Liquidity

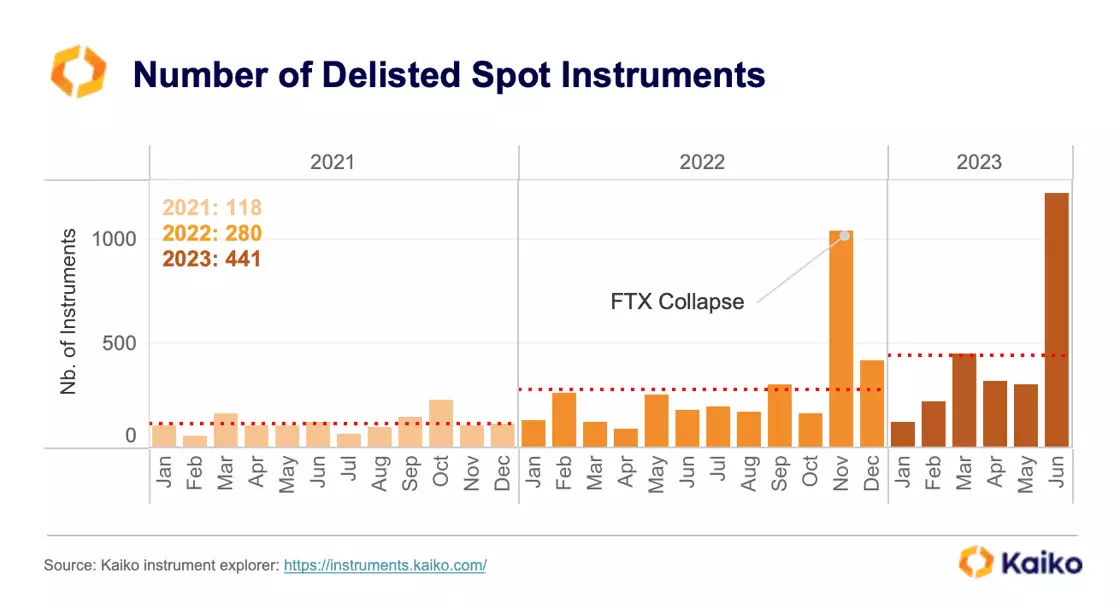

The number of delistings hits multi-year high.

