Join us for our latest webinar in collaboration with Cboe

Bybit’s Liquidity Resilience Post-Hack

The data behind Bybit’s liquidity recovery following the largest hack in crypto history.

Bybit’s liquidity recovery sets a new benchmark for crisis resilience in crypto markets. This report analyzes how the exchange recovered its market depth, tightened spreads, and regained trader confidence amid a volatile macro backdrop.

Part 1: Bybit’s 30-Day Bitcoin Liquidity Recovery

Part 2: Altcoin Market Liquidity Analysis and Execution Costs

Part 3: Trading Volumes Post-Hack

In Partnership With:

Researched by:

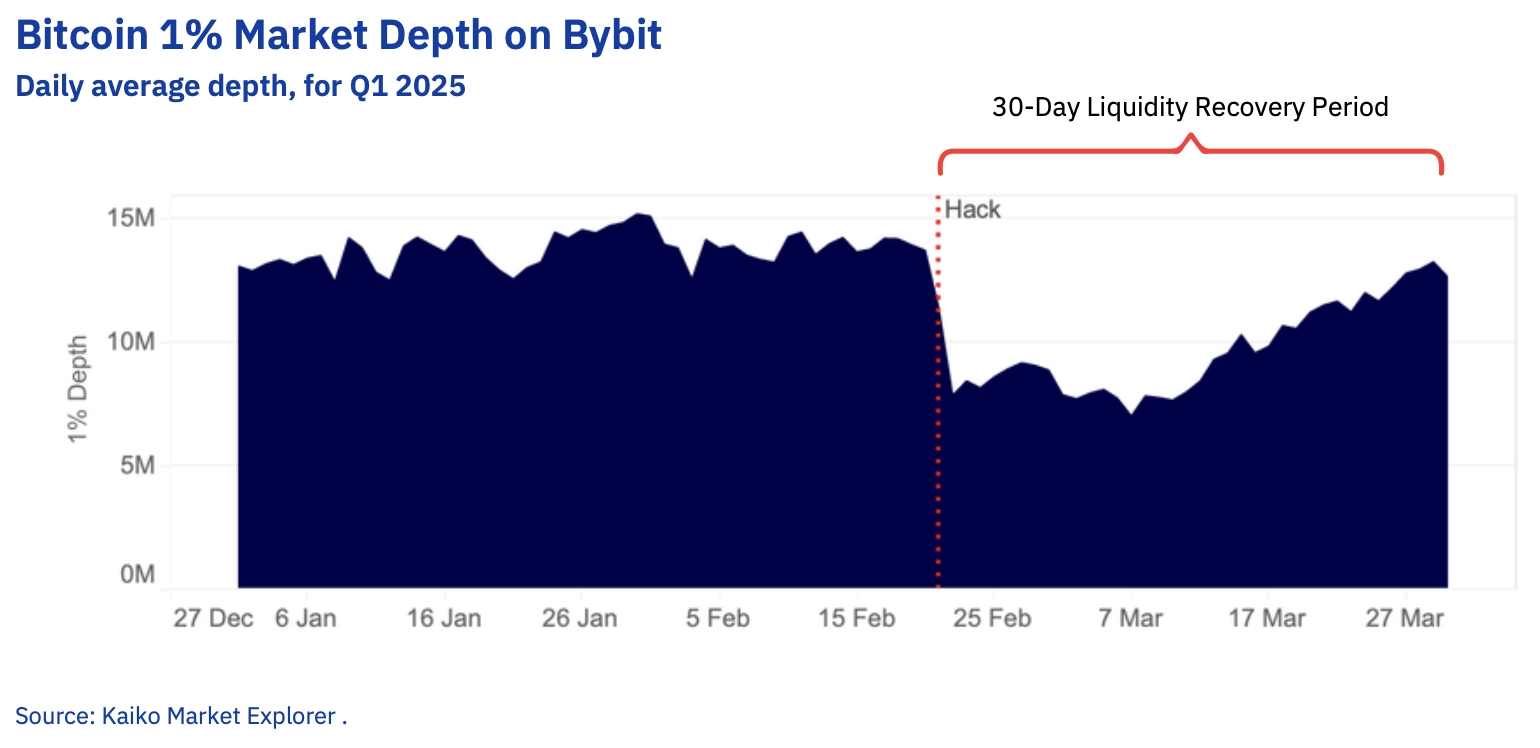

