Around the World in Crypto Trends

USA🇺🇸

BTC ON THE BALANCE SHEET.

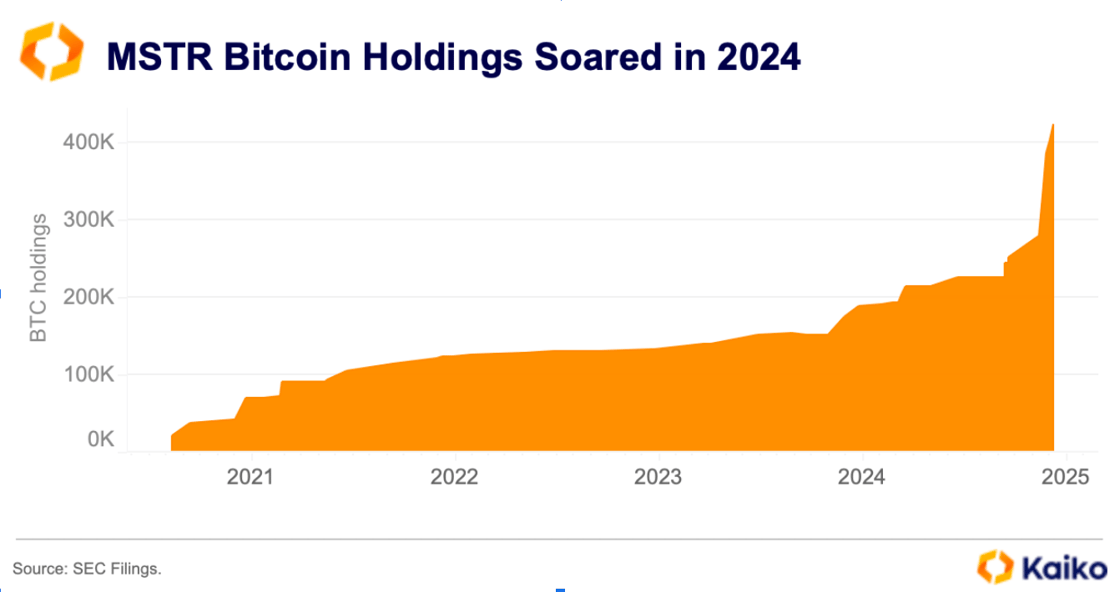

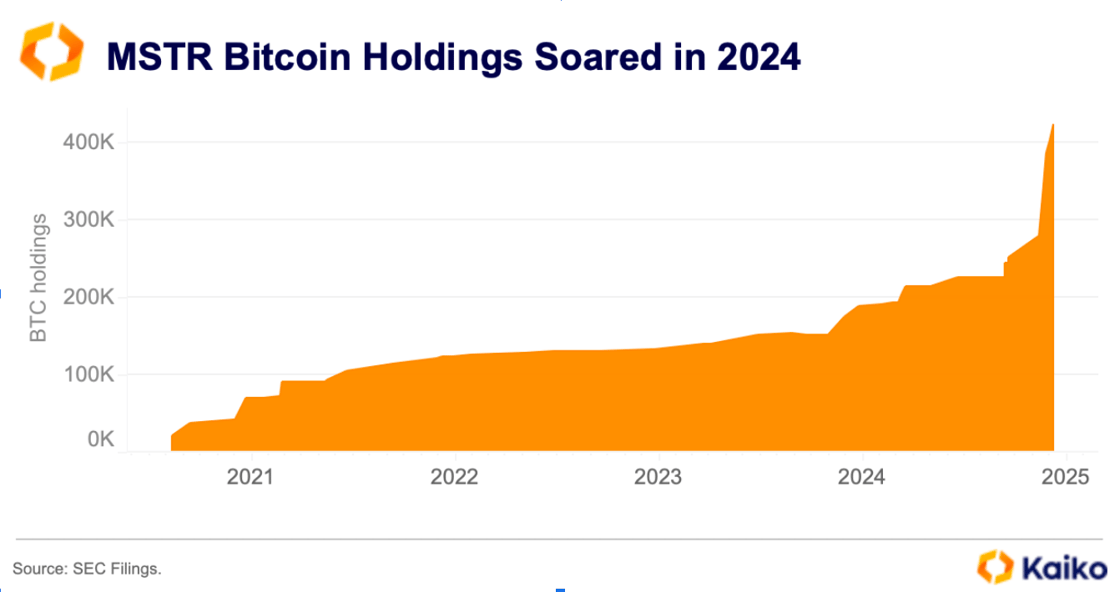

US corporations have pioneered the use of Bitcoin as a treasury asset, with MicroStrategy leading the way. Under Michael Saylor’s leadership, the company began its Bitcoin buying program in August 2021. It now holds over 400,000 BTC, valued at more than $25 billion, and plans to grow its holdings to $49 billion in the coming years.

MicroStrategy isn’t alone in holding Bitcoin. Publicly traded miners and companies like Tesla have also added BTC to their balance sheets. Marathon Digital recently purchased $1.1 billion worth of Bitcoin, signaling growing corporate interest.

Meanwhile, the idea of a US Bitcoin strategic reserve is gaining attention. Senator Cynthia Lummis is advocating for it, and former President Trump has weighed in. While such a move could be a game-changer akin to Bitcoin ETF approval, its absence wouldn’t significantly impact the market, as few are betting on this outcome.

