Stablecoin Market Structure

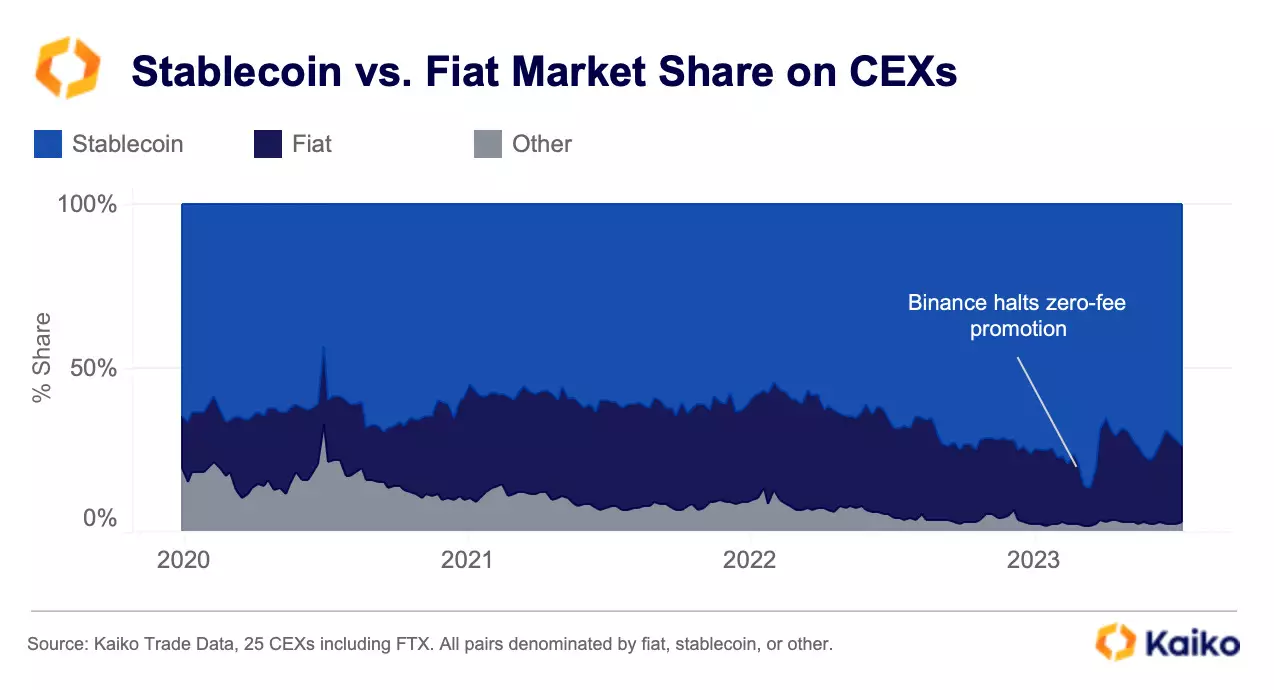

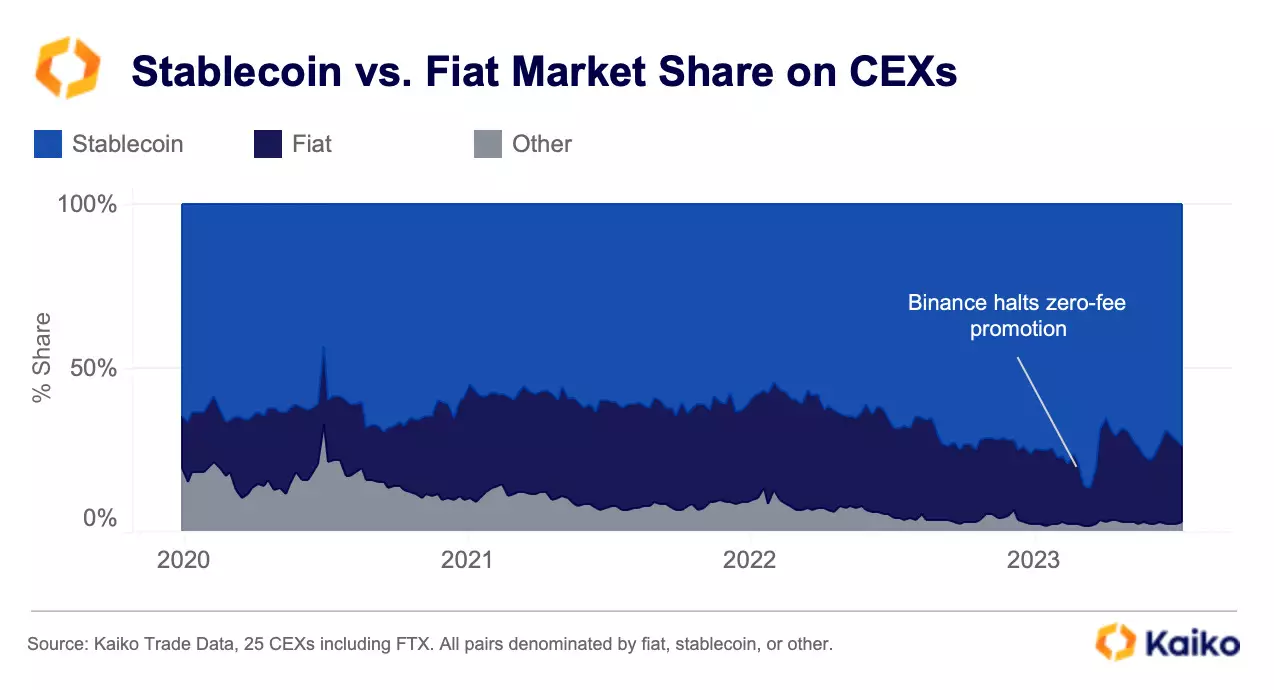

Today, 74% of all cryptocurrency transactions on centralized exchanges incorporate a stablecoin. This is an increase of 10% since the start of 2020, but well below all time highs hit in March, when very briefly, 87% of all crypto trades incorporated a stablecoin. The rapid increase in stablecoin market share was linked almost entirely to Binance’s zero-fee trading promotion.

Right after Binance halted this program, we observed a near instantaneous drop in stablecoin market share. Overall, though, the data shows that fiat currencies play a relatively small role in global cryptocurrency markets, with just 23% market share.

