Trend of the Week

Bitcoin breaks above $80K.

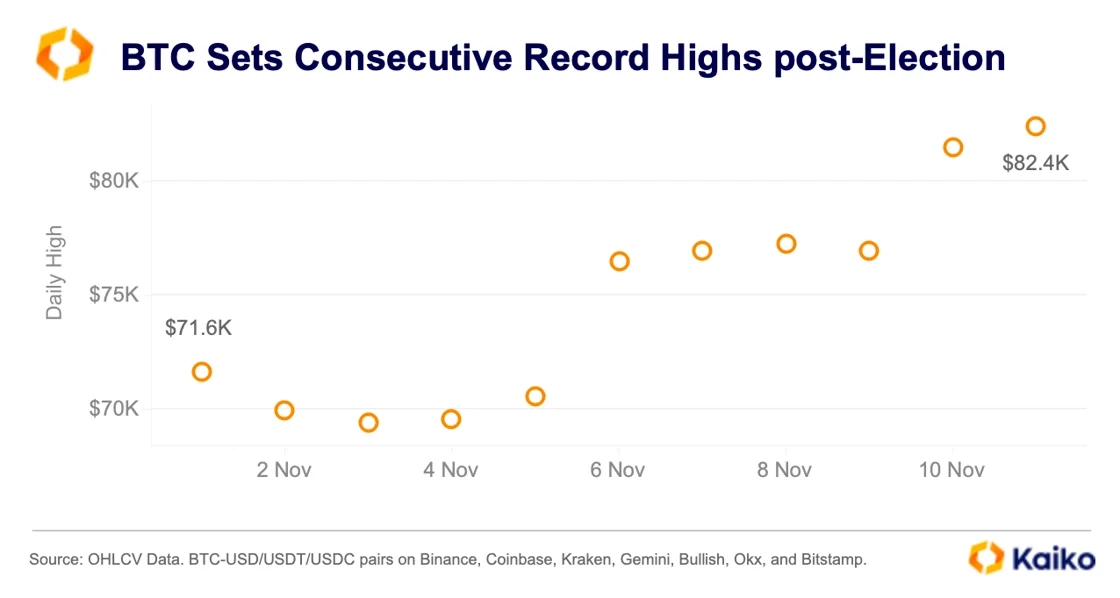

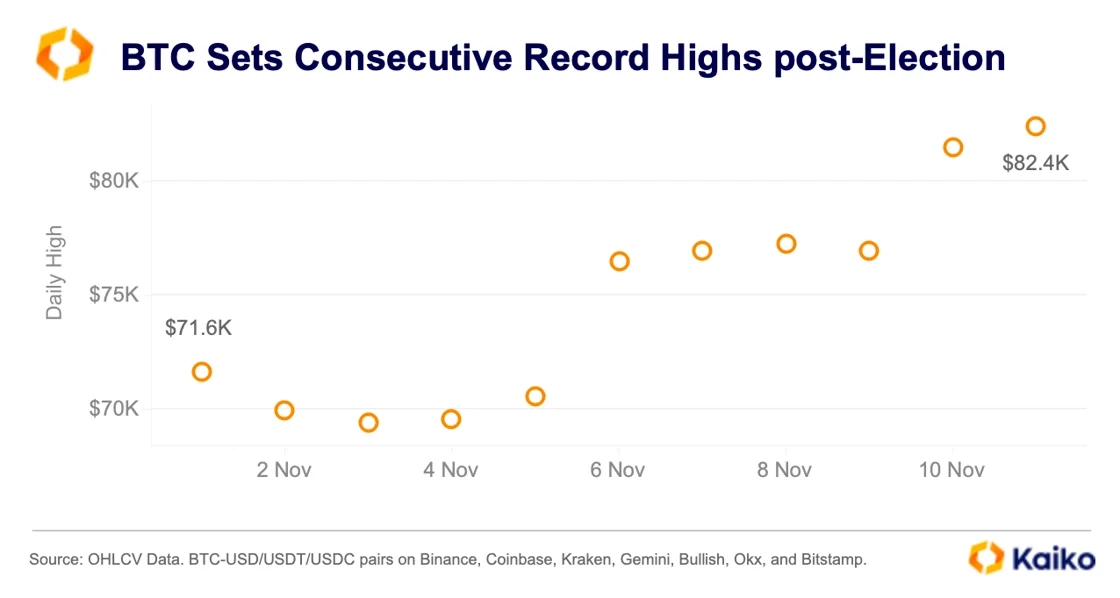

Bitcoin led a rally in crypto prices last week following the US general election. The headline result as well as down-ballot results in the Senate are widely perceived as positive for crypto. This has led to increasingly bullish sentiment in markets as traders position for a rally into the end of the year.

During the early hours of Wednesday morning, BTC set a new record high for the first time since March; it would go on to break this record four more times last week on its way to $80k.

