Liquidity

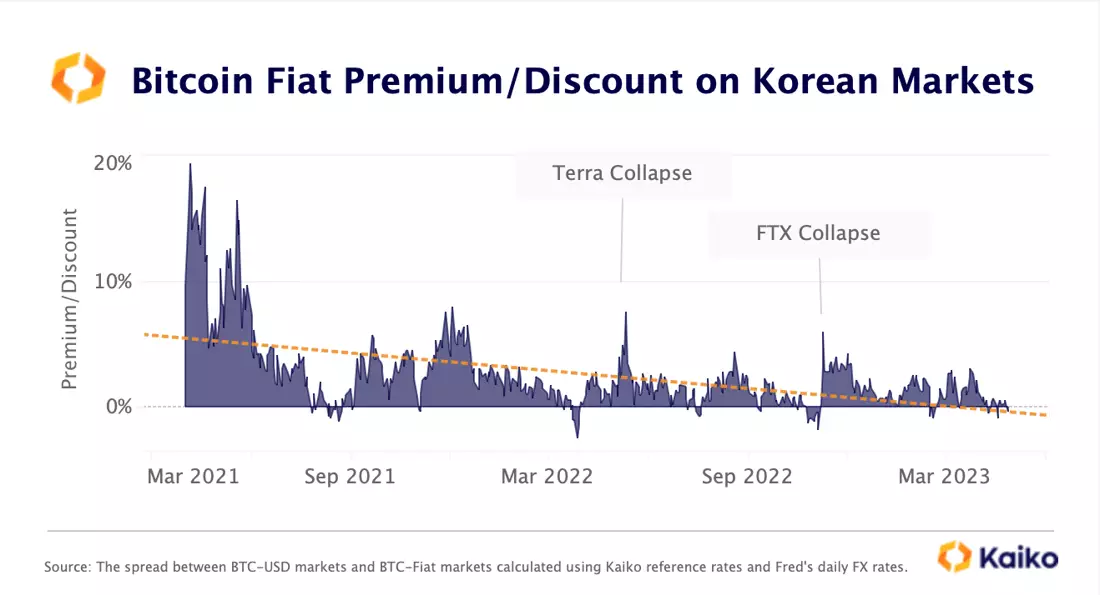

Effects of Terra’s collapse are still being felt one year later.

