Liquidity

Bitcoin enters summer liquidity doldrums.

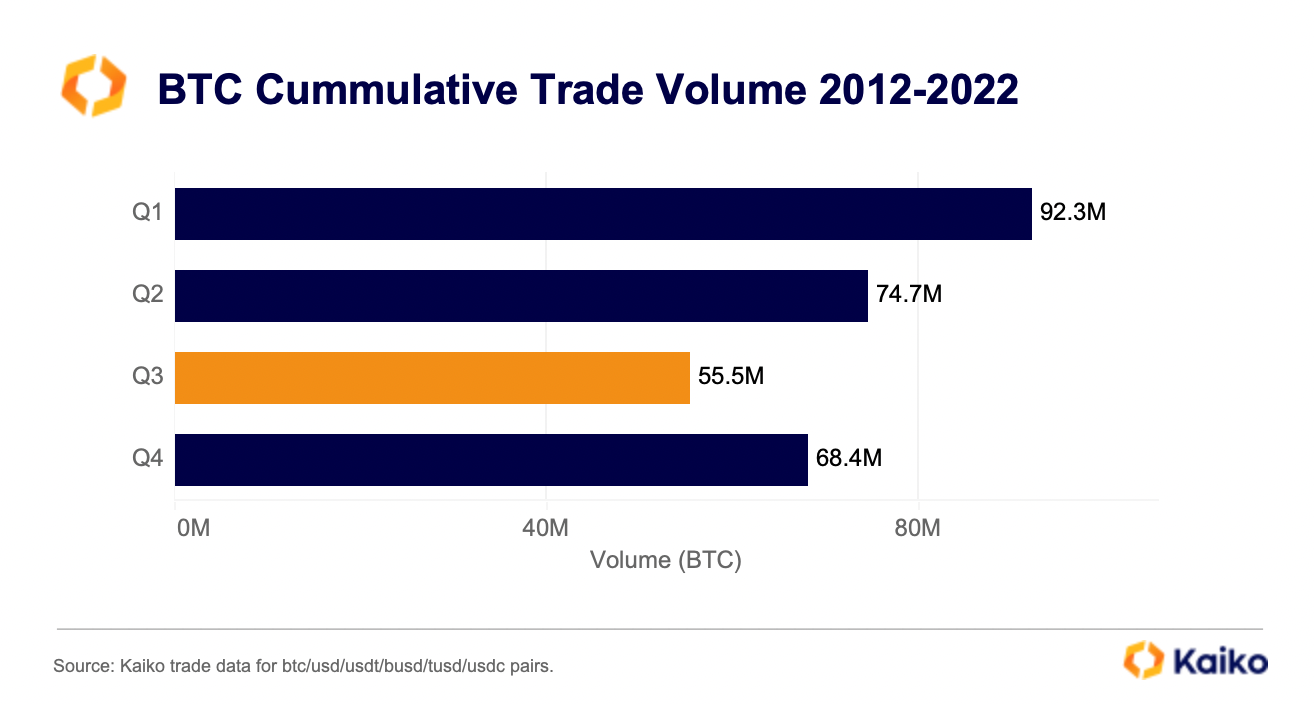

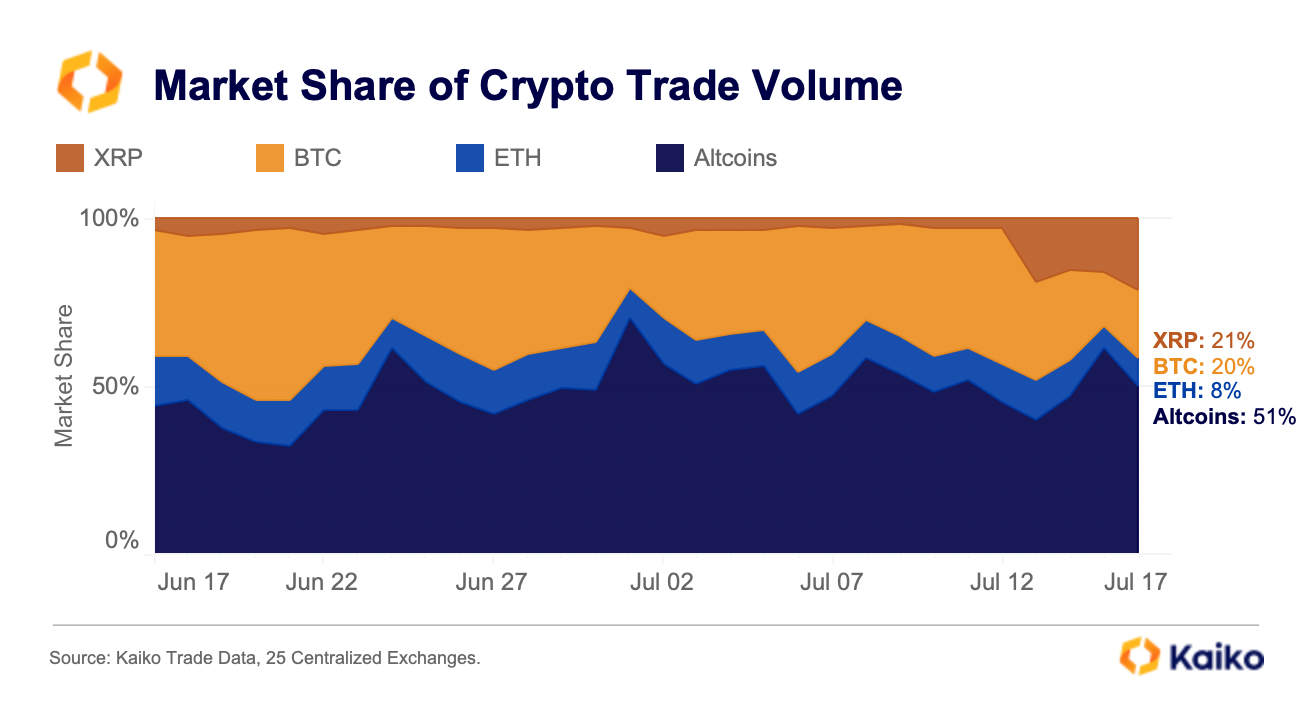

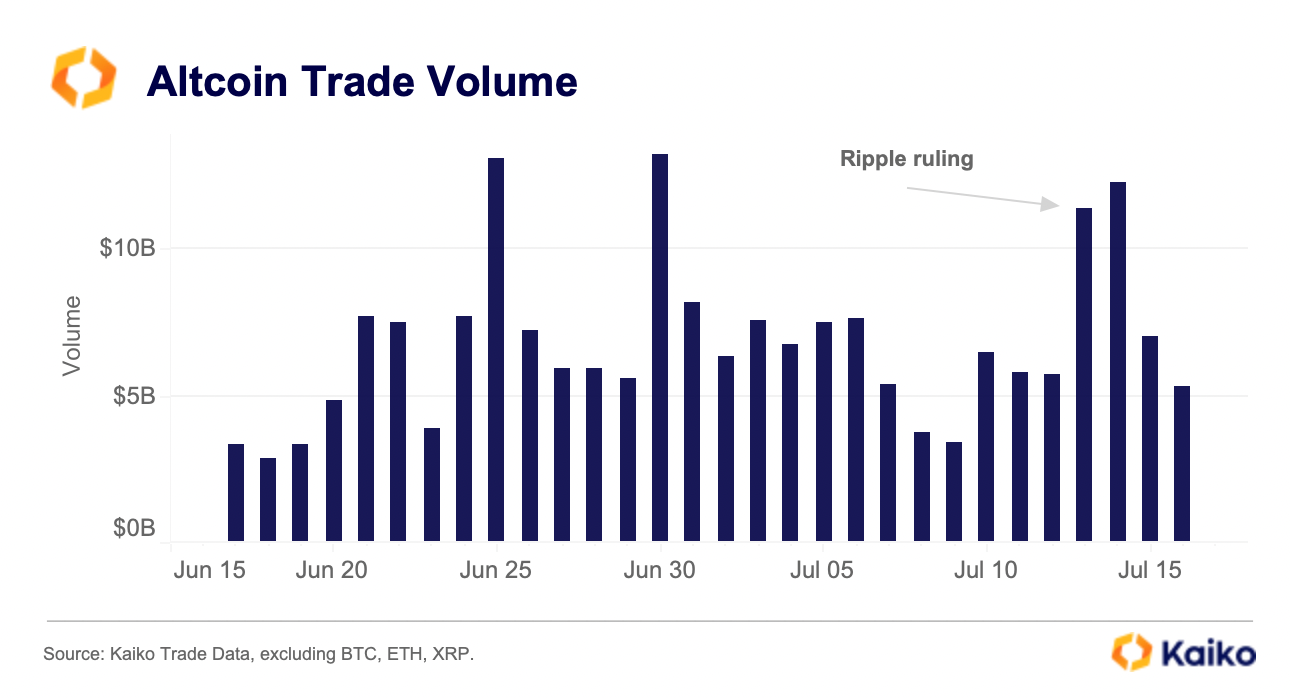

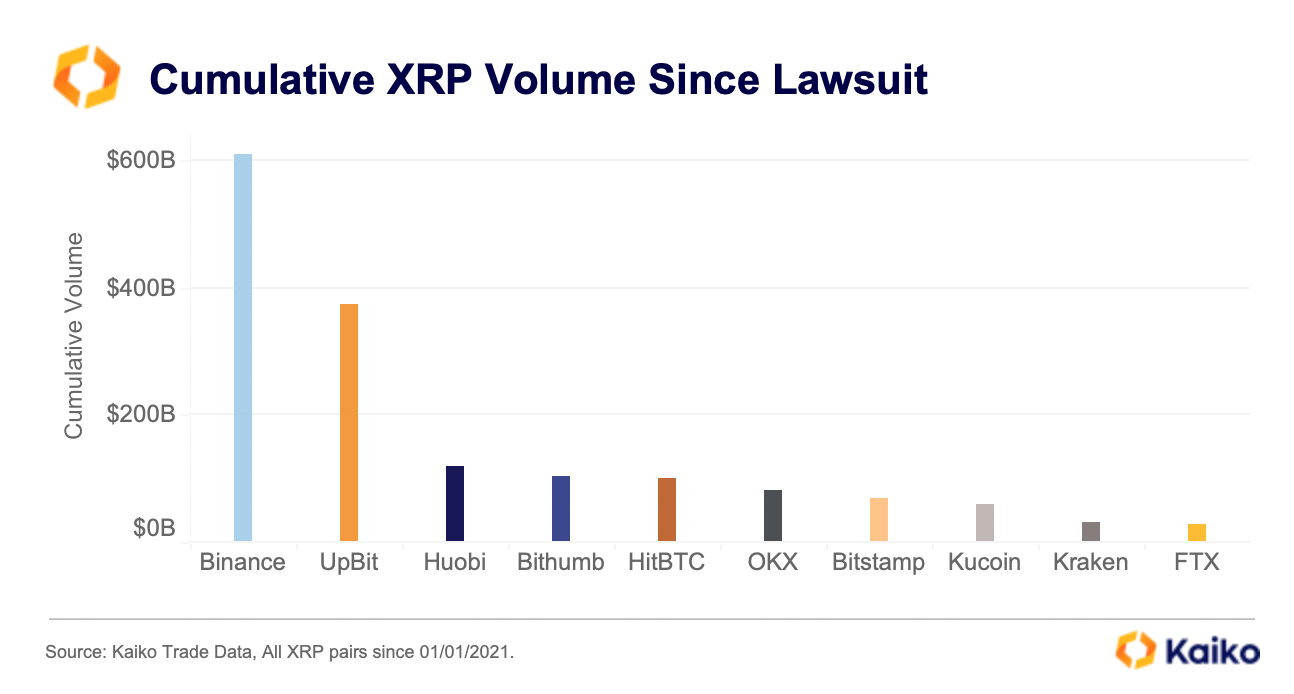

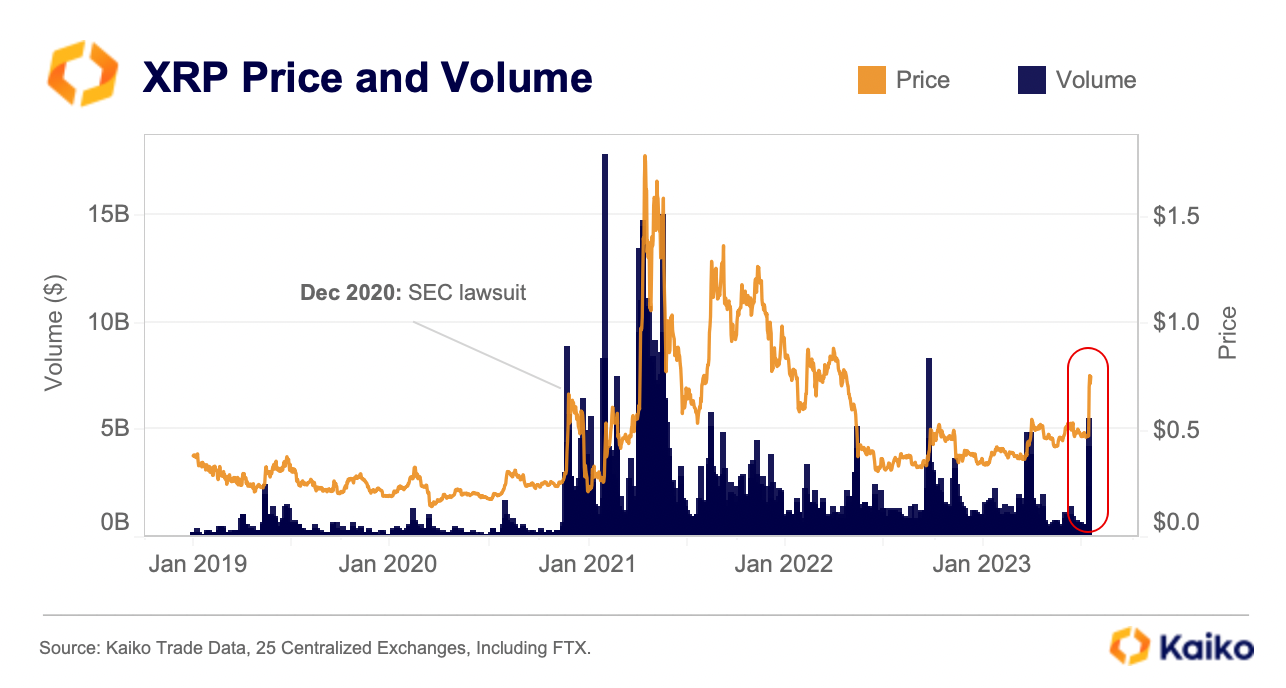