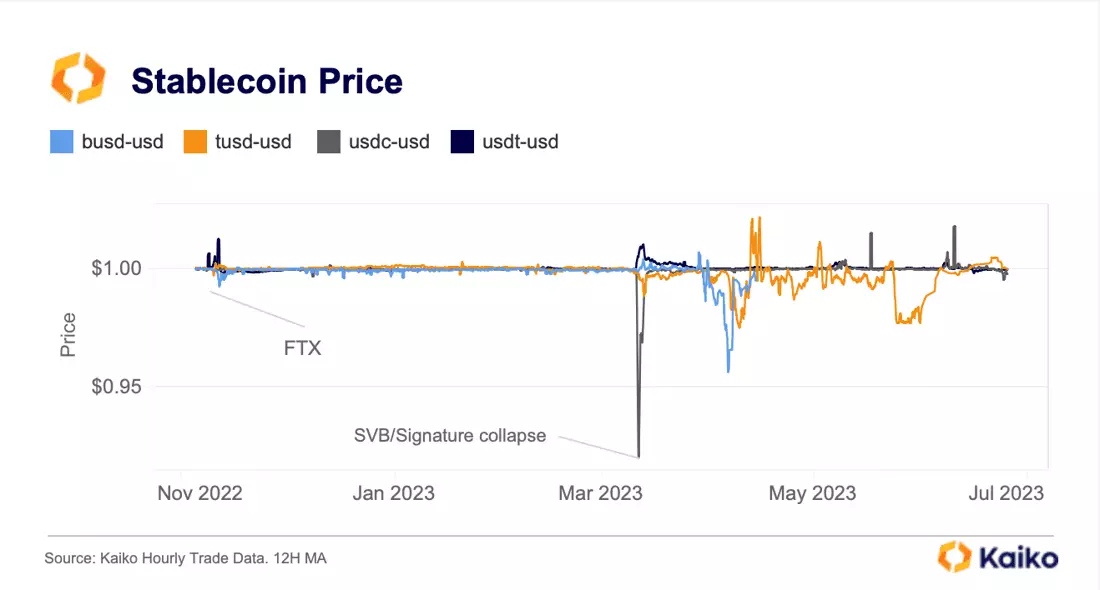

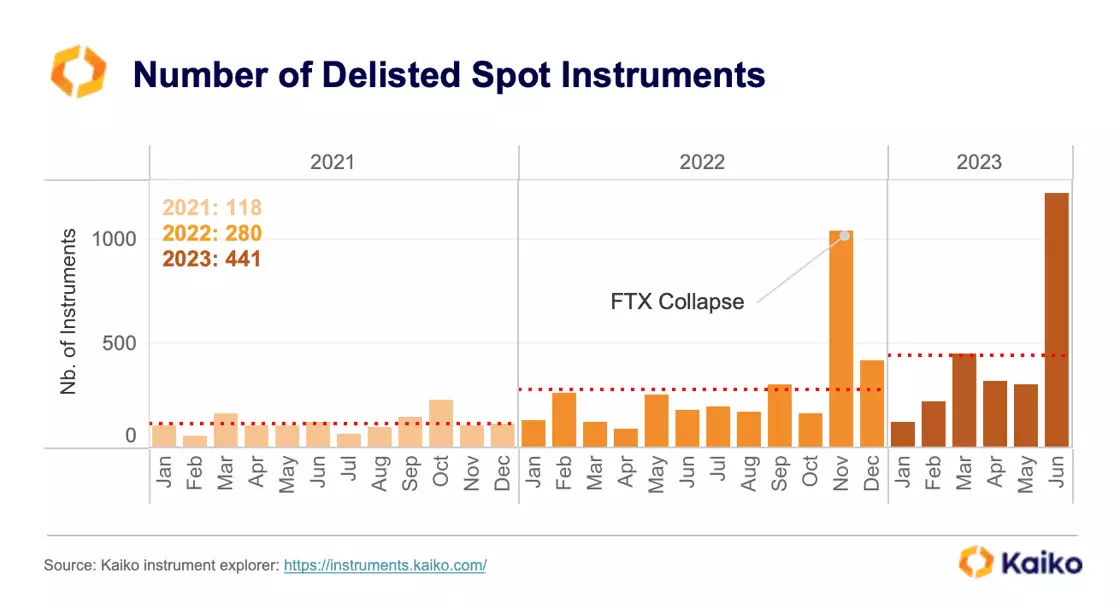

In June, the number of delisted spot instruments reached a multi-year high, surpassing the previous peak seen in November 2022 during the collapse of FTX and FTX.US. While delistings have been steadily increasing, with monthly figures doubling each year since 2021, the trend has significantly accelerated in 2023.

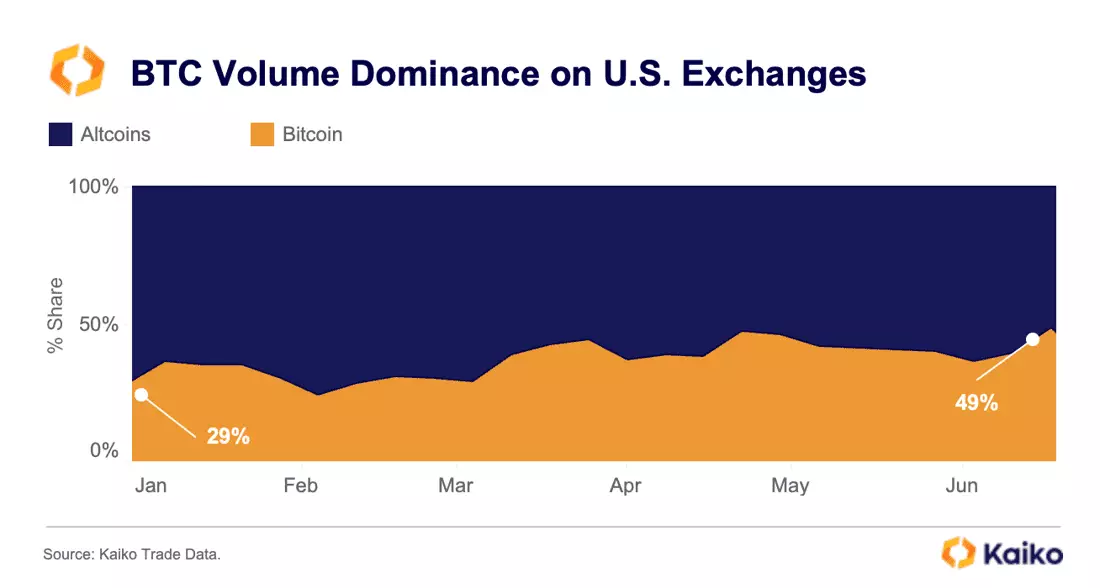

The majority of spot instruments were delisted from offshore exchanges, such as Huobi and HitBTC. However, the proportion of delistings on U.S.-based platforms has risen to 22% in 2023, up from 8% the previous year, primarily driven by Bittrex and Binance.US. Both exchanges have faced charges by the U.S. SEC for violating securities laws. Last week, Binance.US announced it would delist most USD pairs and transition to a crypto-only exchange.

