Introduction

Global regulators are tightening controls on stablecoins, reshaping the market and setting the stage for broader adoption. In Europe, MiCA regulations, which started in June 2024 and wrap up this month, have already driven meaningful changes in the EUR stablecoin market.

In the U.S., the Senate is set to vote today on the Genius Act, a stablecoin bill that would impose regulations similar to those for traditional financial institutions, potentially encouraging institutional participation.

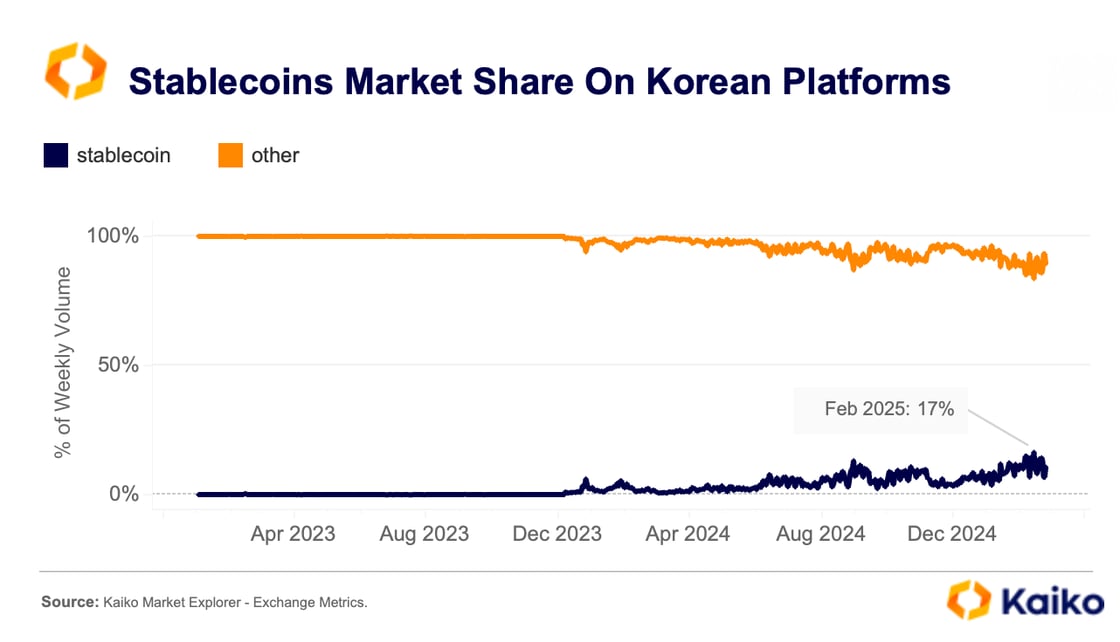

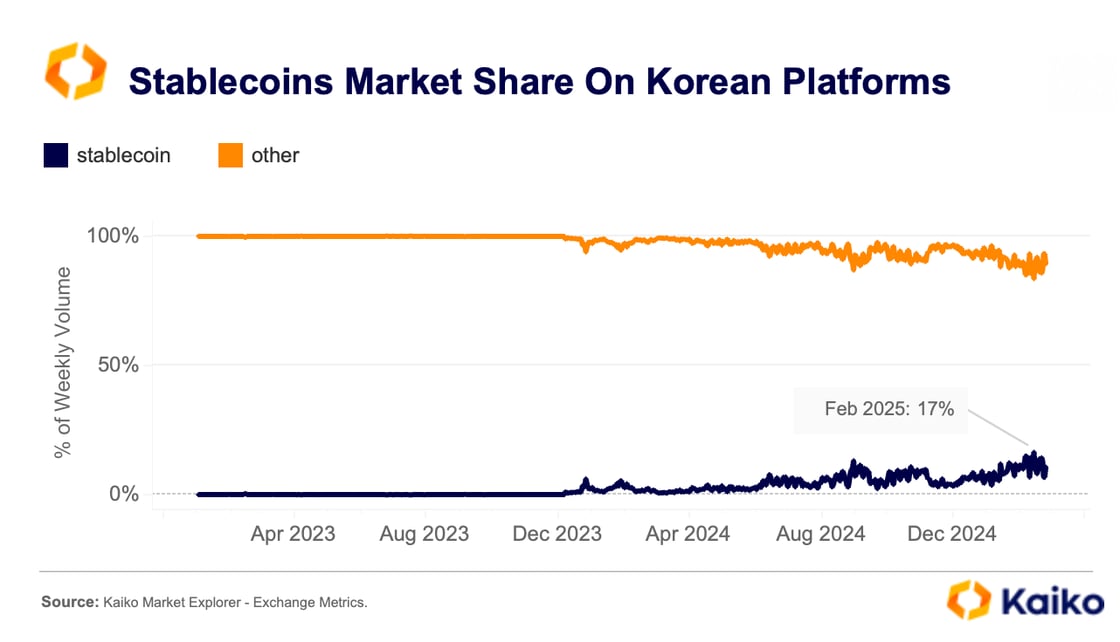

In South Korea, regulatory clarity around stablecoins is also improving with the Ministry of Finance announcing plans to regulate stablecoin-to-fiat cross-border transactions. The move comes as local demand for stablecoins is growing. In 2025, USDT traded at a premium on Korean exchanges for 80% of the time with a discount for just 10%. By February, stablecoin-related trades accounted for about 17% of all volume on Bithumb and Upbit.

Though this share is still modest compared to global crypto exchanges—where stablecoins dominate over 80% of transactions—this marks an all-time high for Korean platforms.