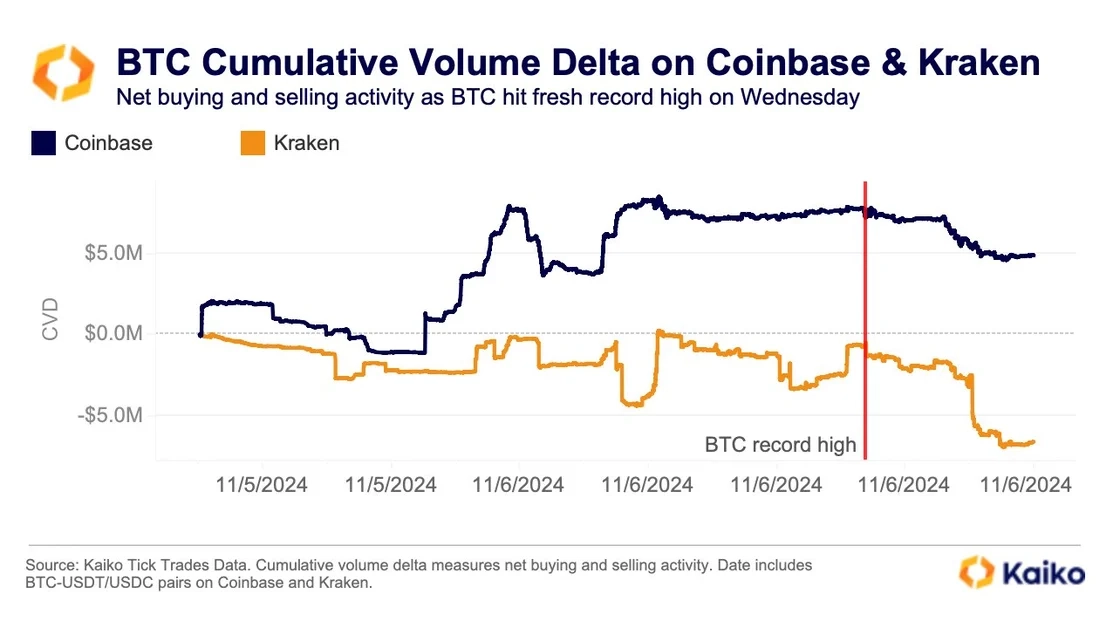

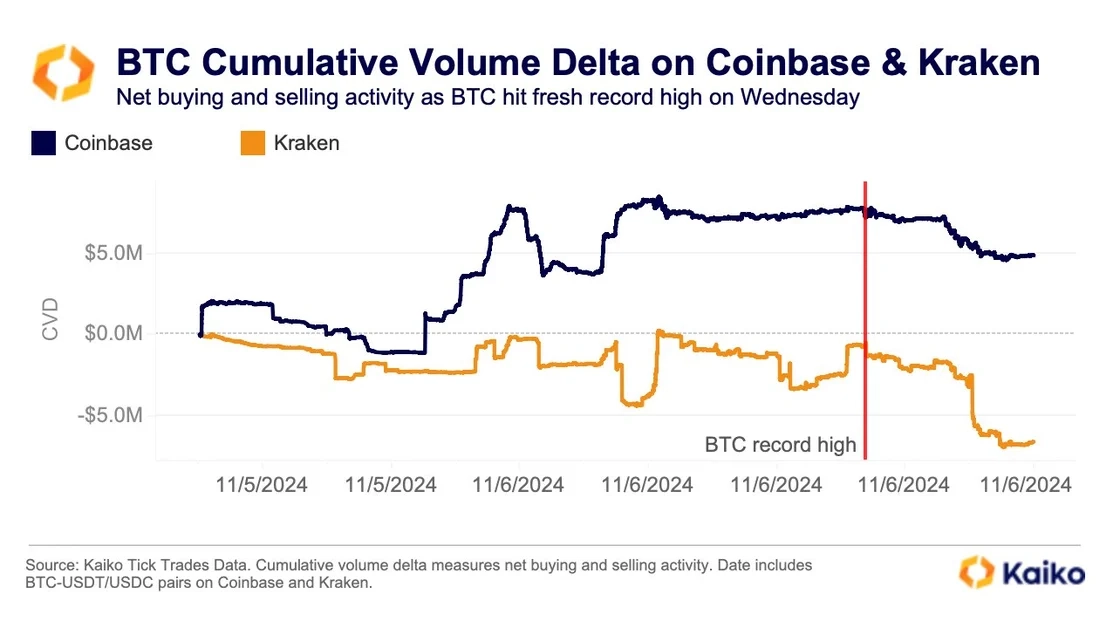

Looking at cumulative volume delta (CVD), which measures net buying and selling activity, it was negative on the exchange as prices soared—while Coinbase was positive, signaling heavy net buying. On Kraken, for instance, prices never broke $75.4k during the initial rally, amid heavy selling pressure.

Selling pressure didn’t last long, however, as BTC set a new record when it climbed above $76k for the first time. Since then, BTC has set record highs nearly every day amid a sense of euphoria in the markets.

BTC remains the only major cryptocurrency to set new highs this week, although the rally has started to extend to other assets. For example, SOL is trading above $200 and ETH has outpaced BTC’s gains in the past few days, trading above $3k for the first time since early August. As a result, the Kaiko top 10 index is up over 30% in the past week.

