Binance Effect on Volumes

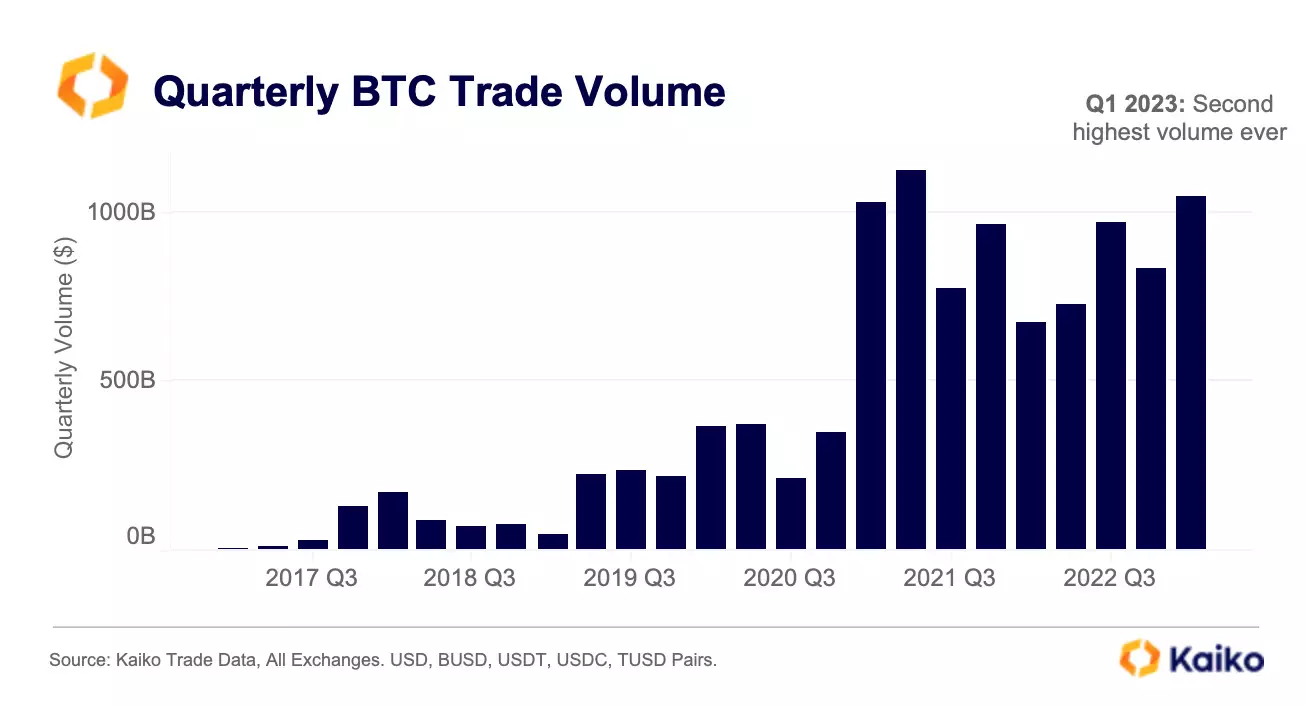

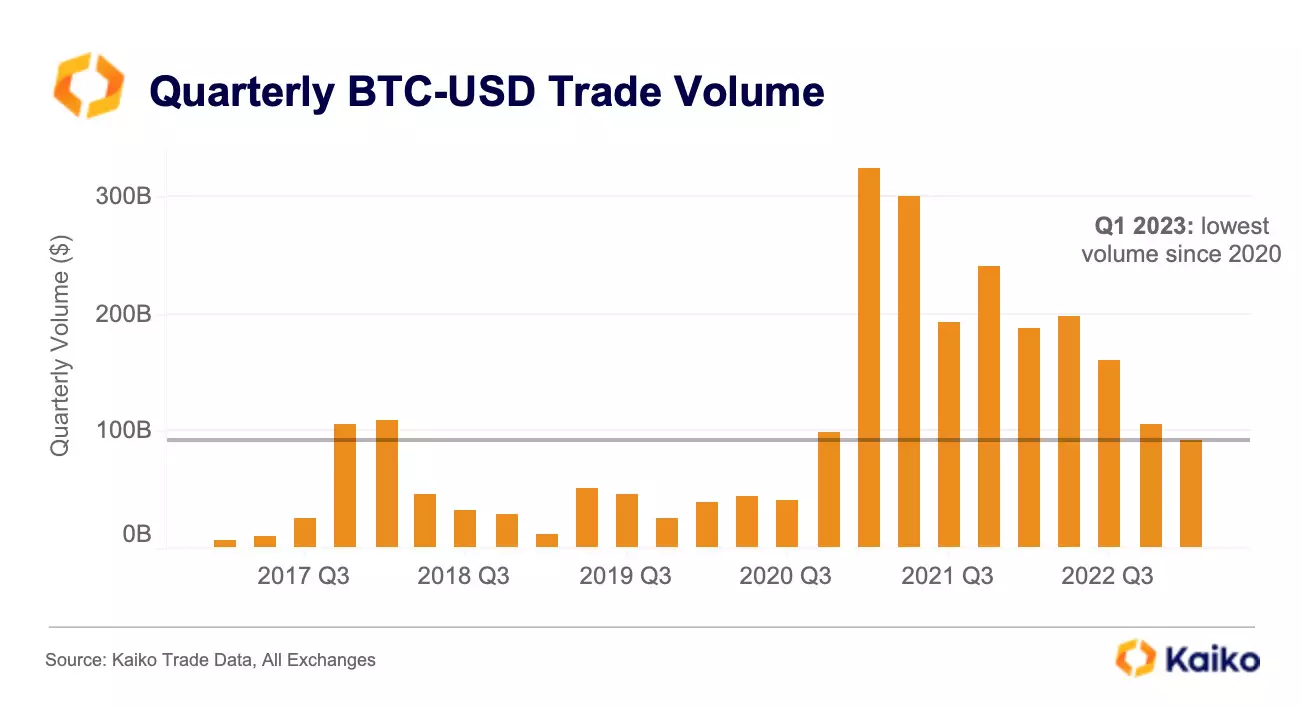

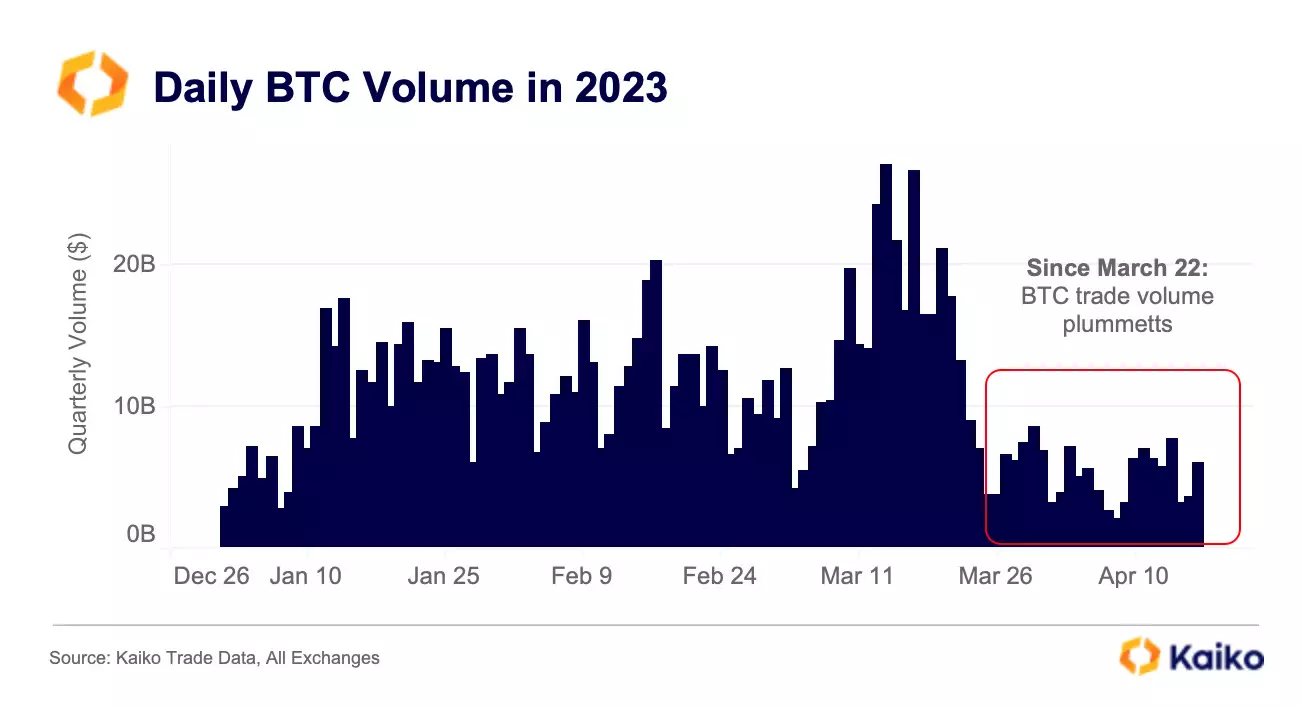

So far, we have just looked at quarterly volume. The problem with that is the crypto exchange market underwent a very drastic change at the end of Q1, which is playing out in the volume figures since then.

