Join us for our latest webinar in collaboration with Cboe

Kaiko research premium

Is South Korea’s Crypto Market Ready for an Institutional Shift?

Recent Trends in Volume and Liquidity

South Korea has long stood out as a major player in global crypto markets, consistently ranking among the top trading hubs. Despite its scale, the market remains largely retail-driven, with trading activity concentrated on a handful of local exchanges and a strong preference for altcoins. This report breaks down the trends reshaping Korea’s crypto landscape and evaluates whether the country is positioned to evolve into an ecosystem capable of attracting institutional capital.

Part 1: KRW’s Trade Volume Slows in Q1

Part 2: Market Concentration and Competition

Part 3:BTC’s Role in Korean Markets

Pt. 1:KRW Trade Volume slows in Q1

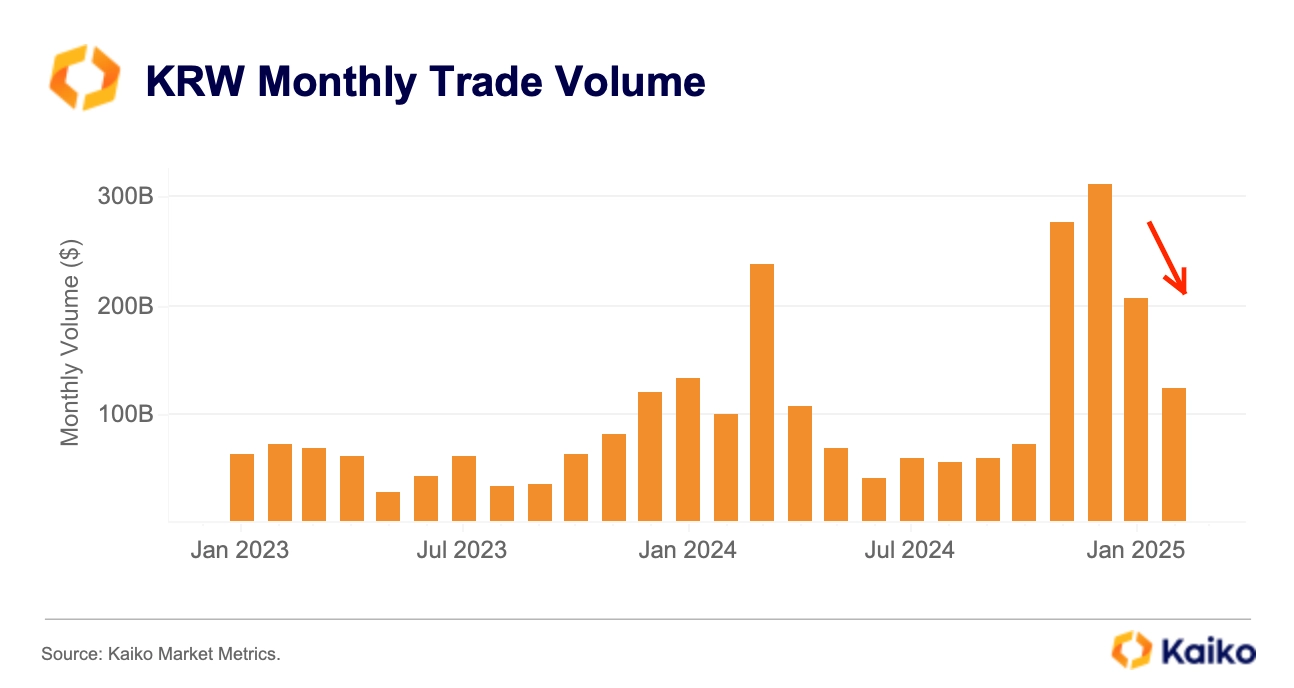

After a 2021 peak decline, Korea’s market rebounded to $300 billion monthly volume by December 2024. Early 2025 saw a slowdown amid global trade tensions and domestic political uncertainty.

→March volumes dropped 62% from November levels.

→Despite this, KRW remains the second-largest crypto market with 35% global share.

