Trend of the Week

WLFI spot market launch off to a strong start.

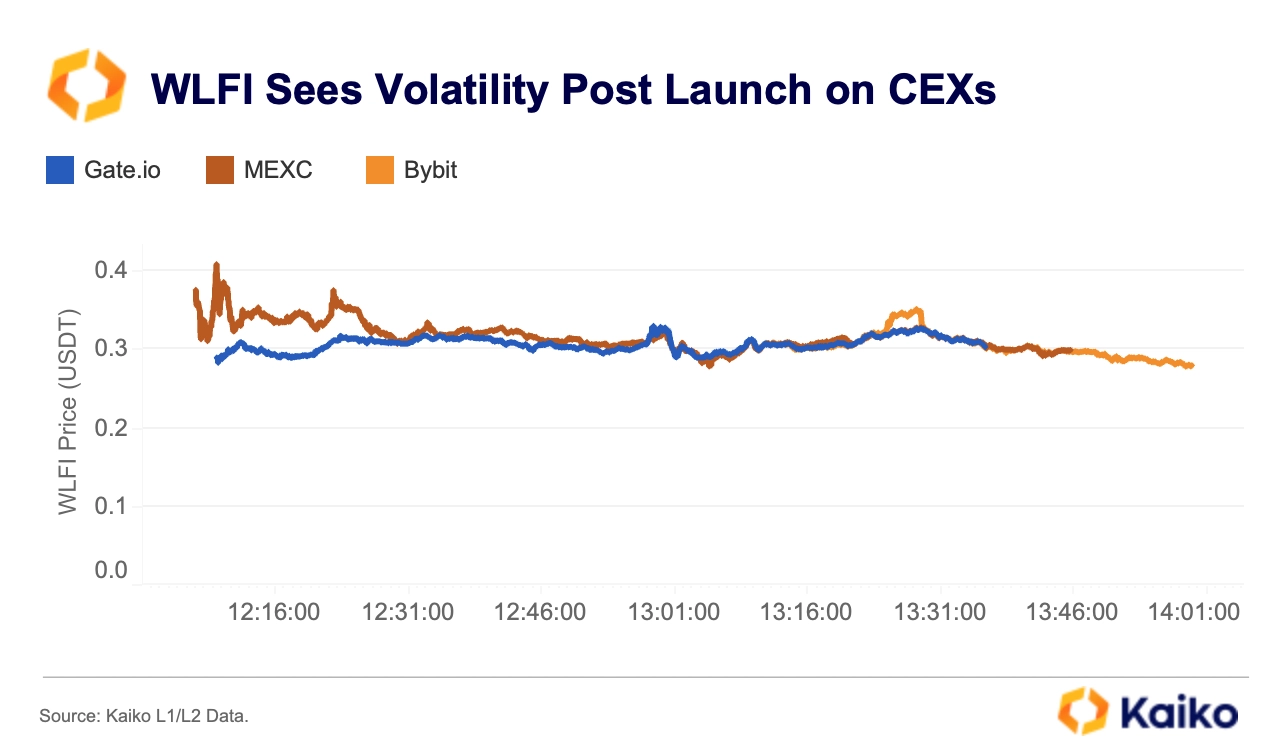

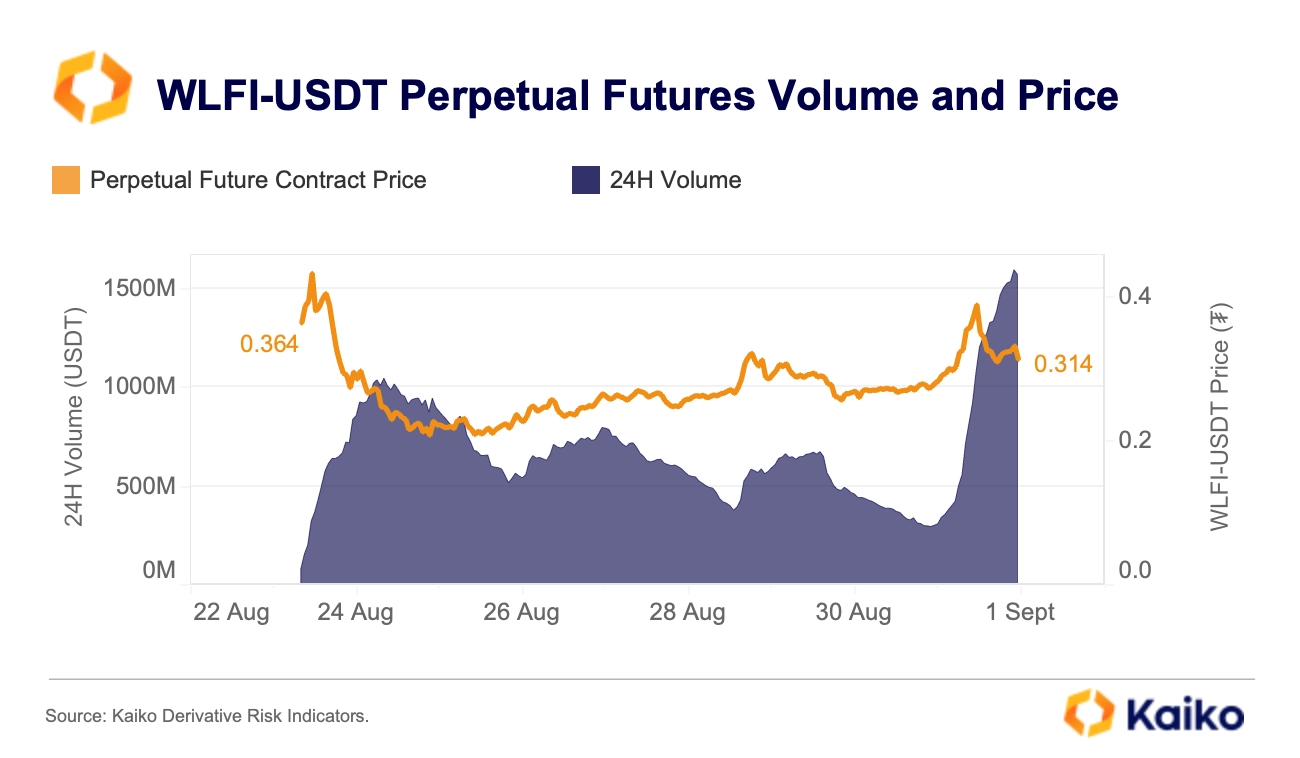

Today at 12pm UTC, 20% of Trump’s WLFI token supply was unlocked. This event coincided with the launch of spot markets for WLFI on several exchanges, including Binance. However, the market had already begun reacting to the news in early August, as WLFI-USDT perpetual contracts became available across multiple platforms ahead of the spot listings and token unlock.

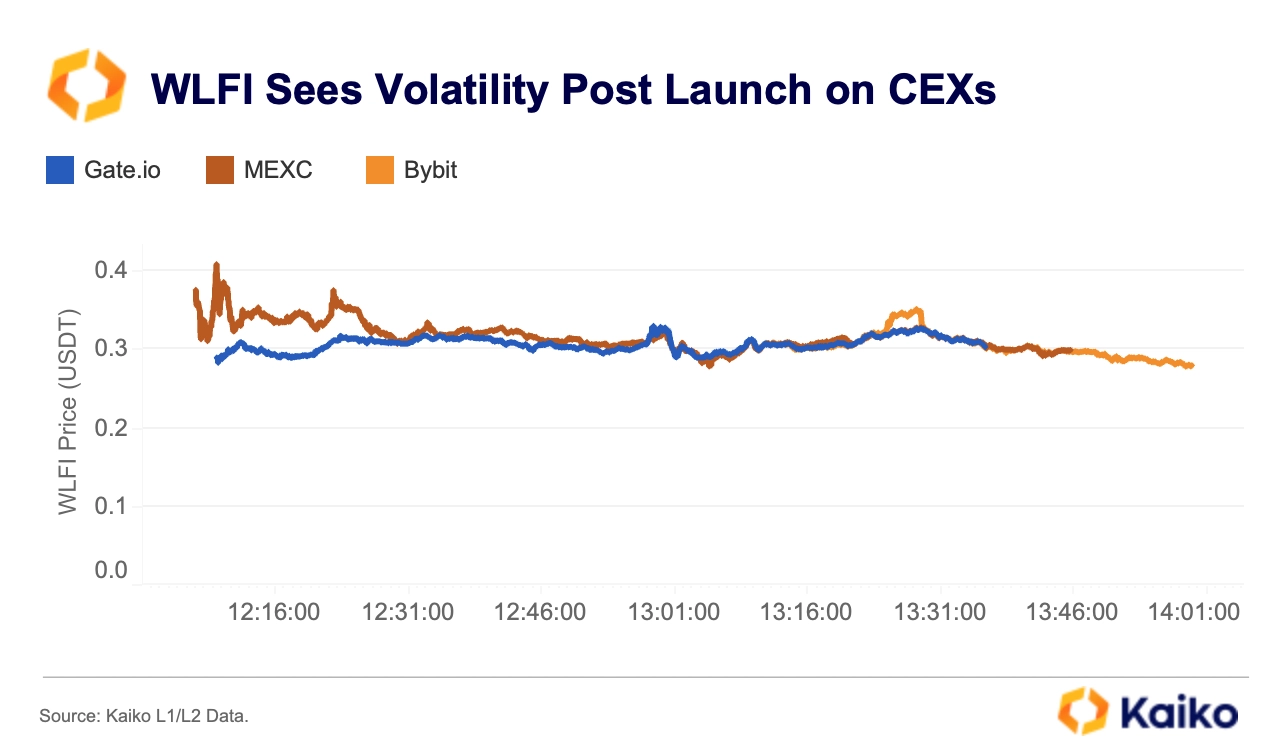

At launch, WLFI spot prices initially diverged between platforms before settling around $0.35 USDT.