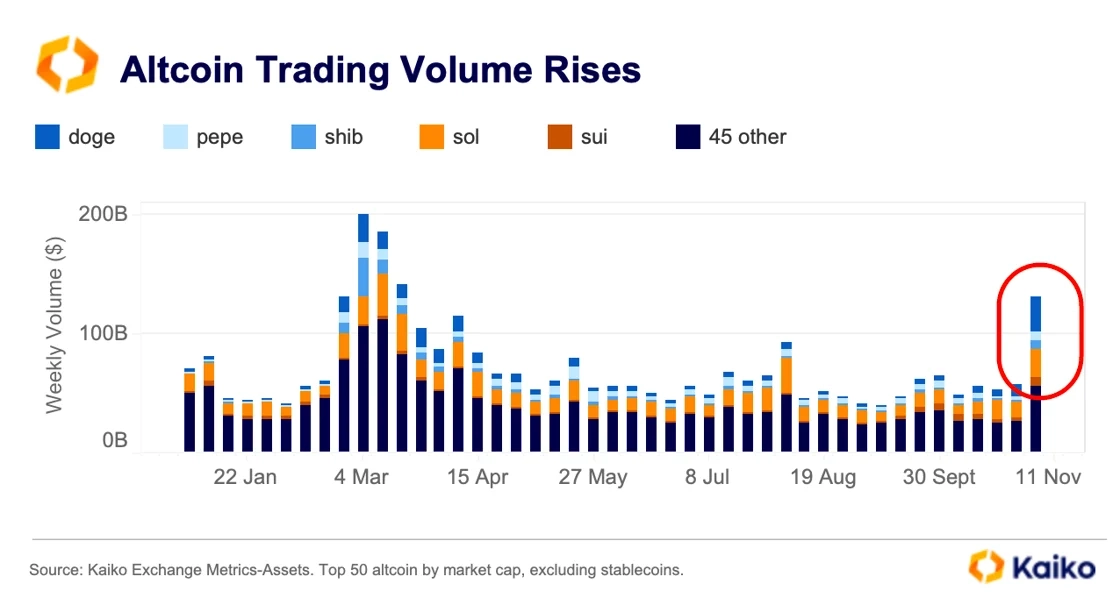

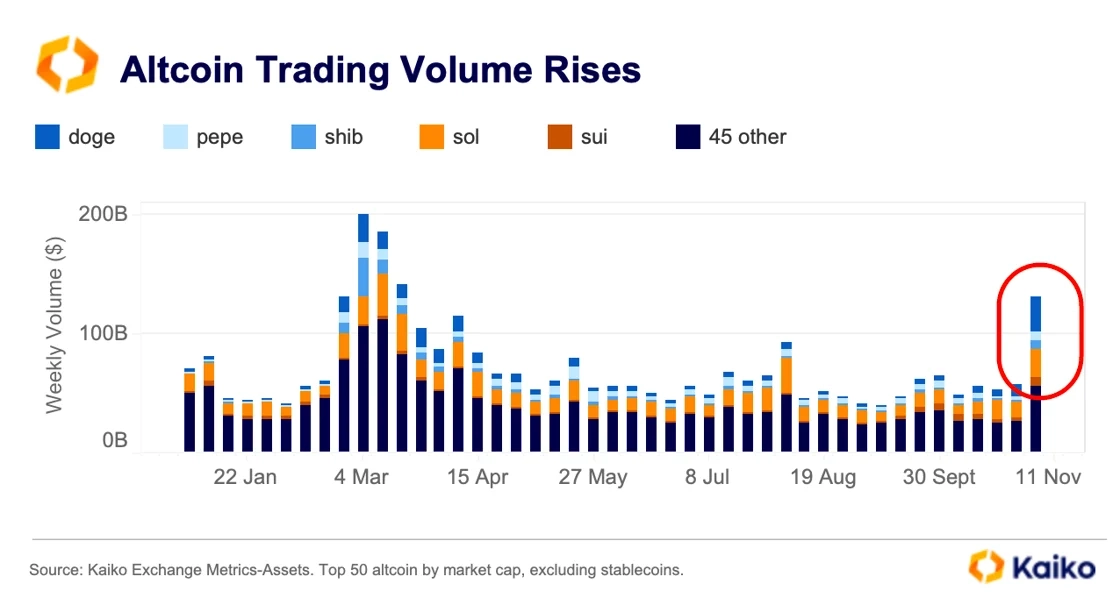

Altcoin weekly trade volumes surged past $100 billion last week, marking the highest level since March. Unlike the broad-based rally in March that coincided with BTC’s all-time highs, this volume increase was more concentrated. The top 10 altcoins accounted for over 70% of the total volume, up from 65% in March.

Leading the surge was DOGE, which hit a yearly high of $29 billion in trade volume during the week of the U.S. election, even surpassing SOL, whose weekly volume hit $24 billion. Upbit overtook OKX as the largest market for the token. Additionally, SOL, PEPE, and SUI also saw strong gains and volume that week.

Despite the broader rally, the top 50 altcoins’ volume dominance relative to Bitcoin remains below the peak of 50% seen in March.

Data Points

Stablecoins see increased volatility.

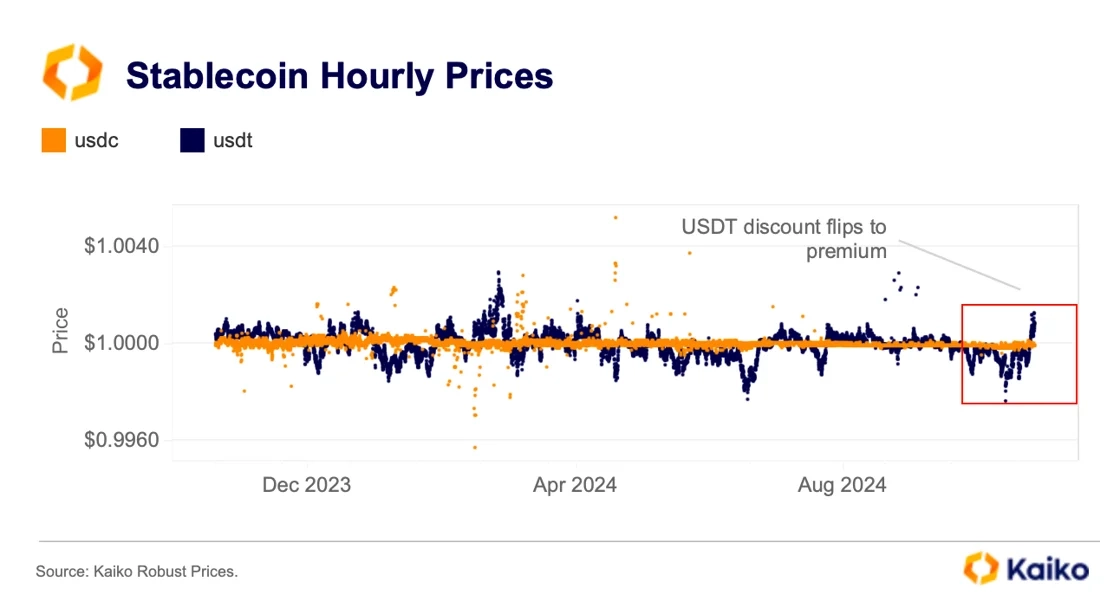

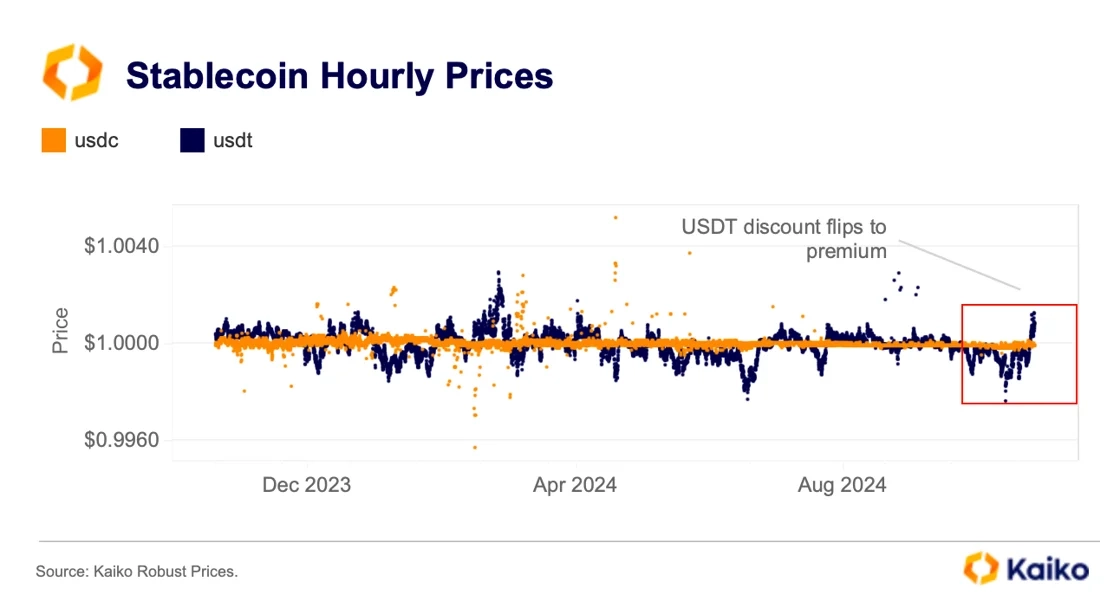

Stablecoins, particularly Tether’s USDT, also saw unusual volatility last week. Within 24 hours, USDT flipped from trading at a discount to a premium against the USD. The move was spurred by strong buying on both U.S. and offshore exchanges and suggests that traders might be moving into stablecoins in anticipation of further market gains. Interestingly, however, USDT’s main competitor, Circle’s USDC, didn’t see a similar spike and instead traded at a slight discount to the USD. This discrepancy may stem from differences in redemption models and user bases.