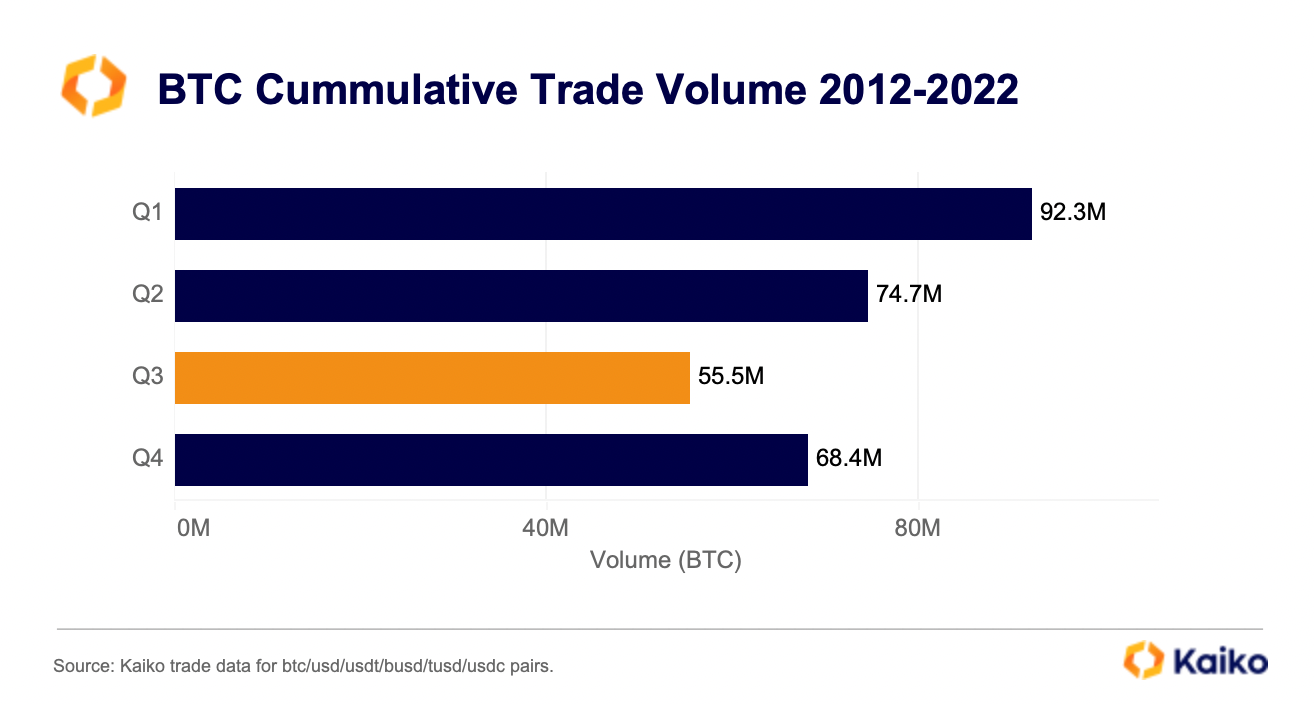

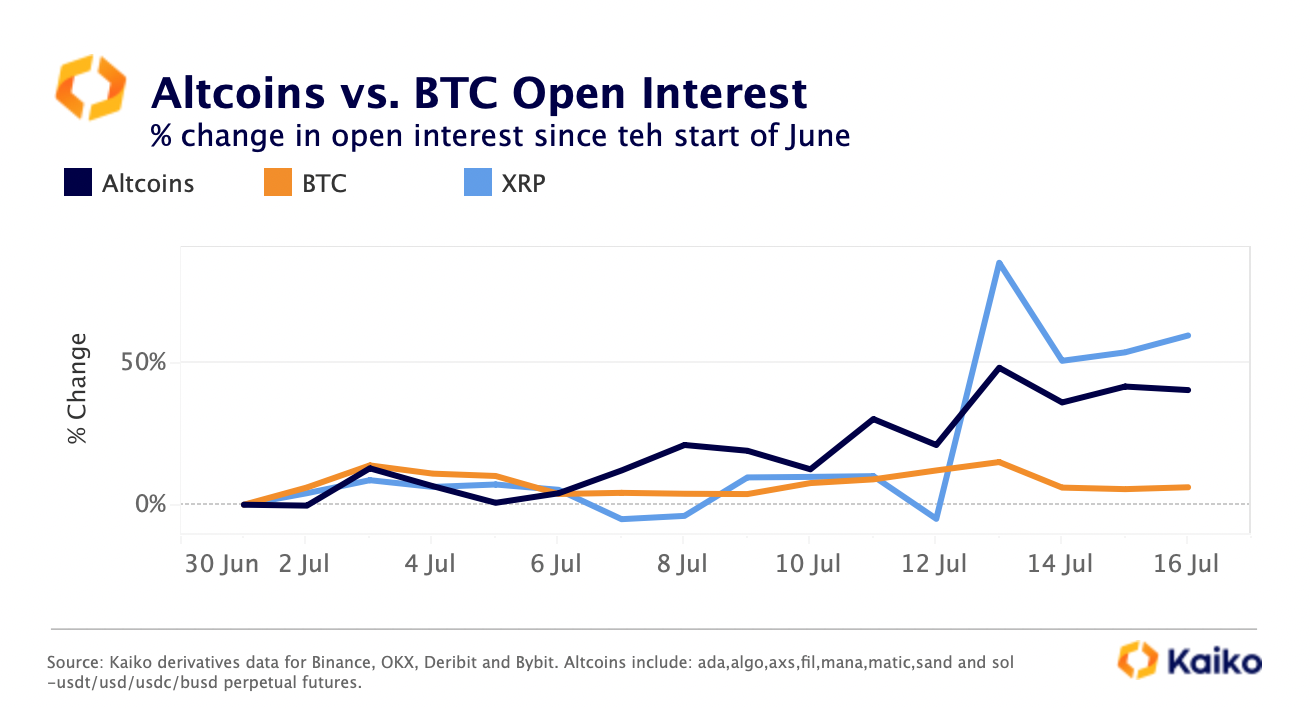

Q3 has historically been the lowest-volume quarter by a decent margin, suggesting that both crypto and traditional financial markets are entering the typical summer trading lull. Cumulative BTC trade volume in Q3 is a full 13 million (BTC) below the next lowest quarter. While the long awaited XRP ruling has the potential to boost lackluster trade volumes, its full impact will likely take some time to unfold.

