Trend of the Week

Staked ETH market tapers amid diversification.

The staked ETH market cooled in 2024. Since August, the ETH validator queue has averaged less than a day and has rarely surpassed four days throughout the year—significantly shorter than the peak of 45 days in June 2023. Compounding this is the decline in ETH staking rewards. Currently, the ETH staking yield is lower than those offered by other major Layer 1 protocols such as Cosmos, Polkadot, Celestia, and Solana, where rewards range between 7% and 21%.

However, Ethereum staking yields remain the de facto benchmark in decentralized finance, playing a role analogous to the US federal funds rate in traditional finance.

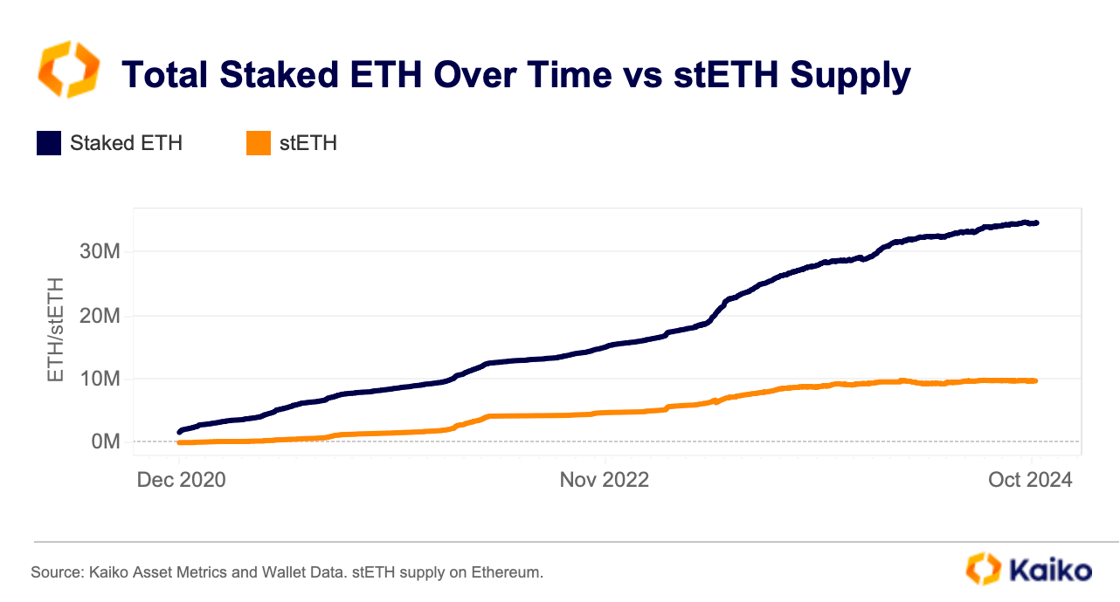

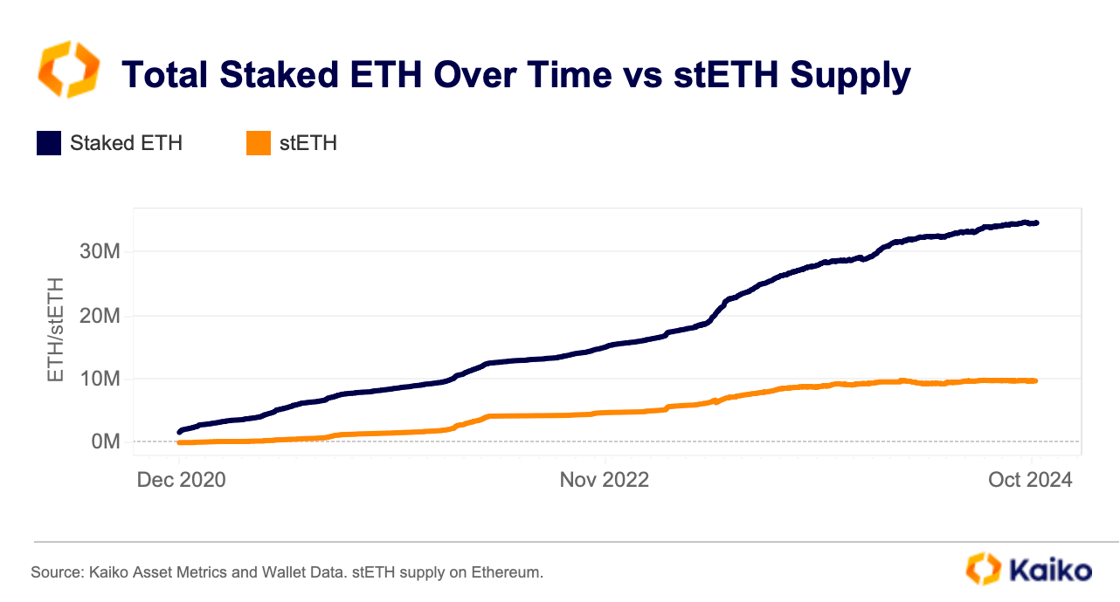

While staking inflows have begun to taper off, growth in the supply of the largest Ethereum staking participant has plateaued. The supply of Lido’s staked ETH, stETH, has remained relatively constant this year, averaging 9.6 million ETH. This reflects a slower growth in the overall amount of ETH deposited in the Beacon Chain contract, which has increased by approximately 5.7 million ETH this year, after nearly doubling last year.

Lido’s stETH, which represents approximately 28% of the total staked ETH market, has seen a modest 5% increase year-to-date, much lower than the 90% increase in 2023. stETH remains widely used as collateral in DeFi, with Lido ranking as the largest DeFi protocol by total value locked (TVL).

