Data Points

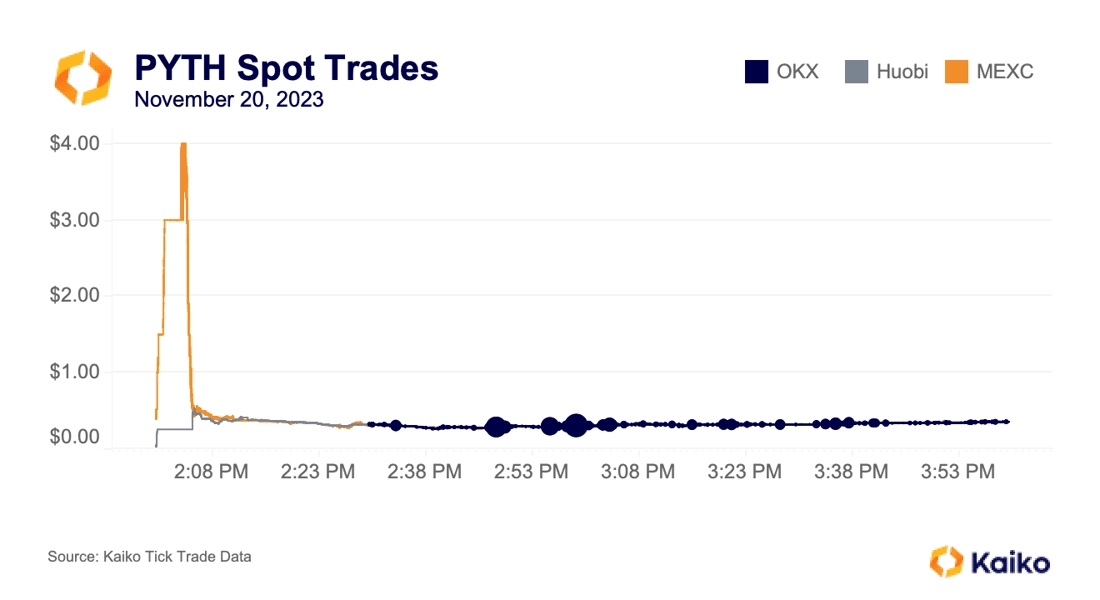

PYTH token surges as Solana ecosystem remains hot.

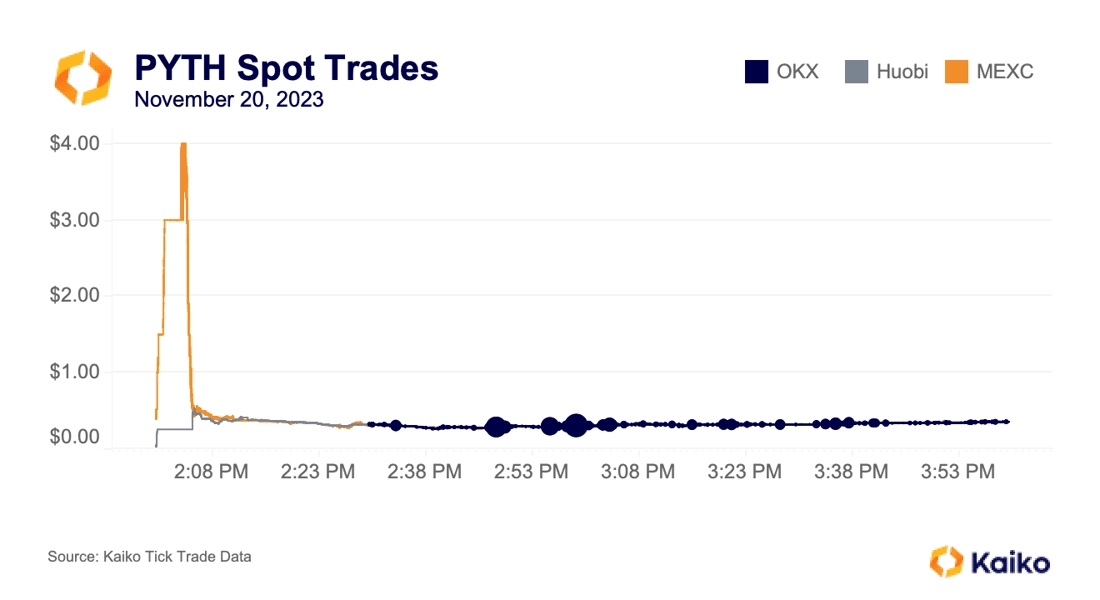

Oracle provider Pyth released its long anticipated token in the form of an airdrop to users who had interacted with protocols using Pyth’s feeds. The token is native to the Solana blockchain, though users on many blockchains received the airdrop. Off-chain, the launch had the characteristic price divergences we’ve seen during past token launches via airdrop.