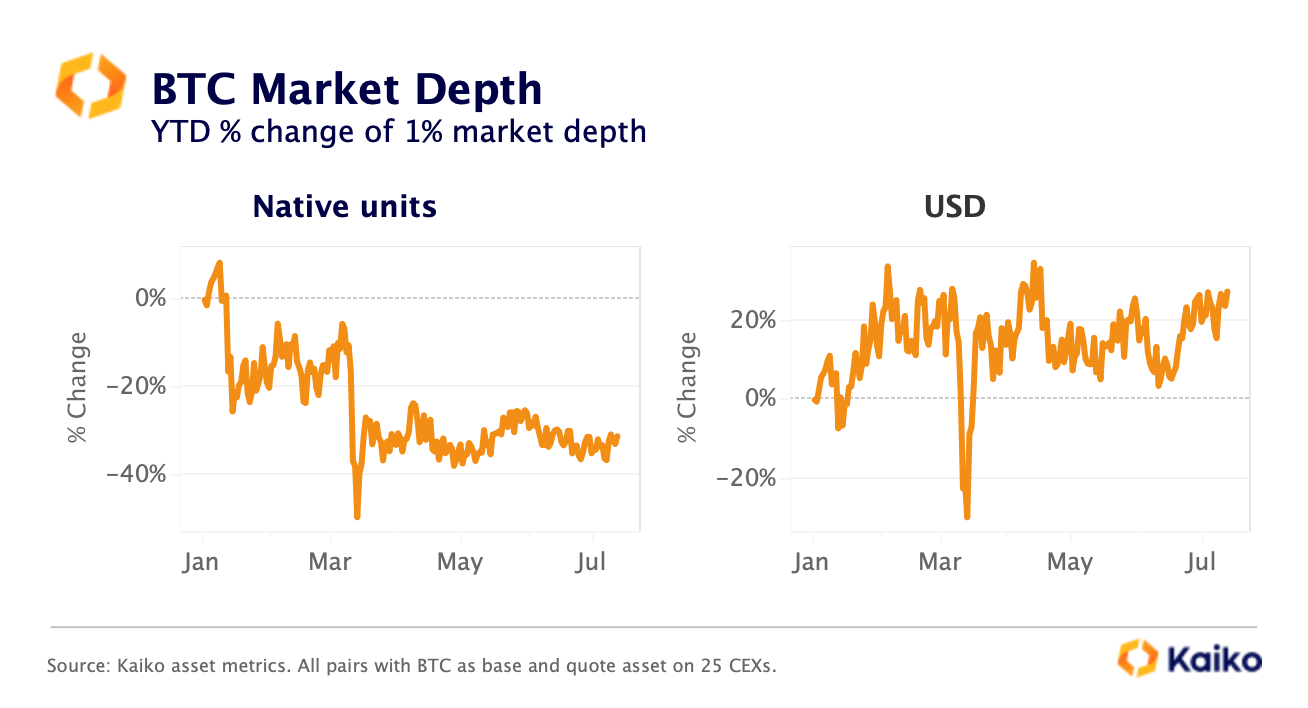

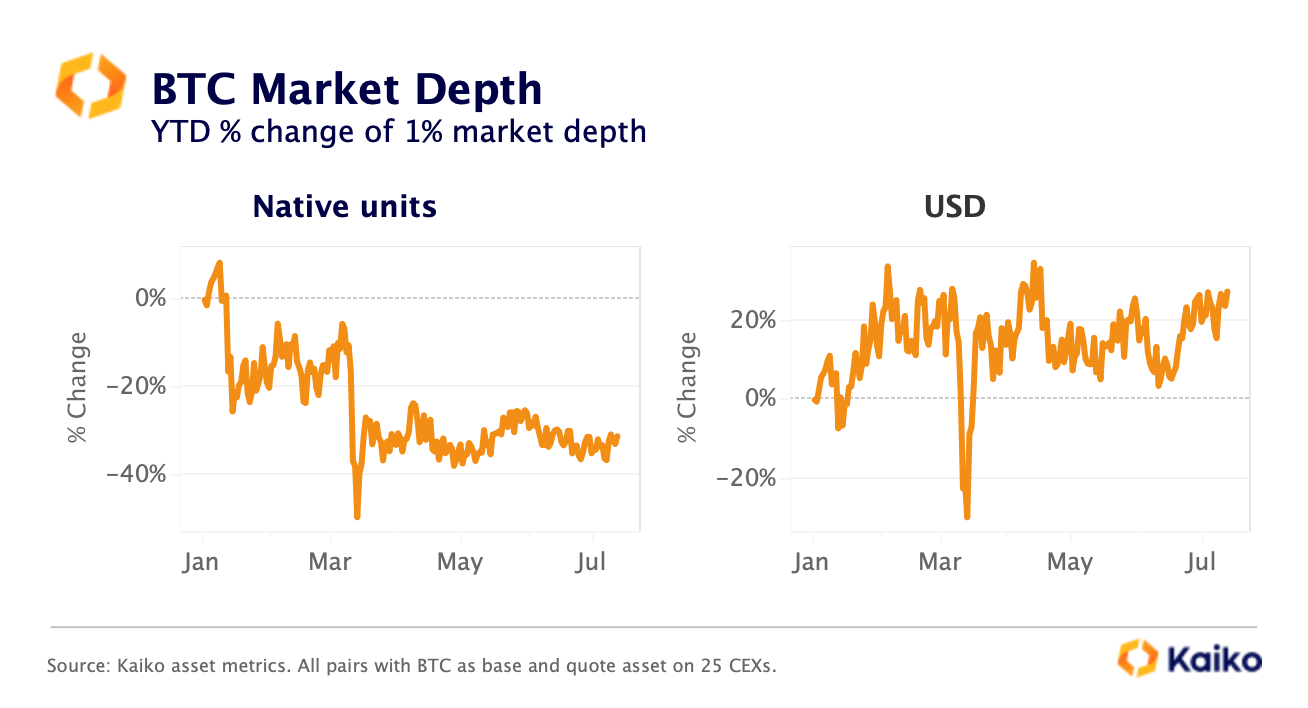

Order book liquidity — as measured by 1% market depth — could also be an area of concern during the summer doldrums, putting pressure on prices.

Despite the recent June rally, BTC 1% market depth as measured in native units remains 30% lower relative to January’s levels. Market depth as measured in dollars is up just 20%, despite BTC rallying far more. The drop in market depth has been stronger on US-based exchanges, where liquidity is down by 40% following an exodus on Binance.US, compared with a 25% drop in off-shore markets.

