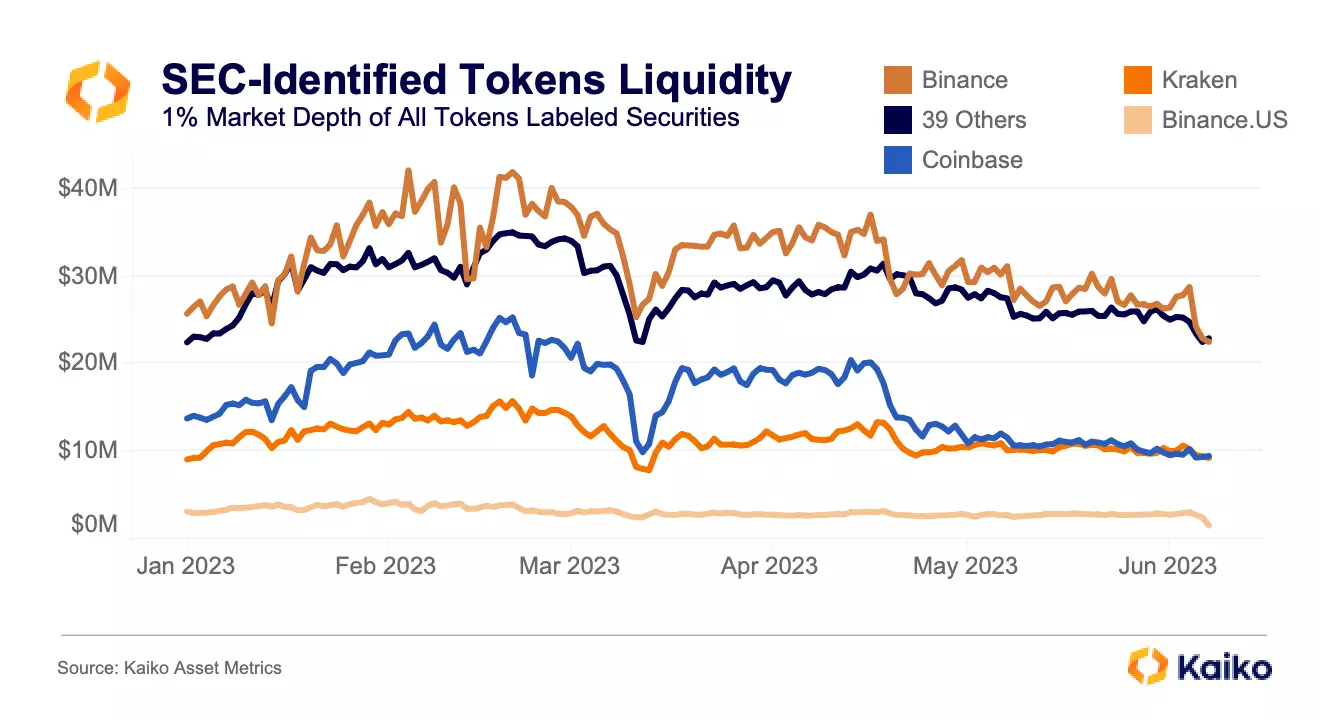

Listing unregistered securities

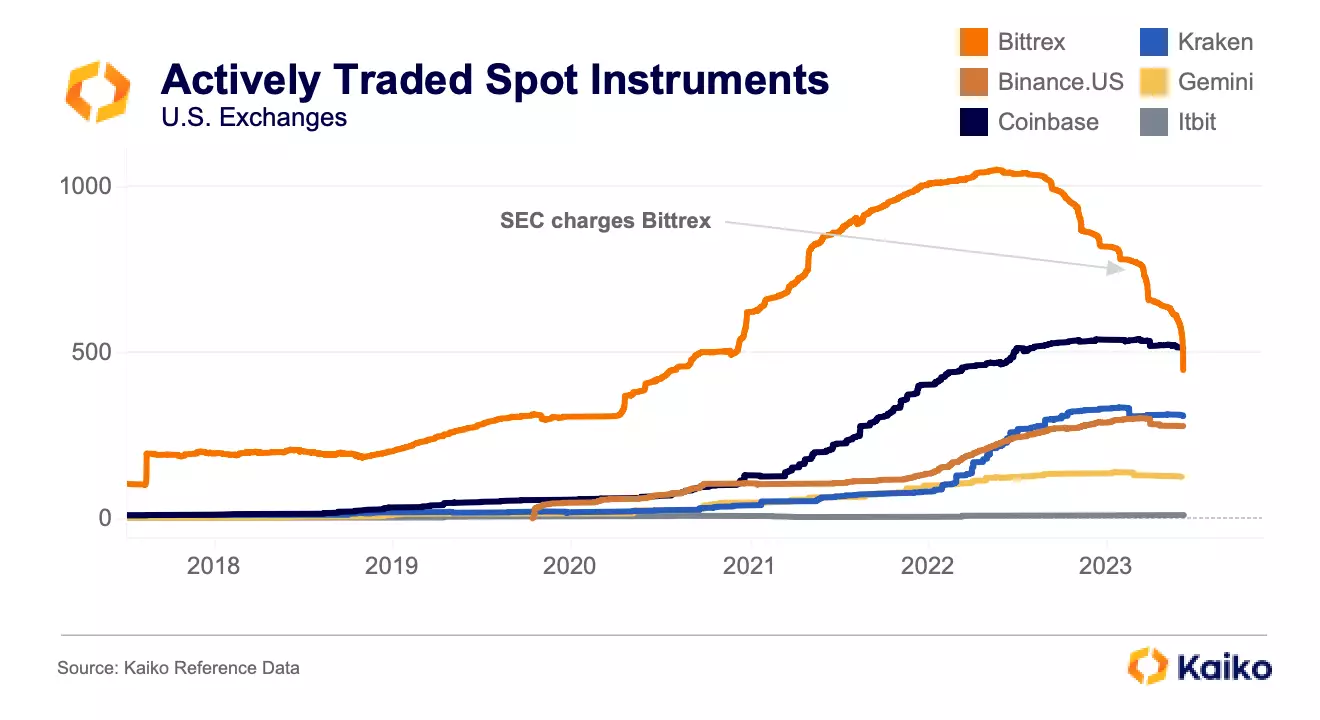

The actions this week were the clearest reflection yet of SEC Chairman Gary Gensler’s repeated assertion that most cryptocurrencies are securities. However, Bittrex – which filed for bankruptcy in May – was the first to be charged in this regard. When examining the active trading instruments on each exchange it’s clear why: Bittrex was by far the most aggressive U.S. exchange in terms of listing new tokens, reaching a peak of over 1,000 instruments in May 2022.

Coinbase, too, took a much more aggressive listing approach in 2021. At the start of 2021, there were 130 instruments on the exchange; a year later there were over 400. Notably, this doesn’t include the thousands of tokens that are available through Coinbase Wallet, which utilizes DEXs like Uniswap and Sushiswap. The SEC included NEXO, which is only available through Wallet, in its list of unregistered securities that Coinbase was offering [1].

Binance.US didn’t accelerate its listing until late 2021, jumping from 120 instruments to a peak of over 300 in March 2023. I’ve included some other U.S. exchanges for context, showing how Kraken was slow to list until 2022, when it began listing even faster than Binance.US. Meanwhile, itBit – the exchange operated by Paxos which is regulated in NY state – has listed just 10 active trading instruments. However, one of its listed tokens is SOL, which was identified as a security in both complaints.