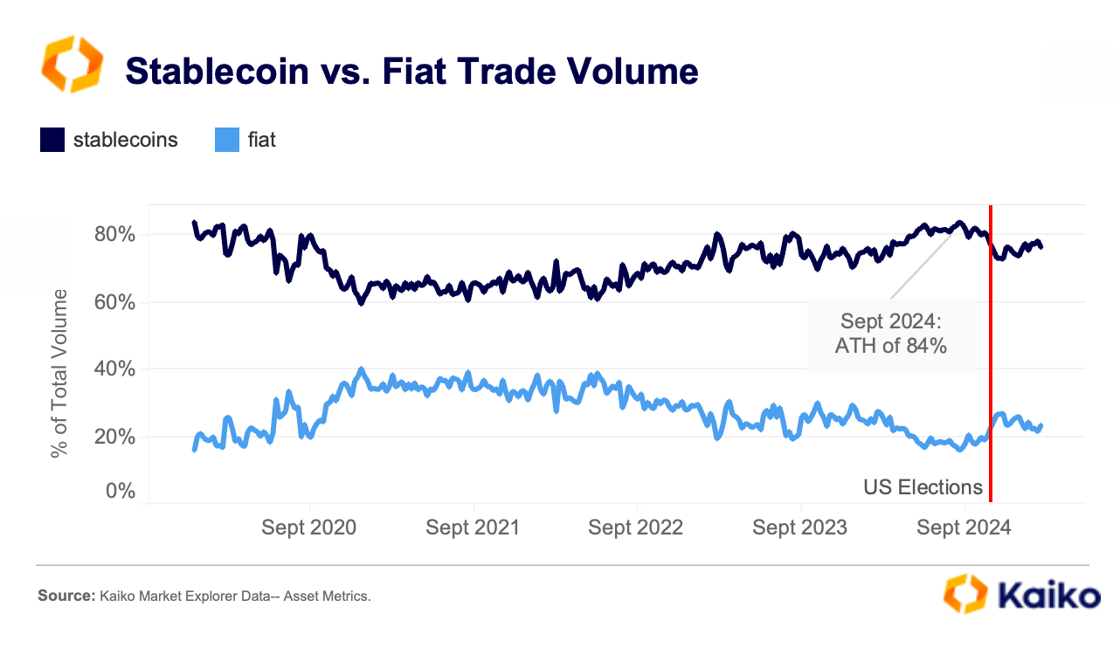

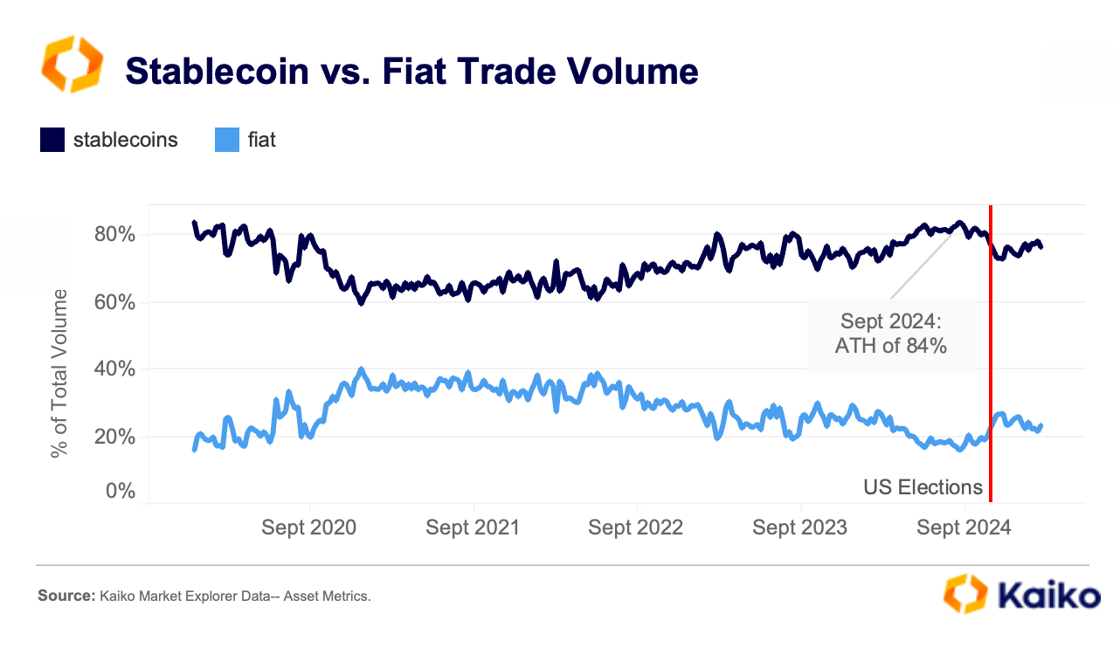

Despite improving global regulatory clarity, however, stablecoin dominance has weakened since November, with the overall stablecoin market share relative to fiat declining from an all-time high of 84% to 77%. This decline is primarily driven by USDT’s falling dominance, with other stablecoins slowly filling the gap.