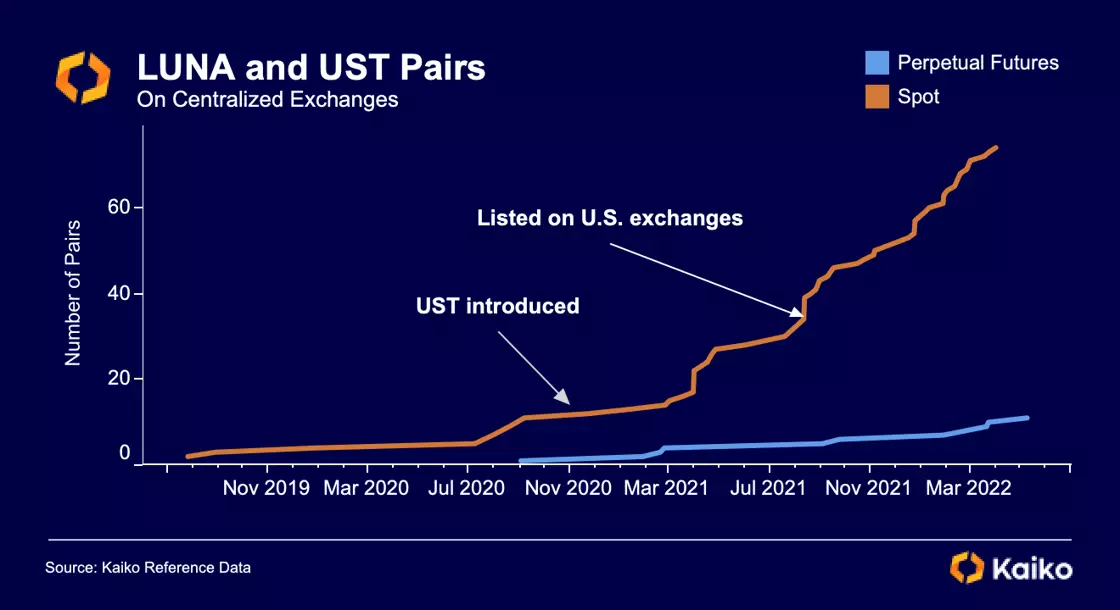

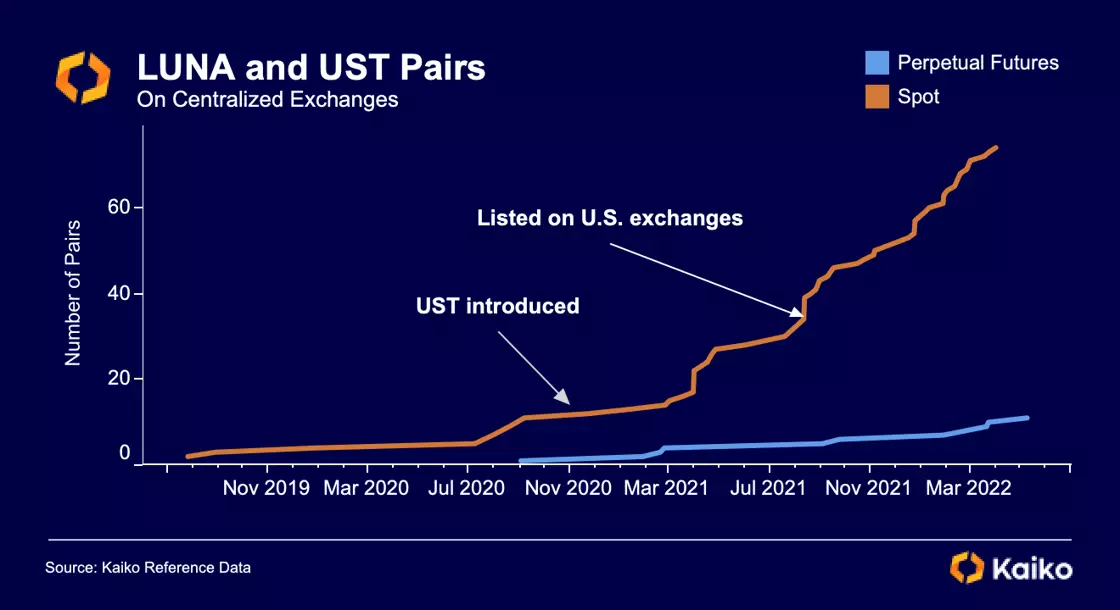

The Terra ecosystem began as a small and under-the-radar project primarily operating in Korea, offering its KRW stablecoin for use in the payments app Chai. This all changed in the Fall of 2020 with the creation of UST, the now-infamous U.S.-dollar stablecoin that depegged in dramatic fashion in May 2022. UST’s growth was supercharged by Anchor Protocol, which offered nearly 20% APY on deposits of the token, making yield generation the stablecoin’s top use case. LUNA and UST were not listed on top U.S. exchanges until late 2021, when LUNA’s price had already surged from under $1 to over $25.

Over the next year, the tokens’ market caps continued to surge, with LUNA hitting an all-time high of over $40bn in April 2022. UST hit nearly $19bn and Terra founder Do Kwon was aiming to dethrone DAI as the top DeFi-native stablecoin.