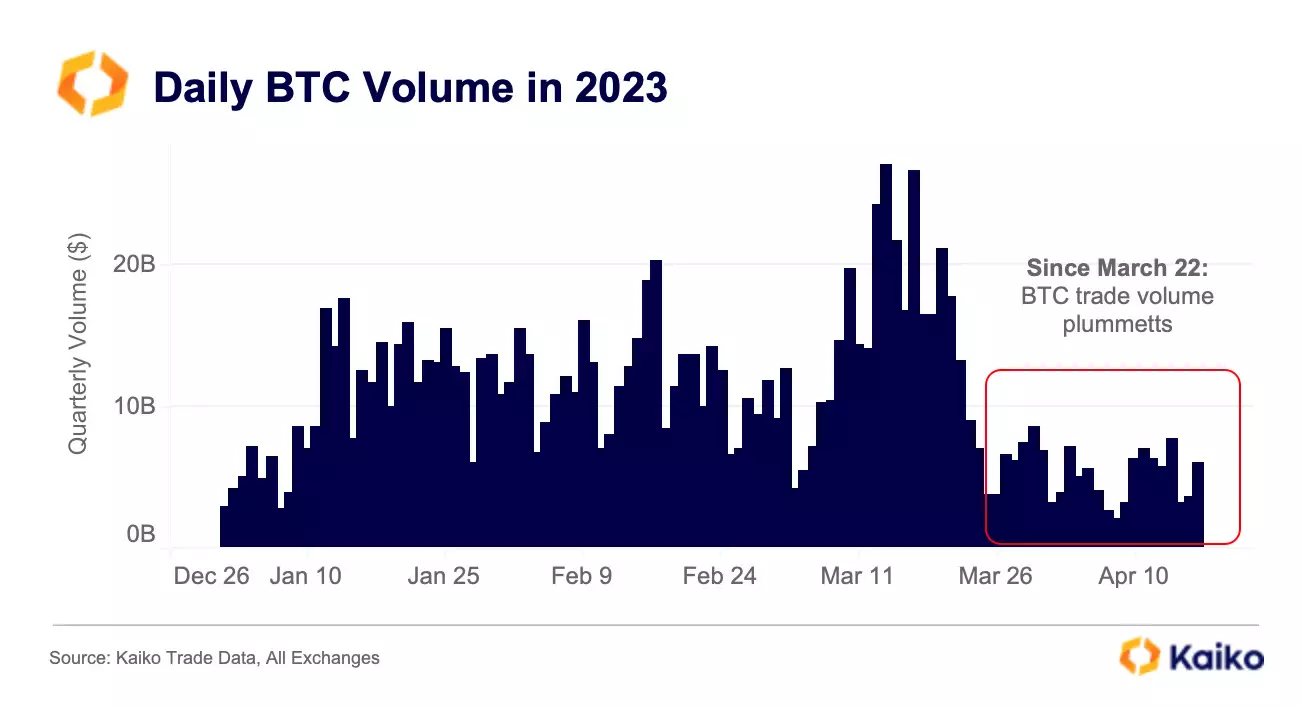

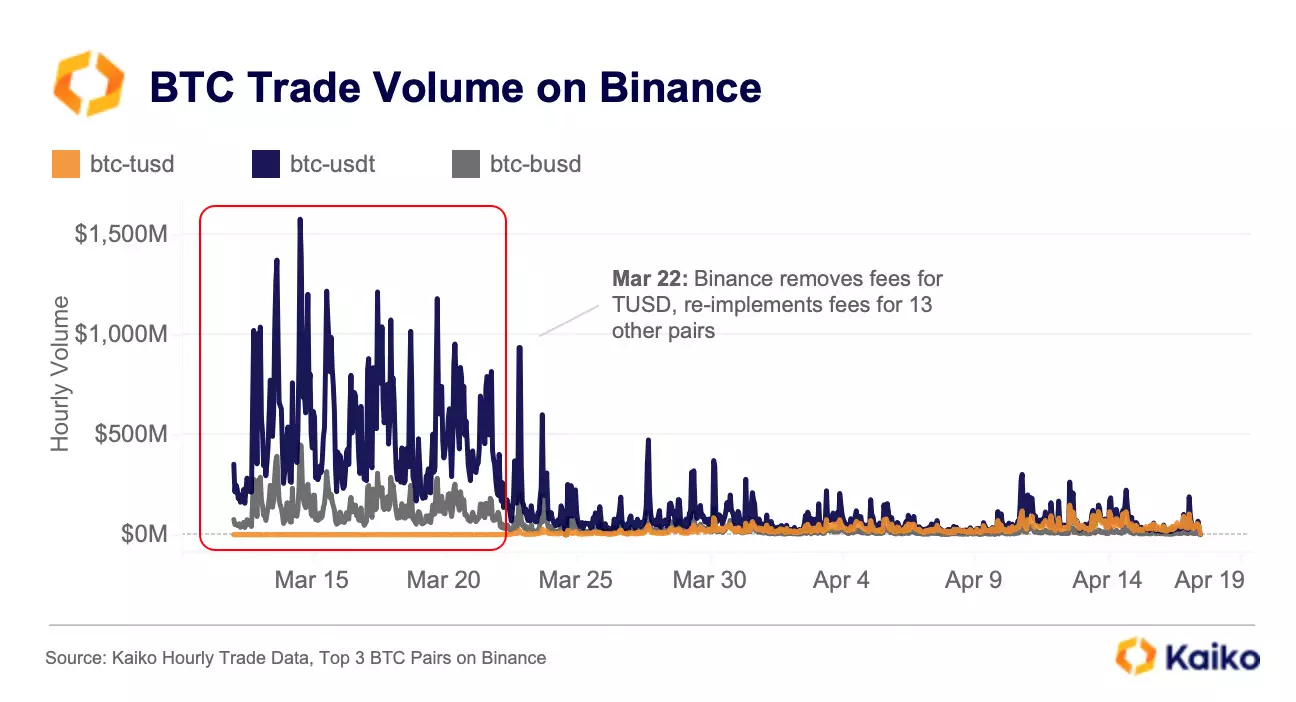

On the 22nd of March, Binance ended their zero fee program for most spot pairs, including their two most liquid BTC pairs, USDT and BUSD. However, the caveat to the announcement was that there was one pair, BTC-TUSD, Binance chose to hold the claim to only zero fee BTC pair on the exchange. Why they chose to do so, for such an obscure stablecoin, is a topic for another Deep Dive, and one my colleague Riyad touched on for Coindesk recently. The impact on the market can not be understated as BTC daily volumes plummeted since the announcement.

