Kaiko's Q1 market report is now live!

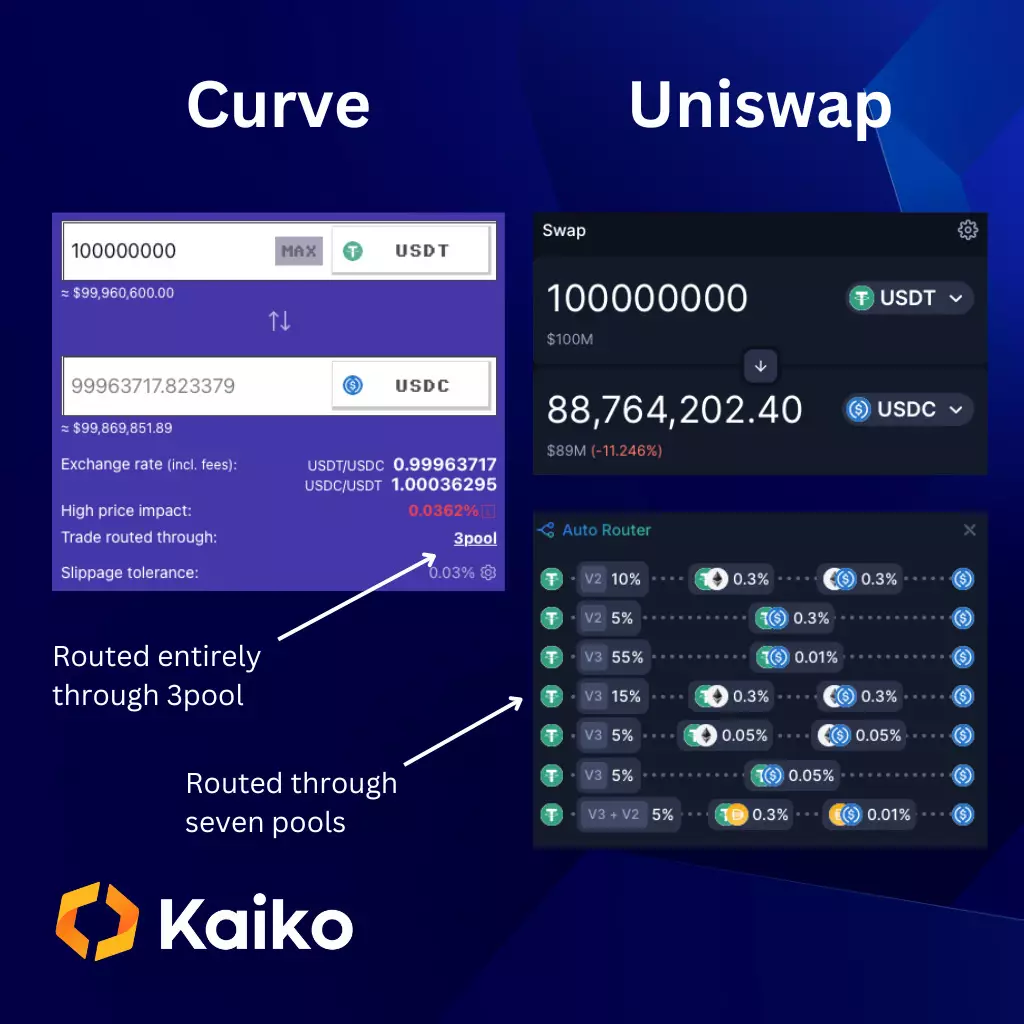

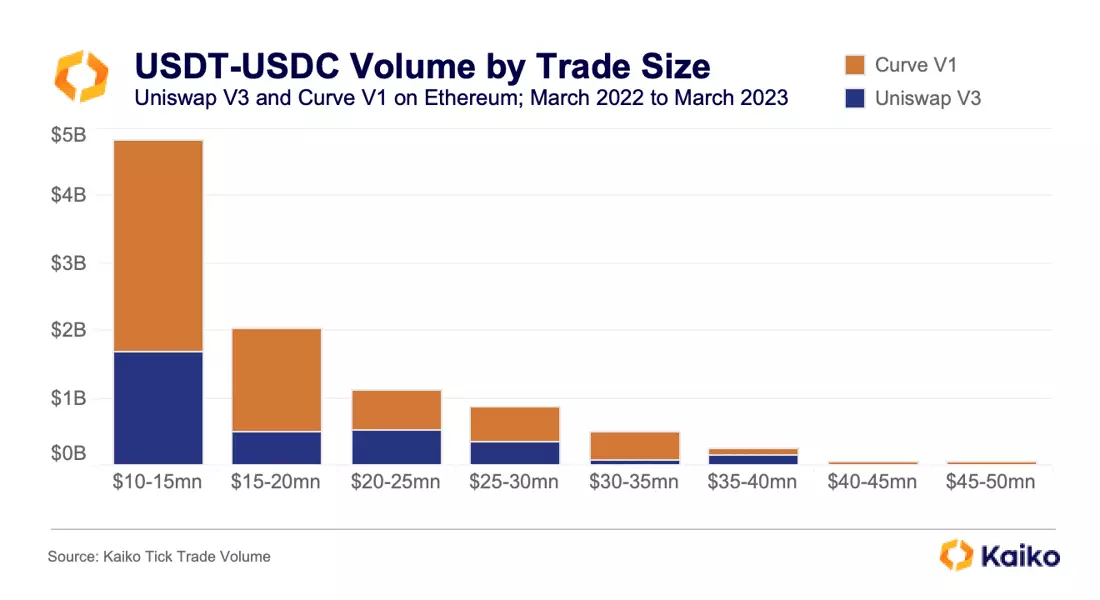

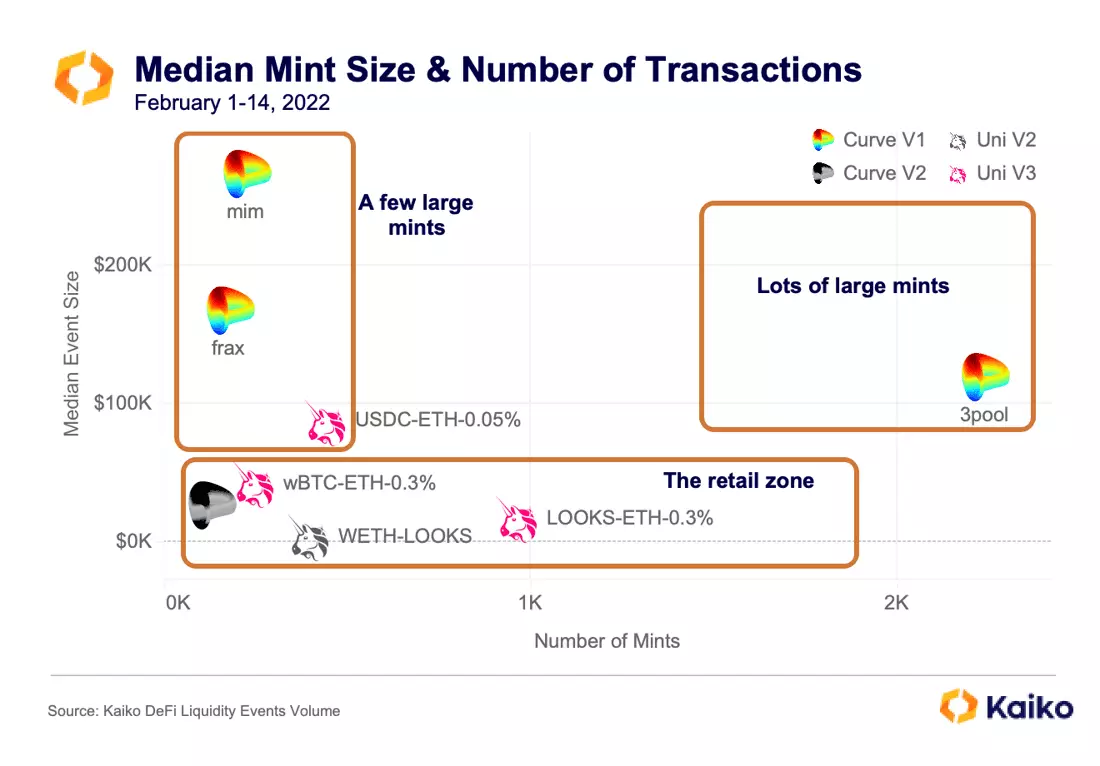

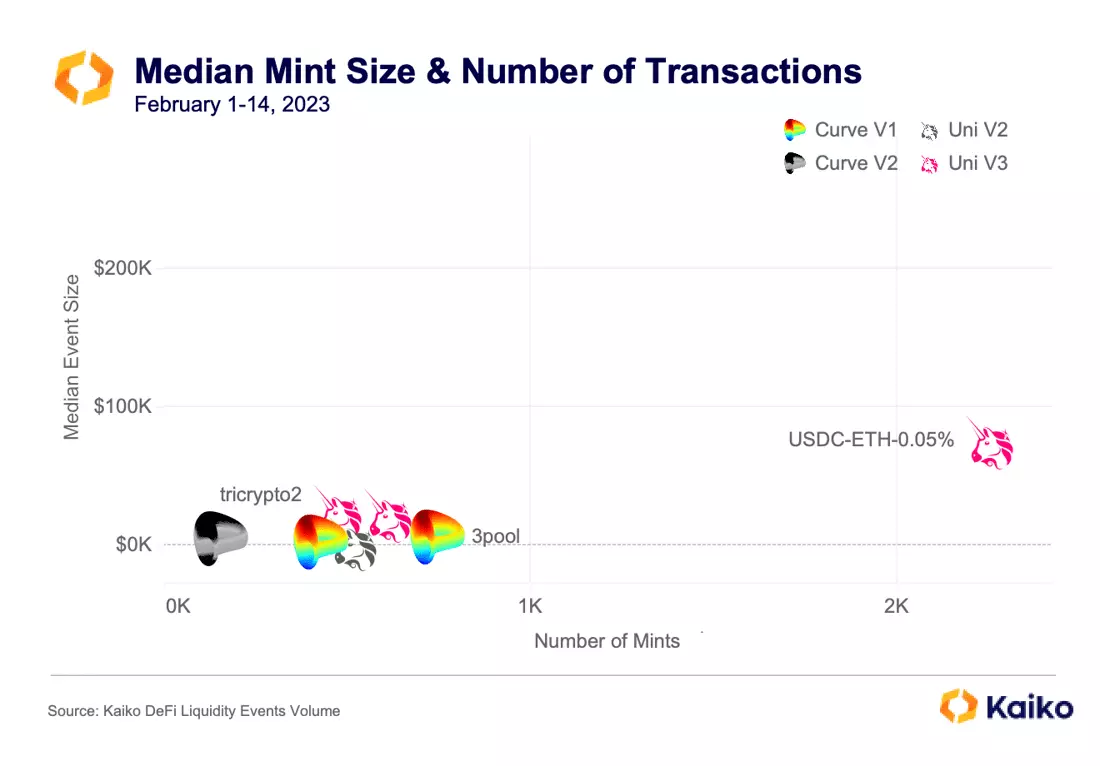

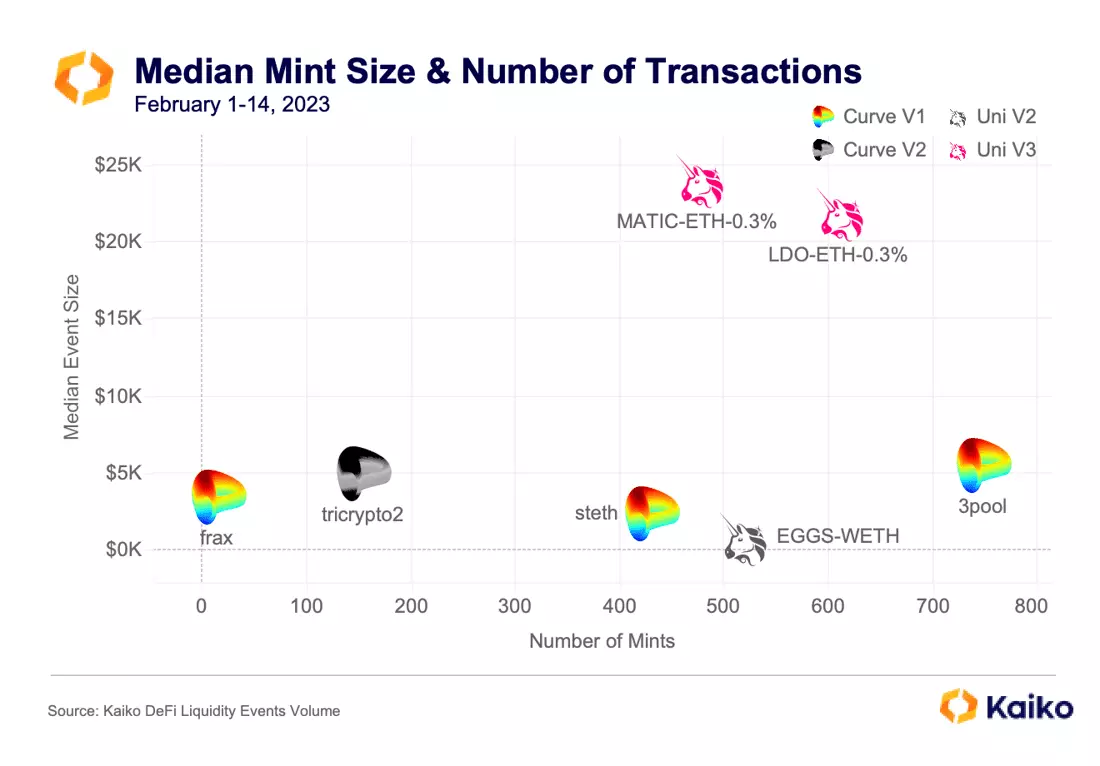

Whales vs. Retail: Who’s Using Curve?

02/03/2023

Data Used In This Analysis

More From Kaiko Research

![]()

Bitcoin

22/04/2024 Data Debrief

Bitcoin Halving Is HereWelcome to the Data Debrief! The much-anticipated fourth Bitcoin