2024 US General Election Special

The path to the white house

The 24/7 nature of crypto markets offers traders an advantage, as traditional markets in the US will be closed during the initial vote count. While this limits risk, it also restricts opportunities as markets may move with election results.

The swing states to monitor on the night are: Pennsylvania, North Carolina, Georgia, Michigan, Wisconsin, Arizona, and Nevada. Each of these states, except Nevada, accounts for ten or more electoral votes. These are the key battlegrounds in the race to 270 electoral college votes.

For instance, if Harris loses Pennsylvania and its 19 electoral votes, the path to the White House becomes significantly more challenging, perhaps even impossible, according to some polls.

Another state to watch will be Georgia, where early voting records were smashed last week. Turnout exceeded 50% across the state with over 4mn voters turning out to cast early ballots, in 2020 that figure was 2.6mn. State law requires early votes to be counted 8 pm EST, so these will offer an early indicator for traders.

What does all this mean for crypto markets? Here are the key metrics to track on election night to stay on top of market moves in real-time.

What to watch on election night

MONITORING BUY AND SELLS

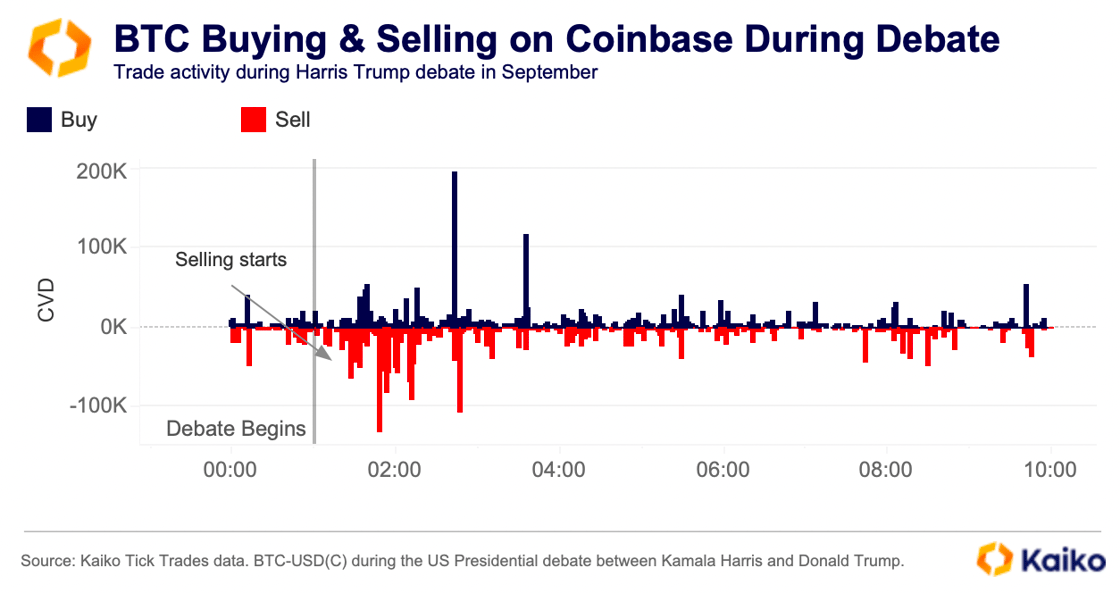

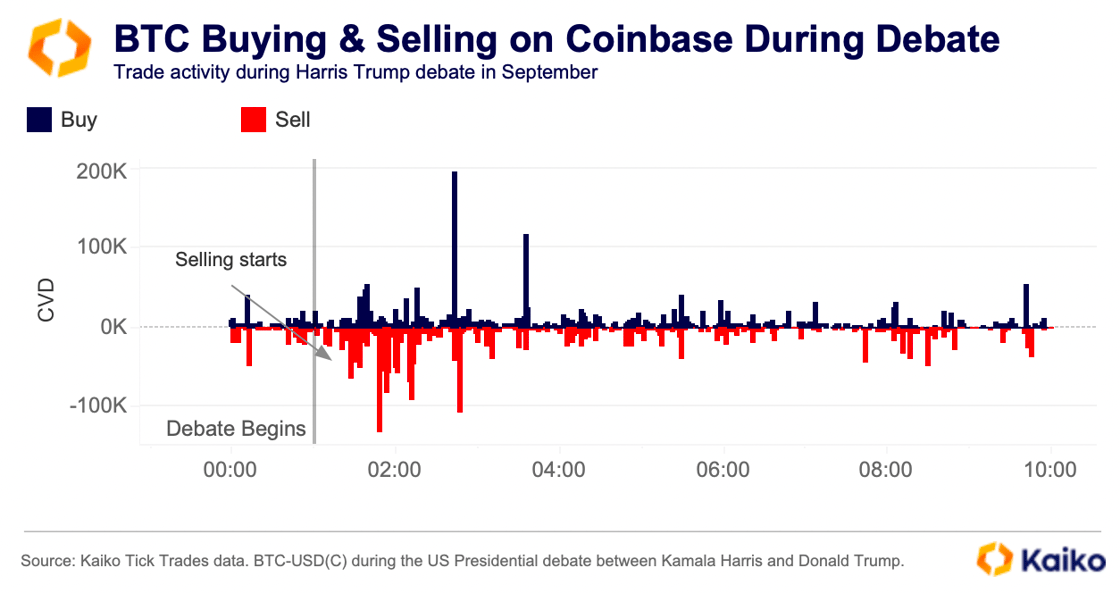

Tick-trades data shows every executed buy or sell trade, on every single market worldwide crypto is traded. This data was particularly insightful to monitor during the first debate and will be again during the election.