Wash trading

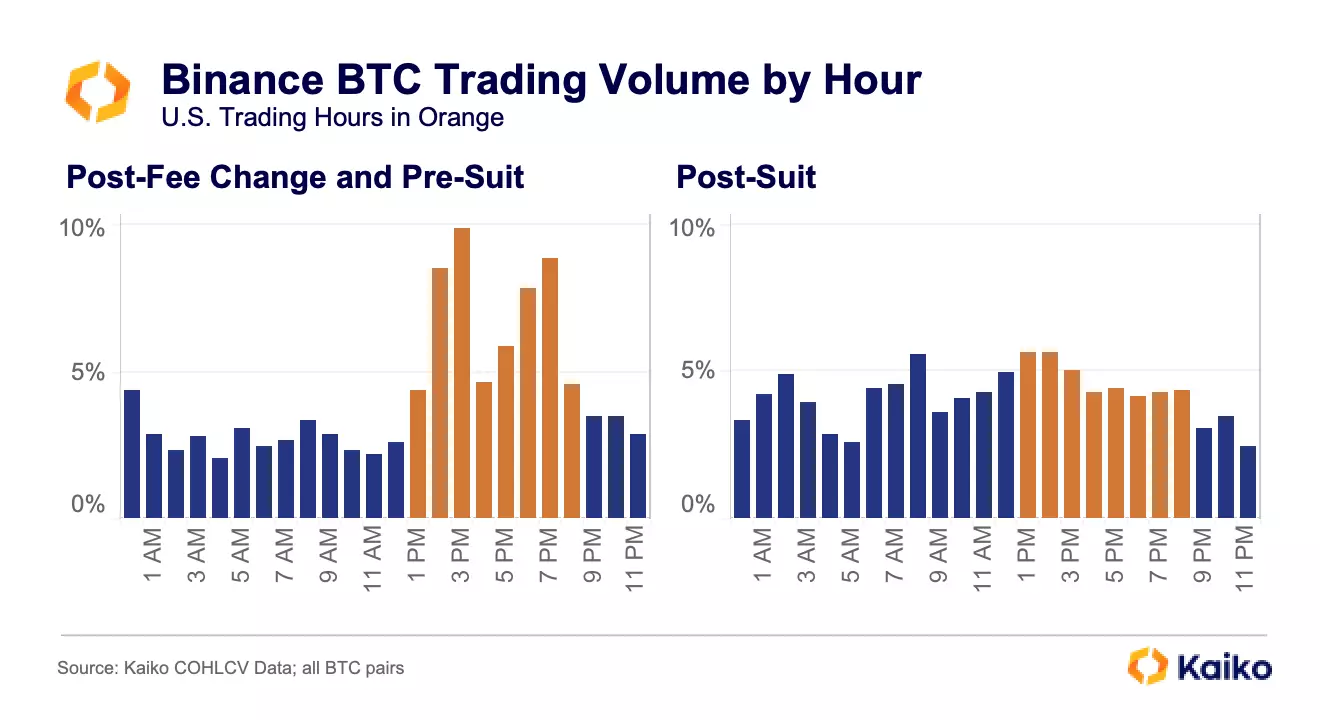

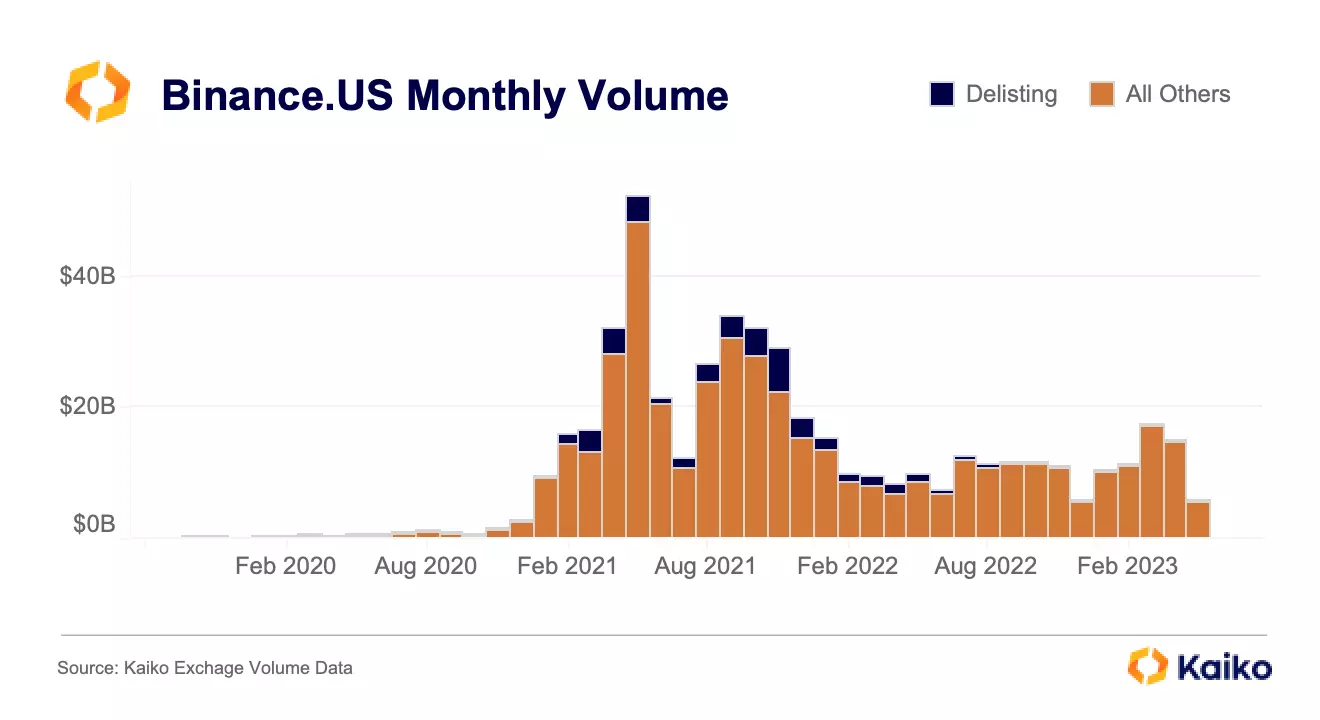

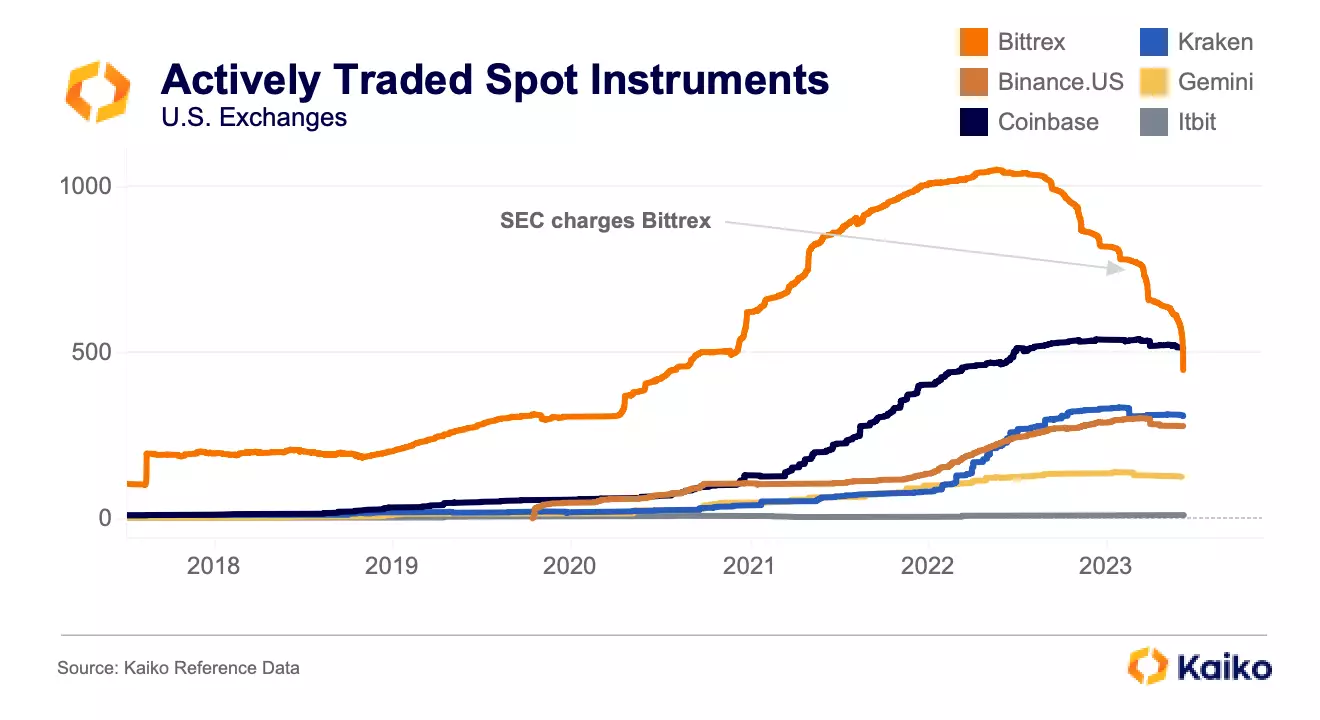

One of the most interesting allegations is that CZ’s trading firm Sigma Chain was wash trading on Binance.US to inflate the exchange’s volumes. The complaint said that wash trading escalated during three critical periods: Binance.US’s launch in September 2019, when new tokens were listed, and the lead up to seed funding in September 2021. The complaint