U.S. elections have not been the only driver of stablecoin volatility this year. The stablecoin space has seen significant shifts due to new regulation in Europe, a growing diversity of use cases, and more recently, the global monetary policy pivot. These factors can have a meaningful impact on the profitability and business models of stablecoin issuers.

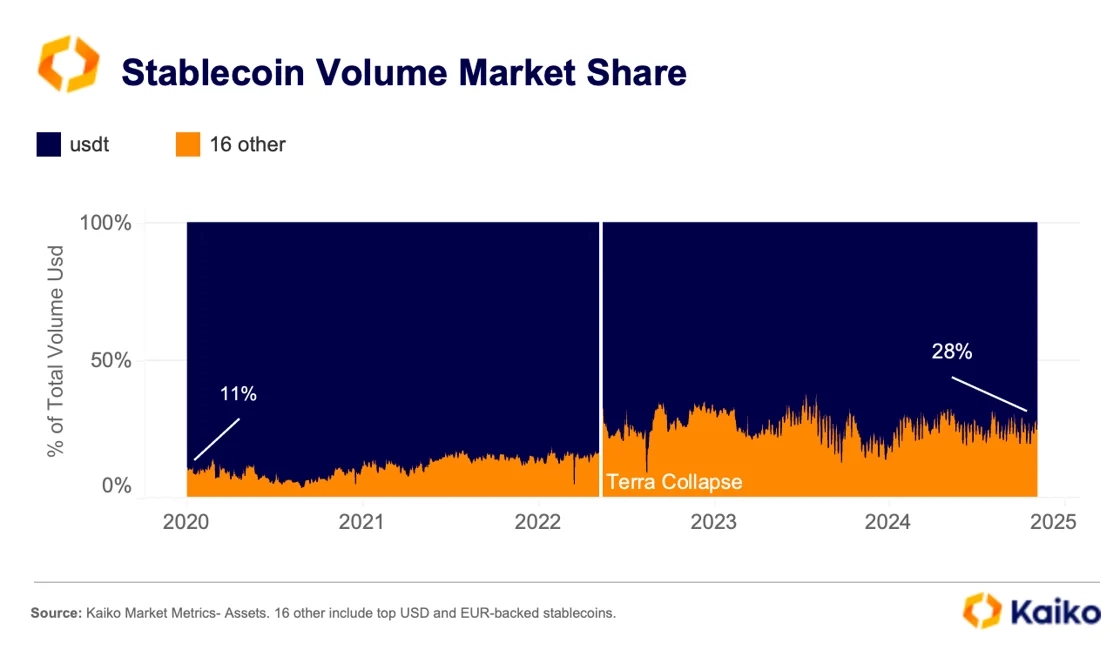

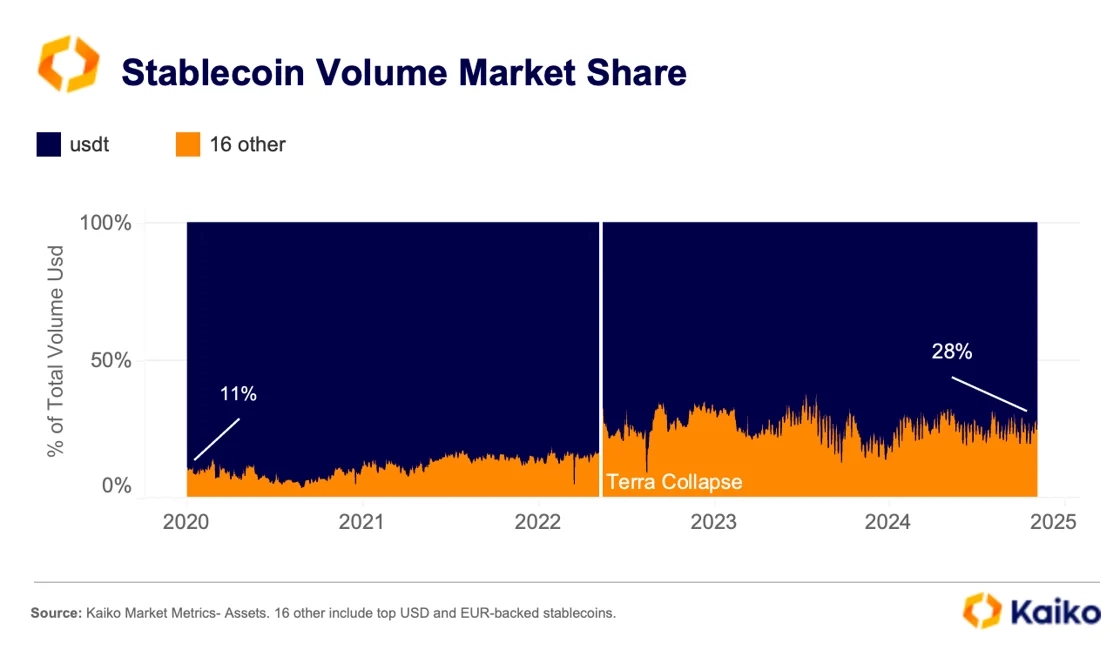

Meanwhile, competition between stablecoins has risen on both centralized and decentralized platforms. On centralized exchanges, USDT still leads with 72% of stablecoin volume, but regulated alternatives like Circle’s USDC and EURC have gained traction since the Terra collapse in 2022. Conversely, on decentralized exchanges, USDC’s market share has declined since the 2023 U.S. banking turmoil, while USDT has gained ground on major DEXs like Uniswap.