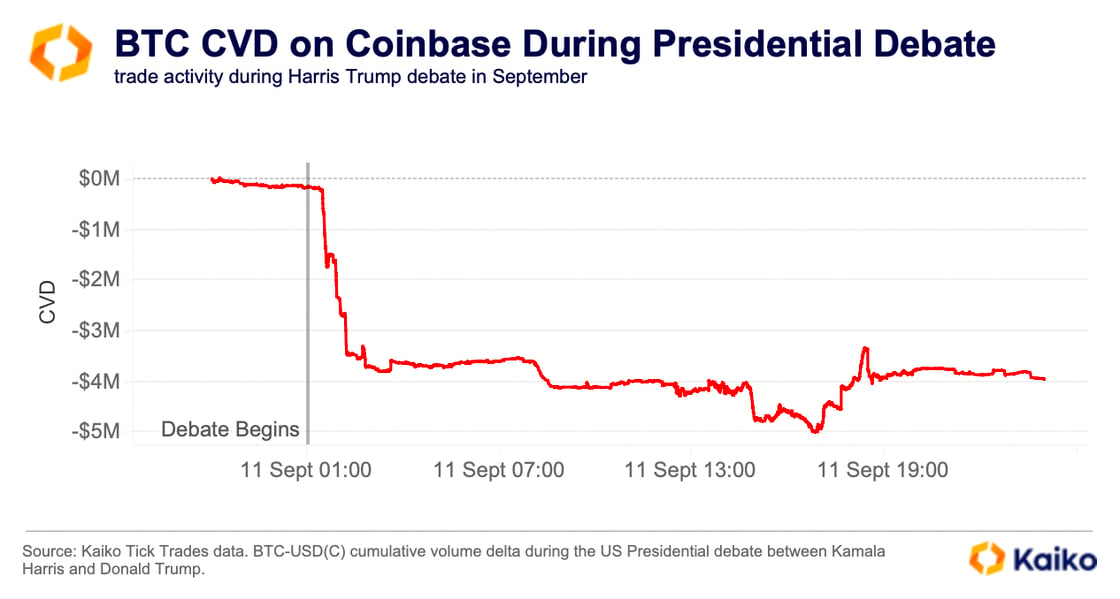

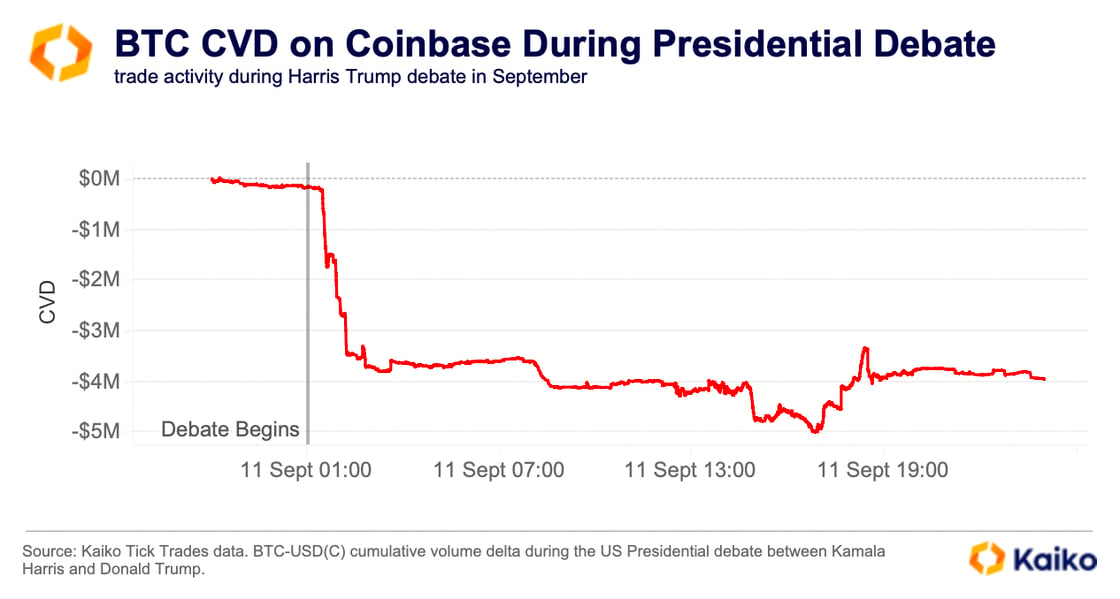

Calculating cumulative volume delta (CVD) from tick trades measures net buying and selling activity. During the debate, CVD turned negative, indicating a bearish reaction to Trump’s performance, as Harris was viewed as potentially unfavorable for crypto at the time.

By separating tick trades into buys and sells, we can see that intense selling pressure began shortly after 1:30 AM UTC (9:30 PM EST). This reflects the real-time market reaction to Trump’s performance. The selling pressure started to ease around 2:30 AM UTC.

