Data Points

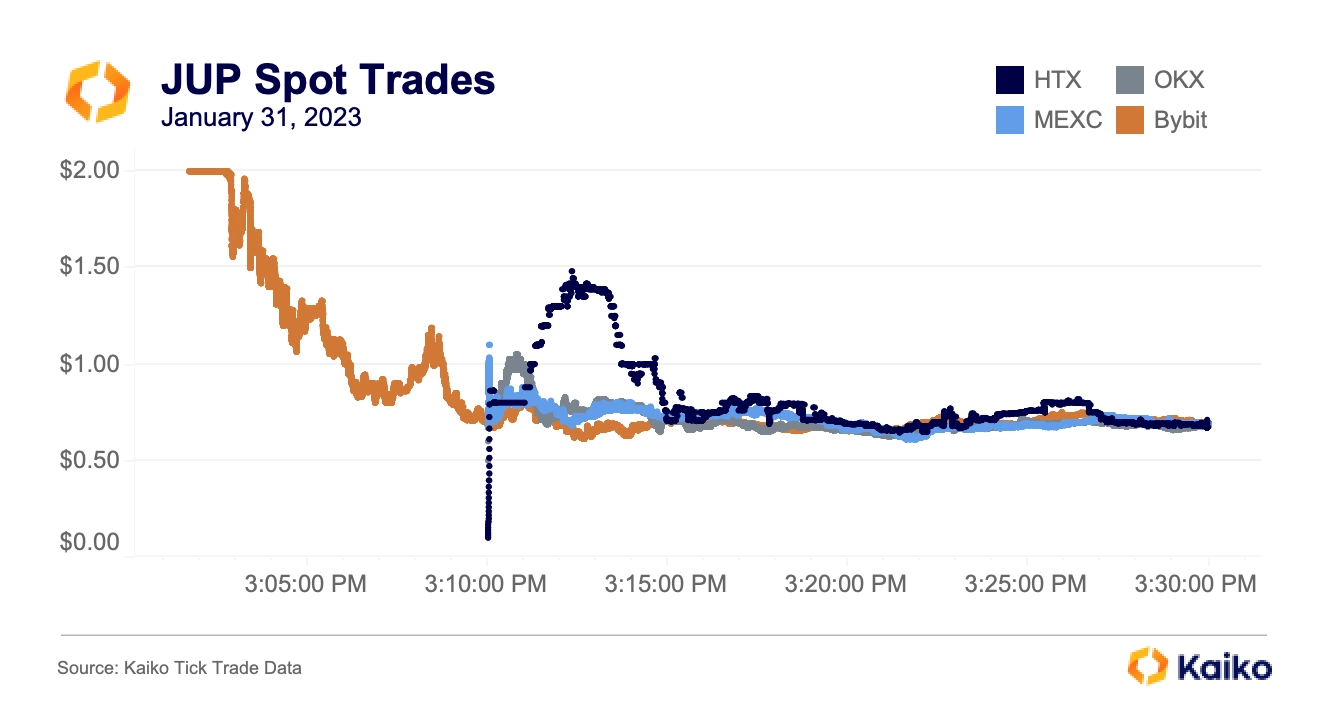

Jupiter completes one of the largest airdrops ever.