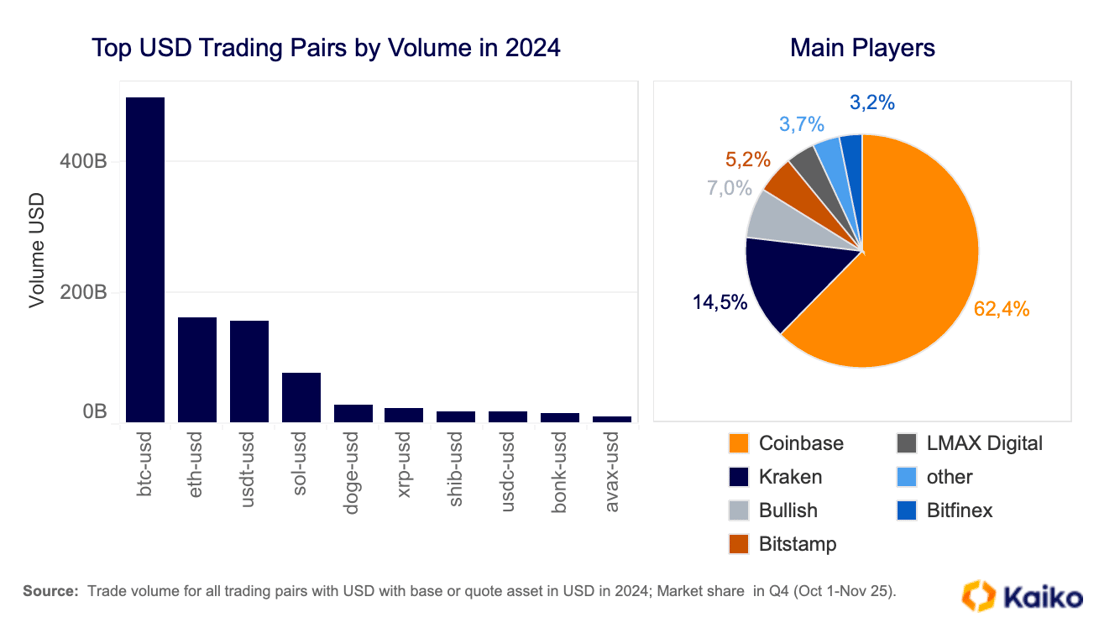

kEY NUMBERS

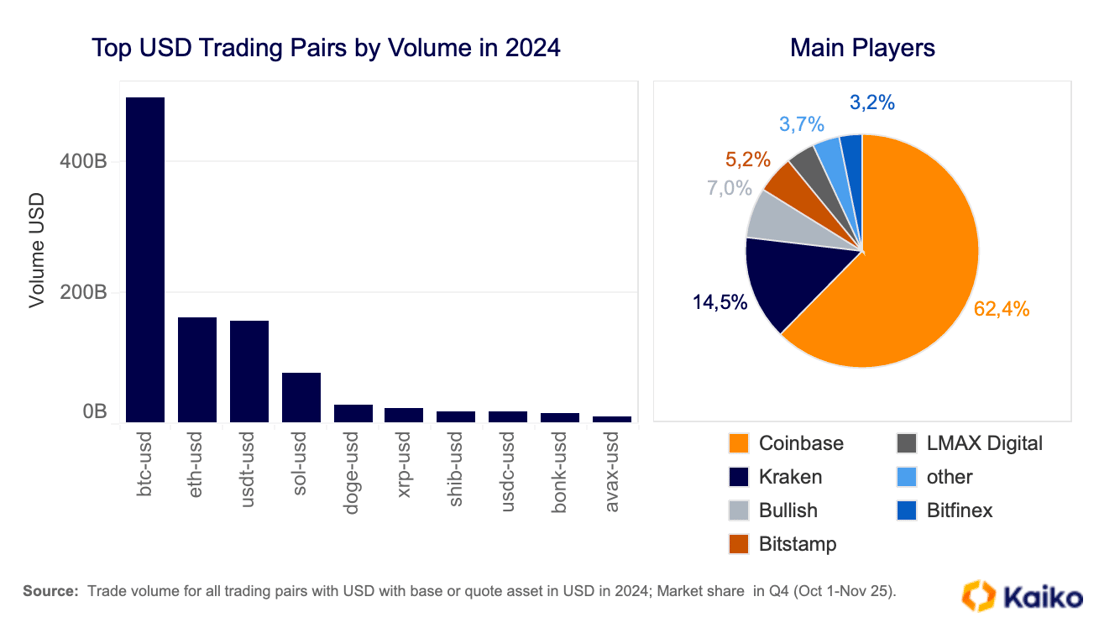

- BTC share in TOP 10 USD Pairs: 49%

- TOP Market Player Share in Q4: 62%

- 24′ Cumulative USD Volume: $1,476bn

- Active Crypto-USD Pairs: 1593

Country Context

The US has long dominated global finance, and its influence in crypto is growing, particularly with the approval of spot BTC and ETH ETFs this year. This shift contrasts with crypto’s early days, when Asian exchanges like Japan’s Mt. Gox, which handled over half of Bitcoin trades before collapsing in 2014, led the market. Nowadays, the world’s most trusted exchanges are US-based, including Coinbase and Kraken.

South Korea 🇰🇷

Listings bump for korean traders

The recent crypto market meltdown in Korea, triggered by political unrest, has highlighted the unique structure of the Korean crypto market and its impact on price discovery. Upbit played a major role in this dynamic:

However, the Korean market remains isolated from global trends due to strict regulations and fragmented liquidity. This has led to anomalies like the “Kimchi Premium” and “Gaduri Premium”—the latter involving price manipulation—attracting whales and arbitrageurs.

