Liquidity

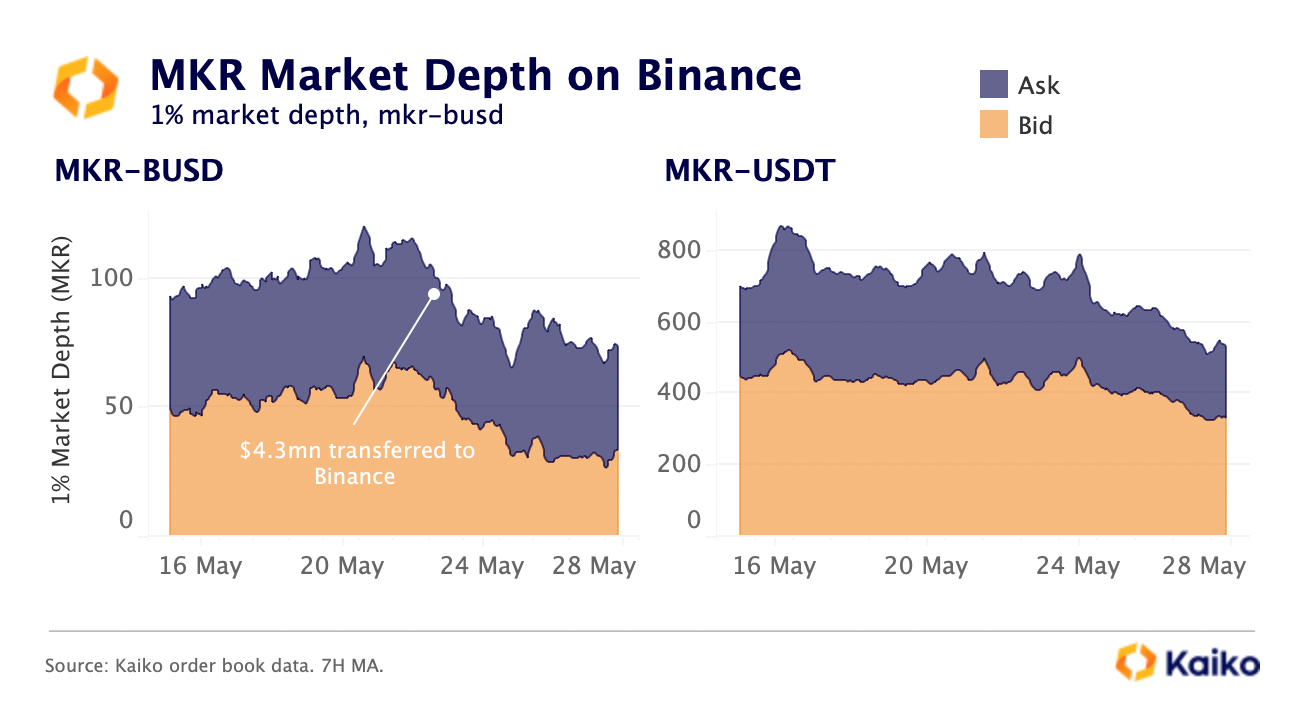

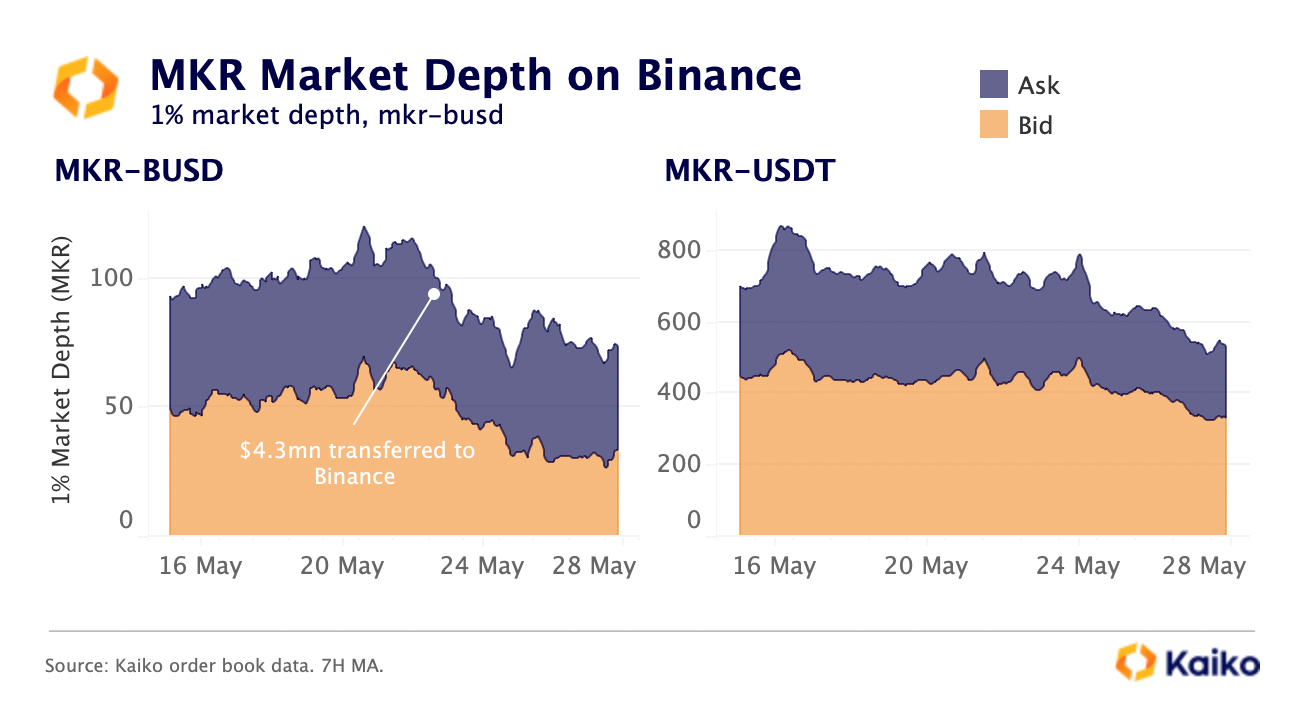

MKR depth drops following large Binance transfer.

Binance market depth for MakerDAO’s native token MKR plummeted last week after the news of a large $4.3mn transfer to the exchange. Such transfers are often seen as preceding transactions and could indicate a possible sell-off. MKR-BUSD 1% market depth halved between May 22 and 25, while liquidity for the most liquid pair MKR-USDT fell 21% to 670 MKR a day later and remained low throughout the week. The sharp move was preceded by a large amount of sell orders placed on Binance between May 19 and 20, after liquidity had already declined sharply in April.

This suggests that liquidity providers remain cautious in the face of increased perceived risks in MakerDAO and its stablecoin DAI. DAI holds most of its collateral in USDC, which temporarily lost its peg in the wake of the collapse of Sillicon Valley Bank. Despite the de-pegging, the MakerDAO community voted to keep USDC as DAI’s primary reserve asset. It also maintained its plans to transfer a portion of DAI’s USDC reserves to Coinbase’s custody program, even though the exchange received a Wells notice from the U.S. SEC earlier this year.

OKX well positioned for Hong Kong re-opening.

Last week Hong Kong’s financial regulator, SFC, announced that its new licensing regime for virtual assets will take effect on June 1st allowing for retail investors to buy certain crypto assets. This, along with the coverage in Chinese state media (which was later removed) has increased the optimism that a portion of China’s substantial $1.4bn household savings could flow into the crypto market.