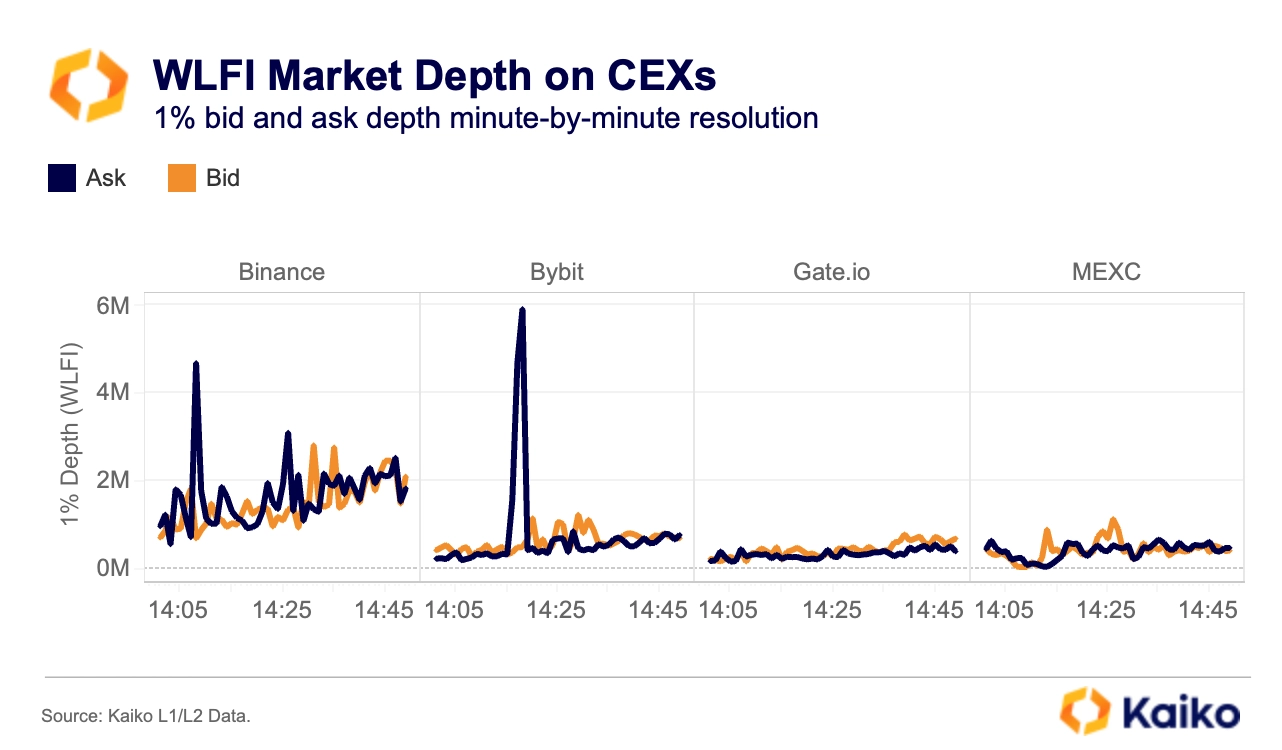

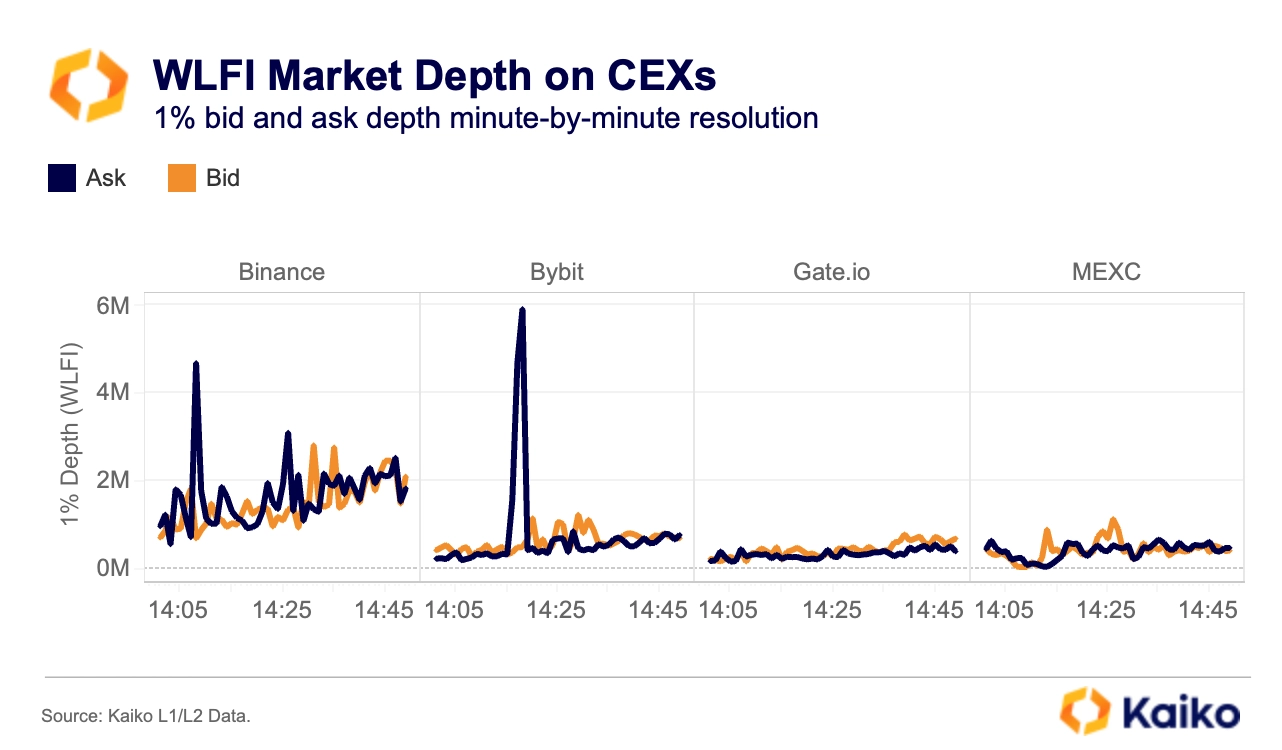

Order book data showed temporary imbalances on Binance and Bybit, with sell-side activity briefly exceeding buy-side demand between 2:00 PM and 2:30 PM UTC. Since then, market depth has improved as market makers recalibrate and trading volumes stabilize.