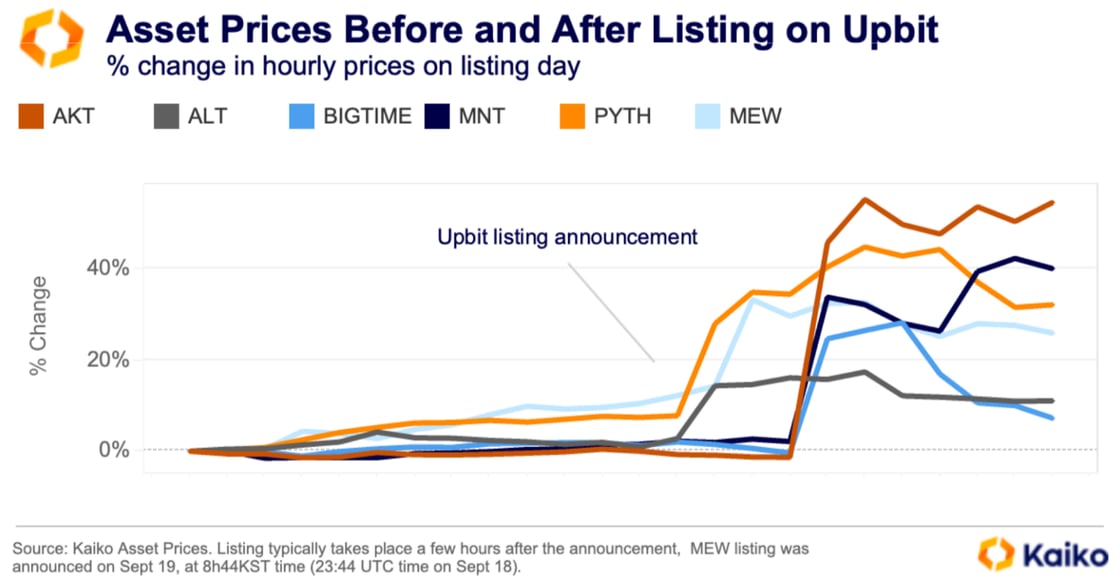

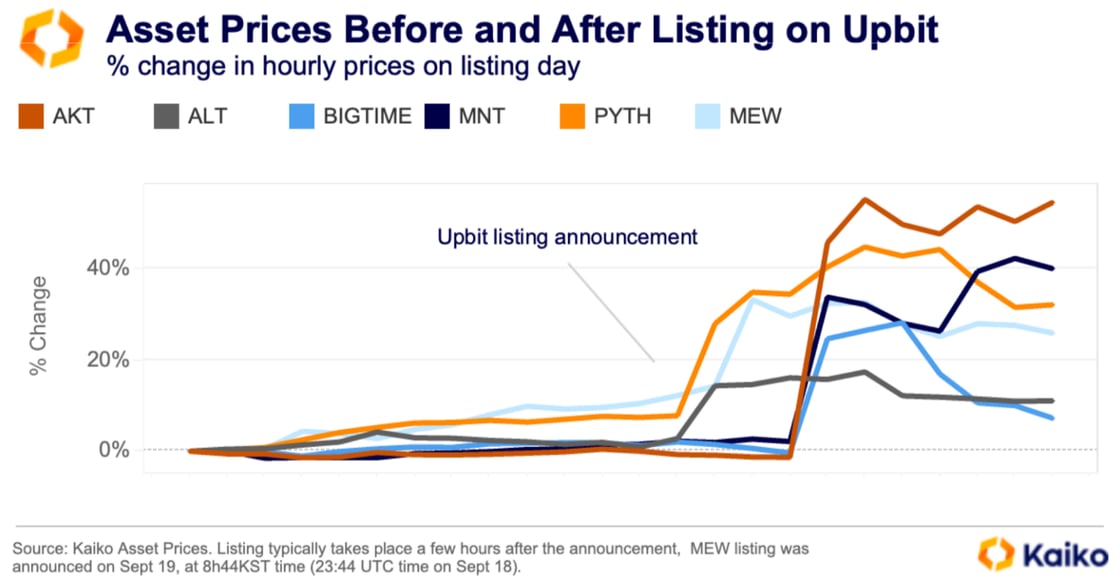

Additionally, the Korean market amplifies trends related to the so-called “listing premium.” Similar to the “Coinbase Effect,” tokens listed on Upbit often experience price surges of 10-40% within hours, with Upbit’s listings having a longer-lasting impact on token prices. This is driven by a mix of factors, including Korea’s isolated market structure and a higher-than-average proportion of risk-loving retail traders.

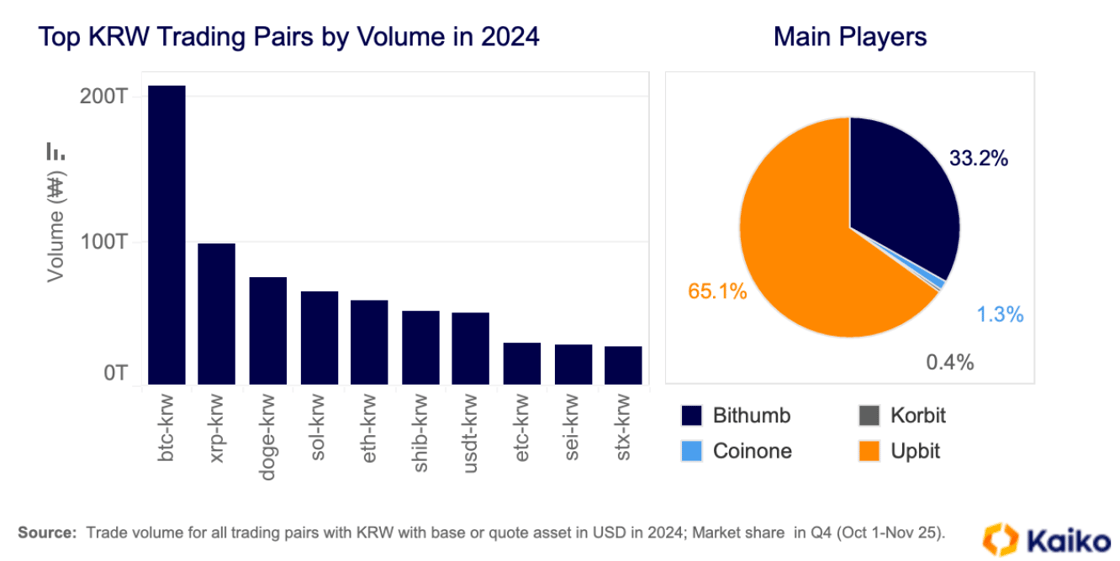

Key Numbers

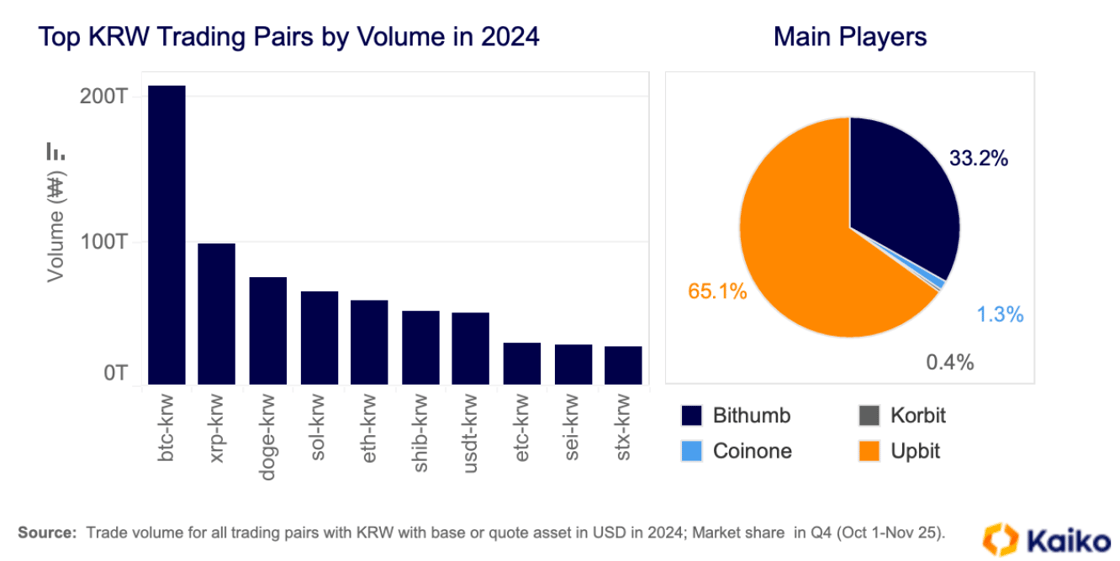

- BTC share in TOP 10 KRW Pairs: 30%

- TOP Market Player Share in Q4: 65%

- 24′ Cumulative KRW Volume: 1,377bn

- Active Crypto-KRW Pairs: 861

Country context

South Korea is home to one of the largest crypto markets, with KRW trading volume reaching $1.1 trillion in 2024, surpassing the KOSDAQ and KOSPI indices. Dominated by retail traders, local platforms are insulated from global markets due to strict capital controls. Altcoins make up 80% of trade volume on the “Big 4” Korean exchanges and often trade at a premium, known as the “Kimchi Premium.”

