Attention Shifts to Meme Tokens

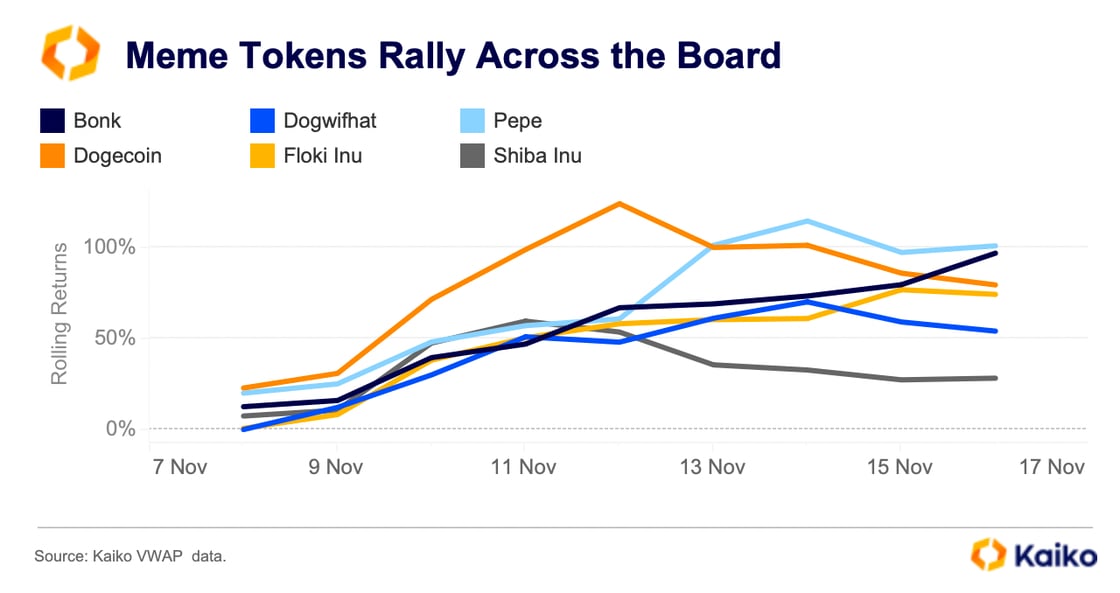

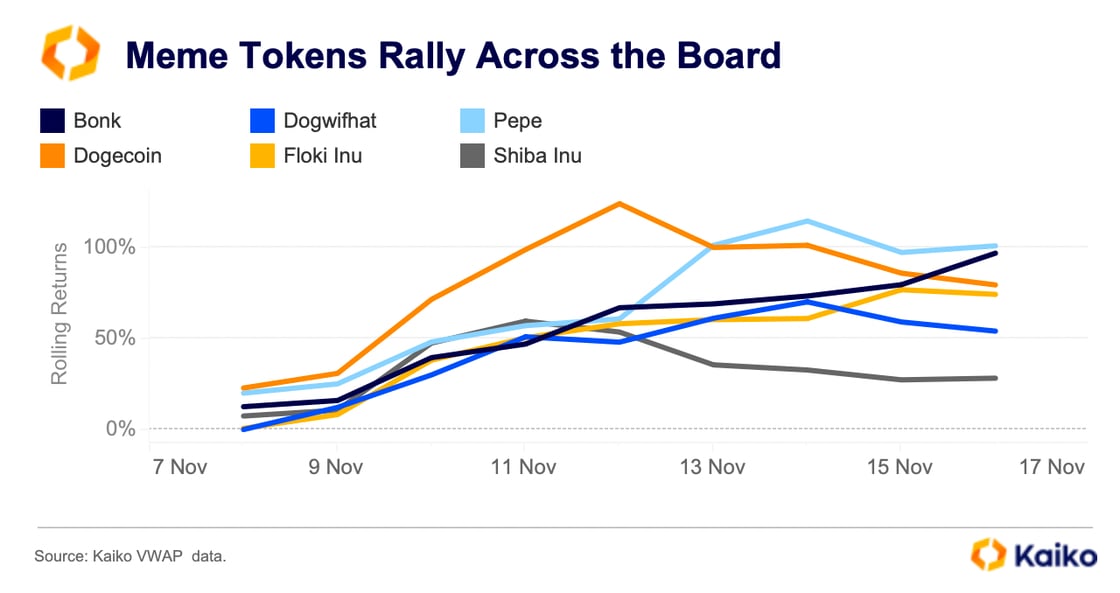

Meme tokens surged last week with familiar tokens leading the way. Dogecoin was up over 100% midway through the week, before ending the week up around 80%. Meanhwhile, Pepe soared 101%.