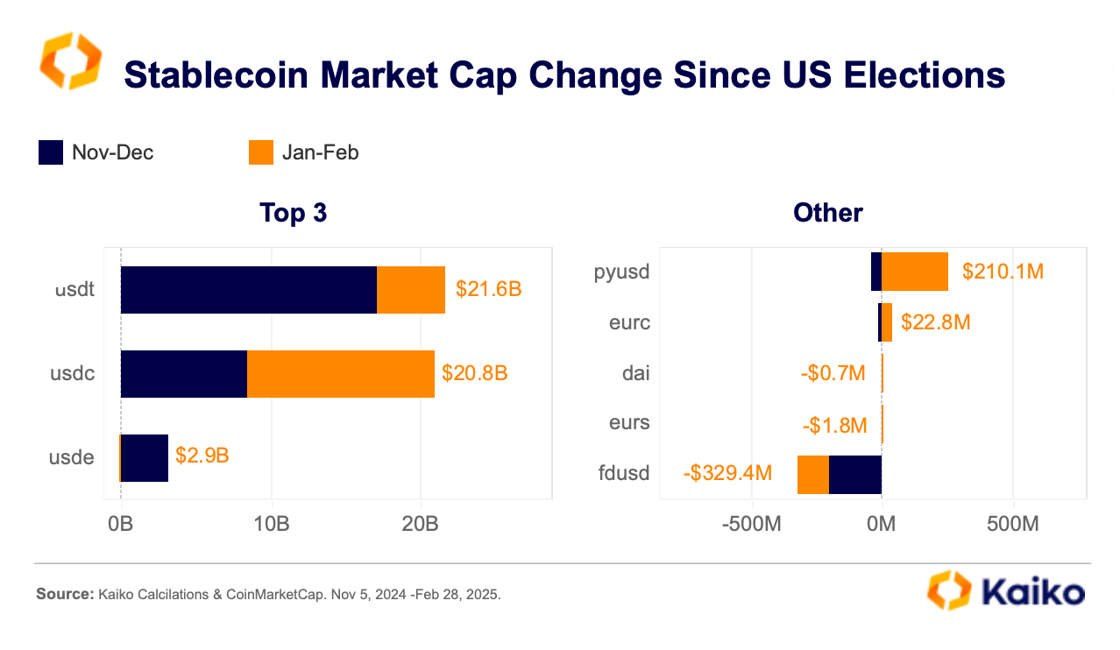

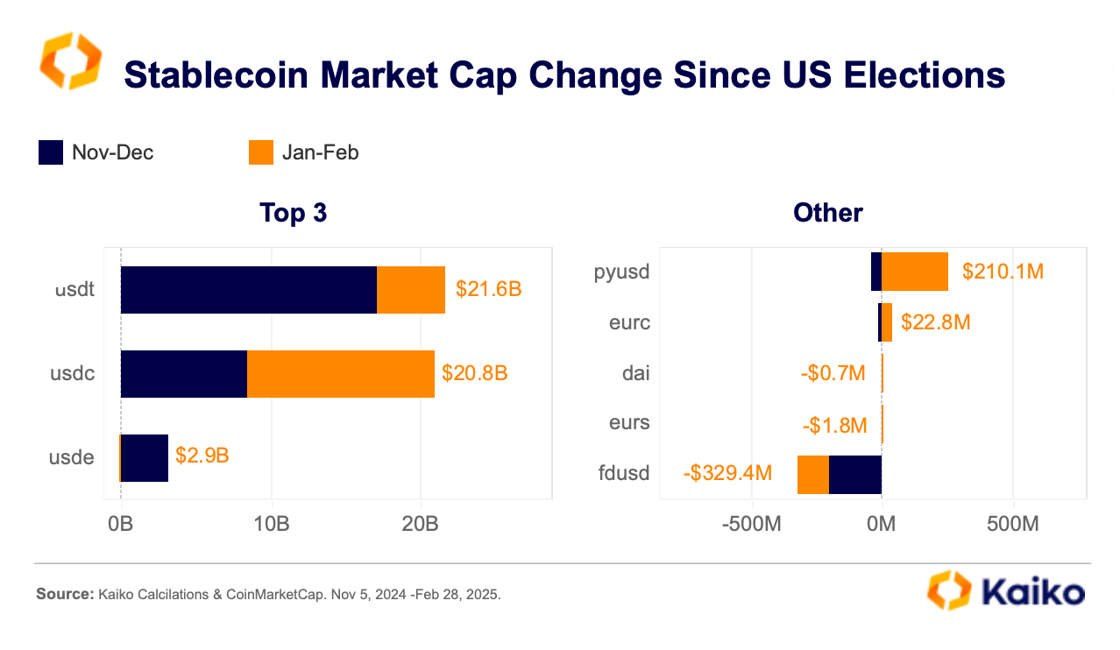

While the market cap of the top stablecoins has increased by $45bn since the November 5 U.S. Elections, a closer look reveals diverging trends since the start of the year.

Regulated stablecoins, such as USDC, PYUSD, and EURC, have been growing steadily YTD, while most of USDT’s post-election gains occurred between November and December 2024.

Overall, while regulatory clarity may help boost global stablecoin adoption in the medium term, demand for stablecoins remains linked to cyclical patterns, especially in altcoin markets.