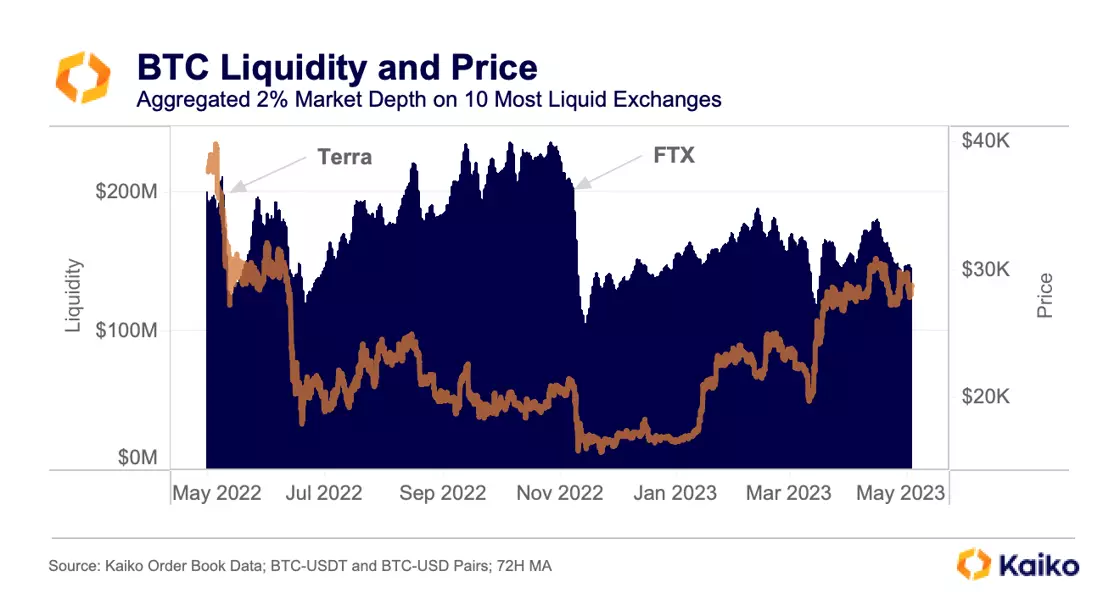

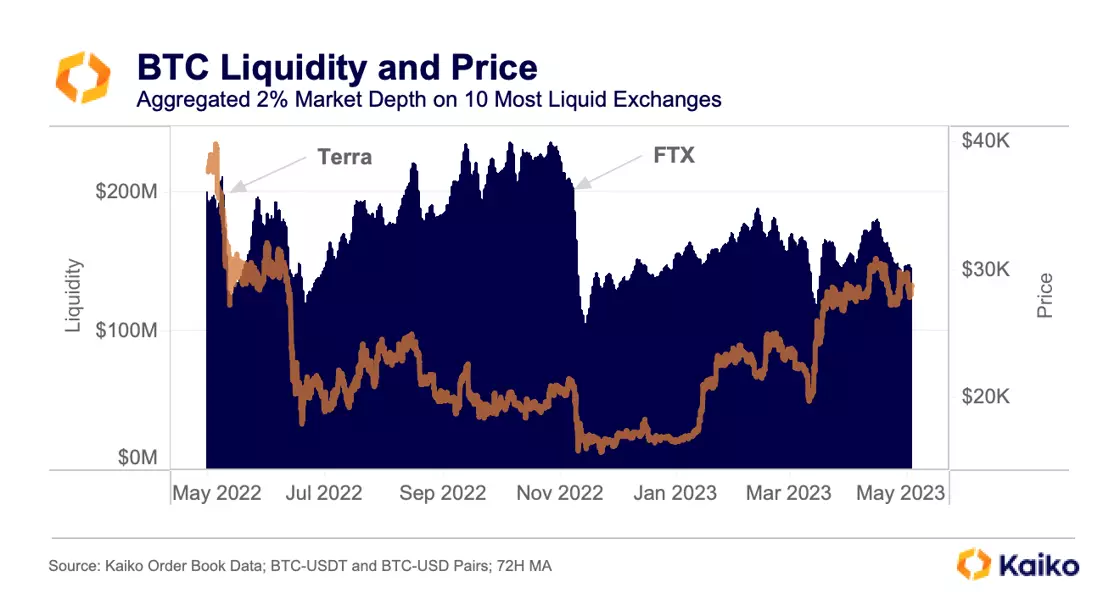

The crash on May 8, 2022 created ripple effects that are still unfolding. Namely, by bringing prices down, it exposed unhealthy business models, ultimately culminating in FTX’s collapse. As Terra collapsed, BTC liquidity plummeted from $210mn to $120mn, in large part influenced by BTC’s price.

Liquidity actually recovered independent of price in late May before Celsius and other CeFi companies began to collapse. Liquidity again recovered while price trended downwards, only to be undone by FTX. Thus it’s fair to say that Terra was not directly responsible for current illiquidity, but was rather the first domino that exposed riskier and riskier actors, eventually taking out FTX and Alameda.

U.S.-based exchanges lag in volume growth.

