Data Points

Introducing: Our Q4 Market Report

Last quarter, ETF speculation became the single biggest catalyst driving markets, propelling bitcoin to 21-month highs. In our latest report, we break down the ETF hype, Binance’s legal resolution, a rise in derivatives activity, Solana’s resurgence, the state of DEXs, and (much) more.

Download Report

SOL market share endures as rally cools.

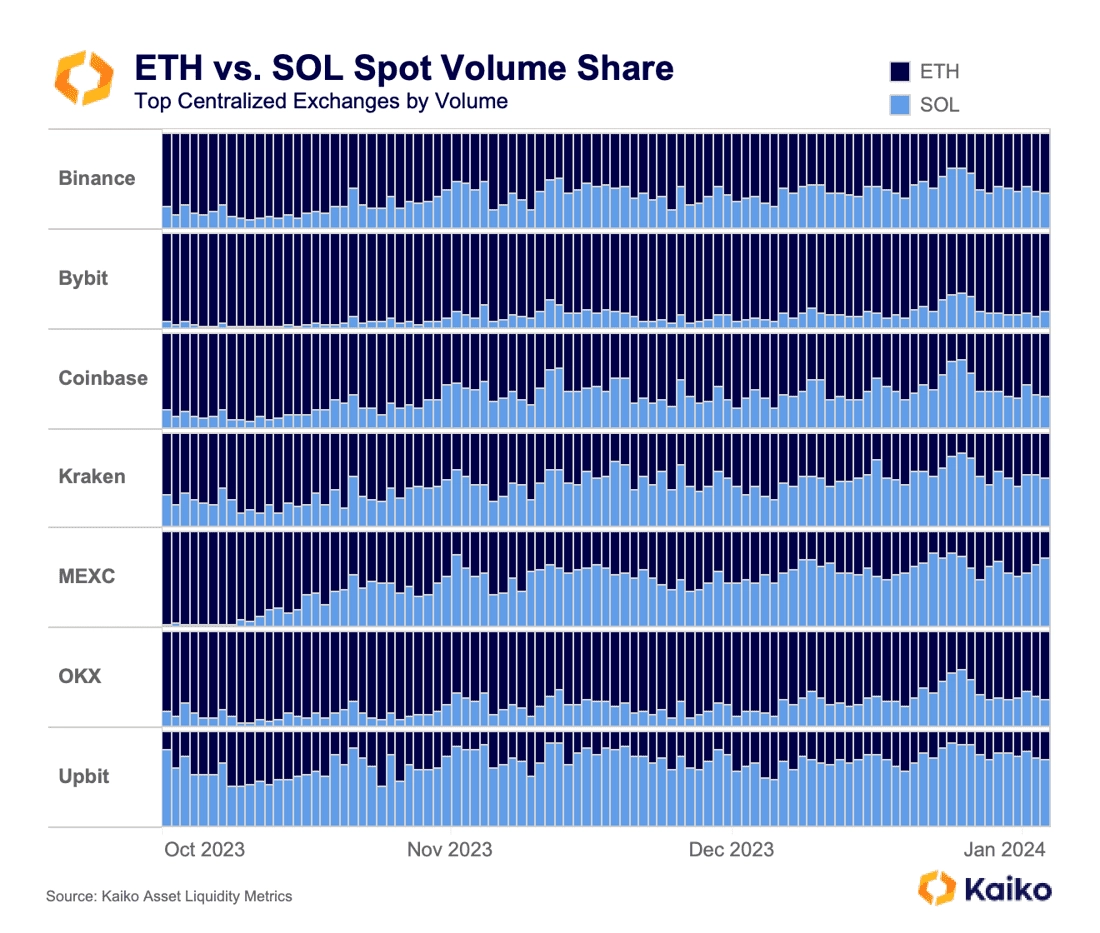

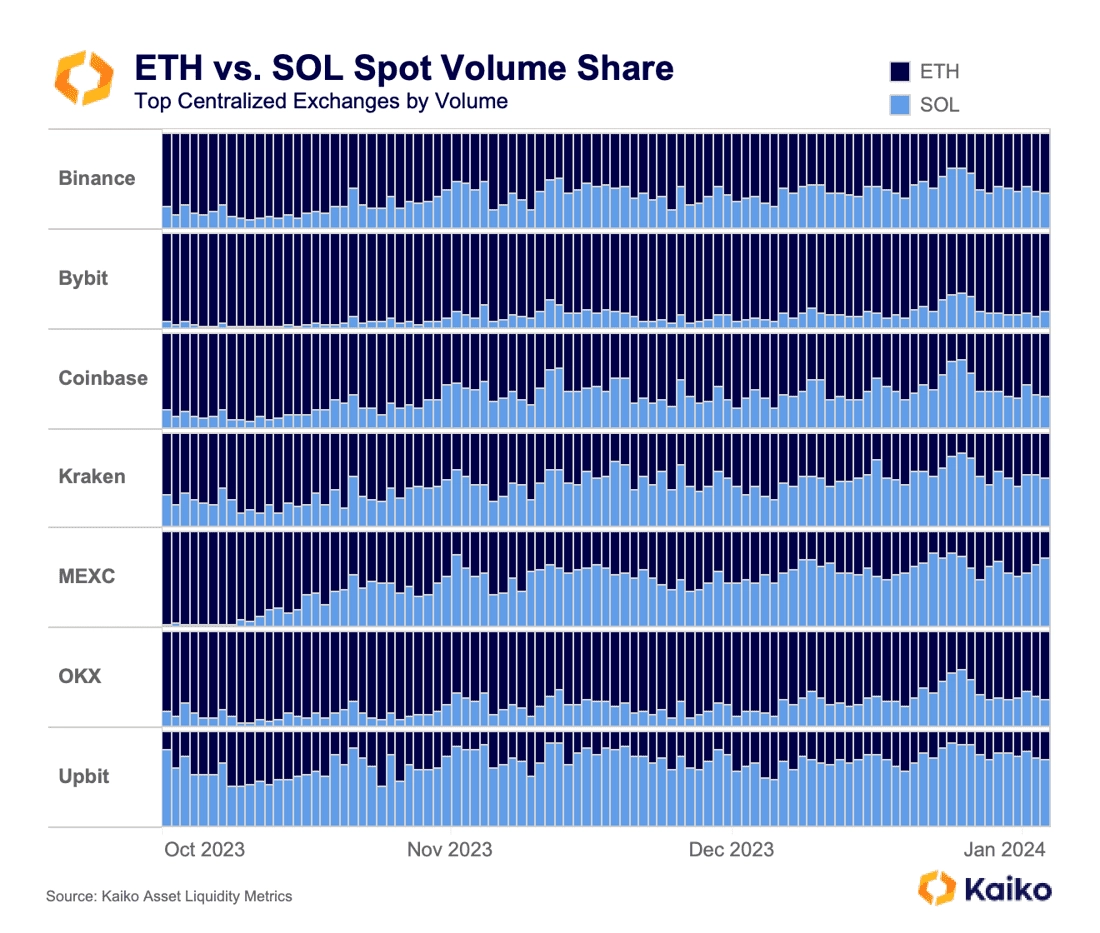

The days surrounding Christmas brought a virtually unprecedented event: an altcoin’s volume surpassing the combined volume of BTC and ETH on multiple exchanges. This altcoin was, of course, SOL, which has rallied to levels not seen since Terra’s collapse. While this phenomenon was short-lived on most exchanges, possibly the more striking trend is SOL’s volume relative to ETH alone.

On most exchanges, especially the largest ones, ETH has been the unquestioned #2 in volume. However, starting back in November, we saw SOL volume start to flip ETH volume on MEXC and Upbit, though this isn’t uncommon for the latter.

ETH’s share relative to SOL surged on Kraken at this time, from under 15% to a high of 70% in November; on Coinbase the figures jumped from 8% to a high of 63%. Binance reached a high of just over 50% in December.

While this may have seemed to be a flash in the pan, this trend has continued, and in some cases strengthened. In the new year, SOL has done more volume than ETH a majority of the days on MEXC, Upbit, and Kraken.

PYUSD trade volume is off to a slow start.

