Join us for our latest webinar in collaboration with Cboe

Binance Volume Plummets After End of Zero-Fee Trading

Welcome to the Data Debrief!

Bitcoin continues to trade at 9-month highs after the Fed hiked rates by a quarter percentage point, suggesting increases are nearing an end. Crypto markets largely ignored news that Coinbase was served a Wells notice, the SEC charged Justin Sun with market manipulation, and Sushi received a subpoena from the SEC.

-

The end of zero-fee trading on Binance

-

Depressed liquidity on Curve’s 3pool

-

TRX wash trading allegations, visualized

Trend of the Week

Binance liquidity in flux after removing zero fee trading.

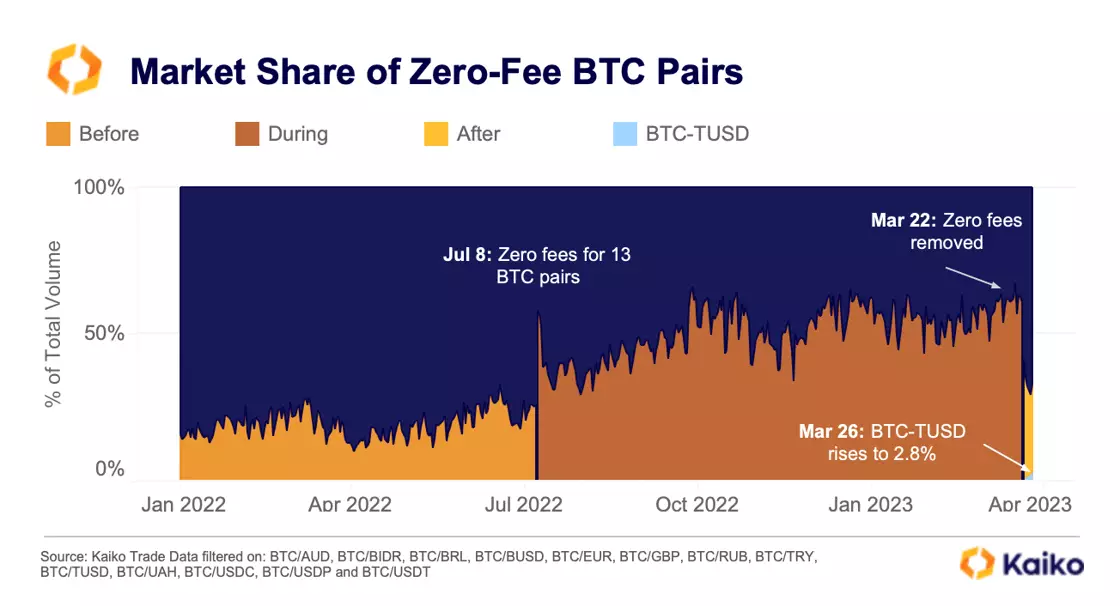

On March 22, Binance halted its no-fee trading promotion for 13 BTC spot trading pairs, reversing a move that helped boost the exchange’s market share by more than 20% relative to its competitors. The exchange also announced that it would be eliminating trading fees for the BTC-TUSD pair, which was mothballed in September and only recently re-listed. It is unclear why Binance has chosen to promote its TUSD pair, although it appears the exchange has selected the stablecoin as a successor to BUSD, which is being phased out because of regulatory actions in the U.S.

Ultimately, the impact of zero-fee trading on Binance cannot be understated. As of mid-March 2023, zero-fee trade volume accounted for a majority of total volume, clocking a high of 66%.

Before July 8 2022, the day zero fees launched, market share of volume for the 13 BTC pairs was just 25%. It has now been just 5 days since fees were reinstated, and market share has halved and is currently below 30%. The zero-fee BTC-TUSD pair now accounts for 2.8% of total volume.

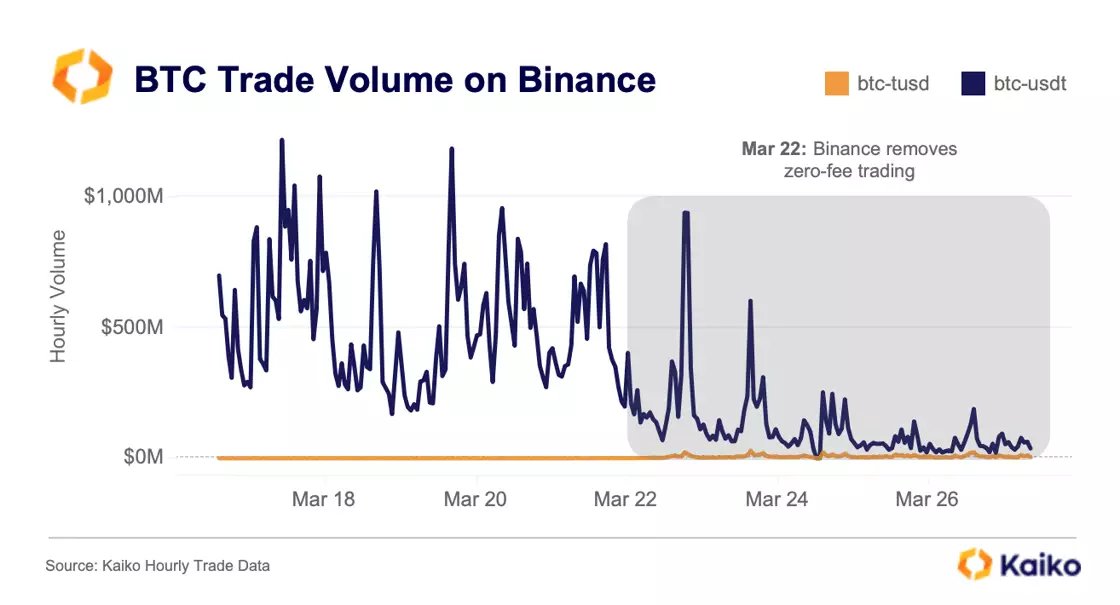

Trade volume for BTC-USDT, the most liquid market in crypto, has been most impacted, with average volumes down a whopping 90%. Hourly volume for BTC-TUSD has climbed to ~$5mn, a significant increase but still minuscule relative to total volume.