Pt. 1: BYBIT’S 30-DAY BITCOIN LIQUIDITY RECOVERY

Bybit’s BTC market depth returned to pre-hack levels just one month after the event, signaling strong resilience from market makers despite broader market uncertainty.

→ Daily average 1% BTC market depth reached $13mn by end of Q1.

→ Liquidity recovered across all order book levels, from 0.1% to 8% of the mid-price.

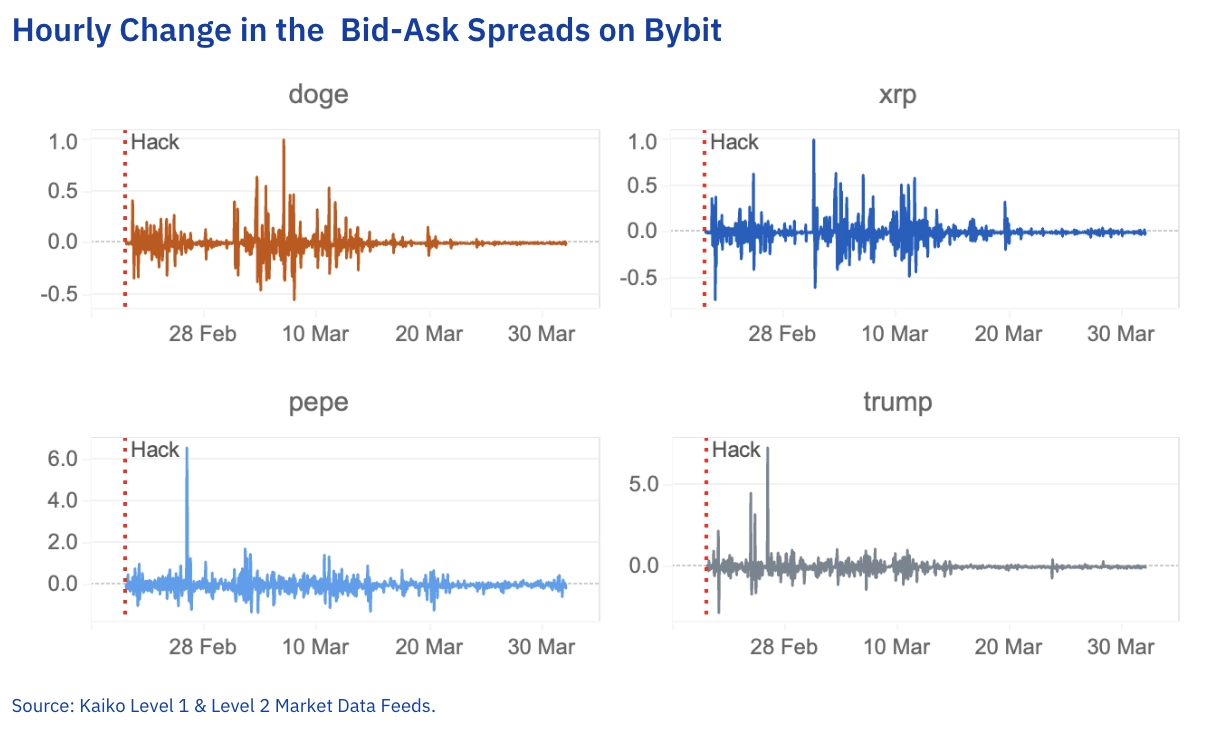

Pt. 2: ALTCOIN MARKET LIQUIDITY ANALYSIS AND EXECUTION COSTS

Altcoin markets on Bybit showed a strong recovery in March, with broad-based improvements in order book depth and trading conditions across major tokens.