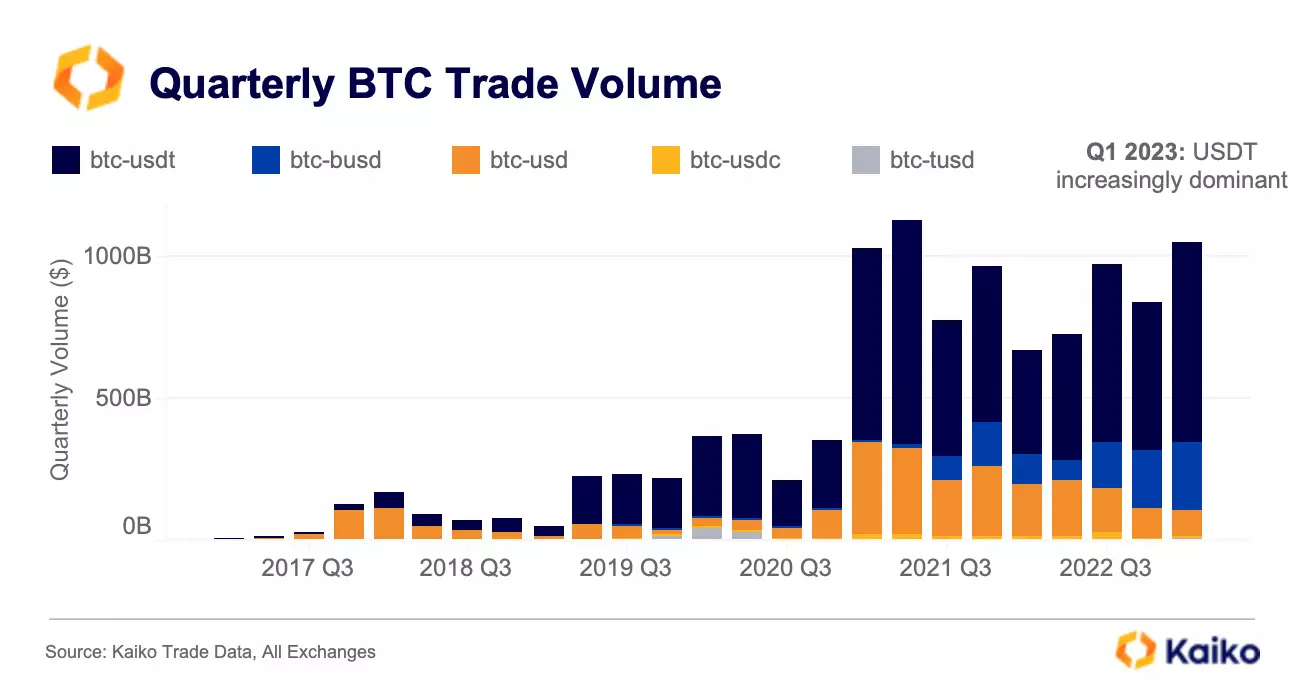

The above chart shows overall BTC daily volume across all exchanges. However, when we dig a bit deeper, it’s clear that Binance was responsible for the sharp increase in volumes. Or perhaps better stated, Binance may have been responsible for the huge increase in volumes, seeing its market share rise by 20% during the 7 months of zero fees on the exchange. Now those fees have been mostly reinstated, the volumes more accurately represent those of a bear market – not the second highest quarter figure we saw earlier.