further quotes a Binance executive who said that Sigma Chain represented up to 50% of Binance.US’s volume at times.

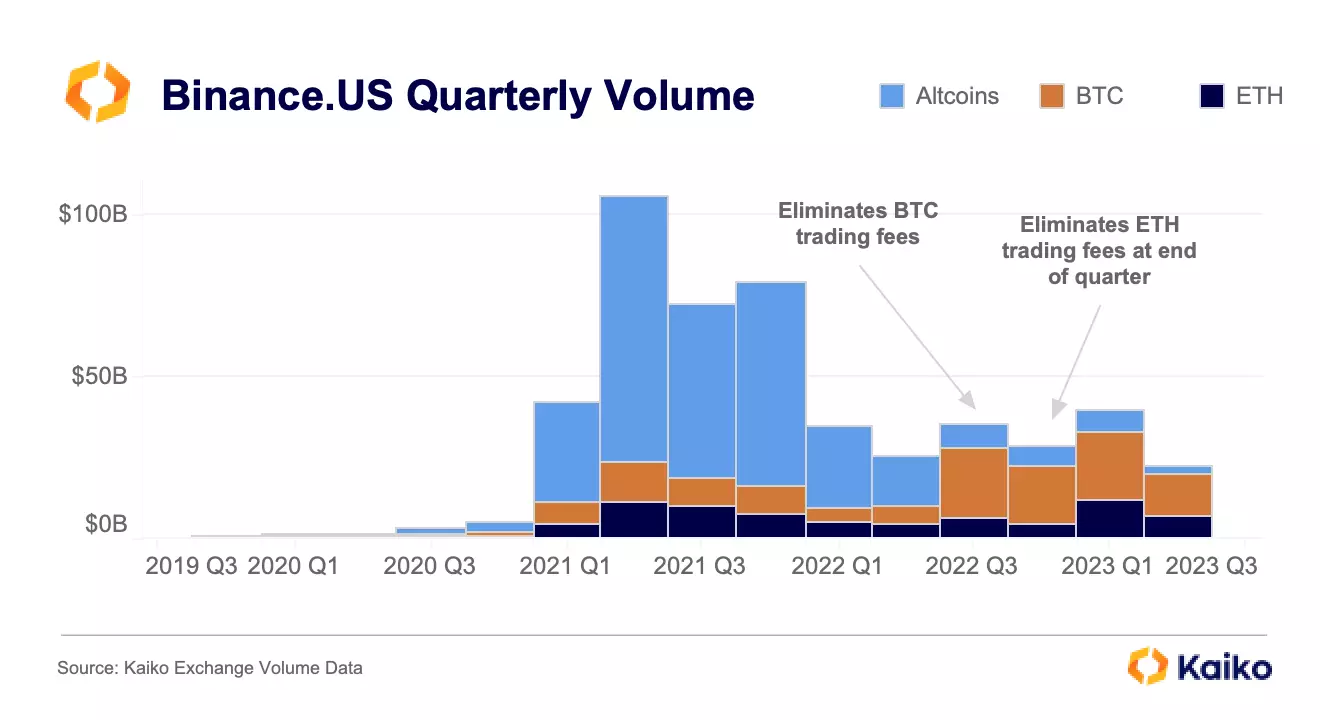

From Q4 2020 to Q1 2021, Binance.US’s altcoin volume exploded from $2.6bn to $30.5bn. The next quarter it hit $82bn, with just $12.5bn BTC and $11bn ETH volume. It’s worth noting how unusual this is: virtually no exchanges outside of Korea have altcoin volume that is higher than BTC and ETH volume combined, and certainly not for such an extended period of time.

Altcoin volume dropped quickly in 2022, shrinking to just $7bn in Q3 2022. That same quarter, Binance.US eliminated fees on BTC trading, which helped boost volumes from $6bn to $22bn. At the end of the next quarter it eliminated ETH trading fees, boosting volumes from $4bn to $12bn.

The bull market began in Q4 2021, which could help explain why the exchange’s volumes skyrocketed the following quarter. However, exchange market share tells a different story.

