Join us for our latest webinar in collaboration with Cboe

Competition for Crypto Options Heats Up

15/09/2025

Data Used In This Analysis

Our industry-leading research is the direct result of combining our proprietary data with world-class in-house experts. Bringing the very best of Kaiko’s people and data together, we unlock the unique insights that form the basis for our discoveries and analysis. We believe in doing so, our data speaks for itself, helping both our clients and the wider industry get a better understanding of the crypto ecosystem, and the evolving trends and patterns in motion at a regional and global scale.

More From Kaiko Research

![]()

Hyperliquid

09/03/2026 Data Debrief

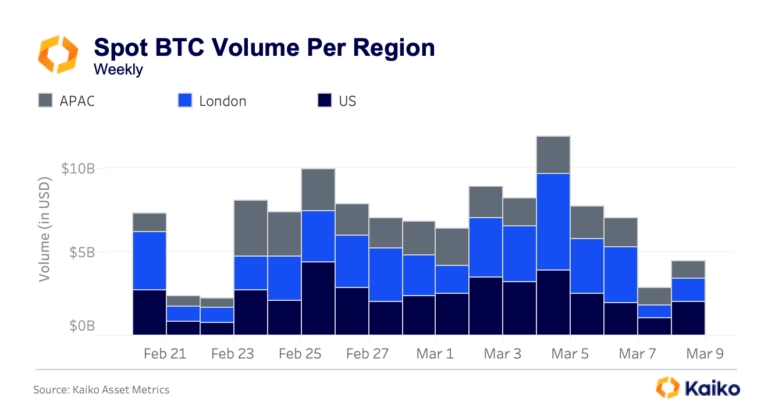

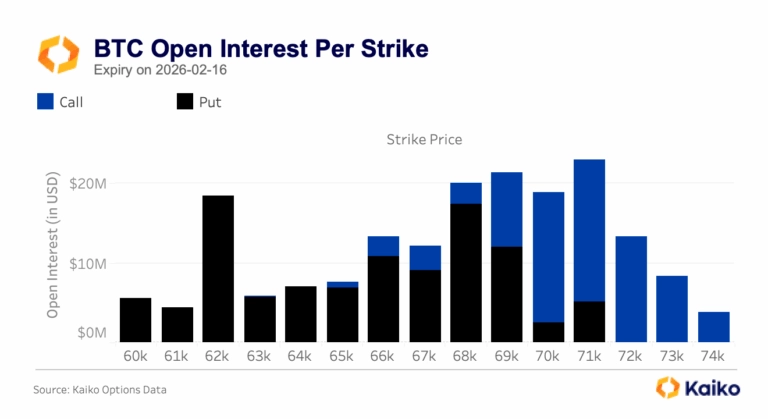

Bitcoin Ranges While Traditional Assets Find New Home on Crypto RailsAs Bitcoin ranges between $60k and $72k following the early February sell-off, the crypto market navigates competing forces, with geopolitical shocks testing 24/7 infrastructure and options markets pricing elevated volatility into the Federal Reserve’s March 18th decision.

Written by Laurens Fraussen![]()

Ethereum

02/03/2026 Data Debrief

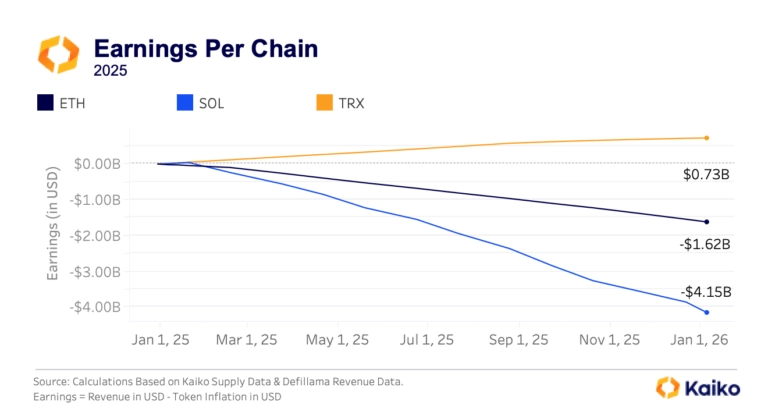

The Pressure of Dilution on Layer 1 ValuationsAs Layer 1 tokens are increasingly traded through ETFs and evaluated like equity investments, the market is discovering an uncomfortable truth, most major blockchains operate as loss-making businesses. With Ethereum posting $1.62B in annual losses and Solana bleeding $4.15B despite generating hundreds of millions in fee revenue, validator dilution costs consistently outpace income by 7-25x.