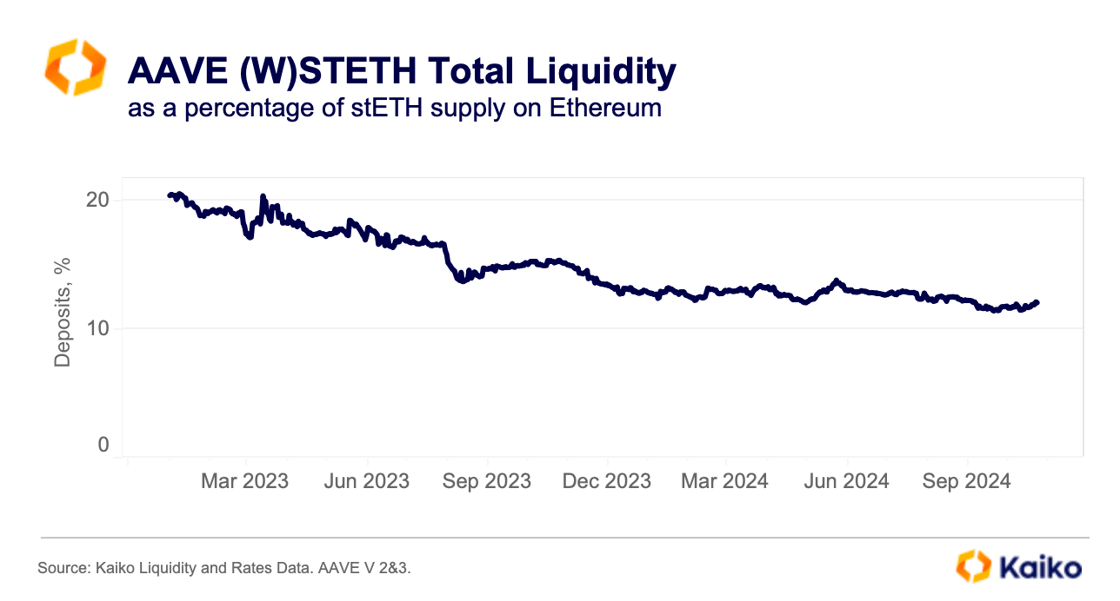

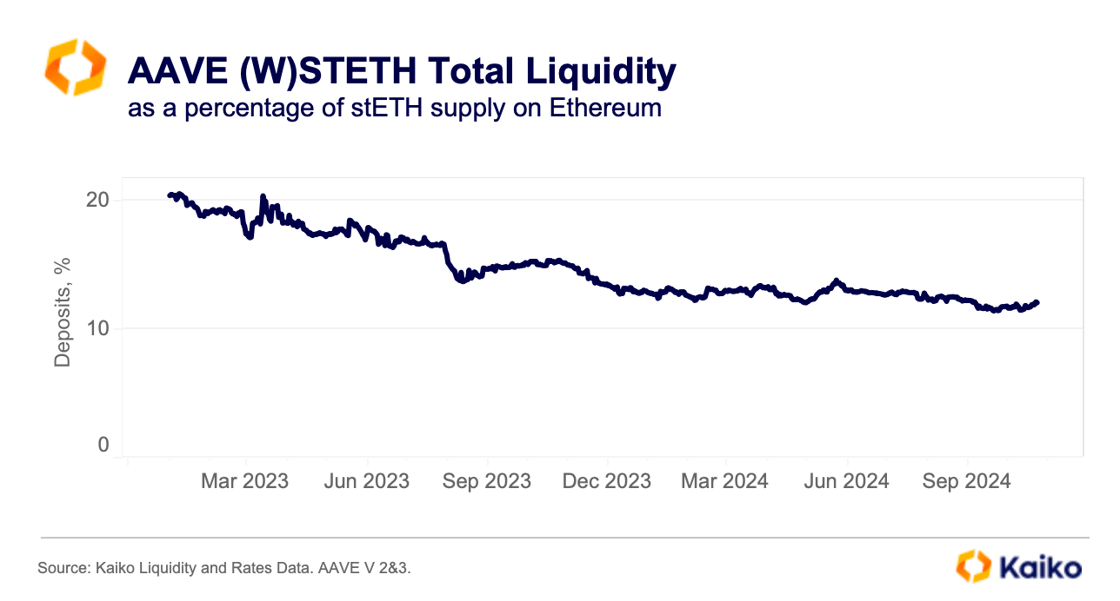

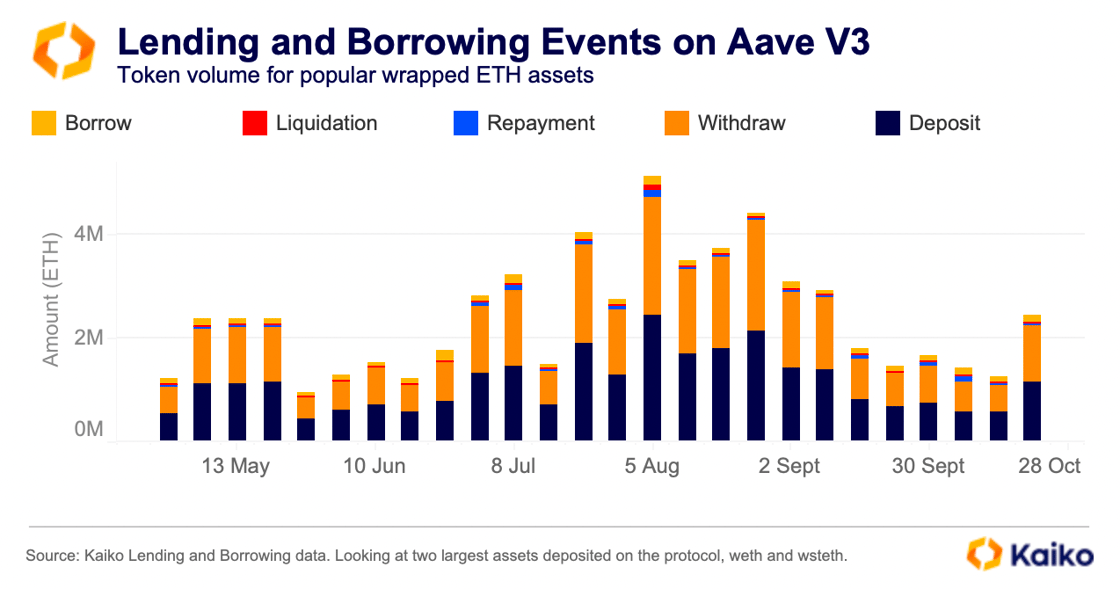

However, competition among protocols has intensified with the emergence of higher-yielding new players like Spark and Morpho, as well as re-staking alternatives like EtherFi. The share of (w)stETH deposited on the largest lending and borrowing protocol Aave, as a percentage of the total stETH supply on Ethereum, has declined from 20% to around 13% in 2023 and has remained relatively flat this year.