On MEXC, the token’s price hit $4 less than 10 minutes after trading began. At launch, trades on Huobi were taking place between $0.05 and $0.10. However, bigger trades didn’t roll in until the token went live on OKX; these trades are represented by the larger blue dots.

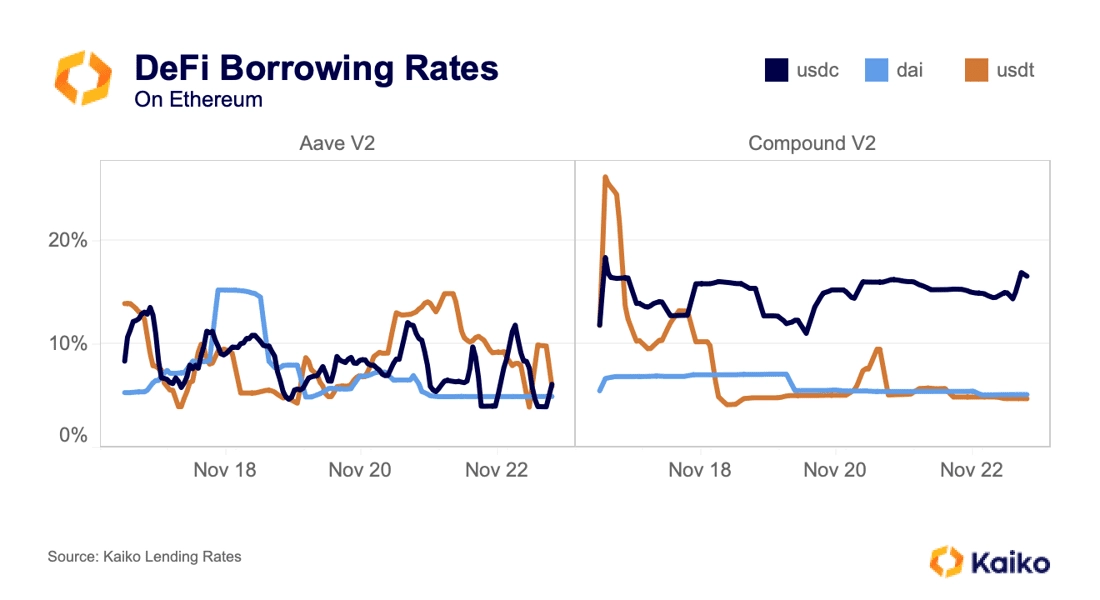

DeFi borrowing rates remain elevated.

