Join us for our latest webinar in collaboration with Cboe

Liquidity Flywheel Drives Binance to 300 Million Users

The data behind Binance’s Journey so far

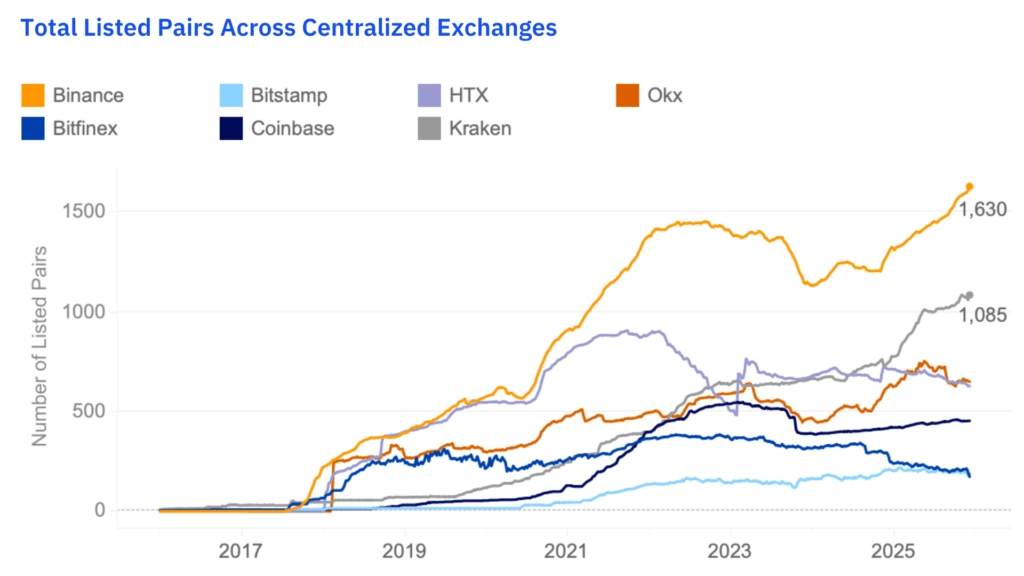

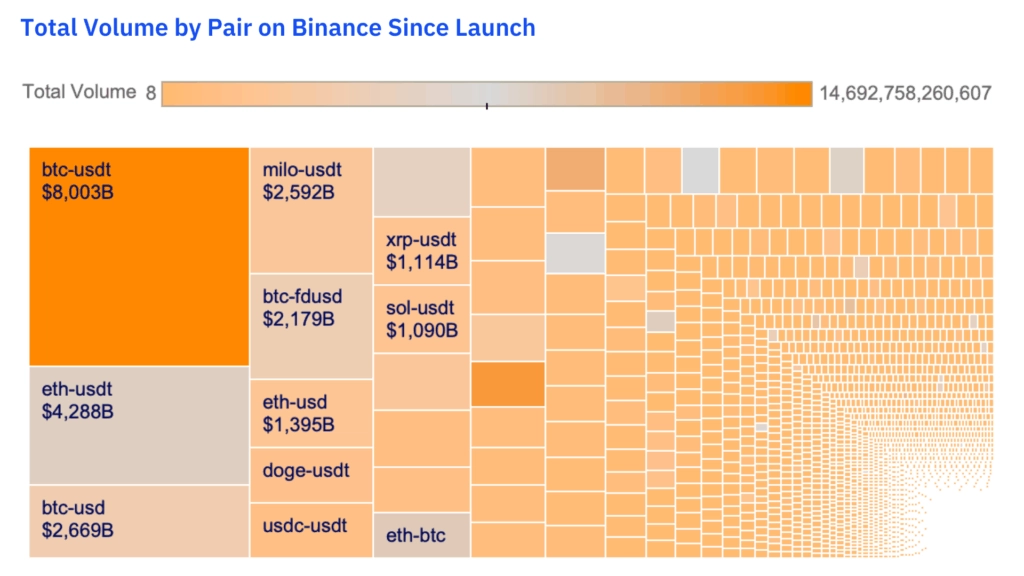

Binance reached 300 million registered accounts in December 2025, eight years after launching. The exchange built liquidity conditions that separated it from competitors, not through guaranteed dominance, but through execution reliability, infrastructure investment, and design choices that compounded across that period. It now processes over $20 billion in daily spot volume across 1,630 trading pairs, maintaining depth that supports both retail and institutional execution with minimal slippage.