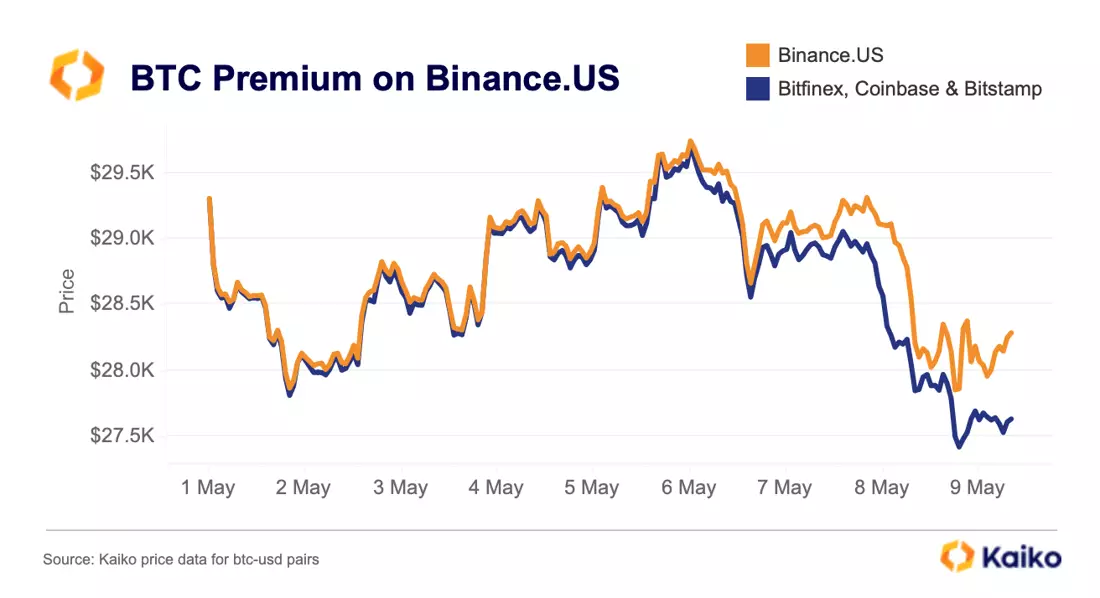

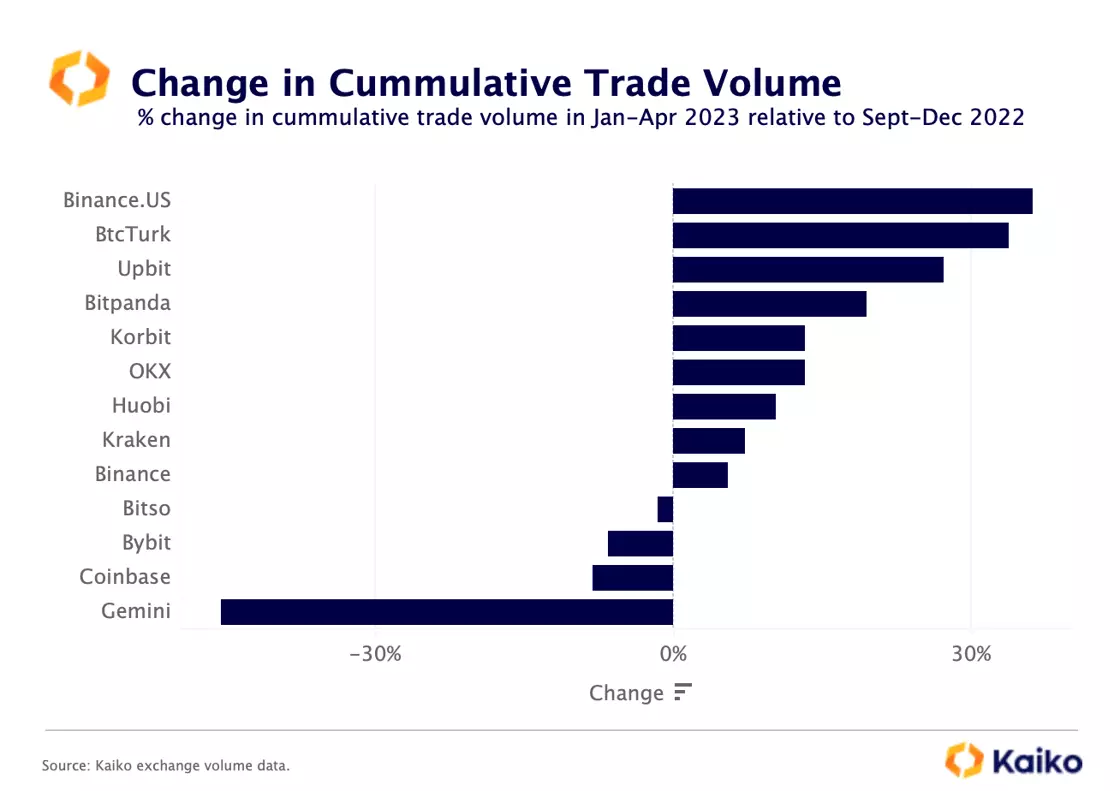

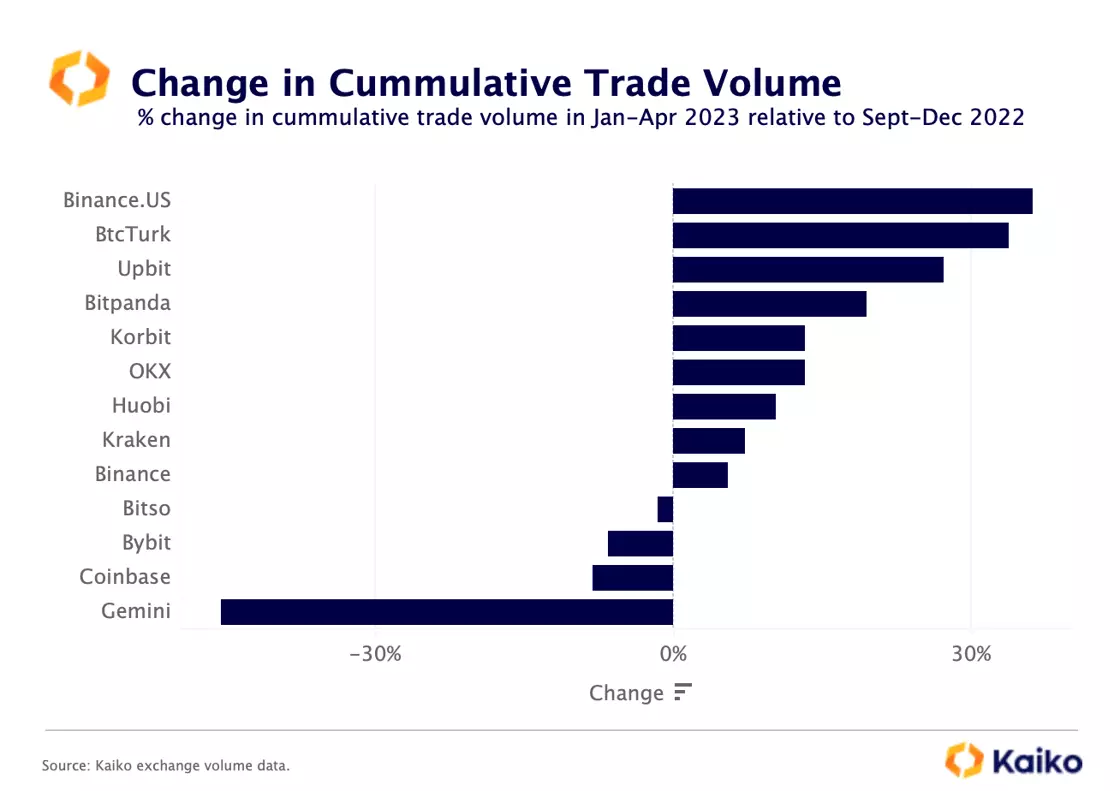

Binance.US, the U.S. arm of the global crypto exchange Binance, recorded the strongest increase in trade volume in the first four months of 2023 compared to the previous four-month period, despite reportedly facing challenges in finding a banking partner after the collapse of Signature Bank and Silvergate in early March. To attract customers, the exchange maintained zero-fees for BTC and ETH pairs while its global affiliate Binance experienced a plummet in trade volume after removing its nine-month-long zero-fee promotion for BTC pairs.

Trade volume on Turkish crypto platform BtcTurk rose by 34% due to increased demand for stablecoins amid inflation and political uncertainty ahead of the country’s general elections. Upbit, the largest Korean exchange, and EU-based Bitpanda also registered strong double-digit increases in trade volume in Jan-April, likely benefiting from the regulatory crackdown in the U.S.