Why is this relevant for the election? Tracking tick trades can help time the market by showing when buying or selling pressure is easing. More importantly, it can offer clues about market participants’ expectations.

Most traders and large institutions will be monitoring results, likely using proprietary tools for an edge. Therefore, observing tick trades on major platforms provides insight into where “smart money” is moving.

Modest build up in leverage in perps markets.

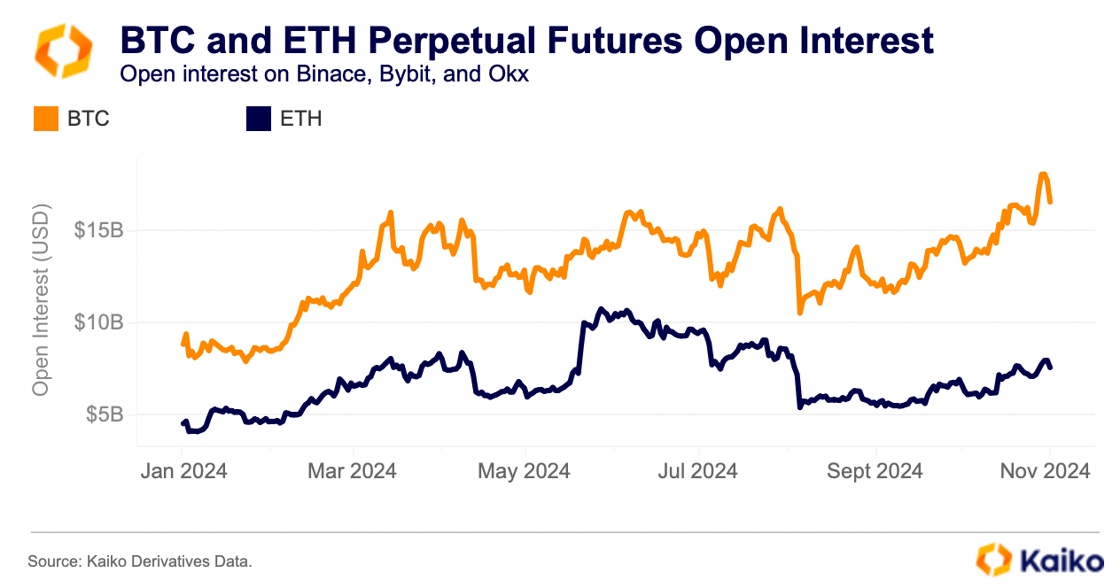

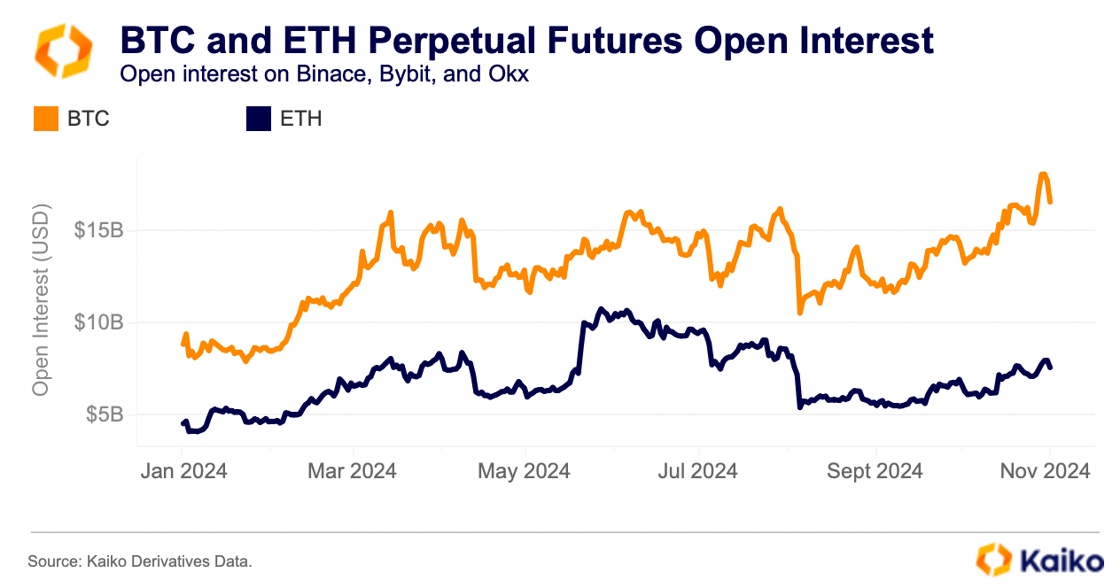

Open interest in BTC perpetual futures markets soared to record highs at the end of October as prices rallied to near record highs.

Open interest in US dollar terms on Binance, Bybit, and Okx rose to record highs last week. The metric is up by over $2 billion since the August crash, however, it remains below March highs in terms of contract units. ETH perps displayed similar trends, albeit with open interest rising at a slower pace than BTC.

The rapid increase in open contracts on major exchanges such wasn’t matched by an increase in leverage.

