Join us for our latest webinar in collaboration with Cboe

The State of Liquidity on Korean Crypto Markets

This report presents a comprehensive framework for measuring liquidity, defined as the ability to quickly execute large orders at a price close to the market, with limited impact. Liquidity must be assessed over time and across market regimes, incorporating the effects of seasonality and macroeconomic events. A rigorous evaluation of liquidity requires a multidimensional approach, as no single indicator can capture all its factors.

The report details the indicators used and their contribution, including metrics such as volume, spreads, market depth, and slippage, and applies this framework to Korean cryptocurrency exchange platforms. It offers a cross-exchange comparison to document the concentration of trading activity and liquidity, and then examines specific dynamics to explain liquidity variations across assets and market regimes.

Part 1: Defining Liquidity in Crypto Markets

Part 2: Trading Costs & Liquidity Structure on Korean Exchanges

Part 3: Liquidity Data Insights on Korean Exchanges

Defining Liquidity in crypto markets

In practice, liquidity is measured by the speed of execution and immediate availability in the order book.

→ No single metric can capture liquidity in all its complexity. Liquidity is multidimensional and must take into account price, size, time, and context. It is part of a macro environment that is specific to an asset or sector.

→ A robust liquidity assessment balances pre-trade and post-trade perspectives. Pre-trade metrics, from the order book, reflect the immediacy and capacity of liquidity available before execution. Post-trades metrics, computed from executed prints, reveal realized trading conditions and market impact.