The drop in global liquidity has also accelerated the pace of delistings. With less capital for market making, exchanges are opting to remove thinly traded instruments.

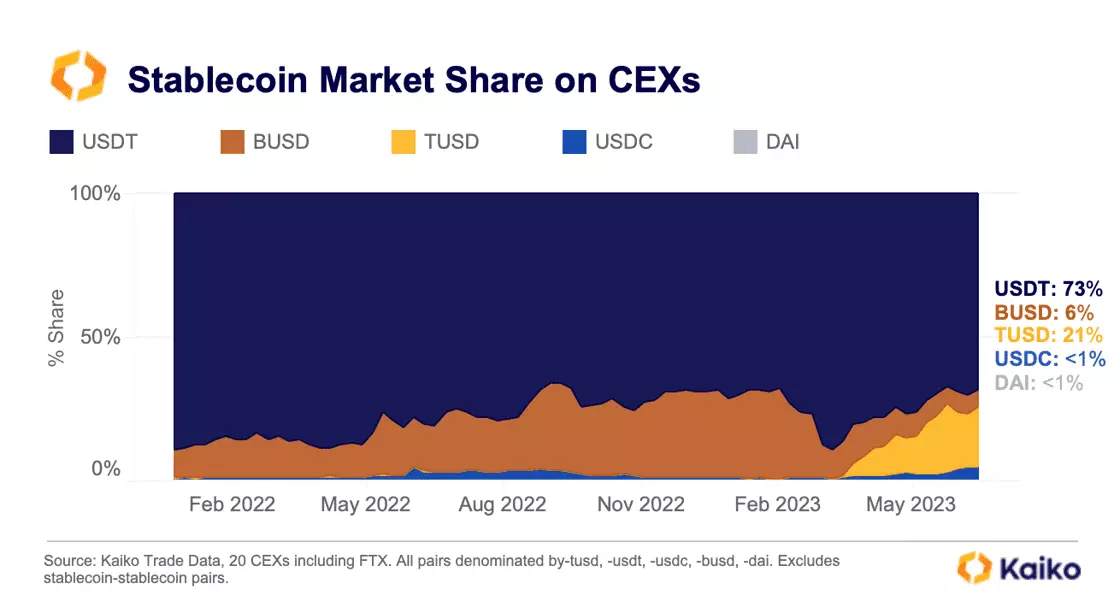

TUSD continues to soar despite redemption troubles.