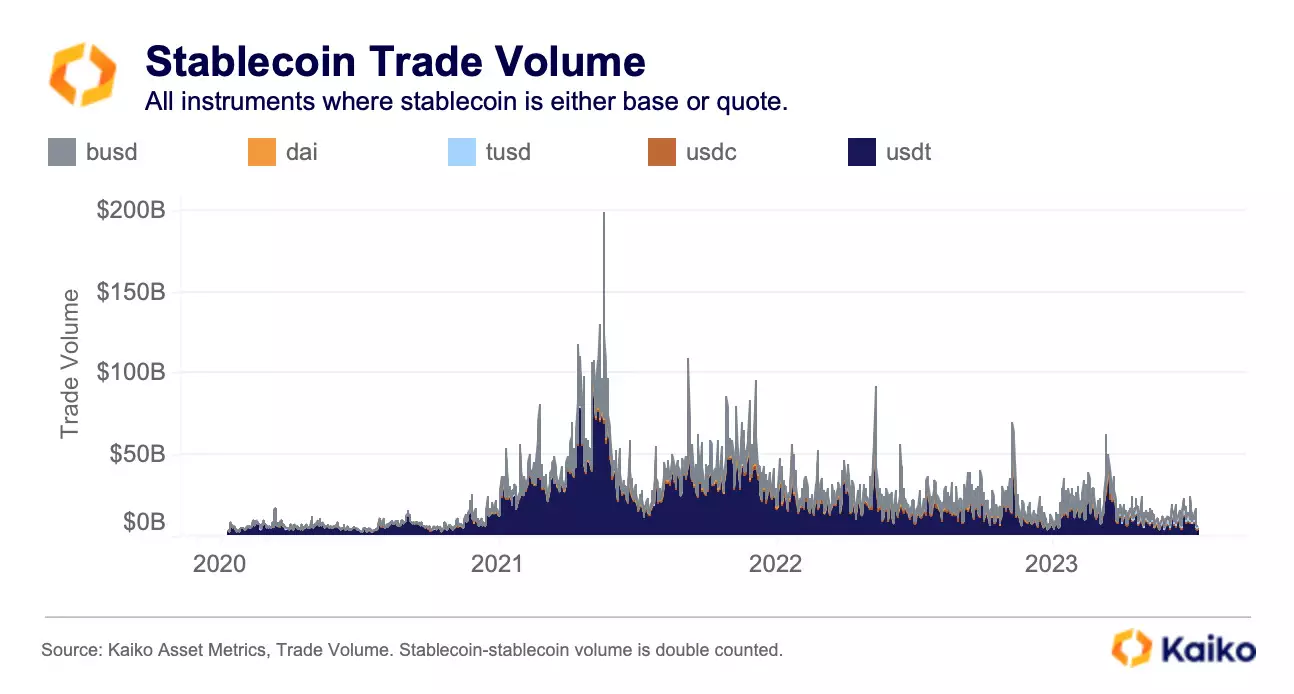

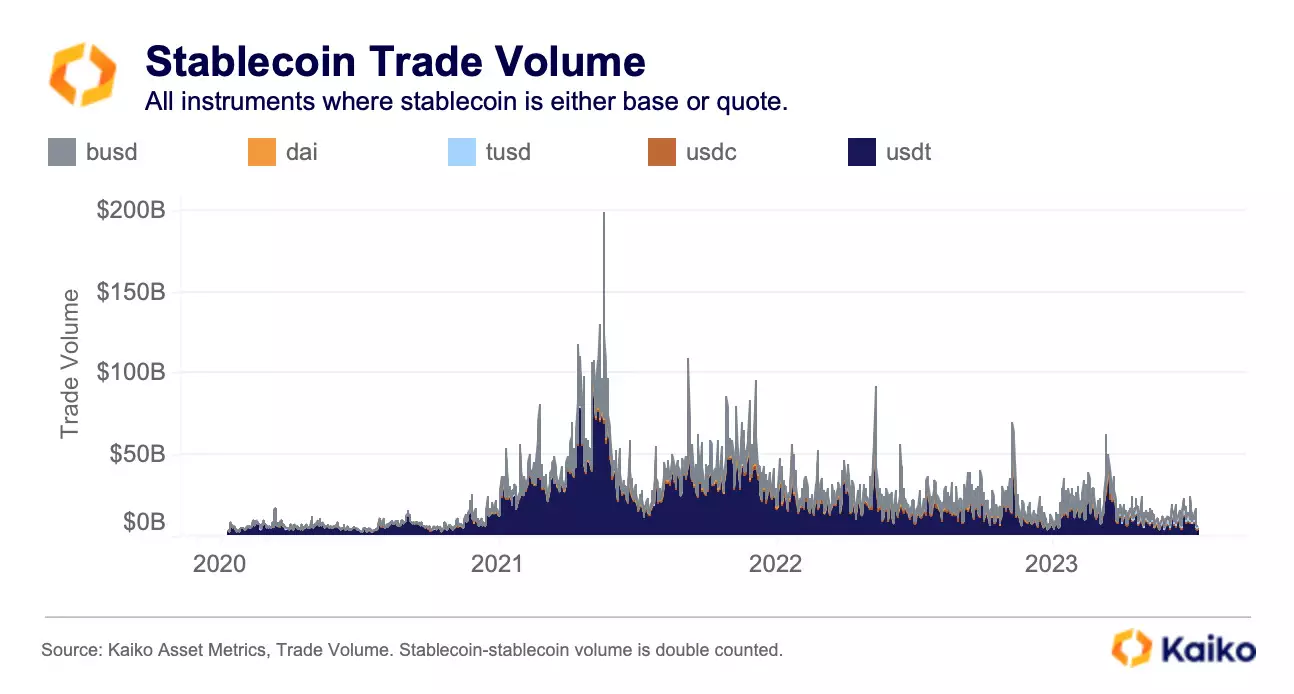

To understand the actual size of these markets, let’s look at trade volume on both centralized and decentralized exchanges for the top five stablecoins: Tether (USDT), USDC, Binance USD (BUSD), TrueUSD (TUSD), and DAI.

Since the start of Q2, around $10-15bn worth of these five stablecoins have been traded every day. While this is a far cry from all time highs hit during the 2021 bull run, it’s still a considerable sum of volume.