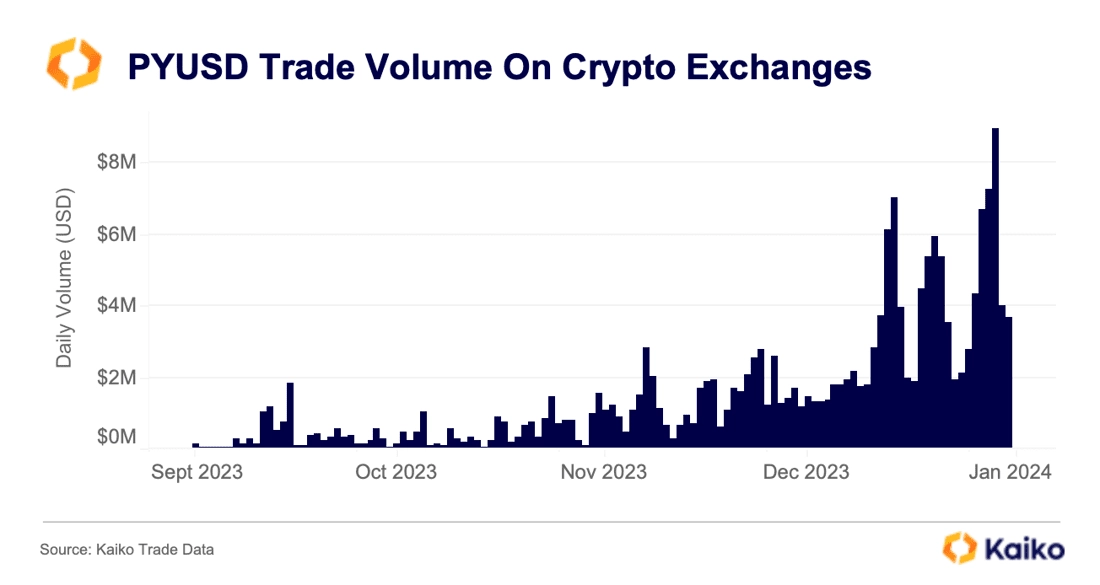

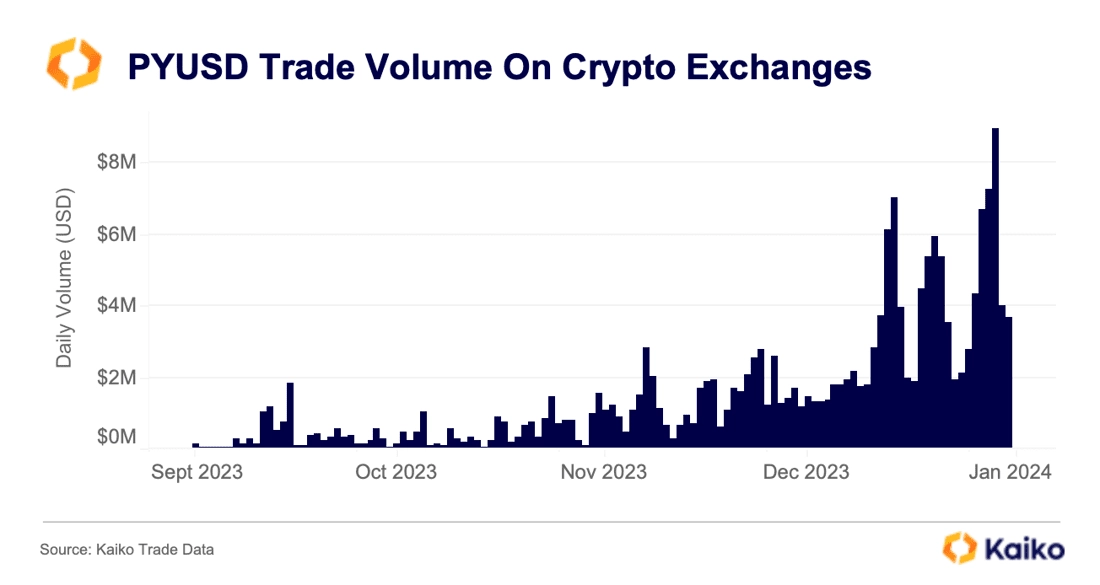

Back in August, Paypal became the first major payments provider to launch a dollar-backed stablecoin. PYUSD is marketed as a stablecoin to be used in payments and within the Paypal app, thus having a slightly different value prop compared with more crypto-native coins like USDT or DAI.