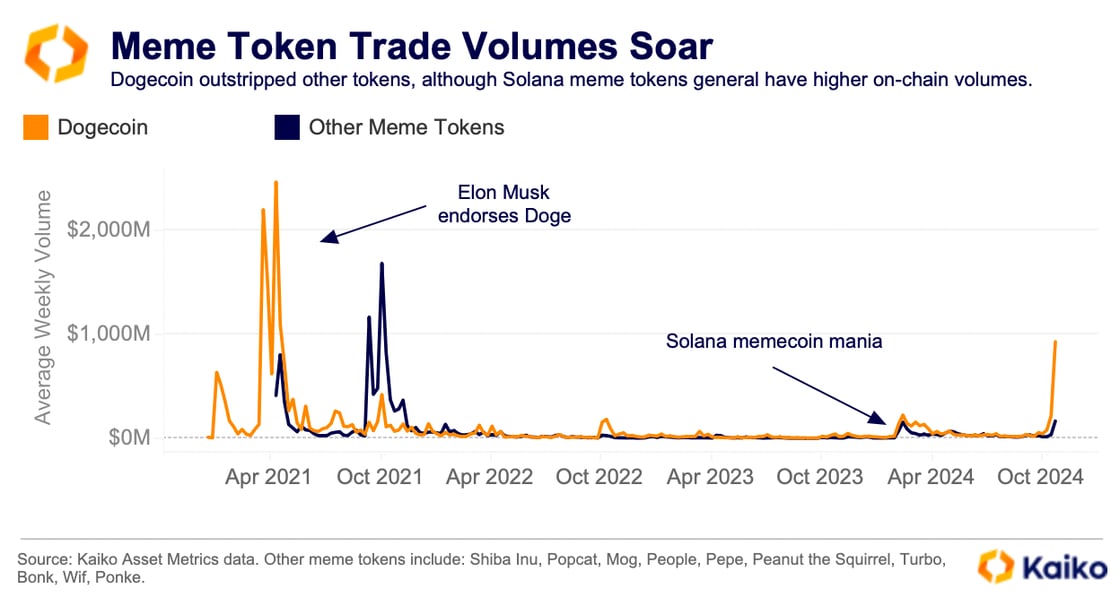

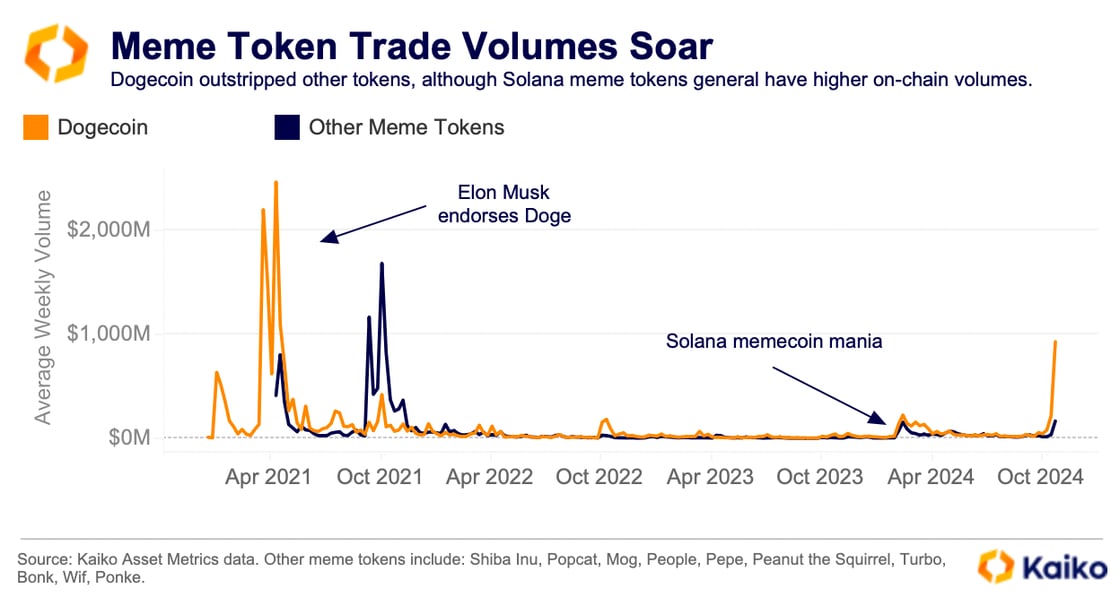

Similar to previous rallies in 2021, Dogecoin dominated volumes last week. Three years ago the dog-themed memecoin surged on endorsements from Elon Musk and Mark Cuban, and this time was no different. Dogecoin moved higher after president elect Donald Trump’s revealed plans to start a “Department of Government Efficiency” (D.O.G.E.) spearheaded by Elon Musk and Vivek Ramaswamy.