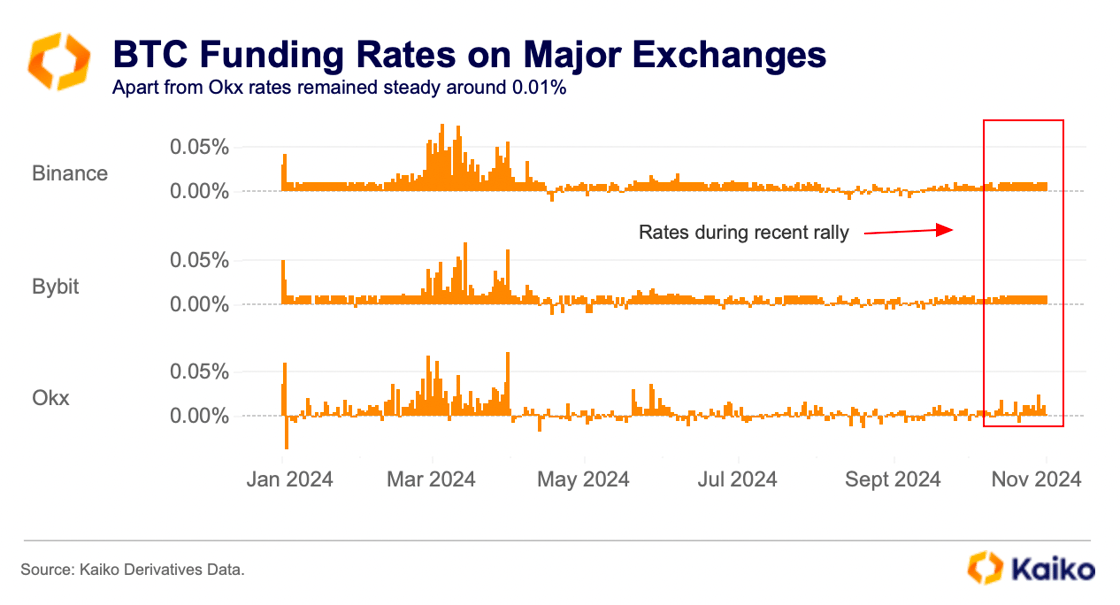

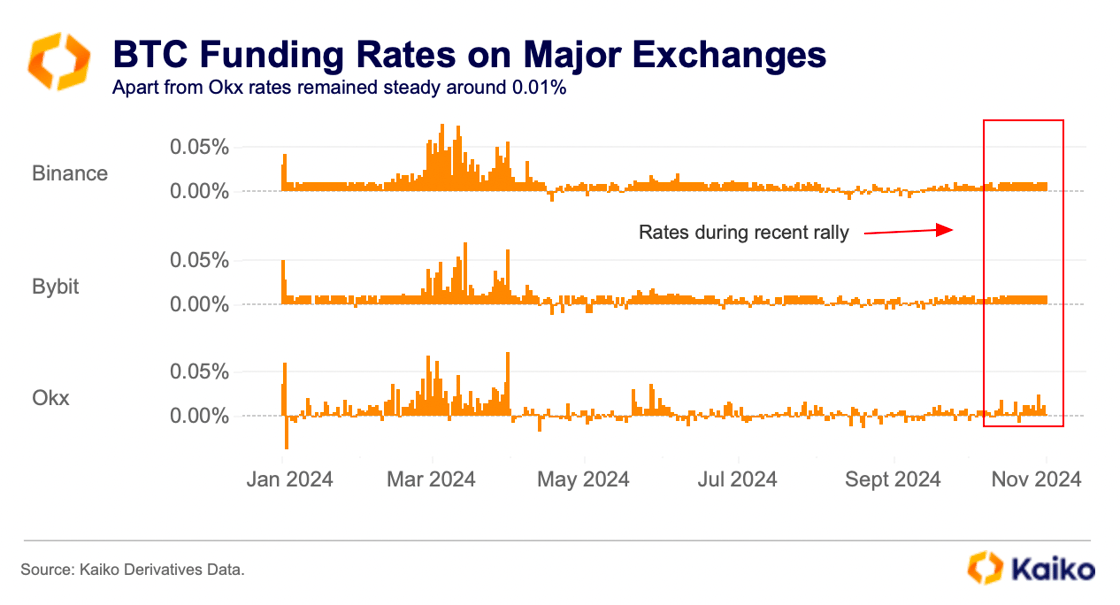

Higher funding rates tend to indicate increased speculation in BTC perps. Since the Fed rate cut in September, when rates were negative (suggesting more short sellers), funding rates on major exchanges have steadily risen.

In March, funding rates spiked above 0.05% as BTC set a new record high above $73k. Last week, rates remained steady around 0.01% on Binance and Bybit—the two largest perps venues—likely indicating less conviction from traders ahead of the election next week.

Funding rates will be crucial to monitor on election day. Binance adjusts these rates every eight hours, starting at midnight UTC. On election day, this means rates will update mid-day (12 PM EST) and after voting closes on the East Coast (8 PM EST).

The next adjustment will occur at 4 AM EST on Wednesday, November 6. By then, there may be a clearer indication of the election outcome. Significant spot market movements could trigger liquidations, depending on the vote count at that time.

Traders, especially those with highly leveraged positions, will be sensitive to changes in the funding rate. Sudden spikes in rates could lead to squeezes and cascading liquidations.

Shifting dynamics in options markets.

Another key derivatives market metric to watch is Implied Volatility (IV). IV is a forward-looking measure that estimates the expected volatility of an asset over a specific time period, making it an effective way to assess risk in financial markets.

