Join us for our latest webinar in collaboration with Cboe

The State of the Japanese Crypto Market

Historical Trends in Trading Activity

Access to the full report in Korean here.

Despite its early adoption advantage, Japan’s crypto market faces unique challenges. This report explores regional crypto market trends and examines the historical factors that have influenced the development of Japan’s domestic exchanges and key players over time.

Part 1: Japan’s Tumultuous Crypto Journey

Part 2: JPY’s Role in Crypto

Part 3: Main Players in Japan’s Crypto Market

RESEARCH BY:

POWERED WITH DATA BY:

Pt. 1: Japan’s Tumultuous Crypto Journey

Japan has been home to two of the largest cryptocurrency exchange hacks to date, making its history with crypto rocky, despite its early adoption by retail investors. This situation forced regulators to become involved much earlier than their counterparts in other countries.

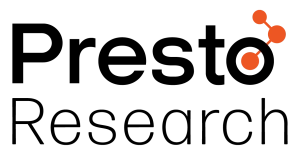

→ Mt. Gox, a Tokyo-based Bitcoin exchange, was once the largest Bitcoin exchange in the world.

→ Its hack in 2014 resulted in the loss of 7% of the total Bitcoin supply.

Pt. 2: JPY’s Role in Crypto

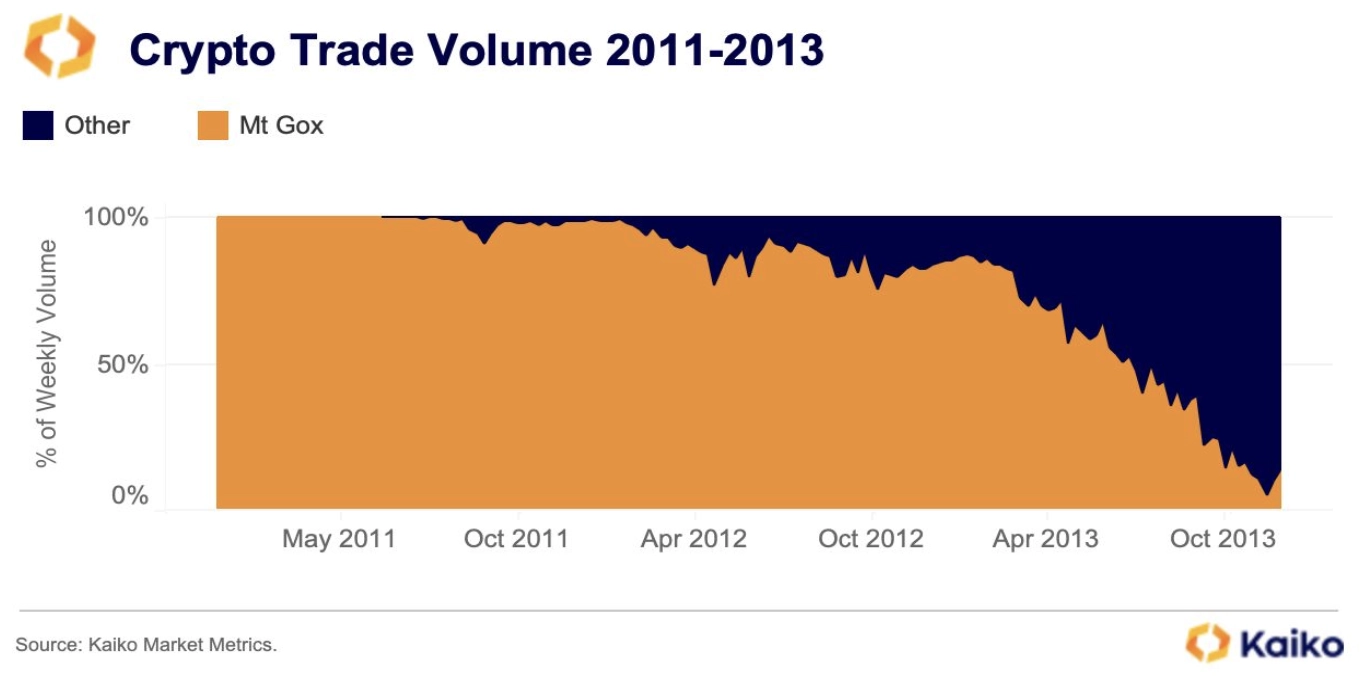

Japan’s crypto market lags behind other regions, particularly due to exchange listing restrictions and taxes. The trend of JPY-denominated trading volume on exchanges accurately reflects Japan’s relationship with crypto.