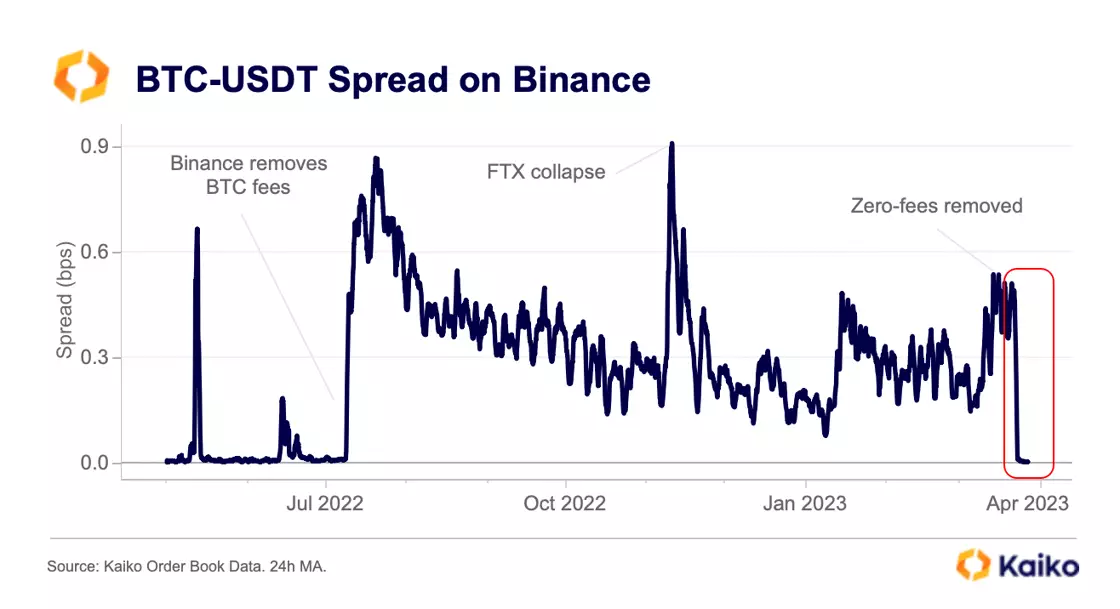

We can also observe some interesting trends in order book data. When fees were first removed, spreads for the BTC-USDT trading pair soared because market makers could no longer count volume towards Binance’s VIP trading fee program. To compensate, they had to increase spreads which was essentially a way of transferring fees to price takers. Spreads instantly plummeted once fees were re-added, and are currently at .004bps.

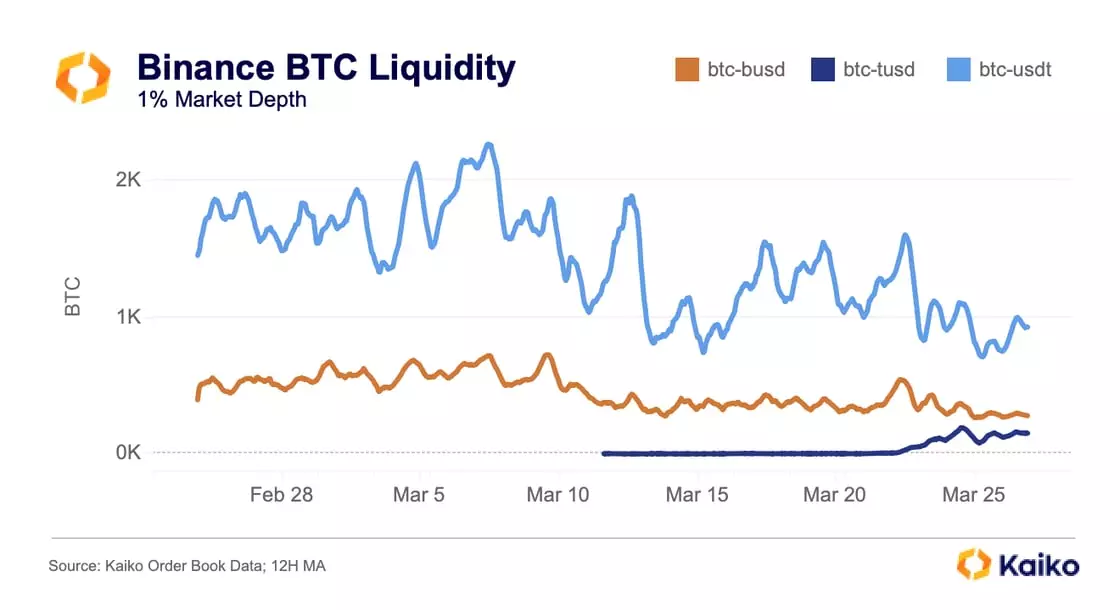

TUSD is off to a relatively slow start, but the pair’s liquidity as measured by market depth has climbed, while both BUSD and USDT’s liquidity has been roughly cut in half.

Binance does not have any public ties to TUSD or the companies involved in its issuance. However, because traders follow low fees and (generally speaking) anything Binance does is hugely influential, we can expect TUSD to become an increasingly important stablecoin.

Perhaps the biggest impact is on Binance’s global market share, which is already down 10% since last week (although a 2 hour outage could have contributed).

Join the Kaiko Research team for our next monthly analyst call, discussing the most significant market trends.

