Join us for our latest webinar in collaboration with Cboe

Korea stands as a technological powerhouse and a significant player in the global cryptocurrency landscape. This report explores regional crypto market trends and examines the historical factors that have influenced the development of Korea’s domestic exchanges and key players over time.

Part 1: KRW’s Role in Crypto

Part 2: Retail Frenzy

Part 3: Main Players in Korea’s Crypto Market

RESEARCH BY:

POWERED WITH DATA BY:

Pt. 1:KRW’s Role in Crypto

Korea stands as a technological powerhouse and a significant player in the global cryptocurrency landscape, driven by widespread internet access and a tech-savvy population.

→As a result, since 2017, Korea has remained one of the largest markets in the crypto space.

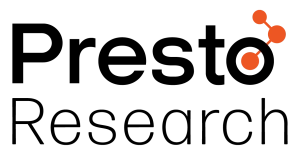

→ KRW has consistently been a top two currency in global fiat volumes.

Pt. 2: RETAIL Frenzy

The retail frenzy in Korea can be attributed to cultural factors such as the widespread adoption of technology due to fast internet speeds, a risk-loving culture, and a monoethnic society where trends quickly gain traction.

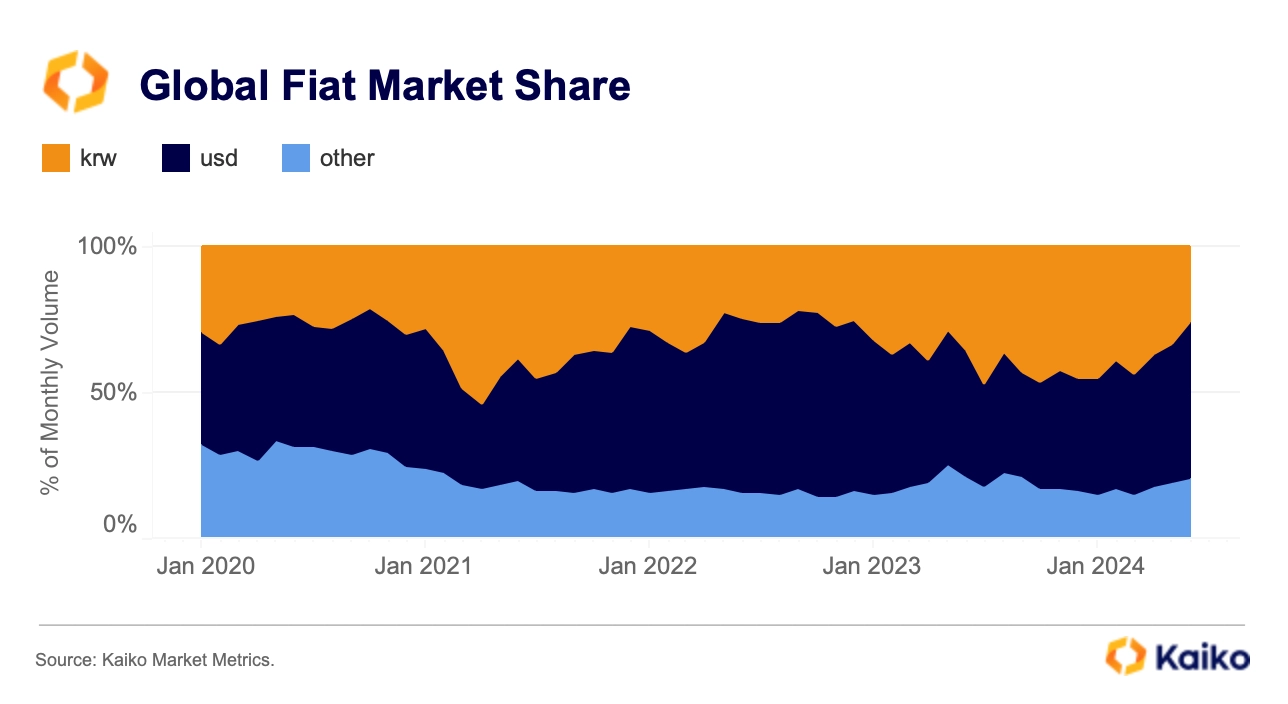

→ Due to regulatory challenges that hinder arbitrage Bitcoin’s premium on Korean markets — the ‘Kimchi premium’ — averages 2-3%.

