

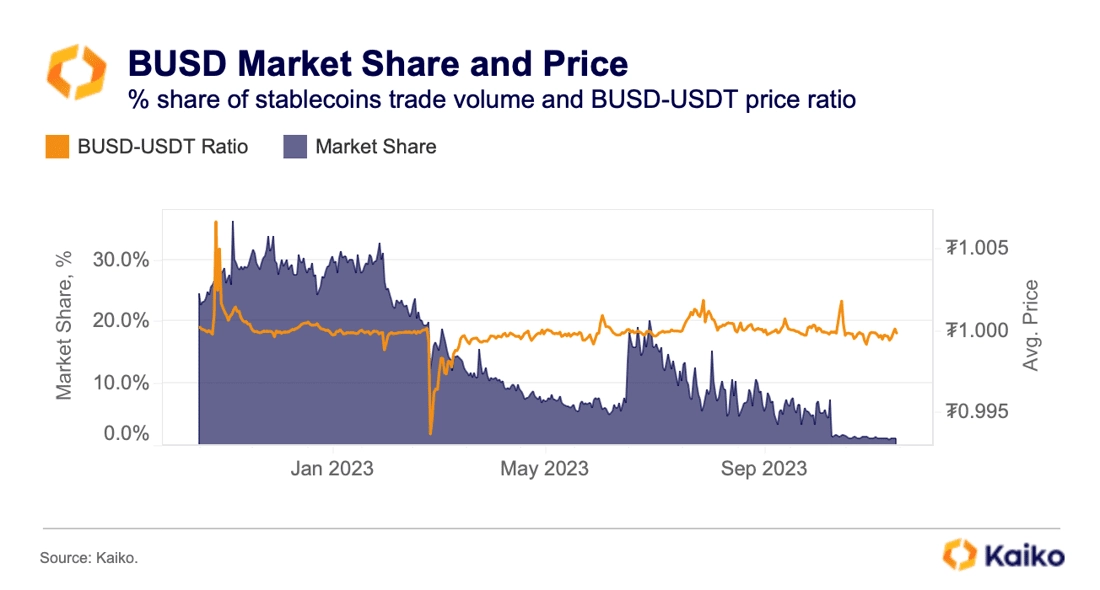

BUSD is stable as Binance prepares to end support.

Last week, Binance announced that it will discontinue support for BUSD on December 15. The move had been expected after BUSD’s issuer, Paxos, was ordered by U.S. regulators to stop minting the token in February. BUSD’s market share has fallen from 30% at the start of 2023 to just 1%. Although BUSD traded at a discount to USDT in November, the BUSD-USDT ratio has remained relatively stable despite its coming demise.

Over the past year, BUSD’s drop in volumes has mainly benefited USDT, which consolidated its leading market position along with the other two Binance favorites: TUSD and, more recently, FDUSD.