While meme token rallies are nothing new, they have been evolving in 2024. Most new meme token issuances this year have been on Solana, where traders can easily launch tokens on platforms like pump dot fun.

The pump dot fun platform lets users create new tokens at ease, with the creator providing the initial liquidity. The platform has in essence created a sort of tokenized lottery where users can buy tokens tied to memes or other pop culture trends and potentially make million, or get rugged—which happens to about 95% of launches, according to some reports.

One such token that captured people’s imaginations this month was PNUT, inspired by Peanut the Squirrel—a New York based pet influencer who’s untimely death led to an outpouring of support (and token launches) online. One trader even turned a $16 investment in PNUT, while it was still on pump dot fun, into a $3mn realized profit. PNUT now trades on several large centralized exchanges, including Binance, Crypto.com, and OKX.

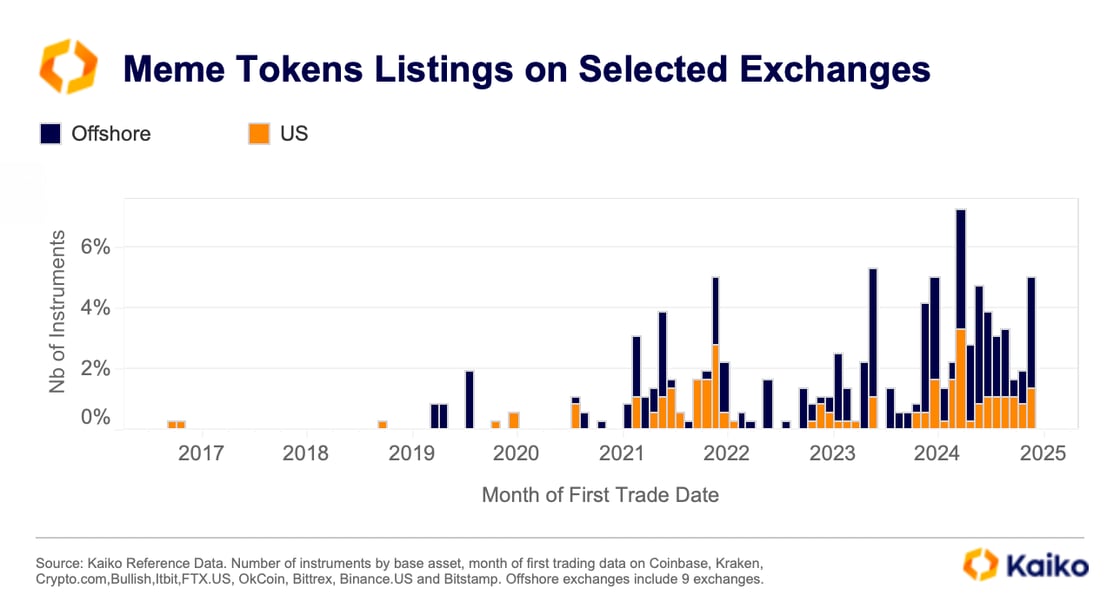

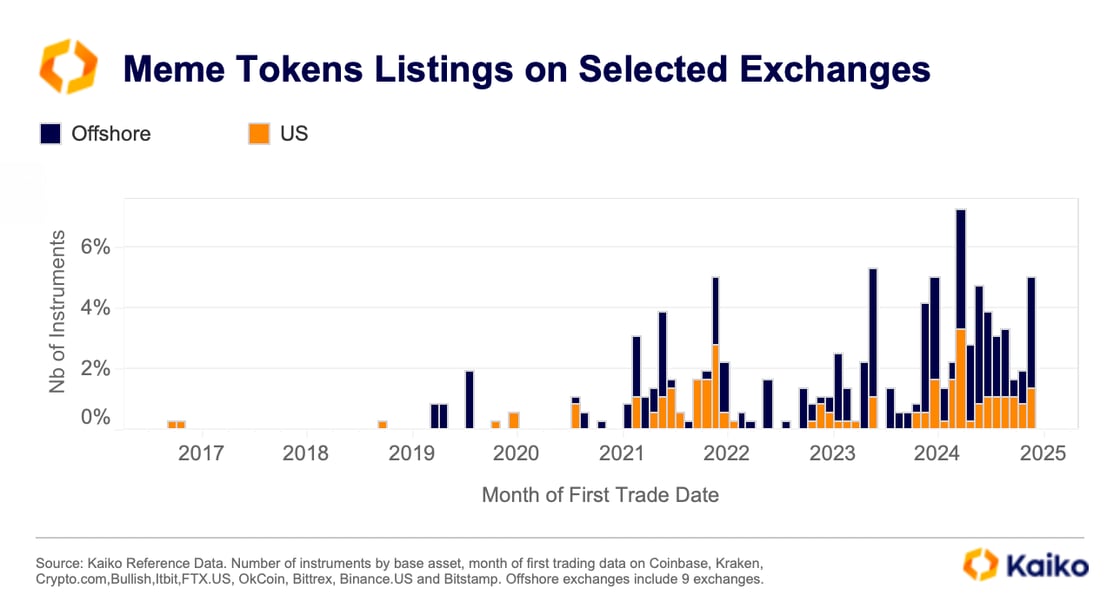

Token listings have increased amid the meme frenzy in 2024, even on traditionally more regulated U.S.-based platforms. From January to mid-November, about 35% of new meme token listings occurred on U.S. exchanges, compared to 26% in 2022 and 20% in 2023. This rising share is partly due to top offshore markets, particularly Binance, facing increased regulatory scrutiny, leading to a more cautious approach to new listings.