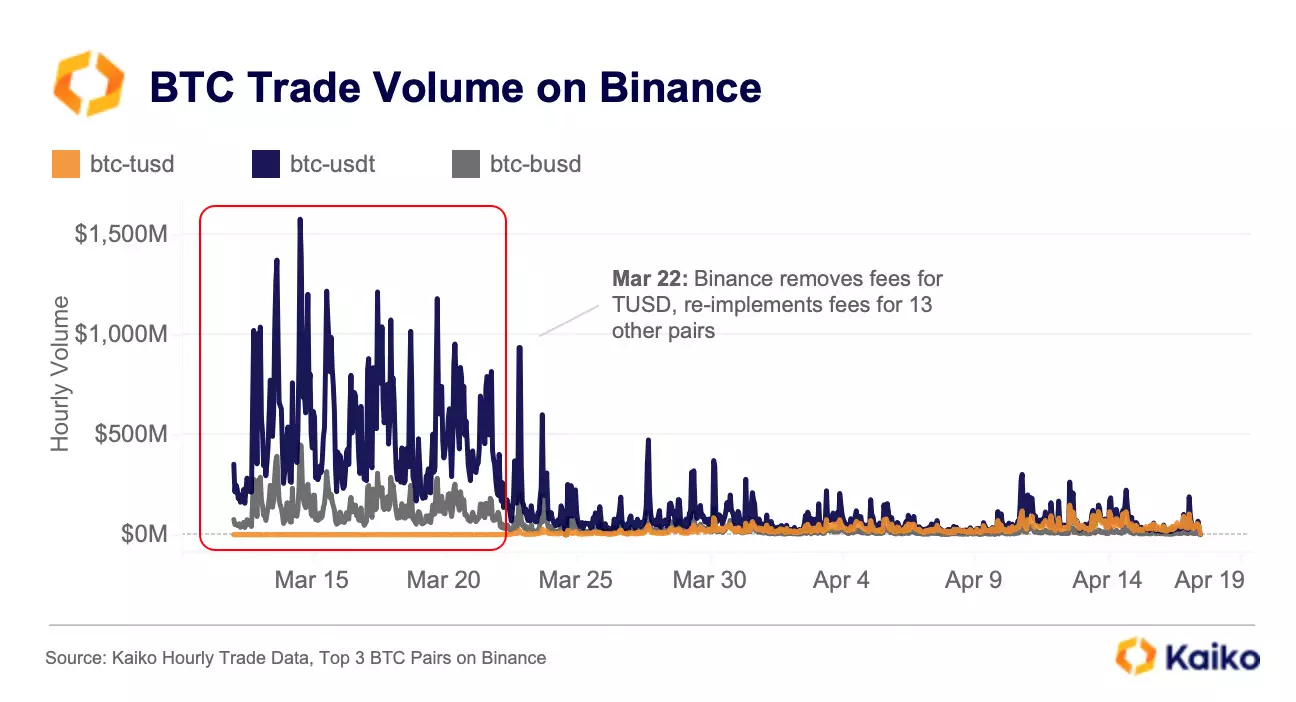

The drastic drop off in volumes was clear on Binance. Right on cue, as soon as the exchange re-introduced fees for BTC-BUSD/USDT, volumes plummeted for both pairs. TUSD has grown from nothing to around $60mn an hour, but this is paltry compared with USDT’s average of nearly $1bn an hour before fees were re-implemented.