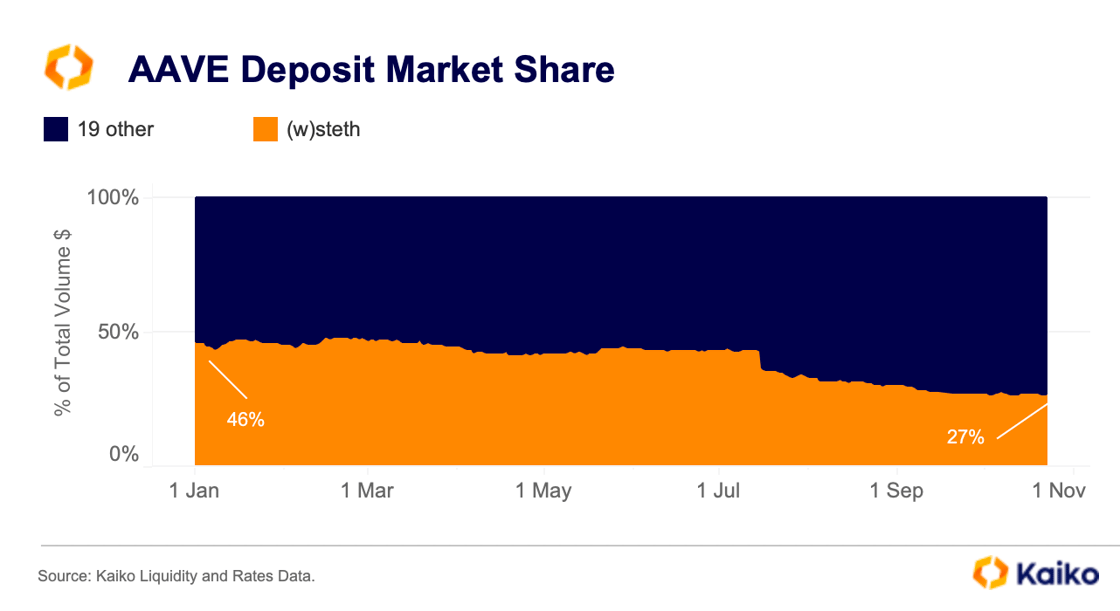

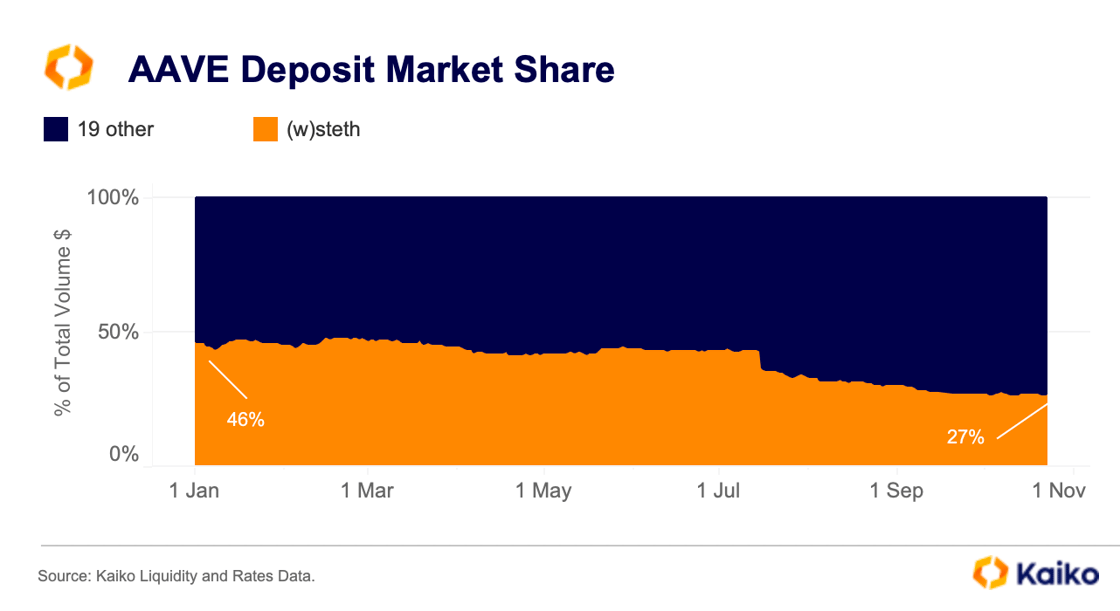

Beyond external protocol-level competition, stETH also faces increased competition as collateral within DeFi protocols, many of which now offer more token options for collateral use. The share of (w)stETH deposits on Aave has dropped from 46% in the beginning of the year to 27% as of last week.

This heightened competition for ETH staking, driven by other proof-of-stake-based Layer 1s offering higher yields and increased diversification within protocols, arguably benefits the staking ecosystem as a whole by reducing reliance on individual players.

Data Points

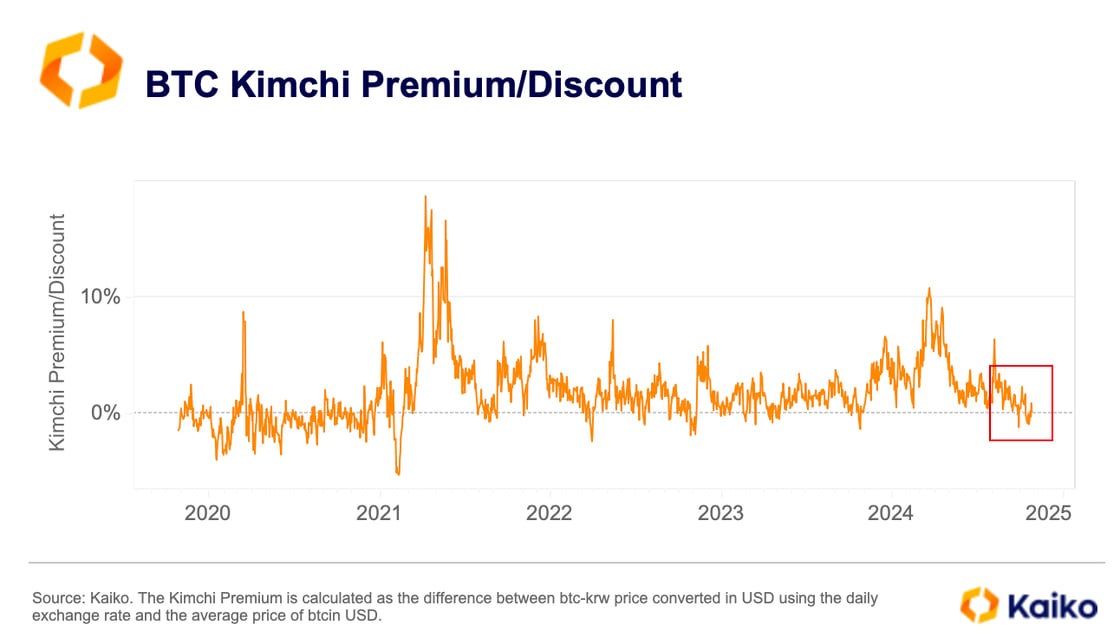

Bitcoin discount emerges on Korean markets.