Japan 🇯🇵

Once bitten, twice shy

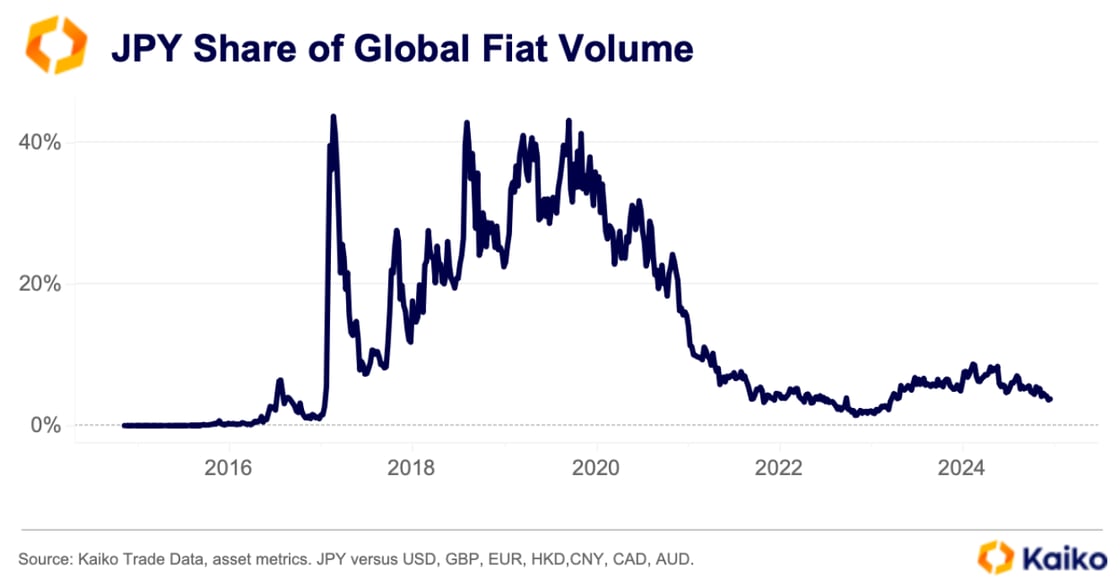

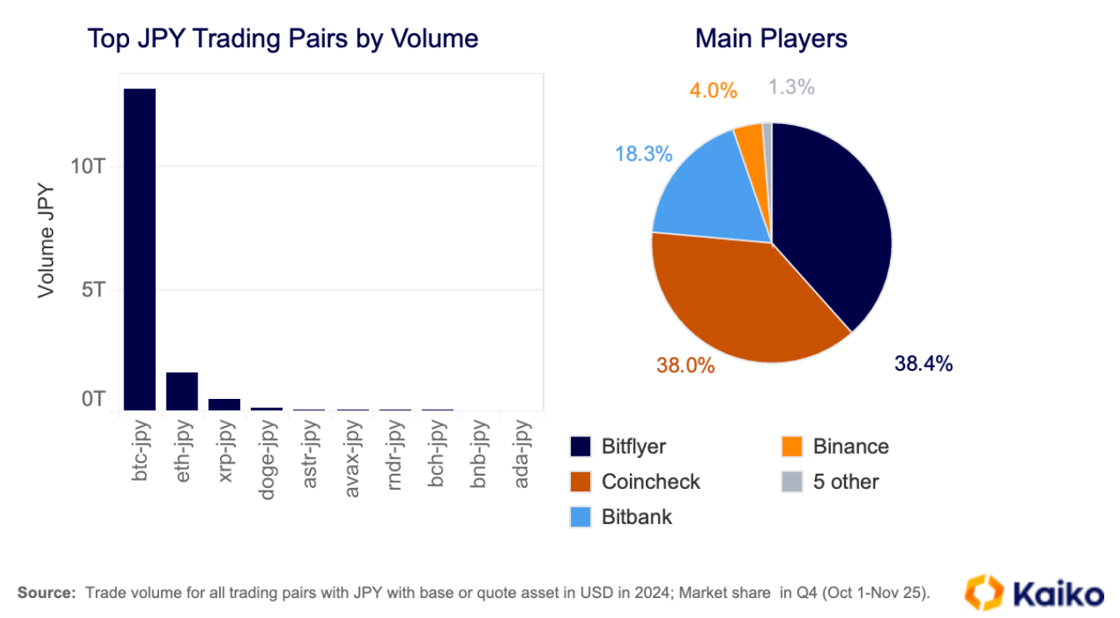

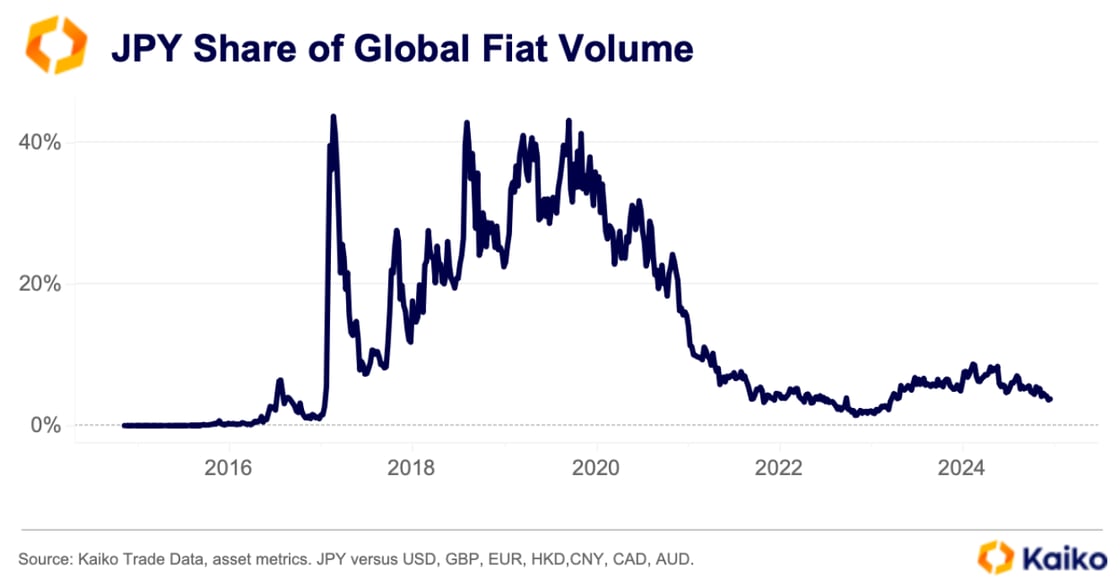

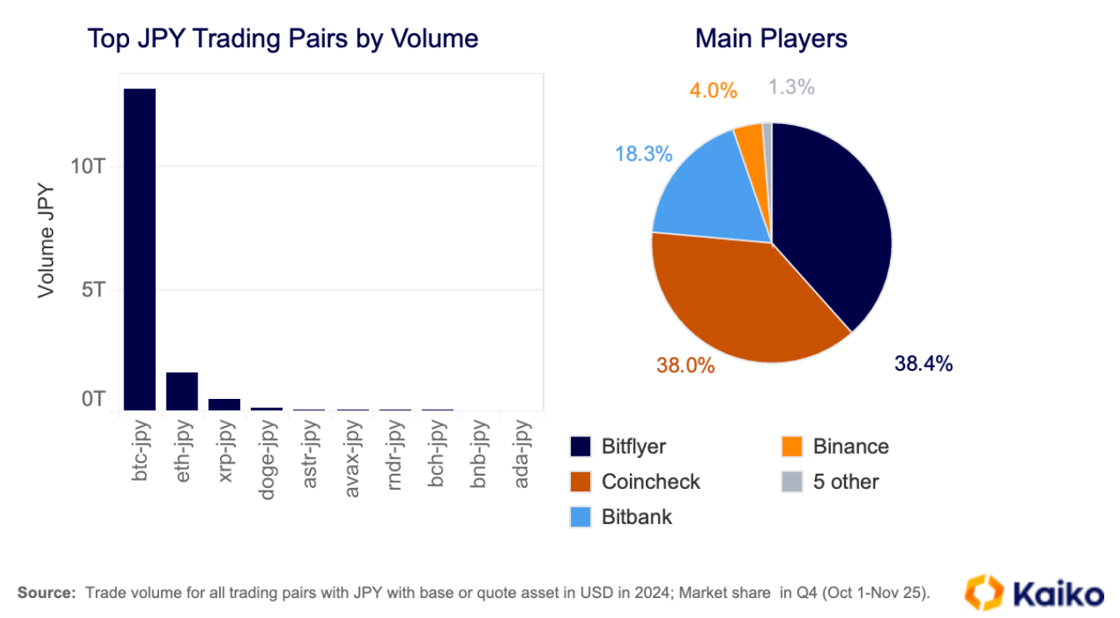

Japan has taken a cautious approach to crypto since the collapse of Mt. Gox in 2014, one of the world’s largest exchanges at the time. Despite regulatory hesitance, there is strong demand for Bitcoin exposure in Japan. While it has lost momentum since 2020 and missed out on the 2021/22 crypto bull run, it remains the third-largest BTC-fiat market by trade volume.

The Japanese market, particularly for Bitcoin, is well-positioned to support potential spot Bitcoin ETFs, if approved. Key developments to watch in 2025 include the regulation of structured products and Bitcoin mining. The biggest news this week was crypto exchange Coincheck’s Nasdaq listing, while asset managers push for crypto ETF approvals and Japan’s largest energy provider mines its own Bitcoin.

Key numbers

- BTC share in TOP 10 JPY Pairs: 84%

- TOP Market Player Share in Q4: 38%

- 24′ Cumulative JPY Volume: 114bn

- Active Crypto-JPY Pairs: 114

country context

Once the largest crypto market, Japan is one of the industry’s oldest players. It is now the fifth-largest crypto market by total fiat volume and the third-largest for BTC-fiat trading pairs. Its cautious listing approach and strict regulations limited its growth during the 2021–22 crypto bull run, but strong demand for Bitcoin exposure remains.