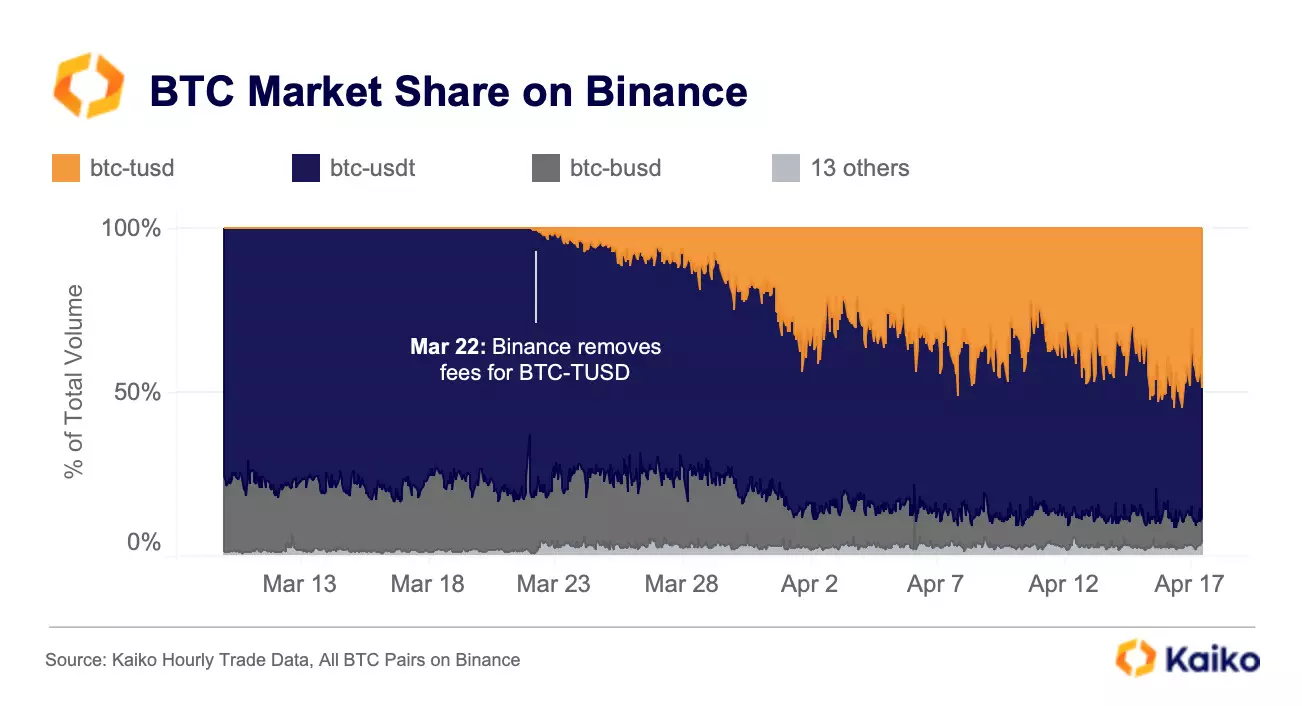

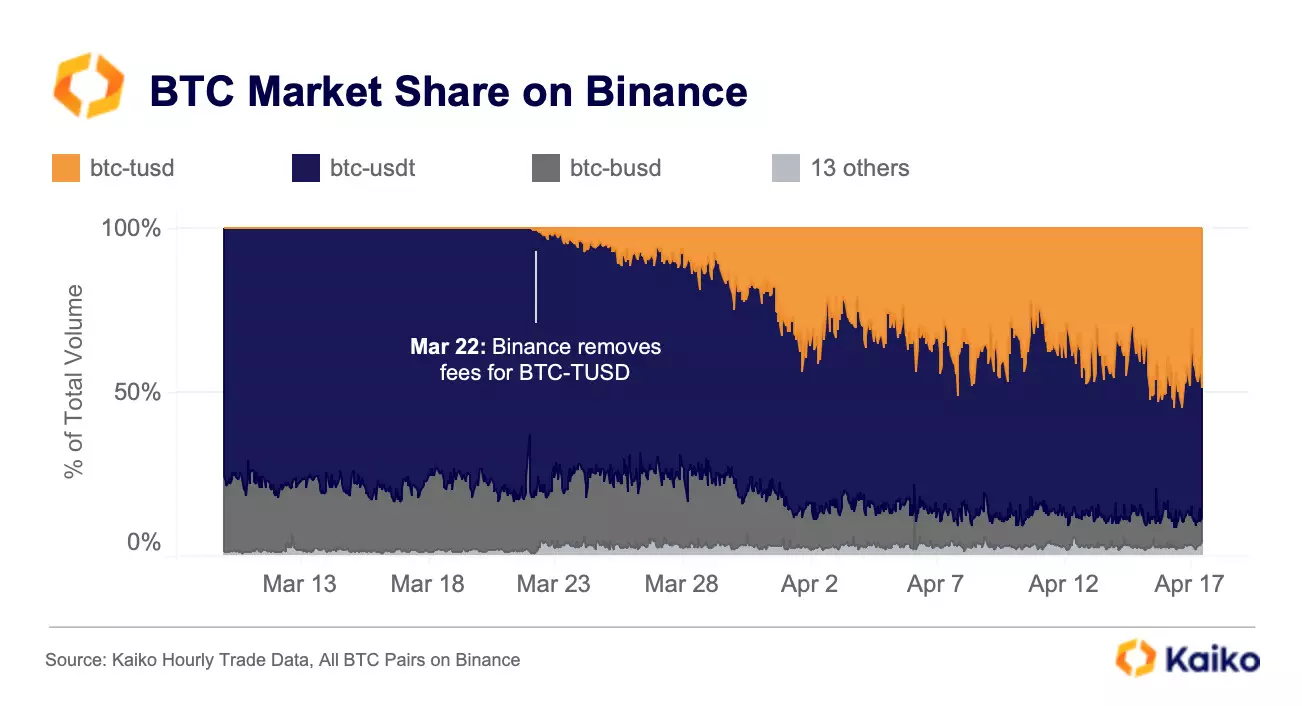

To hit home just how drastic an impact this decision is for the crypto market, the BTC-TUSD just became the largest Bitcoin pair in crypto. BTC-TUSD now commands 50% of total BTC volume on Binance, rising from practically 0% just a month ago before the announcement.

For as long as zero fee trading lasts on BTC-TUSD, TUSD needs to be considered a top stablecoin in crypto, whether people like it or not. Similar to how Binance favored BUSD, TUSD is the benefactor of increased volumes now, even if the reasons why Binance granted TUSD this gift are unclear.