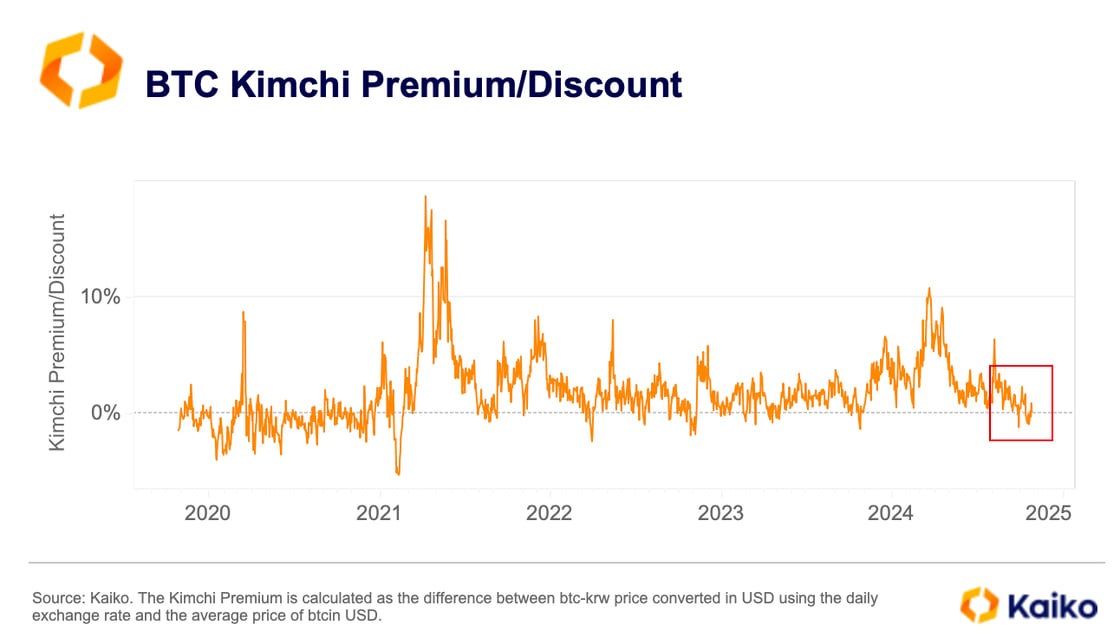

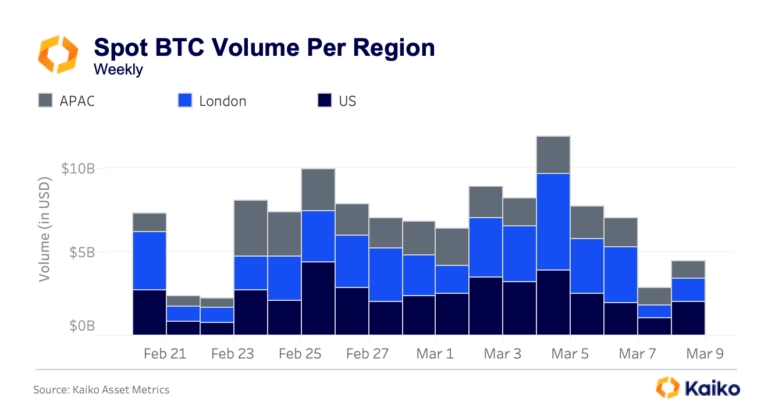

Bitcoin briefly traded at a discount of around 1% on Korean markets last week for the second time since September. Historically, it traded at a premium of up to 50% on Korean markets, due to South Korea’s unique regulatory framework that limits cross-border capital transfers for foreigners. More recently, the “Kimchi premium” spiked to 10% in March as BTC hit an all-time high before dropping to 1-2% over the summer.

Korean markets often serve as a barometer for risk sentiment in the crypto space, with trading volumes typically rising more quickly during bullish periods. Notably, previous instances of a negative Kimchi premium have often foreshadowed rallies in the broader crypto markets. However, this time, market uncertainty remains high, especially with the upcoming U.S. elections where crypto has been a major talking point.