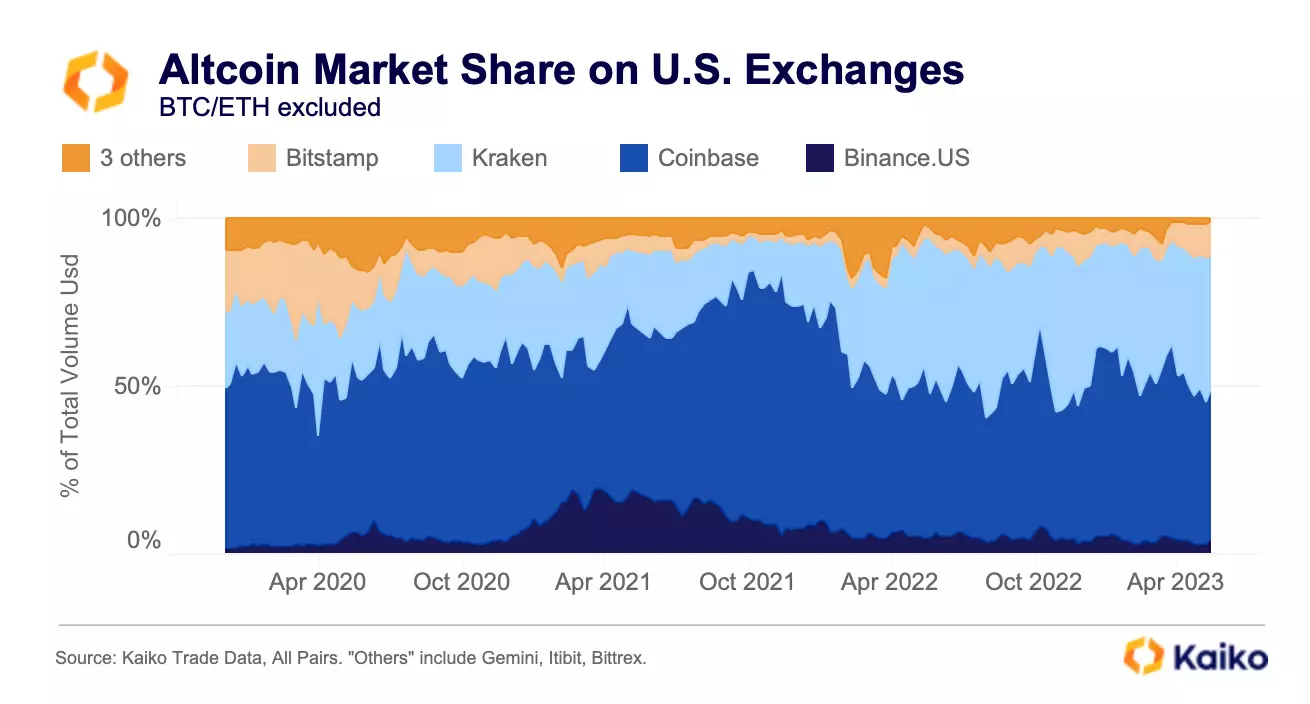

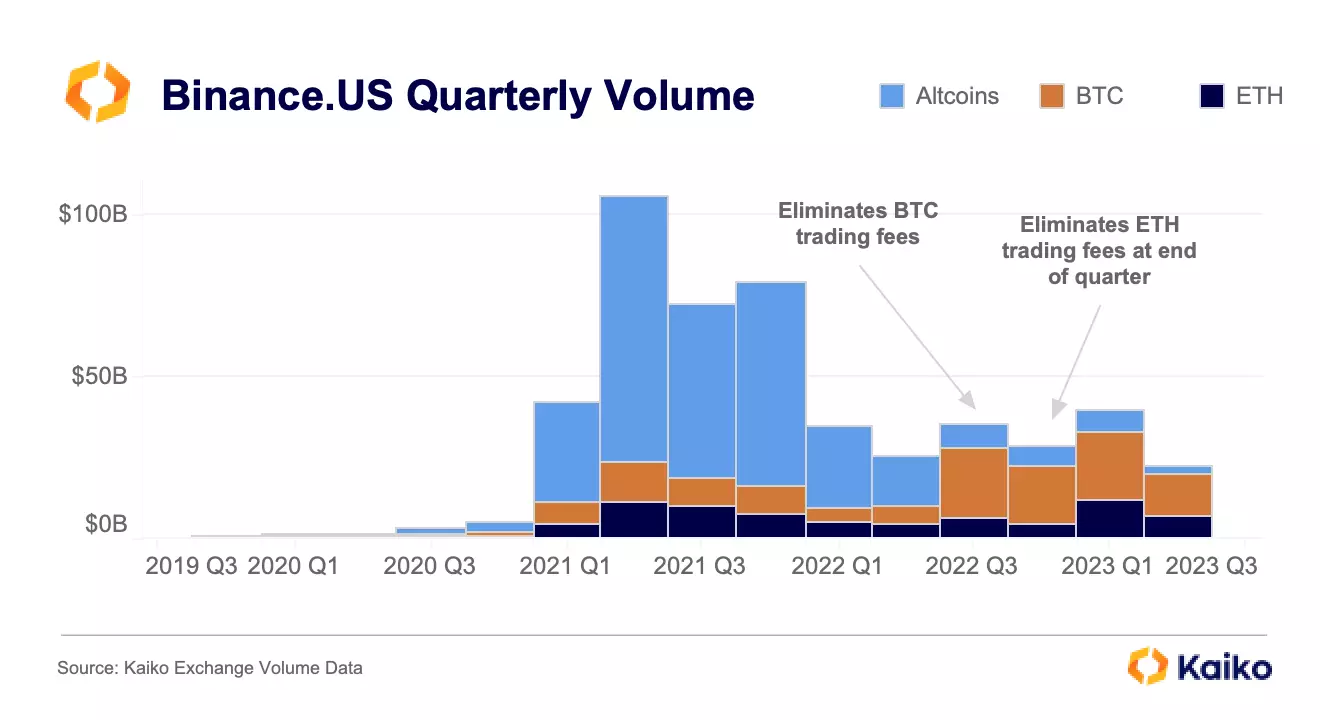

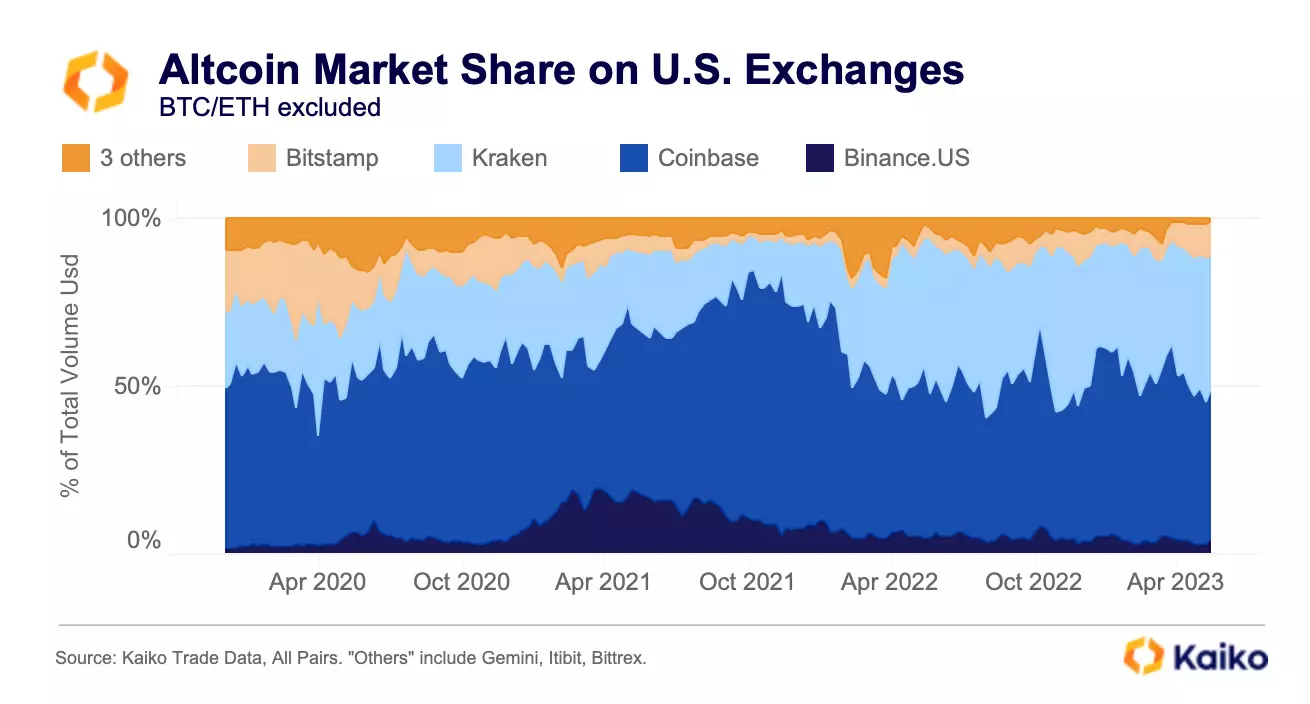

Below is charted altcoin volume market share amongst U.S. exchanges. BTC and ETH are excluded to eliminate the noise associated with the aforementioned fee changes.

Beginning in 2021, Binance.US quickly surged to a near 25% market share in the spring, then remained there until the fall, declining from September until December before rising slightly again in early 2022. The SEC’s most specific claim alleges wash trading before the exchange’s seed funding in September 2021.