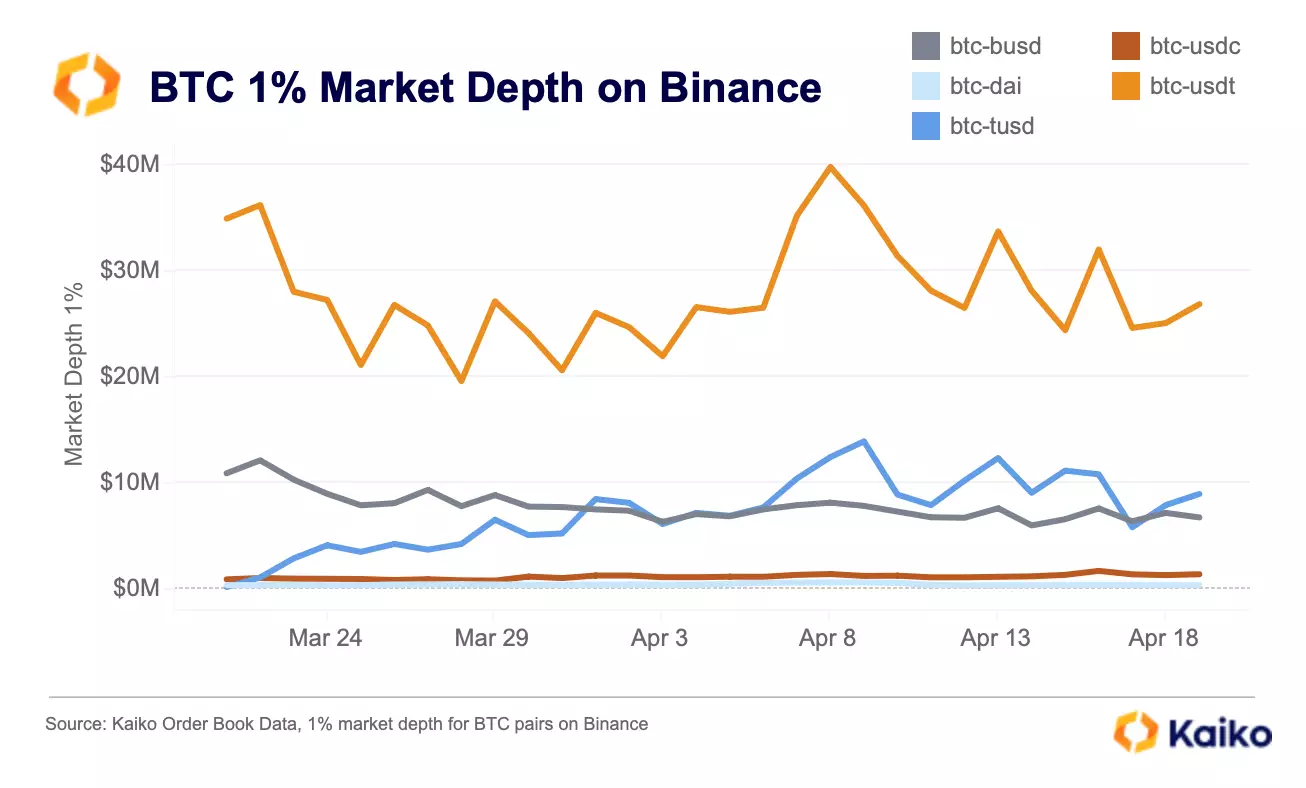

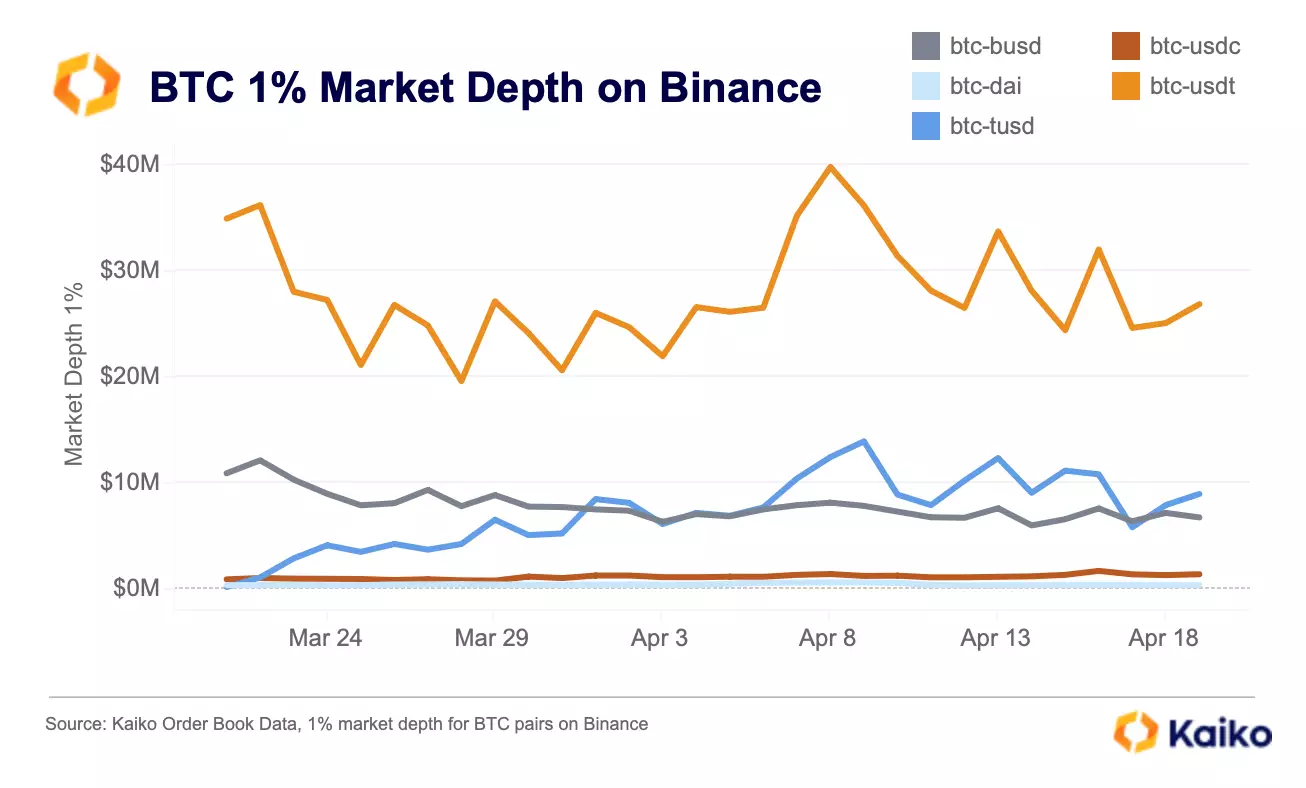

However, market depth data on Binance shows us that BTC-USDT is still king from a liquidity standpoint, with market makers evidently more comfortable with exposure to Tether over TUSD. The rise of TUSD liquidity is remarkable though, up again from virtually zero to around $10mn at the 1% depth level, overtaking BUSD as the second most liquid pair on Binance. BTC-USDT liquidity sits at $27mn.

Now, looking past just BTC volumes, total CEX volumes for all pairs are still mostly denominated in USDT, with 80% market share of volumes – by far the biggest stablecoin in global trading volumes. However, second spot looks TUSD’s to grab. BUSD is currently second at 10%, with TUSD at 9%, however BUSD has an expiry date next year and is being phased out by Paxos, leaving TUSD as now the next largest stablecoin by trading volume. One month ago, TUSD wasn’t remotely relevant. The Binance Effect has pushed TUSD to become the second largest stablecoin on CEXs globally in just one month.