Turkey 🇹🇷

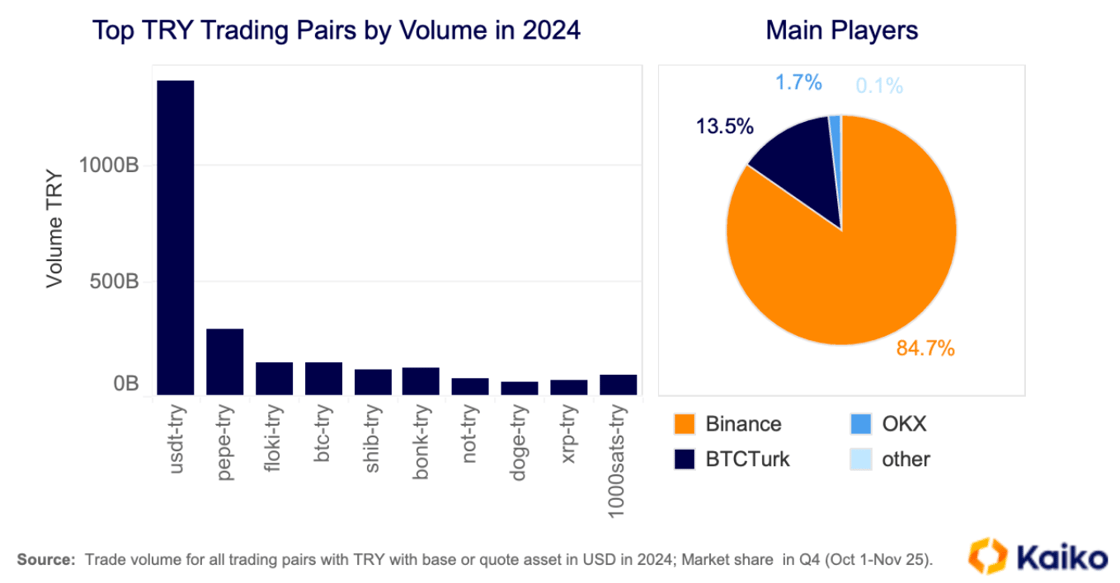

stablecoins offer relief from macro woes

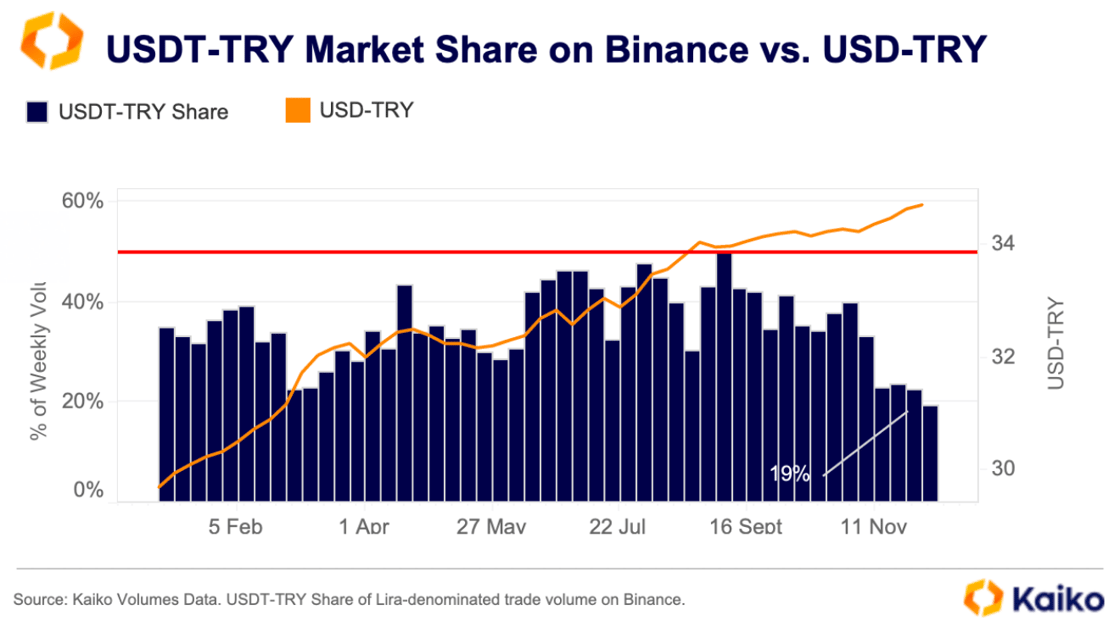

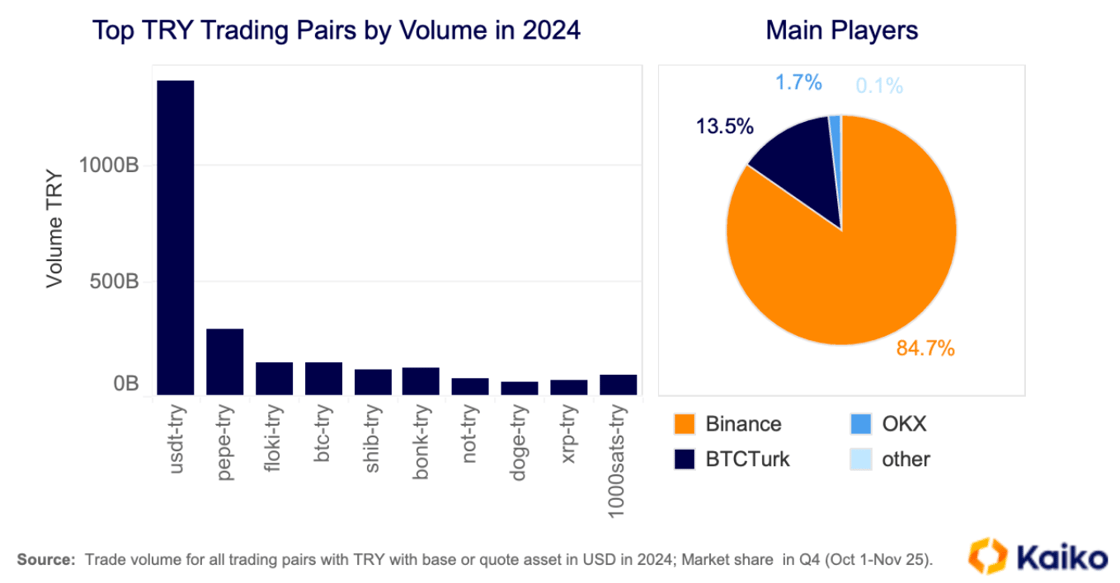

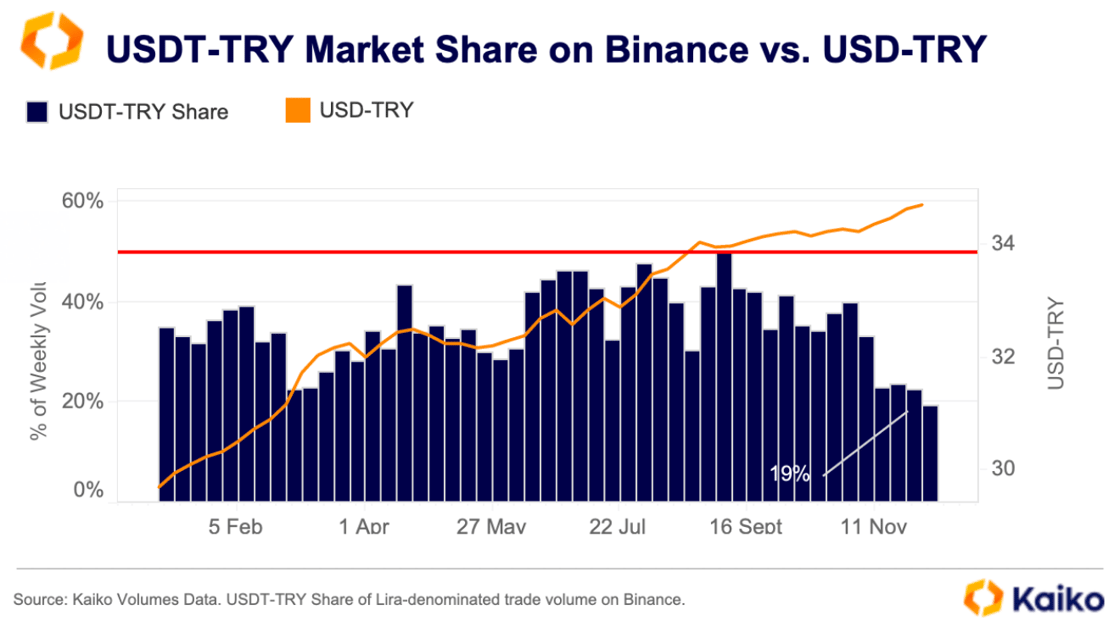

Turkish traders have long used stablecoins like USDT to hedge against the Lira’s devaluation and high inflation. Since 2021, the Lira has lost over 300% against the US Dollar, with inflation above 40%. USDT-TRY has consistently ranked among the top 20 pairs on Binance.

However, in 2024, despite the Lira’s continued devaluation (down 18% YTD), USDT-TRY’s share of Lira-denominated volume has dropped to 19%, raising the question of whether USDT is losing dominance. Turkish traders are diversifying into high-yield meme tokens and altcoins, with XRP’s share of TRY-denominated volume surging ten-fold in November.