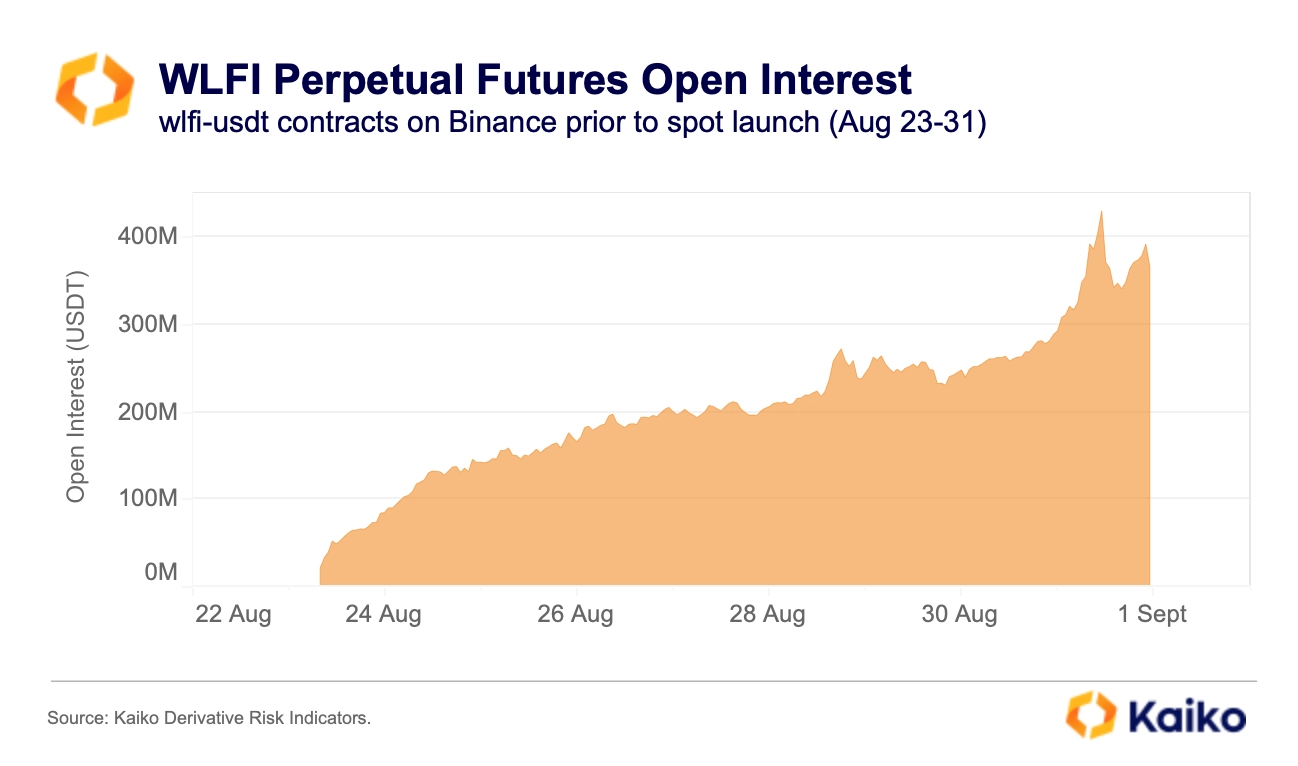

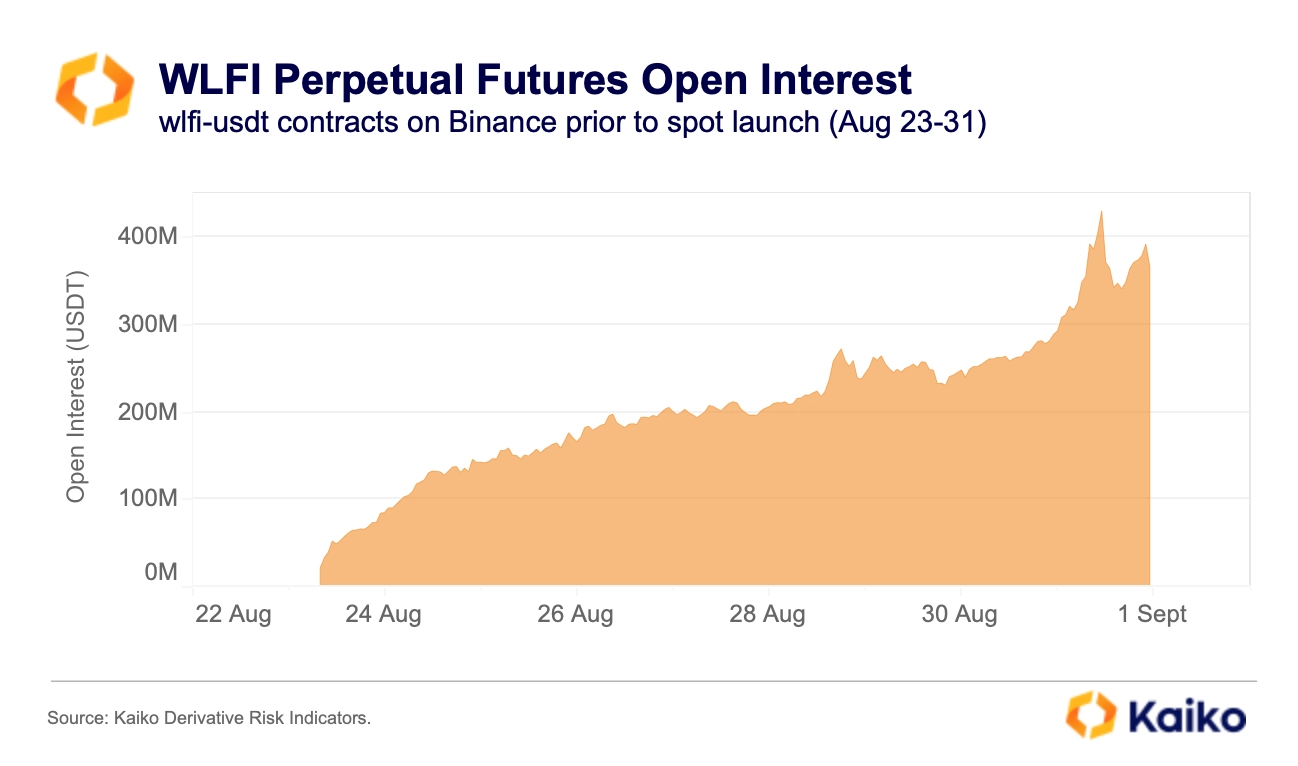

Kaiko derivatives data shows that traders were actively positioning in perpetual markets ahead of today’s trading. Since the launch of WLFI-USDT perpetual contracts on Binance on August 23rd, open interest surged from $21 million to over $360 million in just five days.

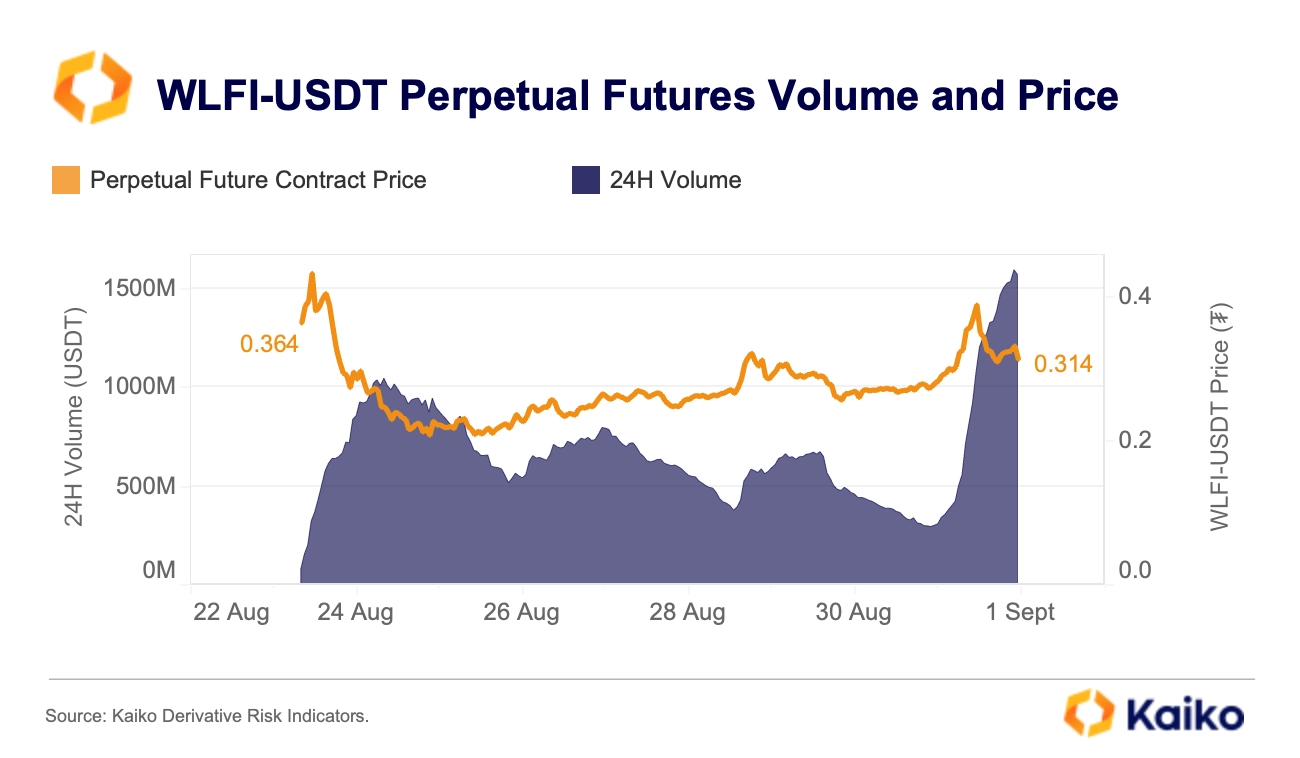

A comparison of volume and open interest shows that, initially, trading volume grew faster than open interest, pointing to aggressive short-term speculation. The pace moderated over the weekend, but volumes picked up again in the hours before the WLFI token unlock.