Trading Costs & Liquidity structure on korean exchanges

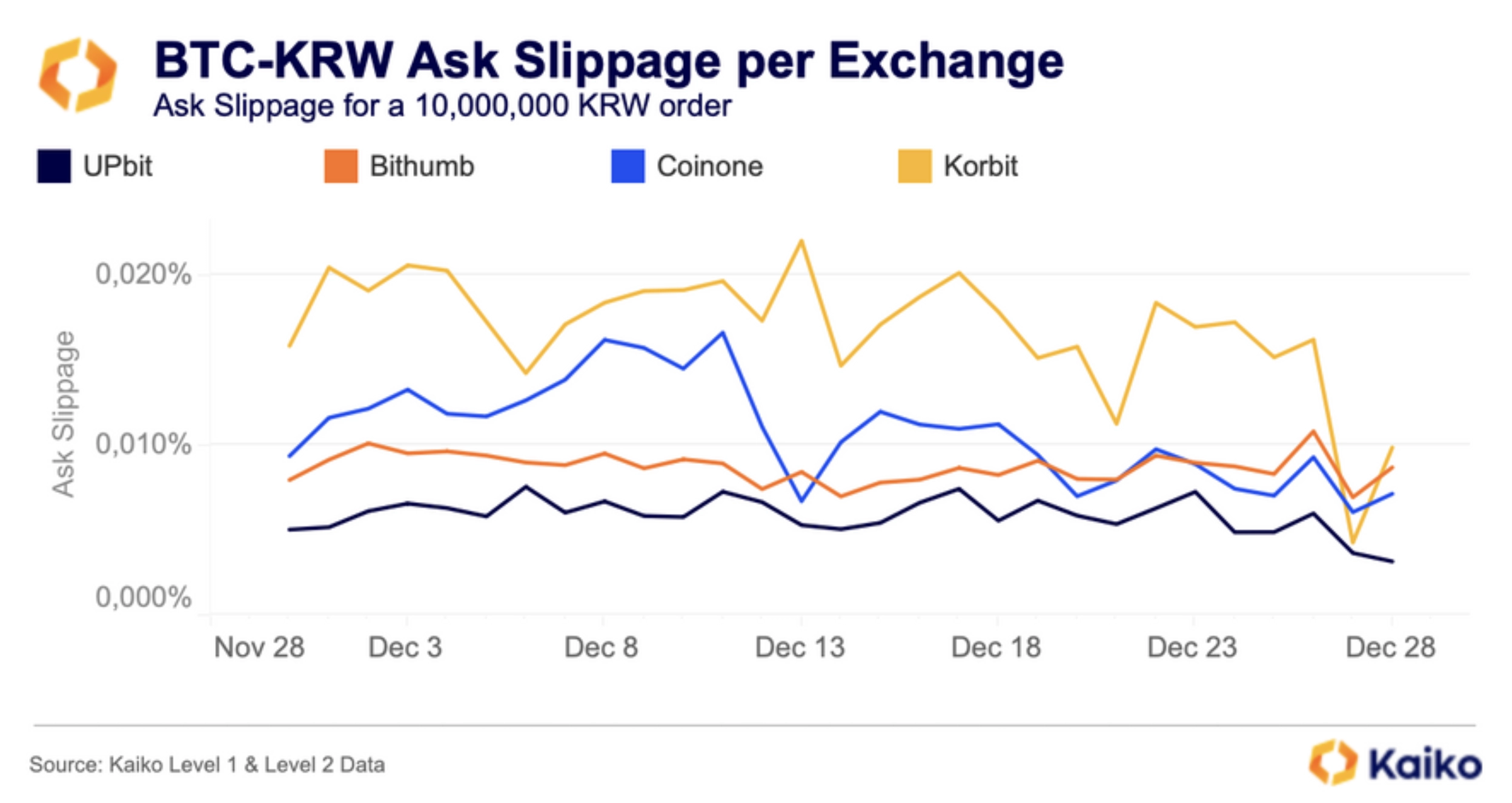

In Korea, KRW markets on exchanges such as UPbit and Bithumb have historically adopted large tick sizes. The primary objective is stability, based on the observation that larger tick sizes reduce noise, limit price movements, and improve order book readability for a very active retail clientele.

→ In the KRW market, UPbit has opted for a gradual price tick size based on a price range. The purpose is to adapt the price granularity to its level, maintaining consistent relative precision while preserving stability.

→ Despite applying relatively large tick sizes, UPbit remains the most liquid exchange, based on ask-side slippage in the BTC-KRW market in late 2025 for a 10,000,000 KRW ask order.

Liquidity Data insights on korean exchanges

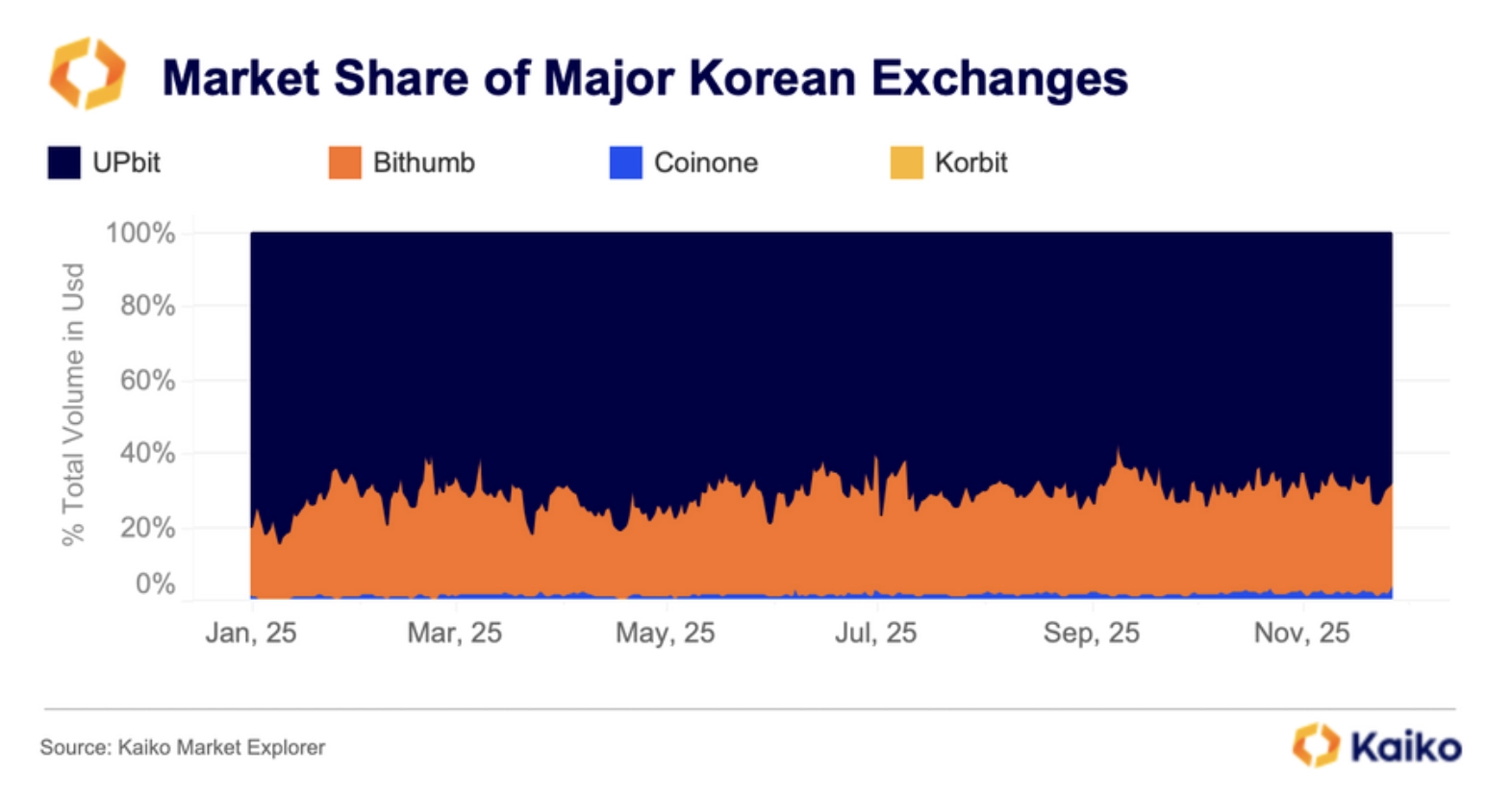

We compare the main Korean exchanges in terms of trading volume and market share and analyze token-specific dynamics.