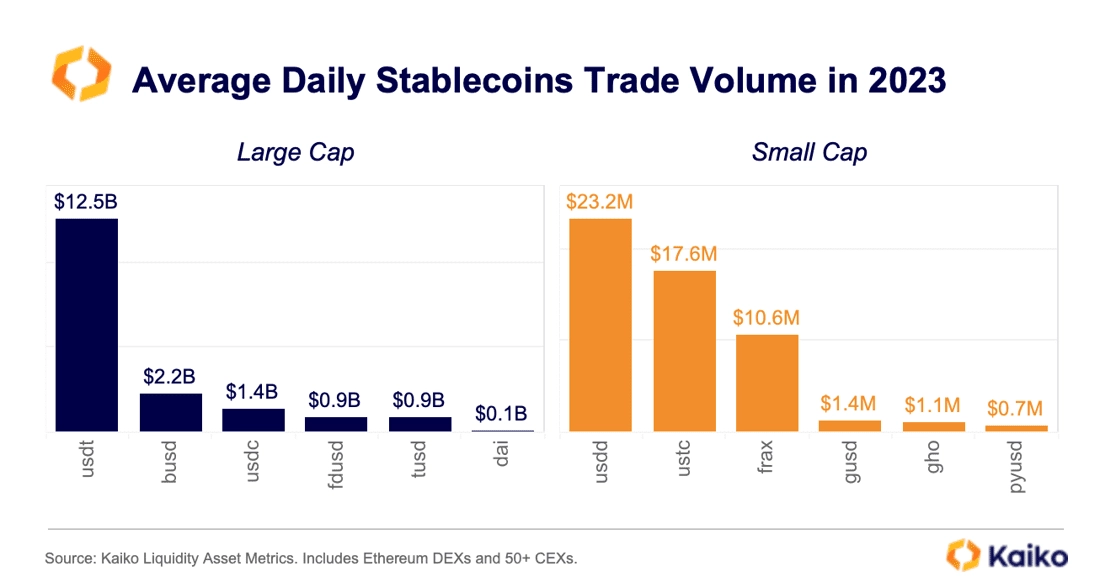

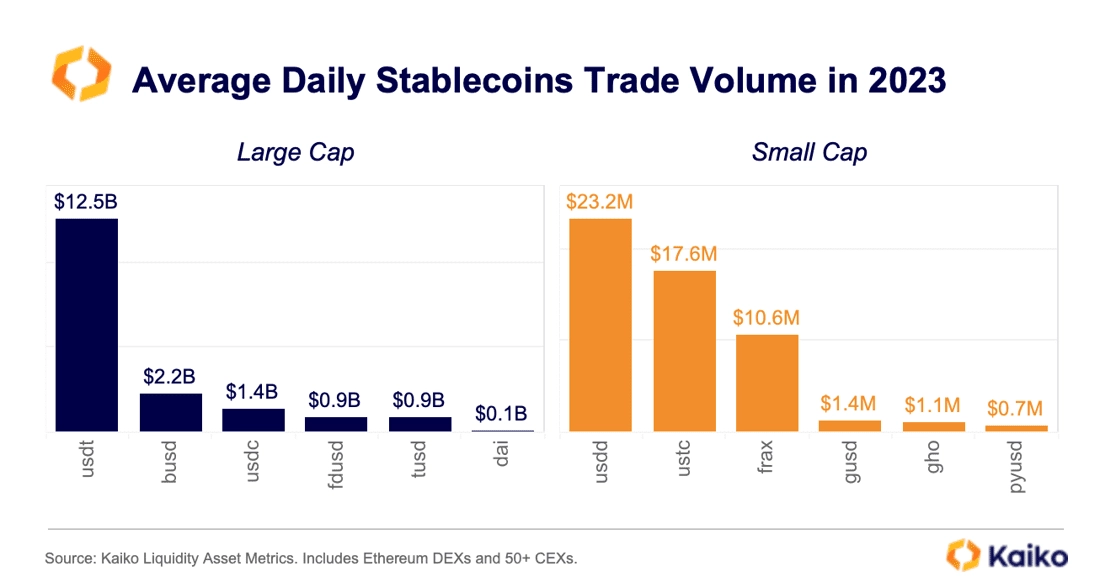

The average trading volume of USDT remained over $12bn in 2023, well above BUSD’s $2.2.bn and USDC’s $1.4bn. TUSD and FDUSD each recorded an average trading volume of $0.9bn, which is orders of magnitude higher than small cap stablecoins such as USDD, Terra’s USTC, or FRAX.