Written by Laurens Fraussen![]()

Ethereum

23/02/2026 Data Debrief

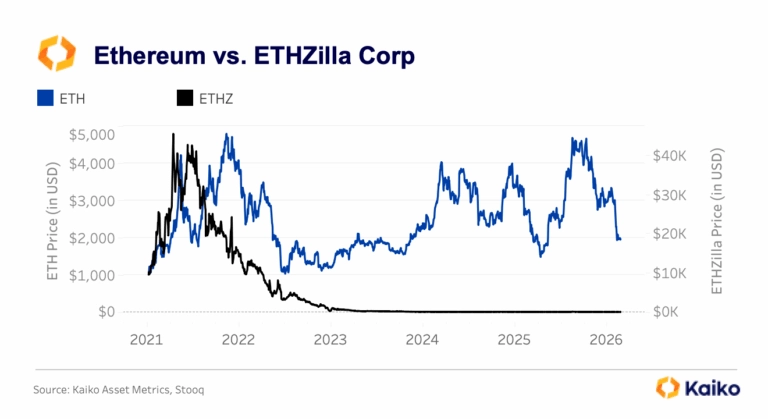

Staking Products Launch Despite Treasury FailuresAs crypto volatility continues, the markets are testing whether institutional ETH adoption follows price or infrastructure development. With ETH plunging 50% from its mid-2025 peaks to $2,000, this triggered a 95%+ collapse in equity treasury vehicles like ETHZilla and $4B in spot ETF outflows.

Written by Laurens Fraussen![]()

Prediction Markets

16/02/2026 Data Debrief

Prediction Markets Liquidity In FocusPrediction markets captured mainstream attention throughout 2025 as Polymarket processed over $2 billion in election-related volume. The post-election collapse from $1 billion to $200 million in open interest exposed fundamental questions about sustainability.

Written by Laurens Fraussen

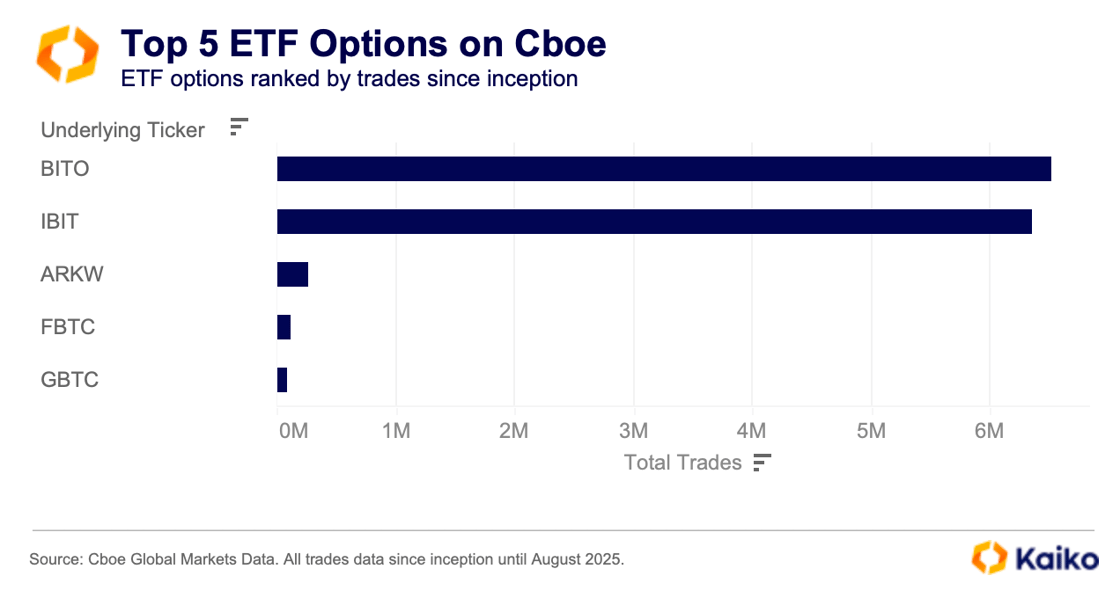

While things are a little different in traditional options markets, where recent product launches have improved competition, there are also clear winners. Prior to 2024, this was ProShares BTC futures ETF, BITO. The market was lopsided towards BITO, with over 7mn trades since inception. For now, there is no room for options on ETH ETFs, which only launched in April of this year.

While things are a little different in traditional options markets, where recent product launches have improved competition, there are also clear winners. Prior to 2024, this was ProShares BTC futures ETF, BITO. The market was lopsided towards BITO, with over 7mn trades since inception. For now, there is no room for options on ETH ETFs, which only launched in April of this year.