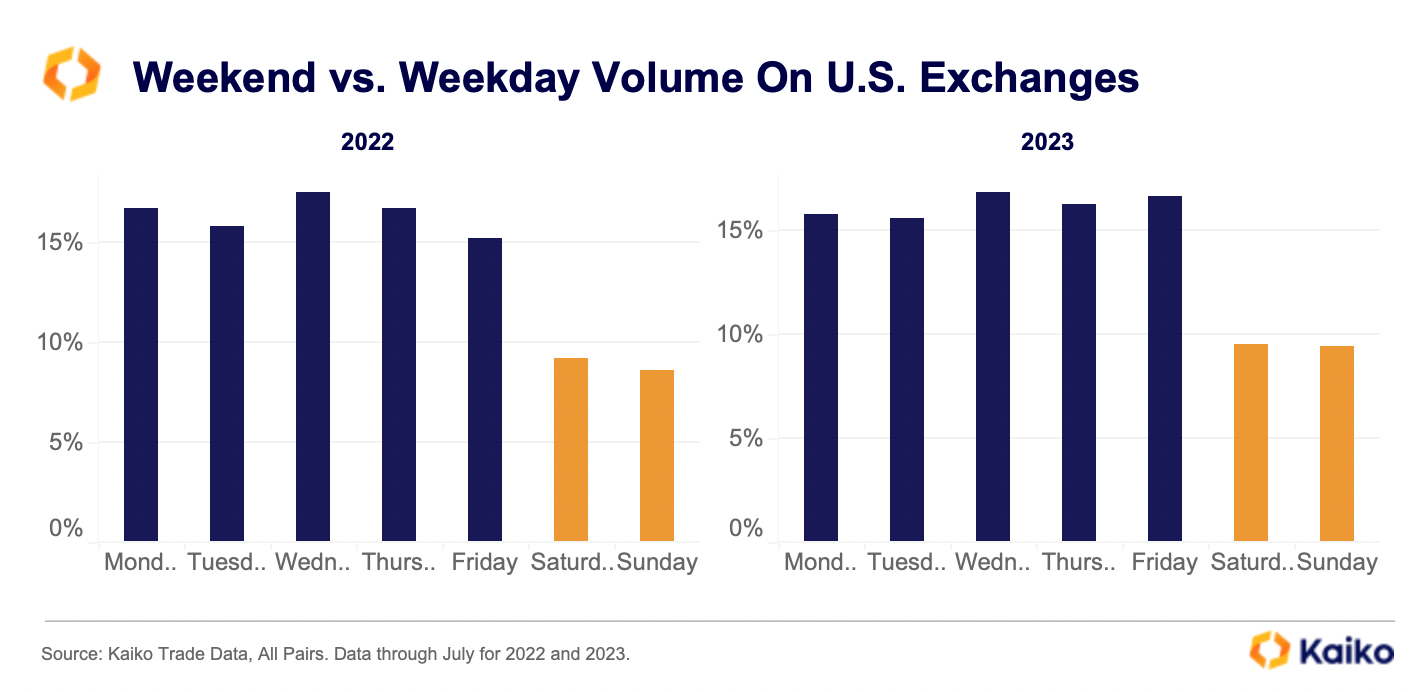

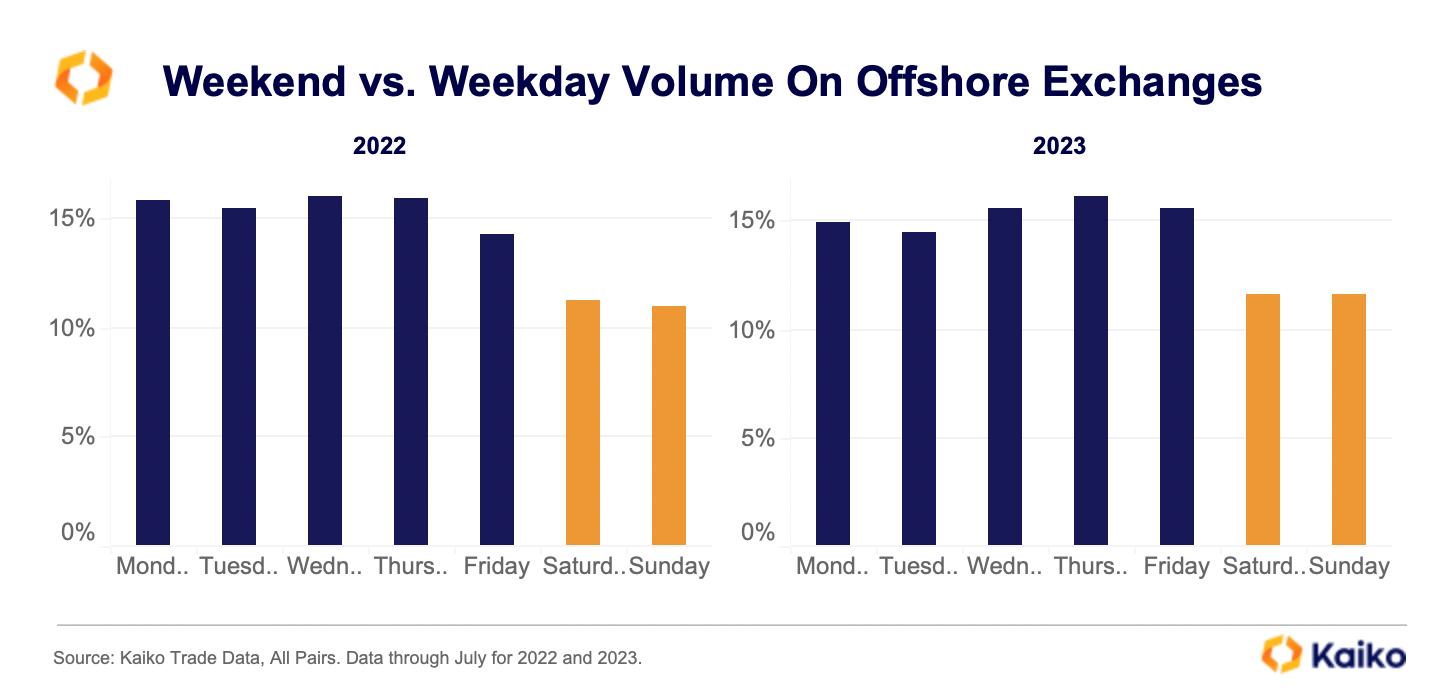

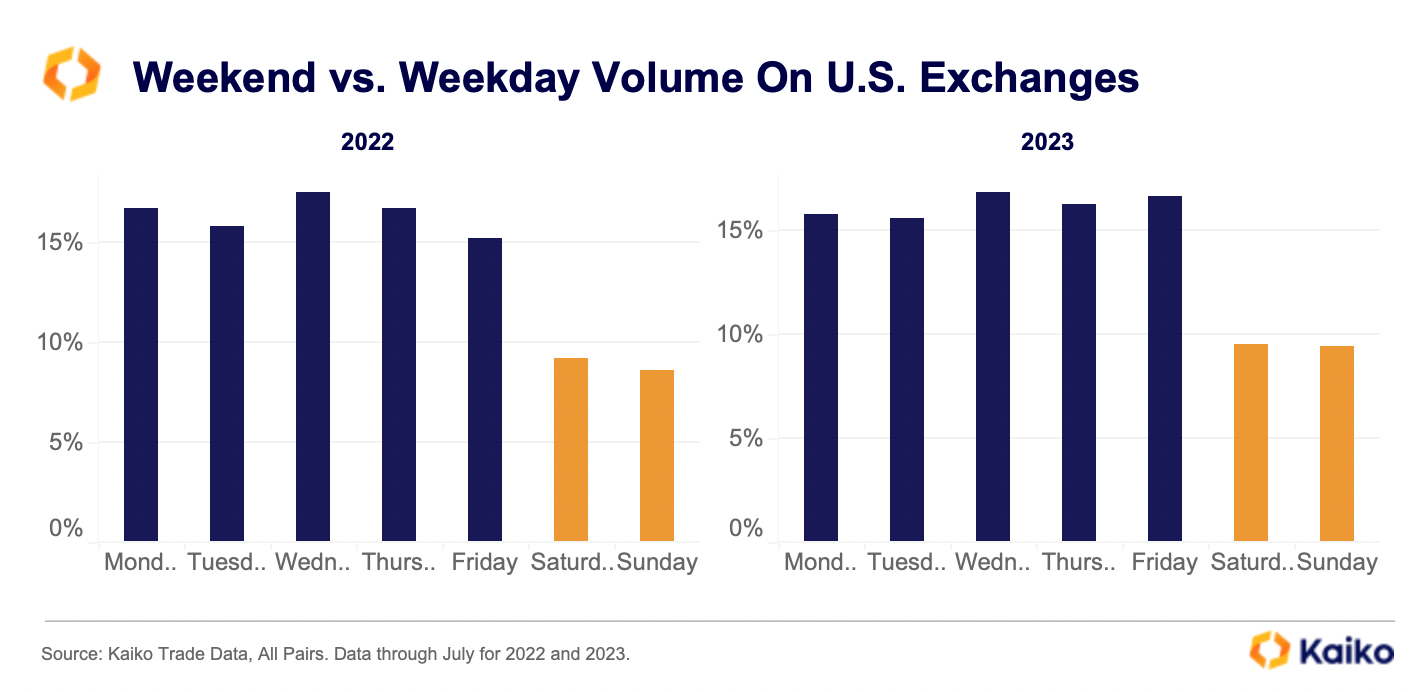

Weekend trading is resilient despite bank collapses.