IV’s strength lies in its ability to consolidate various data points—such as different strike prices, expirations, and put-call ratios—into a single number. This allows traders to quickly identify whether options are relatively cheap or expensive.

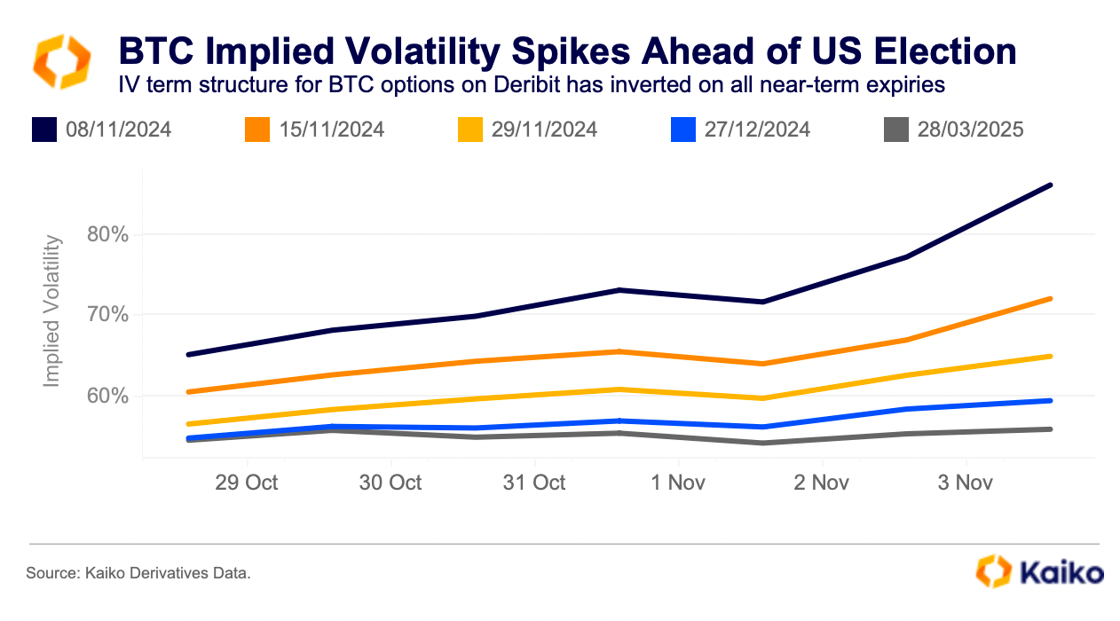

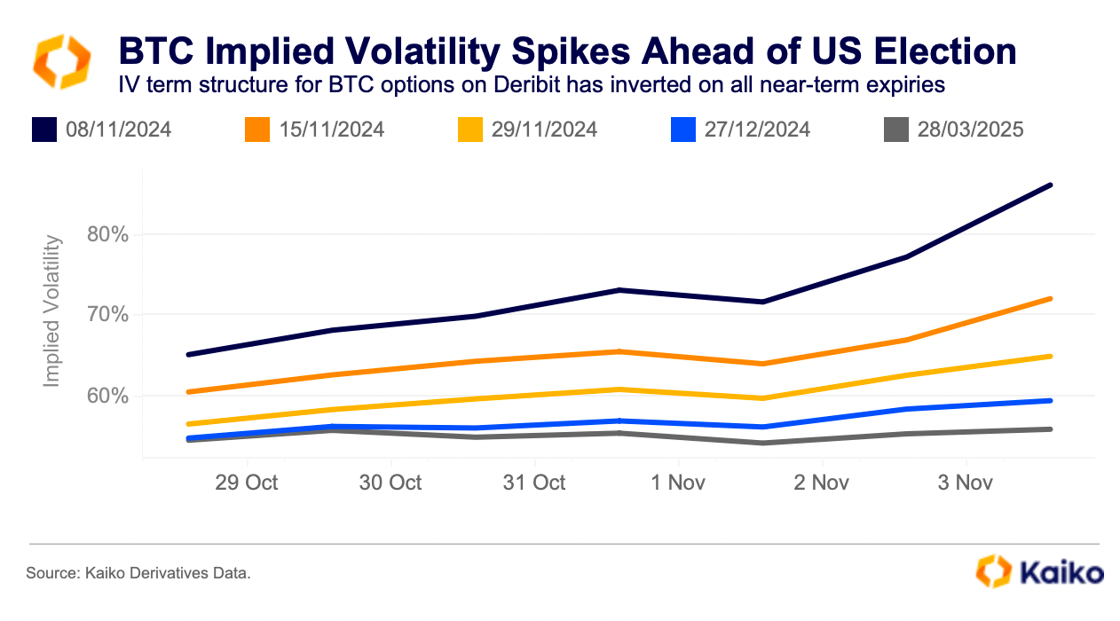

Monitoring the IV term structure is particularly useful. If short-term IV exceeds long-term IV, it results in an inverted term structure. Inverted term structures typically suggest a high likelihood of a near-term risk event, such as the US election. In this case, the surge to nearly $73k may also have contributed. Traders were likely caught off guard by the move, prompting them to adjust their exposure before Tuesday.

This phenomenon occurred last week as BTC’s price rallied to near record highs, as shown below.

