Ever since the FTX collapse, we’ve paid special attention to crypto market liquidity, producing recurring reports such as:

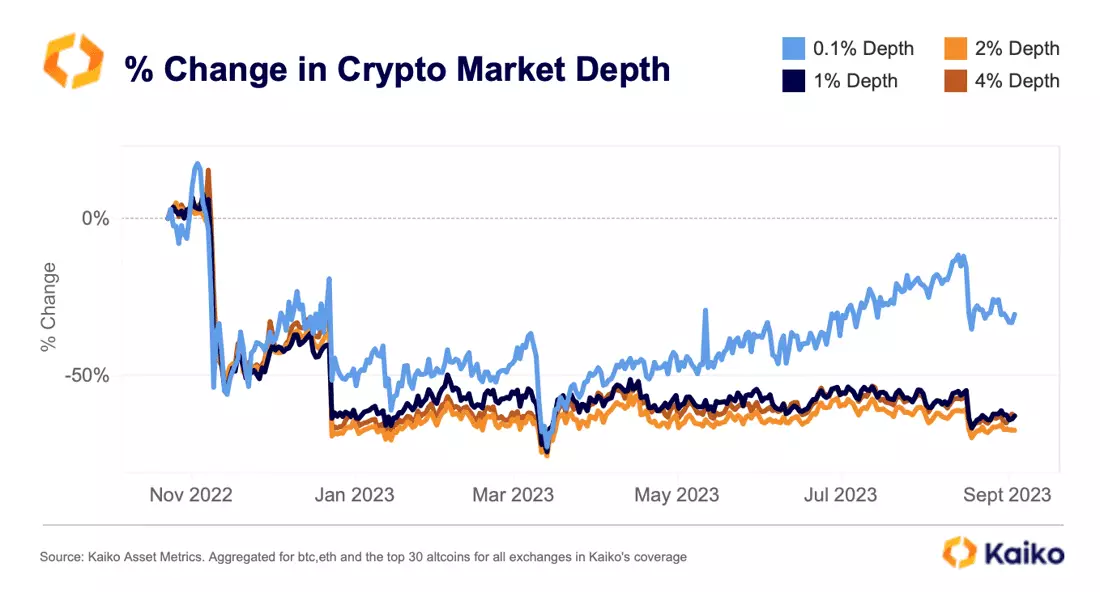

Today, we present a new liquidity report exploring the concentration of liquidity across exchanges. We believe that this is an important topic as market makers retreat, regulators crack down on exchanges, and volume/volatility hits multi-year lows.

Highly-concentrated crypto markets are both a good and bad thing. There is undoubtedly a shortage of liquidity, which when spread thin across many exchanges and trading pairs can exacerbate volatility and disrupt the price discovery process. Natural market forces have inevitably led to increasing concentration of this liquidity on a handful of platforms, which benefits the average trader.

However, highly-concentrated crypto markets can create points of failure for the industry (ex: the FTX collapse). Many centralized exchanges still lack basic protections for traders in case of failure, hacks, or market manipulation.

By understanding the concentration of liquidity at a global scale, we hope traders and market makers can make more informed decisions on where to deploy capital.

The Data

We are able to explore liquidity at the exchange-level thanks to our new data product, Asset Liquidity Metrics. This product massively simplifies the process of aggregating trade and order book data across the 100+ exchanges that Kaiko covers.

For example, if I’m interested in BTC market depth and volume, I can quickly pull aggregated liquidity data – which would include BTC-USDT on Binance, BTC-TUSD on OKX, BTC-KRW on Upbit, and 200+ other instruments – since the token was first listed, all converted into USD and broken down by exchange.

For this report, we compiled average 1% market depth and cumulative trade volume for BTC, ETH, and the top 30 crypto assets by market cap. The vast majority of crypto trading activity is concentrated on these top 30 assets, thus we believe it provides a suitable gauge for measuring exchange-level liquidity.