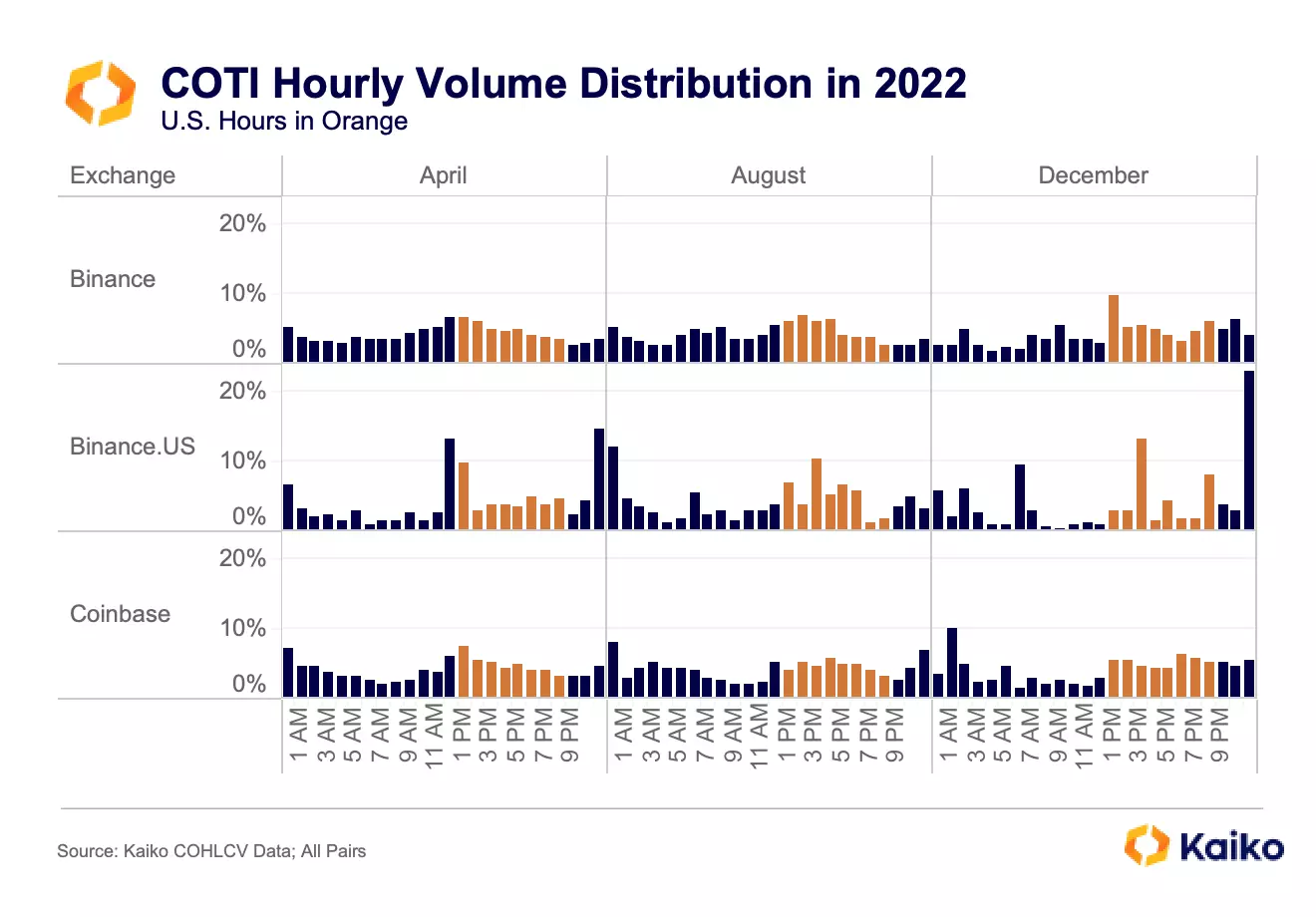

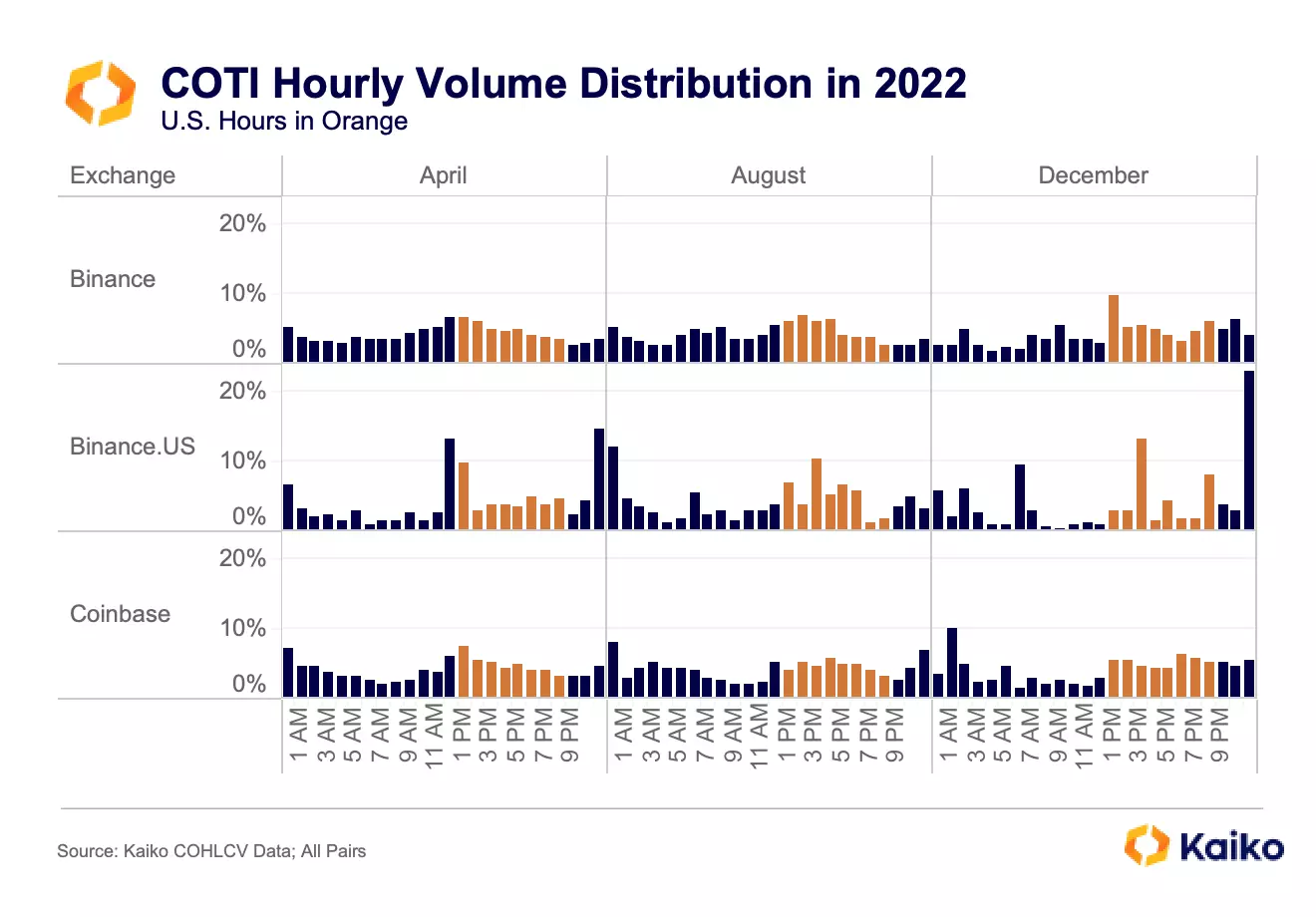

The complaint singles out COTI, using it as an example of newly listed token wash trading, claiming that up to 35% of the token’s volume came from Sigma Chain. It’s unclear how the SEC assigned such precise figures to Sigma Chain’s alleged wash trading given that centralized trading data is anonymous, but as discussed in a previous Deep Dive, there are still ways to investigate this claim.

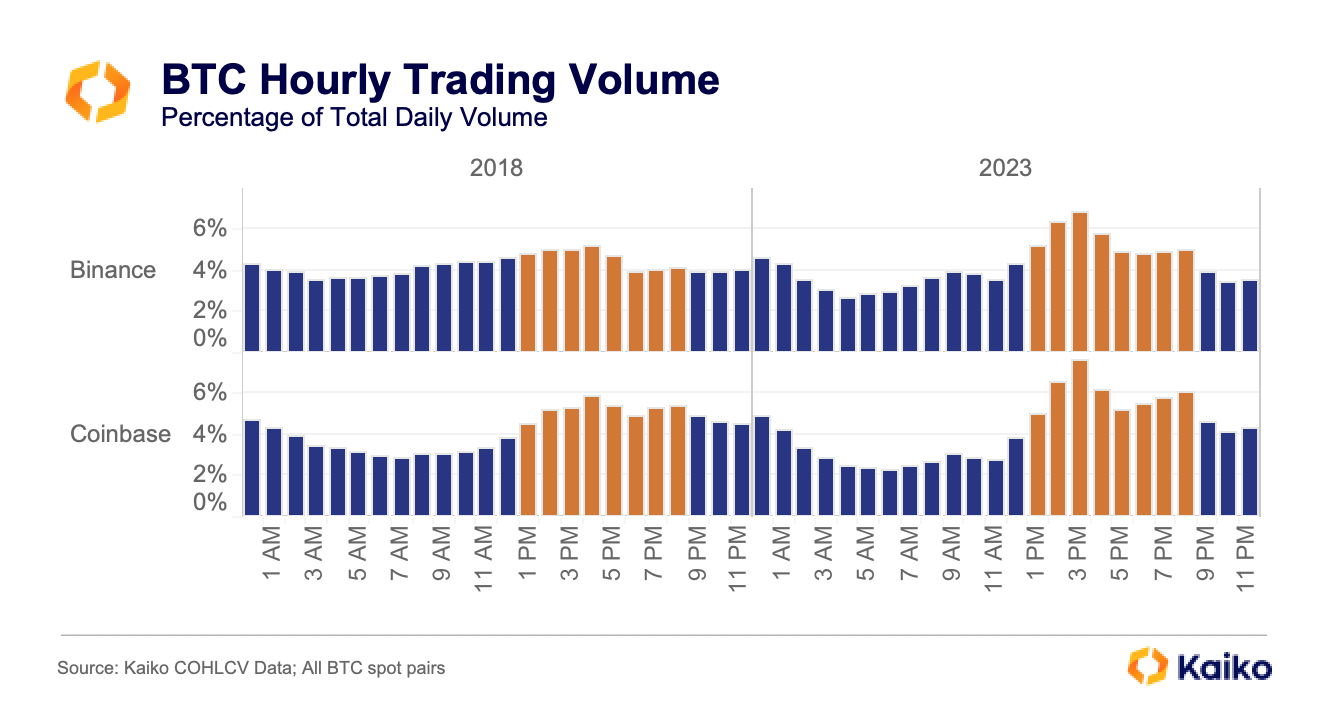

One of my favorite ways is to look at the hourly volume distribution. Charted below is the breakdown of hourly COTI volume in 2022 on Binance, Binance.US, and Coinbase.

Binance and Coinbase show relatively standard volume distributions, with smooth curves that usually peak at the beginning of U.S. hours. Binance.US’s volume is incredibly irregular, with spikes in certain hours in certain months. For example, in April 2022, the hours of 8am and 7pm ET accounted for nearly 30% of volume. In December, 11am and 7pm accounted for 36% of volume.

While this does not definitively prove that there was wash trading, it does indicate that trading activity was highly unusual.

![]()

![]()

![]()

![]()