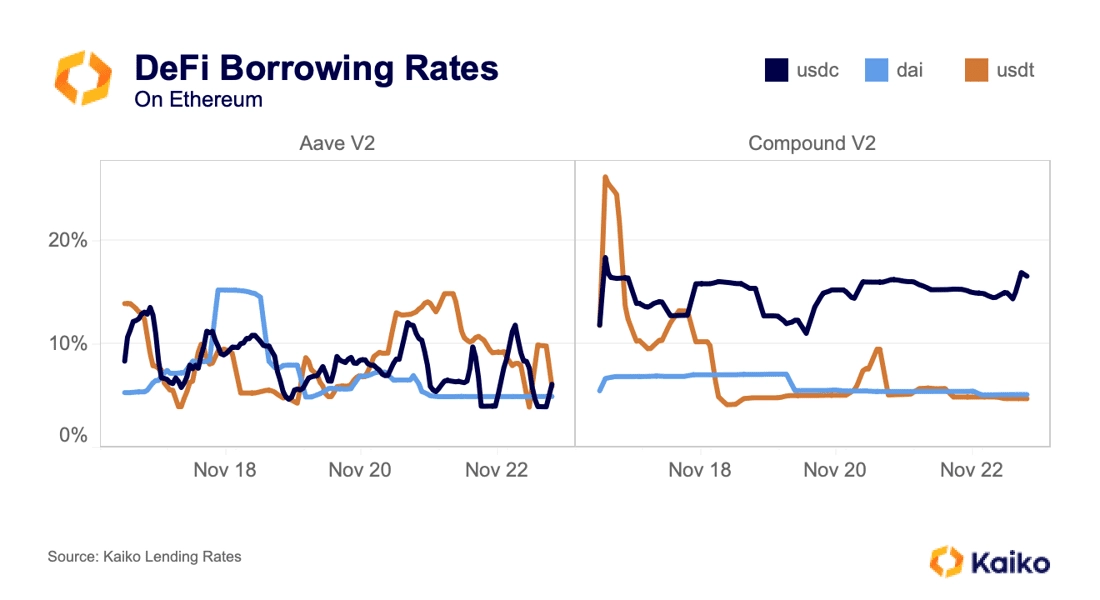

Borrowing rates on Aave V2 and Compound V2 have remained high – about 13% APR on Compound and between 4% and 15% on Aave for USDC – as demand for stablecoins has increased. Rates on Aave have been especially volatile as the utilization rate remains very close to optimal for USDC, DAI, and USDT. The utilization rate describes what percentage of a token deposited into a protocol is being borrowed; when the “optimal” percentage is breached, rates increase rapidly to encourage repayments or deposits, bringing the utilization rate back down.

Utilization rates on the above protocols have trended higher because of increasing borrowing demand for stablecoins in the short term as well as the migration to their respective V3s over the long term.

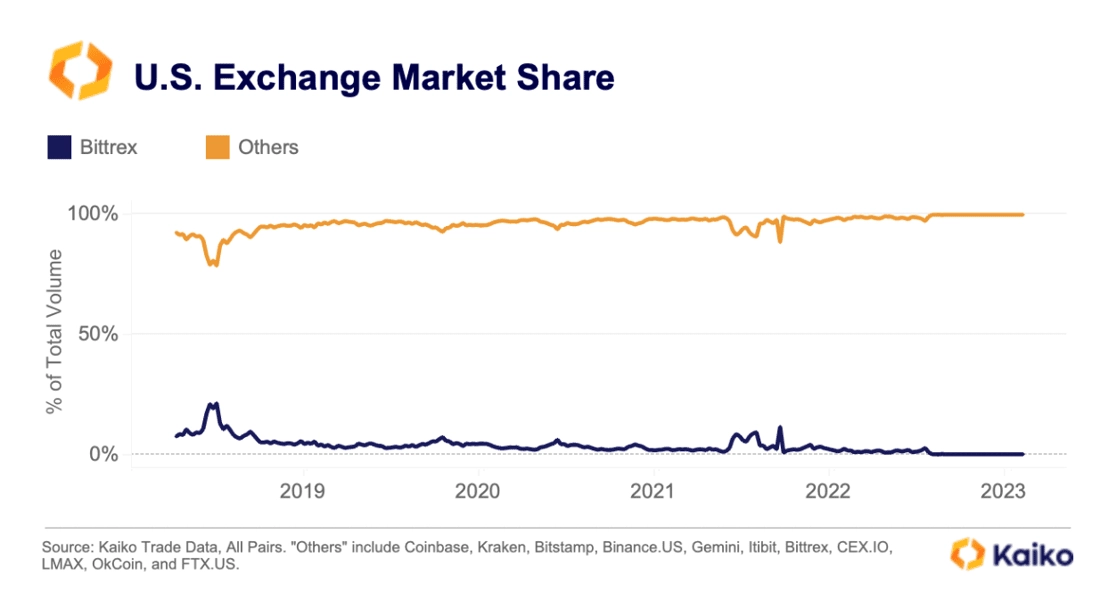

The end of Bittrex.