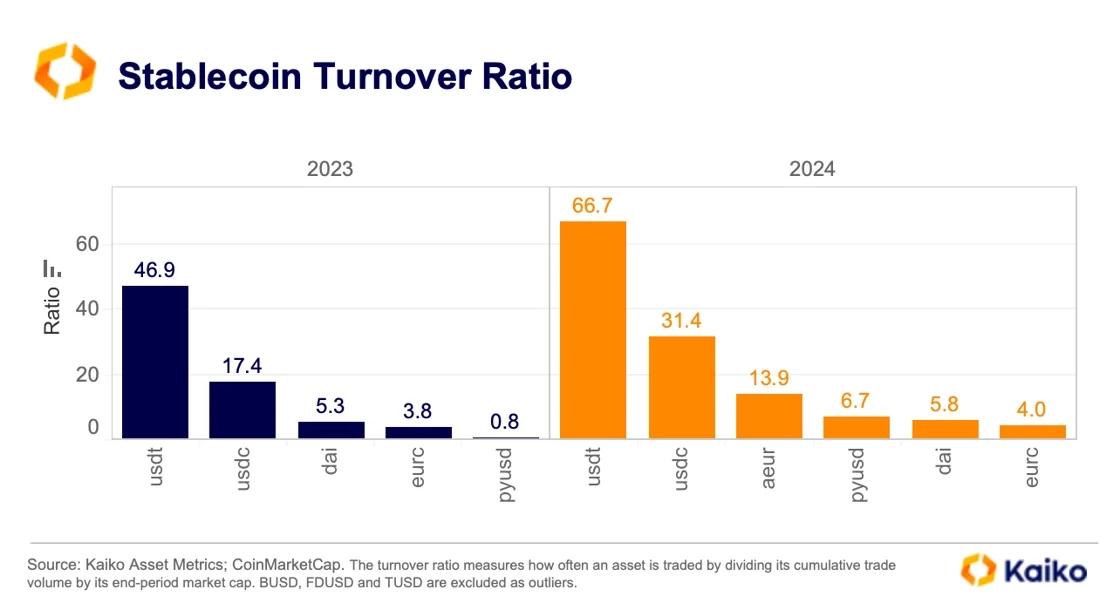

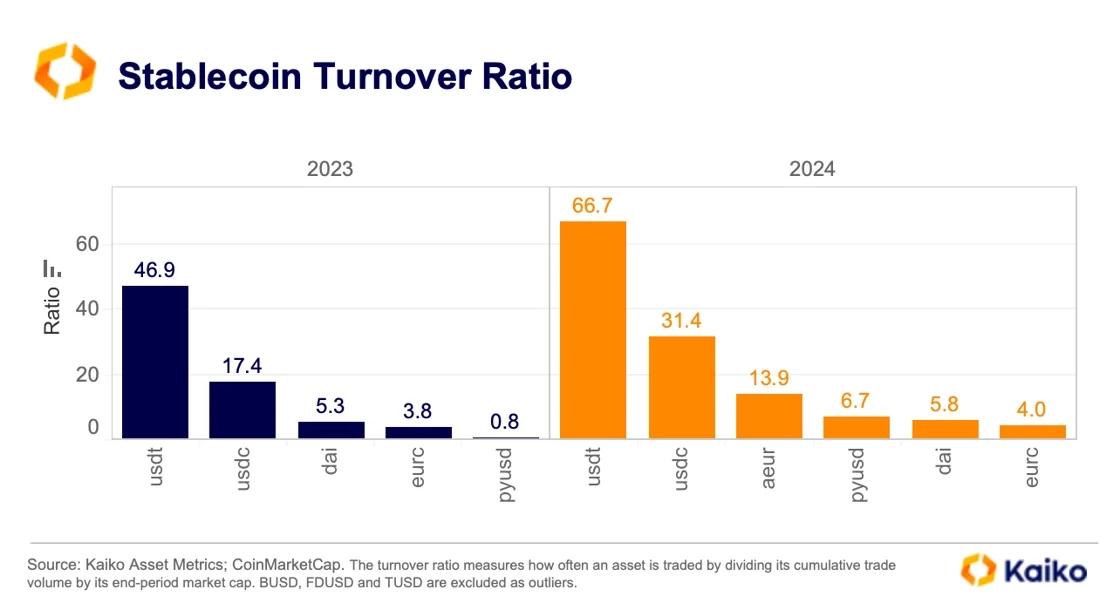

The use of stablecoins as a medium of exchange has also surged in 2024, as reflected by a rising turnover ratio, which shows trading volume growing faster than market cap. Additionally, stablecoins are increasingly adopted in traditional financial transactions, with companies like Stripe integrating them into their payment systems.

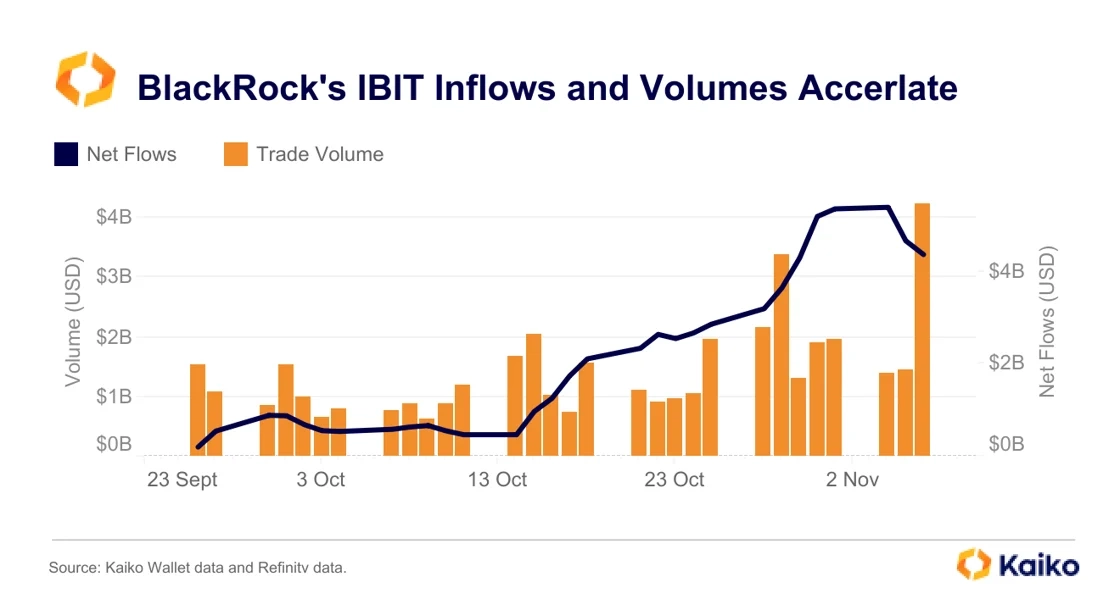

BTC ETF inflows keep pace with rapid price moves.