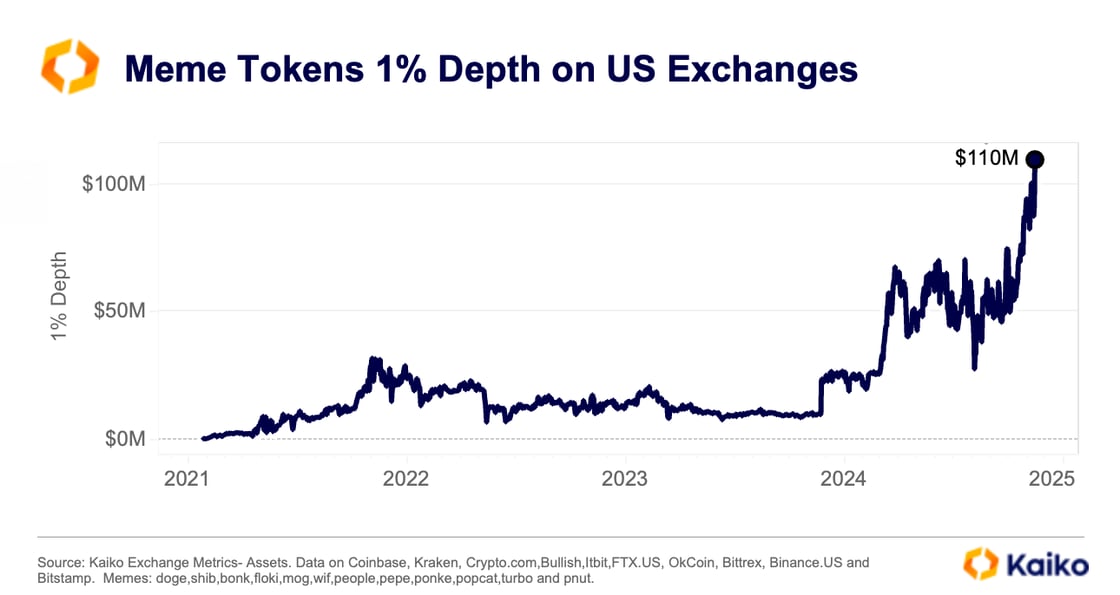

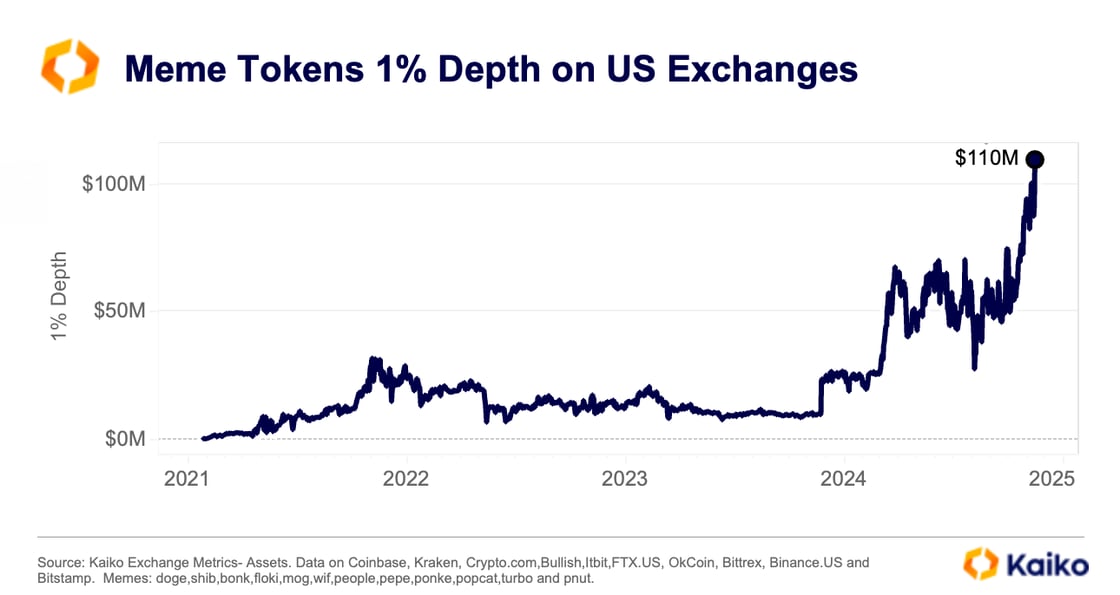

With trading volumes and token offerings on the rise, market makers—who earn revenue from bid-ask spreads—are increasingly incentivized to provide liquidity.

Meme token liquidity as measured by the 1% market depth on U.S. exchanges reached an all-time high of $110 million last week. While large-cap meme tokens like SHIB and DOGE continue to dominate with over 70% market share of the total depth, their share has been gradually declining, indicating a growing interest in smaller tokens.