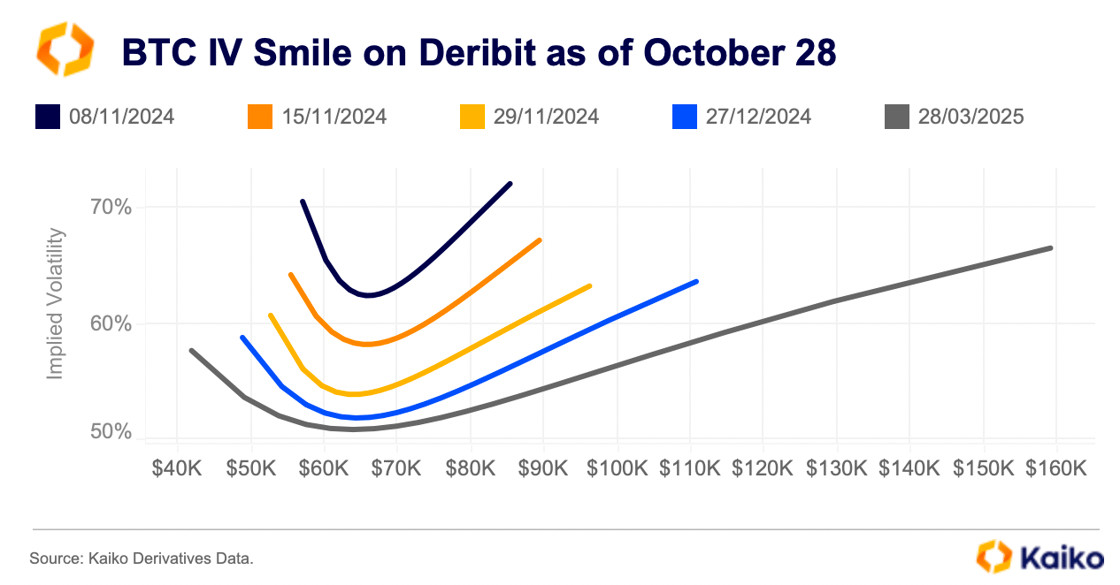

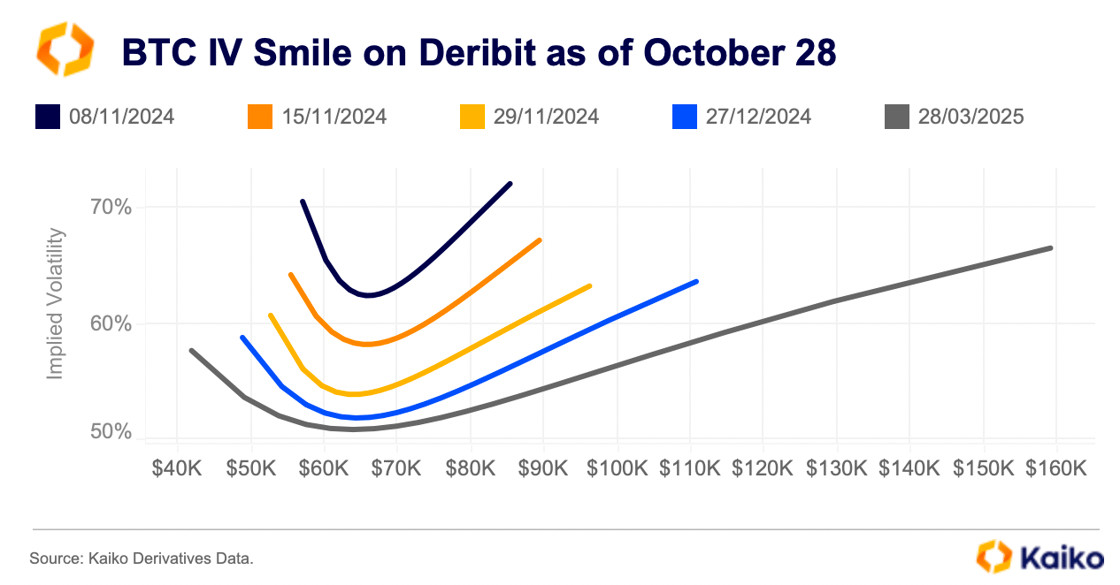

The push towards record highs also affected BTC’s IV Smile last week, making it an important metric to monitor as the election unfolds. The IV Smile snapshot from October 28 shows that IV was higher for strike prices just below and above the market price (around $67k at the time).

The smile was slightly tilted to the right, indicates that the market was anticipating upside volatility—as higher IV indicates more demand for these options.