Price

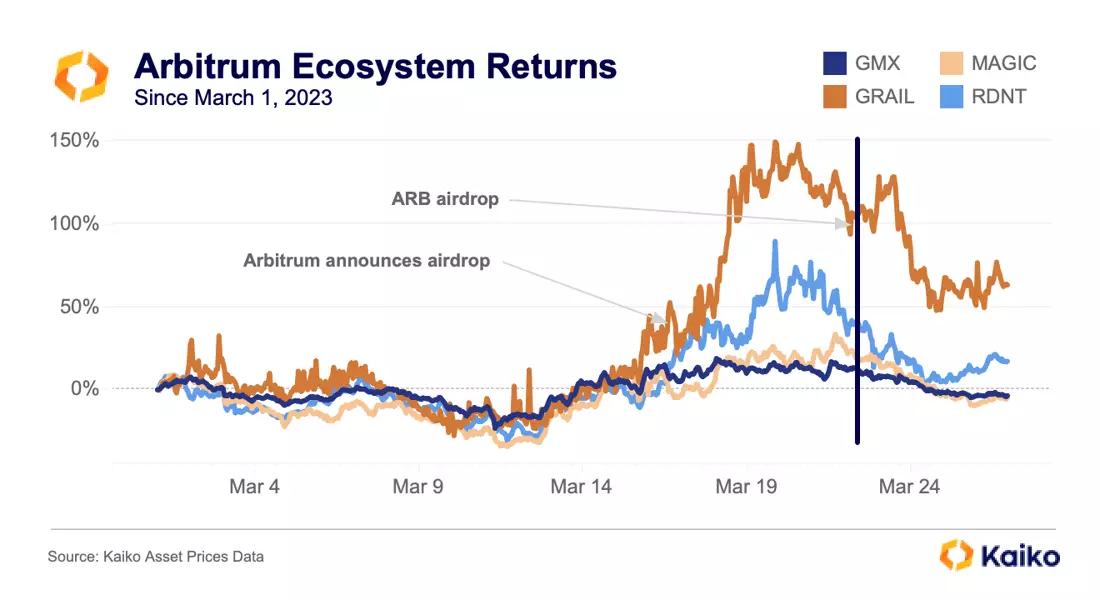

Arbitrum small-caps surge on airdrop news, then fall.

Arbitrum ecosystem tokens with smaller market caps surged following news that the layer 2 would finally be airdropping its ARB token. This airdrop was for users and protocols on the network, with GMX (token: GMX) and Treasure DAO (MAGIC) receiving the highest allocations of 8mn ARB each. Camelot DEX (GRAIL), a rapidly growing Arbitrum-native exchange, received 2.1mn tokens while Radiant Capital (RDNT), a cross-chain lending and borrowing protocol received 3.3mn.

While GMX and MAGIC did surge roughly 25%, this paled in comparison to newer and lower cap tokens like GRAIL and RDNT, which jumped 150% and 90% from their March 1 level, respectively. However, they peaked a day before the airdrop and have slumped post-airdrop as hype has dissipated and ARB has settled into a price range.

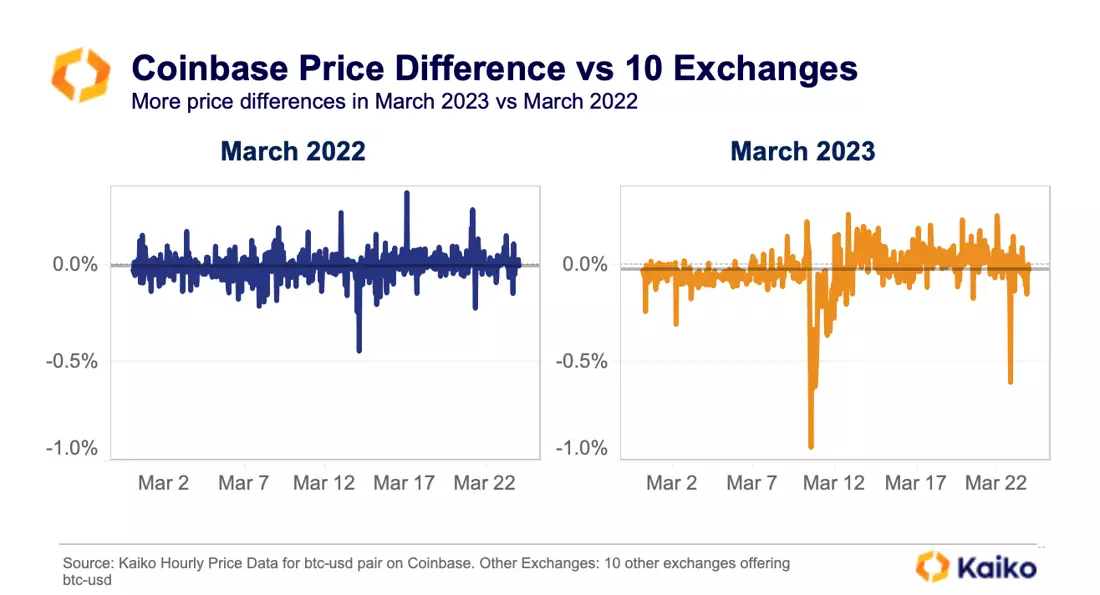

USD arbitrage opportunities are on the rise.

Arbitrage between exchanges is becoming harder as the shut down of USD payment rails has made logistics challenging for some market makers, particularly on U.S. exchanges. As liquidity hits 10 month lows, price discrepancies between some U.S. exchanges become more frequent as volatility increases.

In 2022, prices on Binance.US tended to stay within a range of 0.1% of the average price across 10 other exchanges. This month, prices on Binance.US displayed far more discrepancies compared to other exchanges, regularly ranging outside a 0.2% difference and spiking past a 0.5% difference three times. Coinbase displayed similar price discrepancies this month with a higher range in differences and a couple of outliers as volatility picked up. Overall it seems the banking cutoff in the U.S. is affecting price homogeneity on U.S exchanges.