→ There was a time when JPY volumes exceeded USD volumes.

Pt. 3: Main Players in Japan’s Crypto Market

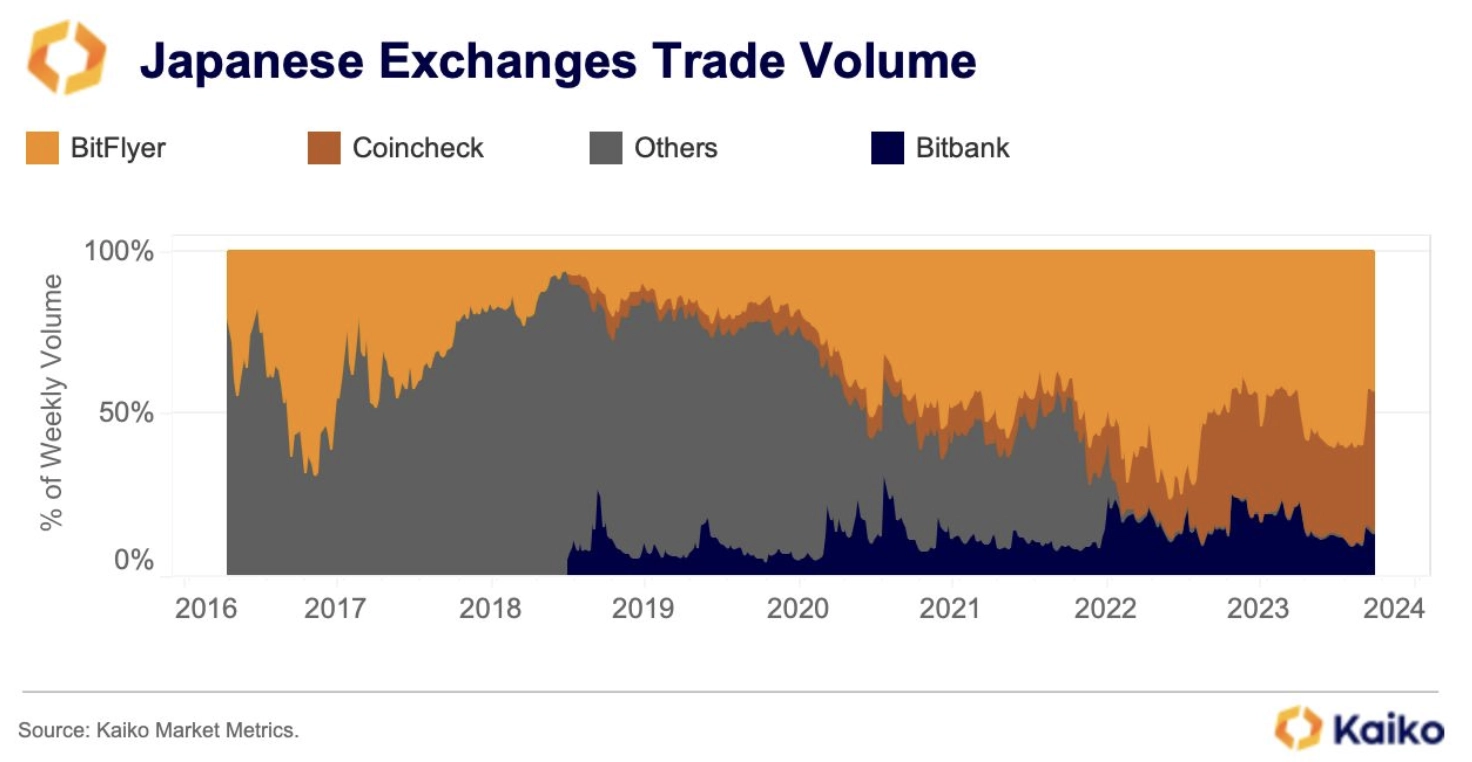

Japanese crypto exchanges struggle to compete with their international counterparts in terms of product offerings, leading to lower trading volumes, despite there being 29 registered crypto-asset exchanges.

→ BitFlyer has maintained its dominance in recent years, amongst domestic exchanges.

→ Japan’s domestic exchanges struggle to compete with Binance in terms of trading volume since Covid.

Download the Report.

Visit the Presto Research website here for more research content.

This research report was written by Presto Labs, with data provided by Kaiko. This content is for informational purposes only, does not constitute investment advice, and is not intended as an offer or solicitation for the purchase or sale of any financial instrument. For any questions, please email [email protected].