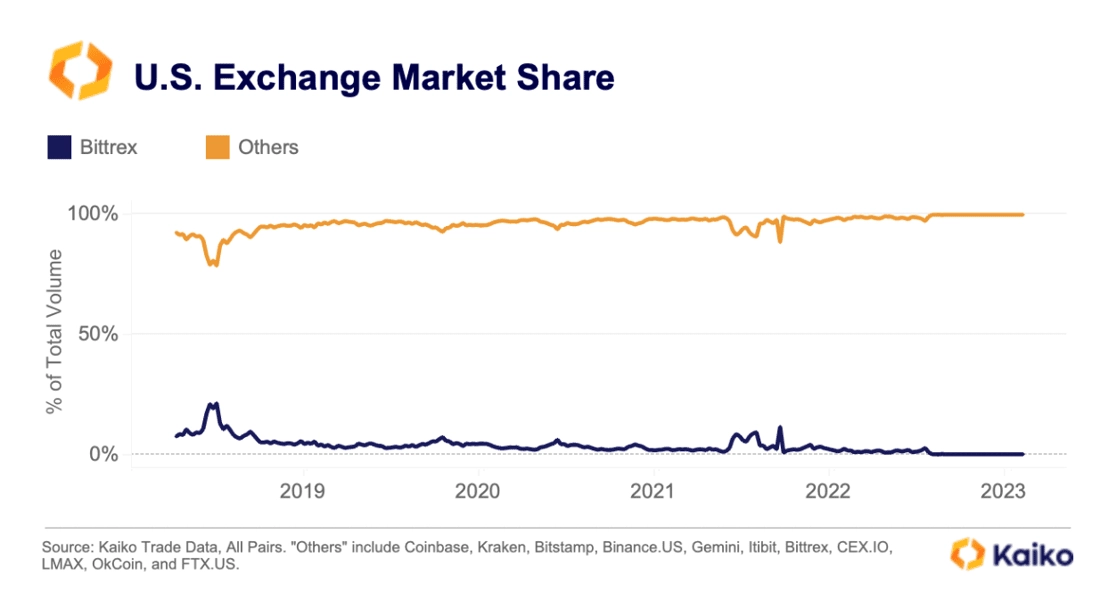

On December 4, Bittrex Global, once of the largest crypto exchanges in the world, will shut down. Bittrex was founded in 2014, making it one of the oldest exchanges. Years ago, it was also one of the largest, on par with exchanges like Coinbase. However, after the 2017 bull market, it failed to maintain its dominance, and since 2018, its market share among other U.S. exchanges has fallen from nearly 20% to less than 1%.