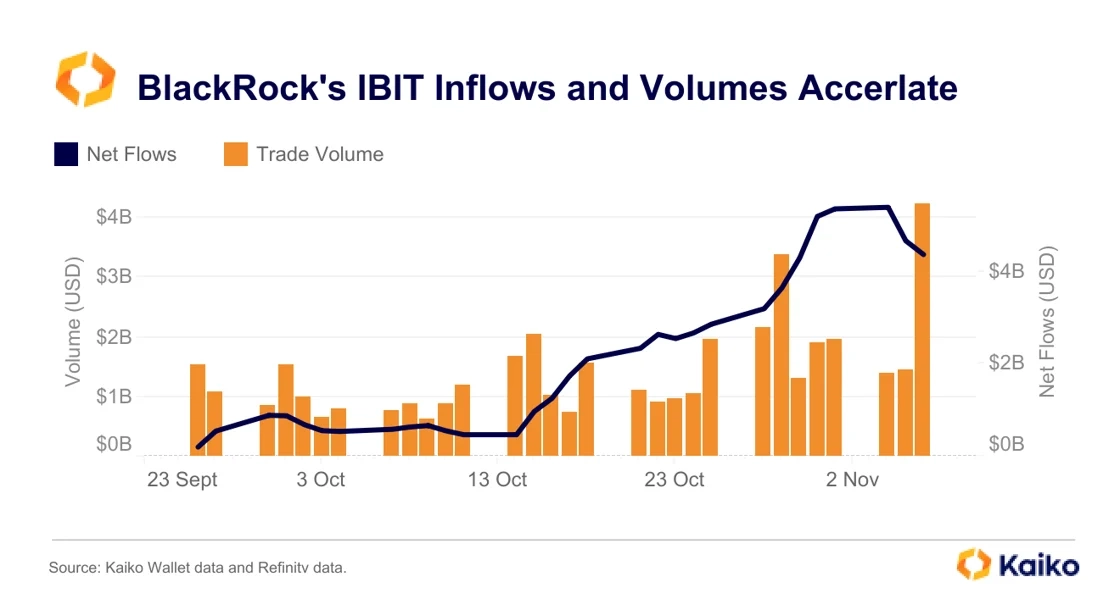

Exchange-traded fund issuers have been major beneficiaries of BTC’s recent price surge. This week, spot BTC ETFs set new records for inflows and trade volume.

On Wednesday alone, these ETFs recorded $6 billion in trade volume as BTC prices climbed with the confirmation of the US election results. The following day, Thursday, saw an additional $1.3 billion in inflows, marking the largest daily inflow since their January launch. Both figures are unprecedented for newly launched ETFs, underscoring the popularity of these products, which have now accumulated $25 billion in net inflows this year.

BlackRock’s IBIT ETF was responsible for 85% of these inflows, with its creation and redemption activities alone generating $4.2 billion in trade volume on Wednesday.

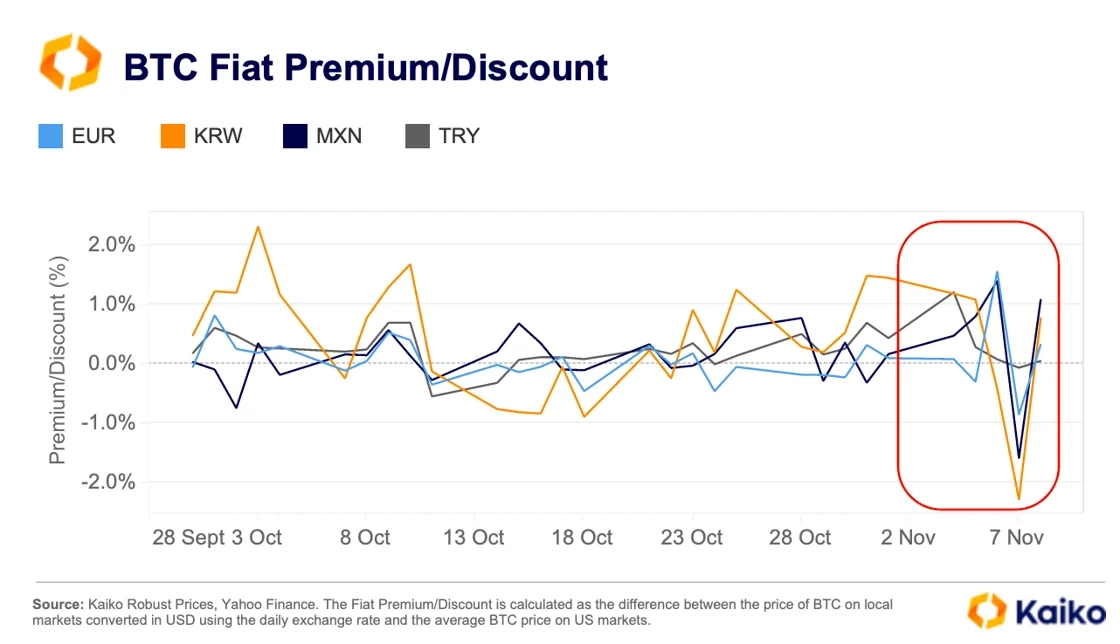

BTC trades at a discount on non-dollar fiat markets.

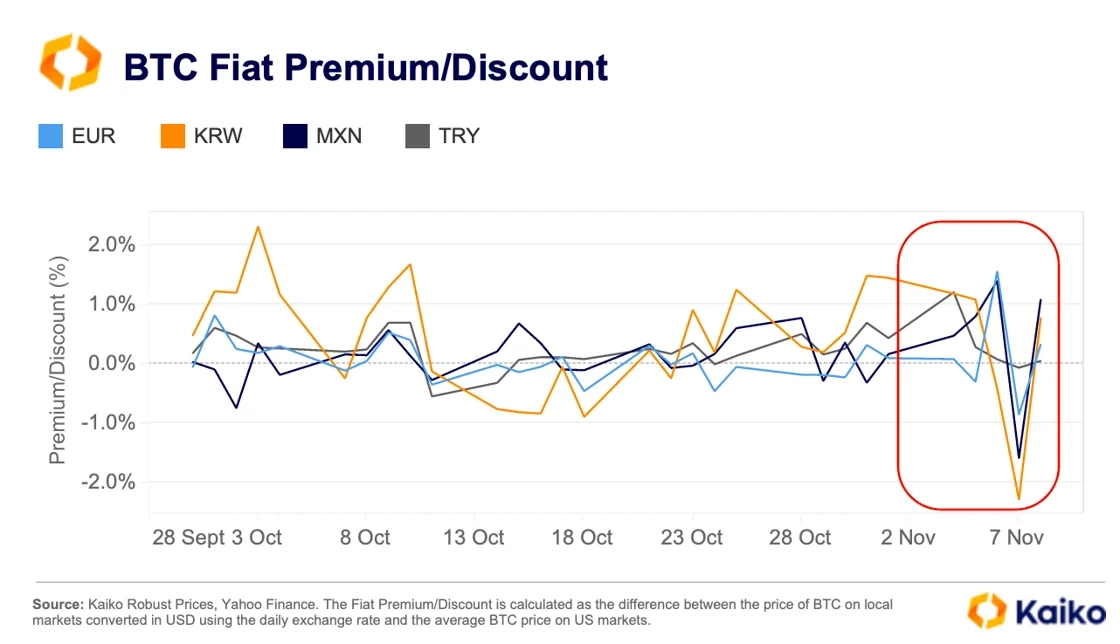

Both Bitcoin and the U.S. Dollar rallied last week, as investors gravitated toward what they considered “Trump trades.” This simultaneous rally had an intriguing effect on Bitcoin fiat premiums, calculated as the difference between Bitcoin prices in various fiat markets (converted to U.S. Dollars) and its average price across USD markets.