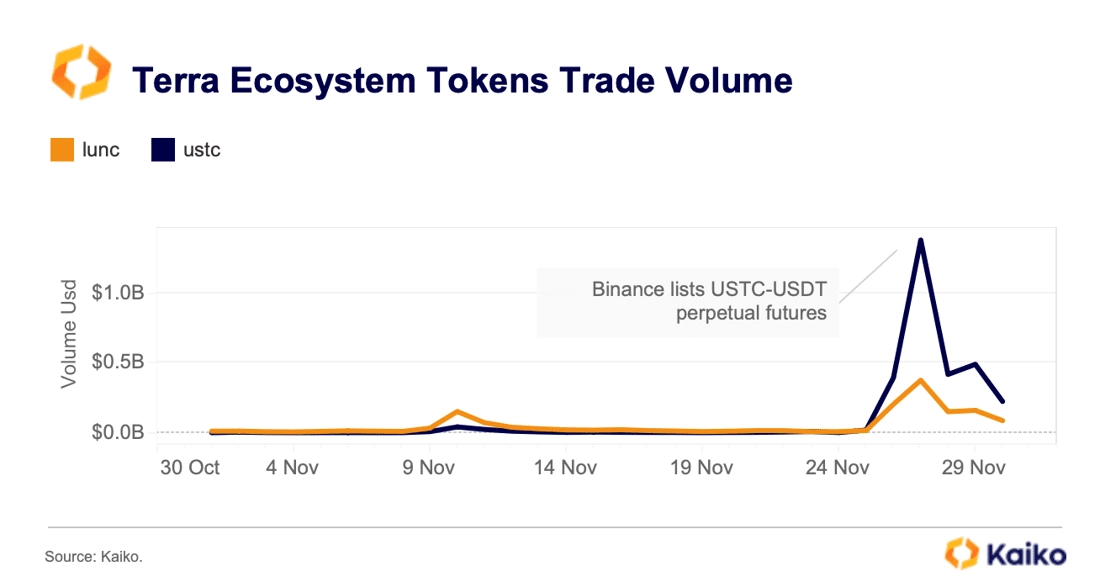

Terra ecosystem tokens rally.