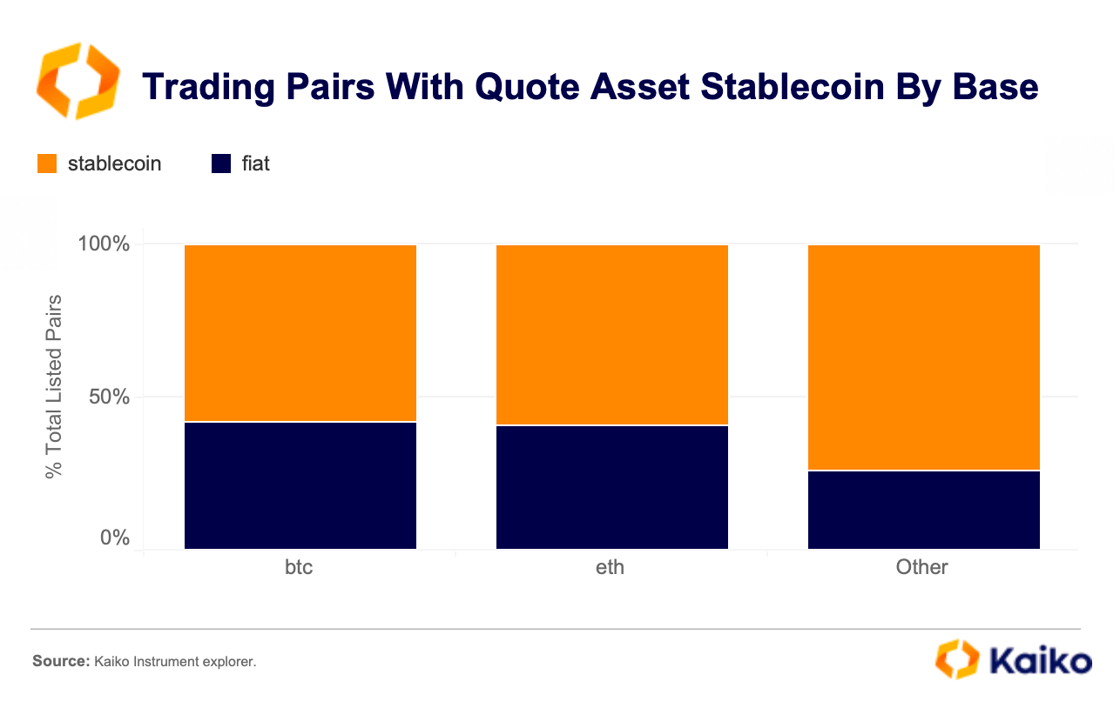

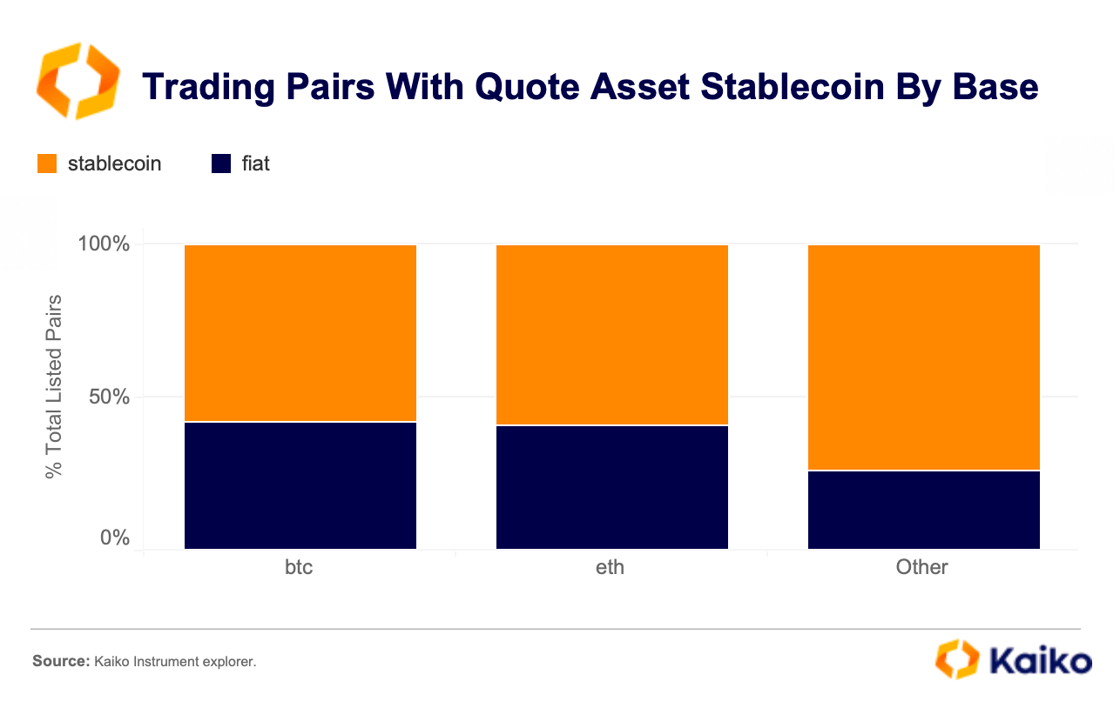

While Bitcoin and Ethereum trading pairs are almost evenly split between fiat currencies and stablecoins, altcoins are mainly traded against stablecoins. As altcoins have been severely impacted by the recent period of volatility, the demand for stablecoins—both as intermediaries and for leverage—has also declined.