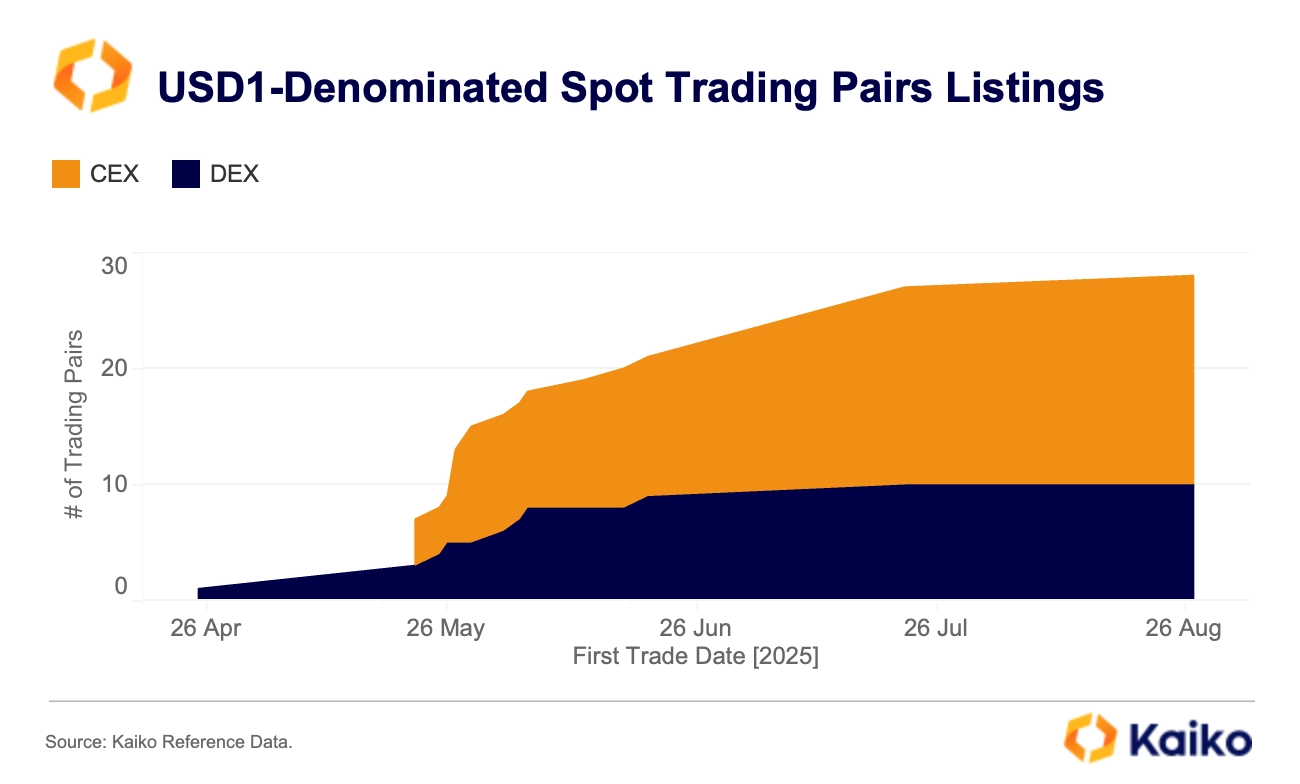

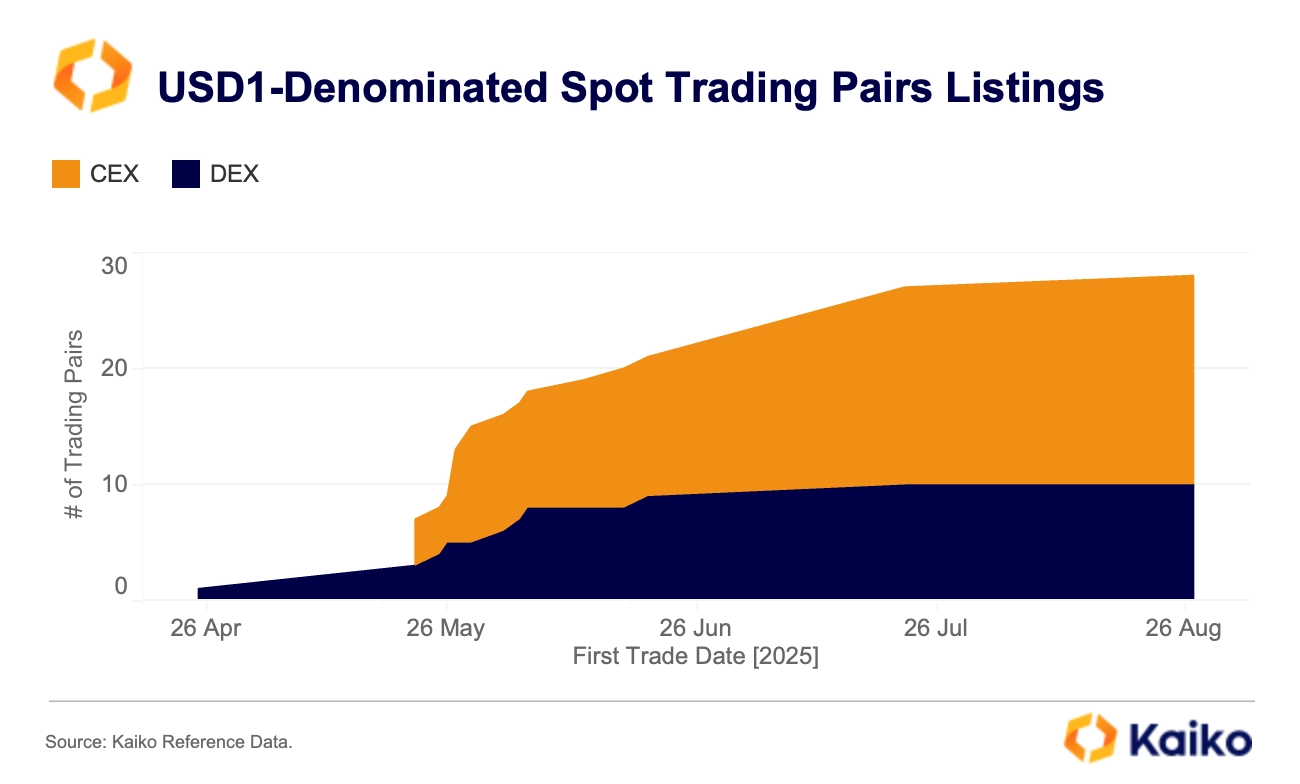

Excitement around WLFI was fueled by speculation that interest generated from USD1 reserves might be used to buy back WLFI tokens. USD1, a stablecoin central to the WLFI ecosystem, supports many of its transactions and operations. Although there is no confirmed buyback mechanism, the growing adoption of USD1 is evident from the increasing number of centralized exchanges listing USD1 trading pairs. This expansion could indirectly encourage greater participation in the WLFI ecosystem. Combined with buyback rumors, these factors likely drove early trader positioning and contributed to heightened market interest before the launch.

Data Points

CRO becomes a treasury asset.

Exchange tokens have often served as quasi-equity proxies for their platforms, but Crypto.com’s CRO token is about to be tested in a new way as the foundation of a $6.4 billion publicly listed digital asset treasury.