Never miss an analysis.

Subscribe to our free weekly Data Debrief email, or learn more about our premium research subscriptions here.

Liquidity

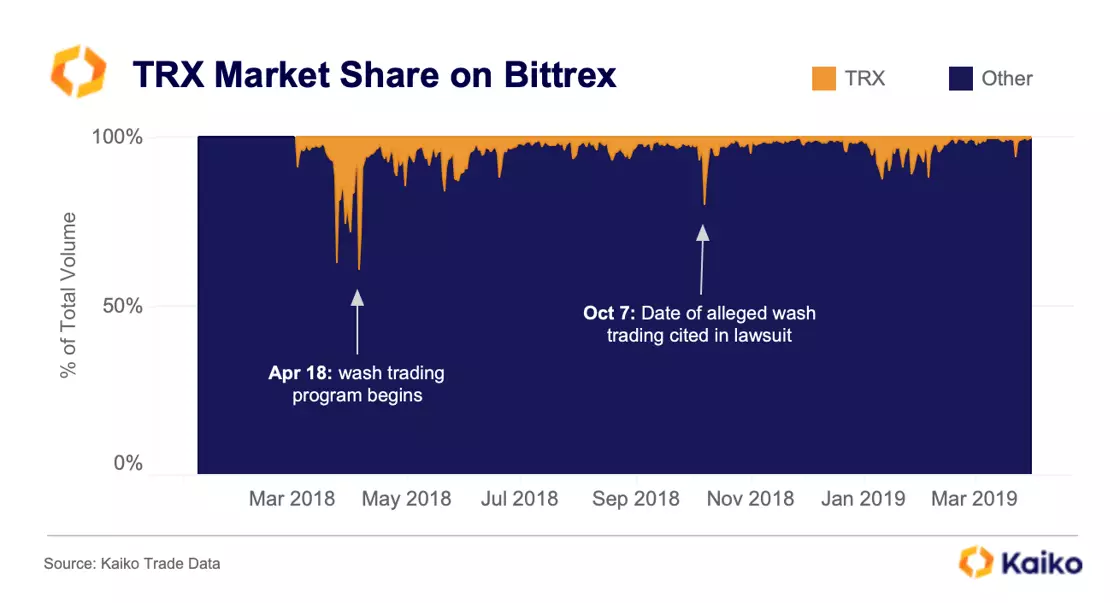

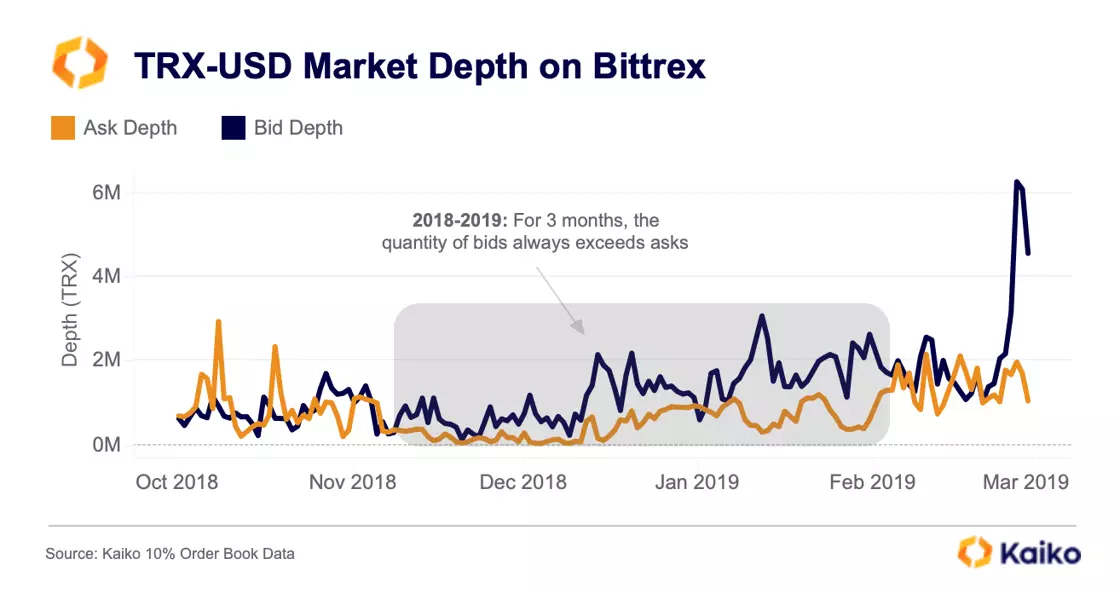

TRX wash trading identifiable in historical data.

Justin Sun, the vocal founder of the Tron network, was just hit with a massive market manipulation lawsuit by the SEC, alleging an extensive wash trading program for the TRX and BTT tokens. The U.S.-based exchange Bittrex was specifically cited as one of the principal venues, so we thought we’d try to identify some patterns in the old historical data from 2018-19. The volume trends perfectly match up to the detailed report, with TRX market share abnormally spiking on the days the wash trades took place.

We can also identify artificial order book patterns using Kaiko’s historical snapshot data. For a period of 3 months, the quantity of bids was always greater than asks, which suggests market makers were placing a bid wall to prevent downwards price movements. Typically, order book imbalances do not last for this long.

Ultimately, the lawsuit is no particular surprise, especially considering crypto wash trading was notoriously pervasive from 2017-2018. Since then, exchanges have improved their market manipulation detection systems and data providers have started publishing exchange transparency rankings.