Key numbers

- BTC share in Top 10 TRY Pairs: 6%

- Top Market Player Share in Q4: 31%

- 24′ Cumulative TRY Volume: 189bn

- Active Crypto-TRY Pairs: 504

Brazil 🇧🇷

Real bad FX woes drive crypto adoption

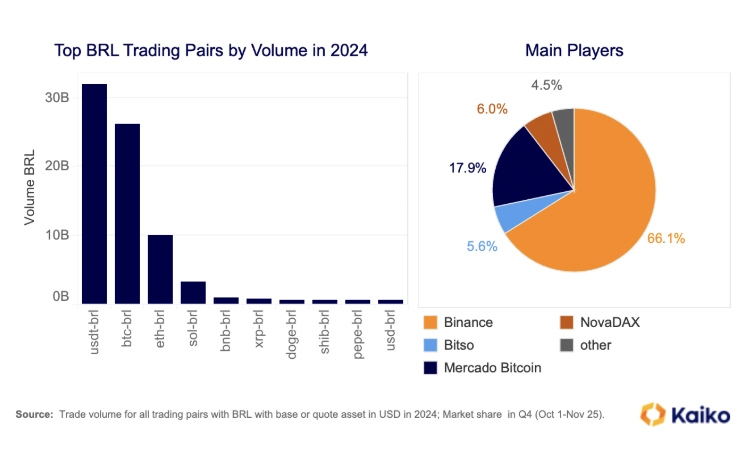

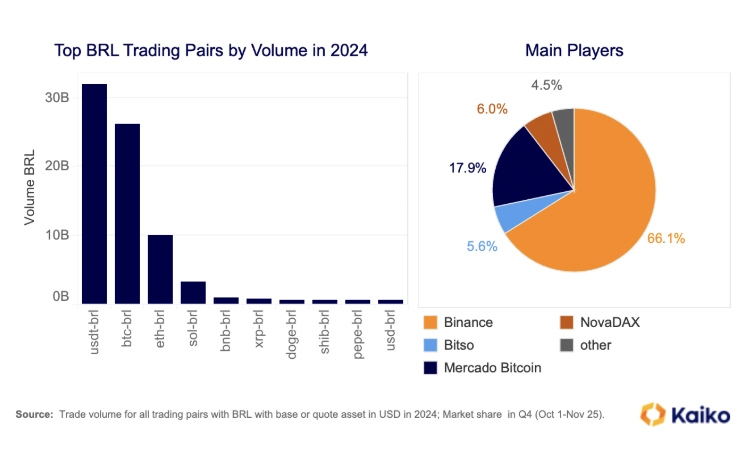

Brazil’s crypto market has grown significantly over the past year, fueled by a favorable regulatory environment and rising prices amid a weakening national currency. Binance remains the largest BRL market with a 66% share, though this is down from 81% in June. Local platforms have gained ground, with MercadoBitcoin’s share increasing by two percentage points since June to nearly 18%.

Key Numbers:

- BTC share in top ten BRL pairs: 34%

- Share of Top Market Player in Q4: 66%

- Cumulative BRL Volume in 2024: 17bn

- Number of active listed BRL trading pairs: 553

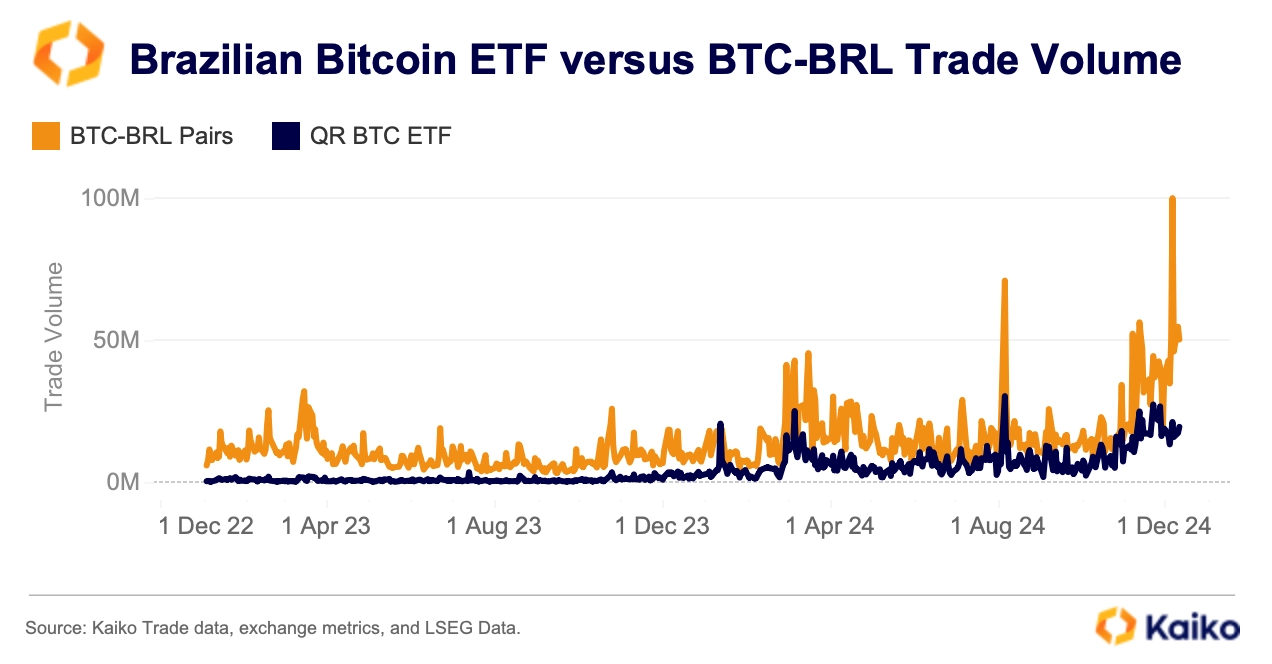

Forging a path for fund investing

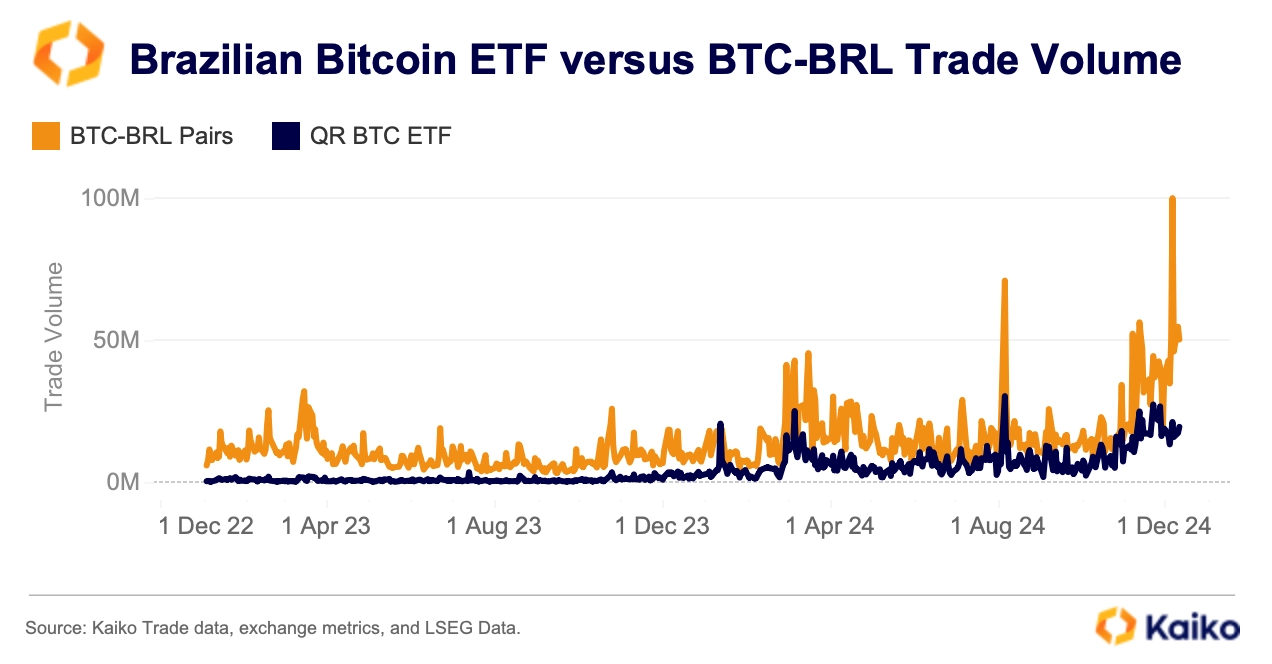

Brazil is a leader in regulated crypto products, particularly spot exchange-traded funds. The first BTC and ETH ETFs in Latin America were launched on Brazil’s S3 stock exchange in 2021 by QR Asset Management and Hashdex.

Volumes surged as BTC neared record highs in late 2021. While they dipped between 2022 and 2023, there has been a strong resurgence this year.

QR Asset Management didn’t stop with BTC and ETH ETFs. Earlier this year, it launched the world’s first spot SOL ETF, followed shortly by Hashdex. This pioneering move by Brazilian regulators and asset managers comes as US counterparts have yet to consider a SOL product.

Mexico

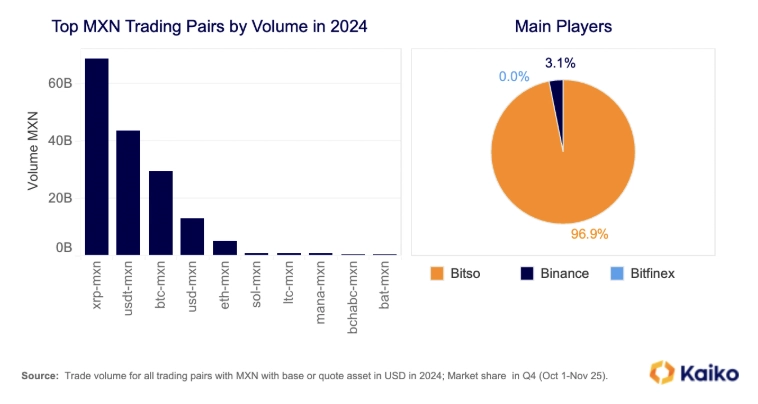

Key Numbers:

- BTC share in top ten MXN pairs: 18%

- Share of Top Market Player in Q4: 97%

- Cumulative MXN Volume in 2024: 9.5bn

- Number of active listed MXN trading pairs : 20

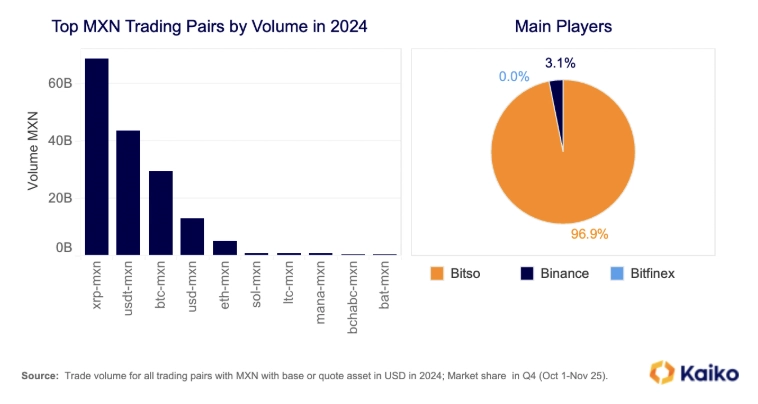

Homegrown hero

The Mexican crypto market is largely dominated by Bitso, founded in 2014 as Mexico’s first crypto exchange. Despite global players like Binance offering MXN pairs, Bitso has maintained its dominance in the local market.