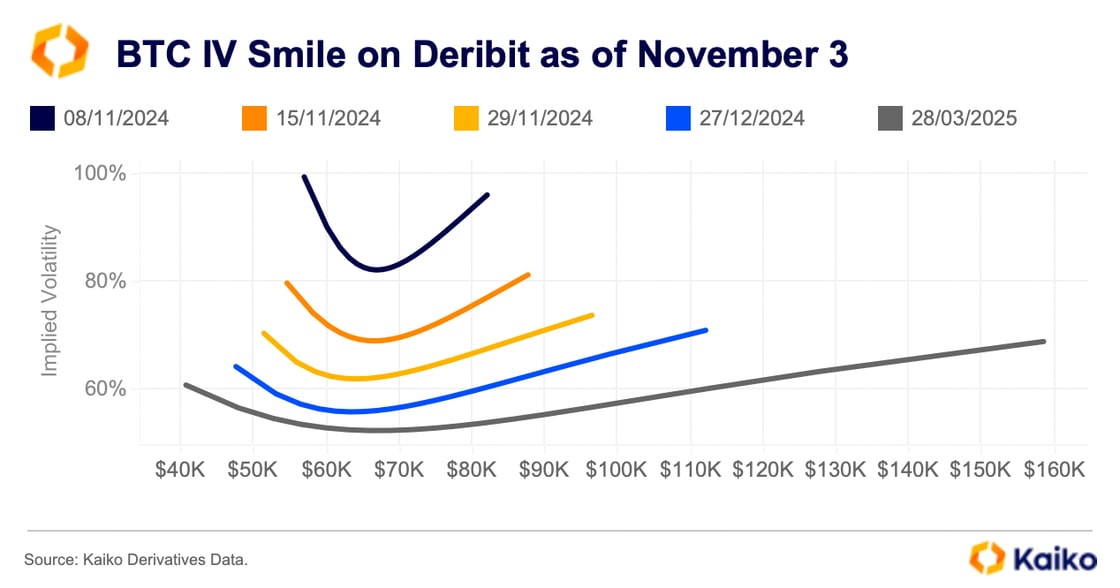

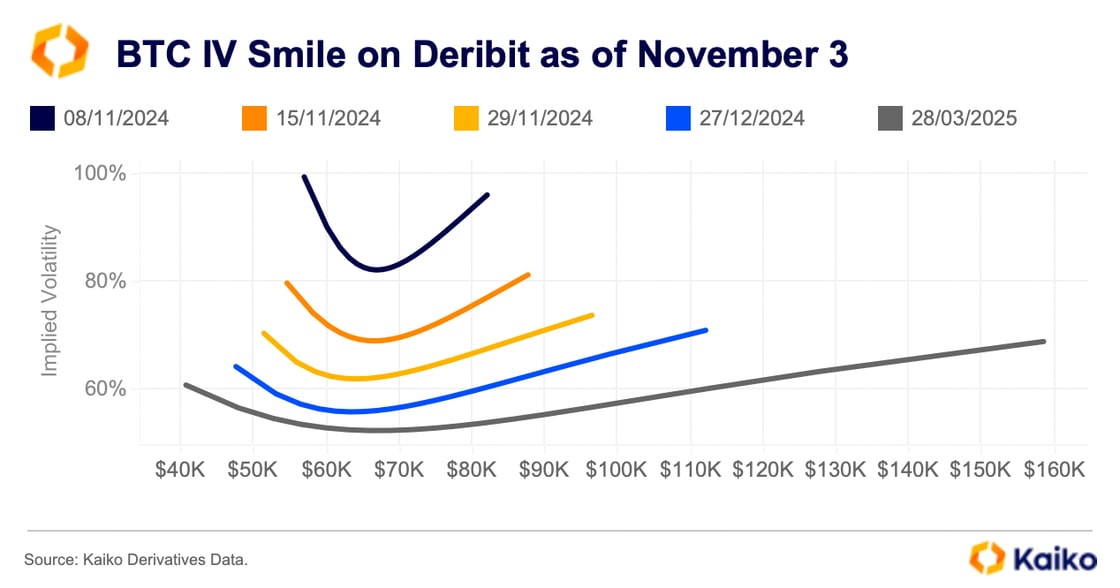

The rapid increase in BTC between Monday and Wednesday last week led traders to reprice their positions, shifting demand dynamics for options contracts. Consequently, the IV Smile observed on October 28 became more pronounced, with IVs rising across all strike prices by November 3. The IV smile on the November 8 contract has since tilted left which indicates hedging against downside moves.

Crypto markets differ from equities in their proneness to price swings in either direction. As a result, traders typically pay a premium for options on both sides of the current spot price—hence the “smile.”