The Results

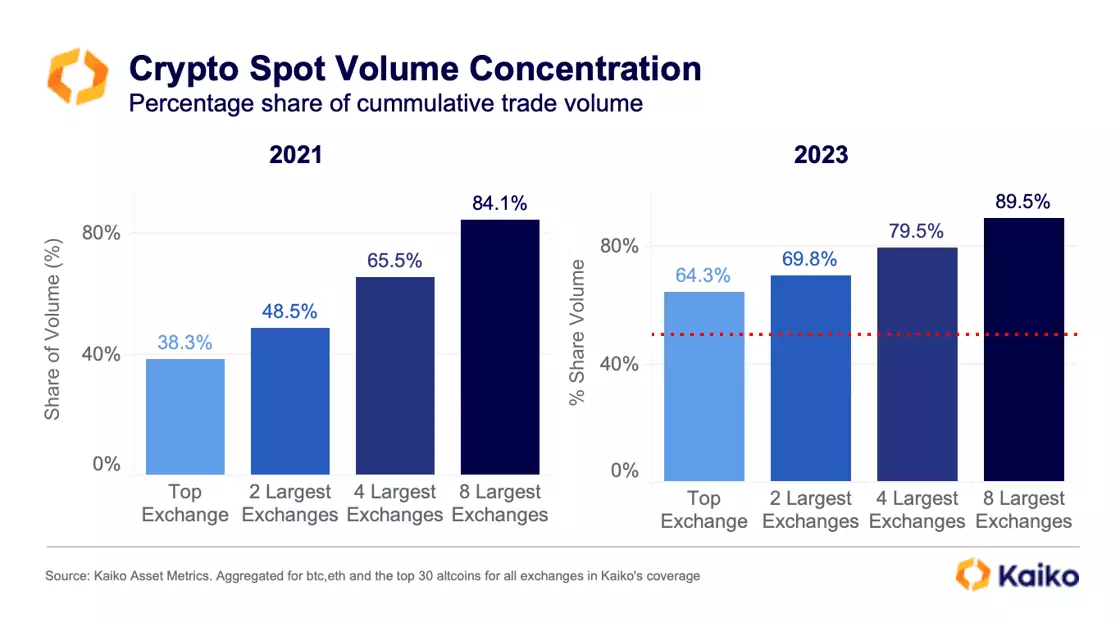

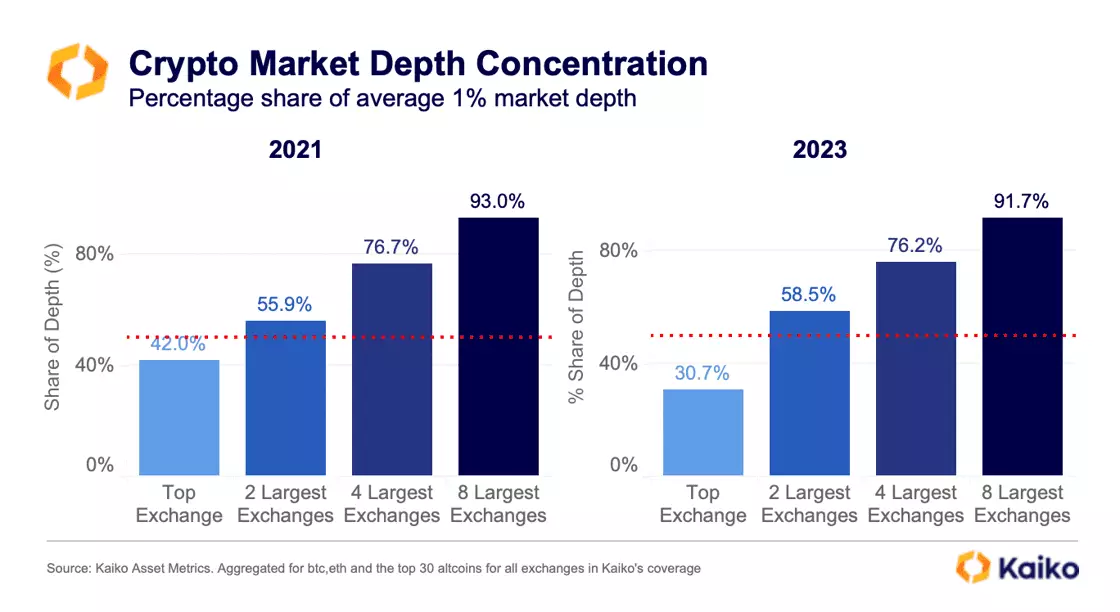

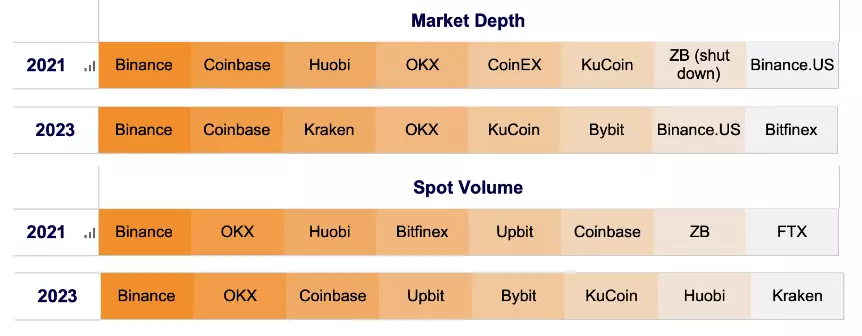

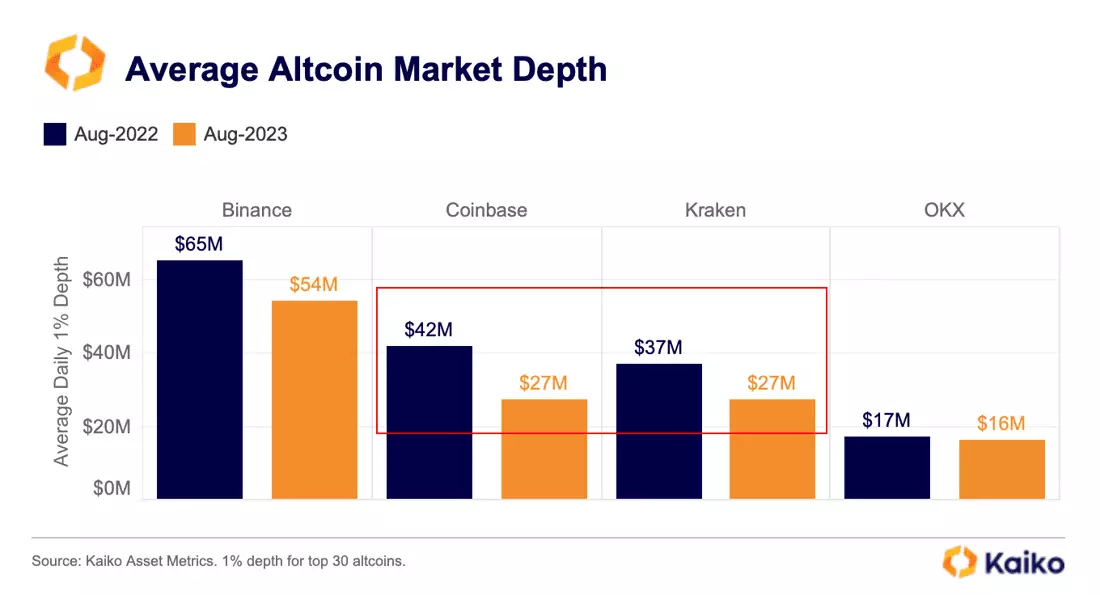

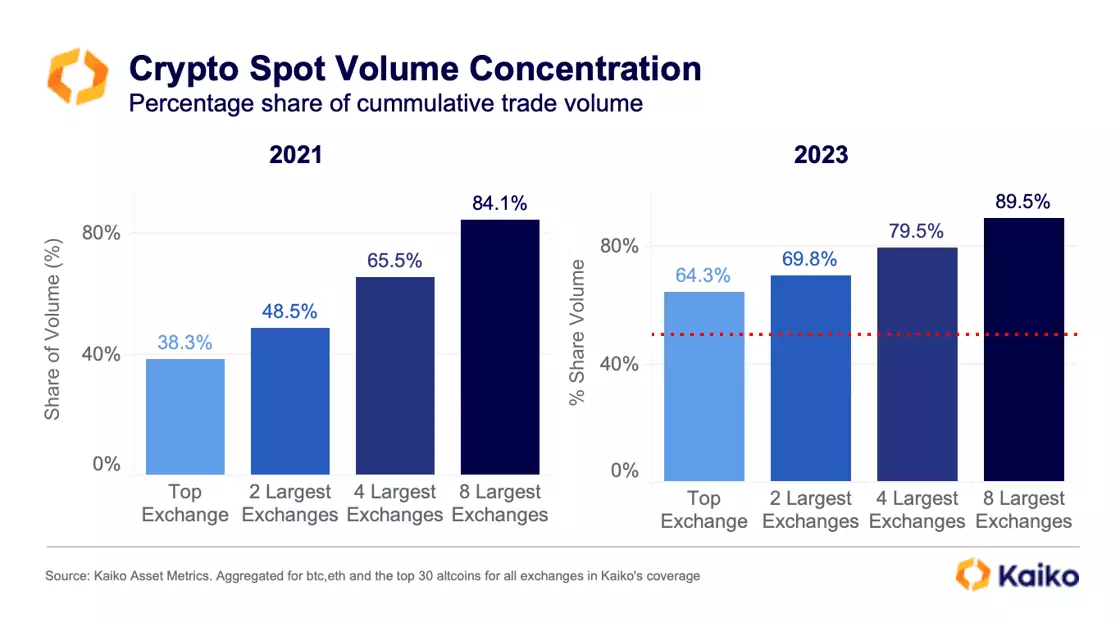

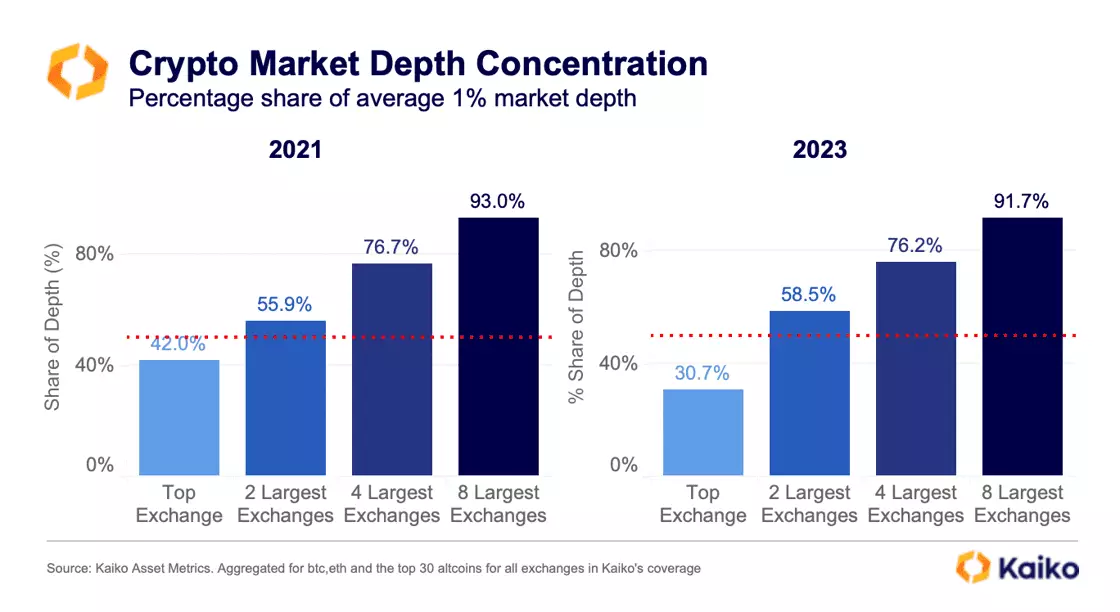

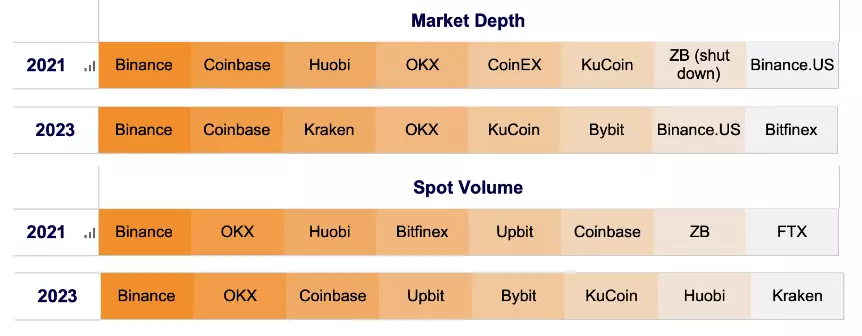

Liquidity is concentrated and has become more concentrated over time. In 2023, the top exchange, Binance, has accounted for 30.7% of global market depth and 64.3% global trade volume. The top 8 largest platforms account for a whopping 91.7% of depth and 89.5% of volume.

Since 2021, Binance’s market share of spot volume has increased from 38.3% to 64.3%. It should be noted that a big part of this increase was linked to Binance’s zero-fee trading promotion.

The concentration of market depth has actually fallen for the top exchange, from 42% to 30.7%, which suggests that Binance’s zero-fee trading program had an unequal impact on volume relative to market depth. However, just 8 exchanges still account for more than 90% of global market depth.

Overall, both spot volumes and market depth are heavily concentrated on just 8 platforms, which have stayed pretty consistent over the years.

![]()

![]()

![]()

![]()