halving went live on April 20. While BTC ended the week flat, transaction fees experienced strong volatility following the launch of Runes, a protocol for issuing fungible tokens on Bitcoin.

Written by The Kaiko Research Team![]()

Asia

15/04/2024 Data Debrief

Crypto Fee War Heats Up in South KoreaWelcome to the Data Debrief! Last week, BTC fell in tandem with risk assets amid escalating geopolitical tensions. However, it regained ground early on Monday after Hong Kong reportedly approved spot BTC and ETH ETFs. In other news, the U.S. SEC issued a Wells notice to Uniswap Labs, and MarginFi experienced over $200 million in outflows as its founder exited.

Written by The Kaiko Research Team![]()

Bitcoin

08/04/2024 Data Debrief

All Eyes on the Bitcoin HalvingWelcome to the Data Debrief! BTC had a shaky start of the new quarter, closing last week flat before surging above $72k early Monday. In other news, DeFi protocol Ethena airdroped its ENA token, Ripple announced a stablecoin, and the Ethereum Foundation proposed to reduce ETH issuance.

Written by The Kaiko Research Team![]()

CEX

02/04/2024 Data Debrief

The Impact of the KuCoin ChargesBitcoin dropped 5% early Tuesday as the U.S. Dollar index climbed to four month highs. Meanwhile, SBF was sentenced to 25 years, three AI protocols announced plans to merge, and the London stock exchange decided to allow applications for crypto ETNs.

Written by The Kaiko Research Team