Data Points

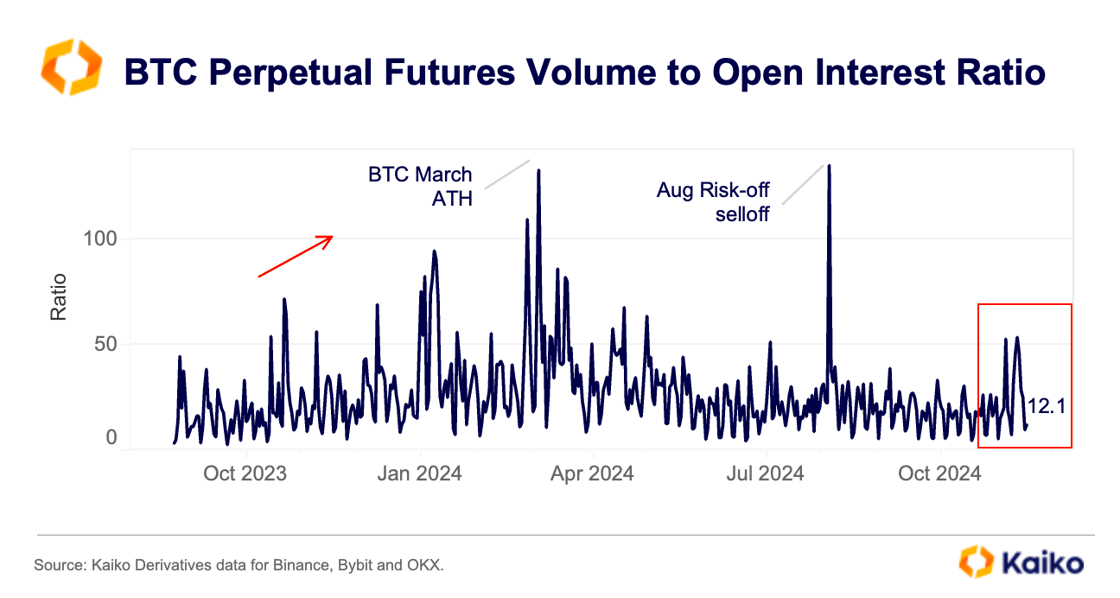

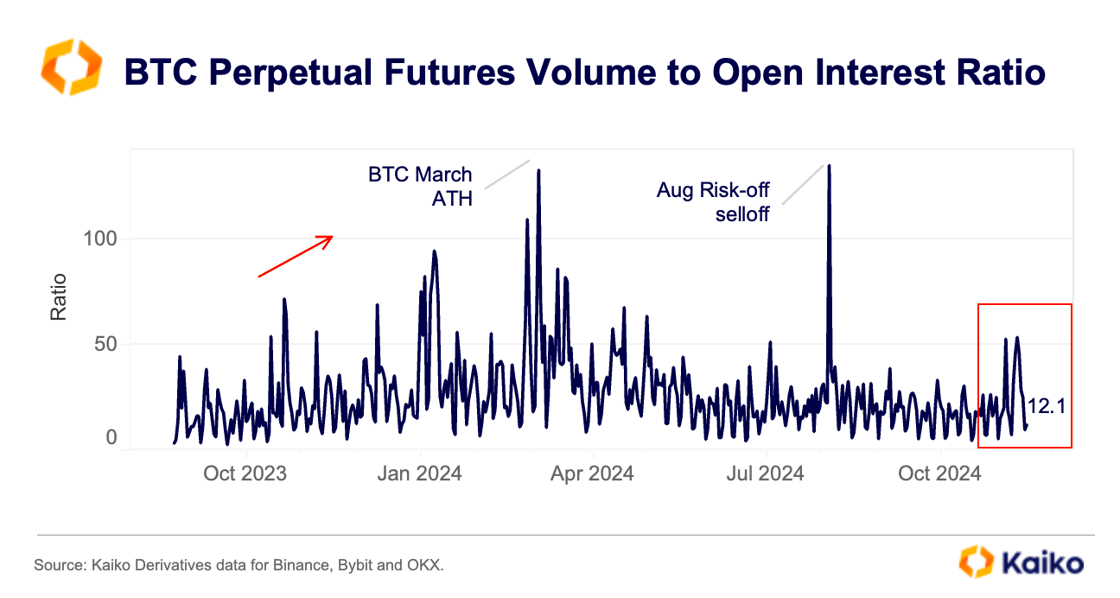

Speculative activity on derivative markets is moderate.

Bitcoin perpetual futures open interest in USD terms on Binance, Bybit, and OKX reached an all-time high last week as spot prices briefly surpassed $93,000. Open interest in BTC units has also risen, indicating capital inflows; however, it remains lower than the levels observed in October 2022. Funding rates—an indicator of market sentiment and bullish demand—remain relatively low by historical standards. This suggests that while sentiment is improving, the market is not overheated.