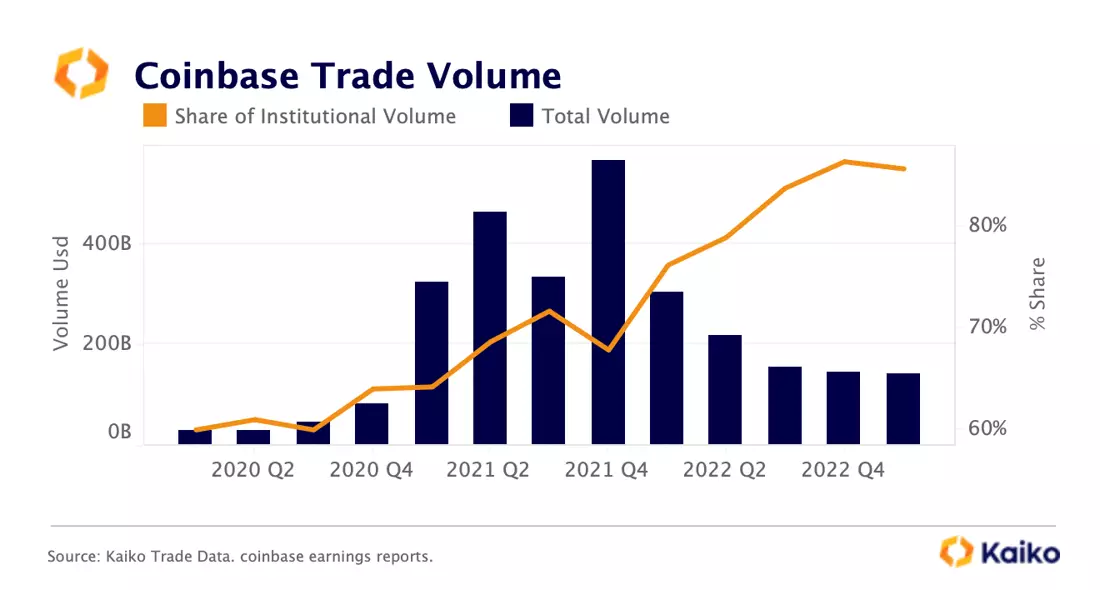

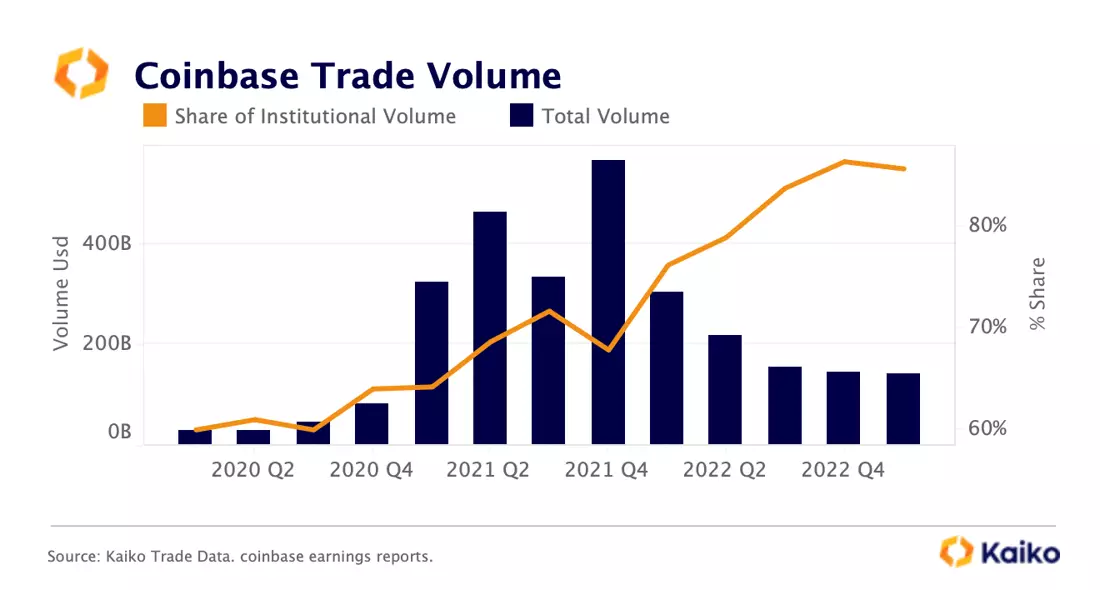

In contrast, trade volume declined for U.S.-based exchanges, such as Coinbase and Gemini, while Kraken’s volume increased modestly by 5%. The worsening regulatory environment in the U.S. has limited the ability of U.S.-based exchanges to launch new products locally, potentially impacting revenue diversification strategies. However, Coinbase’s recent earnings call showed lower-than-expected losses in Q1 of $79mn, partially due to strong institutional revenue on its prime platform, which hit an all-time high.

Interestingly, even though the increase in revenue resulted from the rollback of market makers discounts, the overall share of institutional trading volume remained resilient, hovering above 85%. This suggests that the exchange may have increased its pricing power (i.e., ability to increase prices without affecting demand). While other exchanges faced operational difficulties following the collapse of Silvergate and Signature, Coinbase quickly replaced lost banking services and resumed offering 24/7 instant settlement, crucial for market makers.