Weekend trade volume on U.S. exchanges has remained resilient despite the collapse of two major crypto friendly banks — Silvergate and Signature — earlier this year. The share of weekend trade volume in 2023 has actually increased since 2022, accounting for a little less than 20% of total weekly volumes, compared with 18% the previous year.

This suggests traders have managed to operate as usual by either paying a higher price for transfers or switching to larger exchanges such as Coinbase, which managed to resume 24h/7 payment services almost immediately after the collapse of the real time crypto payment networks SEN and Signet.

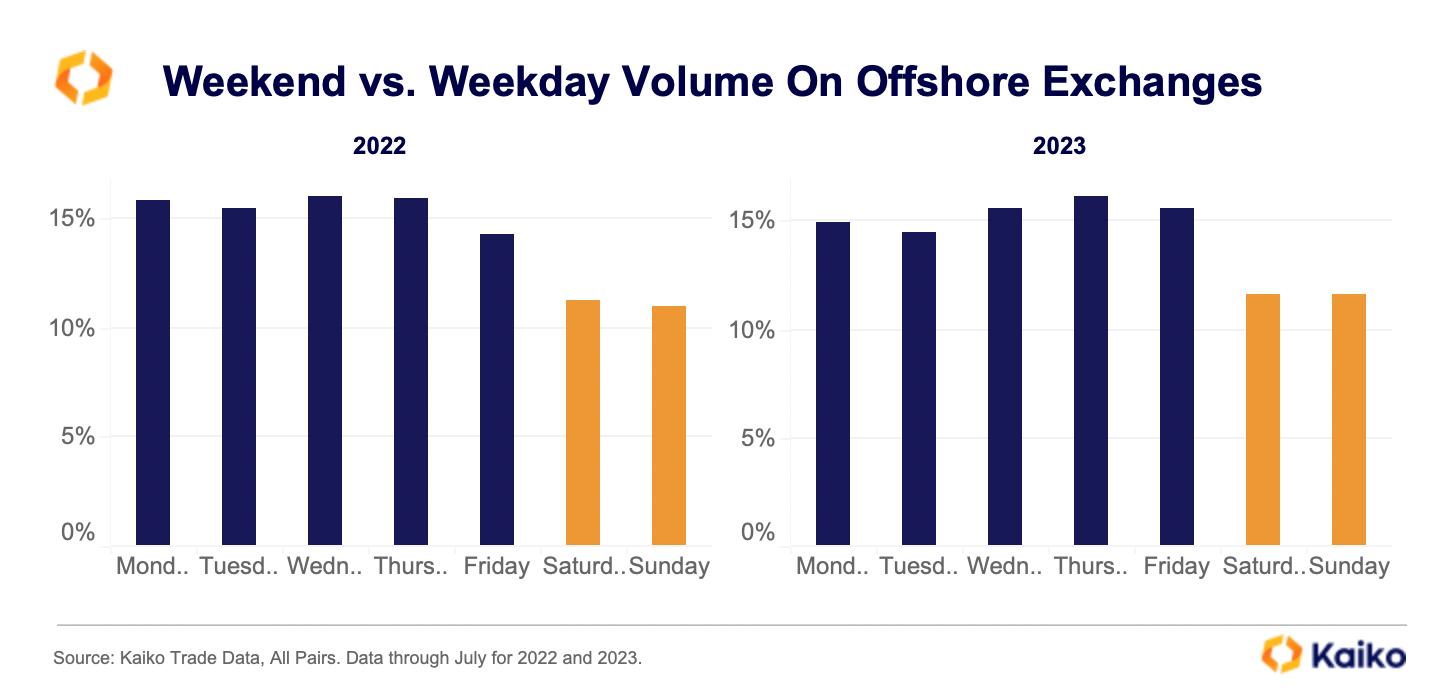

Interestingly, the gap between weekend and weekday trading is much smaller on offshore exchanges, suggesting these markets are more retail-driven. The share of weekend trading is firmly above 20%, with virtually no change year-on-year.

Many predicted the collapse of SEN and Signet would have had hugely detrimental effects to weekend trading activity, but so far we are not seeing this in the data.