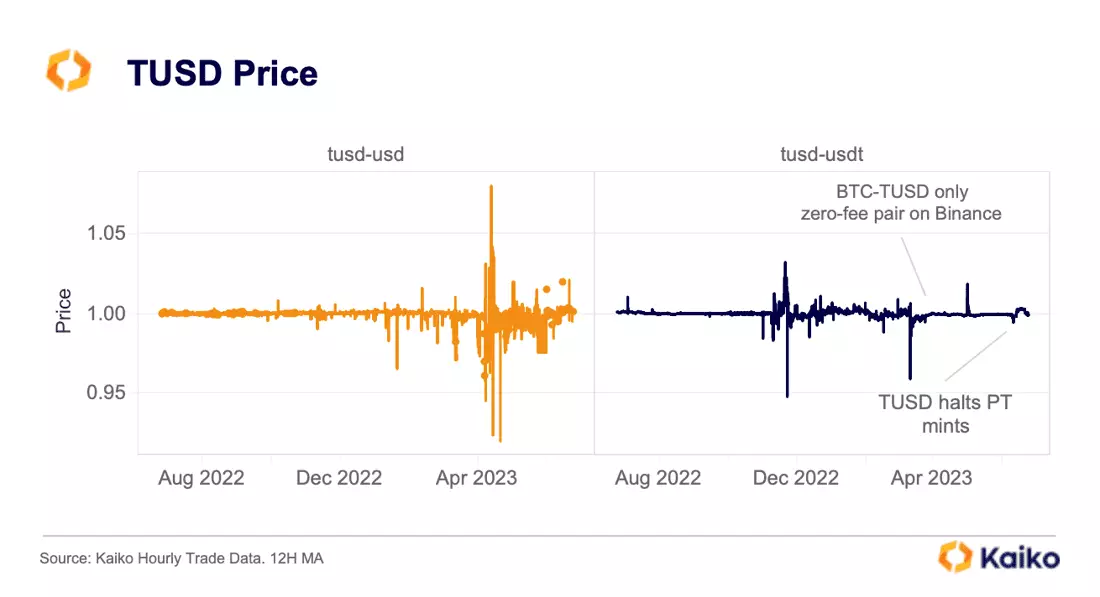

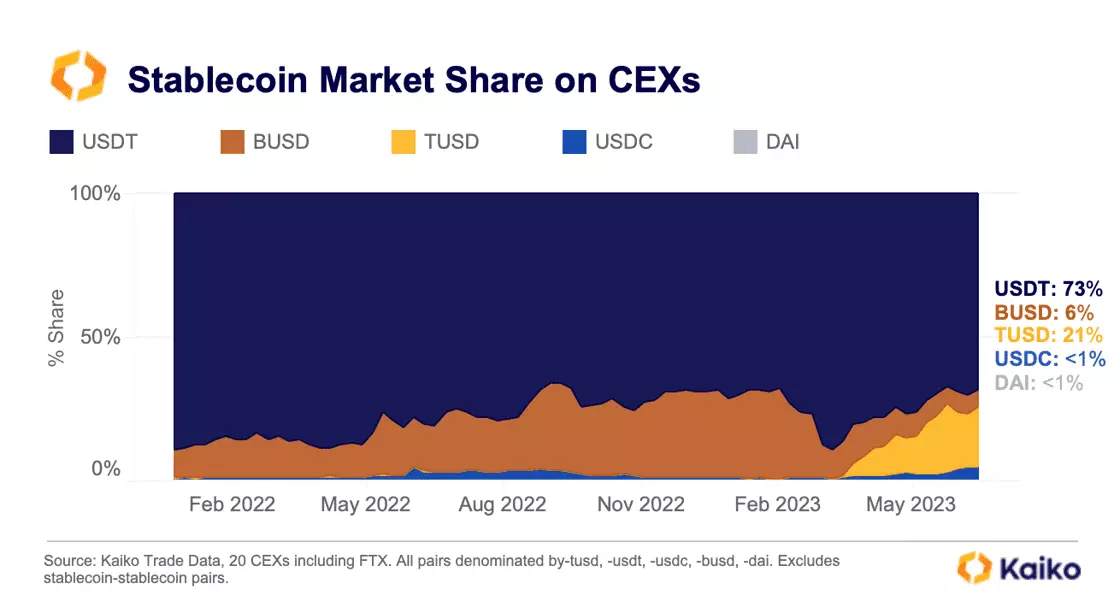

TUSD has quickly become the second largest stablecoin by trade volume, surpassing BUSD just one month after Binance started promoting the stablecoin in March. This rapid surge is almost entirely driven by Binance’s zero-fee BTC-TUSD trading pair. Today, global TUSD-denominated trade volume accounts for 20% market share among other stablecoins, up from practically zero pre-Binance listing.

Yet, TUSD is facing a growing crisis of confidence after Prime Trust, a U.S.-based custodian, halted redemptions last week. The stablecoin claims to have no exposure, but this hasn’t stopped traders from shorting it.