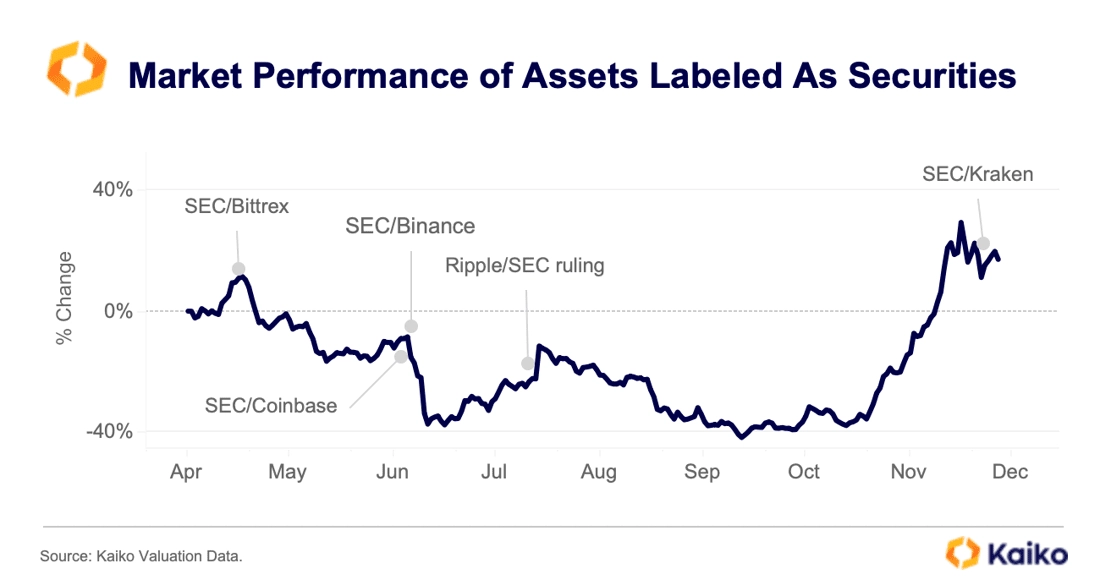

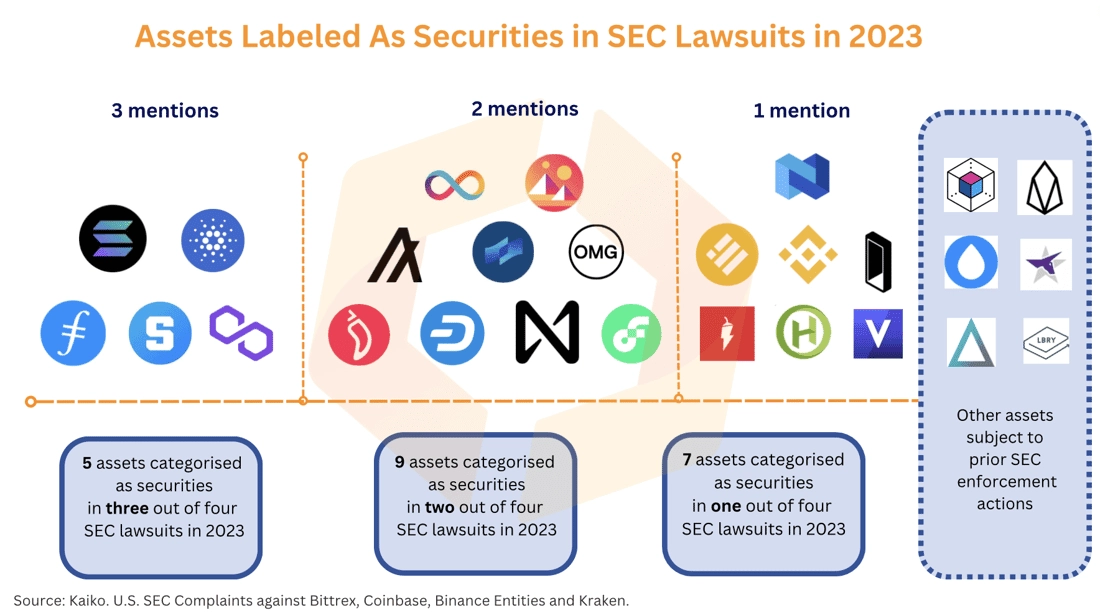

Assets labeled securities are steady despite SEC action.

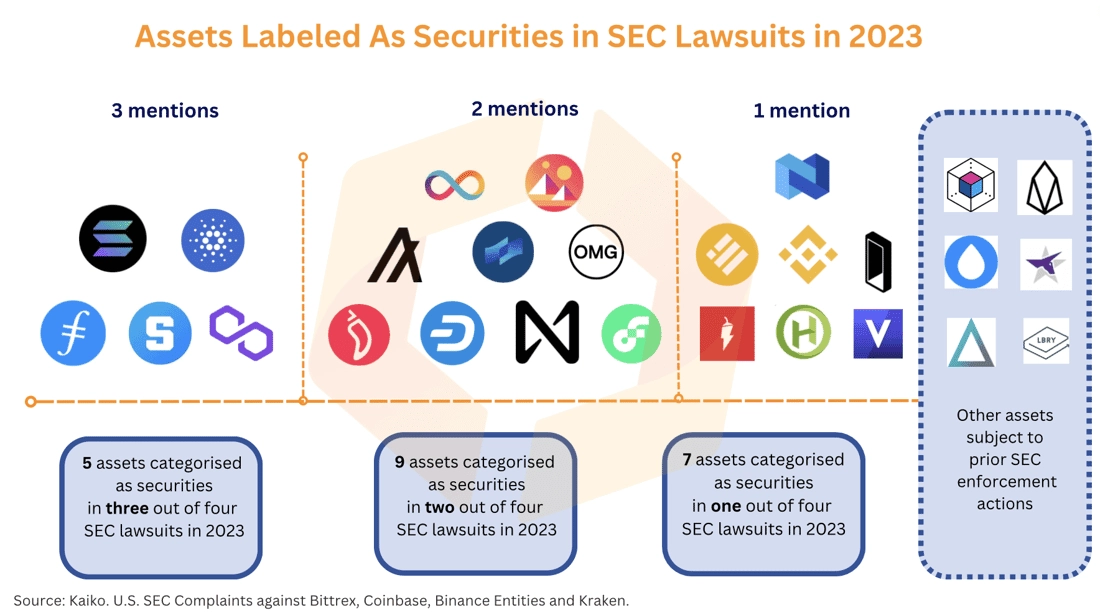

In 2023, the U.S. SEC stepped up its enforcement action against centralized exchanges, suing four platforms for illegally operating as a securities exchange without registering. The agency has also indirectly taken a much wider aim at the crypto industry, explicitly designating several altcoins as securities. Over the past year, nine crypto assets were mentioned twice in the SEC’s complaints against Kraken, Coinbase, Bittrex, and Binance and five were mentioned three times.