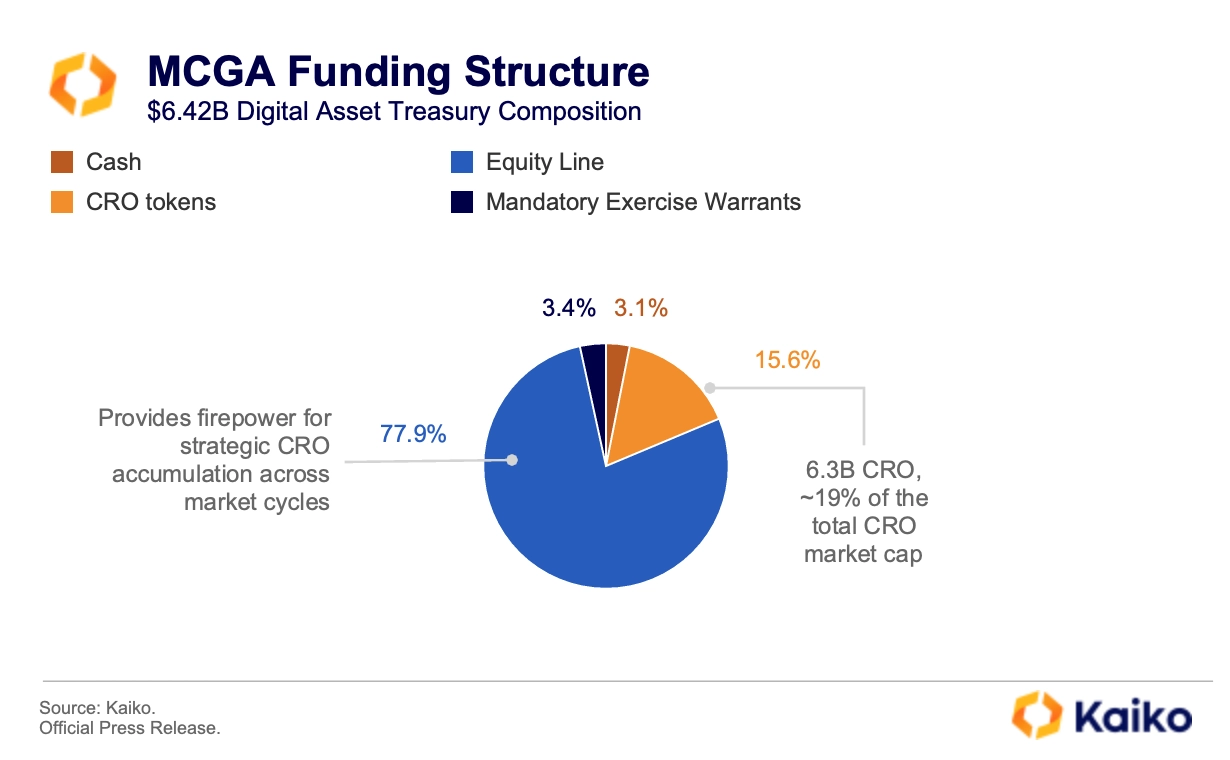

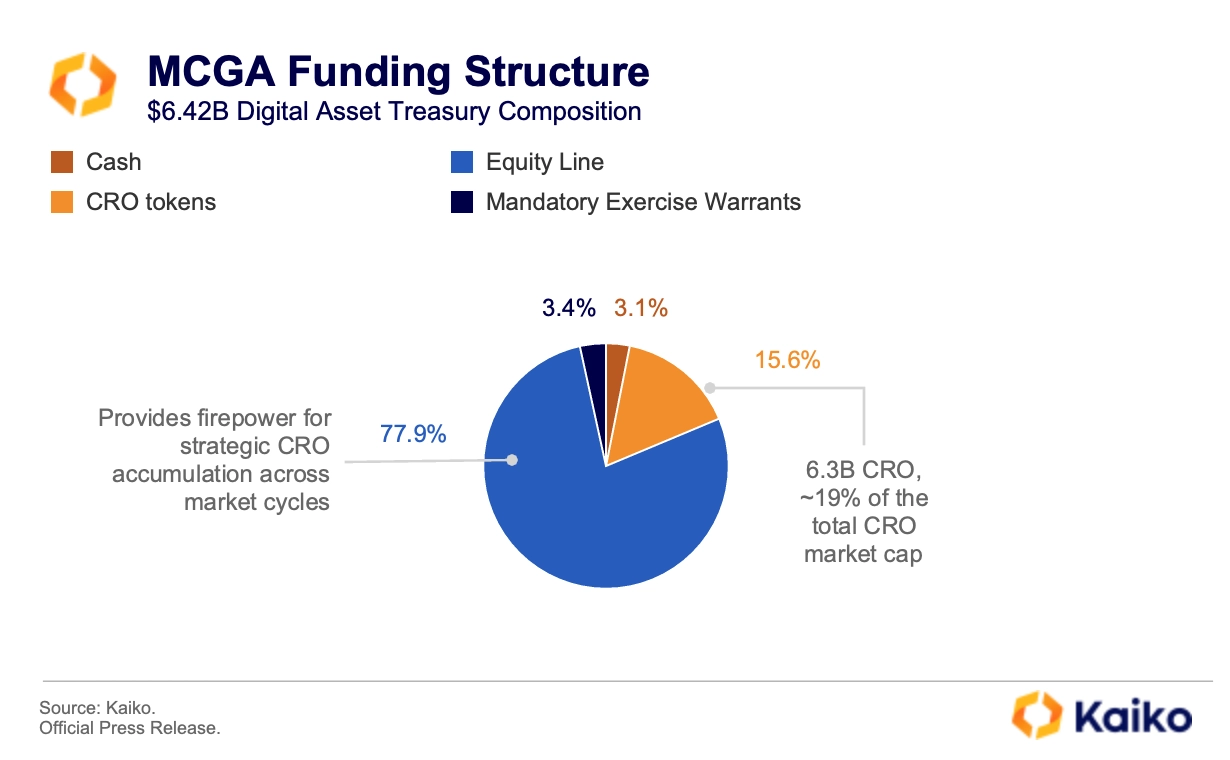

Last week, Trump Media & Technology Group and Crypto.com announced plans to launch the first publicly traded CRO treasury vehicle, which will list on Nasdaq under the ticker MCGA. The entity will be backed by $1 billion in CRO (about 19% of the supply at the time of announcement), $200 million in cash, $220 million in warrants, and access to a $5 billion equity line of credit.

Unlike a hedge fund or trading desk, MCGA is structured to be a long-term buyer. CRO will be accumulated, staked, and locked, removing a significant portion of the liquid supply and establishing a persistent bid in the market.

The impact was immediate. CRO surged 40% in a single day following the announcement, with hourly trading volumes reaching $168 million on August 26 and briefly surpassing those of BNB.

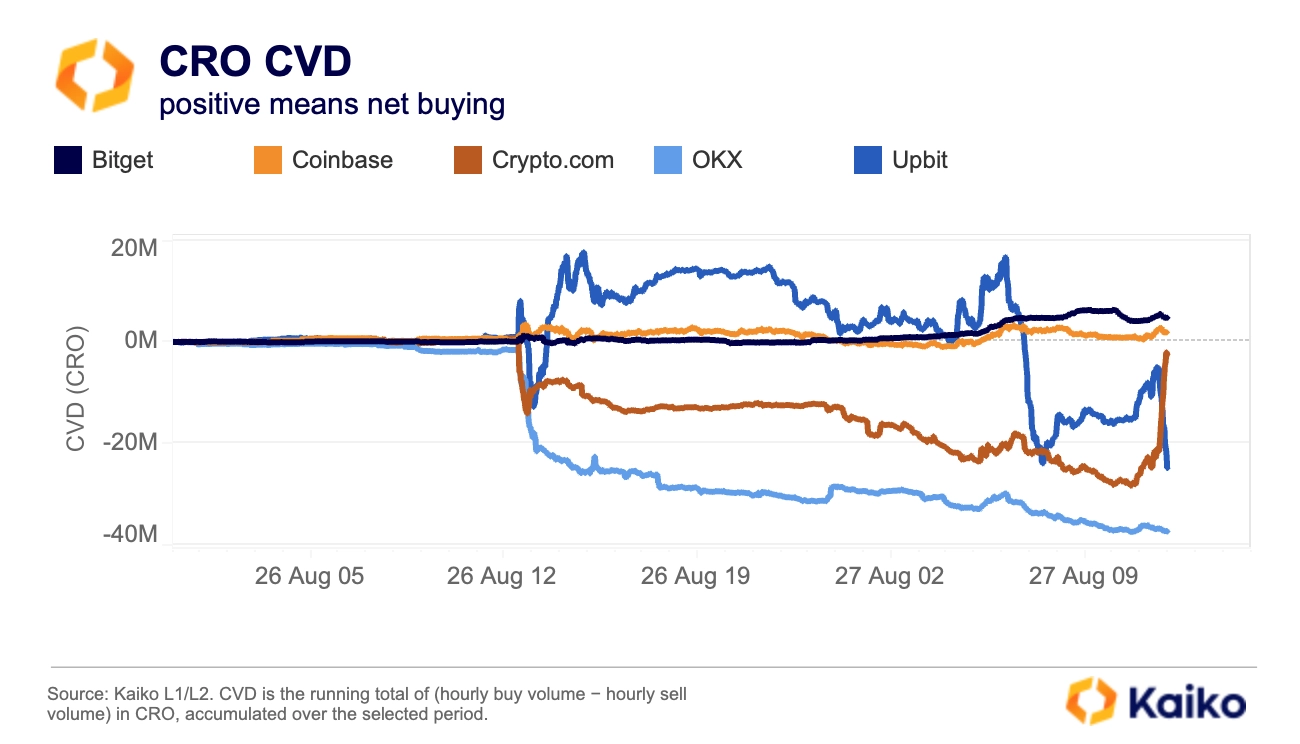

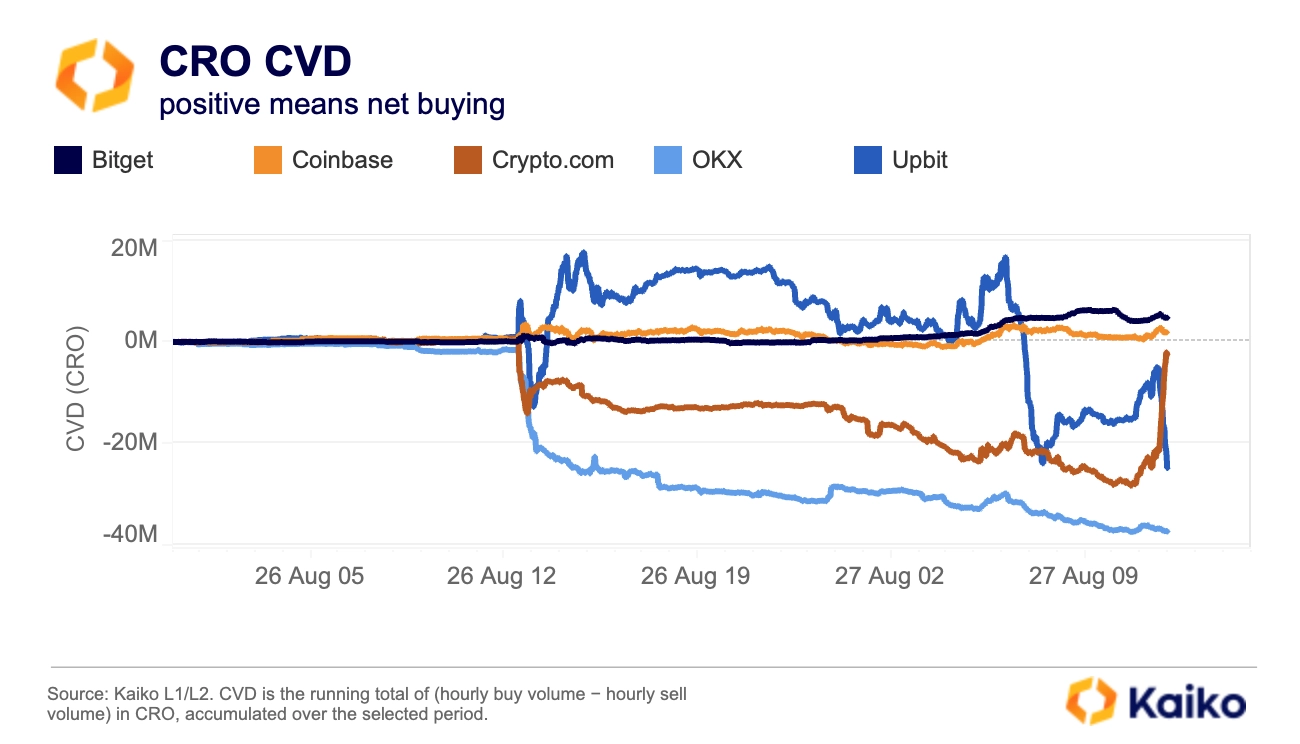

However, flows were uneven, with net buying concentrated on Upbit, Bitget, and Coinbase, while profit-taking occurred on Crypto.com and OKX.