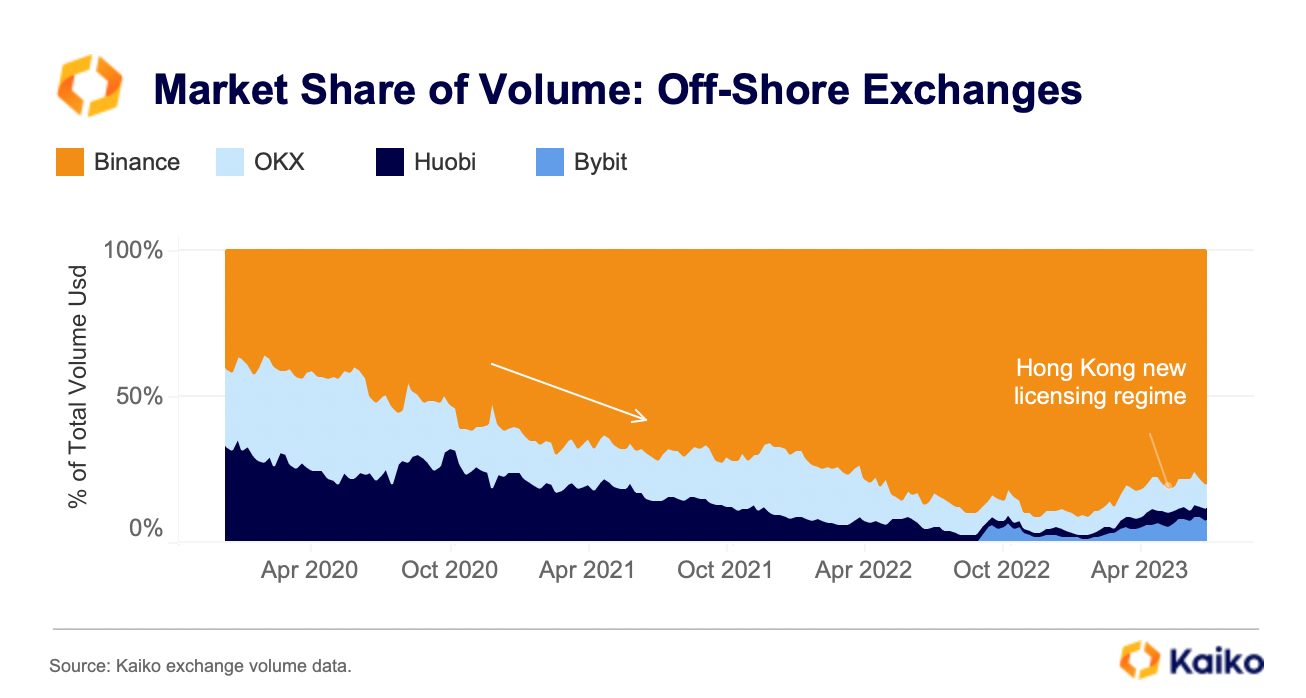

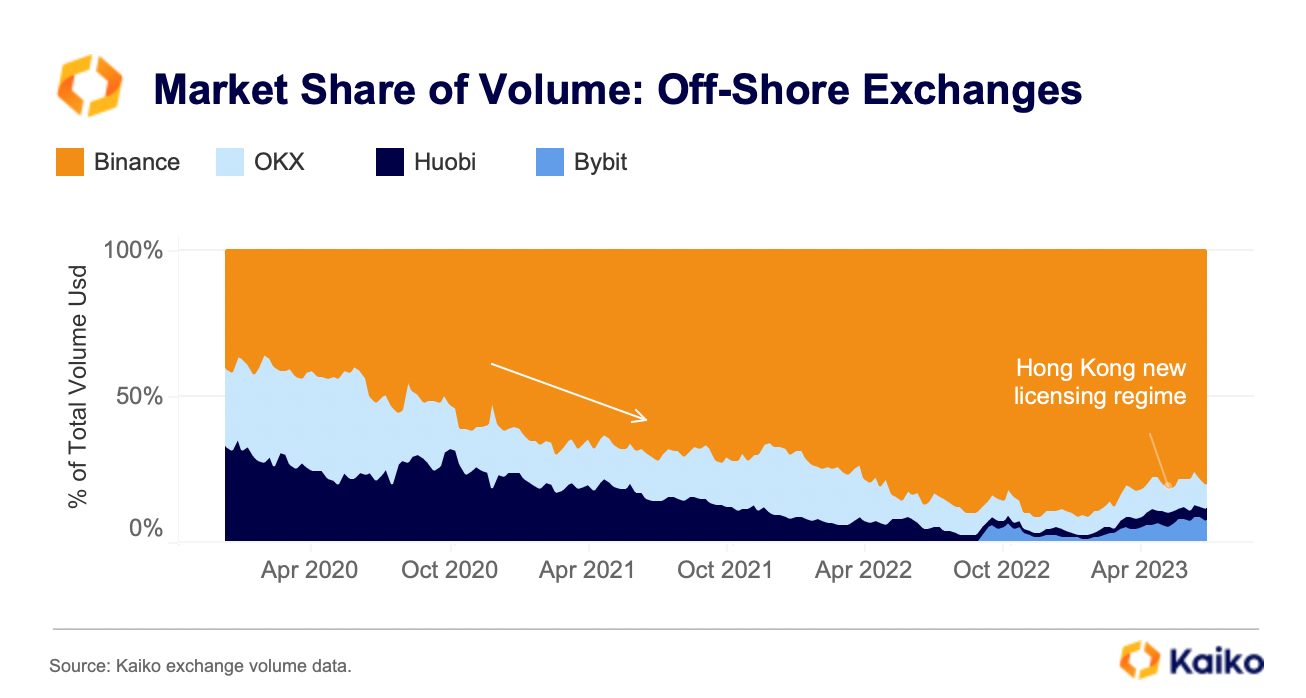

Binance faces competition among offshore exchanges.

Over the past few months, offshore markets have become less concentrated, with smaller exchanges gaining momentum as Binance’s global dominance suffers steep setbacks. Bybit, which launched its spot trading platform in 2022, saw the strongest increase in market share this year growing from 1% to 8%. OKX market share also jumped to 13% in June, before retreating to 9% in July. Although Huobi’s market share remains well below the highs of 2020/2021, it has rebounded to 5% after hitting an all-time low at the end of 2022.

The ongoing Hong Kong reopening will further intensify competition between exchanges. All three exchanges launched dedicated Hong-Kong platforms over the past few months and have seen strong local interest. This suggests some pent-up demand even though a rising number of economists fear a period of sluggish growth in China due to a lack of borrowers (known as a balance sheet recession).