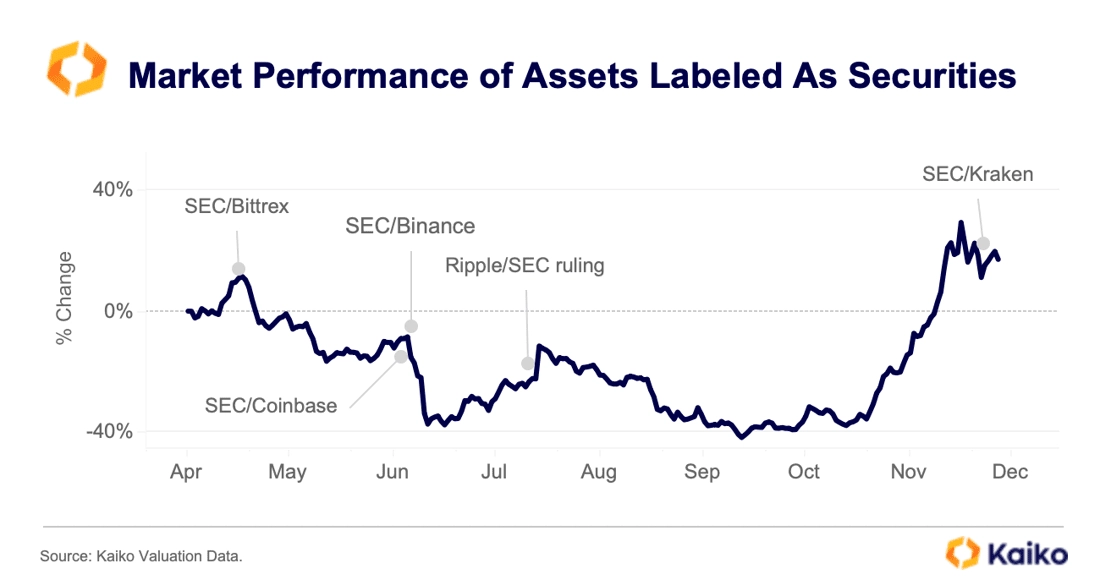

How have markets for these assets reacted? The chart below shows an equally weighted simulated portfolio of the five assets most frequently cited by the SEC: SOL, ADA, SAND, FIL and MATIC.

The market reaction following the announcement of the Coinbase and Binance lawsuits on June 5 and 6 was strong and the basket lost 31% of its value. The move was exacerbated by Robinhood and other platforms announcing the delisting of assets and several market makers selling a portion of their altcoin holdings. This led to cascading liquidations in derivatives markets between June 9-11 and a broad altcoin selloff.

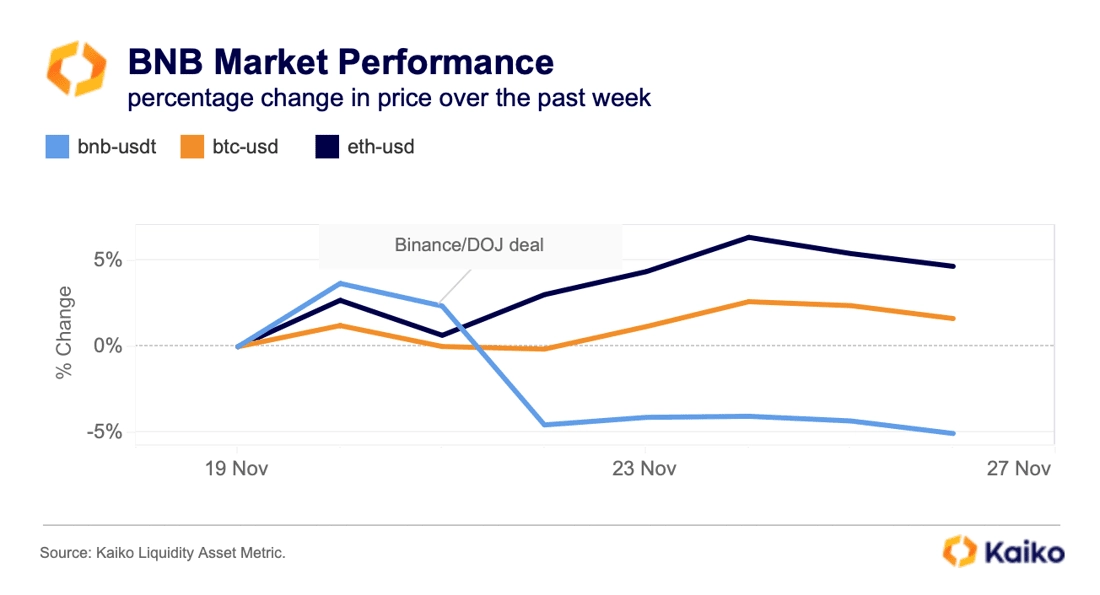

Last week, however, prices initially fell after the official announcement of the Binance/DOJ deal, but quickly recovered with BTC briefly hitting a yearly high of $38k. The SEC/Kraken lawsuit did not lead to delistings of any of the assets named, suggesting that confidence in the market has increased following the landmark rulings in the XRP and Grayscale cases.