Pt. 2: Competition and Concentration

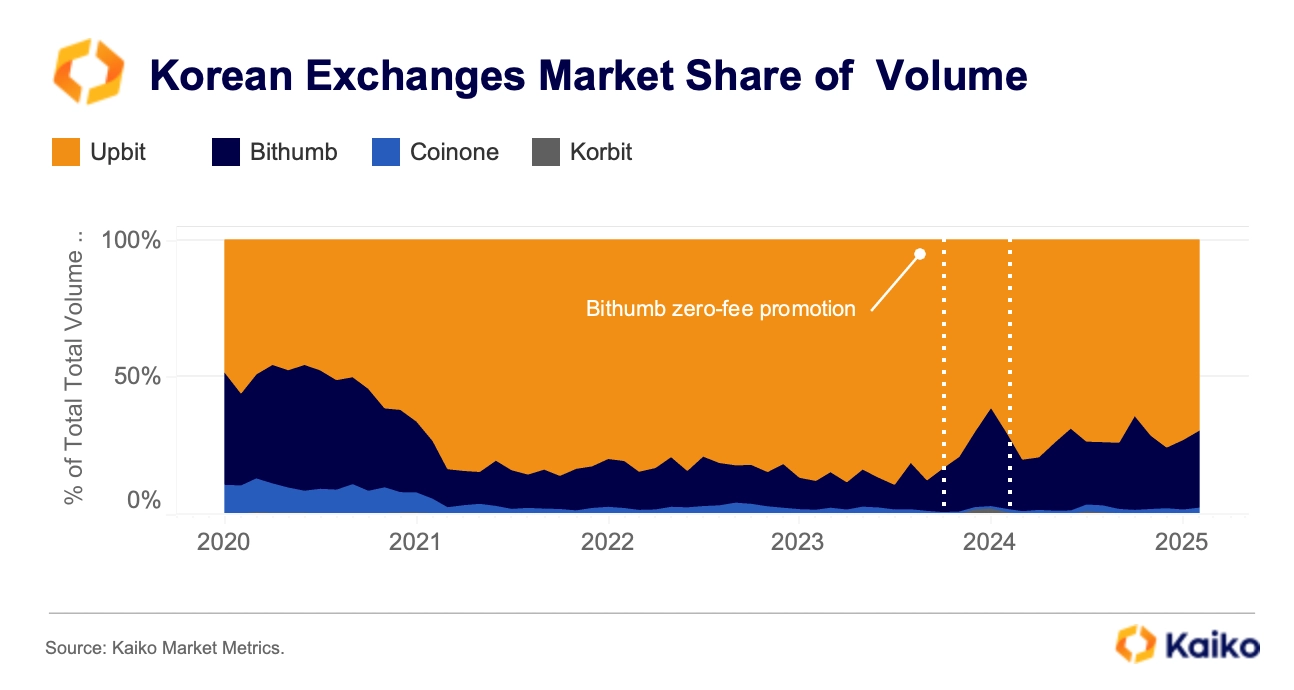

Korea’s crypto market remains highly concentrated, with Upbit holding a dominant 69% market share as of February 2025. However, its dominance has declined from a peak of 86% in 2021,due to fee-free campaigns by competitors that attracted some users.

→ Korean exchanges have seen muted gains from the post-U.S. election rally compared to their global counterparts.

Pt. 3: BTC’s role in Korean markets

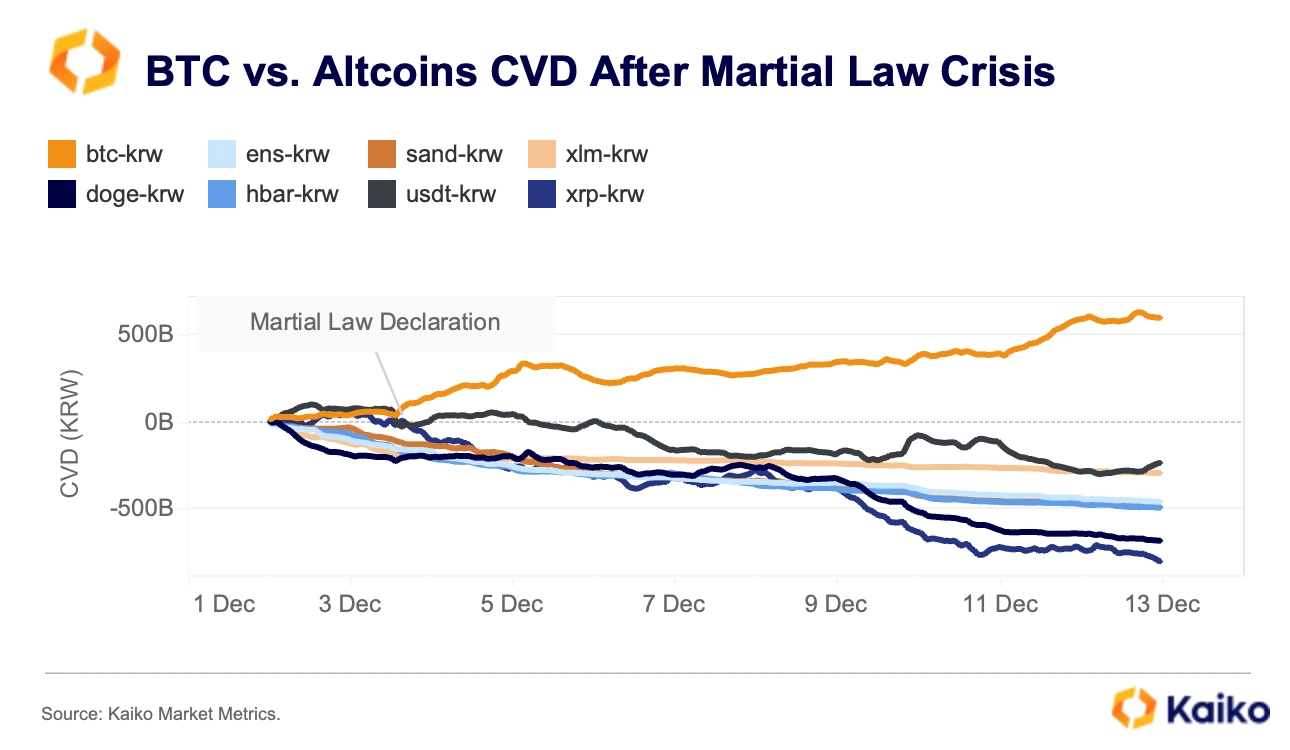

The December 2024 “Martial Law Crisis” triggered a notable spike in Bitcoin demand across South Korea, as evidenced by a positive shift in cumulative volume delta (CVD), while most altcoins experienced net outflows.

→ In January 2025, a rising premium on Korean exchanges persisted even as global BTC prices declined, indicating resilient local demand.

→ The average 1% market depth for Bitcoin on major Korean platforms reached around $1.3 million in Q1 2025.