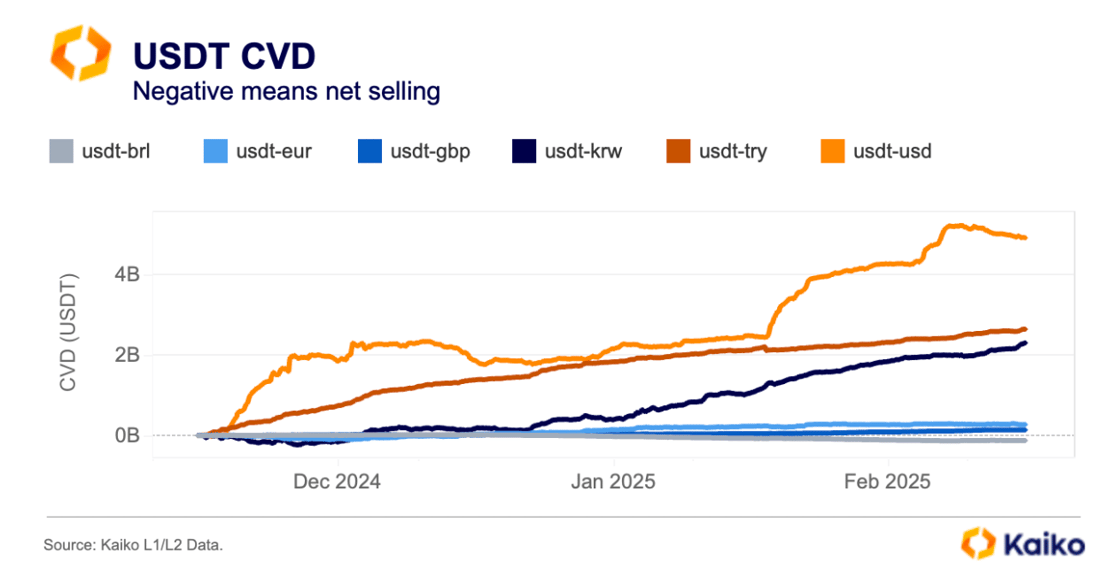

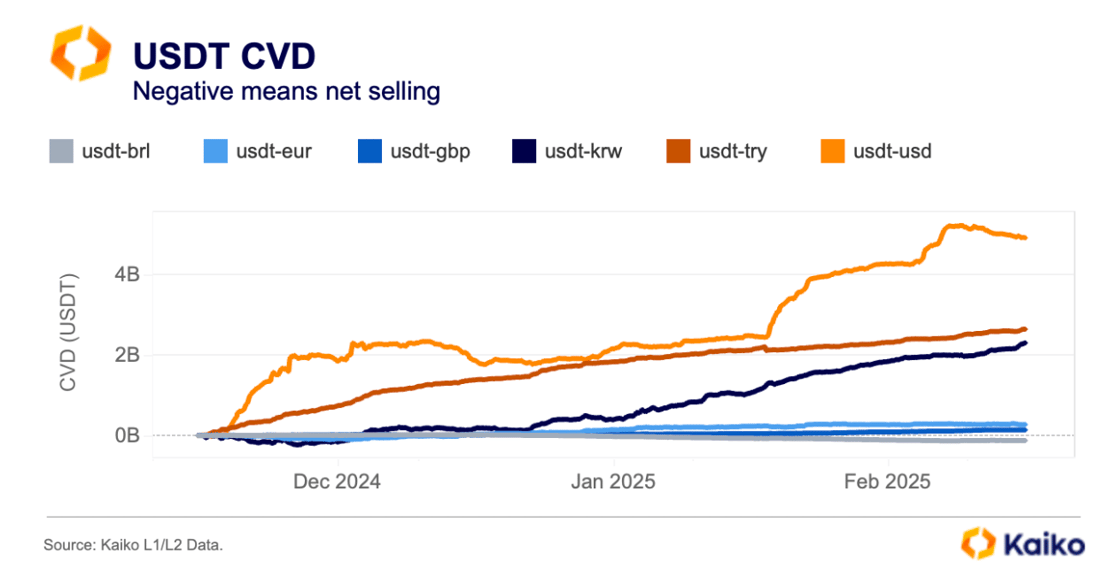

A regional analysis of stablecoin cumulative volume delta (CVD) further reveals distinct trends and use cases.

In Korea, traders have turned to stablecoins amid political instability following the December Martial Law crisis, while in Brazil, a proposed ban on self-custodial stablecoins has led to cashing out. The USDT-BRL has been negative since December, suggesting selling outweighed buying despite a record weakening of the Brazilian Real against the Dollar.

Meanwhile, USDT demand remains strong in Turkey where inflation is still significantly higher compared to most other countries.

Data Points

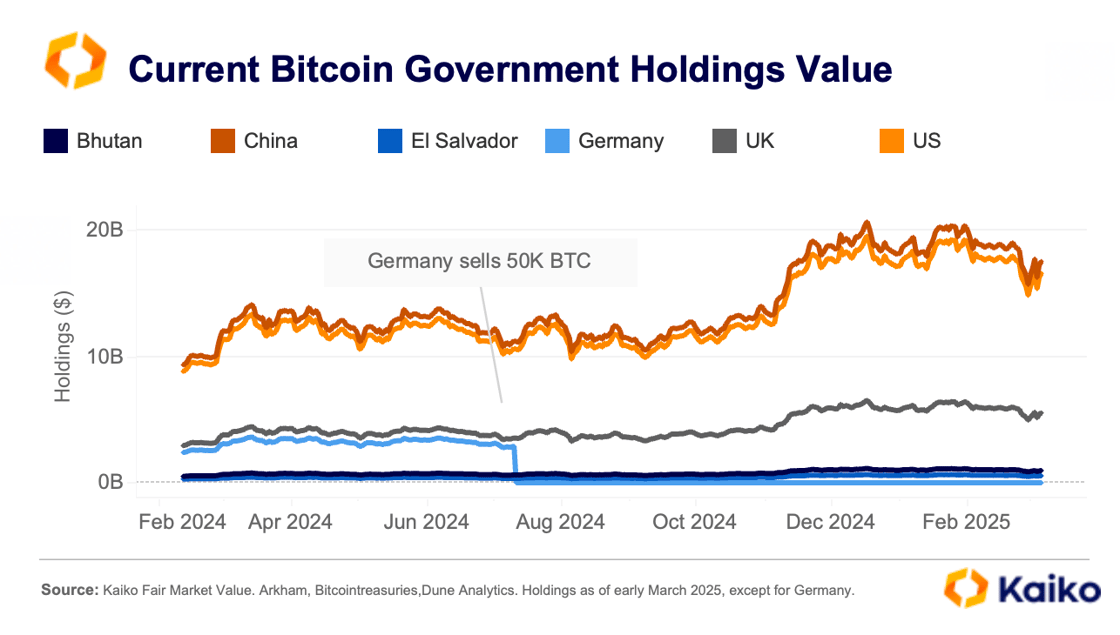

Does a US Crypto Reserve mean less selling pressure?