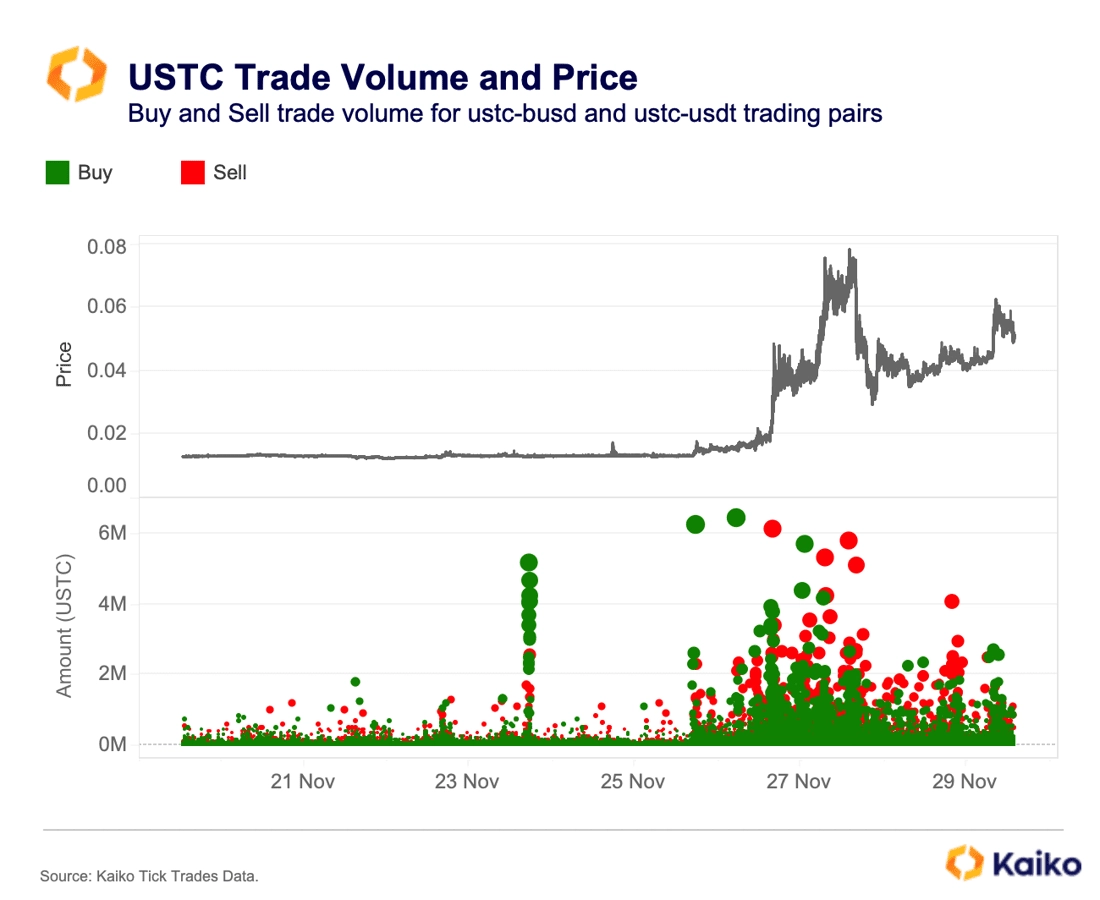

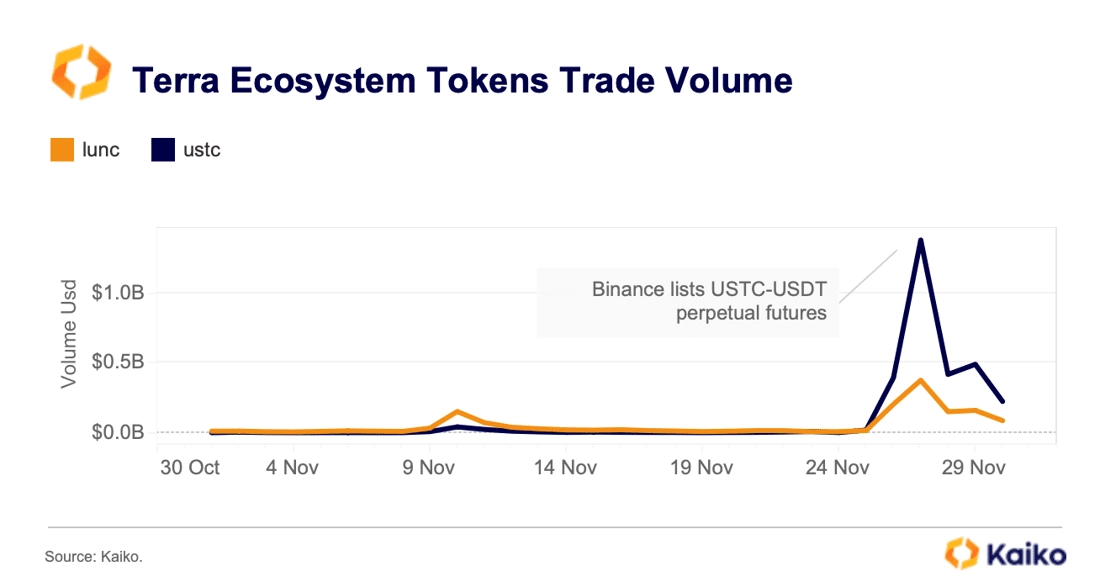

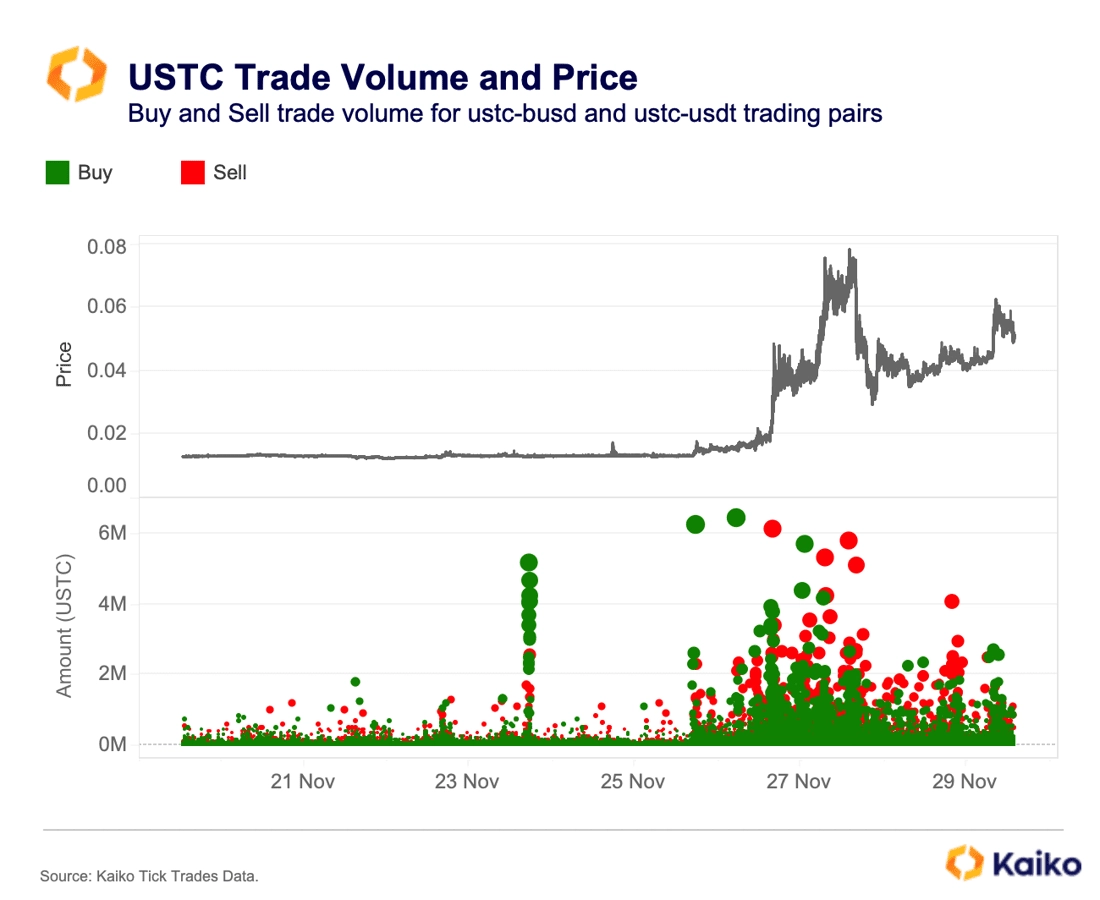

TerraUSD (USTC) and LUNC – remnants of the collapsed Terra ecosystem — saw a surge in trade volume and price last week. The activity was linked to Binance listing a highly leveraged USTC-USDT perpetual futures contract on November 27 and Terra Classic Labs (TCL) investing $500mn in the stablecoin. Buying and selling accelerated on November 27, propelling the stablecoin’s daily trade volume to more than $1.3bn.

Interestingly, USTC buying kicked off on November 23 with a series of large buy orders. Two days later, prices started to increase, at which point some large sell orders started. Overall, market share of trade volume rose from near zero to 6.5% within a few days. LUNC, the other native token from the Terra ecosystem, also rose by nearly 90% since the start of November to $380mn.