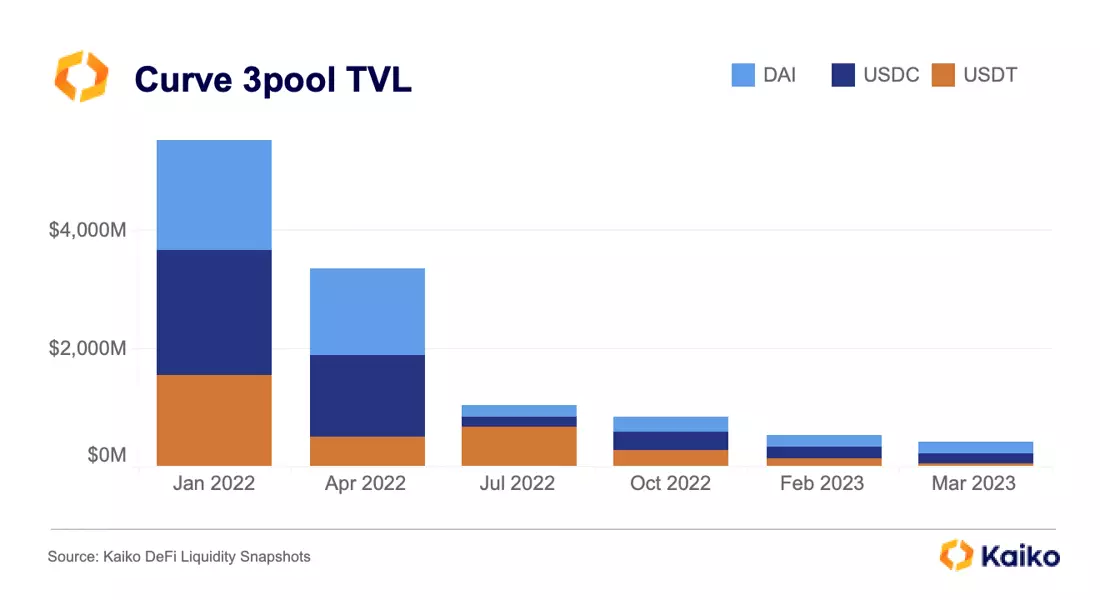

Curve 3pool remains depressed following USDC’s depeg.

Does anyone remember when the second largest stablecoin dropped lower than $0.90 just a couple weeks ago? Crypto narrowly escaped what could have been one of its biggest market events ever, yet markets and narratives have continued to move along unbothered. But the ripple effects are still being felt.

Nowhere is this more obvious than Curve’s 3pool: one of the best barometers for stablecoin sentiment. Its TVL currently stands at just $420mn, down from $5.5bn in January last year. Additionally, the pool is composed of just 11% (under $50mn) USDT as users have opted to switch from USDC and DAI to the stablecoin with (apparently) no exposure to ongoing U.S. banking and regulatory issues.

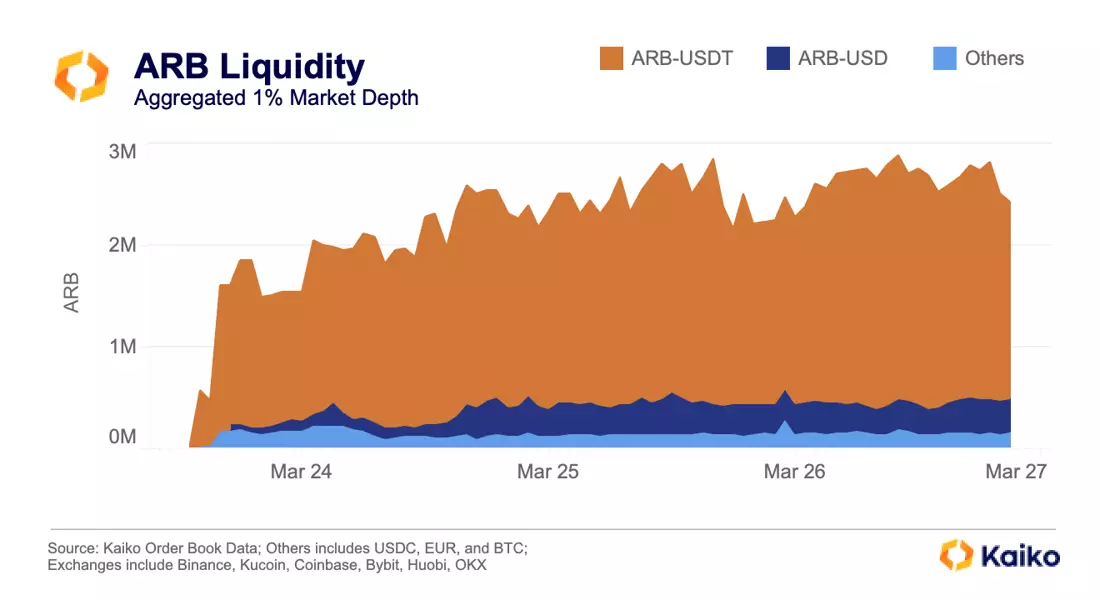

ARB liquidity surges, settles into a range after listing.

ARB trading began on most exchanges as soon as the token was airdropped. However, there was some difficulty for users to claim and move their airdropped tokens as the Arbitrum network became extremely congested and the Arbitrum Foundation’s claim site crashed.

Thus, in the first few hours of trading most centralized exchange pairs were relatively illiquid. It took 6 hours before 1% market depth (the sum of bids and asks within 1% of the mid price) hit nearly 2mn ARB. However, liquidity continued to grow over the weekend, hitting nearly 2mn, the vast majority of which is in USDT pairs. USD pairs have roughly double the liquidity as those included in Other (USDC, EUR, and BTC), at 325k to 160k, while USDT pairs hold 1.9mn ARB. Tether continues to be absolutely dominant in CEX trading.