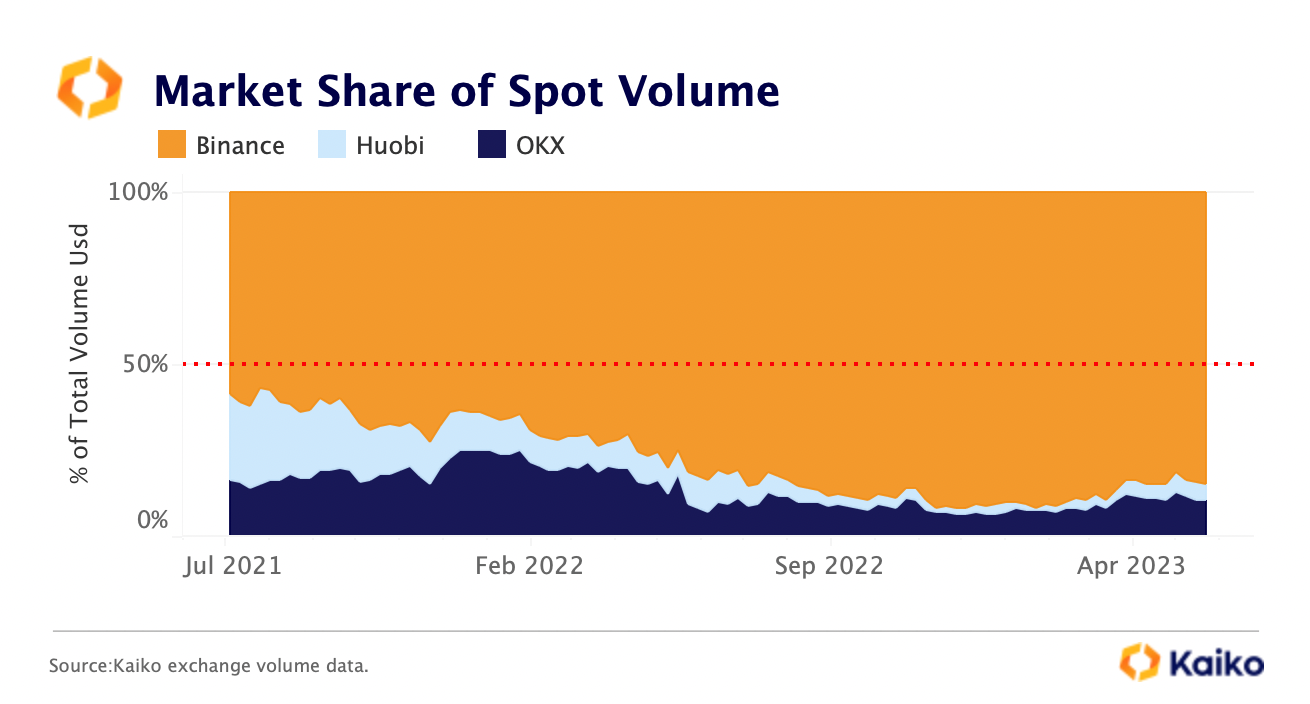

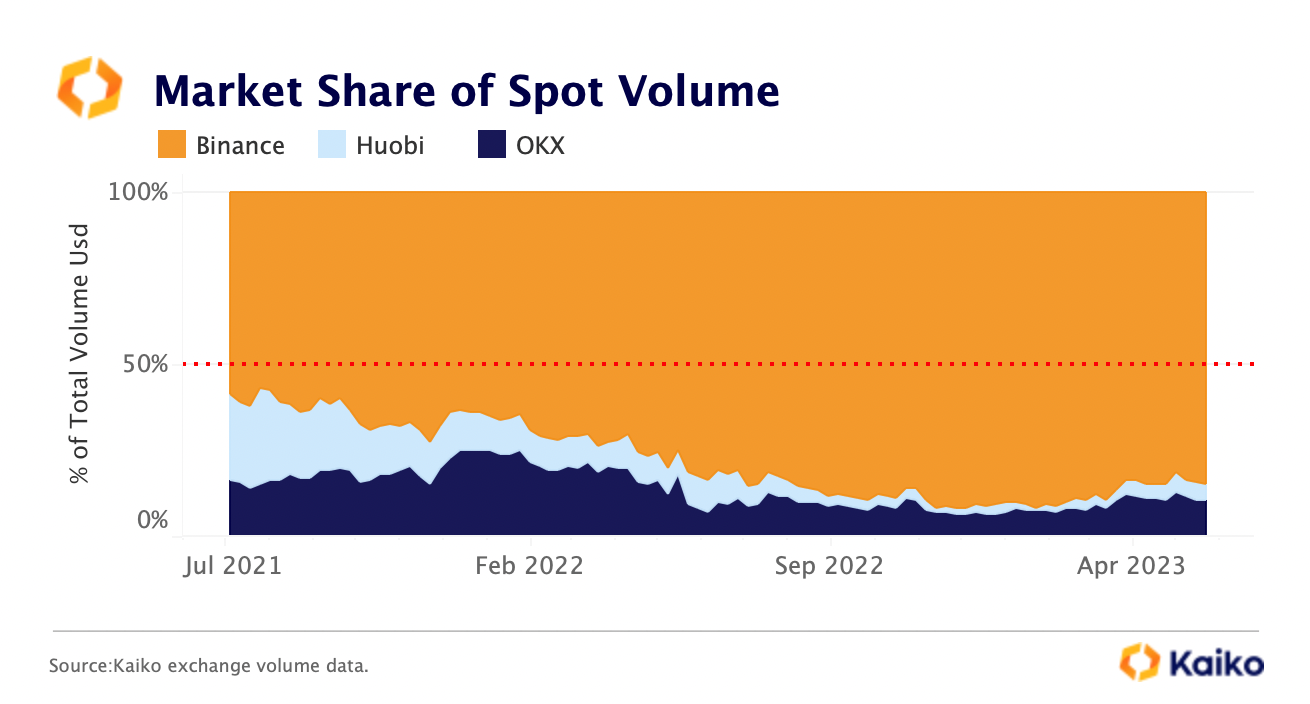

China has been engaged in crackdowns on the crypto industry since 2017 with several exchanges officially exiting the country and halting registrations for mainland Chinese users. OKX and Huobi, which were founded in Hong Kong and China respectively, were among the main losers of the country’s adverse stance on crypto, losing significant market share to global rivals such as Binance.