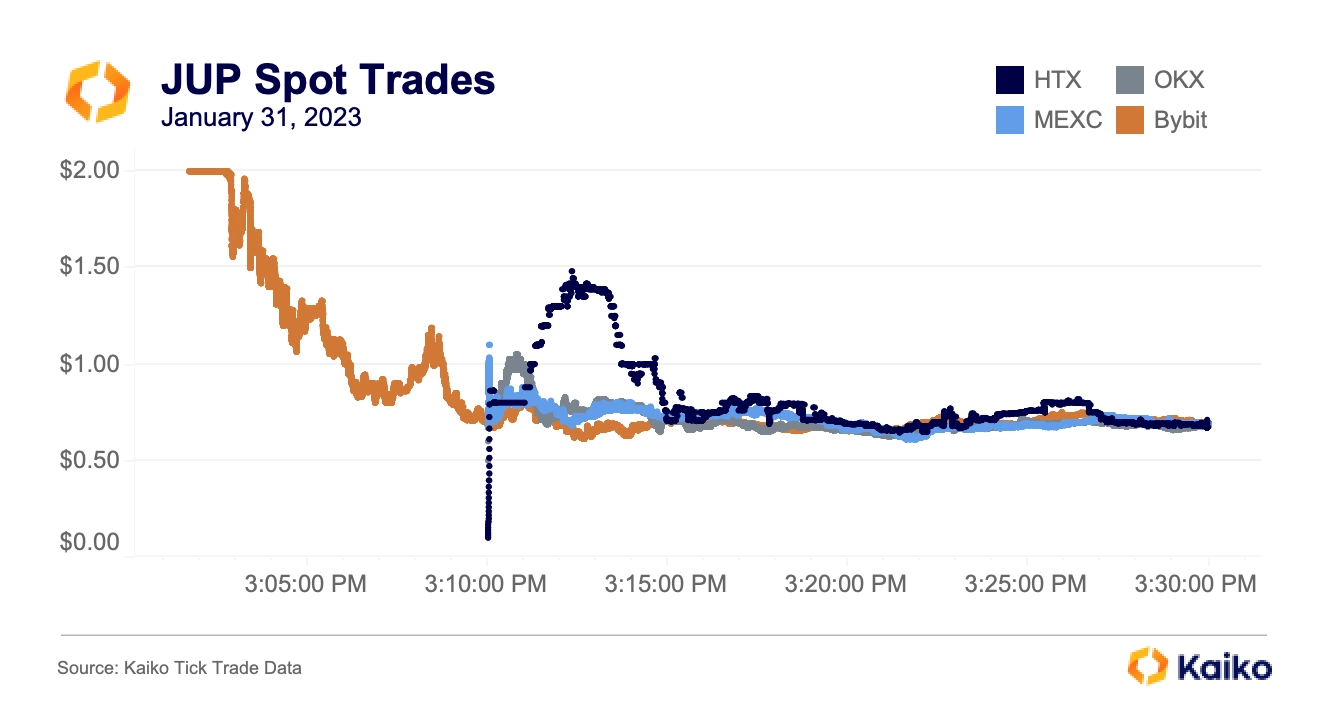

Last week, Solana DEX aggregator Jupiter airdropped its 1 billion JUP tokens – about $700mn at post-launch prices – to users who had qualified. While some users did have issues claiming tokens for various technical reasons, the Solana network had no downtime, a significant accomplishment given that downtime has long been one of the major criticisms of the network.

Meanwhile, centralized exchanges appeared to take precautions against volatility. In the past, there was often be a mad dash for users to send their newly airdropped tokens to CEXs and sell them; with next to no liquidity, this caused large price dislocations.

This time around, most CEXs announced that they would allow deposits and only open trading once certain liquidity parameters were met. Bybit was the first to open trading at 3pm UTC, as soon as the airdrop went live; it began trading at $2 before falling to the on-chain price of around $0.75. HTX, MEXC, and OKX all waited until 3:10pm UTC, though there was still some strange price action on HTX. Binance did not open trading until 3:30pm UTC.

Coinbase buying spree causes wick to $43,700.

On Friday, a flurry of buying caused the exchange’s BTC-USD price to rise and fall more than 2% in less than a minute. Just after 3pm UTC, nearly 100 market buy orders were placed nearly simultaneously, the largest of which was worth $1.1mn USD. In total, about 600 BTC worth $25mn were purchased in less than a minute. While liquidity has improved and Coinbase’s BTC-USD pair is one of the most liquid BTC instruments available, this rapid and large buying caused its price to jump from $42,800 to $43,700 in just a few seconds. It’s unclear why the orders were placed like this, though user error is a likely answer.