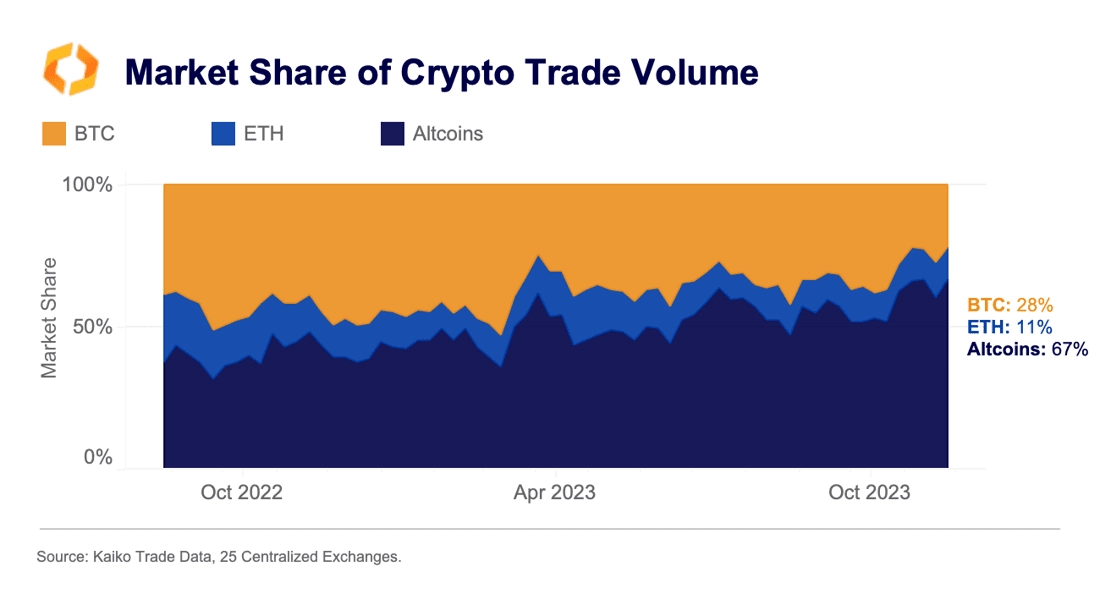

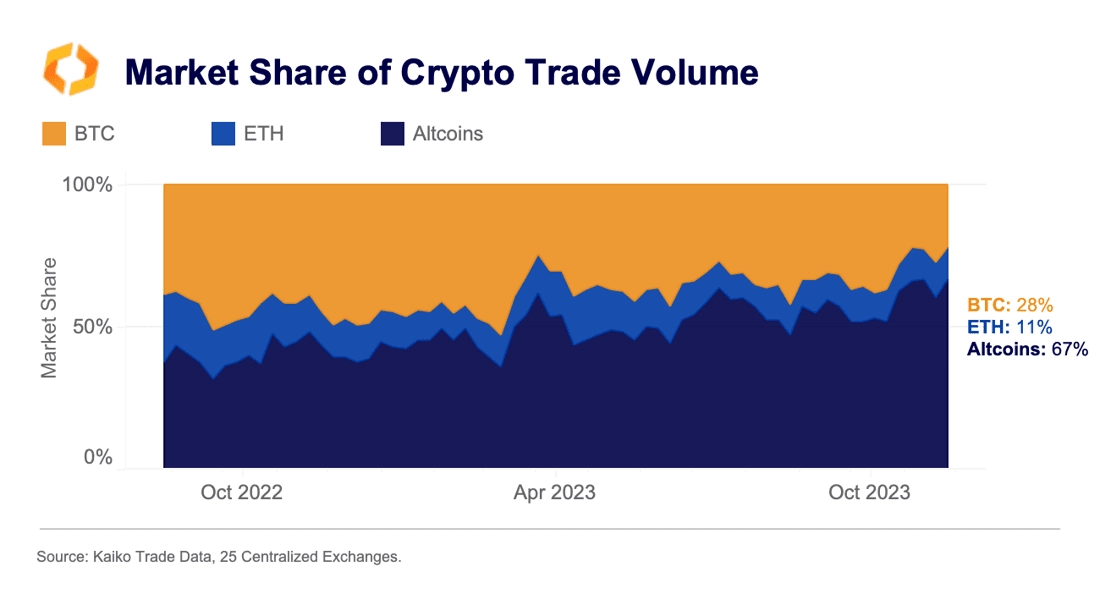

Altcoin market share continues to rise.