Monthly Mexican Peso trade volumes have steadily increased since September 2023. However, Bitso’s share of total volume has been declining since June, following Binance’s entry into the Mexican market with several MXN pairs. Despite this, Bitso still commands around 93% of the BTC-MXN market.

Rest of the world

Beyond the countries mentioned above, we’ve provided a brief overview of other regions and links to further research.

We recently collaborated with Bitvavo to write a detailed report on the European market, which you can read here. The report highlights how regulation, particularly the European Markets in Crypto-Assets Regulation (MiCA), has created a safer, more predictable environment for European crypto investors, potentially unlocking long-term institutional demand. We also explored the euro market in depth.

Another country to watch is Nigeria. The West African nation is a leader in crypto adoption, but the availability of Naira pairs is limited. This has worsened since the Nigerian government clamped down on Binance in the spring, resulting in the exchange delisting all active NGN pairs.

Conclusion

As we’ve shown, crypto market trends vary significantly by region and country. While 2024 was a pivotal year for crypto adoption in the Western world, it was largely centered around Bitcoin. The leading cryptocurrency dominates developed markets due to easy access to hard currencies but lags behind stablecoins and altcoins in developing countries. This trend highlights different crypto use cases, and as adoption grows, these factors could further decouple Bitcoin’s price from risk assets.

![]()

![]()

![]()

![]()