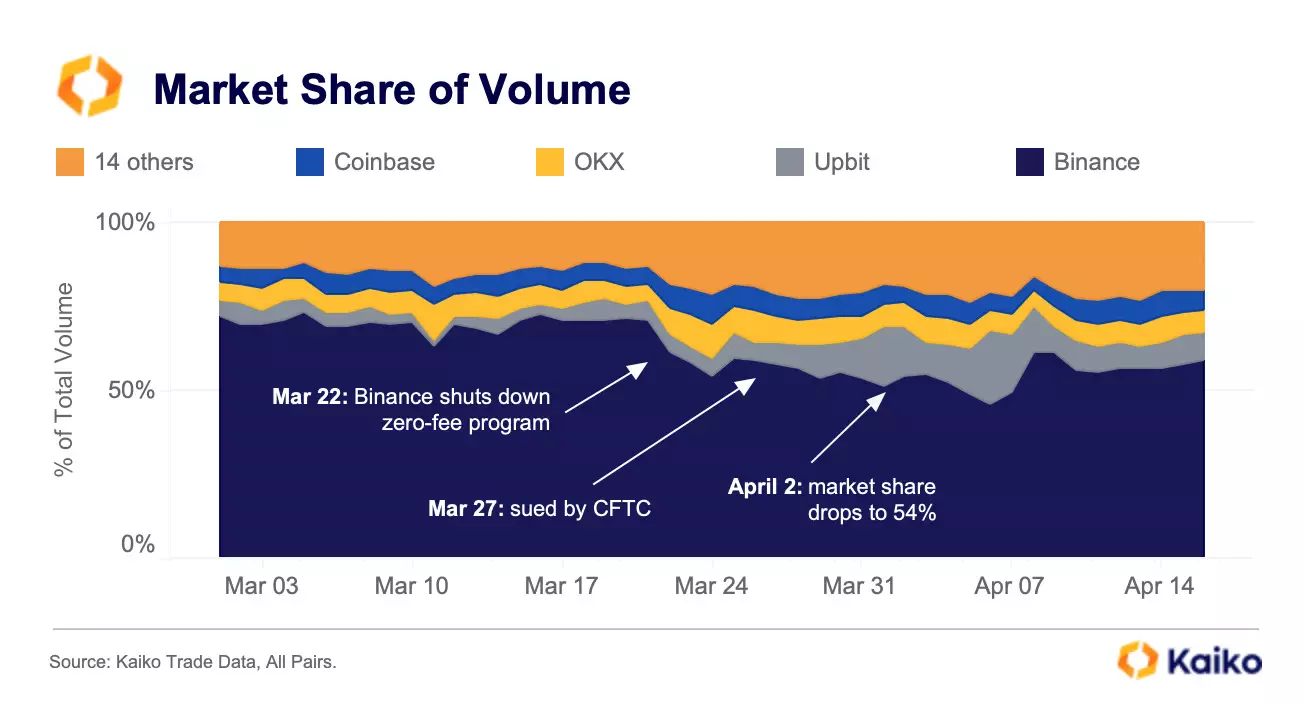

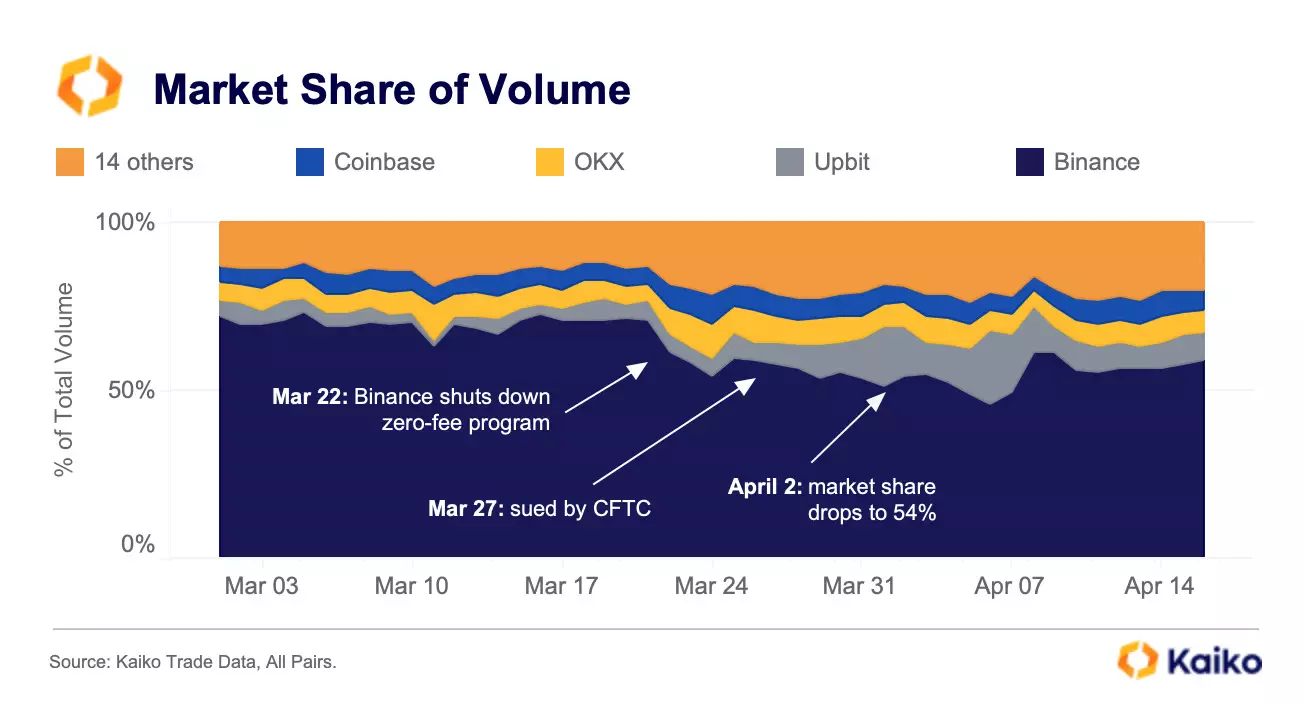

Finally, the decision by Binance has not only altered the stablecoin market structure, but also the exchange structure. After Tether volumes plummeted on Binance since the end of zero fees, Binance lost nearly all of the 20% market share it had gained in the last 7 months during the zero fee program. Interestingly, early signs are that the market share of Binance has gone to Upbit, a Korean exchange, rather than Coinbase, who face near term regulatory uncertainty.

![]()

![]()

![]()

![]()