→ Over 80% of pre-shock market depth restored for the top 30 altcoins by market cap.

→ Bid-ask spread volatility declined across the board, signaling improved market stability and growing confidence from liquidity providers.

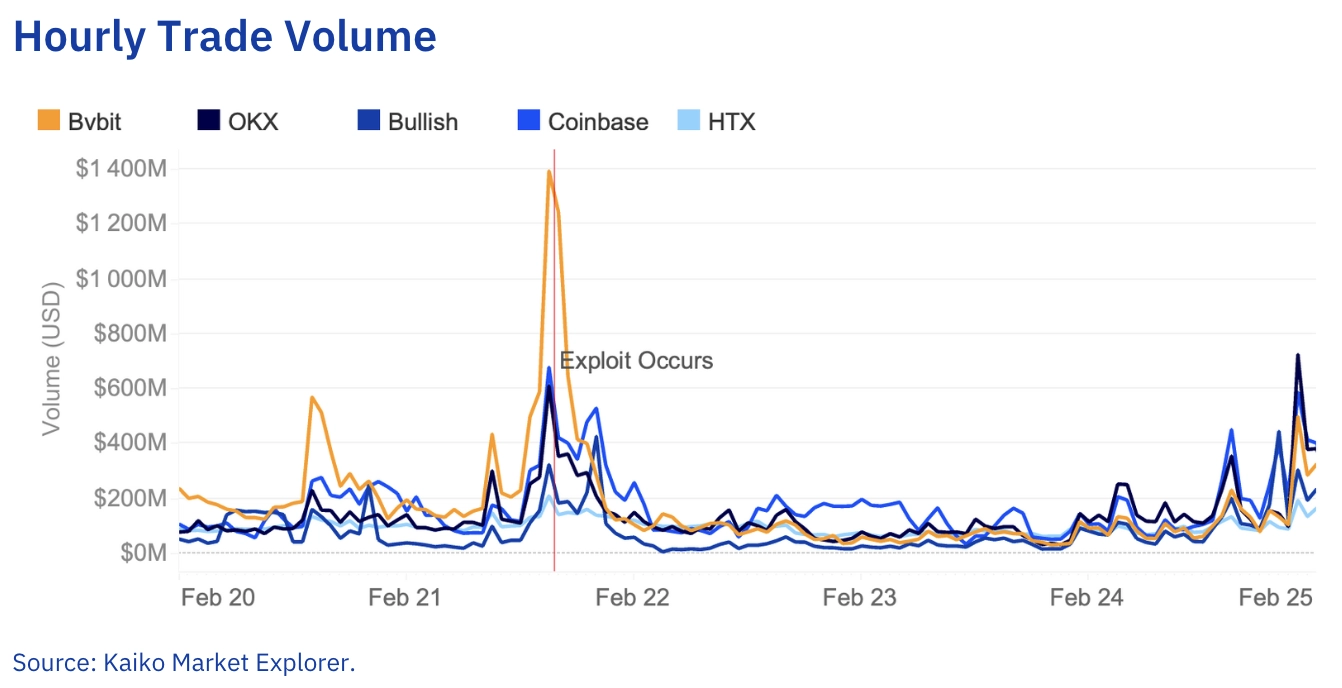

Pt. 3: TRADING VOLUMES POST-HACK

Bybit’s trading volumes normalized faster than after comparable market events, highlighting strong user retention and platform resilience despite continued macro uncertainty.

→ Hourly trading volume briefly spiked to $1.2bn post-incident, before rebounding in line with broader market patterns.

→ Volumes recovered more quickly than after the Binance.US SEC suit or the 2016 Bitfinex hack, pointing to sustained user confidence.

Download the Report.

This research report was paid for by Bybit, but written independently by Kaiko. This content is for informational purposes only, does not constitute investment advice, and is not intended as an offer or solicitation for the purchase or sale of any financial instrument. For any questions, please email [email protected].