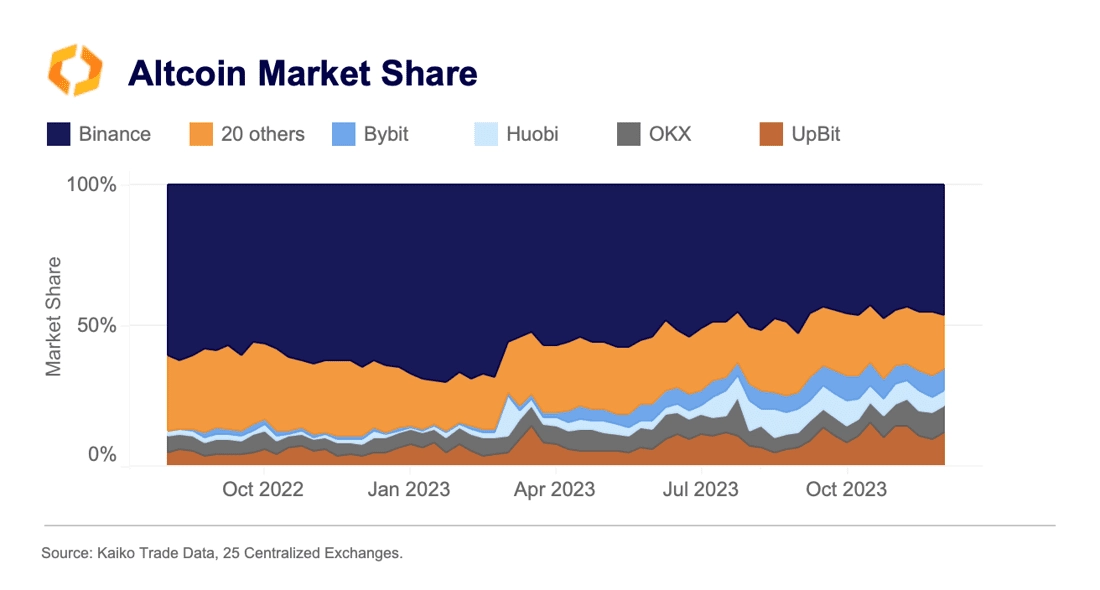

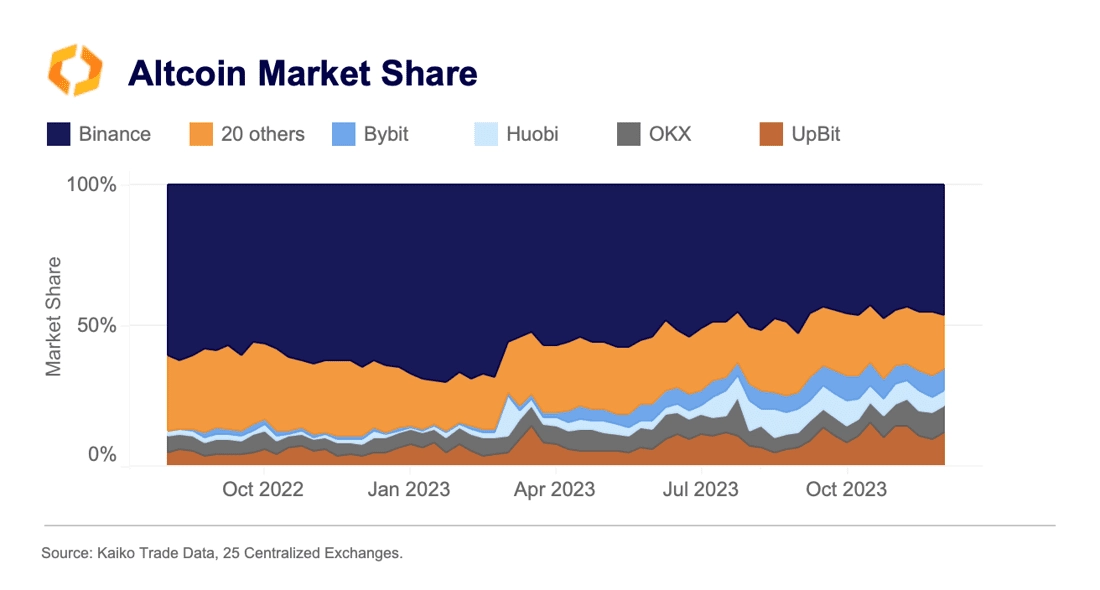

Altcoin market share of trade volume surged to 67% last week, its highest level since March 2022, as traders continued rotating into riskier assets amid an ongoing rally. Daily altcoin trade volume spiked above $20bn in early November for the first time since April 2023. While altcoin volumes continue to be driven by offshore markets, Binance’s influence has shrunk, with its market share of global altcoin volume dropping to 46% last week, down from 60% in September 2022.

Upbit, Bybit, OKX, and Huobi were the main winners, commanding a combined 35% of altcoins volumes, up from 11%.