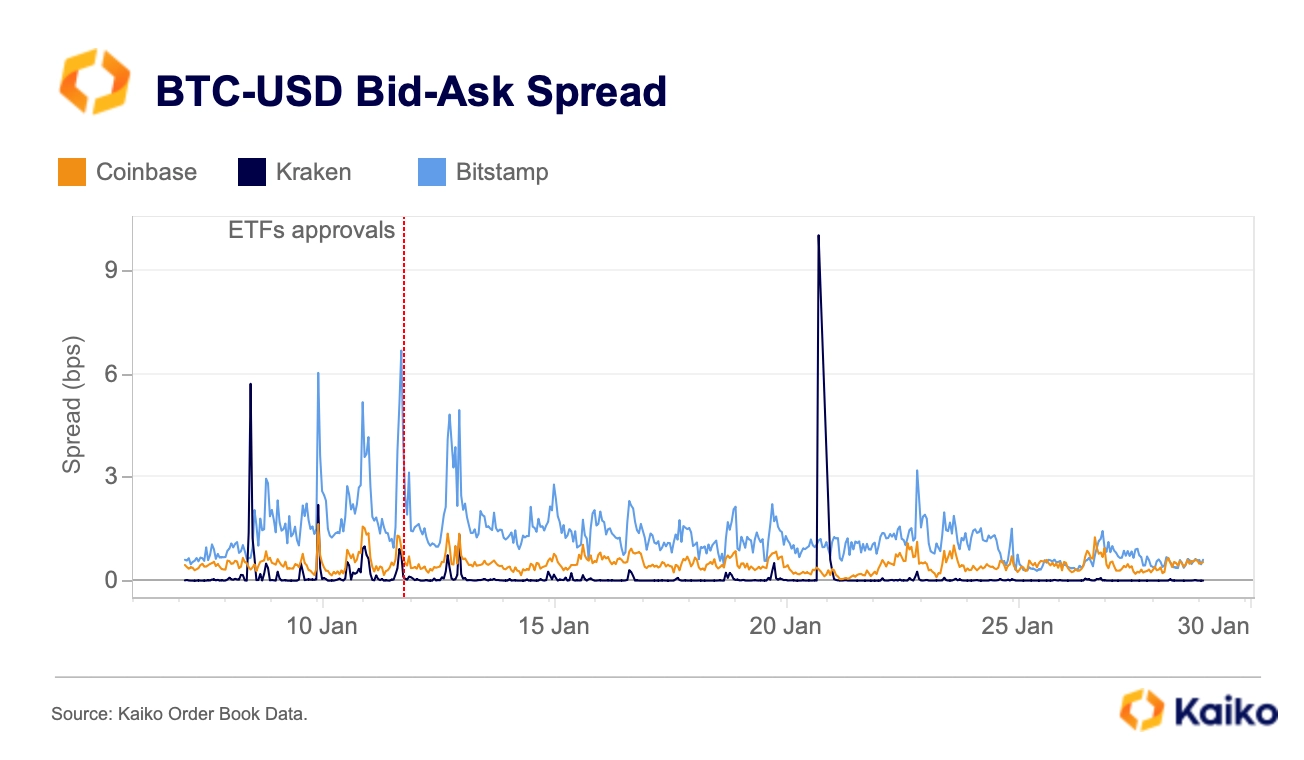

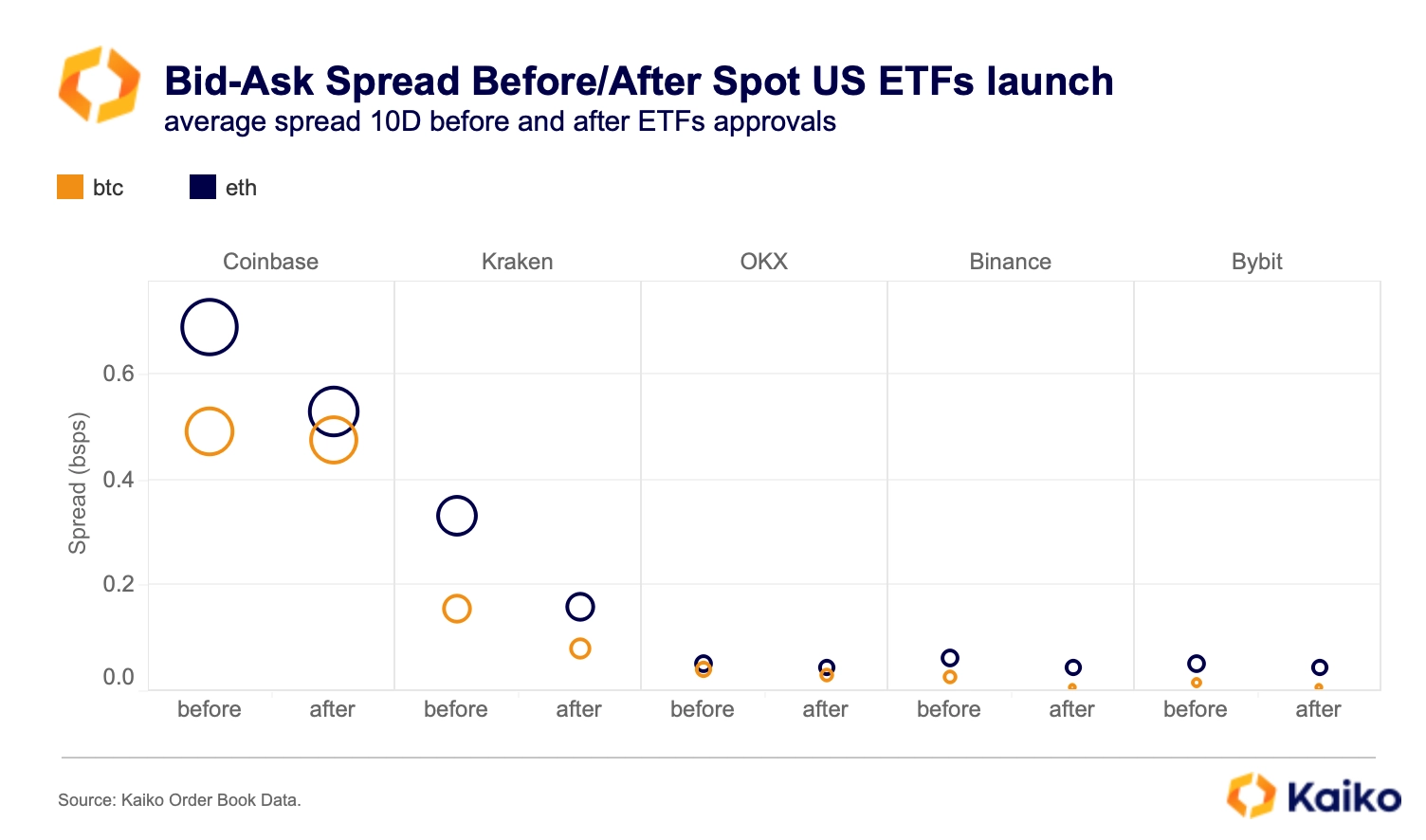

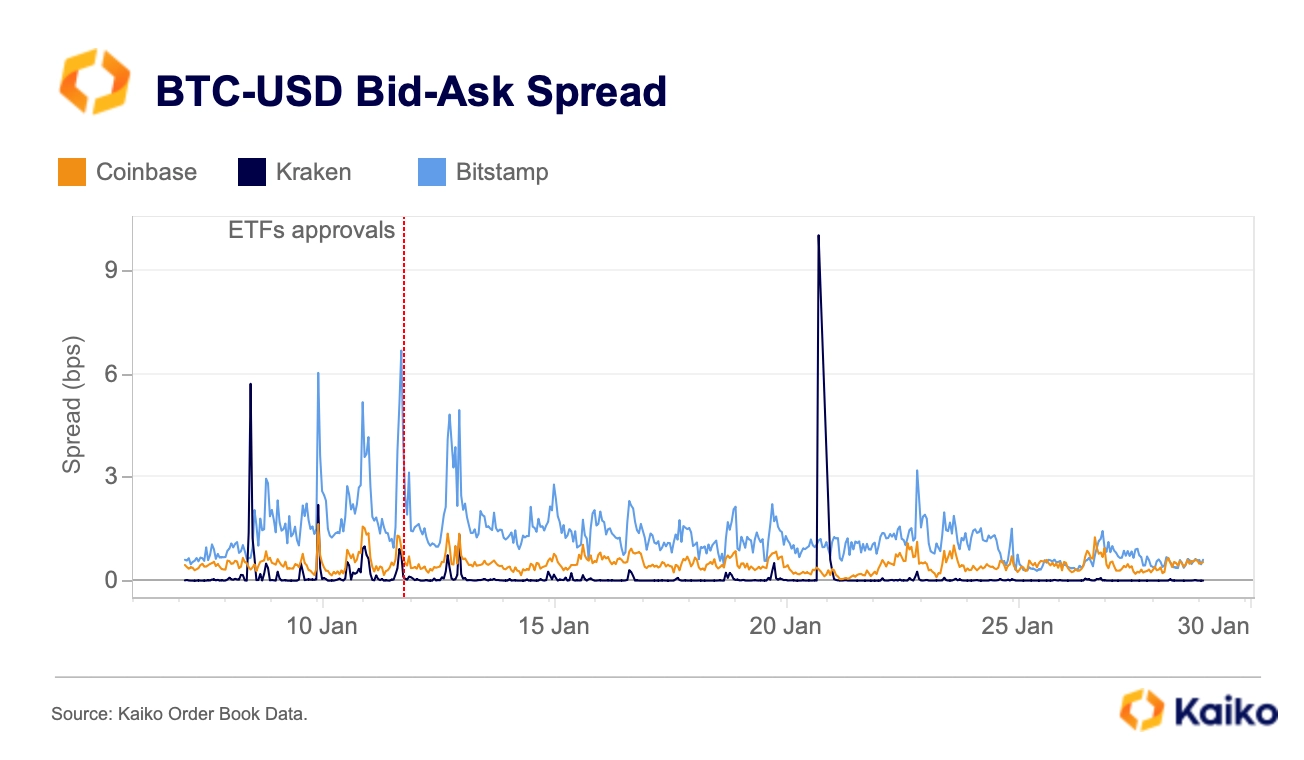

Spreads narrow post-ETF approvals.

After experiencing significant volatility in early January, the bid-ask spreads for BTC-USD markets on three major U.S.-available exchanges — Coinbase, Kraken and Bitstamp — have declined in the days following the spot ET approvals. The trend suggests liquidity conditions are improving and mirrors an increase in BTC market depth.

The bid-ask spread is the difference between the highest price a buyer is willing to pay for an asset and the lowest price a seller is willing to accept. Typically, the smaller the spread the more liquid the market. Kraken had the most volatile spreads in January, spiking to 10bps on January 20. Spreads on Bitstamp and Coinbase peaked at 6.7 and 1.7, respectively, between Jan 8-13, before dropping below 1bps last week.