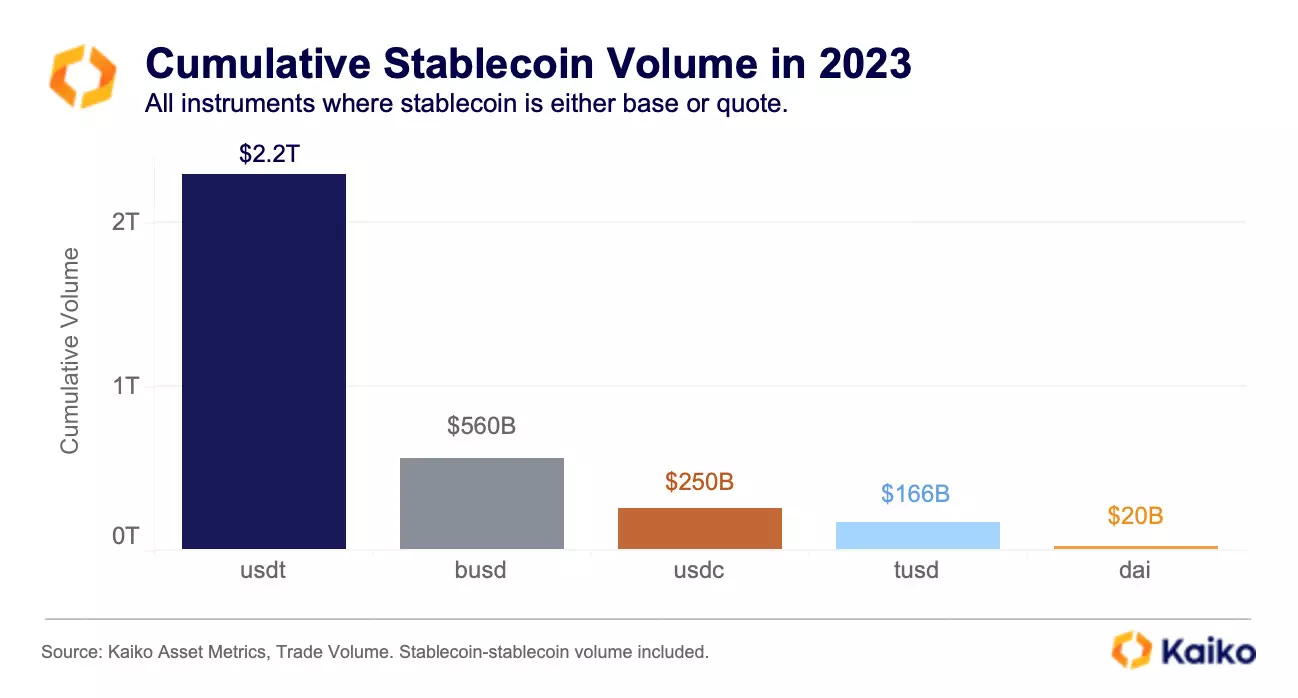

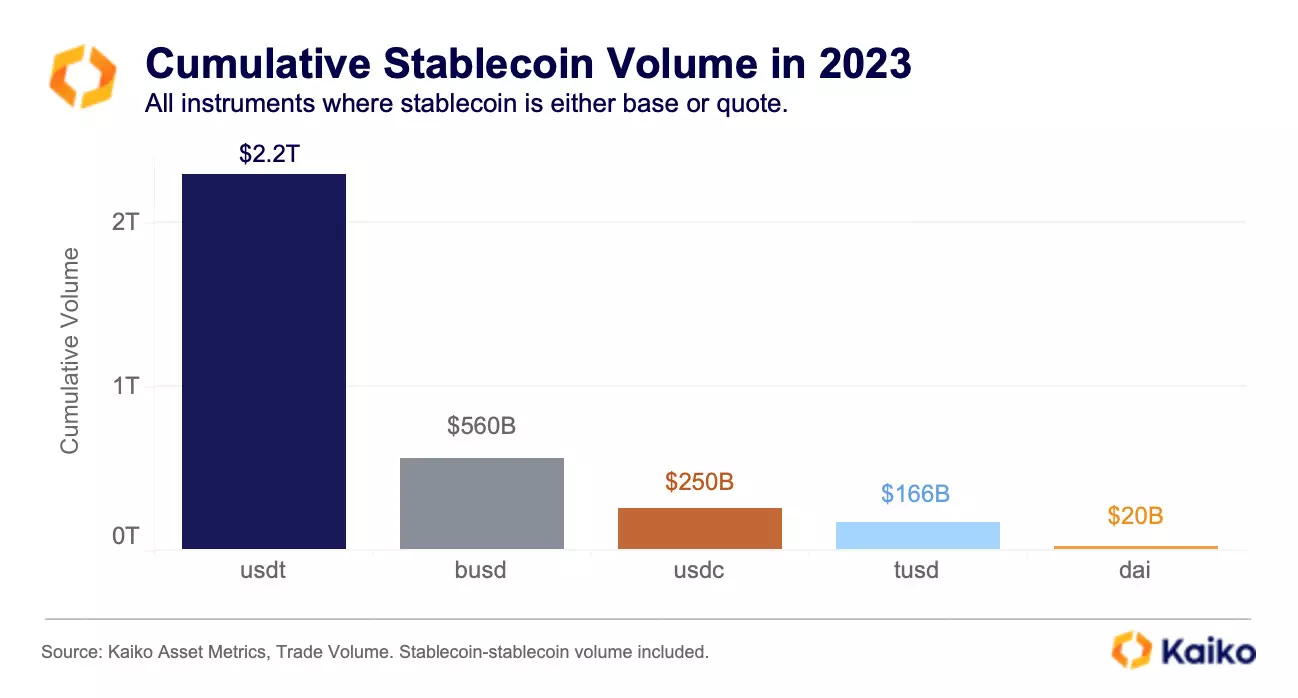

Viewed another way, the cumulative stablecoin trade volume in 2023 is greater than $3 trillion, with Tether dominating.