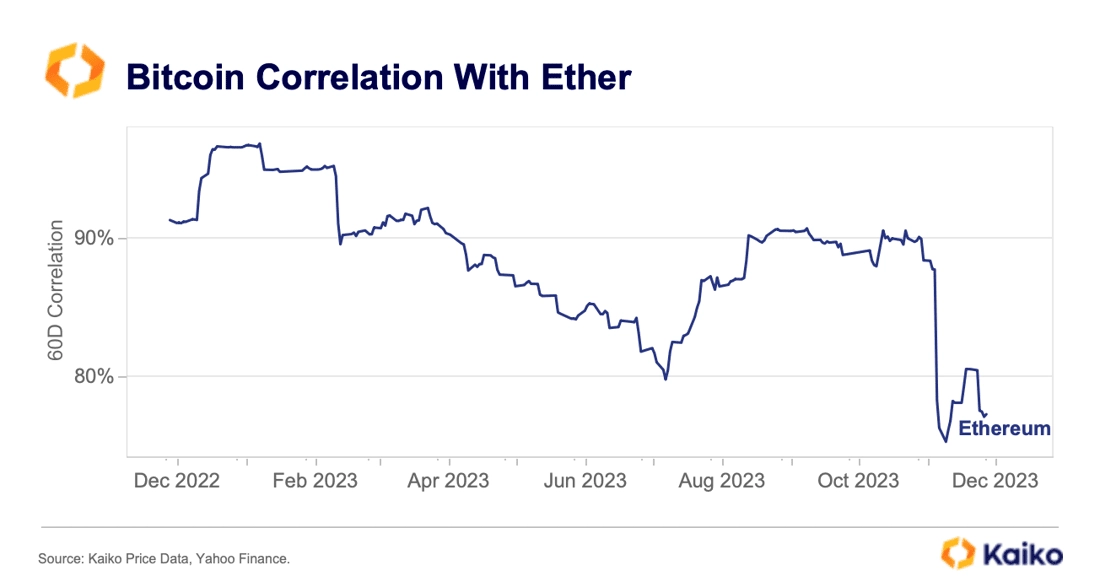

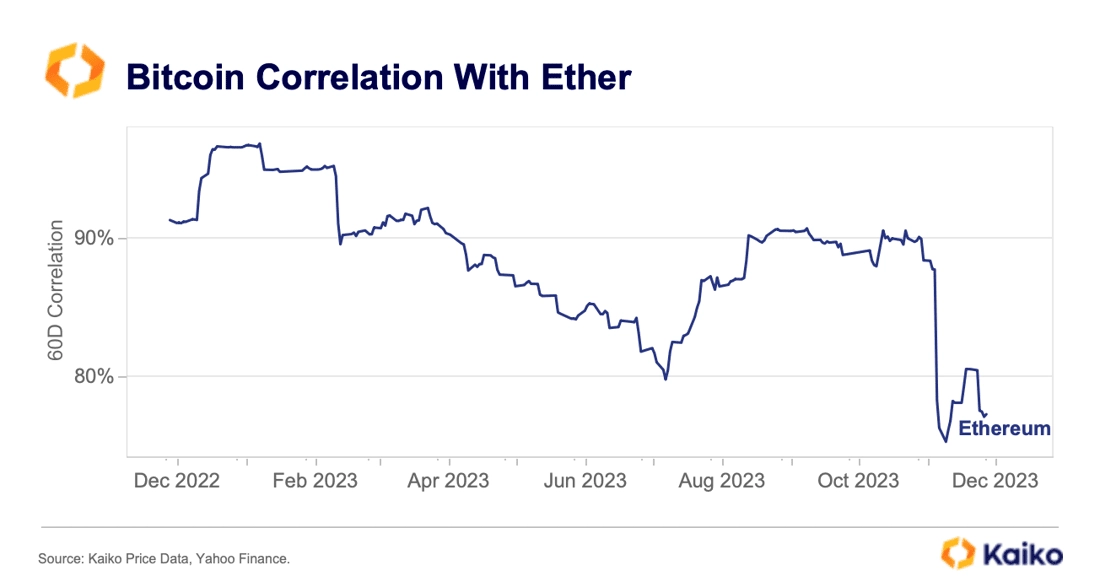

BTC correlation with ETH hits a multi-year low in Nov.

BTC’s 60-day correlation with ETH fell to a multi-year low of 75% in November and continued hovering below 80% for the longest period since July 2021. ETH has mostly underperformed BTC and other altcoins since the Merge despite undergoing another successful major upgrade in April. The slight decorrelation suggests investors increasingly perceive the assets differently.

![]()

![]()

![]()

![]()