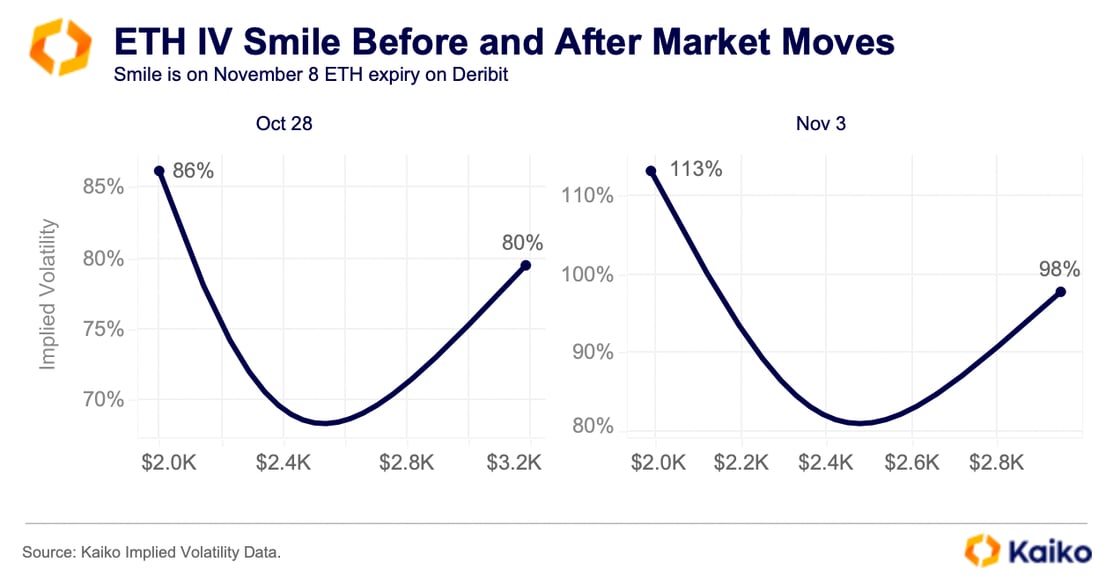

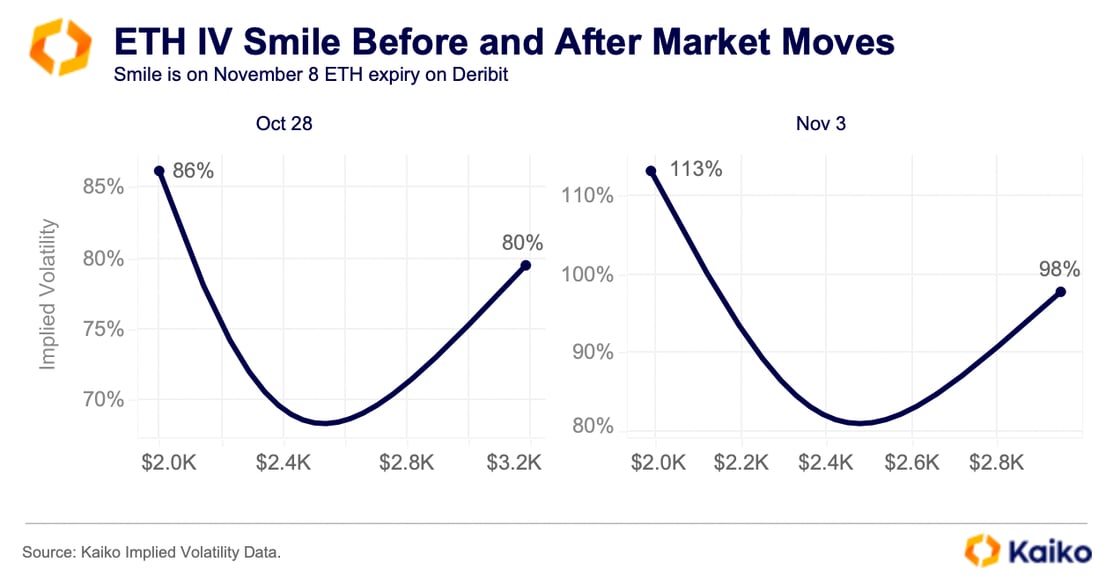

If the smile skews to the left (right), it could signal bearishness (bullishness). In the below chart we can see repricing in markets for ETH between October 28 and November 3 led to the smile tilting to left, indicating bearishness.

Looking beyond the White House in 2025.

The Presidential race might get all the attention this week, but down ballot results are just as important—particularly when it comes to shaping crypto policy going forward.

What really matters when it comes to crypto regulations is who controls the House and Congress. As such, new voices on either side of the aisle will be crucial to shaping crypto policy in the US going forward.

The last congress failed to pass a comprehensive stablecoin bill over the past two years, despite bipartisan support. Passing regulations on stablecoins will continue to be top of mind for lawmakers, particularly in light of recent consolidations in the space. Stripe, one of the world’s largest fintechs, acquired Bridge—which enables businesses to easily transact in stablecoins.

Crypto-related exchange-traded funds will continue to be a topic of discussion in 2025. Last week, the US Securities and Exchange Commission formerly acknowledged Grayscale’s latest filing—to convert its digital large cap trust into a spot ETF. The outcome for this and spot applications for XRP, SOL, and LTC will likely depend heavily on the election result.

Other areas such as decentralized finance will also need to be address in the next two years. As recently as September the House financial services committee held a hearing on the topic, titled “Decoding DeFi: Breaking Down the Future of Decentralized Finance.”

Conclusion: The finite wisdom of markets.

Markets simply reflect supply and demand, which are influenced by market participants. In other words, the market positioning outlined in our last report shows sentiment and market trends, but the predictive nature of these trends is very much still up for debate since traders aren’t infallible.

For example, in 2016 Sam Bankman-Fried, then a trader at Jane Street, rose to fame on the trading floor for a trade on the US election. The prop trading firm theorized that global equity markets would plummet if Donald Trump won that election. It was Bankman-Fried’s job to design a system to predict election results faster than media outlets to give his firm an edge.

The system worked and correctly predicted a Trump victory, however, Jane Street lost $300mn on the trade, according to author Michael Lewis. Markets rallied following Trump’s victory, leaving the firm with massive losses—and they weren’t alone.

With this in mind its important to use a wide range of metrics to monitor markets reaction in real-time. Tick-trades allow us to see large buy or sell orders, while IV shows us how markets are pricing risk. Understanding the rationale behind changes in one market can help better contextualise market moves overall.

![]()

![]()

![]()

![]()