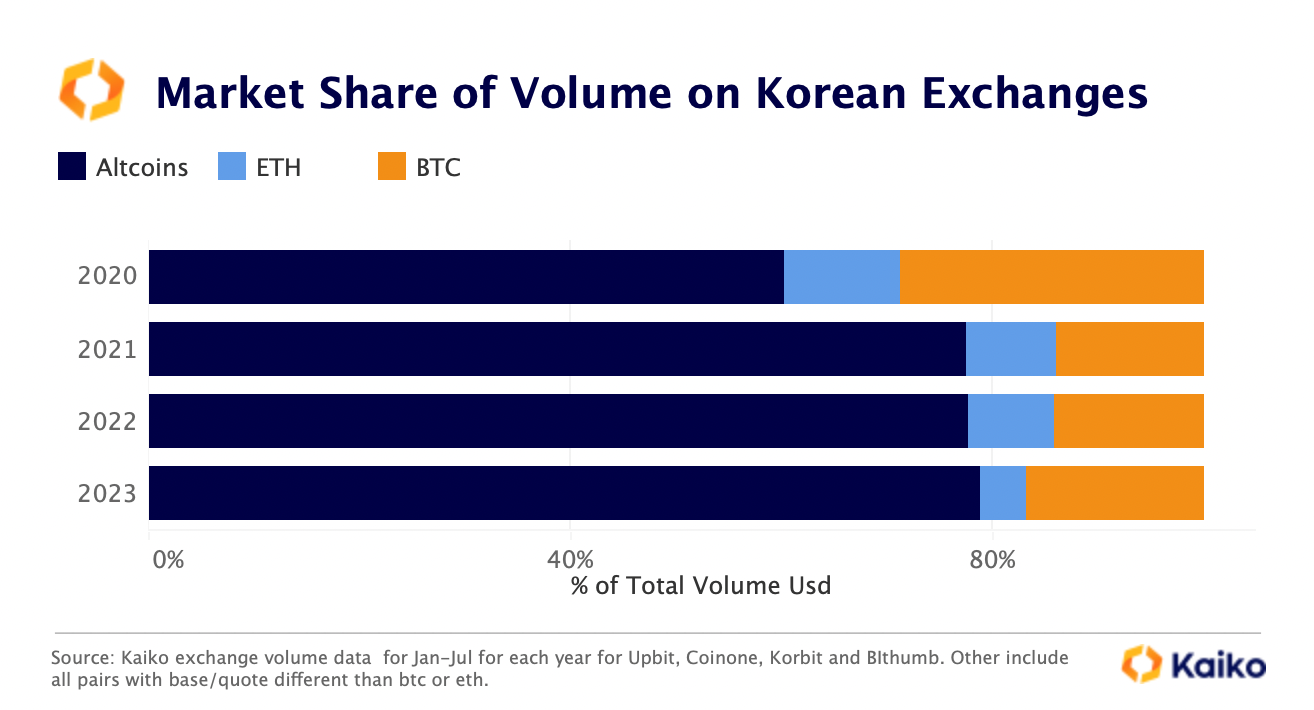

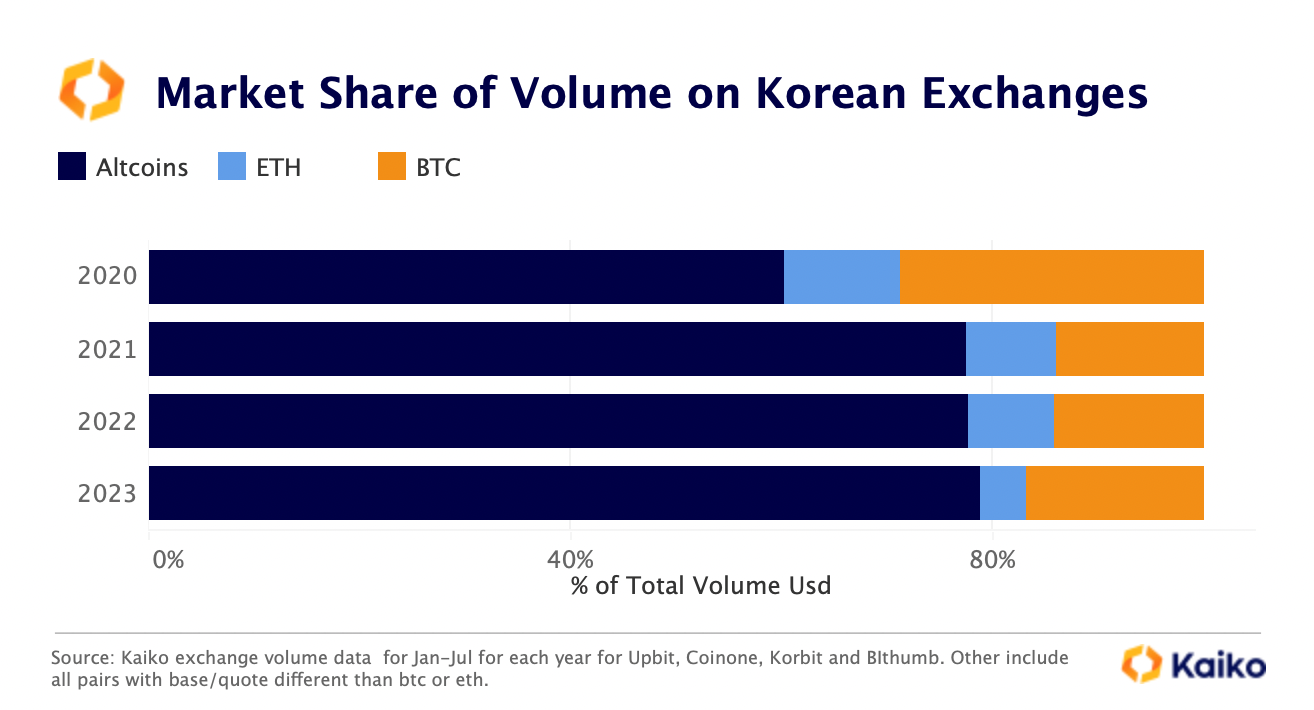

Altcoins increasingly dominate Korean markets.

Rising global bitcoin dominance has even managed to boost BTC trading on Korean exchanges, which are heavily-dominated by altcoins. The share of BTC traded on Korean markets rose from 14% to 17% in the first six months of 2023, after mostly declining over the past few years. Interestingly, the share of altcoins, which has been steadily rising since 2019, continued increasing and currently hovers around 80%. ETH lost the most interest from Korean traders.

South Korea has already implemented strict AML and KYC rules for virtual asset providers over the past few years and has recently adopted a new bill designed to enhance investors’ protection. The country’s crypto market is primarily driven by altcoin trading and was hit hard by the collapse of Terra’s ecosystem last year with around 200k local victims.

![]()

![]()

![]()

![]()

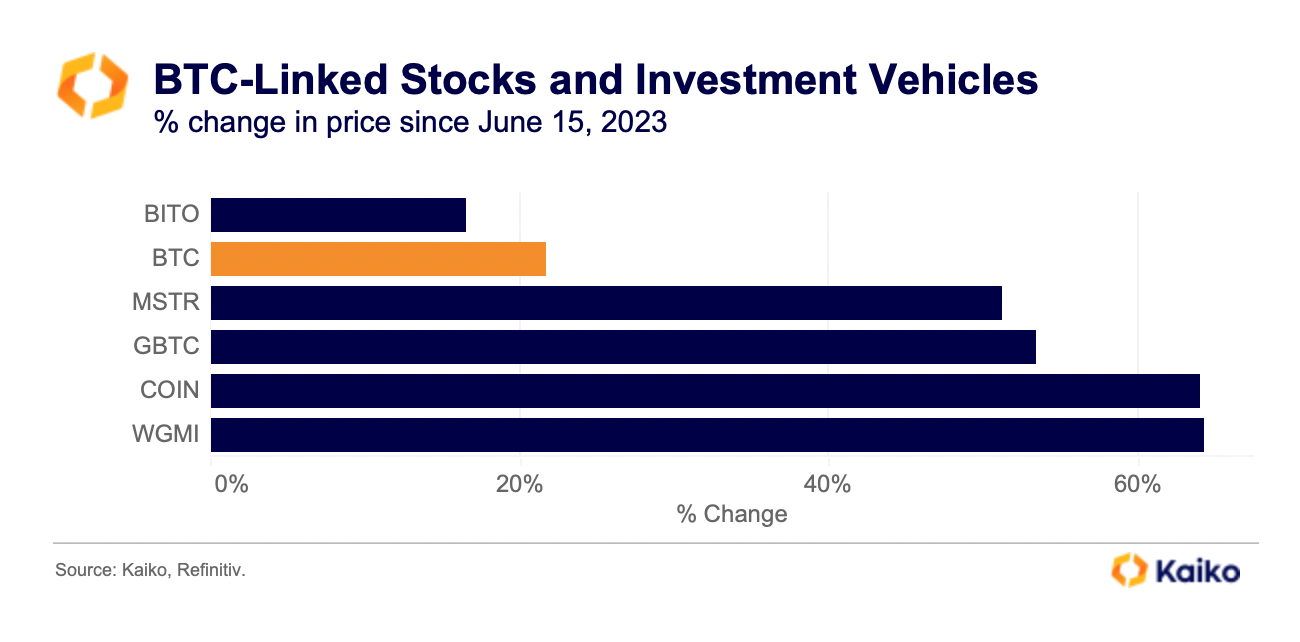

BlackRock’s spot BTC ETF filling has had diverging second-order effects on Bitcoin-linked stocks and investment vehicles as investors are factoring in its potential market impact. ProShares BITO futures-backed ETF underperformed BTC spot prices since June 15, while BTC miners and Coinbase outperformed by a large margin.

BlackRock’s spot BTC ETF filling has had diverging second-order effects on Bitcoin-linked stocks and investment vehicles as investors are factoring in its potential market impact. ProShares BITO futures-backed ETF underperformed BTC spot prices since June 15, while BTC miners and Coinbase outperformed by a large margin.