→ The vast majority of trade volume in Korea is concentrated on UPbit, with recurring spikes far exceeding Bithumb, particularly during periods of macroeconomic shock.

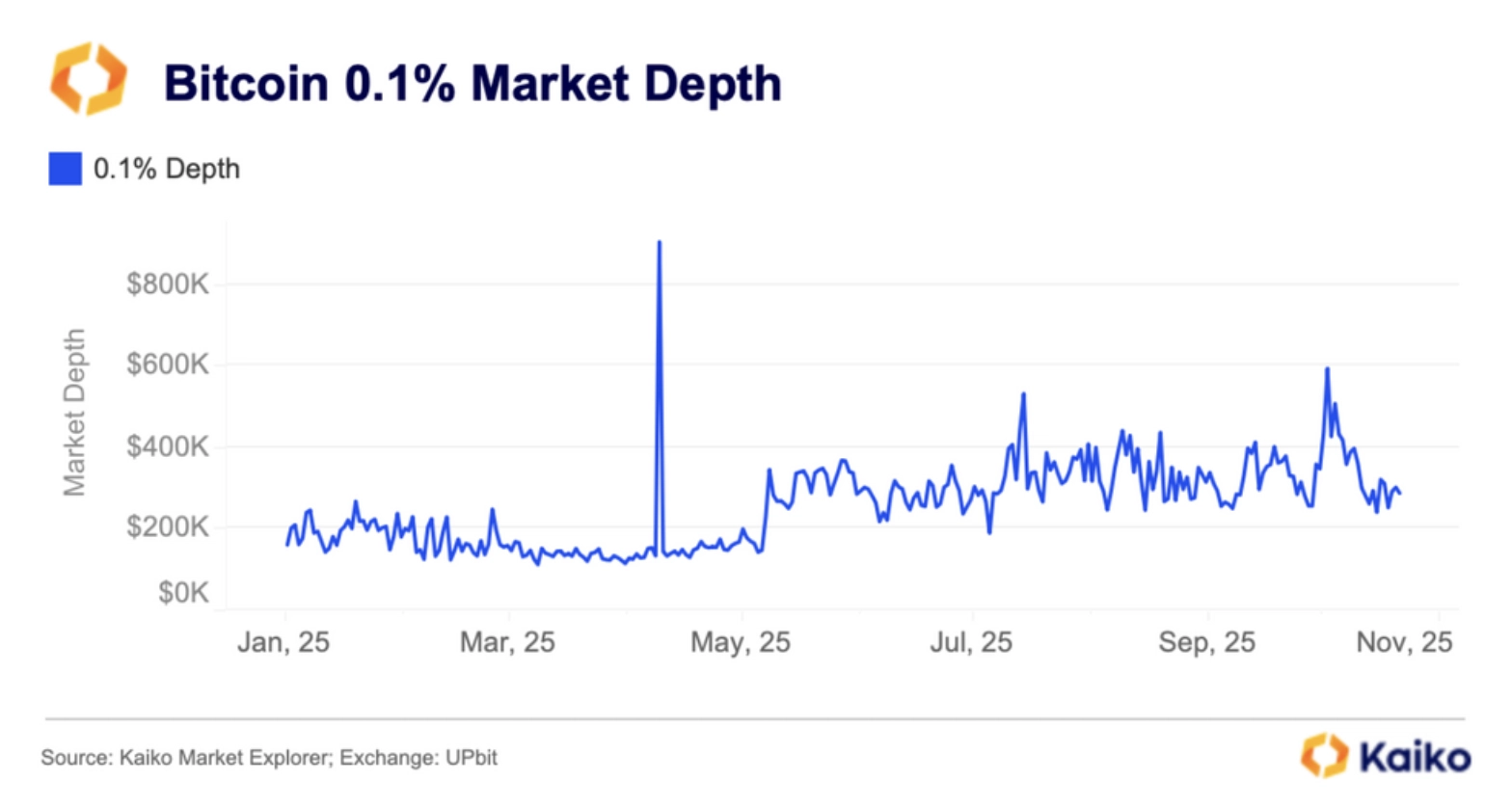

→ Liquidity can also be analyzed when BTC reaches new all-time highs, as has been observed several times in 2025. Rising prices attract new capital, which tends to fill the order book and tighten spreads on the most liquid pairs.

Download the Report.

This research report was produced in partnership with UPbit, but written independently by Kaiko. This content is for informational purposes only, does not constitute investment advice, and is not intended as an offer or solicitation for the purchase or sale of any financial instrument. For any questions, please email [email protected].