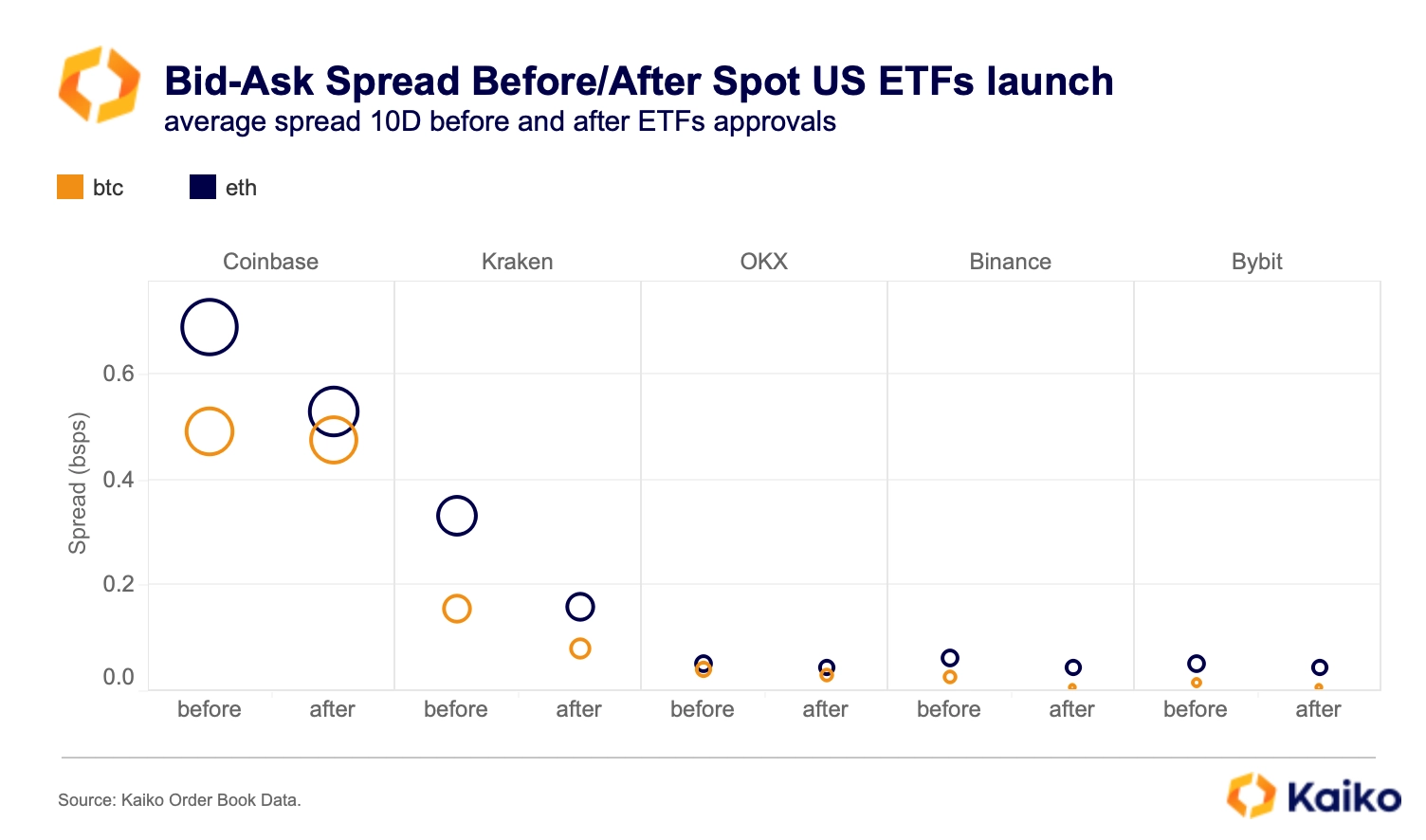

The trend was not limited to U.S. markets (or to BTC). The average bid-ask spread for the most liquid BTC and ETH trading pairs has fallen on most exchanges.

Coinbase and Kraken saw the strongest decline while the drop was less pronounced on Binance and OKX, which already offer very low spreads.

Overall, the approval of spot ETFs is likely to reignite the fee war between exchanges; Coinbase has already announced fee waivers for large traders. This will put further downward pressure on spreads, which are heavily dependent on exchange fee structure.