Other indicators of speculative activity, such as the perpetual futures volume-to-open-interest ratio, also point to increased speculation but remain below March levels. A rising ratio reflects trading volumes growing faster than open interest. This typically occurs because speculators, who trade over shorter time frames, drive up volumes quickly, unlike hedgers who focus on long-term positions that increase open interest. The ratio briefly climbed above 50 last week before declining below the Q3 average.

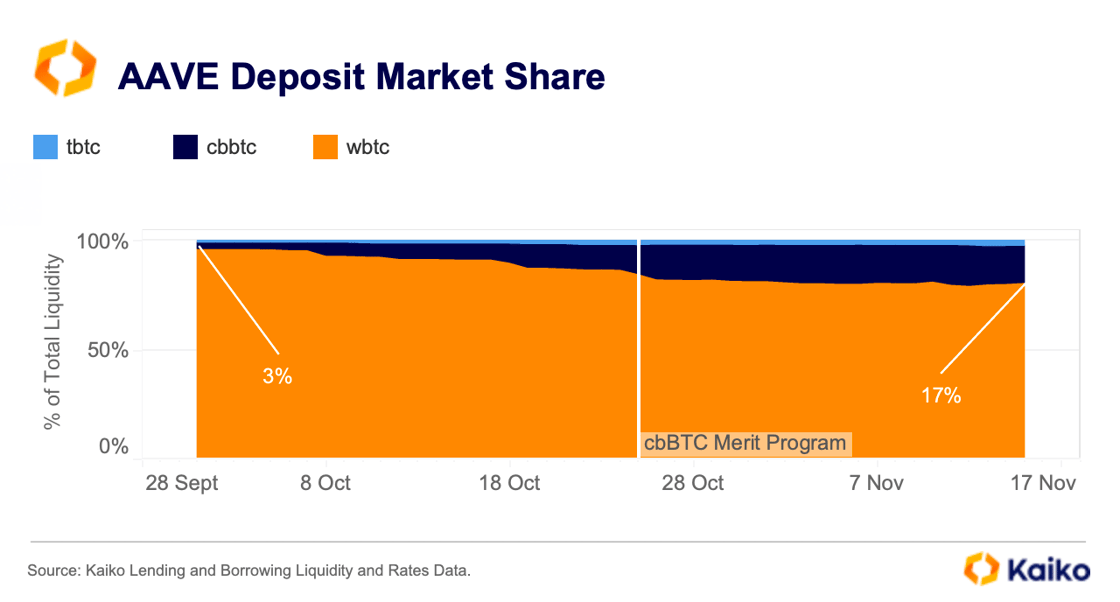

Will Coinbase’s cbBTC challenge wBTC’s dominance?