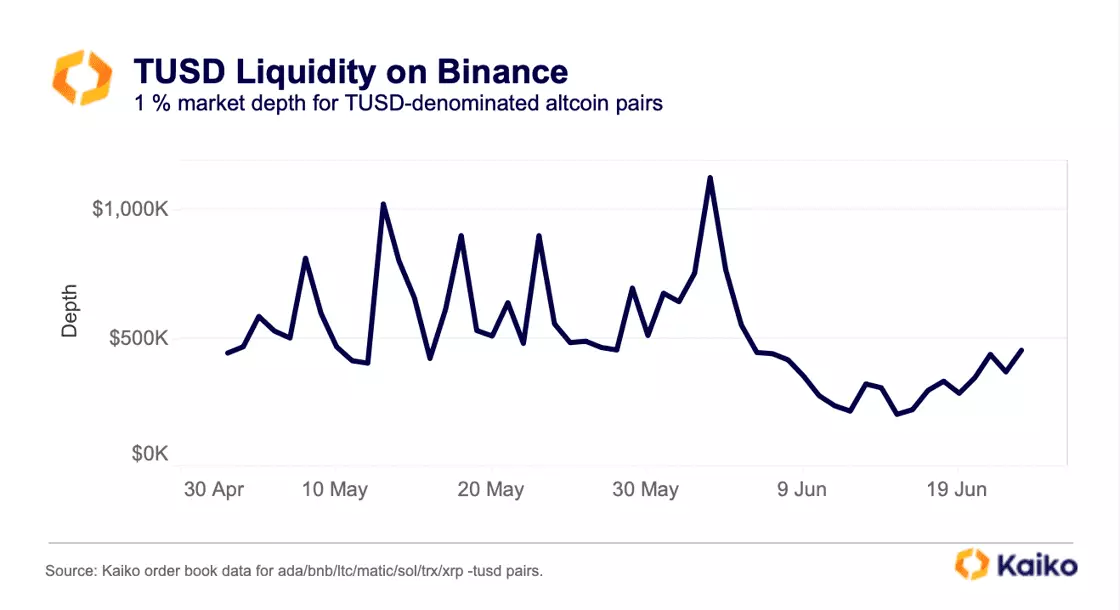

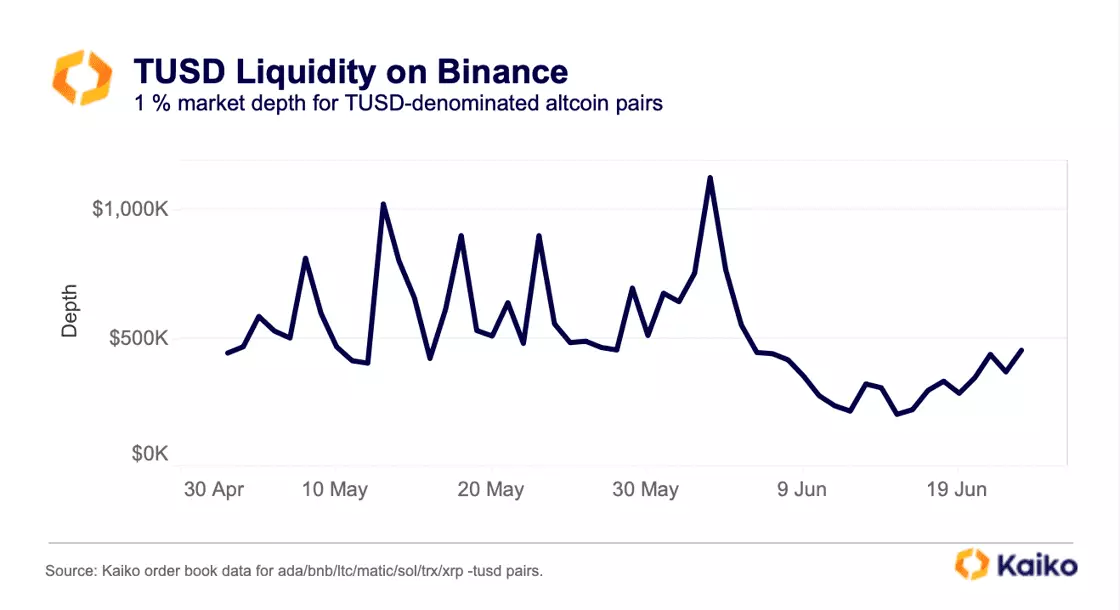

Despite the surge in TUSD volumes, market depth has lagged, which suggests market makers are cautious to hold this high-risk stablecoin. Low liquidity poses a significant risk for the exchange in the event that TUSD loses its peg. The market depth for top altcoin pairs denominated by TUSD has decreased by nearly half in June compared to May, amounting to approximately $400k.

To enhance TUSD liquidity, Binance recently announced that it is expanding its TUSD maker zero-fee promotion to all TUSD pairs, a move designed to shore up low liquidity for altcoin markets. Daily trade volumes have surged, hitting as high as $11mn, almost 40 times the market depth, following the Prime Trust announcement on June 10.