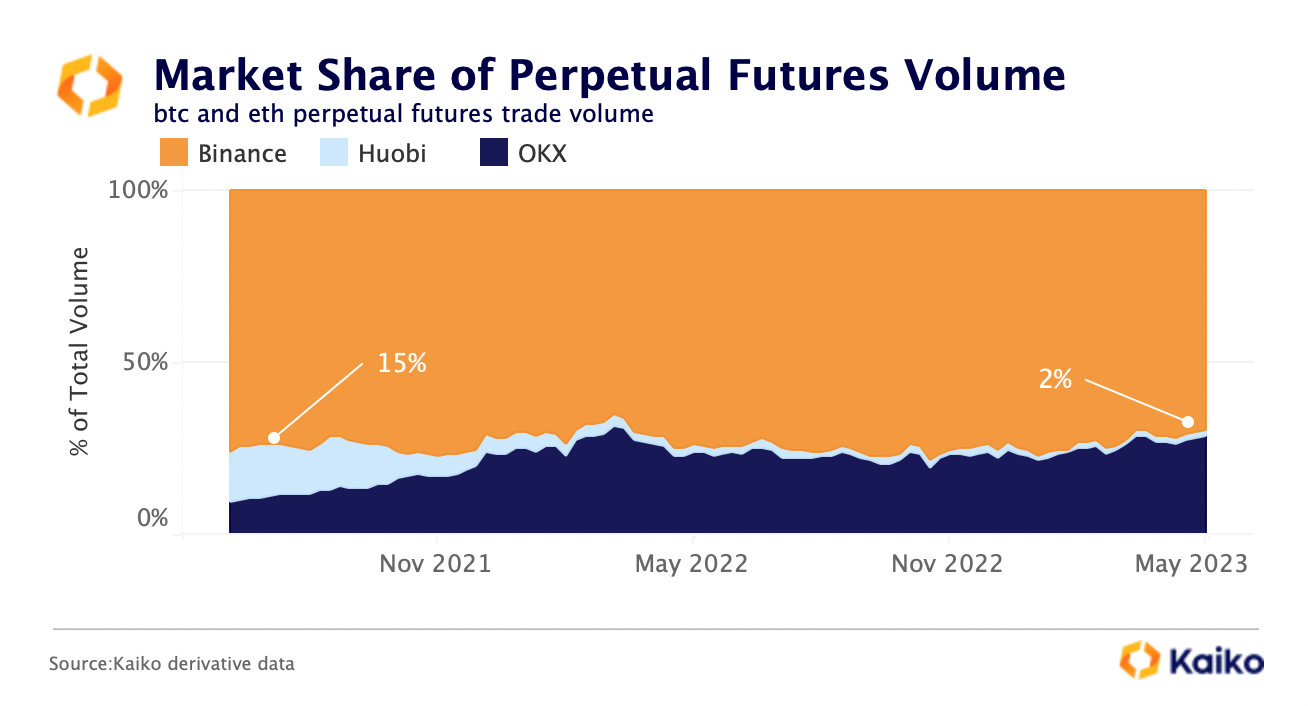

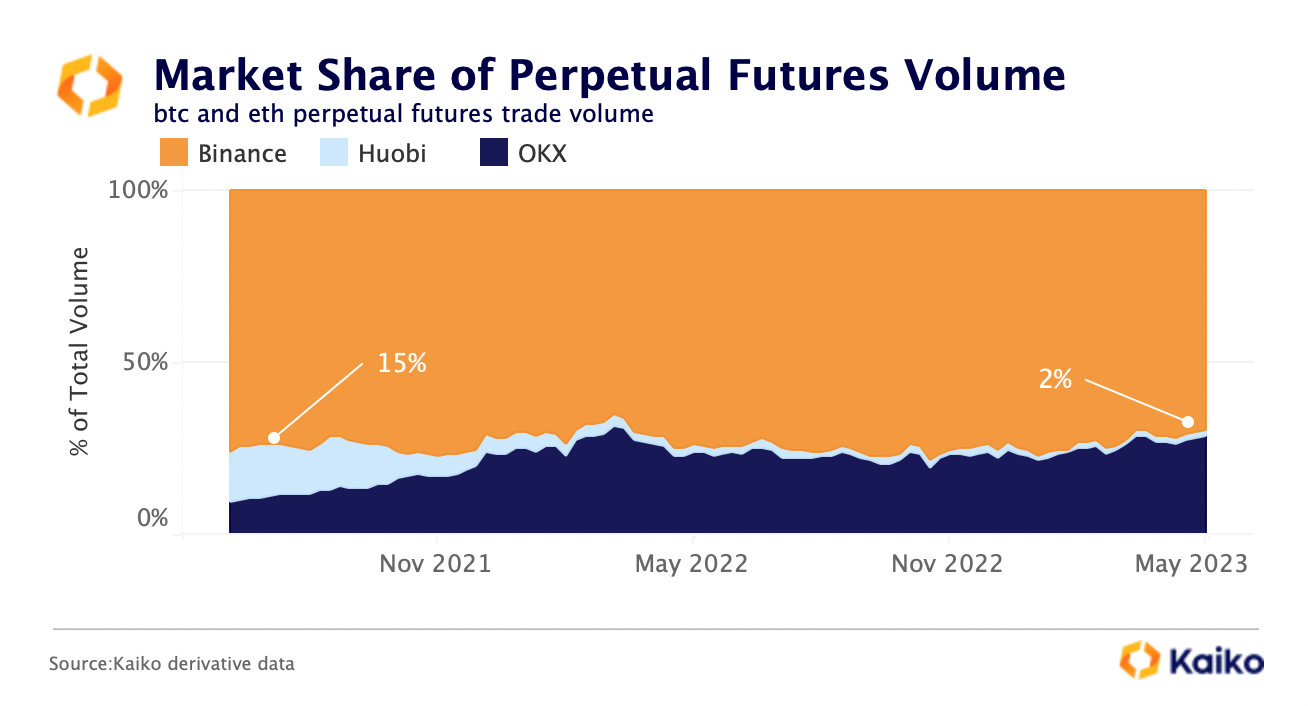

However, while both exchanges have seen their market share relative to Binance shrink, OKX has fared significantly better, helped by its burgeoning derivatives market. Huobi spot market share fell fourfold from 25% to 5% since July 2021 while OKX has seen a smaller decline from 16% to 10% over the same period. Looking at derivatives markets, OKX has actually managed to increase its market share in BTC and ETH perpetual futures three-fold from 9% to 30%.