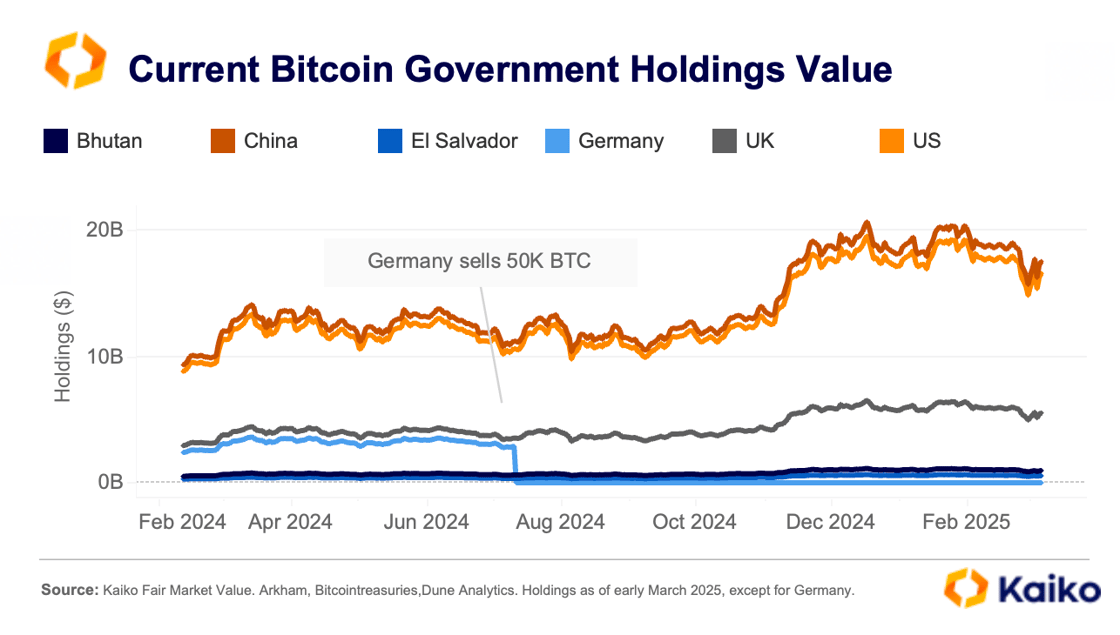

Fears of government BTC sales have long contributed to market volatility as governments are among the largest holders of Bitcoin. The most recent example occurred just before Donald Trump’s inauguration when the U.S. DOJ reportedly approved the sale of 69,370 BTC, triggering a market sell-off.

The introduction of official U.S. Bitcoin reserves last week could help mitigate some of these risks, as White House AI and crypto tsar, David Sacks, said the U.S. will not sell any Bitcoin deposited in the reserve, describing it as “a digital Fort Knox for the cryptocurrency.” However, it is unlikely to eliminate this threat entirely.

Bitcoin’s unique upside potential and transferability may lead countries to manage their reserves more actively, adjusting their holdings based on economic strategies and market conditions.

Smaller developing nations, which tend to accumulate higher reserves relative to GDP, might be tempted to take profits. A similar trend is seen with gold, where developing countries often adopt a more active approach than developed economies in managing their holdings.

One recent example is Bhutan, which currently holds 10.64K BTC. While this amount is small compared to the U.S. and China, which lead in nominal holdings, it is significant for Bhutan, equating to about 30% of its GDP. In November 2024, Bhutan sold part of its Bitcoin holdings, capitalizing on Bitcoin’s price appreciation.

Overall, while the market reaction to last week’s news was rather muted, the move has strong symbolic significance as it essentially recognizes Bitcoin as a strategic asset, i.e., an asset that provides a significant competitive advantage for the U.S.