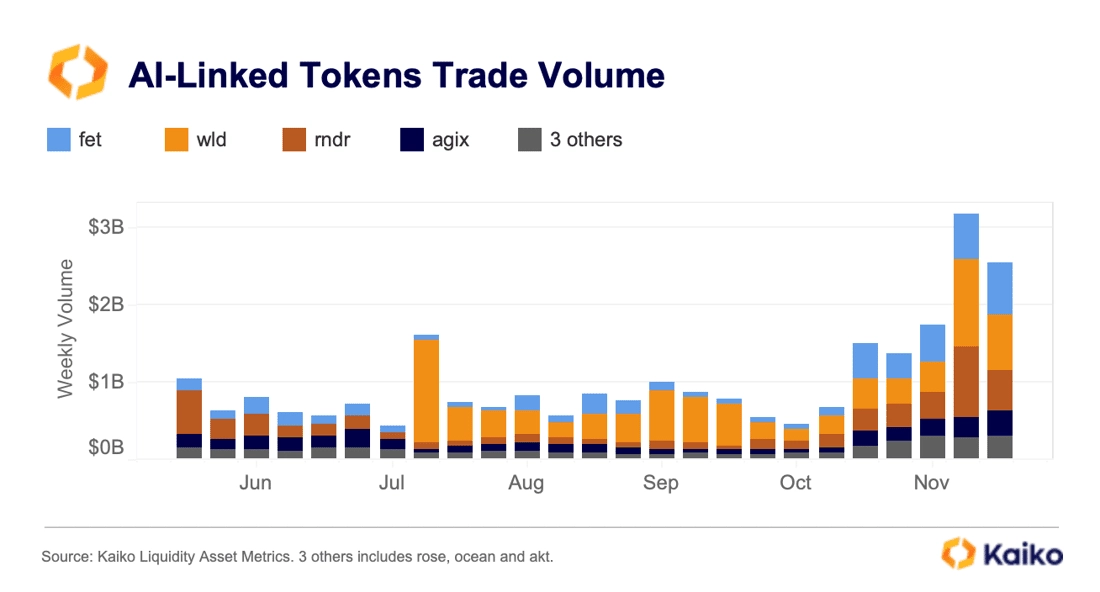

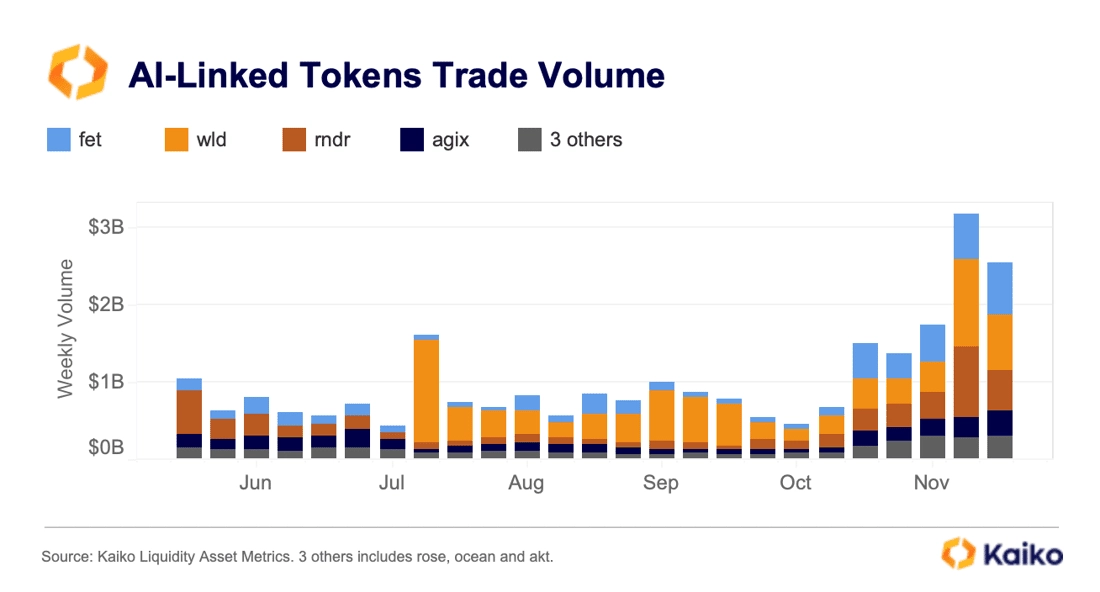

AI-linked crypto token trade volume takes off.

The weekly trade volume of AI tokens reached a multi-month high of over $3bn in early November as global sentiment has improved on the back of better macro conditions and better-than-expected quarterly results by chipmaker Nvidia. The increase was driven by Sam Altman-affiliated Worldcoin (WLD) and Render (RNDR), which accounted for more than half of overall volume in November.

Binance is the largest market for AI-linked tokens. However, its market share has declined significantly from 74% in July to 61% as of last week. By contrast, the share of volume on U.S.-available exchanges has increased. Coinbase has emerged as the second largest AI market and accounts for 9% of global AI tokens volumes, up from just 1% in July.