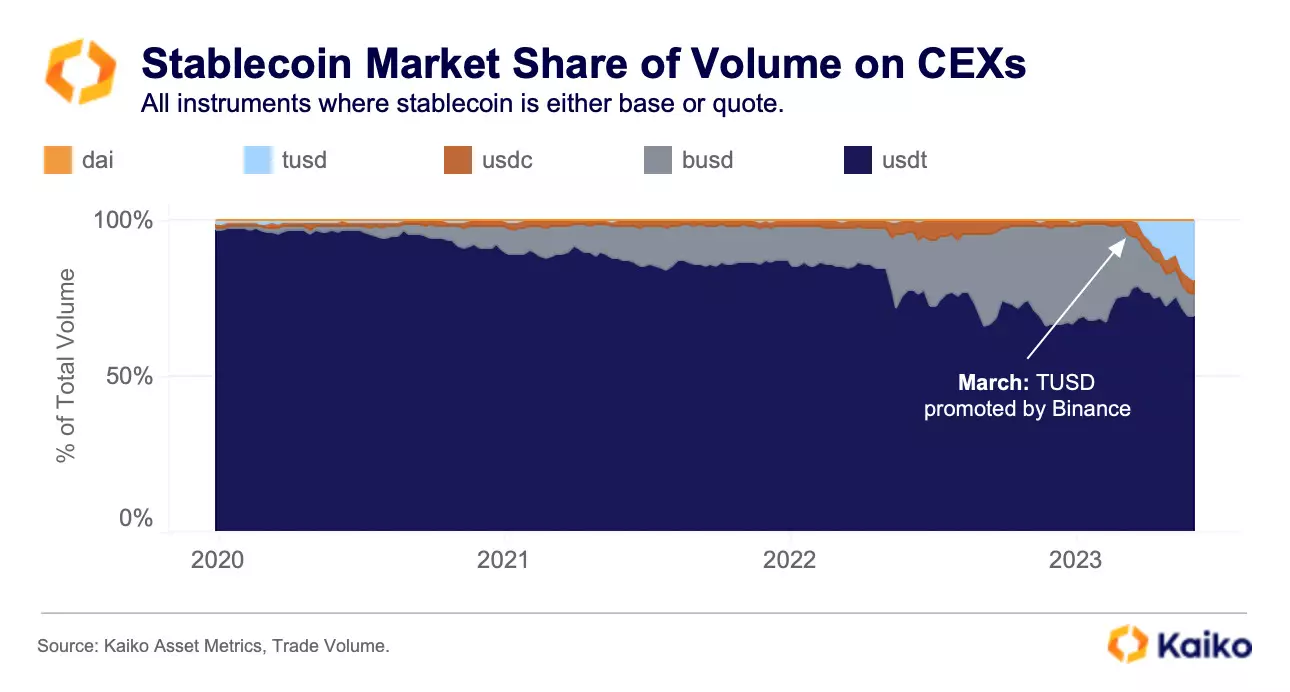

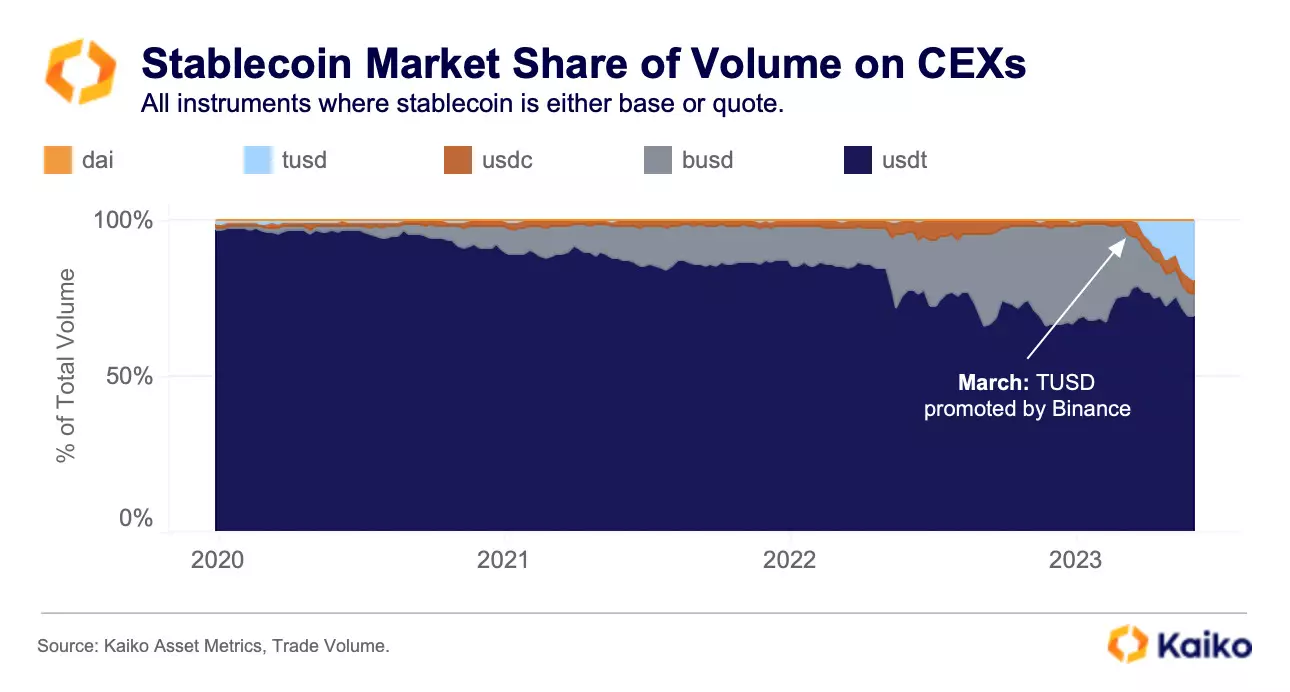

Today, Tether possesses a whopping 70% market share on centralized exchanges. Binance’s BUSD almost came close to becoming a top rival before its issuer, Paxos, was forced to halt earlier this year. BUSD’s market share is now slowly dwindling ahead of its official end in 2024, dropping from highs of 30% to just 6% today.