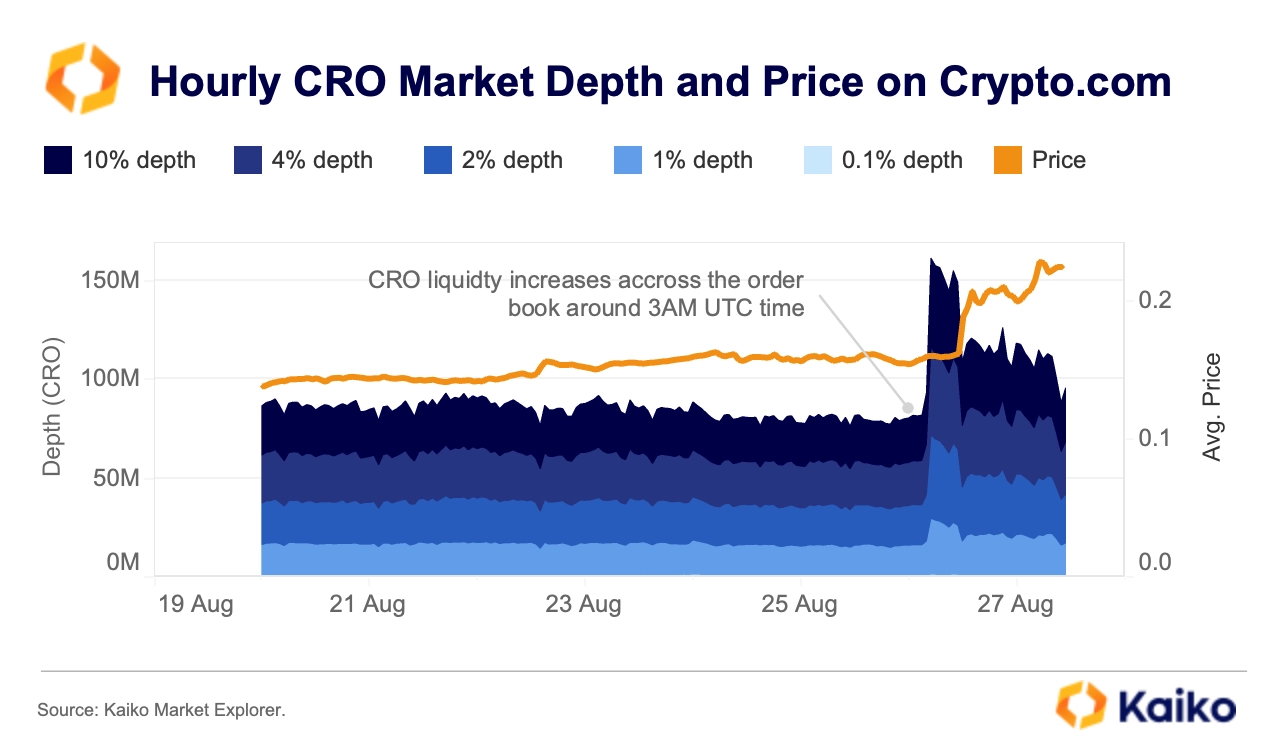

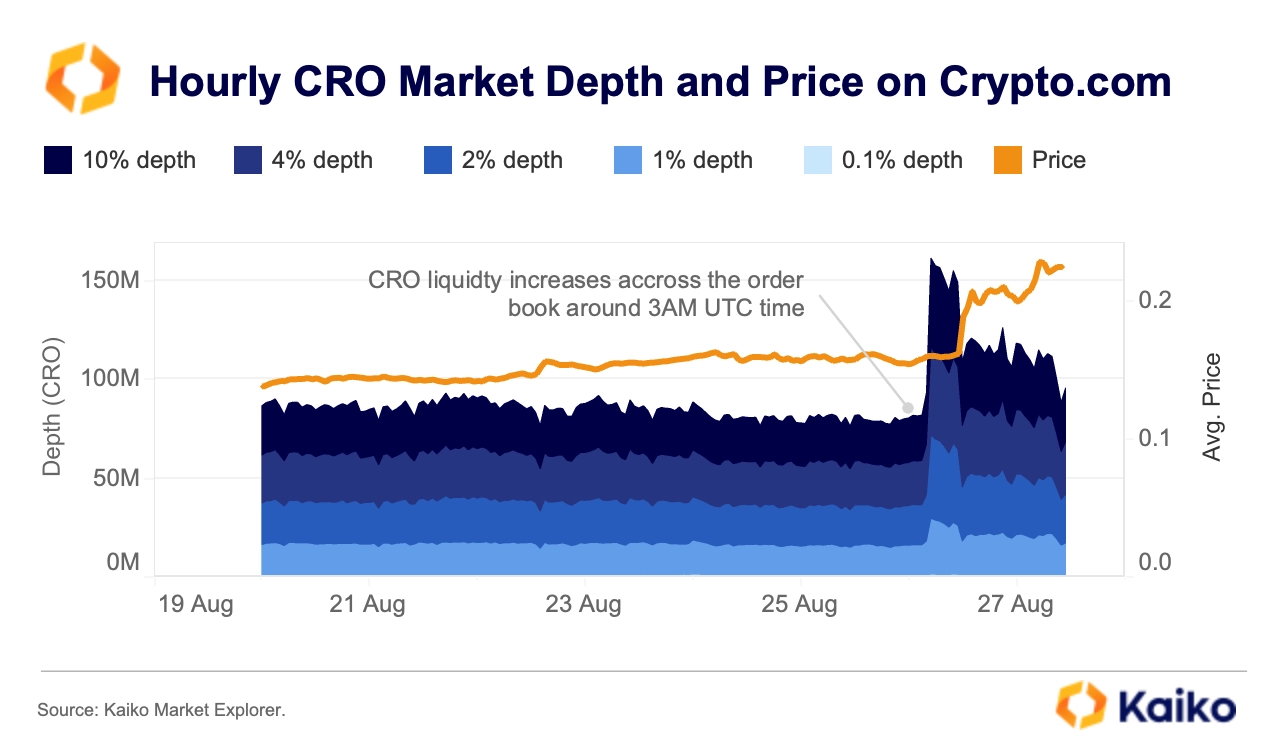

This surge in activity put CRO’s liquidity to the test. Ahead of the announcement, as the Asian session opened on August 26, order book depth increased and cross-venue liquidity remained resilient.

However, execution quality varied by exchange. A simulated $100,000 sell resulted in slippage of around 0.2% on Crypto.com compared to over 3% on MEXC, highlighting differences across venues. The increase in depth before the announcement suggests that market makers likely built up inventory in anticipation of higher volatility.

The deal effectively locks up about 19% of the circulating supply, increasing CRO’s sensitivity to new flows. With less inventory available and a large buyer accumulating more, price movements could become more pronounced in both directions.

