Join us for our latest webinar in collaboration with Cboe

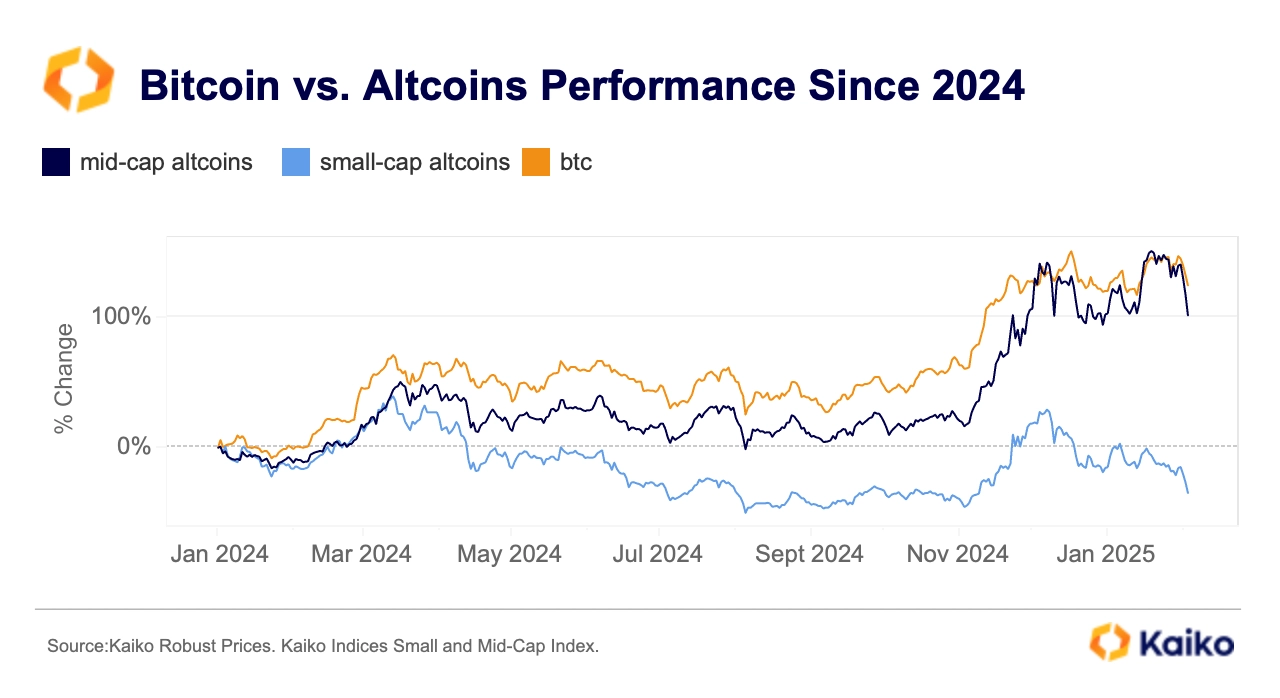

Bitcoin rallies have historically fueled altcoin seasons, during which investors rotate profits into altcoins, driving broad crypto market gains. However, even if Bitcoin hits multiple all-time highs in 2024, many altcoins haven’t reached their 2021/22 peaks. Instead, altcoin trading activity has been increasingly concentrated within a few tokens. This report examines altcoin volume and liquidity trends during recent rallies, exploring some of the factors shaping capital allocation and what a potential altseason might look like, given the broader context.

Part 1: Altcoin Performance: A Mixed Bag

Part 2: Altcoin Market Concentration

Part 3: Factors Shaping Capital Allocation

RESEARCH BY:

POWERED WITH DATA BY:

Pt. 1:Altcoin Performance: A Mixed bag

Altcoin performance has been a mixed bag following the U.S. elections. While Bitcoin hit new all-time highs in November, many tokens remained below their 2021–2022 peaks or March 2024 levels.

→Large caps like SOL and XRP surged.

→Mid and small caps experienced uneven results.