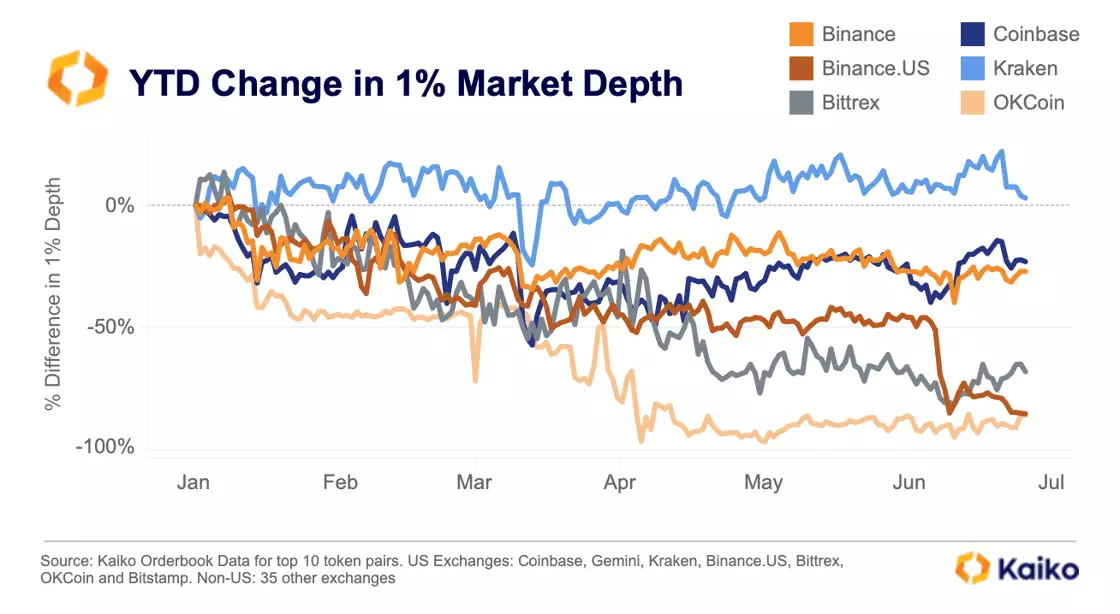

Kraken bucks global liquidity trends.

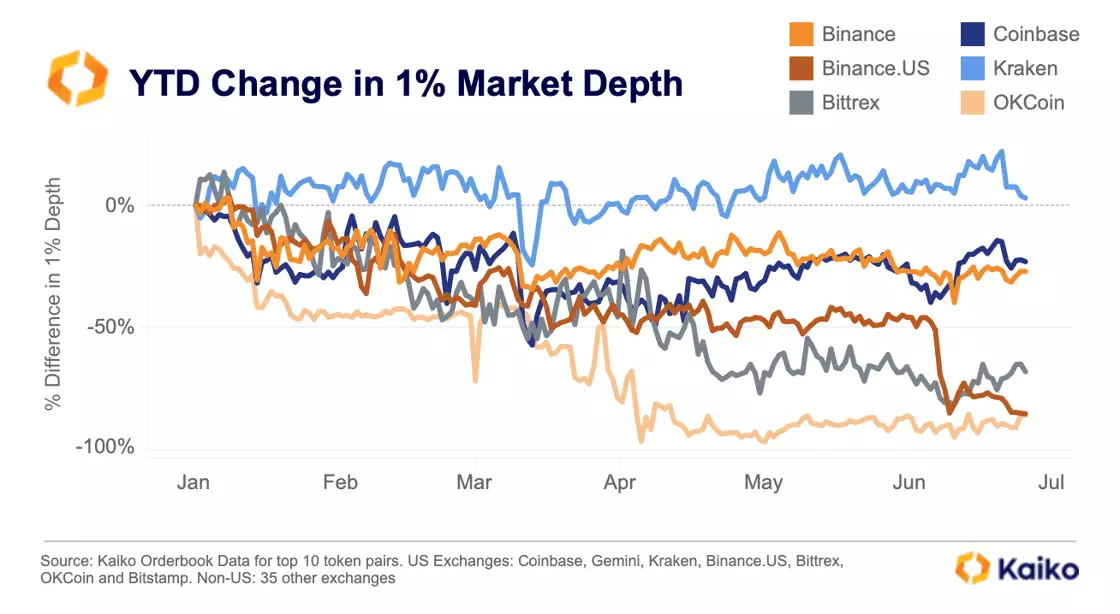

Kraken seems to be flying the flag for U.S. crypto liquidity. Kraken is the only exchange we cover that has increased its market depth since the start of the year. All other U.S.-available exchanges have experienced a sharp drop in liquidity.

Bittrex, Binance.US and OKCoin have seen their market depth drop the most for the top 10 tokens, with Bittrex depth down 68%, while Binance.US and OKCoin are both down 85% year to date. OKCoin suspended USD deposits after the banking crisis in March and Bittrex recently filed for bankruptcy. Kraken has largely avoided the regulatory crackdown, although it was forced to shutter its ETH staking service earlier this year.