Typically, a strengthening U.S. Dollar boosts Bitcoin prices on U.S. exchanges. This often creates short-lived price differences with non-U.S. markets—a pattern intensified by the fragmented nature of crypto liquidity and country-specific factors like capital controls and local demand for crypto. Consequently, despite a global rise in demand, Bitcoin briefly traded at a 1–2% discount on most fiat markets compared to U.S. markets on November 7.

Last week, Tiger Research, in collaboration with Kaiko, examined the complex factors driving the “Kimchi premium” on Korean platforms, a well-known fiat premium. Historically, Bitcoin prices in Korean markets have consistently been higher than U.S. prices due to high retail demand, strict capital controls, and fragmented local liquidity. For instance, in 2023, the Kimchi premium was positive almost every day except for 18. This premium often reflects risk-driven demand.

Interestingly, despite Bitcoin’s recent price rally, the Kimchi premium has stayed relatively low since August, falling from over 10% in March to under 1% in October. This decrease likely reflects profit-taking, a shift toward other risk assets, and new cryptocurrency regulations introduced in South Korea in July.

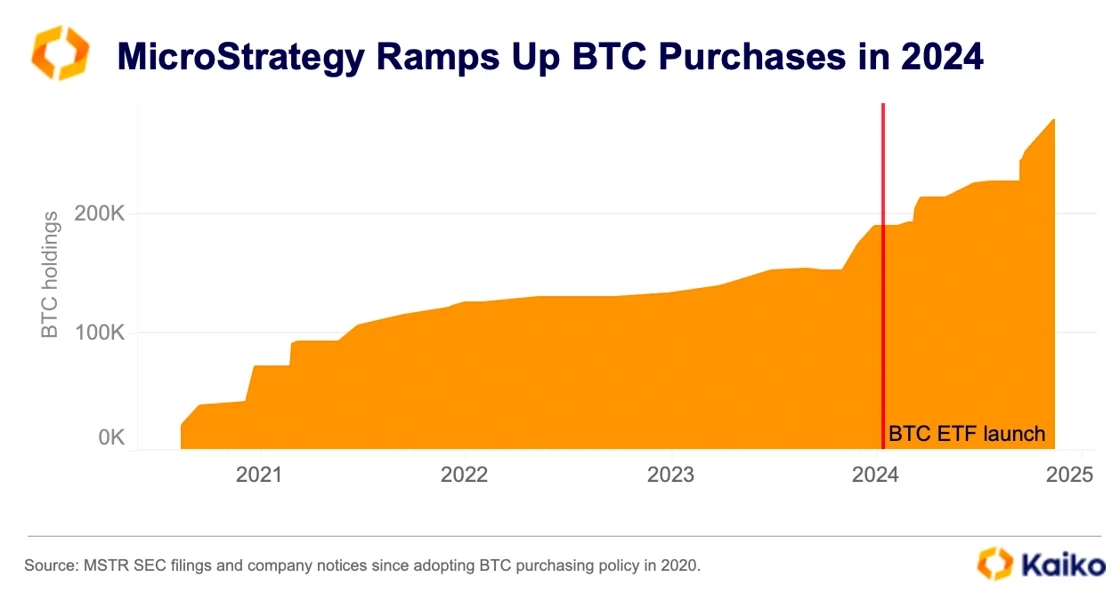

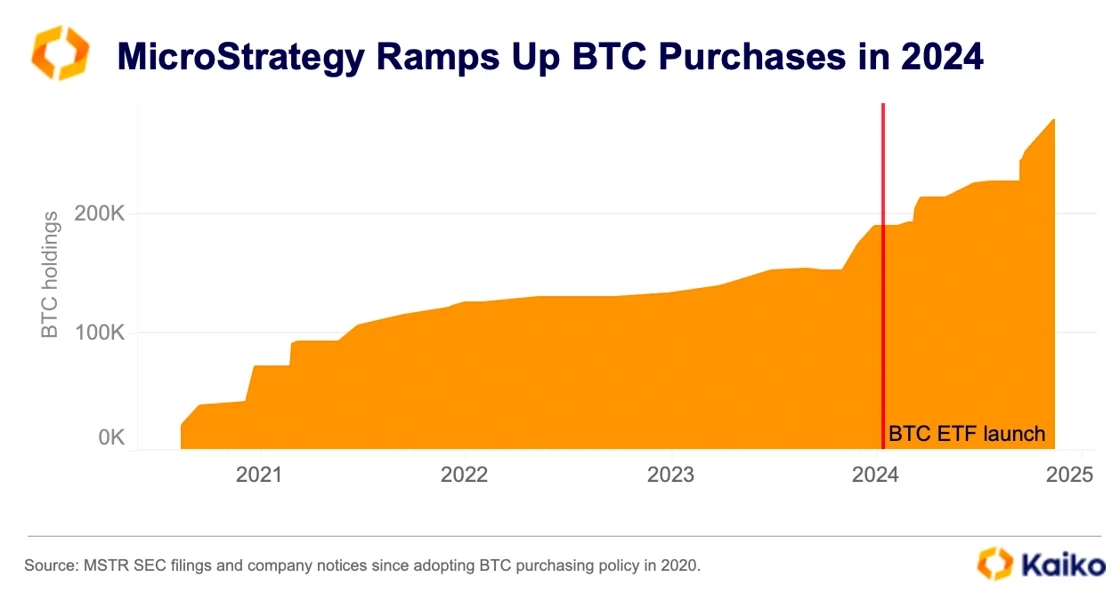

MicroStrategy’s stock back to dot com bubble levels.

Self-described Bitcoin treasury company MicroStrategy is reaping the rewards of its bold strategy. Michael Saylor’s firm has been adding BTC to its balance sheet since August 2020, and since the launch of BTC ETFs in January, they’ve even accelerated their purchases.

Originally launched in the late 1980s as a mobile software and data company, MicroStrategy has acquired over 250,000 BTC at an average purchase price of approximately $40,000, making its holdings worth nearly $20 billion at today’s prices. About 25% of its total BTC holdings were acquired this year, marking the most BTC purchased in a single calendar year.