Perhaps the biggest surprise of the year has been the rapid rise of TUSD, which in just three months saw its market share climb from <1% to 19%. TUSD was a little-known stablecoin that had virtually no volume before Binance essentially selected it as a successor to BUSD and began promoting a zero-fee BTC-TUSD pair. The vast majority of all TUSD volume comes from this one pair.

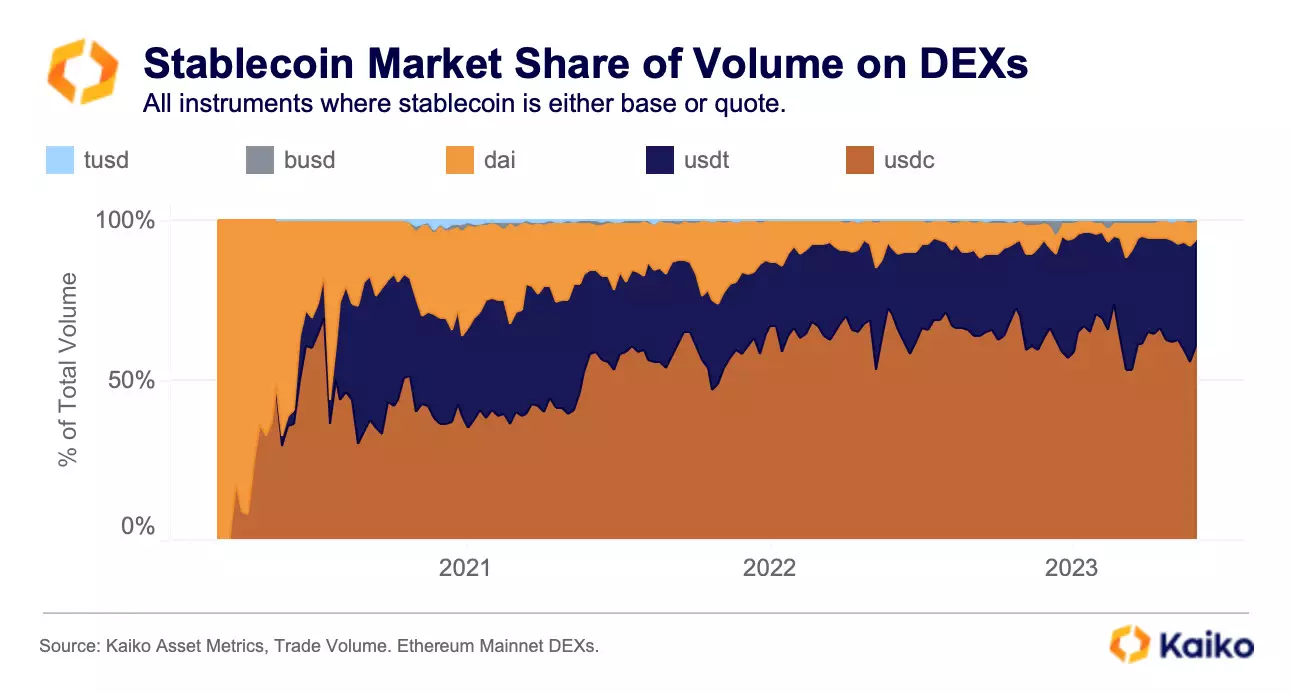

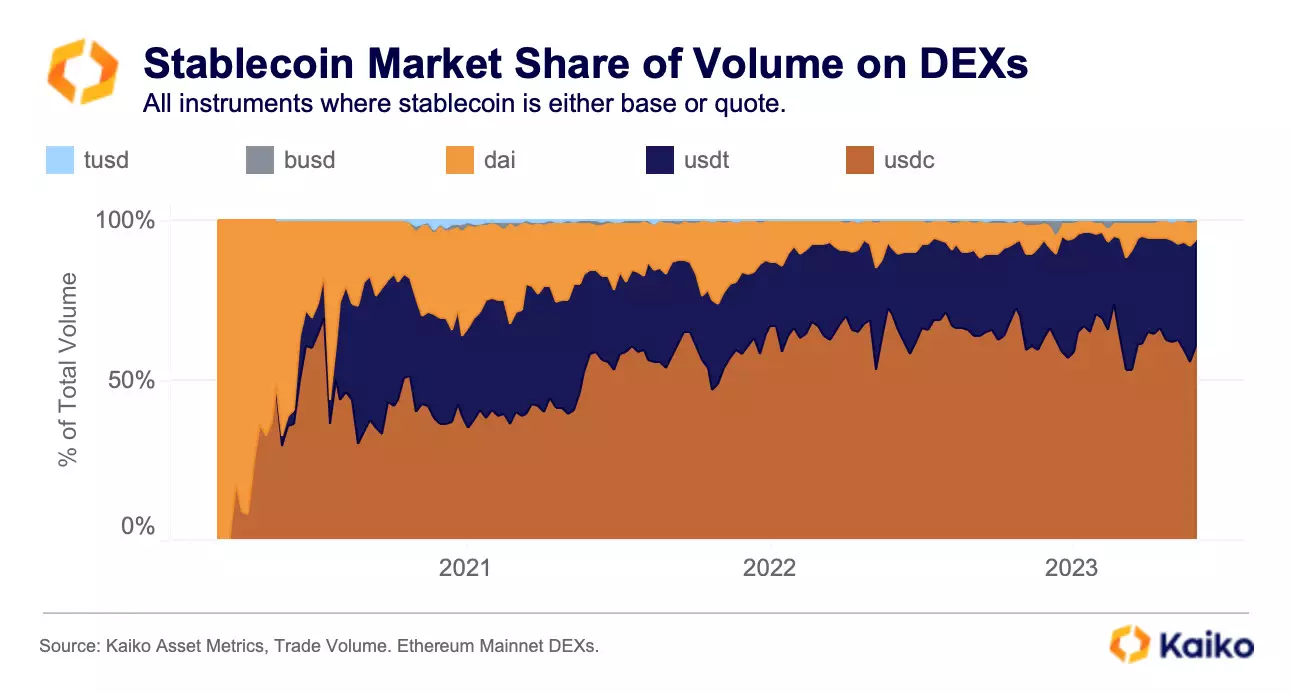

On decentralized exchanges, the breakdown in market share is considerably different. The most obvious trend involves the rapid fall of DAI, the only top stablecoin that is decentralized. DAI used to account for the majority of DeFi activity, but its dominance was quickly supplanted by USDC and USDT.

One explanation for this shift involves the relative capital efficiency of each stablecoin: DAI requires overcollateralization to mint 1 USD worth of DAI, whereas USDC and USDT do not, which enabled these centralized stablecoins to quickly attract more users and capital. Today, USDC is systemically in DeFi protocols, especially on lending protocols where it serves as a high percentage of total collateral.