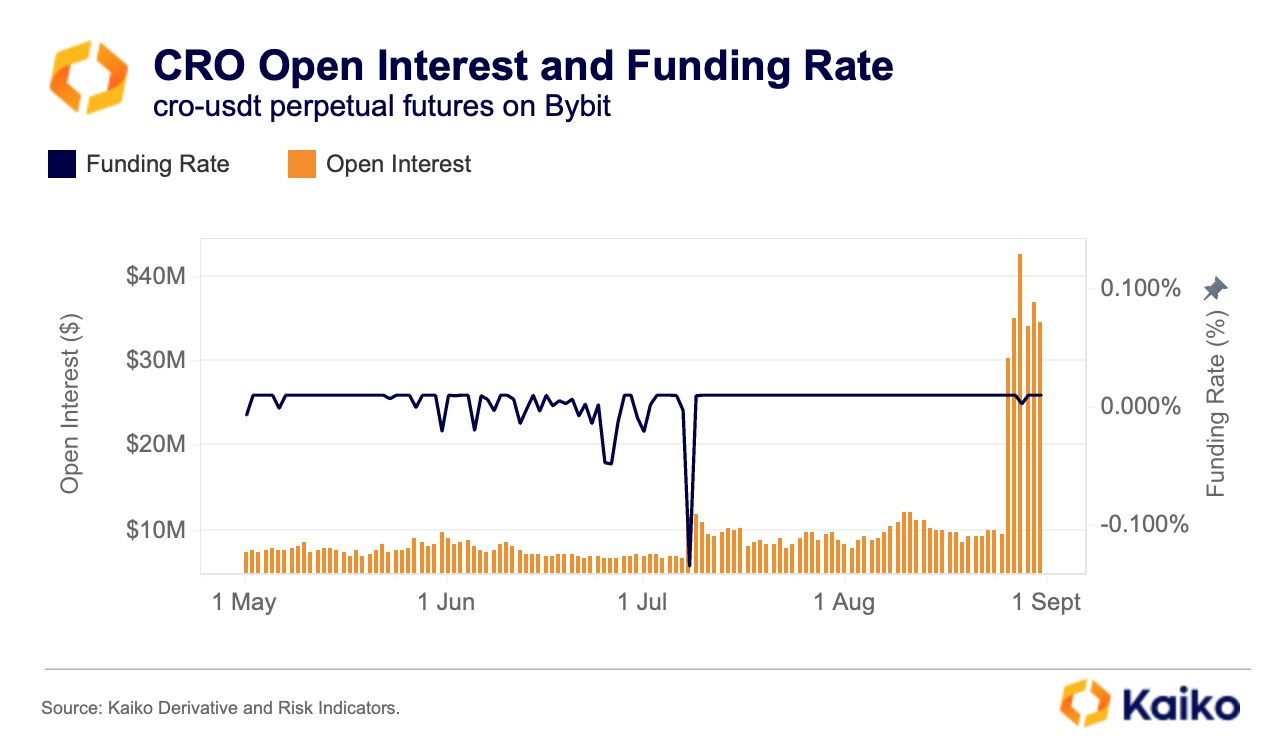

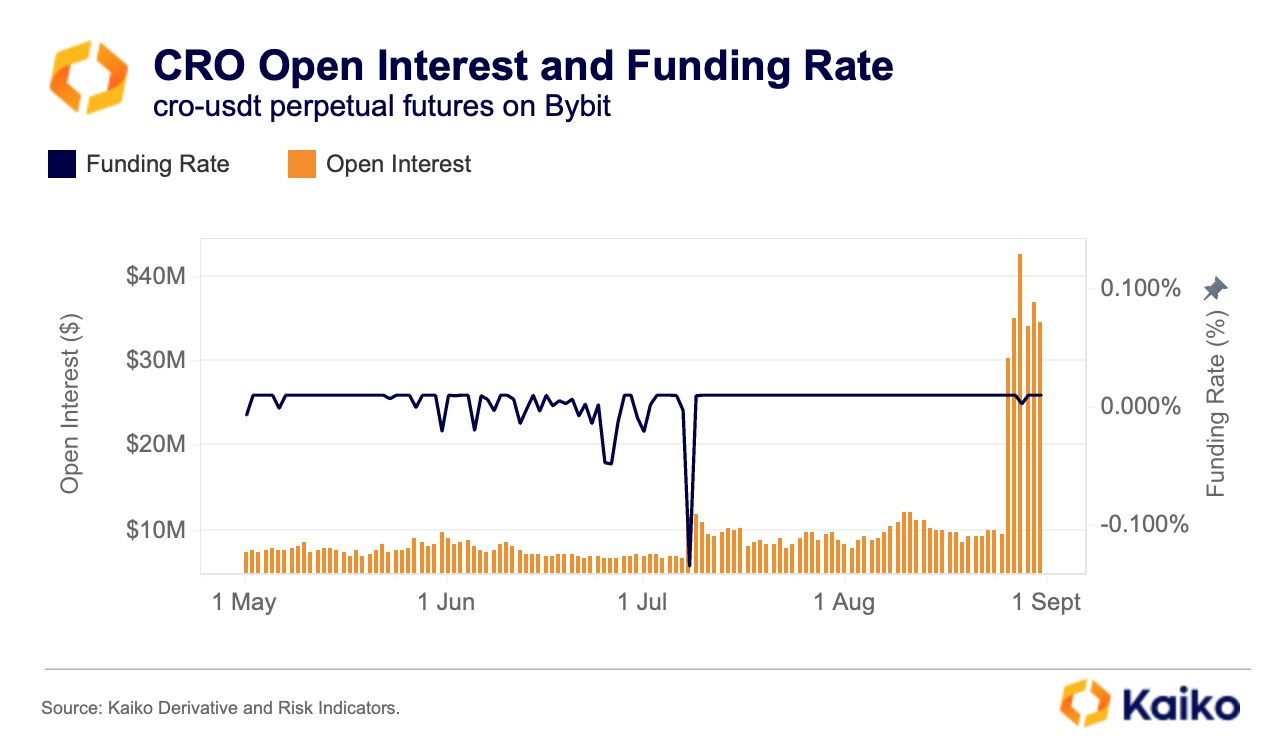

This uncertainty is reflected in the derivatives markets. CRO-USDT open interest on Bybit tripled between August 25 and 27, while funding rates remained near neutral at approximately 0.01% per interval, signaling a mix of long-term bullish positioning and short-term speculation.

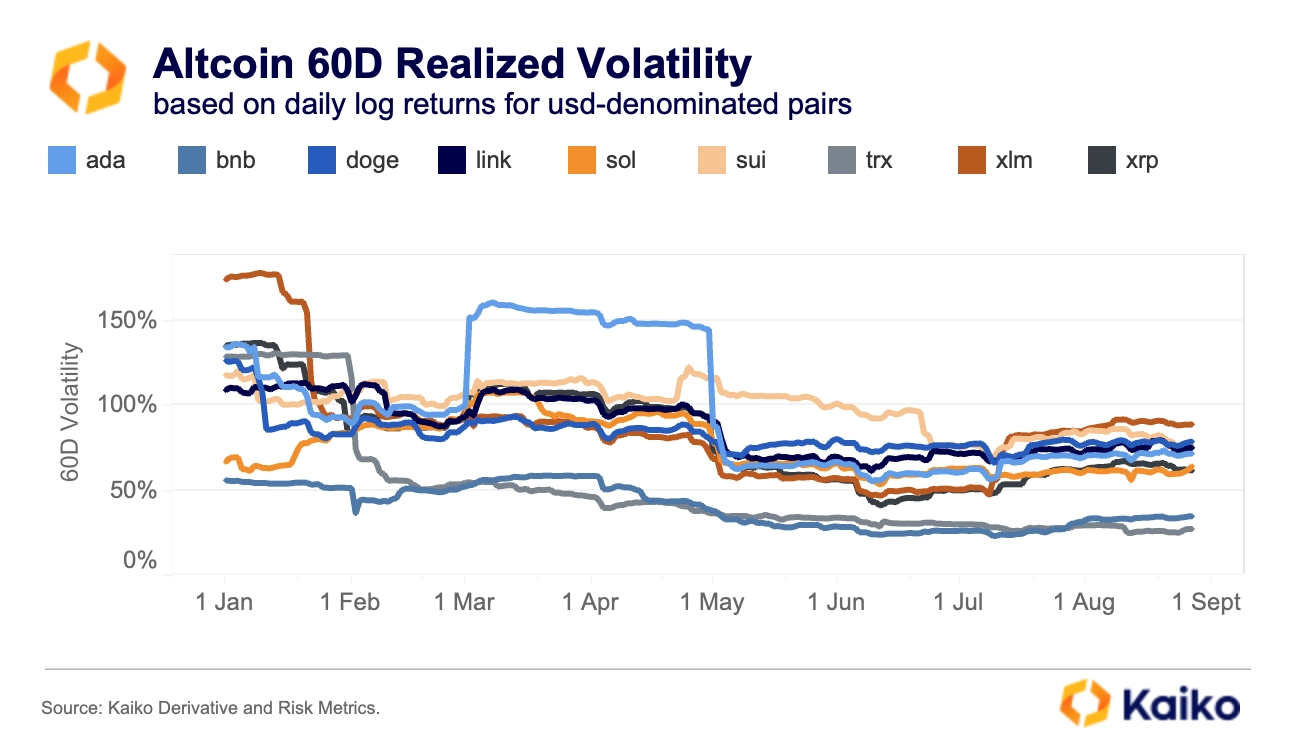

Altcoin risk reward profile improves in Q3.