The firm’s stock price has become tied to the fortunes of BTC and is now trading near record highs for the first time in 24 years—since the dot-com bubble burst in March 2000.

The firm’s stock price has become tied to the fortunes of BTC and is now trading near record highs for the first time in 24 years—since the dot-com bubble burst in March 2000.

While MicroStrategy is a pioneer in corporate BTC purchases, some Republican lawmakers want the U.S. government to emulate this. Senator Cynthia Lummis has promised to build a strategic BTC reserve following Donald Trump’s victory in the U.S. presidential election.

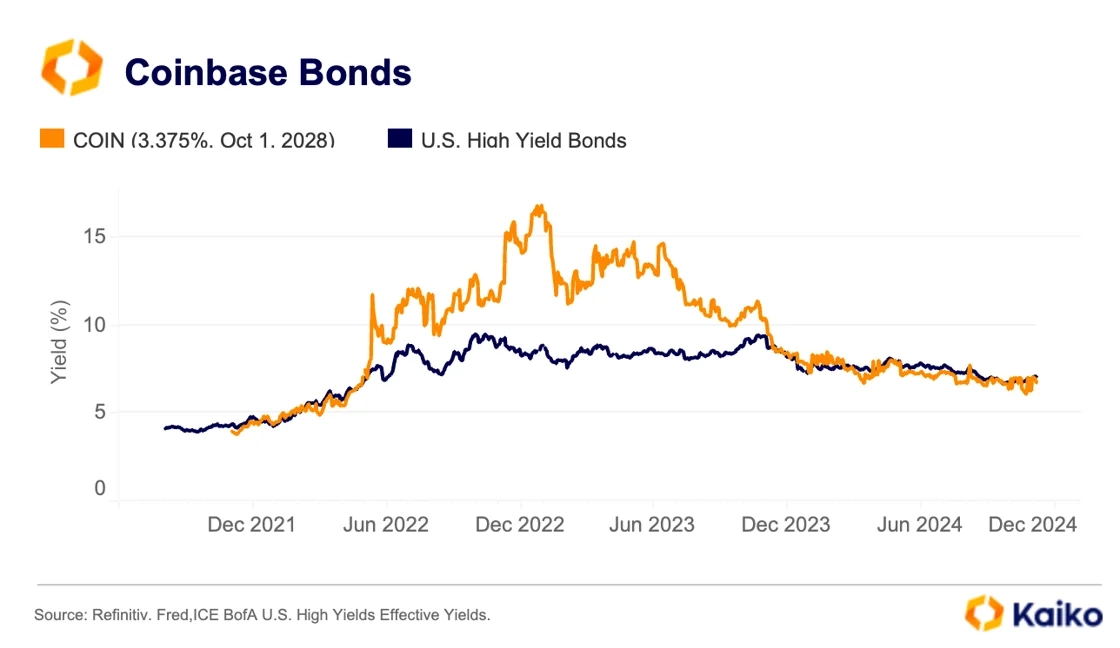

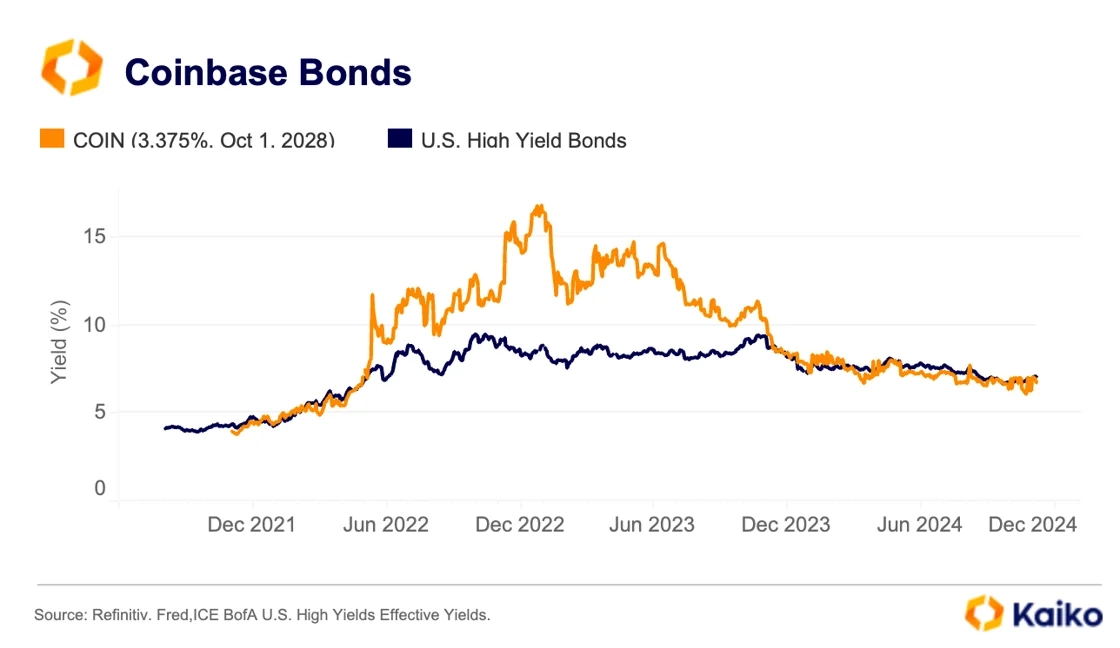

Coinbase bond yields signal improving sentiment.

Yields on Coinbase’s convertible bonds, maturing in October 2028, have fallen to 6.2%, nearing their lowest level since April 2022. Typically, falling bond yields indicate improving market sentiment and decreasing risk perception among investors.

Despite weaker-than-expected Q3 results, Coinbase stands to benefit from the recent crypto price rally and a potentially more favorable regulatory climate following the U.S. election. More than half of its revenue comes from transactions in BTC, ETH, and SOL, and a Trump victory could ease SEC scrutiny on some of these assets, potentially supporting new listings. Increased federal clarity may also impact state-level policies, which is critical as several U.S. states, including California and New Jersey, have restricted crypto staking.

Overall, Coinbase bond yields have nearly halved following an ETF-driven rally in late 2023. Previously, these yields were about 4% higher than U.S. high-yield bonds but now sit slightly below, suggesting a more optimistic longer-term market outlook for the crypto industry.

![]()

![]()

![]()

![]()

The firm’s stock price has become tied to the fortunes of BTC and is now trading near record highs for the first time in 24 years—since the dot-com bubble burst in March 2000.

The firm’s stock price has become tied to the fortunes of BTC and is now trading near record highs for the first time in 24 years—since the dot-com bubble burst in March 2000.