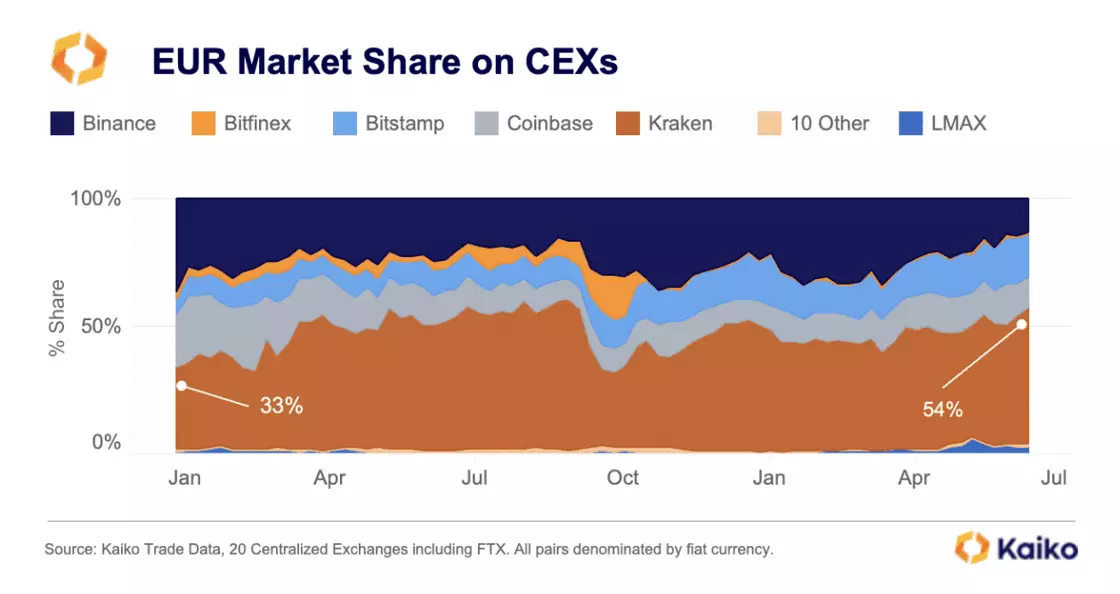

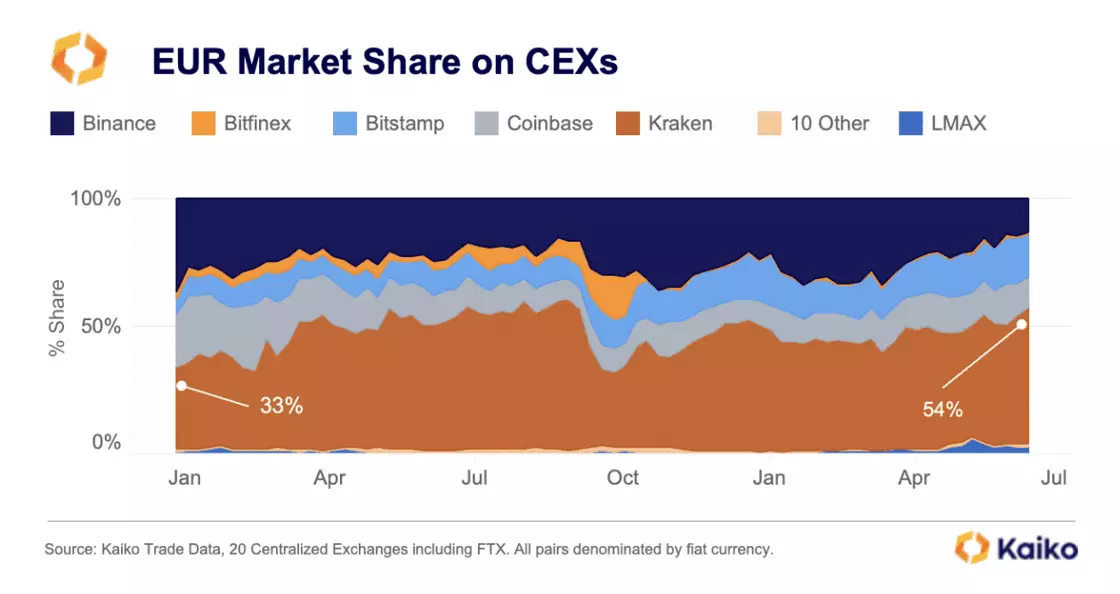

The good news continues for Kraken when zooming in on EUR market share of volumes, as it has improved its share from 33% to 54% this year. The increase in share for Kraken has largely been at the expense of Binance and Coinbase. Bitstamp has also seen a significant increase in its share of volumes.