In contrast, Huobi which in 2021 was the second largest derivative market after Binance has seen its derivatives market share virtually vanish from 15% to 2%.

Although optimism surrounding China’s economic reopening has waned compared to earlier this year, the regulatory clarity provided by Hong Kong’s licensing regime could unlock substantial pent-up demand for certain crypto assets and platforms. Despite the official ban on crypto trading, Chinese and Hong Kong users still represented 11% of FTX’s user base, as revealed in the bankruptcy filings of the failed exchange. This is nearly as much as the combined user bases of Singapore, Taiwan, and Korea.

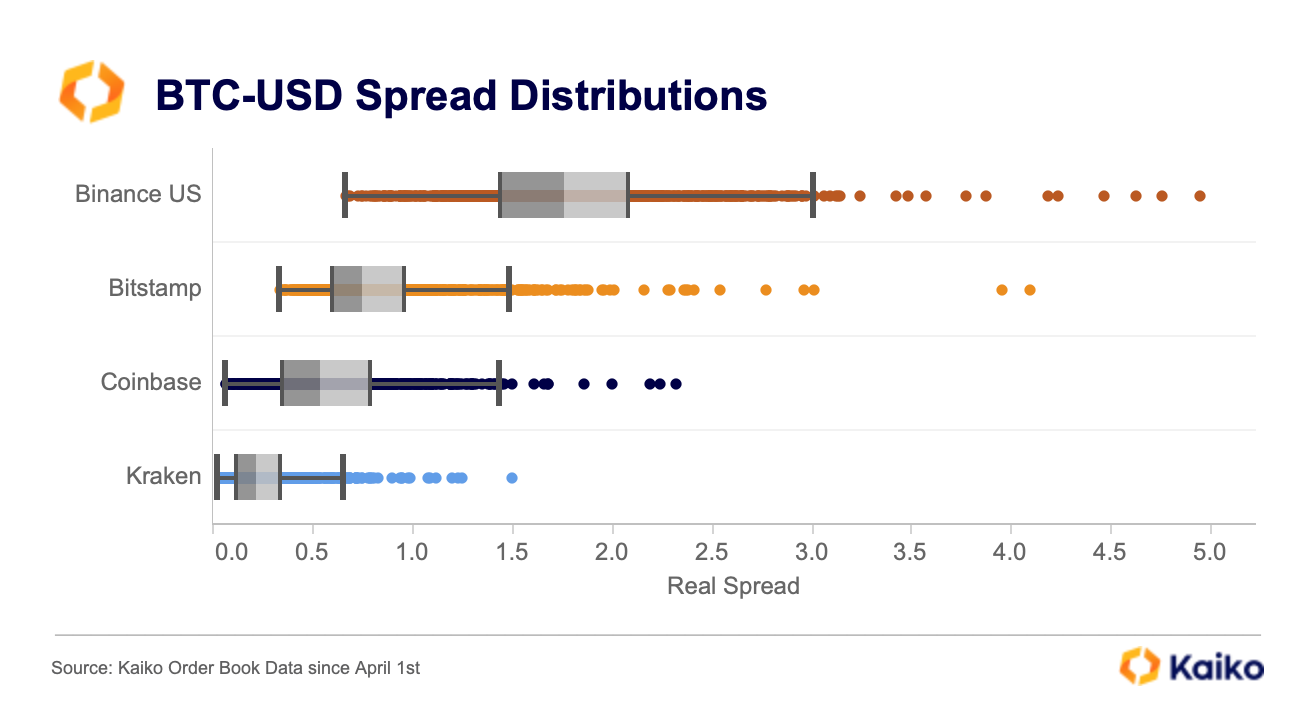

Kraken spreads tightest while Binance.US suffers.