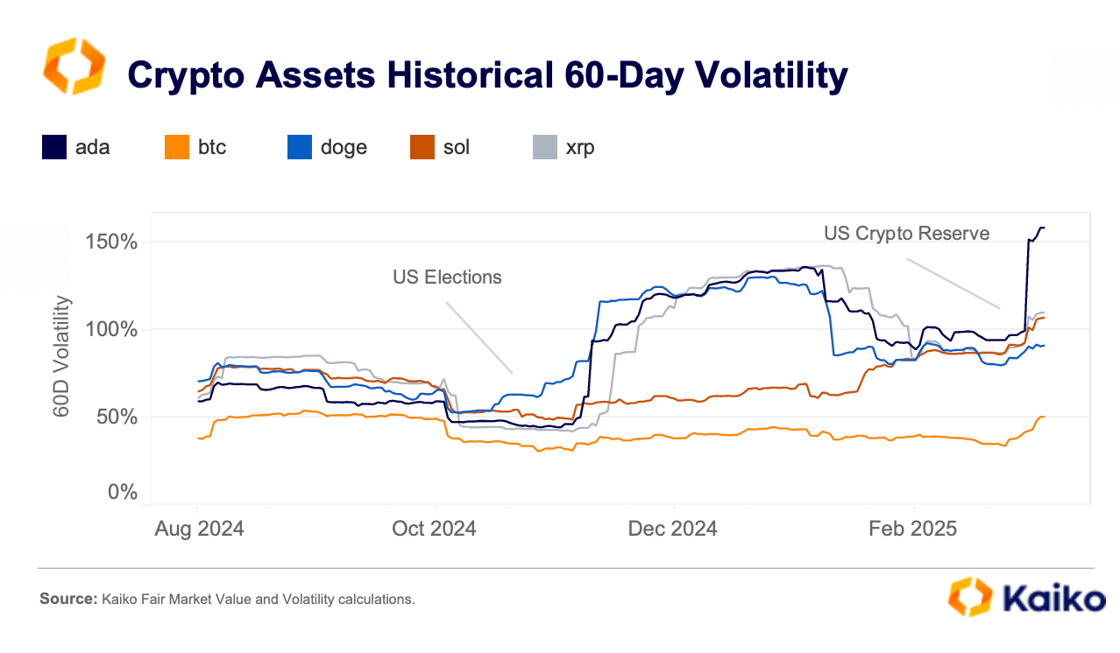

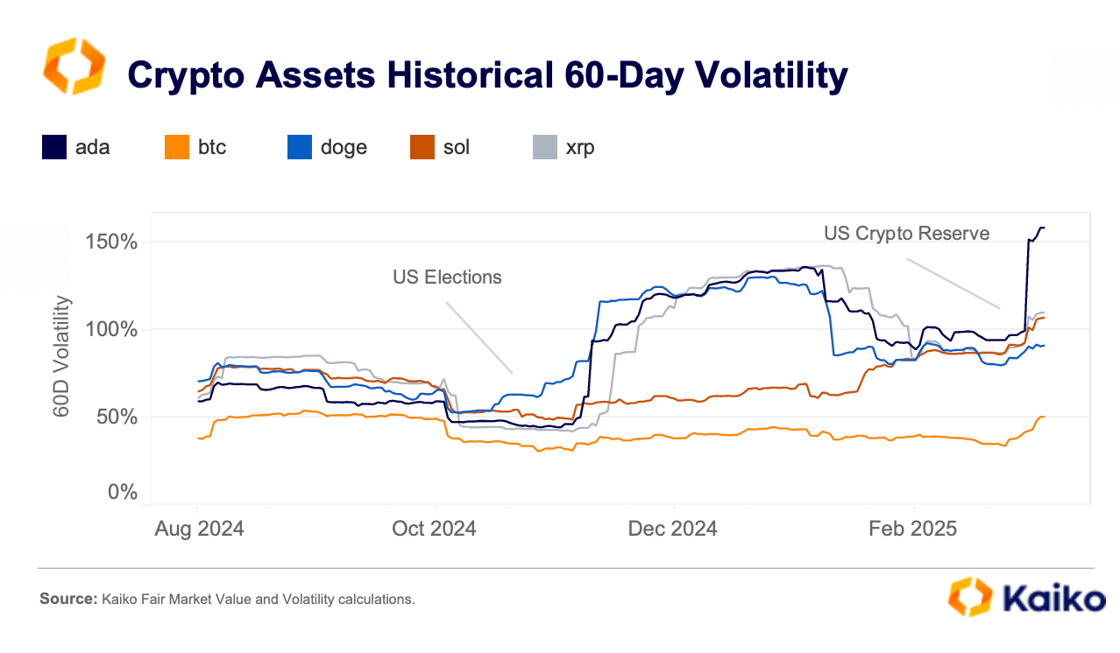

Altcoin volatility surges.

Altcoins’ realized volatility surged in March, with ADA reaching an all-time high of 150% and SOL and XRP surpassing 100%. While Bitcoin’s volatility has also increased, it remains relatively lower at 50%, still below historical peaks.

Until February, both Bitcoin and stocks showed resilience to the growing uncertainty in U.S. economic policy, largely supported by hopes for positive changes following Trump’s inauguration.

However, weaker-than-expected U.S. economic data at the end of February sparked concerns about growth and triggered a sharp decline in risk assets. Additionally, the recent letdown over the U.S. crypto reserve announcement has further soured investor sentiment.

Exchange ranking tracks shifting market dynamics.

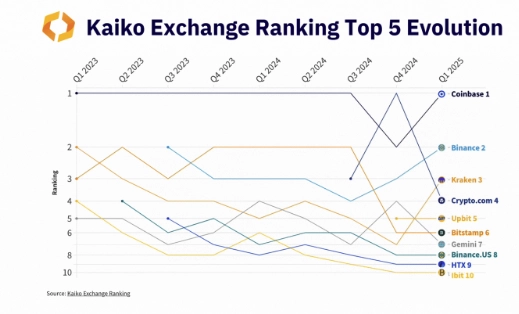

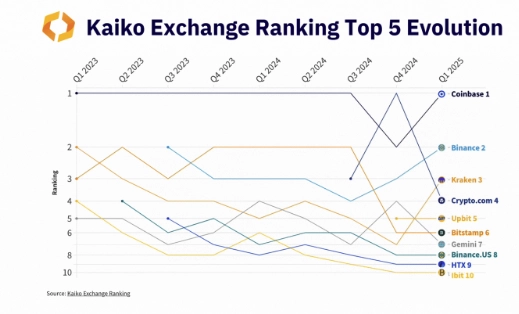

The Q1 Kaiko Exchange Ranking, covering 45 centralized exchanges, was released last week. The latest results showed some movement among top exchanges, with Coinbase reclaiming the number one position.

The largest U.S. exchange excelled in liquidity and security, with its technology and data quality scores improving as well. Coinbase, for instance, is now the sole AAA-rated exchange in our ranking.

While Coinbase often occupies the top spot, this hasn’t always been the case, as illustrated below. The top 5 exchanges tend to shift positions quarter-on-quarter.

View the full ranking to understand the individual breakdown in criteria.