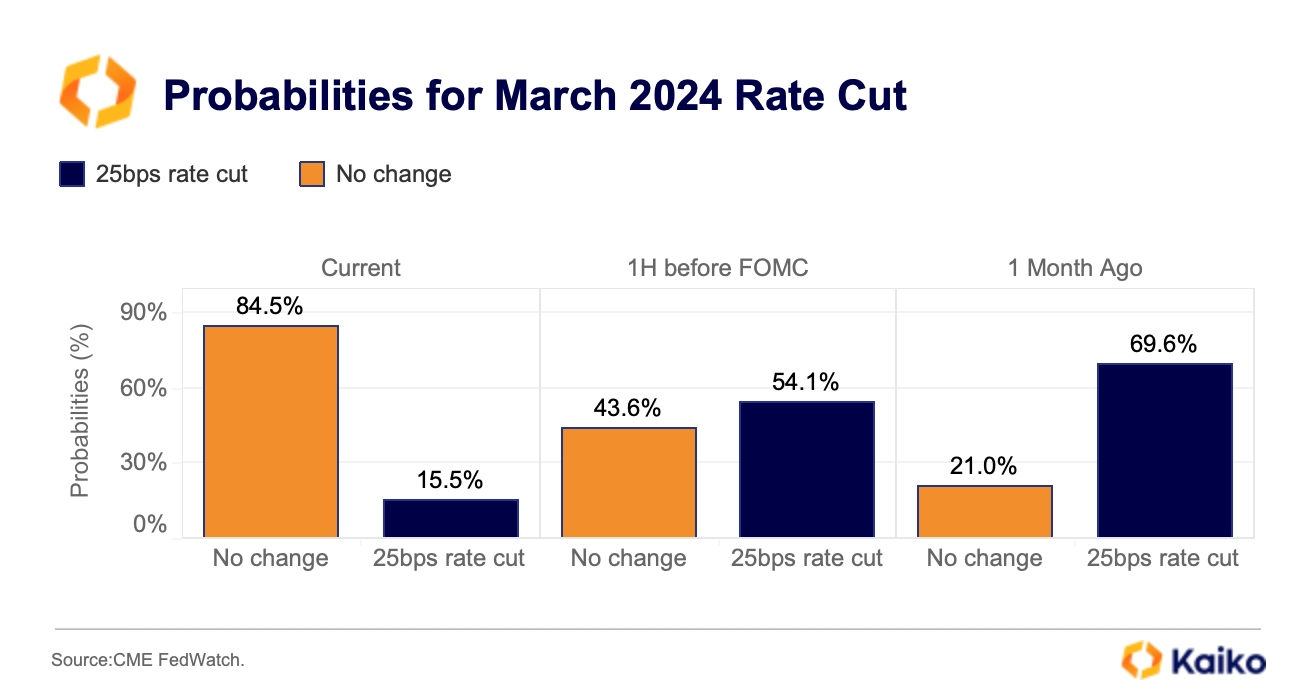

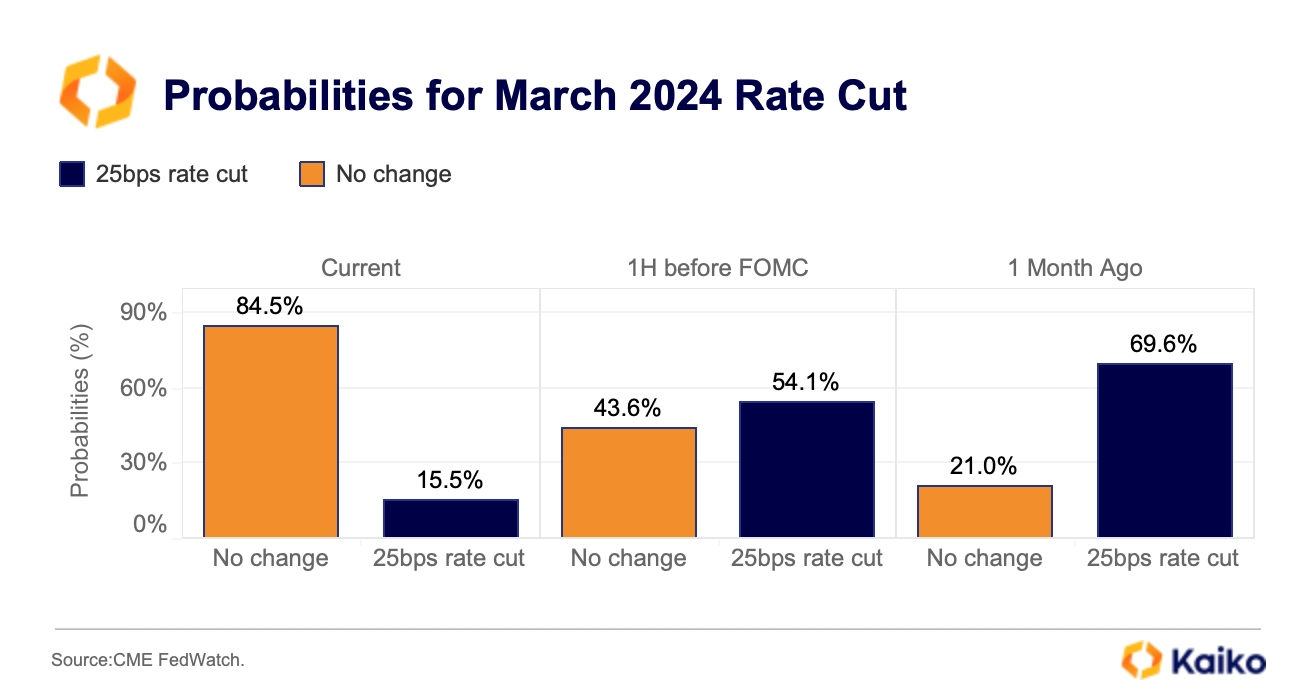

The U.S. Fed injects volatility into markets.

Risk assets saw significant volatility last week after the U.S. central bank pushed back against market expectations for imminent rate cuts and data showed that the labor market remains resilient. In the days after the Fed’s FOMC press conference, probabilities for a March rate cut dwindled from more than 54% to just 15.5%, according to the CME FedWatch tool. Overall, however, the macro backdrop remains supportive, with the Fed expected to start cutting rates in Q2. This will coincide with the Bitcoin halving event, which is seen as a potential tailwind for crypto assets.

![]()

![]()

![]()

![]()