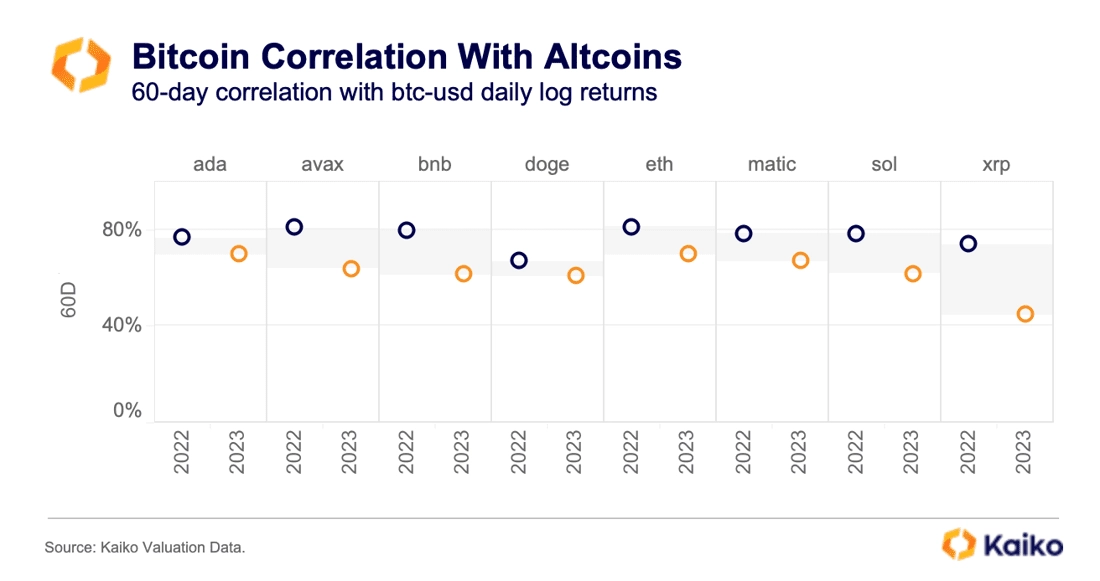

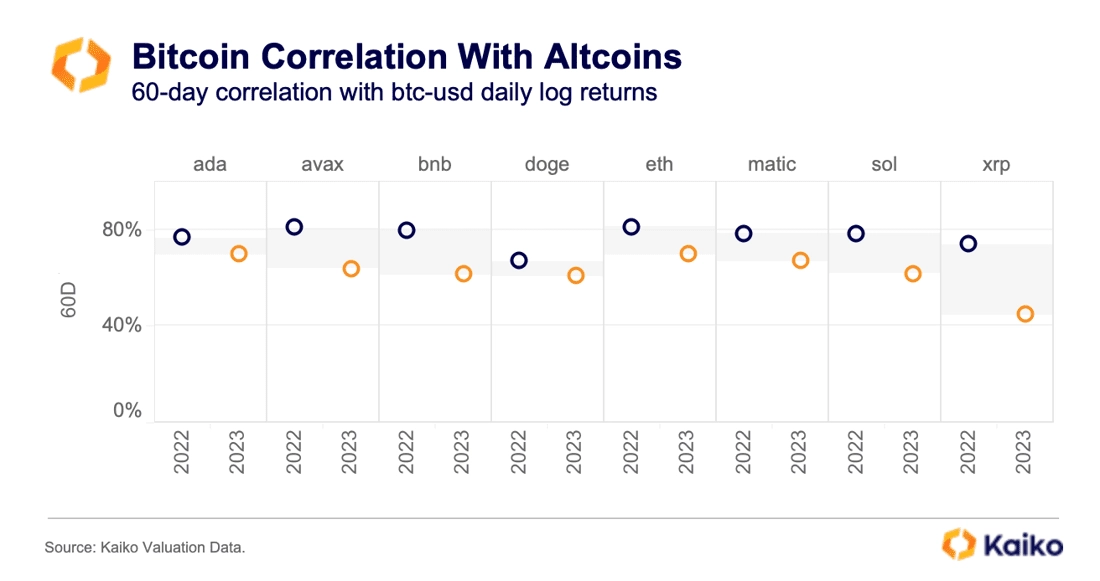

Bitcoin is less correlated to altcoins in 2023.

Bitcoin’s appeal as a portfolio diversifier has increased this year because it has de-correlated with traditional assets while posting significant returns. XRP and BNB have registered the largest drop in correlation with BTC while DOGE and ADA have remained mostly correlated. Bitcoin has been outperforming most altcoins over the past few months, attracting institutional inflows on rising enthusiasm around a potential spot ETF approval. While altcoins have been lagging behind, they have gained some traction in November as global risk sentiment improved.

![]()

![]()

![]()

![]()