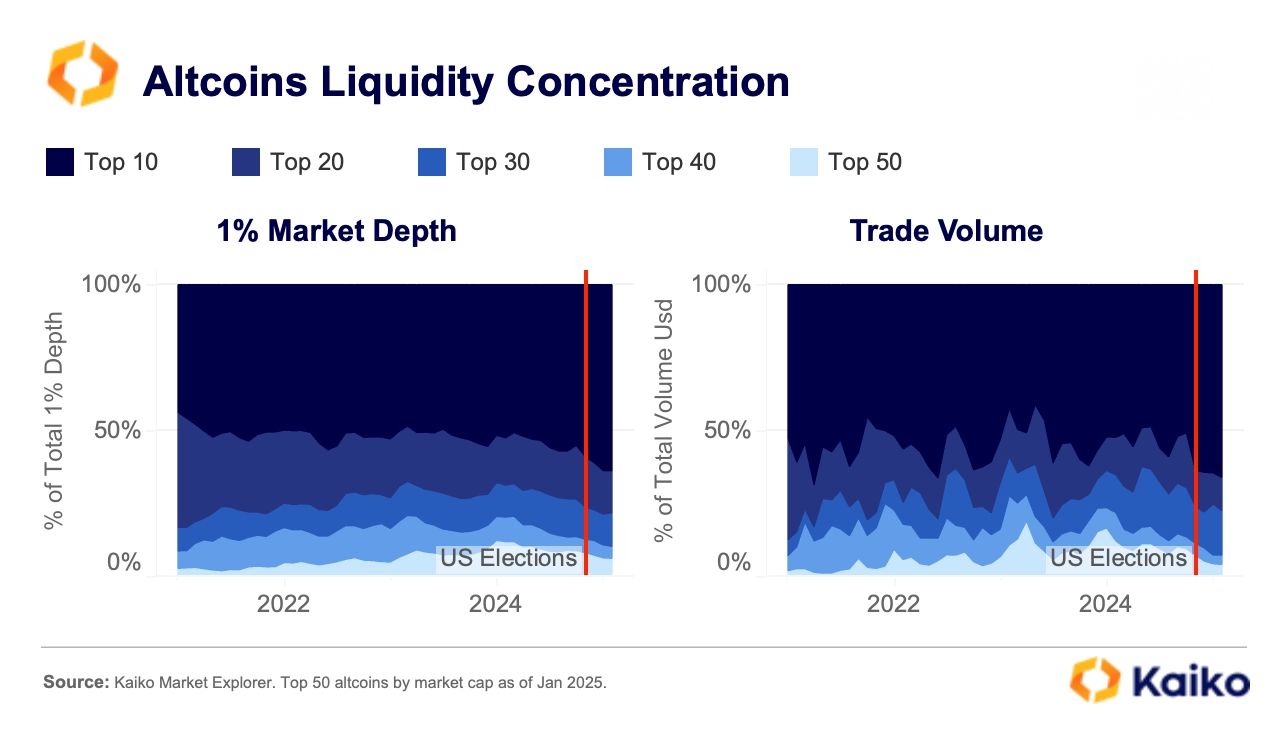

Pt. 2: Altcoin Market Concentration

A key difference between the 2021/2022 bull run and the recent rise of crypto assets is the increasing liquidity concentration among a few assets. Altcoin trade volume has returned to pre-FTX levels, but it is more concentrated than ever.

→The top 10 altcoins account for 64% of the total volume, indicating that investors are focusing capital on a select group.

→ Market depth mirrors this trend, with the top 10 comprising over 60% of the 1% depth. This concentration notably accelerated after the U.S. elections.

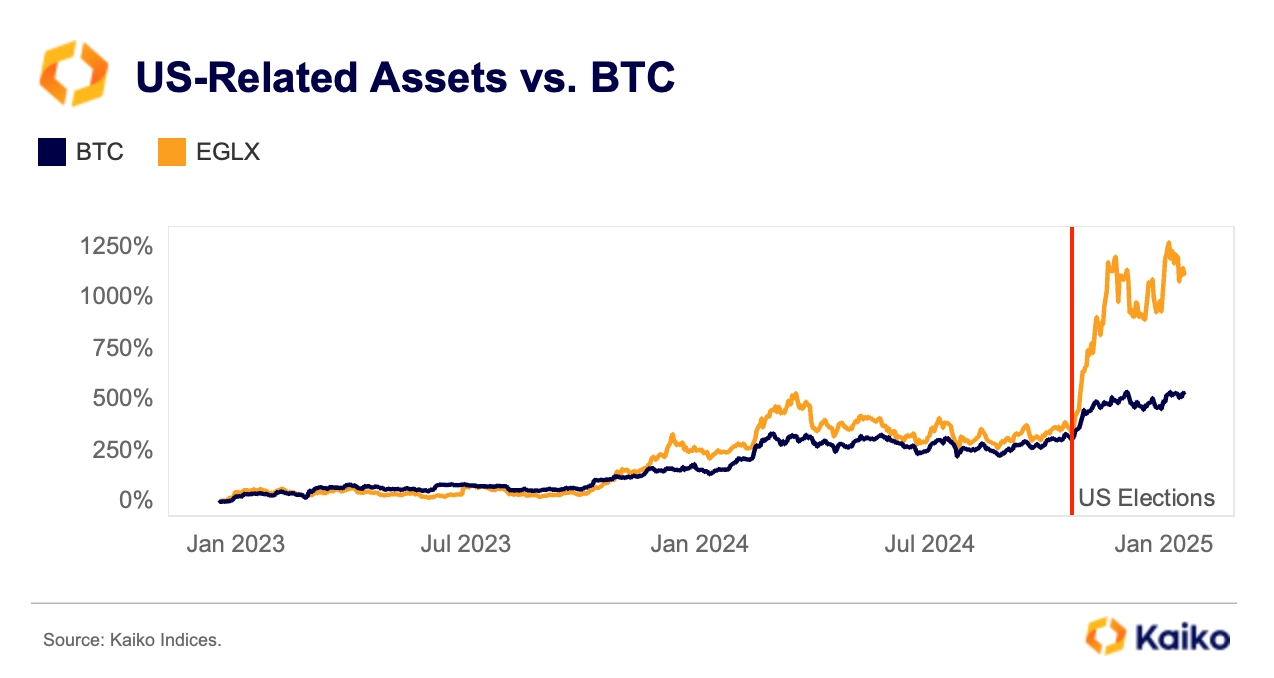

Pt. 3: Factors influencing capital allocation

Regulation is emerging as a key factor in determining where capital is allocated in crypto markets. The U.S. elections have fueled optimism, with the SEC dropping lawsuits and repealing restrictive rules (SAB 121). U.S. -based projects, tracked by Kaiko’s EAGLE Index (EGLX), have outperformed Bitcoin post-election, reflecting investor confidence.

Rising interest rates have also fundamentally altered capital allocation, setting the 2024 rally apart from the liquidity-driven 2021/2022 bull run.