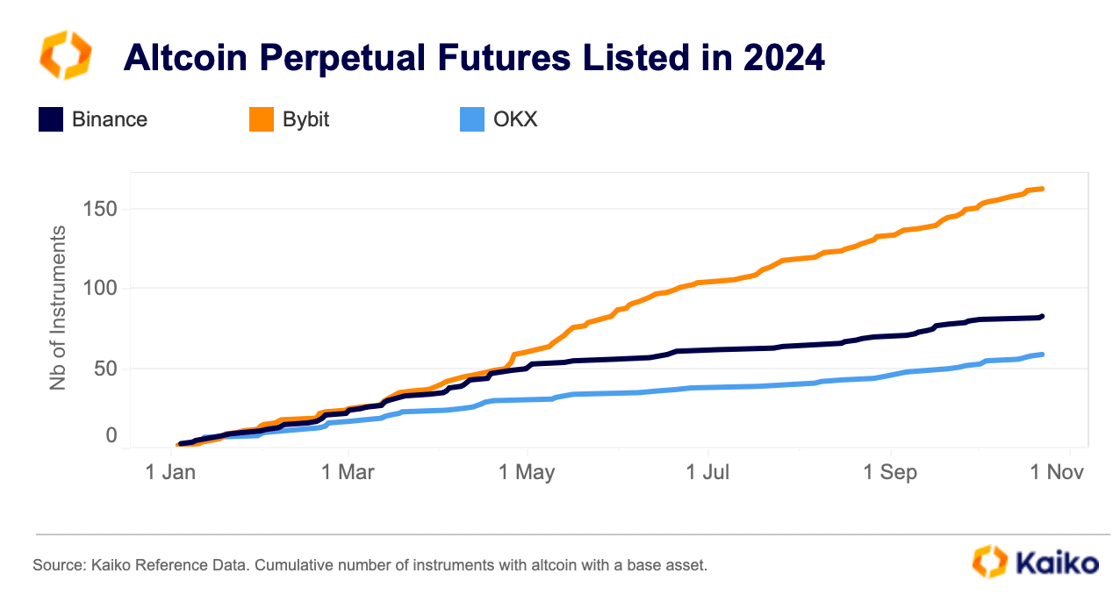

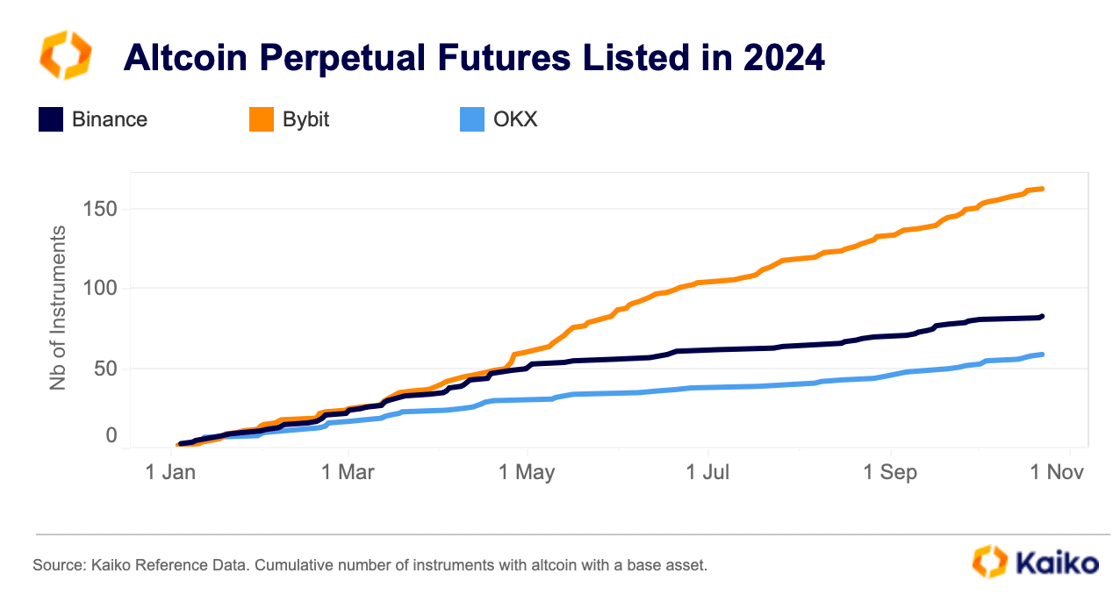

Bybit steps up its derivative listings.

In 2024, Bybit has accelerated its pace of listing new altcoin perpetual futures, surpassing both Binance and OKX. The exchange introduced 167 new perpetual futures contracts this year, compared to Binance’s 79 and OKX’s 61. Perpetual futures play a key role for traders by enabling both hedging and speculation.

While most exchanges generally list around twice as many spot trading pairs as perpetual futures, this gap has narrowed in 2024 due to growing demand for leverage and a recovering crypto market. The spot-to-derivatives listing ratio varies across platforms: Binance lists four times as many spot pairs as perpetual futures, OKX maintains a two-to-one ratio, while Bybit’s spot listings are only slightly above its perpetual futures offerings. Currently, Bybit has 456 actively traded perpetual futures contracts, compared to 362 on Binance and 229 on OKX.