However, PYUSD is listed on several centralized crypto exchanges, which suggests Paypal would also like the coin to be used for crypto trading activities. Paypal does not provide market data, so it is impossible to know the volume of transactions done using PYUSD within Paypal or for payments.

We can track its volume on crypto exchanges, though, and can see that across 7 exchanges that list the coin, volume has remained relatively low. Trade volume hit a high of ~$9mn at the end of December, which is an increase from September, but relative to a stablecoin like Tether, next to nothing.

Tellor’s wild ride ends in a crash.

Previously under-the-radar oracle project Tellor (TRB) was thrust into the spotlight on New Year’s Eve as its price exploded to nearly $600 before dropping back to $150 in the span of just two hours. Much like other rallying tokens over the holidays, TRB began to show significant price dislocations across exchanges after days of aggressive spot buying.

As the rally peaked, Coinbase showed $500, while Binance showed $625 and OKX over $700. In the hours leading up to the peak, open interest in native units fell from 725k to 450k and funding rate turned sharply negative, suggesting that long traders were quickly closing their positions.

To add to the drama, a wallet linked to the Tellor team deposited millions of dollars worth of TRB tokens to Coinbase just before price crashed. However, cumulative volume delta shows that the selling leading to its crash started minutes earlier on Binance than on Coinbase, as is shown with Binance’s rapid drop just before 11pm UTC.