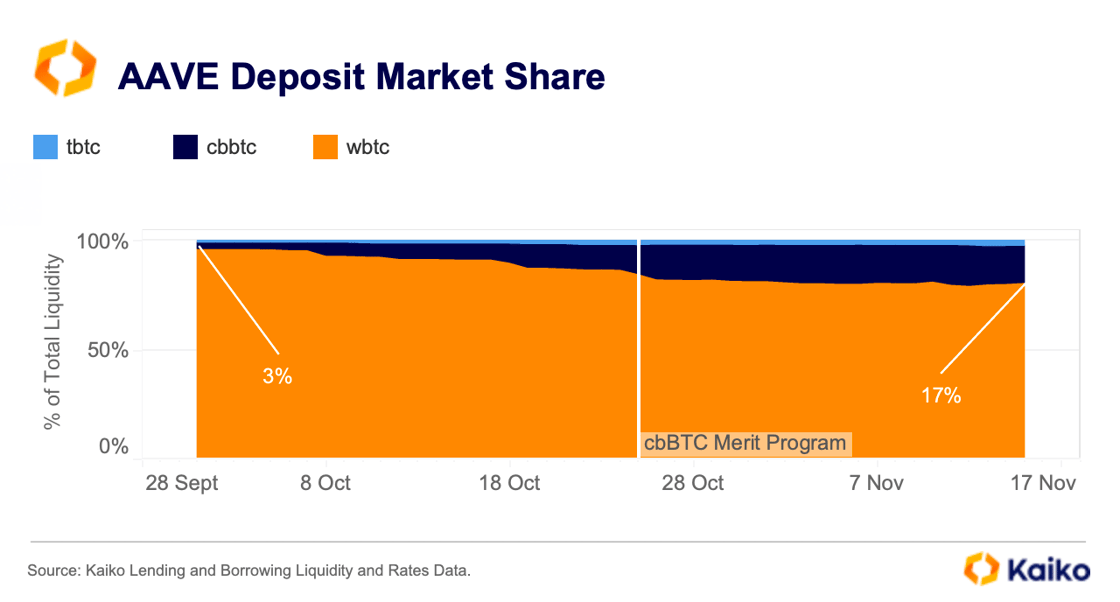

Coinbase’s wrapped Bitcoin, cbBTC, has been gaining traction on Aave, the largest lending and borrowing protocol by total value locked (TVL). Since early October, cbBTC’s share relative to other wrapped Bitcoin assets on the protocol has increased more than fivefold, from 3% to 17%.

Launched by Coinbase in September, cbBTC reached a market cap of $1.3 billion within just two months, representing nearly 10% of the largest wrapped Bitcoin token, wBTC, which has a market cap of $13 billion. While cbBTC’s popularity partly stems from its role as a diversifier to the dominant wBTC, its growth has also been driven by incentives, such as Aave’s October Merit reward program, which encourages cbBTC deposits and USDC borrowing.

Meanwhile, cbBTC’s largest competitor, wBTC has faced scrutiny over management and transparency issues. In August, its issuer, BitGo, announced plans to transfer control of wBTC to a joint venture involving Justin Sun’s Tron ecosystem. This led MakerDAO, the organization behind the DAI stablecoin, to consider discontinuing wBTC as collateral for minting DAI.

Wrapped assets like wBTC are redeemable for the underlying asset at a 1:1 ratio, but their values are not pegged and can fluctuate due to market events and liquidity shortages. Since August, wBTC has been trading at its largest discount relative to BTC since the FTX collapse.

For context, back in November 2022, the collapse of FTX and its sister company Alameda Research led to a loss in confidence in wBTC’s backing. Alameda, one of wBTC’s top merchants, was responsible for minting a significant portion of wBTC tokens.

For context, back in November 2022, the collapse of FTX and its sister company Alameda Research led to a loss in confidence in wBTC’s backing. Alameda, one of wBTC’s top merchants, was responsible for minting a significant portion of wBTC tokens.

ETH finally breaks above $3k, but risks persist.