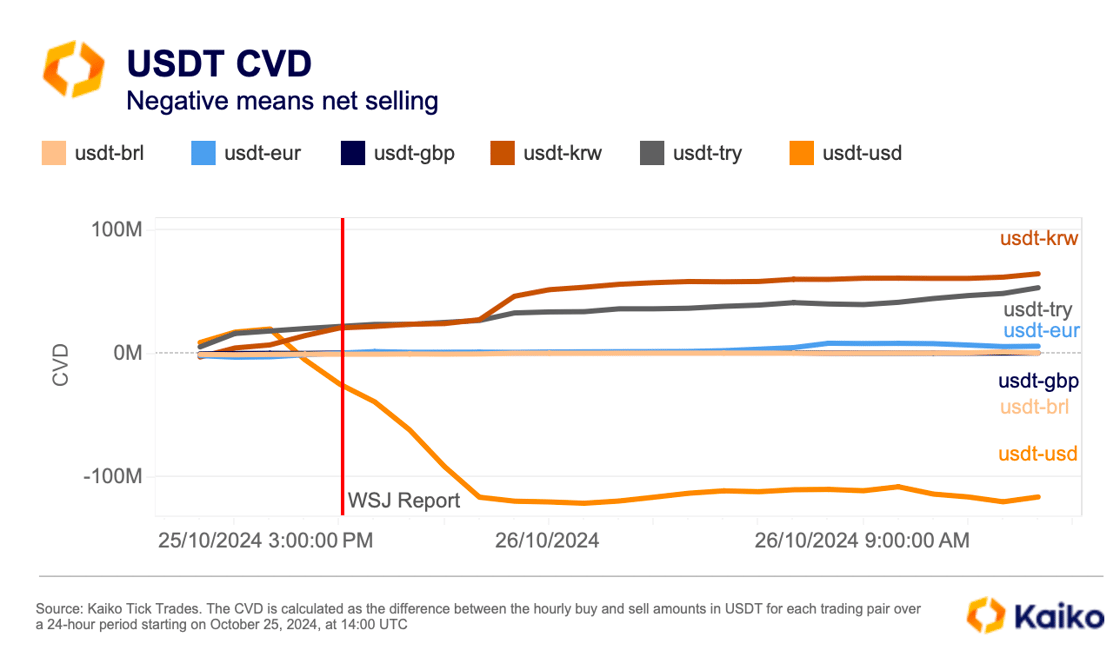

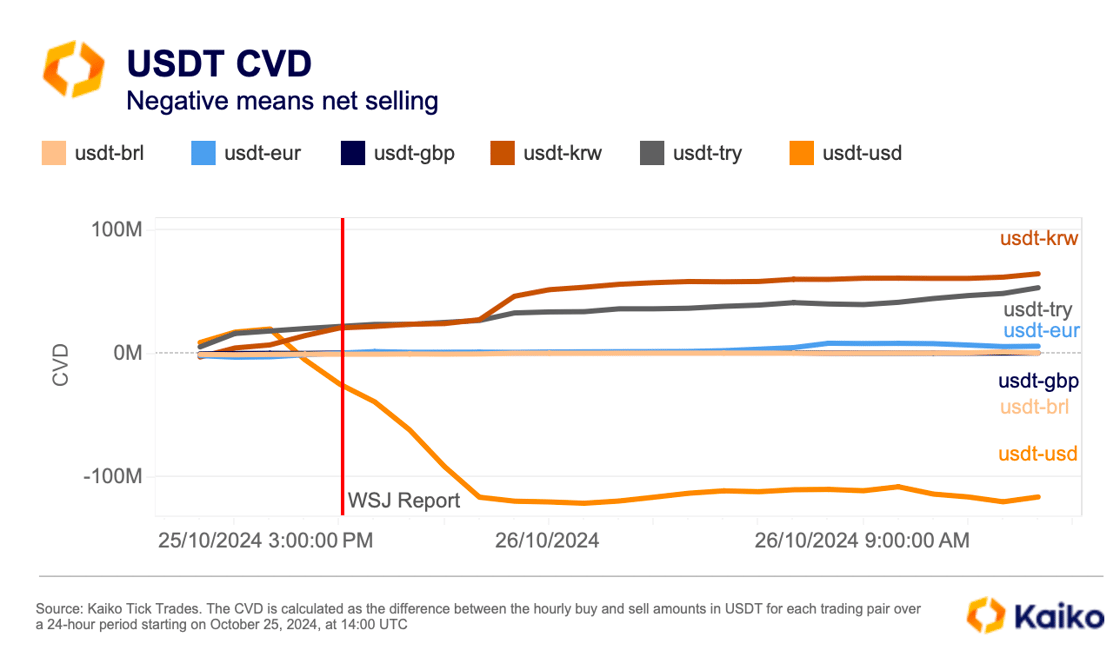

USDT depegs amid DOJ investigation rumours.

Rumors of a DOJ probe into Tether for money laundering and sanctions evasion triggered panic selling of USDT last week, pushing its price to $0.994 on U.S. exchanges, its lowest level this year.

Coinbase and Kraken saw significant sell orders following the report followed by a collapse in trading activity during the weekend. Interestingly, however, in most fiat markets, USDT saw net buying.

USDT still holds a 75% share of stablecoin trading volume despite growing interest in regulated options like USDC since the collapse of the Terra ecosystem in May 2022. USDT’s volatility partly stems from its redemption mechanism, requiring a 0.1% fee and a minimum redemption amount of $100K, which drives smaller traders to open markets during instability. In contrast, USDC offers more flexible redemptions, with no fees for daily redemptions under $15 million and a minimum redemption of only 100 USDC.