→ Another interesting phenomenon is the ‘listing pump’, which occurs when Upbit or Bithumb announce the listing of a project.

Pt. 3: MAIN PLAYERS IN KOREA’S CRYPTO MARKET

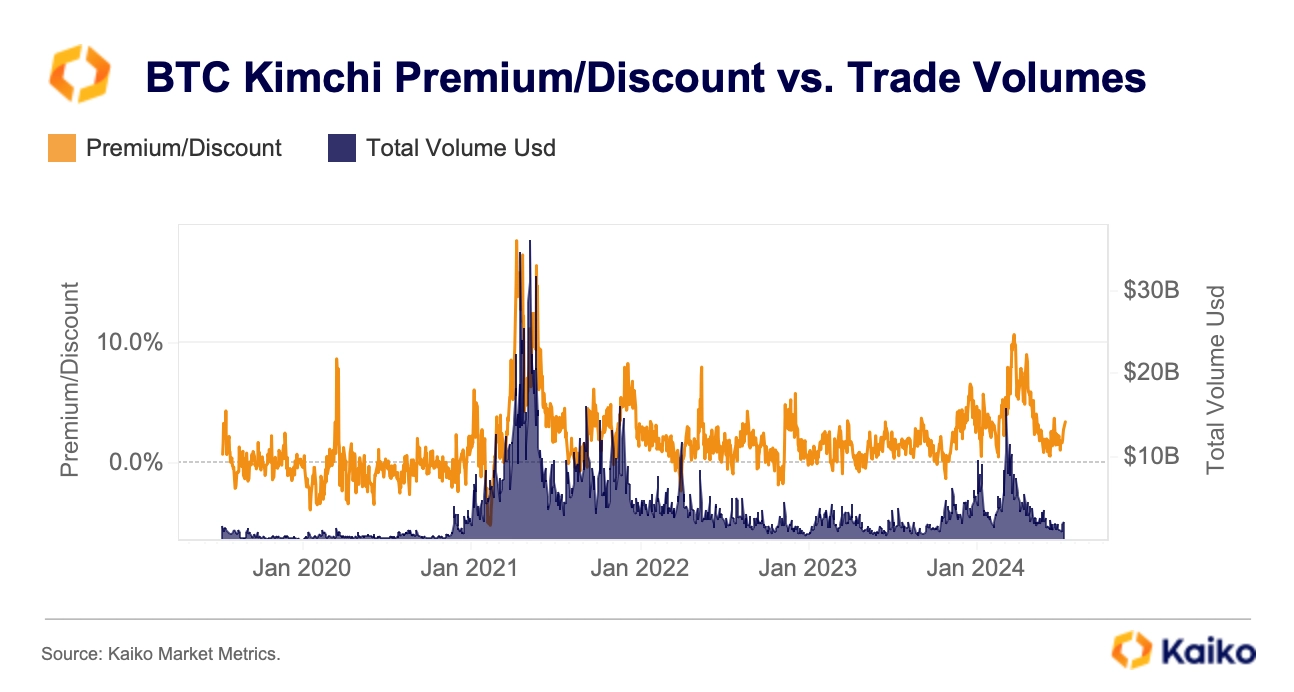

The Korean cryptocurrency market is dominated by five major spot exchanges: Upbit, Bithumb, Coinone, Korbit, and Gopax.

→ These exchanges command significant market shares, with Upbit and Bithumb accounting for nearly 96% of the total trading volume.

Download the Report.

Visit the Presto Research website here for more research content.

This research report was written by Presto Labs, with data provided by Kaiko. This content is for informational purposes only, does not constitute investment advice, and is not intended as an offer or solicitation for the purchase or sale of any financial instrument. For any questions, please email [email protected].