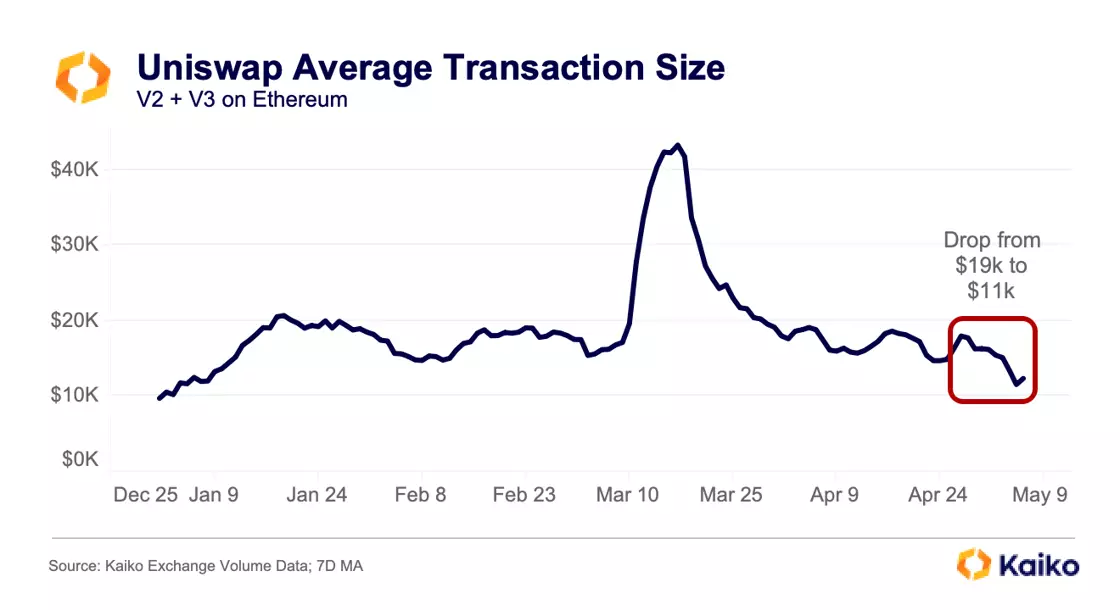

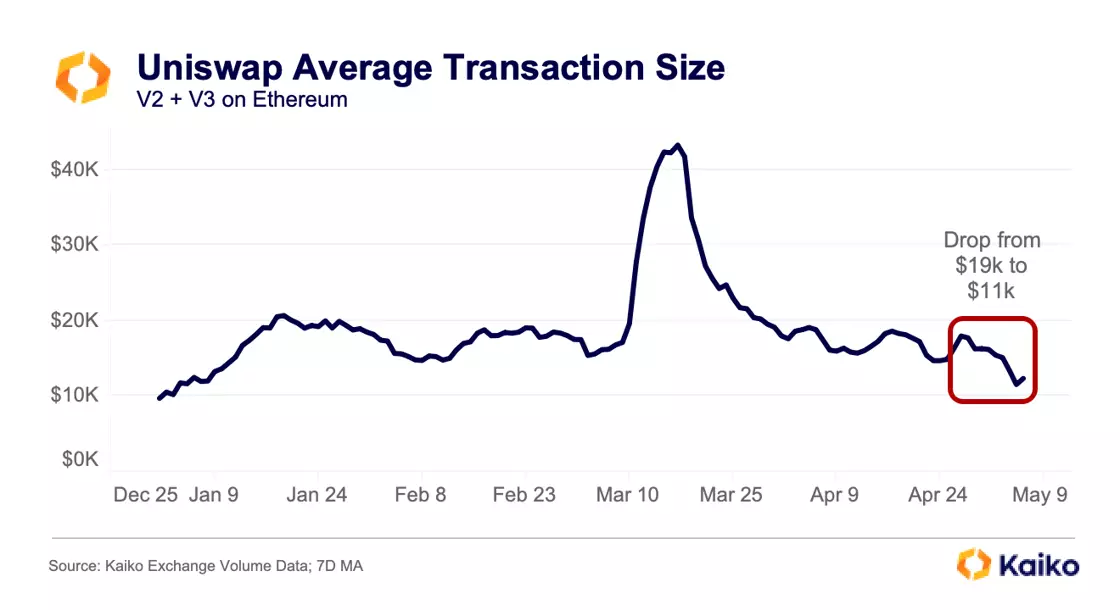

Uniswap average trade size falls as memecoin mania takes hold.

The average trade size on Uniswap has fallen to its lowest level since the beginning of the year as trading of meme tokens like PEPE has become the dominant activity on Ethereum. The flurry of activity has also caused gas prices to hit levels not seen since Terra’s crash, making it expensive for users to transact on the network. The high cost of gas is likely the reason the average trade size has not dropped even further, as fees in excess of $15 make trading less profitable for all users, but particularly retail users who are trading smaller size. This cost has driven much of the more speculative retail activity to L2s and other networks.

![]()

![]()

![]()

![]()