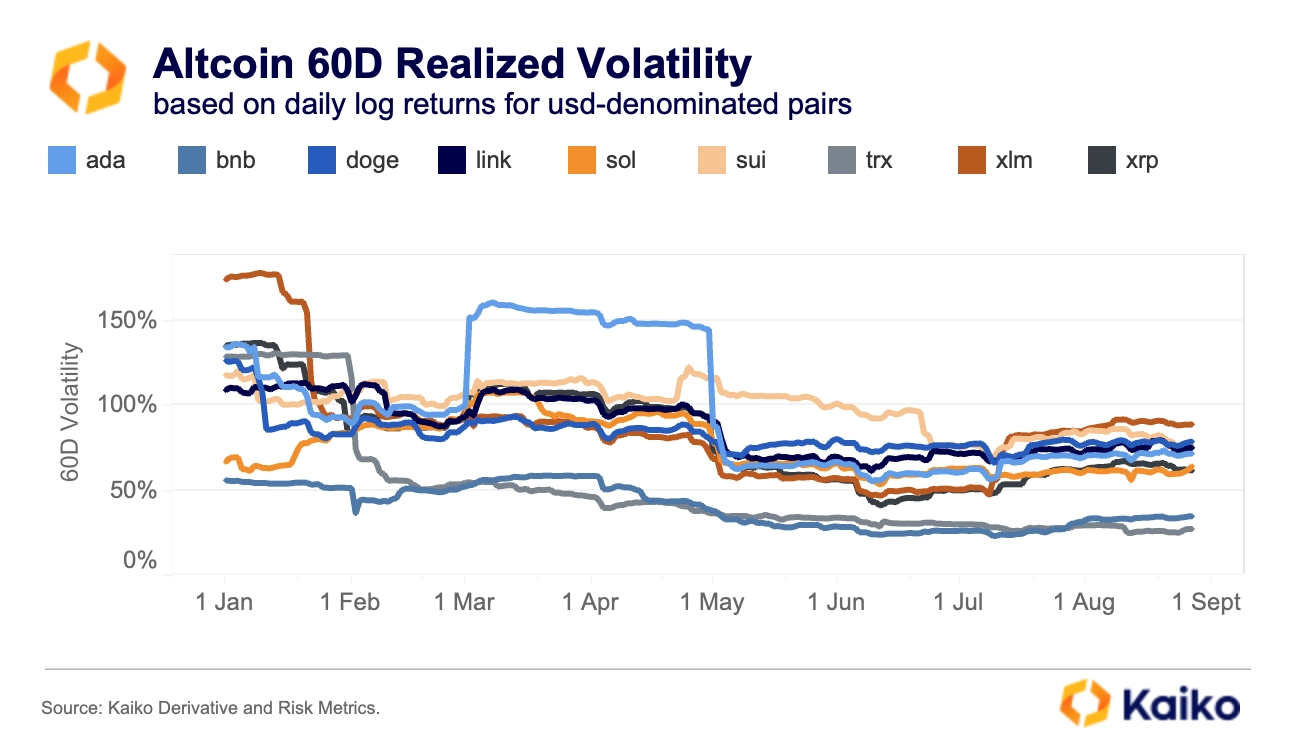

Altcoins staged an unexpectedly strong rally this summer, with Ethereum narrowing the gap to Bitcoin. Since early July, most leading altcoins by market capitalization have seen their volatility drop to around 75%, compared to levels of about 125% earlier this year. This shift has recalibrated the risk-reward profile for altcoins, leaving traders better compensated for the risks they take.

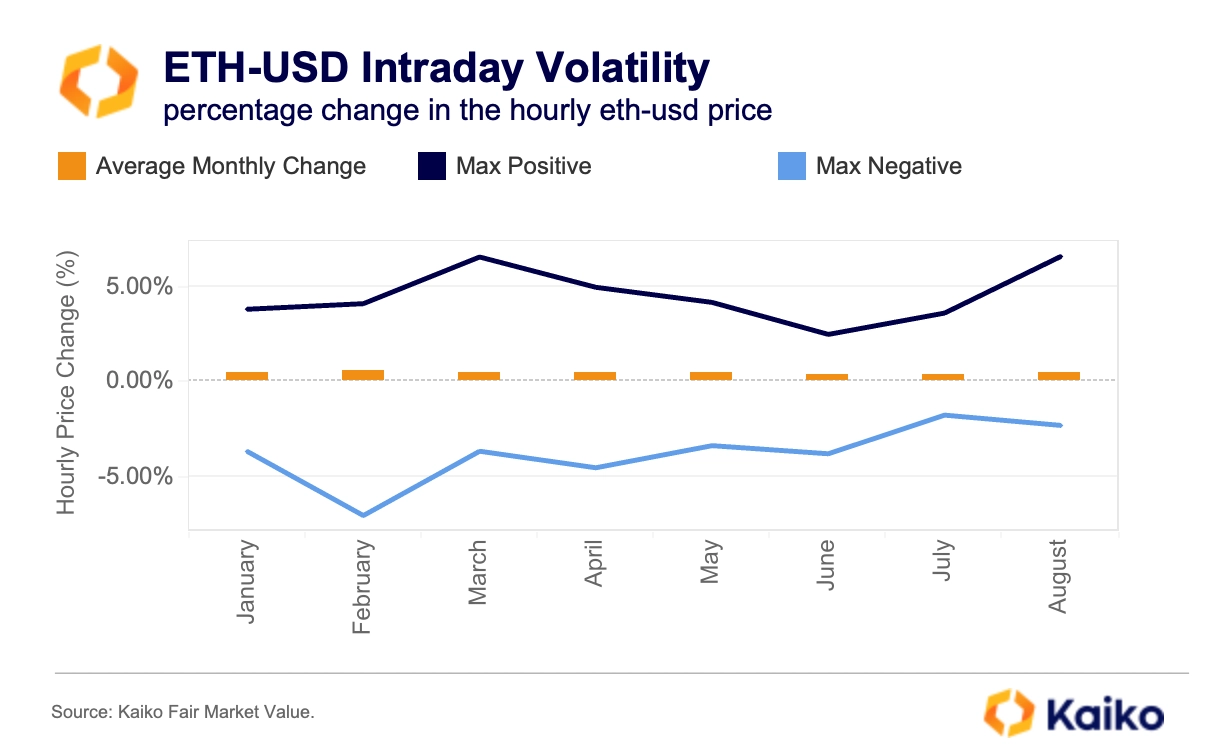

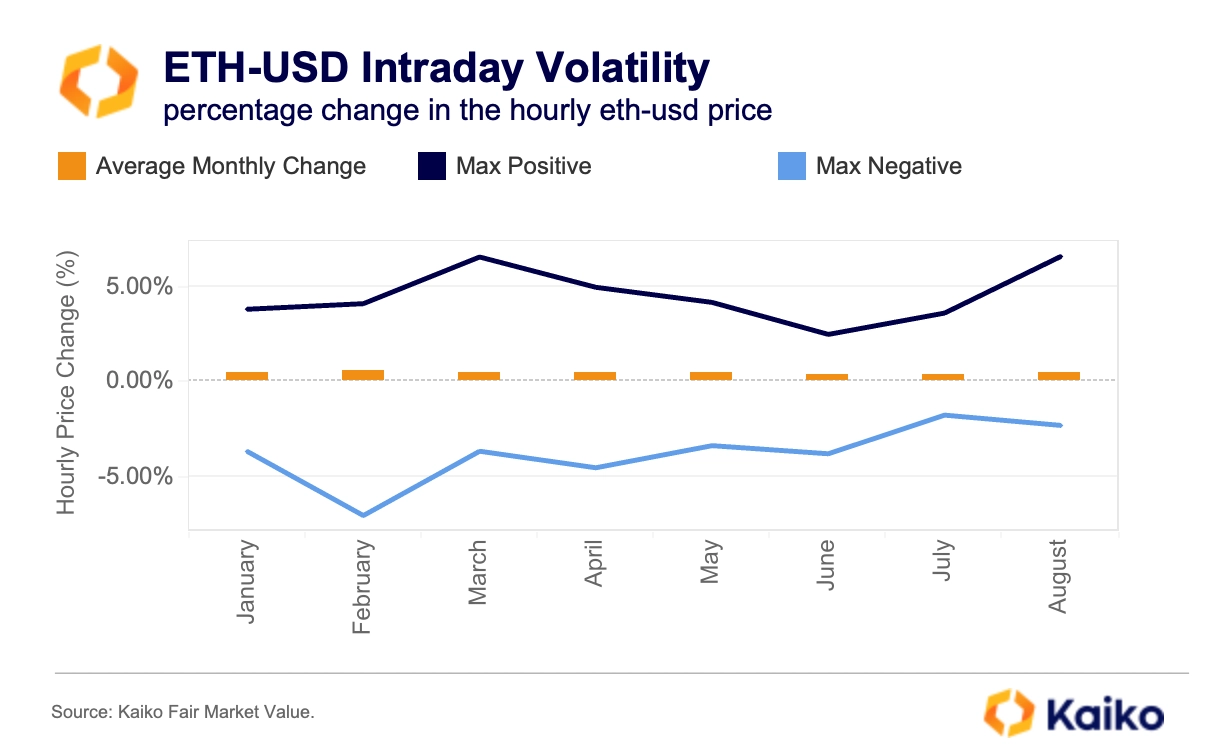

For ETH-USD specifically, August’s intraday volatility showed a clear positive skew and a pronounced shift into US market hours. Despite only a modest rise in overall volatility, August saw the largest positive hourly move of the year, and about 80% of extreme moves (±2% in an hour) occurred during US trading hours (14:00–21:00 UTC), compared to approximately 52% from January to July. This suggests a US-driven impulse, likely reflecting a combination of Fed policy repricing and institutional FOMO, rather than globally distributed overnight flows.

Unlike previous cycles, participation was much broader. Trading volumes across the top 20 altcoins (excluding ETH) reached a record $882 billion in July and August. While September is typically one of the most volatile months for crypto, the current macro backdrop is supportive. Markets are pricing in an 87% probability of a US rate cut, which is encouraging greater allocation to risk assets. Combined with revived volumes and improving liquidity, this suggests that altcoins could remain resilient despite the usual seasonal volatility risks.

![]()

![]()

![]()

![]()