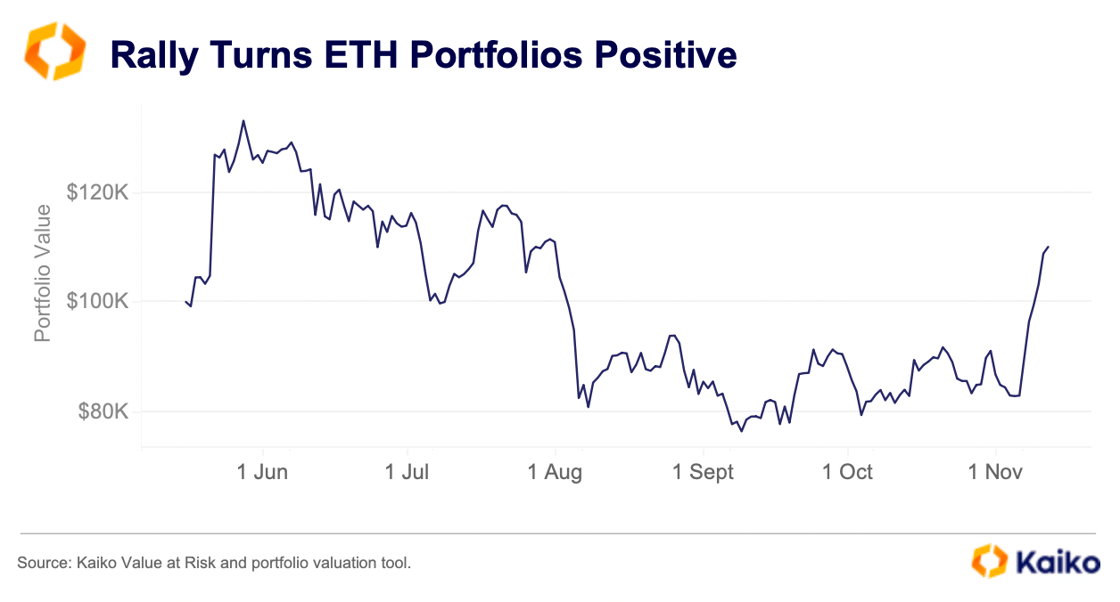

Ethereum has lagged Bitcoin since the Merge in 2022 and the ETH/BTC ratio continues to tick lower. However, the recent rally in crypto prices saw ETH briefly outperform BTC, as we discussed in our latest Deep Dive.

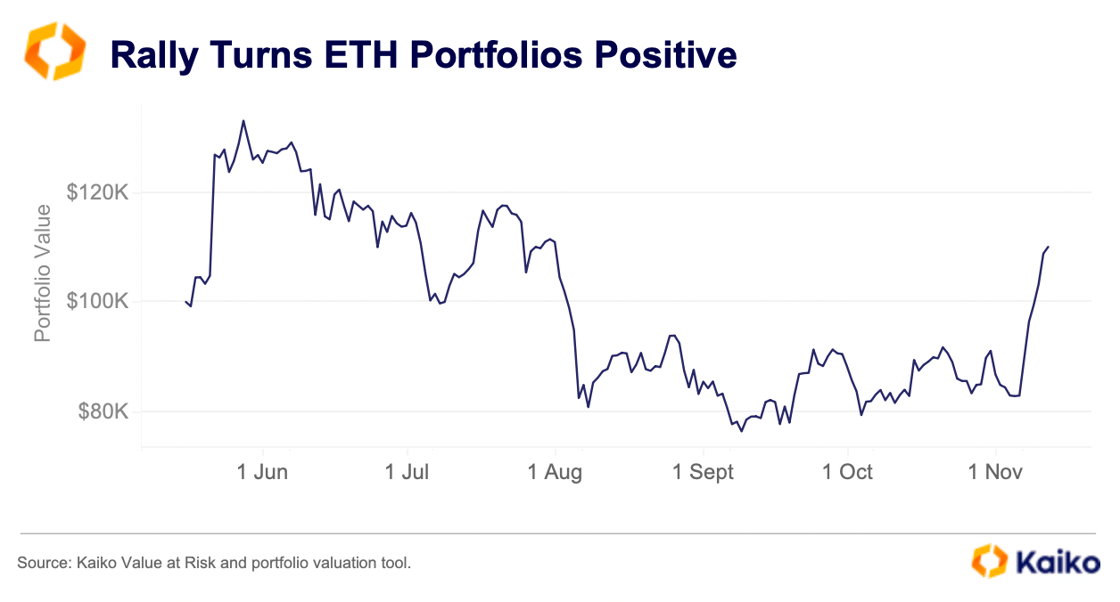

Looking at a simulated portfolio which invested $100k into ETH in May and held it until today we can visualize the impact the post-election rally had for ETH holders. This portfolio was in the red since August, but the rise in prices this month saw it recover to trade near pre-August levels.

Meanwhile, the 95% Value at Risk (VaR) of this portfolio rose, from $3k at the end of October to as high as $4.5k by mid-November. VaR is a risk indicator used to quantify the extent and probability of potential losses in a portfolio. This means that losses exceeding this amount would occur about 5% of the time, or one day out of every 20.

In contrast, the daily loss for a BTC only portfolio would have been much lower, around $2.7k. BTC VaR at the 95% confidence level has steadily declined since August, indicating reduced downside risk. This suggests there is a greater potential for loss from ETH only portfolios at present.

![]()

![]()

![]()

![]()

For context, back in November 2022, the collapse of FTX and its sister company Alameda Research led to a loss in confidence in wBTC’s backing. Alameda, one of wBTC’s top merchants, was responsible for minting a significant portion of wBTC tokens.

For context, back in November 2022, the collapse of FTX and its sister company Alameda Research led to a loss in confidence in wBTC’s backing. Alameda, one of wBTC’s top merchants, was responsible for minting a significant portion of wBTC tokens.