Part 1: The Journey So Far

Part 2: Trading infrastructure at scale

Part 3: Liquidity Foundation

Part 4: The adoption curve

Part 5: Future proofing crypto infrastructure

The Journey So Far

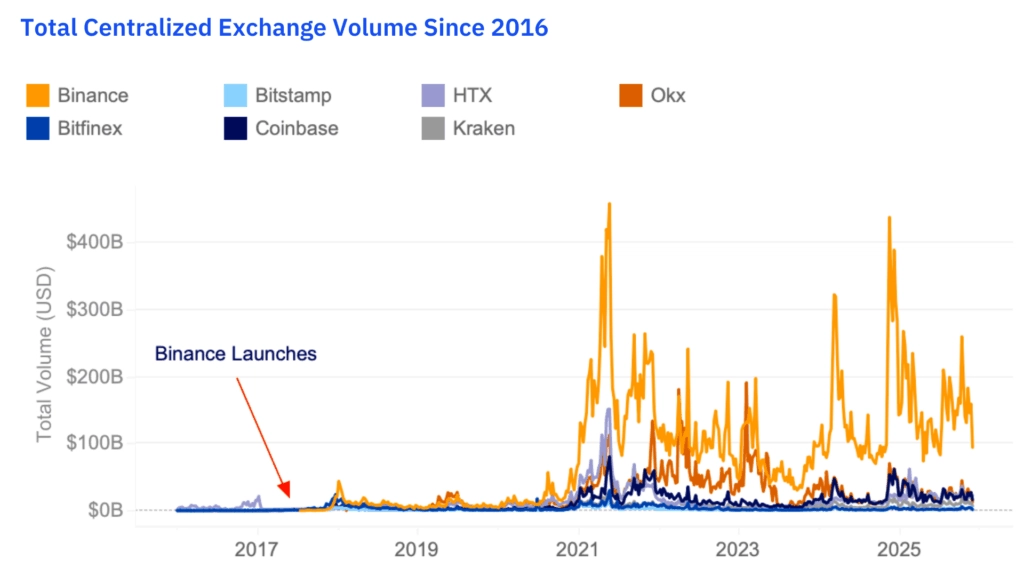

Binance’s early years were marked by a simple market truth: liquidity follows flow.

→ In 2017 and 2018, the exchange reduced barriers for a global retail audience.

→ Volumes climbed rapidly with Binance surpassing competitors by early 2018, following its July 2017 launch.

Trading infrastructure at scale

The current infrastructure picture underscores why execution costs remain low even as activity rotates between assets.

→ Market structure has converged in several important ways. Cross-venue basis between Binance’s BTC USDT and Coinbase’s BTC USD is generally within a basis point during normal conditions.

→ Peak capacity during high volatility remains a differentiator. In October the market processed more than $60 billion of spot volume in a single day with intraday swings around 20 percent.

The adoption curve

User behavior observed through volumes and book conditions points to a broad base of retail activity supplemented by systematic strategies and institutional rebalancing.

→ On the snapshot day, Binance processed 61.9 million trades for $20 billion in spot volume, implying a small average trade size and frequent prints.

→ The long tail remains active enough to sustain tight spreads on a subset of pairs, and liquidity migrates quickly as narratives evolve.

Download the Report.

This research report was paid for by Binance, but written independently by Kaiko. This content is for informational purposes only, does not constitute investment advice, and is not intended as an offer or solicitation for the purchase or sale of any financial instrument. For any questions, please email [email protected].