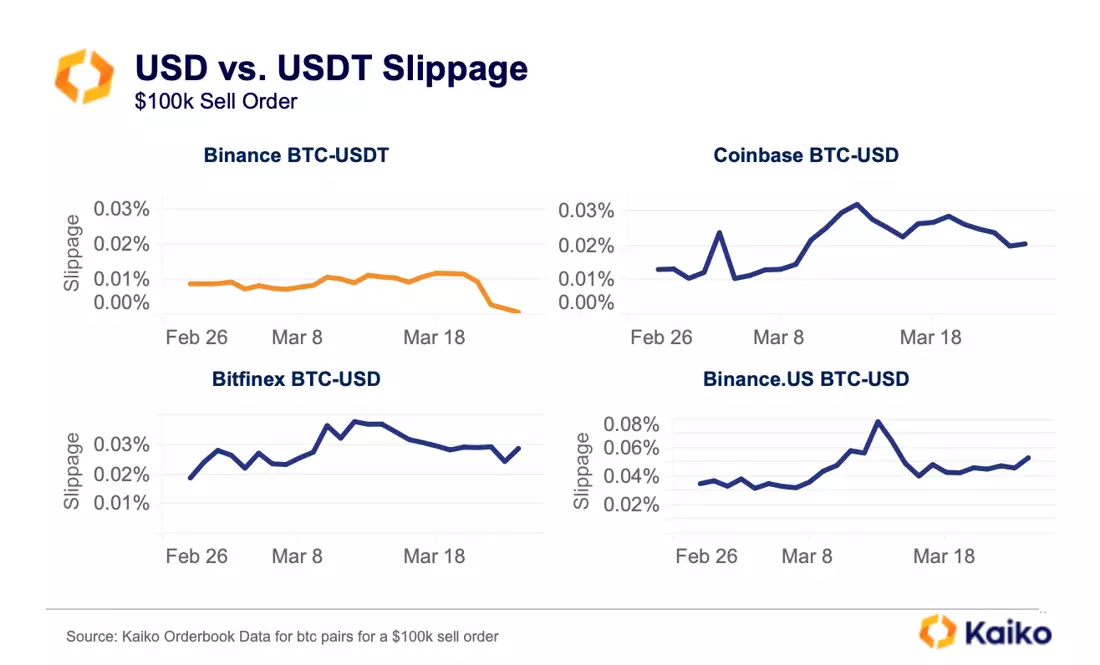

Price slippage has increased on U.S. exchanges.

Thus, in the first few hours of trading most centralized exchange pairs were relatively illiquid. It took 6 hours before 1% market depth (the sum of bids and asks within 1% of the mid price) hit nearly 2mn ARB. However, liquidity continued to grow over the weekend, hitting nearly 2mn, the vast majority of which is in USDT pairs. USD pairs have roughly double the liquidity as those included in Other (USDC, EUR, and BTC), at 325k to 160k, while USDT pairs hold 1.9mn ARB. Tether continues to be absolutely dominant in CEX trading.

For a $100k sell order in BTC markets, the most liquid USD pair (Coinbase) and the most liquid USDT pair (Binance) had similar slippage of 0.1% to start March. However, the fears over USD payment rails gripped liquidity markets in the U.S and we can see the spike in slippage around March 13 on Coinbase, compared to only a slight increase on the USDT pair on Binance. Slippage for the BTC-USD pair on Coinbase remains 2x higher than it was at the start of the month as USD liquidity suffers across the board in crypto markets.

The next most liquid BTC-USD pairs on Bitfinex and Binance.US both suffered from spikes in slippage, increasing 0.1% since the start of the month, with spikes of 0.2% and 0.4% respectively during the peak of the U.S. banking fears.

New DeFi Coverage

Now Live

We are proud to have expanded our DeFi coverage with the launch of Curve v2, Maker, and Balancer v2. Kaiko’s DeFi data allows clients to visualize swaps, mints, burns, and more for the top decentralized protocols. Now covering:

-

Curve v2: trading, and liquidity data for uncorrelated assets

-

Maker: L&B activity + real-world asset events data

-

Balancer v2: trading and liquidity data in smart pools

Derivatives

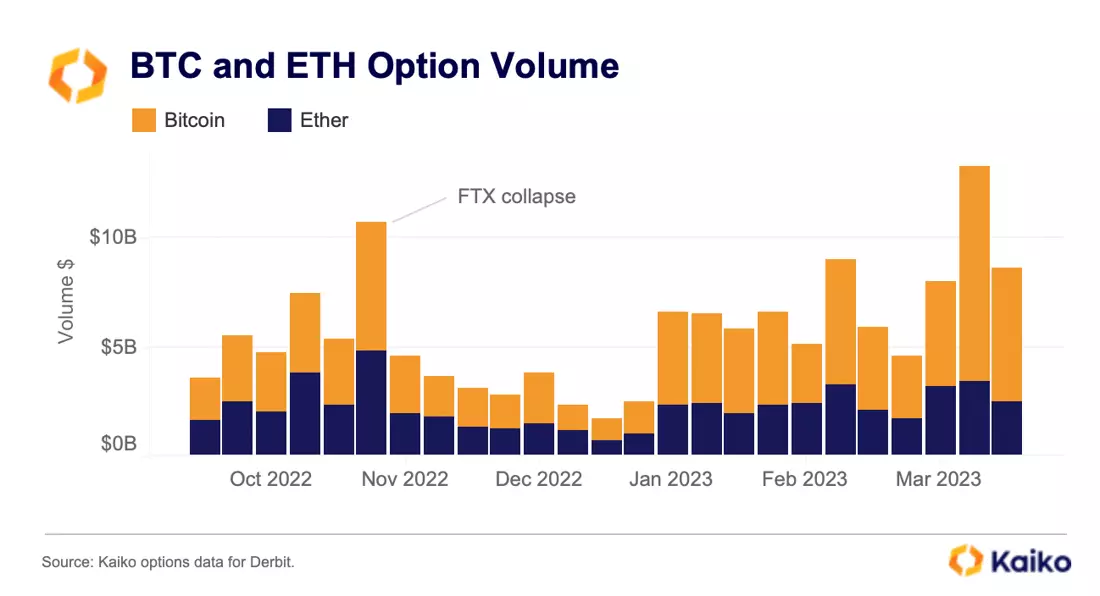

BTC option volumes retreat from a yearly high.