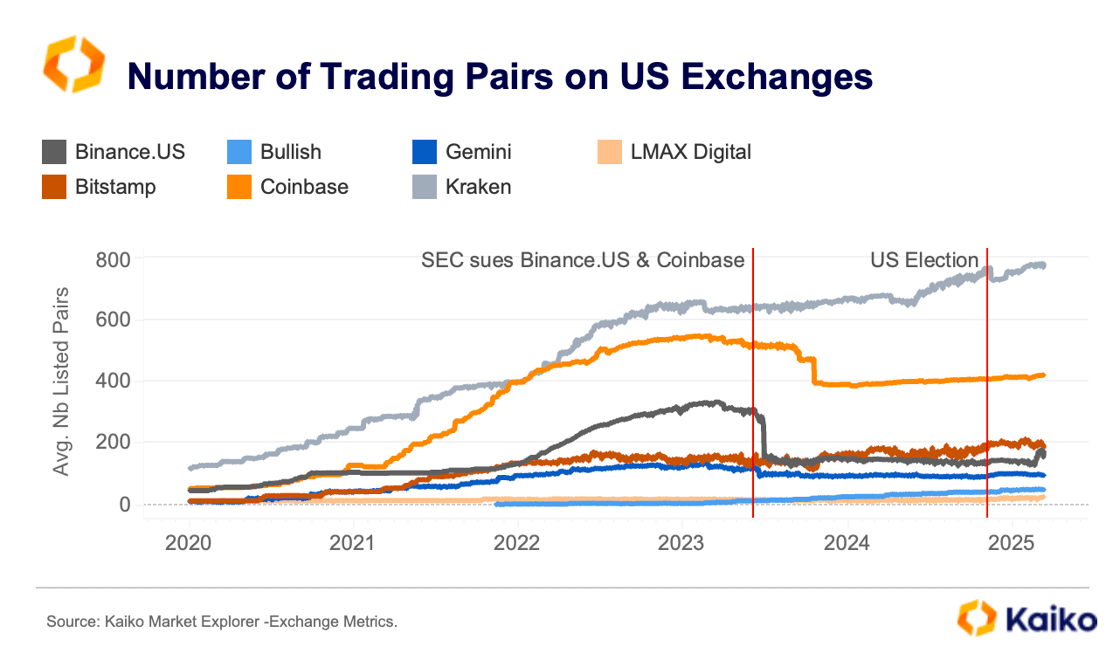

Exchange listings increase since the U.S. Elections.

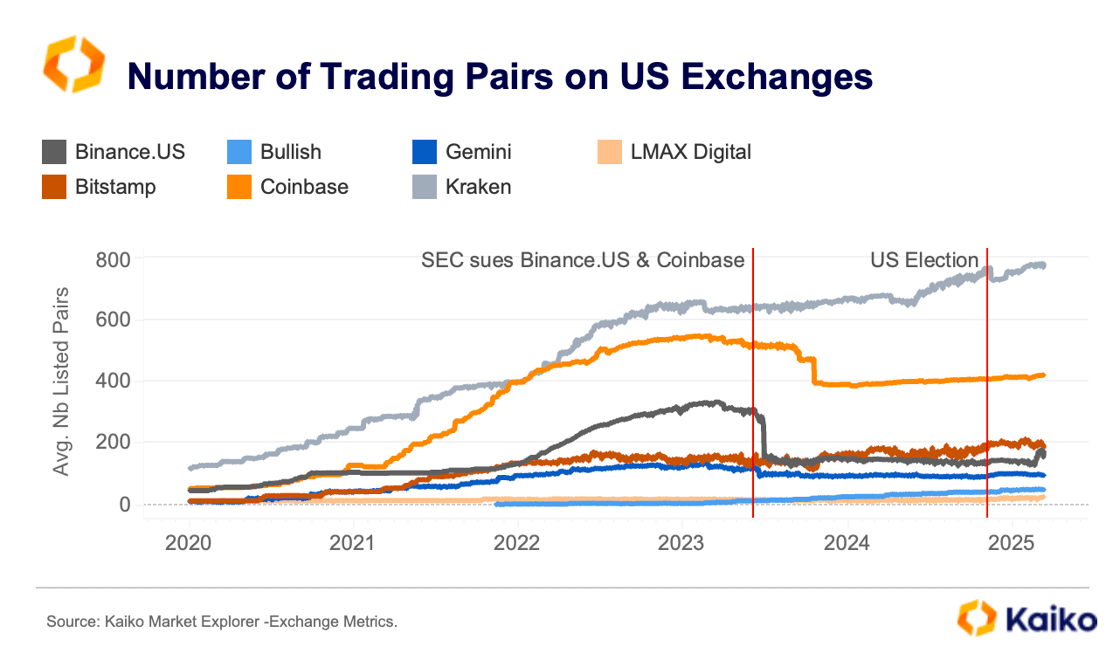

The number of active trading pairs on U.S. exchanges has increased moderately since the elections, amid growing optimism about the regulatory environment. This metric rises when new listings exceed delistings, serving as a useful indicator of net listings.

The U.S. SEC has dropped several lawsuits against major crypto platforms, including Coinbase, Kraken, and Uniswap, and has paused its case against Binance.US. LMAX Digital and Binance.US saw the largest percentage increases in trading pairs, rising by 40% and 24%, respectively, since November. Still, the overall increase remains modest, indicating that exchanges remain cautious despite expectations of a more favorable regulatory climate.

Following SEC lawsuits in 2023, both Coinbase and Binance.US saw a wave of delistings. Binance.US saw a sharp decline after removing all USD-quoted pairs and shifting to a crypto-only platform.

![]()

![]()

![]()

![]()