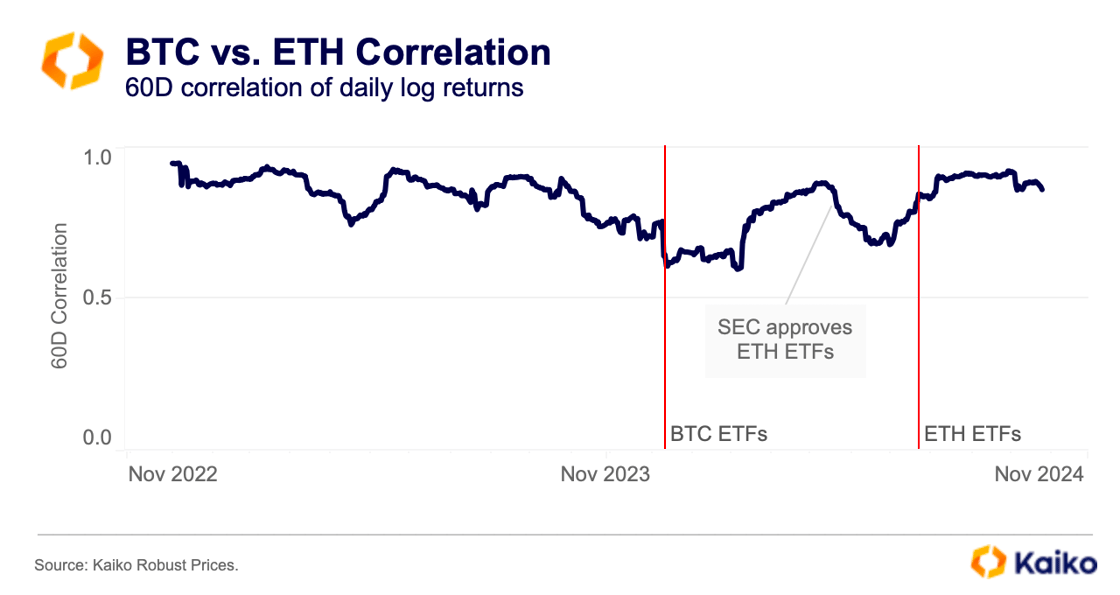

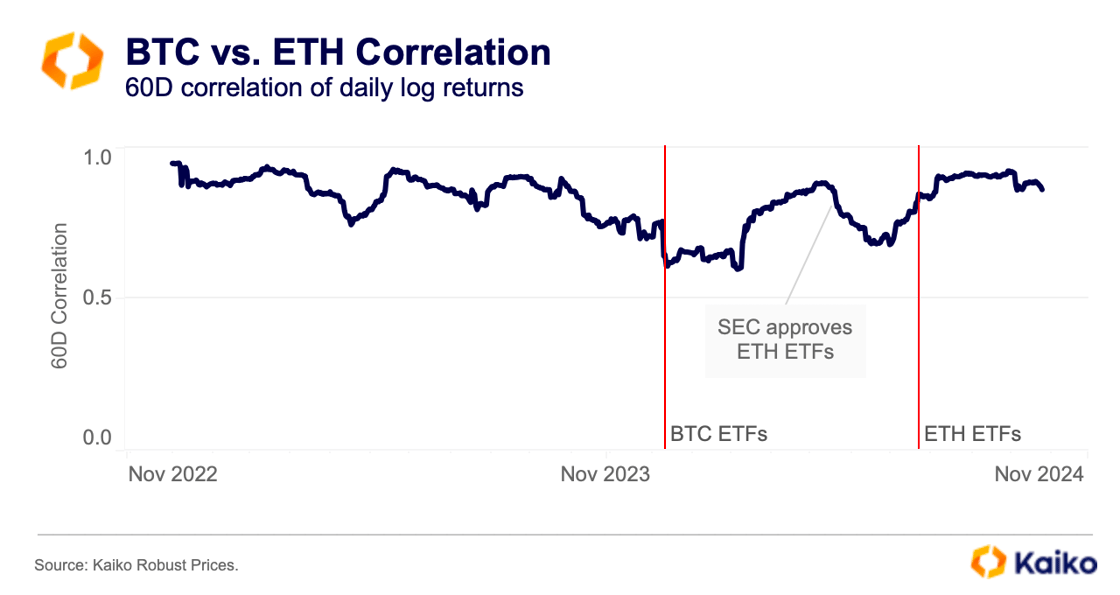

BTC correlation with ETH recovers.

The 60-day correlation between BTC and ETH has experienced notable fluctuations this year, reaching a multiyear low of 0.6 in March before rebounding to 0.87 in May and then declining again in June. Since the launch of spot ETH ETFs at the end of July, the correlation bewteen the two assets has stabilized above 0.8.

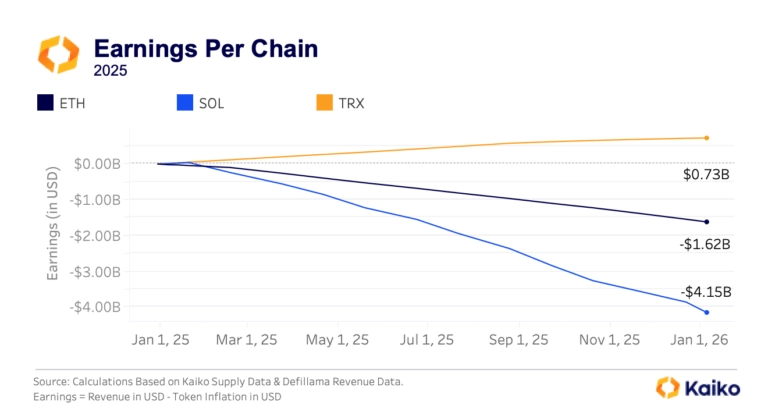

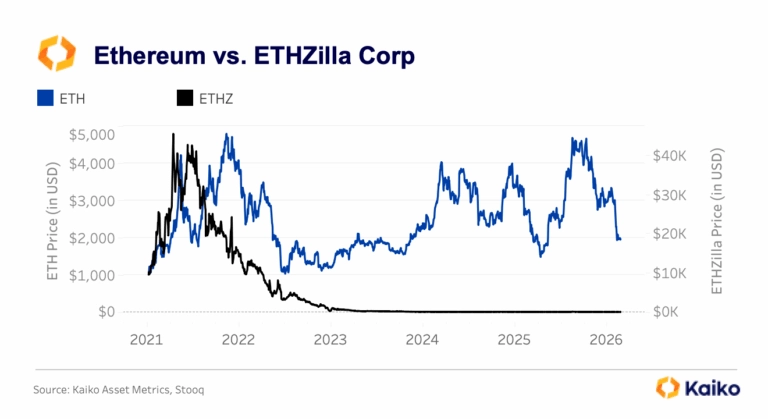

This suggests that ETH continues to provide similar diversification benefits as BTC. Despite this, ETH has underperformed BTC since the Merge, which marked Ethereum’s transition to proof-of-stake.

One possible explanation for this underperformance is the complexity of ETH’s value proposition as a programmable smart contract platform, which contrasts with Bitcoin’s simpler narrative as “digital gold.” This complexity may deter some investors. Additionally, ETH tends to be more volatile than BTC, which can make it less appealing for risk-averse investors.