BTC weekly option volume on the largest options exchange Deribit fell by 40% last week to $6bn, retreating from a yearly high of over $10bn reached earlier this month. The decline comes amid a slowdown in BTC spot price following last week’s Fed decision to hike rates and ongoing worries around the health of the U.S. banking system. Overall, bullish bets (calls) continued to outweigh bearish bets (puts), accounting for over 60% of total volume.

ETH options volumes have been mostly lackluster this year hovering around $2bn. The trend suggests weak hedging and speculative demand despite rising volatility and the upcoming Shanghai fork – a major risk event for ETH. BTC weekly options volumes are currently 70% higher than ETH vs. 57% higher in Jan.

Macro

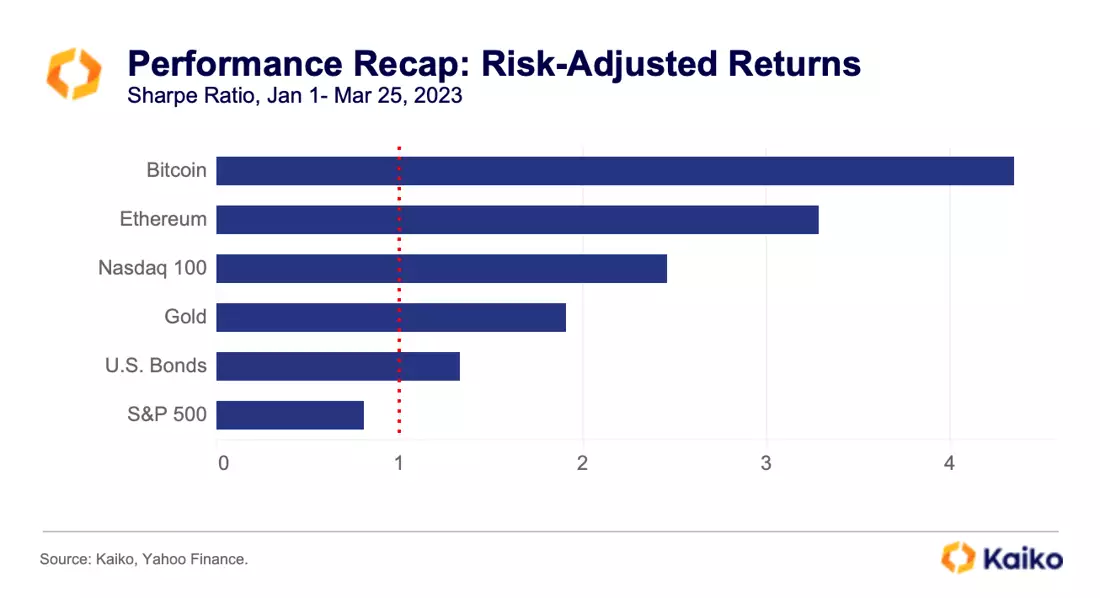

Bitcoin is still the best performing asset YTD.

BTC and ETH registered higher YTD risk-adjusted returns, as measured by the Sharpe ratio, than traditional assets despite rising regulatory pressures and the ongoing global banking turmoil. The Sharpe ratio measures the excess return of an asset per unit of volatility. A ratio of 1 or above is typically considered to be good. Both BTC and ETH ratio is higher than 3, well above the S&P 500 which registers a ratio of 0.8.

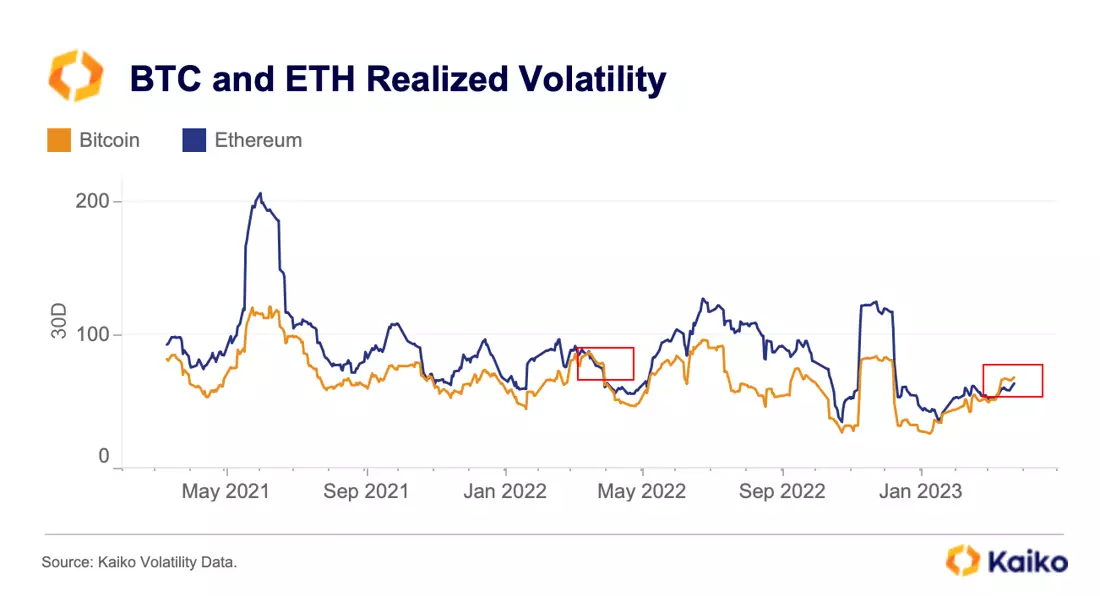

Overall, crypto asset’s risk adjusted returns have improved over the past year due to falling volatility as the amount of risk taken by investors is declining relative to the compensation received.