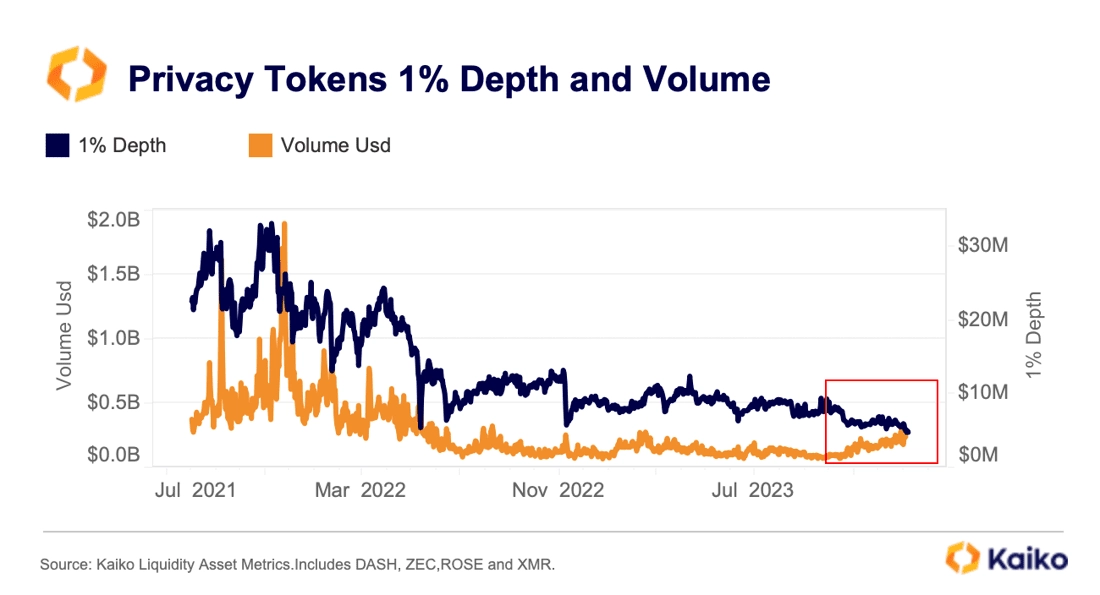

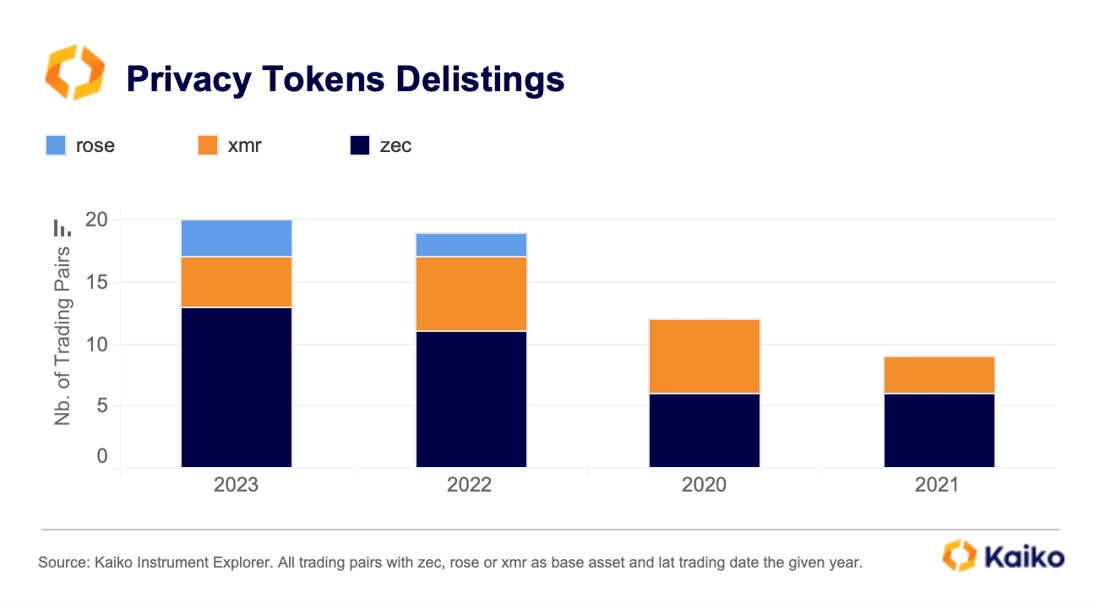

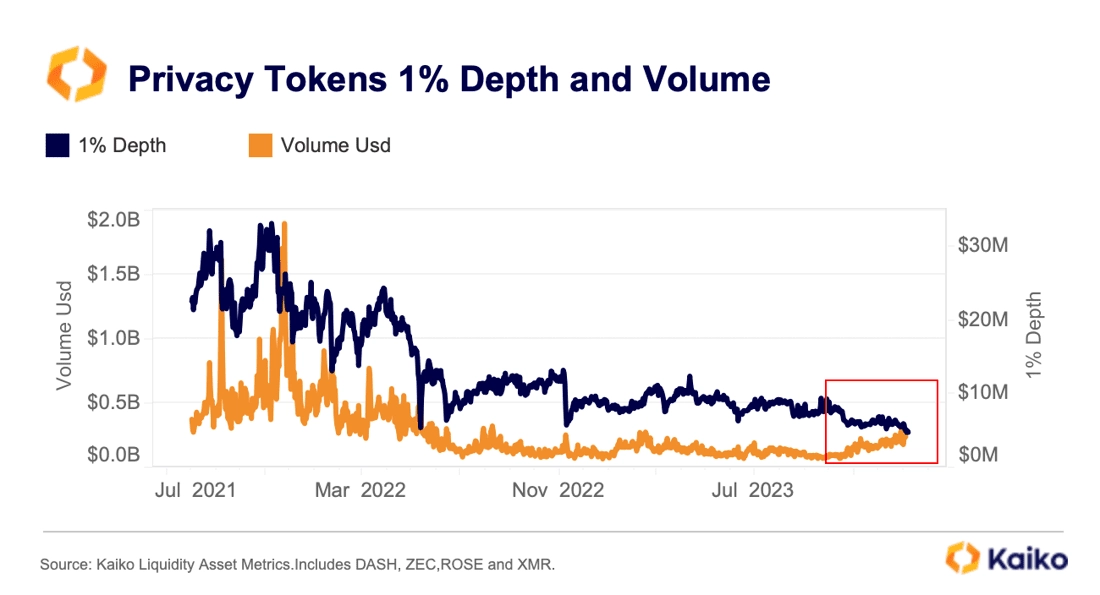

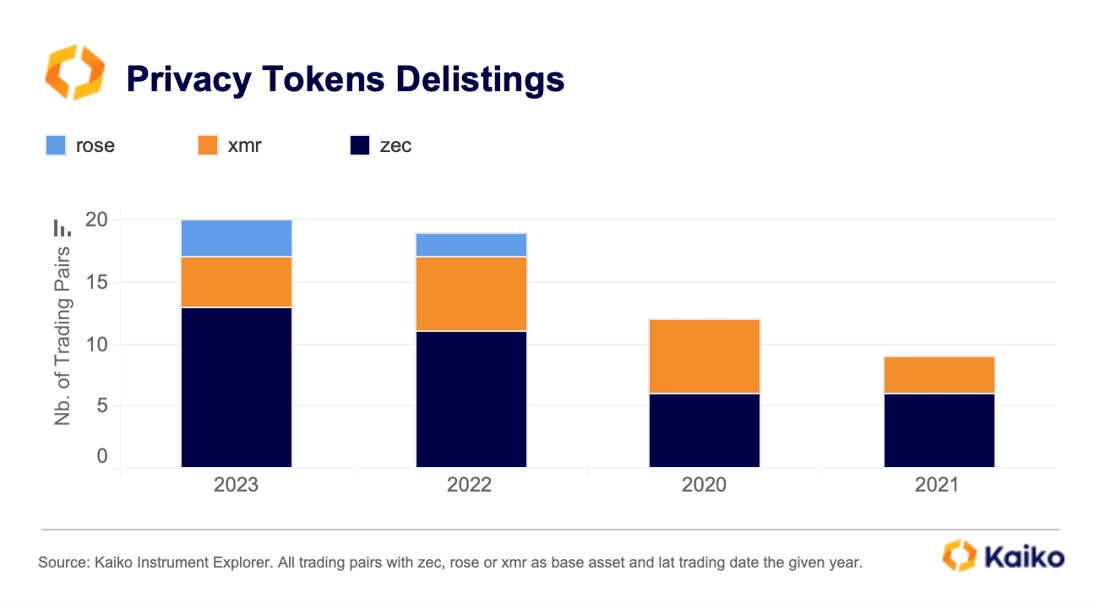

Privacy token liquidity hits all-time low.

Privacy token liquidity — as measured by 1% market depth — for Monero (XMR), Zcash (ZEC), DASH and ROSE hit an all-time low of just $5mn last week after OKX delisted several trading pairs for failing to meet listing criteria. While trade volumes gradually increased since October, they are still well below their 2021 levels.

Over the past two years, privacy tokens, which are designed to obscure transaction details, have increasingly been delisted by major platforms due to regulatory pressure. This has helped to exacerbate the decline in liquidity during the crypto bear market. Both XMR and ZEC are currently at high risk of being delisted on Binance due to low liquidity.

ZEC has been the most delisted privacy token over the past two years. This has lead to a greater fragmentation of the market, with XMR dominating on large exchanges, while ZEC and DASH are mostly traded on smaller unregulated venues.