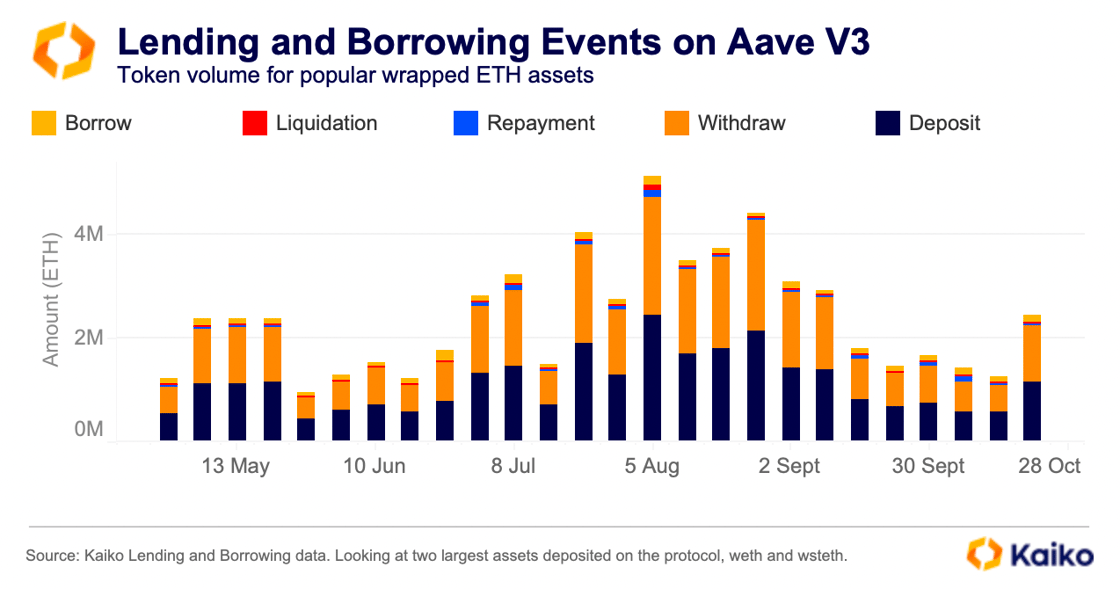

Competition among DeFi protocols

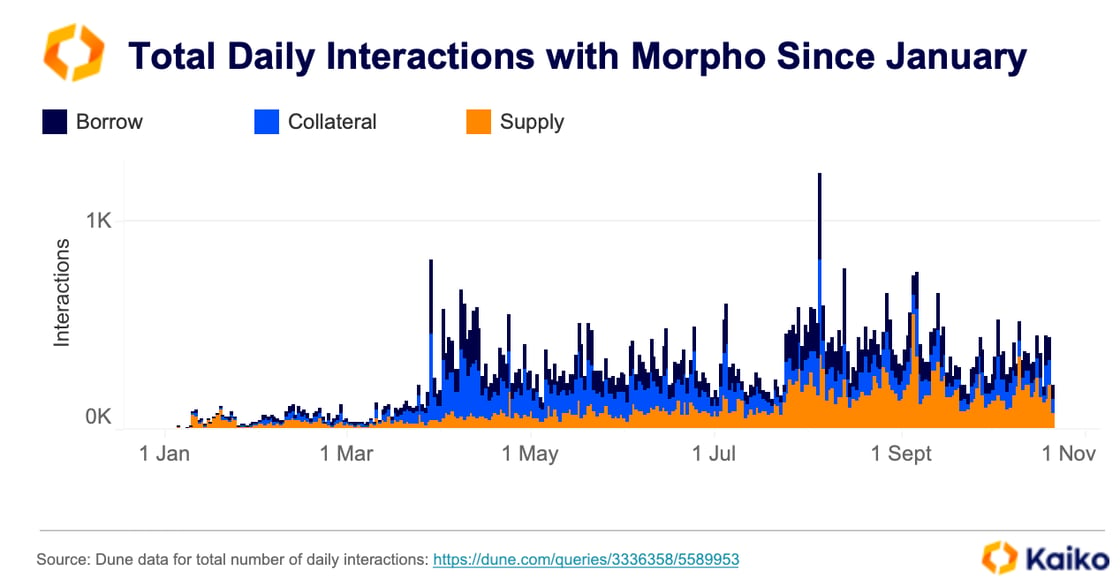

Competition among decentralized finance (DeFi) protocols, particularly in lending and borrowing, intensified in 2024. A notable example is the rift between Aave, the leading DeFi lending protocol by total value locked (TVL), and Morpho, a peer-to-peer lending optimizer, earlier this year.

For context, Aave V3, launched in early 2023, currently holds around $16 billion in assets on Ethereum mainnet. The two largest assets on the platform are wrapped ETH products, WETH and WSTETH, each with over $3 billion in value. The three largest assets on Ethereum Mainnet are ETH and its staking derivatives stETH and eETH, with a combined value exceeding $9 billion in total deposits on the platform.

Since the beginning on the year, Aave faces new competition, mainly from Morpho protocol. Built on top of existing lending protocols like Aave, Morpho sought to improve efficiency by directly matching lenders and borrowers, thereby enhancing offered rates.

However, tensions escalated between Morpho and Aave DAO delegates when Aave Chain Initiative founder Marc Zeller stated, ‘Morpho optimizers are a leech on top of the Aave protocol that provides zero benefits and steals potential revenue at the scale of millions per year for negligible yield improvement of users, subsidized by the fact they take zero revenue for doing this.’

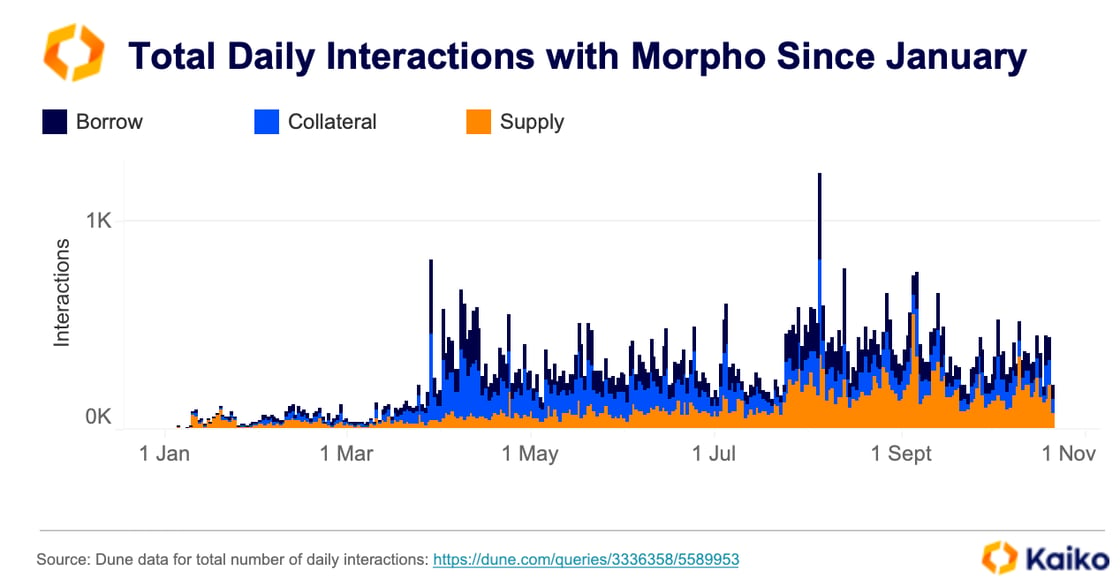

The launch of Morpho Blue marked a turning point, as Morpho positioned itself as a direct competitor with its own lending and borrowing protocol that enables isolated lending markets. The tension is particularly evident as Morpho actively targets Aave’s user base, encouraging them to migrate to their new platform – a strategy that could be reflected in Morpho Blue’s steady growth in its TVL since April 2024.

Adding to the tensions, Gauntlet, Aave’s former risk manager, emerged as a notable vault curator for Morpho Markets.

The fundamental difference in approach became clear: while Aave maintains its ‘Just Use Aave’ monolithic structure championed by Marc Zeller, Morpho positions itself as ‘infrastructure for banks’ through its isolated market design, as stated by founder Paul Frambot.

![]()

![]()

![]()

![]()