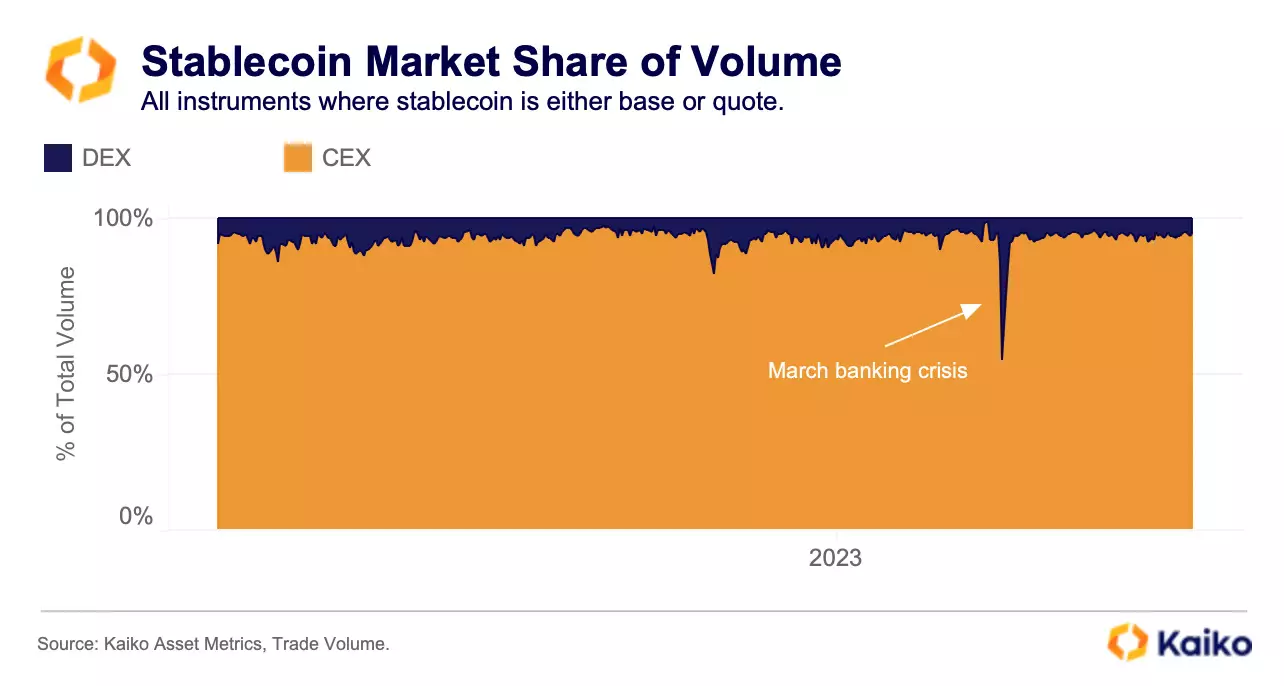

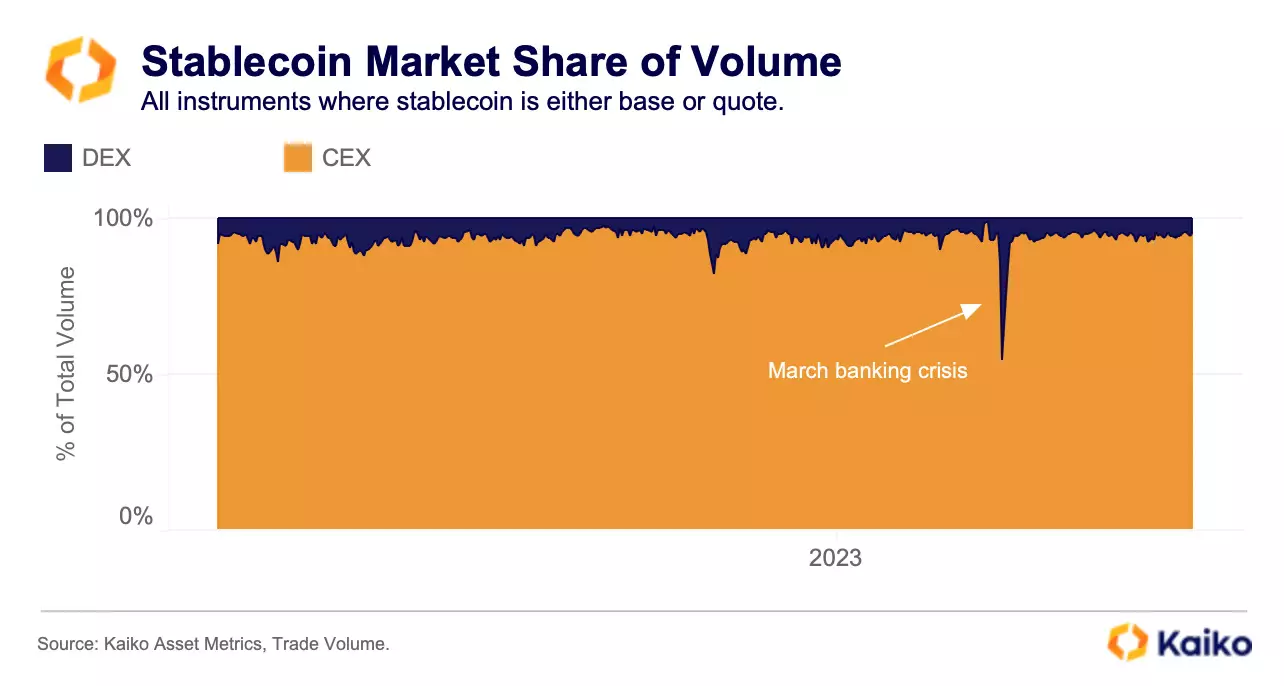

Overall, the vast majority of stablecoin activity today happens on centralized exchanges. Only 5% of stablecoin trades are executed on decentralized exchanges, although this briefly spiked to 45% during the March banking crisis. [Kaiko’s DEX data includes the most liquid protocols on Ethereum Mainnet, which today possesses the majority of volume across chains].

The CEX to DEX ratio of volume suggests that today, stablecoins are primarily used to trade on centralized exchanges.

Conclusion

The CEX to DEX ratio of volume suggests that today, stablecoins are primarily used to trade on centralized exchanges.

With this information, we can draw the following conclusions on the state of stablecoin market structure:

- The vast majority of crypto activity incorporates centralized stablecoins, not fiat.

- Tether accounts for the majority of these transactions, although TUSD is rapidly gaining market share.

- The primary use case for stablecoins is trading on centralized exchanges.

This week, the European Banking Authority told stablecoin issuers they must take immediate measures to comply with the upcoming MiCA regulation, which puts several stablecoins in a precarious position considering the general lack of transparency and governance. While Circle has made huge efforts to improve USDC transparency (and even Tether has made some efforts over the past year), the relatively unknown TUSD is today posing the biggest risk, offering the least information about its reserves or corporate structure.

While TUSD is not yet a systemically important stablecoin, Binance is an extremely influential exchange, so any activity on it should be scrutinized. Historically, though, transparency has never seemed to be a big issue for stablecoin users, and unless an outright ban is implemented or regulators coordinate legislation across every major geography, we will likely continue seeing similar market structure.

This analyses was done using Asset Metrics, which aggregates trade data from all centralized and decentralized exchanges in our coverage, covering 10k+ active spot markets.

![]()

![]()

![]()

![]()