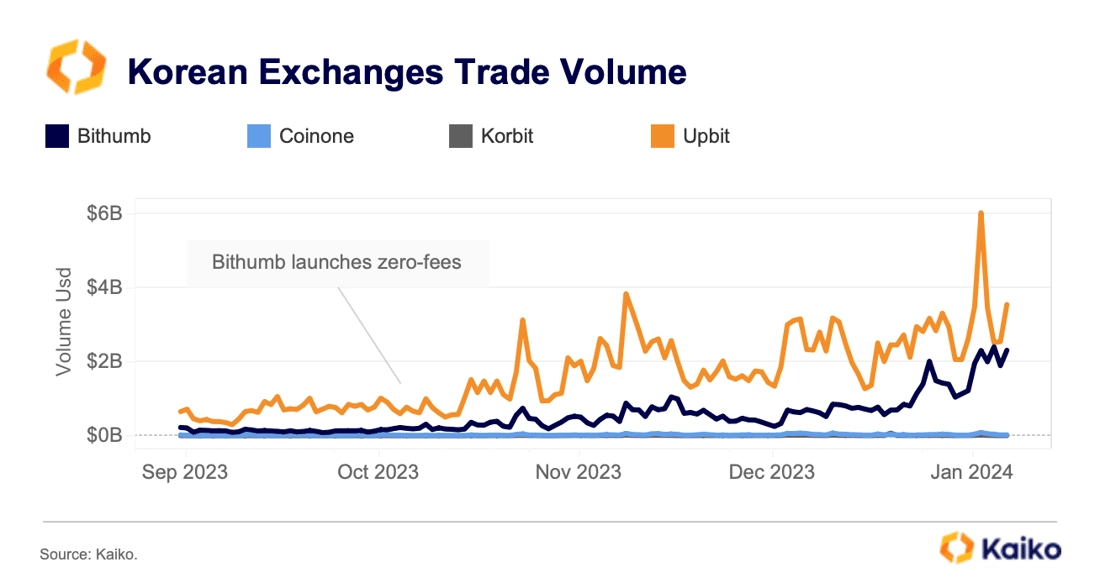

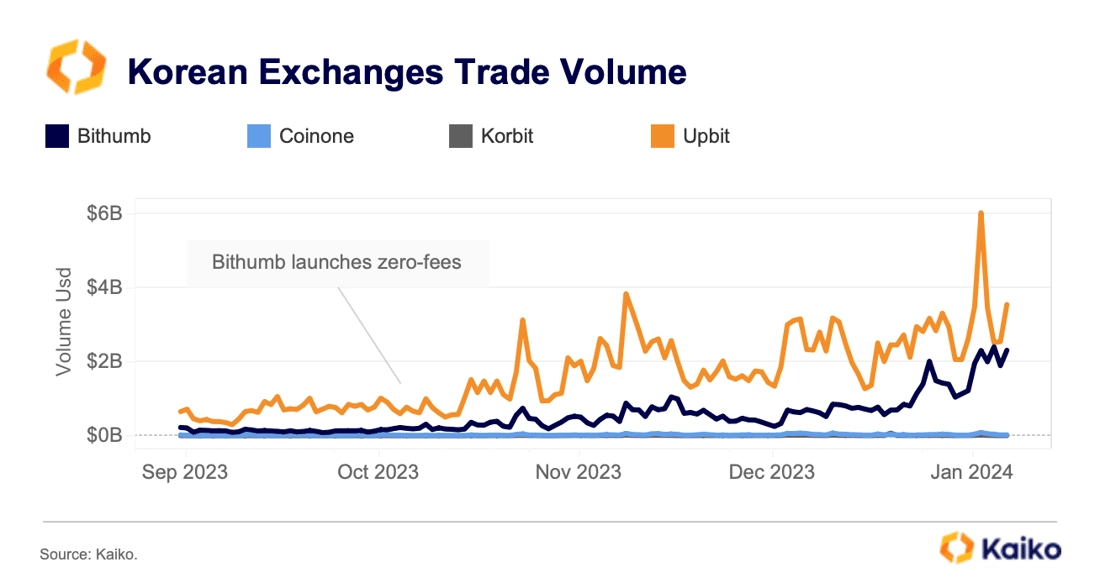

Korean exchange trade volume hits multi-year high.

Trade volume on Korean exchanges hit its highest level since March 2022 during last week’s selloff. Interestingly, while altcoins typically account for more than 80% of trade volumes on Korean markets, their share dropped to less than 70% last week while Bitcoin’s rose to 32% for the first time since 2020.

Bithumb and Upbit both saw strong rise in trading activity with Bithumb’s market share briefly spiking to 48%. The exchange launched a zero fee promotion back in October but its initial impact has bee muted with volumes starting to increase markedly only at the end of December.