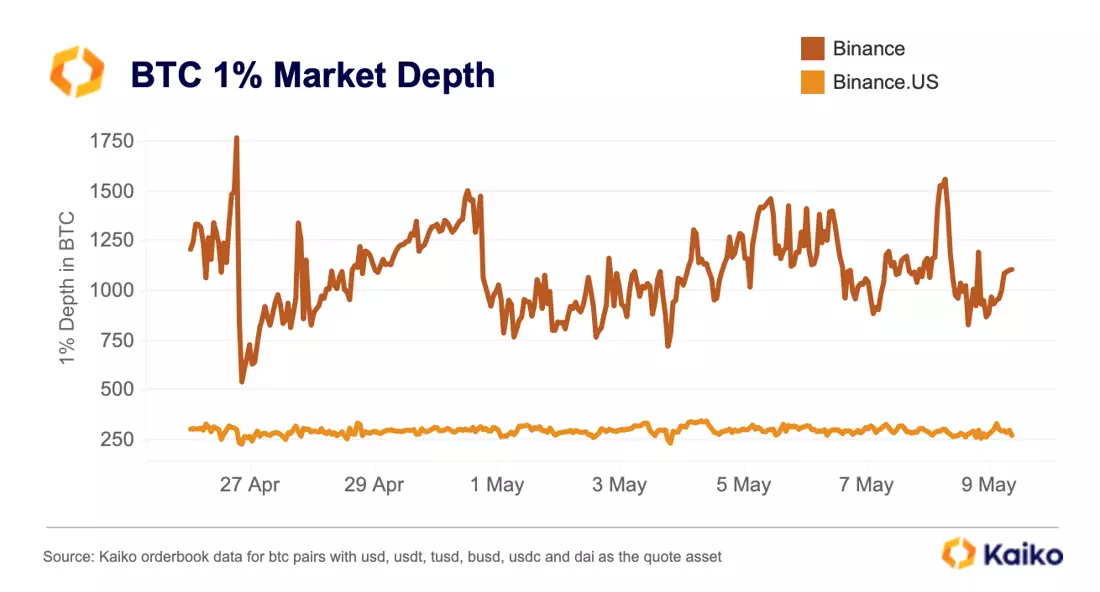

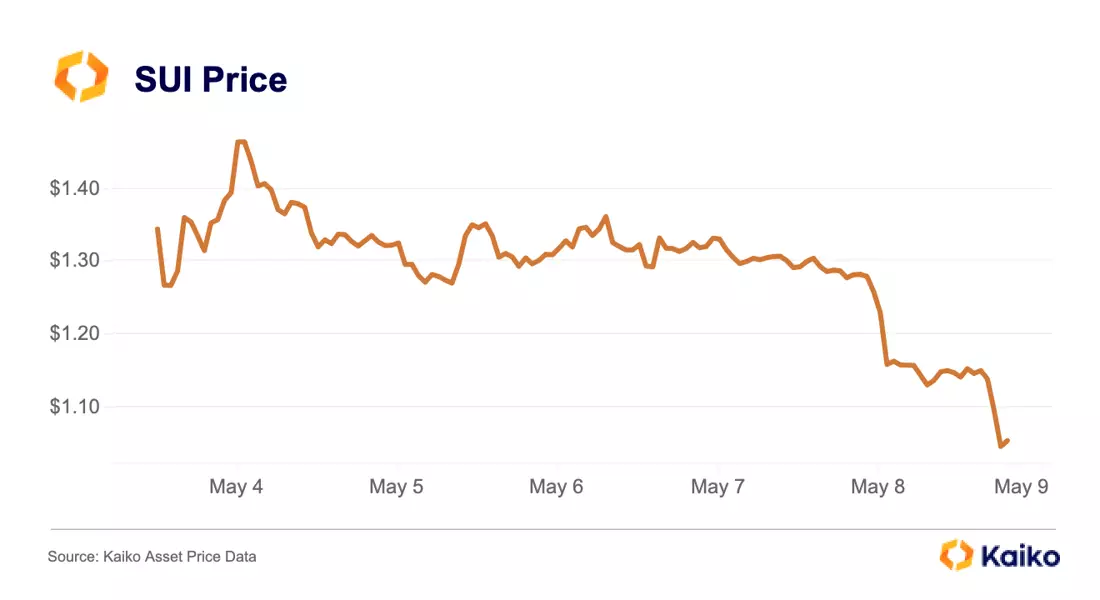

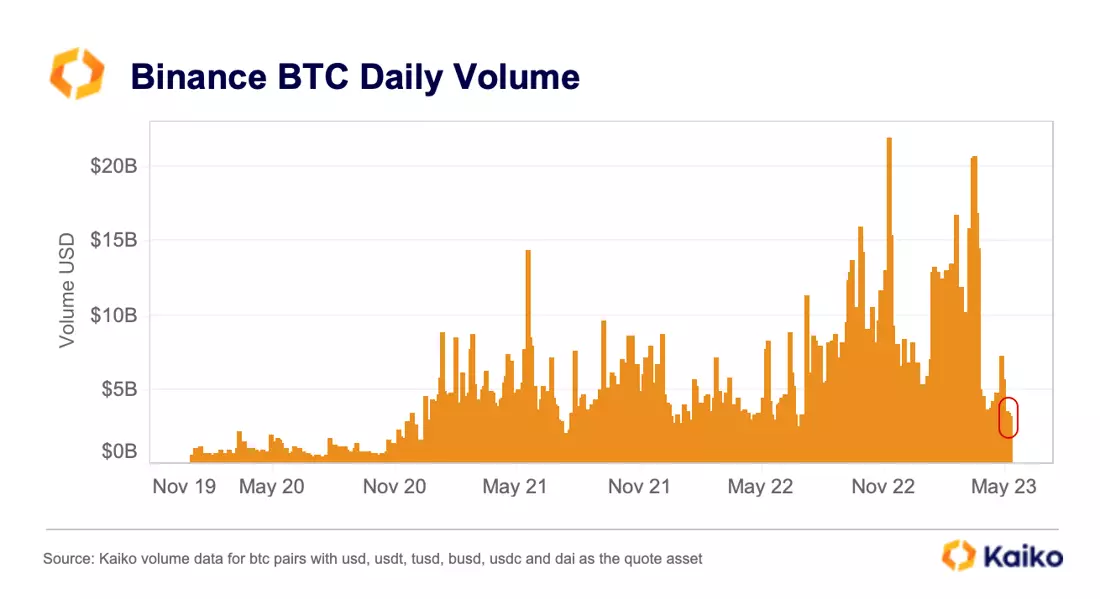

The rise in popularity of BRC-20 tokens, essentially memecoins on the Bitcoin blockchain, has pushed Bitcoin fees to 2 year highs. BRC-20s have massively increased demand for Bitcoin blockspace for the first time in recent history, with the network suffering from congestion and unconfirmed transactions as a result. Over the weekend, Binance had to pause BTC withdrawals twice as they hadn’t accounted for a surge in BTC fees in the amount they pay miners, which had caused many transactions to go unconfirmed. Other exchanges were able to process BTC transactions, making this a Binance-specific issue. BTC volumes on the exchange barely spiked at all, meaning this wasn’t driven by any particular worries about Binance, as was the case in December.

The rise in popularity of BRC-20 tokens, essentially memecoins on the Bitcoin blockchain, has pushed Bitcoin fees to 2 year highs. BRC-20s have massively increased demand for Bitcoin blockspace for the first time in recent history, with the network suffering from congestion and unconfirmed transactions as a result. Over the weekend, Binance had to pause BTC withdrawals twice as they hadn’t accounted for a surge in BTC fees in the amount they pay miners, which had caused many transactions to go unconfirmed. Other exchanges were able to process BTC transactions, making this a Binance-specific issue. BTC volumes on the exchange barely spiked at all, meaning this wasn’t driven by any particular worries about Binance, as was the case in December.