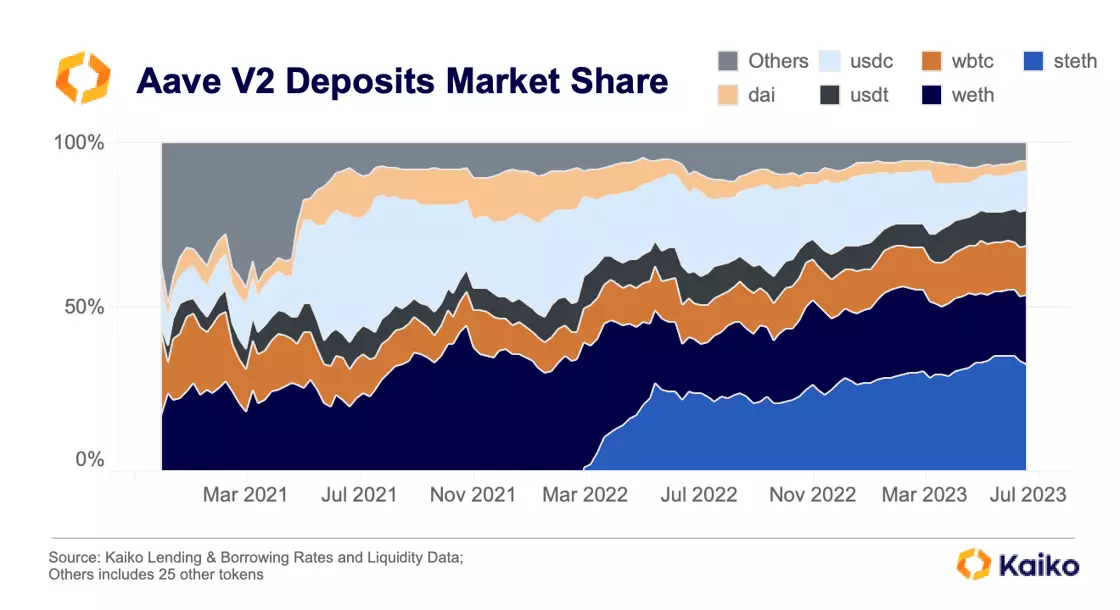

stETH’s deposit share on Aave drops from all-time highs.

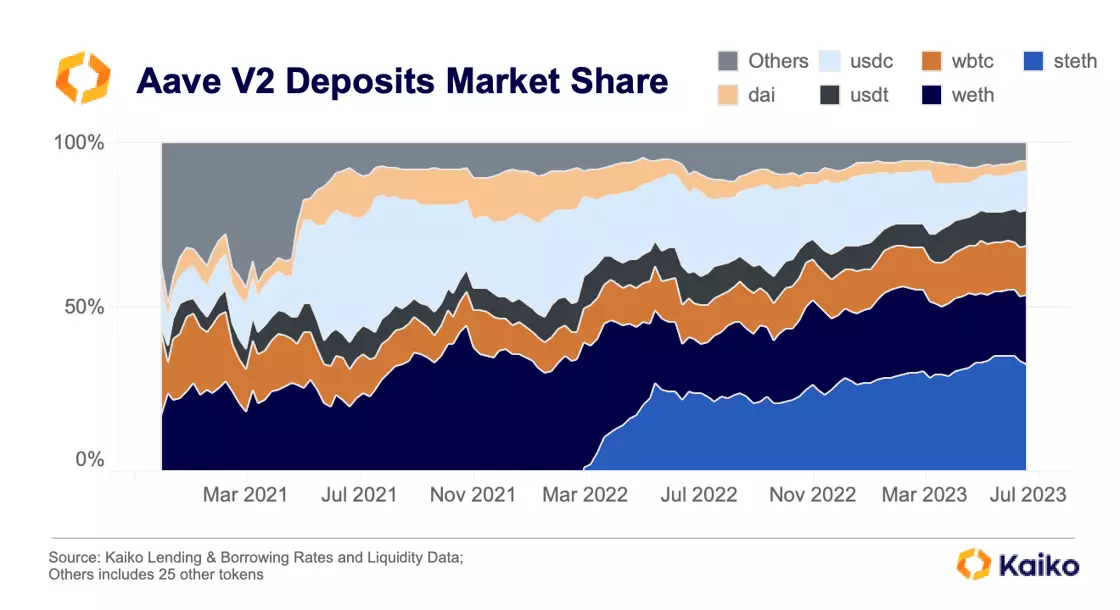

Within three months of being added to Aave V2, stETH became the most popular deposited asset, displacing wETH. Since September of last year, its share has steadily grown from 20% to 35% of total deposits. However, over the last two weeks, it has declined from its all-time high share of 35% to 32% as about 100k stETH have been removed from the protocol. Meanwhile, the Aave V3 protocol has been steadily growing, suggesting that the events of the past two weeks involving CRV (detailed in our latest Deep Dive) may have spurred some users to migrate from V2 to V3.

![]()

![]()

![]()

![]()