This suggests their volatility profile is converging with that of traditional assets, with some analysts expecting they will be even by 2025. However, the drain in crypto liquidity since November – which we dubbed the “Alameda gap” – has increased volatility.

Interestingly, BTC realized volatility surpassed ETH’s for the first time in a year last week. Historically this is rare and has happened only a few times since ETH was launched back in 2016. Typically, ETH is more volatile than BTC and outperforms during bull runs while underperforming in bear markets. However, this trend has shifted over the past few weeks with ETH underperforming BTC by a large margin in March.

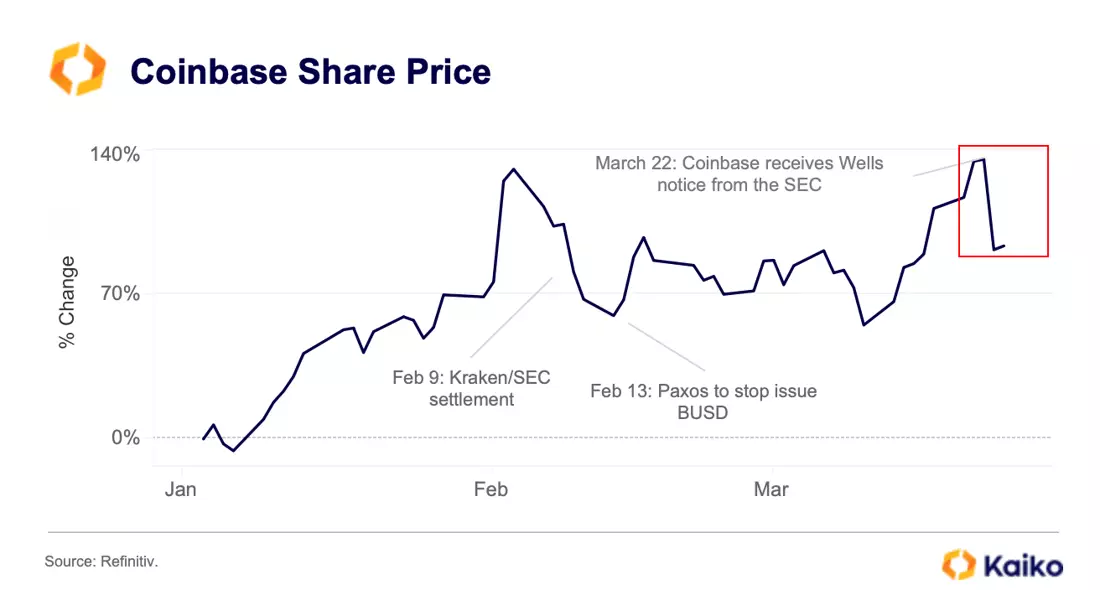

Coinbase’s share prices tumble following Wells notice.

Coinbase’s share prices tumbled by 22% in a single day last week after the exchange received a Wells notice from the U.S. Securities and Exchange Commission (SEC). The notice is a letter informing individuals or companies of competed investigation where infractions have been discovered. It is reportedly related to Coinbase’s spot market and staking program Earn as well as its prime wallet products. While a Wells notice does not represent an enforcement action it often precedes it.

Data Used in this Analysis

Derivatives Data

![]()

Futures, perpetual futures, and options metrics from the leading derivatives exchanges, in historical or real time format.

Liquidity Metrics

![]()

The most granular order book data in the industry optimized for quantitative analyis.

Trade Volume

![]()

Centralized exchange data sourced from the most liquid venues, covering all traded instruments.

More From Kaiko Research

![]()

Derivatives

09/02/2026 Data Debrief

Bitcoin's Latest Drop Signals Halfway Point of Bear MarketLast week’s correction triggered approximately $9 billion in liquidations and pushed stablecoin dominance above 10%, exceeding levels last seen during the FTX collapse.

Written by Laurens Fraussen![]()

Binance

02/02/2026 Data Debrief

Fed Reforms Spark Cross-Asset Volatility SpikeThe final week of January 2026 delivered a stress test across multiple markets simultaneously. As the Federal Reserve held rates steady at 3.5-3.75% amid leadership transition uncertainty, Bitcoin declined 15% from $88,000 to $74,500, triggering ~$7 billion in liquidations.

Written by Laurens Fraussen![]()

Macro

26/01/2026 Data Debrief

Tariff Uncertainty Exposes Bitcoin's Identity CrisisTariff volatility exposed Bitcoin’s ongoing identity crisis. Trump’s Greenland tariff threats triggered a violent round-trip in crypto markets, with Bitcoin plunging below $88,000 while gold surged over 5%, highlighting their inverse correlation. Behind the headlines, orderbook depth remained surprisingly stable even as the CME basis collapsed into negative territory for the first time in years, signaling the unwind of institutional carry trades that had anchored demand since ETF launches.

Written by Laurens Fraussen![]()

Macro

20/01/2026 Data Debrief

Infrastructure Is Holding Back TokenizationReal-world asset tokenization has evolved from a theoretical exercise into a measurable market, but the data reveals a split reality. Stablecoins have achieved massive scale, while tokenized securities, commodities, and infrastructure tokens remain concentrated, illiquid, and far from self-sustaining.

Written by Laurens Fraussen