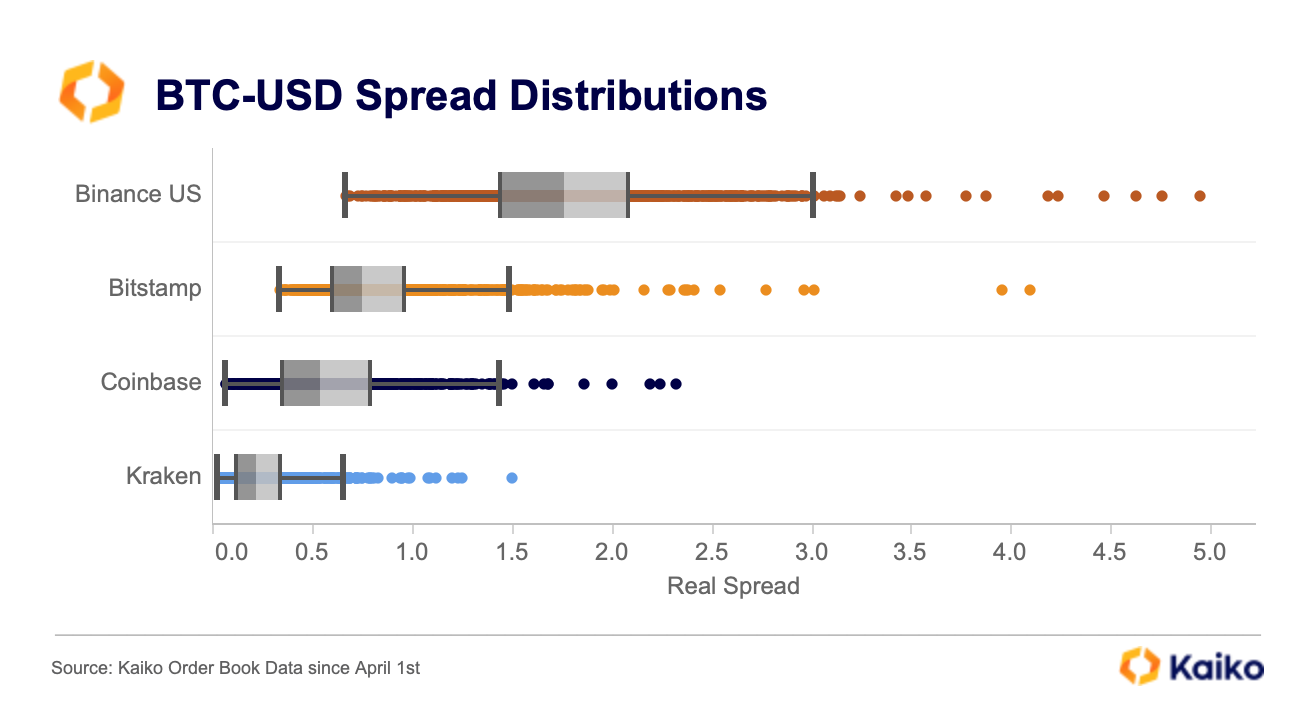

A look at distributions of Bid-Ask spreads helps us understand which exchanges suffer the highest volatility of spreads with large outliers and wide ranges. Out of the 4 chosen U.S exchanges, Kraken looks to have the tightest spread range, as measured by the interquartile spread, or the difference between the 25th percentile result vs the 75th percentile result, indicated by the shaded grey box. Kraken spreads are closest to zero and have the least amount of outliers. Coinbase has a wider range of spreads than Bitstamp but offers overall narrower spreads and fewer outliers. Binance.US suffers the most from large outliers and has a significantly wider range of spreads than the other exchanges, offering the worst liquidity from a spreads point of view.

![]()

![]()

![]()

![]()