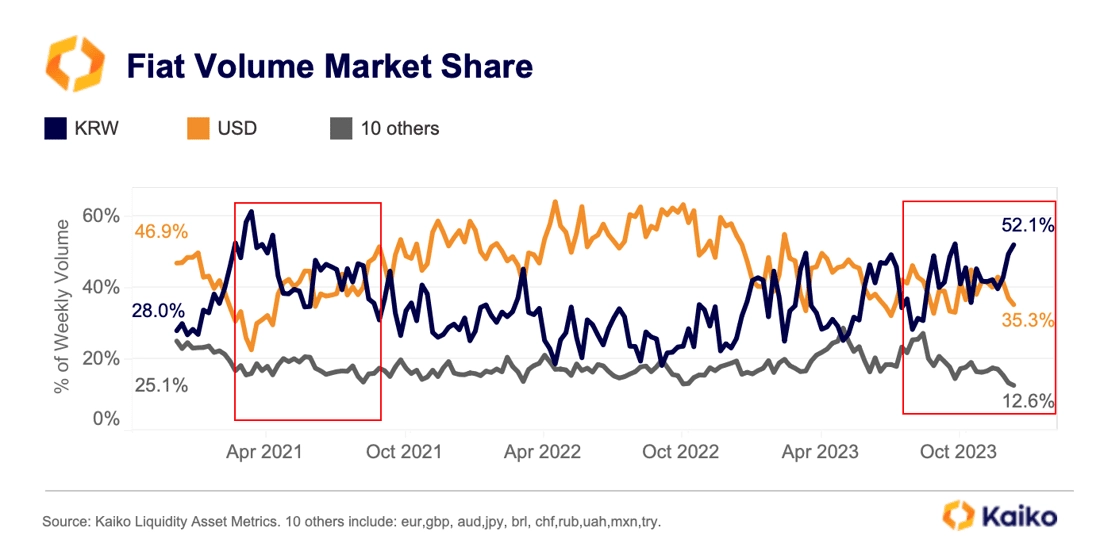

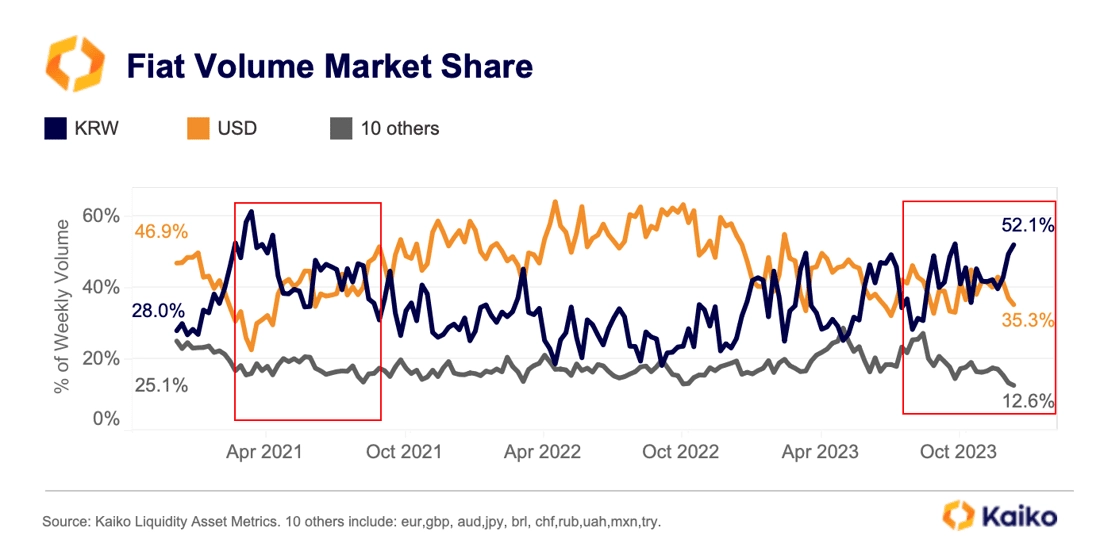

During the recent rally, the Korean won (KRW) has been dominating fiat trading, surpassing the US Dollar as the largest fiat trading pair in crypto. It accounted for 40-50% of fiat transactions compared to 30-40% for the USD. The last time the KRW dominance was so high was during the 2021 bull run.

The recent recovery comes even though South Korea’s financial regulator has ramped up its efforts to regulate the crypto industry over the past months, proposing new rules to protect users on crypto exchanges and a ban on crypto purchases with credit cards.

![]()

![]()

![]()

![]()